4/1/2022 12:13:02 PM - Rebounding toward its all-time high with today's 7th consecutive gain. Reported earnings +2% on +12% sales revenues for the Dec '21 quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

10/28/2021 12:30:34 PM - Slumped back below its 50 DMA line ($116) which has been acting as resistance following volume-driven losses after wedging to new all-time highs with gains in prior weeks lacking great volume conviction. Reported earnings +6% on +15% sales revenues for the Sep '21 quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

10/4/2021 12:28:50 PM - Slumping further below its 50 DMA line ($116) with today's 7th consecutive volume-driven loss after wedging to new all-time highs with gains in prior weeks lacking great volume conviction. Reported earnings +88% on +49% sales revenues for the Jun '21 quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

10/1/2021 12:18:39 PM - Slumped below its 50 DMA line ($116) this week with volume-driven losses after wedging to new all-time highs with gains in prior weeks lacking great volume conviction. Reported earnings +88% on +49% sales revenues for the Jun '21 quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

7/30/2021 12:30:37 PM - Hitting new all-time highs with today's 4th consecutive gain. Reported earnings +88% on +49% sales revenues for the Jun '21 quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

9/22/2020 12:12:05 PM - Violating its 50 DMA line with today's 4th consecutive loss. Reported earnings -26% on -15% sales revenues for the Jun '20 quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

4/24/2020 12:35:44 PM - Rebounding above its 200 DMA line with recent gains. Reported earnings +14% on +14% sales revenues for the Mar '20 quarter. Prior quarterly comparisons were not strong and stead above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

1/31/2020 1:03:39 PM - Today's big volume-driven loss has it slumping well below its 50 DMA line ($236.44) and undercutting prior lows in the $226-228 area raising greater concerns. Reported earnings +25% on +20% sales revenues for the Dec '19 quarter. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

1/23/2020 1:03:41 PM - Today's big volume-driven loss is violating its 50 DMA line ($237) and testing prior lows in the $226-228 area defining important near-term support. Last noted with caution in the 12/10/19 mid-day report - "Reported earnings +32% on +21% sales revenues for the Sep '19 quarter. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good."

12/10/2019 12:55:51 PM - Today's 4th consecutive loss is violating its 50 DMA line ($234) which acted as support during recent consolidations. Reported earnings +32% on +21% sales revenues for the Sep '19 quarter. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

12/9/2019 12:22:23 PM - Today's 3rd consecutive loss is testing its 50 DMA line ($234) which acted as support during recent consolidations. Reported earnings +32% on +21% sales revenues for the Sep '19 quarter. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

12/9/2019 12:22:23 PM - Today's 3rd consecutive loss is testing its 50 DMA line ($234) which acted as support during recent consolidations. Reported earnings +32% on +21% sales revenues for the Sep '19 quarter. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

10/24/2019 12:28:37 PM - Found support near its 50 DMA line during its recent consolidation and hit a new all-time high with today's volume-driven gain. Reported earnings +32% on +21% sales revenues for the Sep '19 quarter. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) history has been very good.

10/3/2019 12:04:03 PM - Finding support near its 50 DMA line while consolidating near its all-time high. Prior mid-day reports cautioned members - "Reported earnings +11% on +15% sales revenues for the Jun '19 quarter, and the prior comparison was also well below the +25% minimum earnings guideline (C criteria)."

8/22/2019 12:54:58 PM - Retreating with higher volume today after wedging to a new all-time high with recent gains lacking great volume. The 7/24/19 mid-day report last cautioned members - "Reported earnings +11% on +15% sales revenues for the Jun '19 quarter, and the prior comparison was also well below the +25% minimum earnings guideline (C criteria)."

7/24/2019 12:00:29 PM - Gapped up today hitting a new all-time high with a considerable volume-driven gain. Reported earnings +11% on +15% sales revenues for the Jun '19 quarter, and the prior comparison was also well below the +25% minimum earnings guideline (C criteria).

4/24/2019 12:36:01 PM - Abruptly retreated below its 50 DMA line ($181) with two big volume-driven losses. Reported earnings +8% on +11% sales revenues for the Mar '19 quarter, well below the +25% minimum earnings guideline (C criteria).

4/18/2019 12:43:52 PM - Abruptly retreated below its 50 DMA line ($180.83) with two big volume-driven losses. Noted with caution in prior mid-day reports - "Reported earnings +24% on +10% sales revenues for the Dec '18 quarter, so 2 of the past 3 quarterly comparisons were below the +25% minimum earnings guideline (C criteria)."

4/17/2019 12:42:44 PM - Abruptly retreating near its 50 DMA line ($180.82) with today's big loss. Last noted with caution on 3/18/18 as it gapped up hitting a new all-time high - "Found support near its 200 DMA line during its consolidation in recent months. Reported earnings +24% on +10% sales revenues for the Dec '18 quarter, so 2 of the past 3 quarterly comparisons were below the +25% minimum earnings guideline (C criteria)."

3/18/2019 12:29:12 PM - Gapped up today hitting a new all-time high. Found support near its 200 DMA line during its consolidation in recent months. Reported earnings +24% on +10% sales revenues for the Dec '18 quarter, so 2 of the past 3 quarterly comparisons were below the +25% minimum earnings guideline (C criteria).

1/15/2019 12:39:02 PM - Rebounding toward prior highs after finding prompt support near its 200 DMA line during its consolidation in recent months. Reported earnings +27% on +10% sales revenues for the Sep '18 quarter, and 3 of the past 4 quarterly comparisons were above the +25% minimum earnings guideline (C criteria).

10/4/2018 12:29:19 PM - Abruptly retreating from its all-time high, slumping back into the prior base today with a 4th consecutive volume-driven loss undercutting prior highs in the $155-156 area. Prior mid-day reports recently noted - "Fundamental concerns remain after it reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria)."

10/3/2018 12:26:49 PM - Gapped down on the prior session, abruptly retreating from its all-time high following an impressive streak of volume-driven gains. Prior highs in the $155-156 area define near-term support to watch. Fundamental concerns remain after it reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria).

10/2/2018 12:15:50 PM - Gapped down today, abruptly retreating from its all-time high following an impressive streak of volume-driven gain. Fundamental concerns remain after it reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria).

10/1/2018 12:41:09 PM - Gapped up on 9/24/18 and powered into new all-time high territory with an impressive streak of volume-driven gain. Fundamental concerns remain after it reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria).

9/25/2018 12:48:00 PM - Gapped up on the prior session and it is hitting new all-time highs again with today's 5th consecutive volume-driven gain. Fundamental concerns remain after it reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria).

9/24/2018 12:19:39 PM - Gapped up hitting a new all-time high with today's 4th consecutive volume-driven gain. Fundamental concerns remain after it reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria).

9/20/2018 12:54:00 PM - Rebounded above its 50 DMA line and it is approaching its all-time high with a spurt of gains lacking great volume conviction. Reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria).

7/30/2018 12:25:40 PM - Gapped down on the prior session violating its 50 DMA line ($146) with a big volume-driven loss. Reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria).

7/27/2018 12:38:00 PM - Gapped down today and violated its 50 DMA line ($146) with a big volume-driven loss. Reported earnings +15% on +12% sales revenues for the Jun '18 quarter, below the +25% minimum earnings guideline (C criteria).

7/11/2018 12:39:33 PM - Consolidating near prior highs and its 50 DMA line which coincide and define important support in the $143 area. Reported earnings +30% on +1% sales revenues for the Mar '18 quarter. Quarterly comparisons have generally shown a sales revenues growth rate deceleration which is of some concern.

4/25/2018 12:48:55 PM - Gapped down today undercutting recent lows and slumping well below its 50 DMA line. Reported earnings +30% on +1% sales revenues for the Mar '18 quarter. Quarterly comparisons have generally shown a sales revenues growth rate deceleration which is of some concern.

2/2/2018 12:32:38 PM - Reported earnings +25% on +16% sales revenues and fundamentals remain strong. Gapped up today hitting a new all-time high, getting extended from any sound base. Recently wedged into new high territory with gains lacking great volume conviction. Its Relative Strength rating improved back above the 80+ minimum guideline for buy candidates. Patient investors may watch for a new base or secondary buy point to possibly develop and be noted in the weeks ahead.

9/27/2017 5:25:43 PM - Met resistance at its 50 DMA line and slumped in recent weeks. It will be dropped from the Featured Stocks list tonight due to technical deterioration. A rebound above its downward sloping 50 DMA line ($114) is needed for its outlook to improve. Fundamentals remain strong.

9/26/2017 6:07:19 PM - G - Met resistance at its 50 DMA line in recent weeks, and a rebound above its downward sloping 50 DMA line ($114.11) is needed for its outlook to improve. Its Relative Strength Rating has slumped to 45, below the 80+ minimum guideline for buy candidates, and it is -9.2% off its all-time high. Fundamentals remain strong.

9/19/2017 7:06:11 PM - G - A rebound above its downward sloping 50 DMA line ($114.73) is needed for its outlook to improve. Met resistance at its 50 DMA line and it has been pulling back with light volume. It is only -8.6% off its all-time high, but its Relative Strength Rating has slumped to 52, below the 80+ minimum guideline for buy candidates. Fundamentals remain strong.

9/13/2017 3:37:16 PM - G - Met resistance at its 50 DMA line and pulling back today with light volume. It is only -8.1% off its all-time high, but its Relative Strength Rating has slumped to 69, below the 80+ minimum guideline for buy candidates. A rebound above its downward sloping 50 DMA line ($115.20) is needed for its outlook to improve. Fundamentals remain strong.

9/6/2017 5:30:21 PM - G - Managed a "positive reversal" after slumping to new 16-week lows today, closing with a gain backed by above average volume.It is only -7.8% off its all-time high, but its Relative Strength Rating has slumped to 70, below the 80+ minimum guideline for buy candidates. A rebound above its downward sloping 50 DMA line ($115.64) is needed for its outlook to improve. Fundamentals remain strong.

9/5/2017 7:29:22 PM - G - Slumped with higher (above average) volume today closing -8.1% off its all-time high. Relative Strength Rating has slumped to 71, below the 80+ minimum guideline for buy candidates. A rebound above its downward sloping 50 DMA line ($115.76) is needed for its outlook to improve. Fundamentals remain strong.

8/29/2017 5:55:31 PM - G - Slumped with higher (near average) volume today closing -8.1% off its all-time high. Relative Strength Rating has slumped to 71, below the 80+ minimum guideline for buy candidates. A rebound above its downward sloping 50 DMA line ($116) is needed for its outlook to improve. Fundamentals remain strong.

8/23/2017 1:04:26 PM - G - Sputtering yet still perched only -7.2% off its 52-week and all-time high. Relative Strength Rating has slumped to 77, below the 80+ minimum guideline for buy candidates. A rebound above its 50 DMA line ($116.53) is needed for its outlook to improve. Fundamentals remain strong.

8/17/2017 11:17:34 AM - G - Perched only -5.6% off its 52-week and all-time high. Relative Strength Rating has slumped to 77, below the 80+ minimum guideline for buy candidates. A rebound above its 50 DMA line ($116.74) is needed for its outlook to improve. Fundamentals remain strong.

8/11/2017 5:59:13 PM - G - Perched within striking distance of its 52-week high but its Relative Strength Rating has slumped to 78, below the 80+ minimum guideline for buy candidates. Still lingering below its 50 DMA line ($116.91) which is now starting to slope downward. Fundamentals remain strong. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a new leg up.

8/7/2017 5:04:22 PM - G - Perched within striking distance of its 52-week high but its Relative Strength Rating has slumped to 75, below the 80+ minimum guideline for buy candidates. Still lingering below its 50 DMA line ($116.92). Reported Jun '17 quarterly earnings +42% on +11% sales revenues, continuing its strong earnings track record. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a new leg up. See the latest FSU analysis for more details and a new annotated graph.

8/1/2017 6:30:03 PM - G - Its Relative Strength Rating has slumped to 67, below the 80+ minimum guideline for buy candidates. Color code is changed to green while sputtering below its 50 DMA line ($116.77). Reported Jun '17 quarterly earnings +42% on +11% sales revenues, continuing its strong earnings track record. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a new leg up.

7/27/2017 1:20:48 PM - Y - Off earlier highs after gapping up today and rebounding above its 50 DMA line ($116.62). Reported Jun '17 quarterly earnings +42% on +11% sales revenues, continuing its strong earnings track record. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a new leg up.

7/25/2017 3:26:49 PM - Y - Pulling back below its 50 DMA line ($116.48) today raising some concerns. Due to report Jun '17 quarterly results following the close on Wednesday, July 26th, and volume and volatility often increase near earnings news. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a considerable new leg up. Volume totals have been mostly below average in recent weeks while holding its ground in a tight range.

7/19/2017 6:30:45 PM - Y - Posted a big gain today with above average volume, rallying from support at its 50 DMA line ($115.91). Color code was changed to yellow with new pivot point based on its 10/10/16 all-time high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a considerable new leg up. Volume totals have been mostly below average in recent weeks while holding its ground in a tight range.

7/18/2017 12:17:21 PM - Y - Consolidating near its 50 DMA line ($115.72) defining near term support. Color code was changed to yellow with new pivot point based on its 10/10/16 all-time high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a considerable new leg up. Volume totals have been mostly below average in recent weeks while holding its ground in a tight range.

7/17/2017 12:03:20 PM - Y - Consolidating above its 50 DMA line ($115.61) defining near term support. Color code was changed to yellow with new pivot point based on its 10/10/16 all-time high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a considerable new leg up. Volume totals have been mostly below average in recent weeks while holding its ground in a tight range.

7/13/2017 12:03:49 PM - Y - Color code was changed to yellow with new pivot point based on its 10/10/16 all-time high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a considerable new leg up. Volume totals have been mostly below average in recent weeks while holding its ground in a tight range perched within close striking distance of its all-time high. Its 50 DMA line ($115.38) defines near-term support to watch above recent lows in the $112 area.

7/12/2017 12:25:40 PM - Y - Color code was changed to yellow with new pivot point based on its 10/10/16 all-time high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a considerable new leg up. Volume totals have been mostly below average in recent weeks while holding its ground in a tight range perched within close striking distance of its all-time high. Its 50 DMA line ($115.23) defines near-term support to watch above recent lows in the $112-113 area.

7/11/2017 12:12:35 PM - Y - Color code is changed to yellow with new pivot point based on its 10/10/16 all-time high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal which could mark the beginning of a considerable new leg up. Volume totals have been mostly below average in recent weeks while holding its ground in a tight range perched within close striking distance of its all-time high. Its 50 DMA line ($115.05) defines near-term support to watch above recent lows in the $112-113 area.

7/6/2017 3:36:59 PM - G - Quietly pulling back after challenging its all-time high. Its 50 DMA line ($114.57) defines near-term support above recent lows in the $112-113 area.

6/30/2017 6:31:16 PM - G - Still perched within close striking distance of its all-time high. Recent low and its 50 DMA line define near-term support in the $112-113 area.

6/26/2017 6:08:30 PM - G - Perched within close striking distance of its all-time high. See the latest FSU analysis for more details and a new annotated graph.

6/19/2017 5:25:23 PM - G - Posted a solid gain today, and its color code is changed to green after rallying above its recent high and above its "max buy" level. Perched within close striking distance of its all-time high

6/12/2017 5:31:59 PM - Y - Ended in the upper half of its intra-day range with a loss on higher volume today. Recently wedged higher with gains lacking great volume conviction since highlighted in yellow in the 5/16/17 mid-day report with a pivot point based on its 4/26/17 high after a cup-with-handle base.

6/5/2017 2:42:02 PM - Y - Recently wedging higher with gains lacking great volume conviction since highlighted in yellow in the 5/16/17 mid-day report with a pivot point based on its 4/26/17 high after a cup-with-handle base.

5/30/2017 1:04:53 PM - Y - Holding its ground stubbornly with volume totals cooling since highlighted in yellow in the 5/16/17 mid-day report with a pivot point based on its 4/26/17 high after a cup-with-handle base.

5/22/2017 5:48:40 PM - Y - Posted a 3rd consecutive small gain with below average volume. Highlighted in yellow in the 5/16/17 mid-day report with a pivot point based on its 4/26/17 high after a cup-with-handle base.

5/17/2017 5:53:42 PM - Y - Pulled back today with near average volume. Highlighted in yellow in the 5/16/17 mid-day report with a pivot point based on its 4/26/17 high after a cup-with-handle base. See the latest FSU analysis for more details and a new annotated graph.

5/16/2017 1:26:06 PM - Y - Color code is changed to yellow with pivot point cited based on its 4/26/17 high after a cup-with-handle base. A gain backed by at least +40% above average volume may clinch a technical buy signal. Reported earnings +32% on +27% sales revenues for the Mar '17 quarter. Three of the past 4 quarterly comparisons had earnings above the +25% minimum guideline (C criteria) and its annual earnings growth (A criteria) is a good match with the fact-based investment system's fundamental guidelines.

10/14/2016 12:13:48 PM - Consolidating near its 50 DMA line. Made gradual progress following a breakaway gap on 7/27/16. Accelerating sales revenues and earnings growth is a reassuring sign after it reported earnings +33% on +23% sales revenues for the Jun '16 quarter. Prior quarterly comparisons were not a great match with the fact-based investment system's fundamental guidelines.

8/19/2016 12:50:28 PM - Hitting new 52-week and all-time highs today. Held its ground in a tight range following a breakaway gap on 7/27/16. Accelerating sales revenues and earnings growth is a reassuring sign after it reported earnings +33% on +23% sales revenues for the Jun '16 quarter. Prior quarterly comparisons were not a great match with the fact-based investment system's fundamental guidelines.

7/27/2016 12:44:05 PM - Hitting new 52-week and all-time highs today following a breakaway gap. Accelerating sales revenues and earnings growth is a reassuring sign after it reported earnings +33% on +23% sales revenues for the Jun '16 quarter. Prior quarterly comparisons were not a great match with the fact-based investment system's fundamental guidelines.

6/15/2016 12:17:44 PM - Slumping further below its 50 DMA line with higher volume behind today's loss, Last noted with caution in the 5/20/16 mid-day report - "Reported earnings +25% on +18% sales revenues for the Mar '16 quarter. Fundamental concerns remain as prior quarterly comparisons showed sub par earnings and sales revenues growth not indicative of great demand for new products or services (N criteria)."

5/20/2016 12:23:46 PM - Pulled back from its 52-week high and undercut its 50 DMA line with 3 consecutive volume-driven losses. Reported earnings +25% on +18% sales revenues for the Mar '16 quarter. Fundamental concerns remain as prior quarterly comparisons showed sub par earnings and sales revenues growth not indicative of great demand for new products or services (N criteria).

5/19/2016 12:21:57 PM - Pulling back from its 52-week high and undercutting its 50 DMA line with today's 3rd consecutive volume-driven loss. Reported earnings +25% on +18% sales revenues for the Mar '16 quarter. Fundamental concerns remain as prior quarterly comparisons showed sub par earnings and sales revenues growth not indicative of great demand for new products or services (N criteria).

5/18/2016 12:19:42 PM - Pulling back from its 52-week high and testing support at its 50 DMA line today. Reported earnings +25% on +18% sales revenues for the Mar '16 quarter. Fundamental concerns remain as prior quarterly comparisons showed sub par earnings and sales revenues growth not indicative of great demand for new products or services (N criteria).

4/5/2016 12:20:28 PM - Gapped up on the prior session for a new 52-week high. Prior mid-day reports noted - "Reported earnings +19% on +9% sales revenues for the Dec '15 quarter. Fundamental concerns remain due to sub par sales revenues growth which is indicative of no great demand for new products or services (N criteria). Reported earnings +34% on +1% sales revenues for the Sep '15 quarter."

4/4/2016 12:28:51 PM - Gapped up today for a new 52-week high. The 2/03/16 mid-day report last noted - "Reported earnings +19% on +9% sales revenues for the Dec '15 quarter. Fundamental concerns remain due to sub par sales revenues growth which is indicative of no great demand for new products or services (N criteria). Reported earnings +34% on +1% sales revenues for the Sep '15 quarter."

2/3/2016 12:39:13 PM - Gapped up today following raised guidance, challenging its 52-week high. Reported earnings +19% on +9% sales revenues for the Dec '15 quarter. Prior mid-day reports cautioned members - "Fundamental concerns remain due to sub par sales revenues growth which is indicative of no great demand for new products or services (N criteria). Reported earnings +34% on +1% sales revenues for the Sep '15 quarter."

1/27/2016 12:20:19 PM - Consolidating above its 50 DMA line after testing support at its 200 DMA line. Wedged into new high territory with gains lacking great volume conviction after noted with caution in the 10/27/15 mid-day report - "Fundamental concerns remain due to sub par sales revenues growth which is indicative of no great demand for new products or services (N criteria). Reported earnings +34% on +1% sales revenues for the Sep '15 quarter."

1/21/2016 1:02:26 PM - Pulled back from a new all-time high and tested support at its 200 DMA line. Wedged into new high territory with gains lacking great volume conviction after last noted with caution in the 10/27/15 mid-day report - "Fundamental concerns remain due to sub par sales revenues growth which is indicative of no great demand for new products or services (N criteria). Reported earnings +34% on +1% sales revenues for the Sep '15 quarter."

10/27/2015 12:37:09 PM - Fundamental concerns remain due to sub par sales revenues growth which is indicative of no great demand for new products or services (N criteria). Reported earnings +34% on +1% sales revenues for the Sep '15 quarter. Perched near its 52-week and all-time highs with no resistance remaining due to overhead supply.

10/26/2015 12:31:57 PM - Consolidating above its 50 DMA line after enduring distributional pressure when recently challenging its 52-week high. Found support near its 200 DMA line. Reported earnings +28% on +7% sales revenues for the Jun '15 quarter. Fundamental concerns remain, and prior mid-day reports cautioned members - "Prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

10/7/2015 12:40:19 PM - Sputtering near its 50 DMA line, enduring distributional pressure after challenging its 52-week high. Found support near its 200 DMA line recently. Reported earnings +28% on +7% sales revenues for the Jun '15 quarter. Fundamental concerns remain, and prior mid-day reports cautioned members - "Prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

10/5/2015 12:23:11 PM - Rebounded above its 50 and 200 DMA lines with 4 consecutive volume-driven gains and it is perched within striking distance of its 52-week high. Reported earnings +28% on +7% sales revenues for the Jun '15 quarter. Fundamental concerns remain, and prior mid-day reports cautioned members - "Prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

10/2/2015 12:38:20 PM - Rebounded above its 50 and 200 DMA lines with 4 consecutive volume-driven gains nearly challenging its 52-week high. Reported earnings +28% on +7% sales revenues for the Jun '15 quarter. Fundamental concerns remain, and prior mid-day reports cautioned members - "Prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

5/19/2015 12:09:14 PM - Still consolidating below its 50 DMA line, it found recent support above its 200 DMA line. Reported earnings +47% on +13% sales revenues for the Mar '15 quarter, however fundamental concerns remain. Noted with caution near its 52-week high in the 3/16/15 mid-day report following a big volume-driven gain - "Prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

4/28/2015 12:41:14 PM - Violated its 50 DMA line with damaging volume-driven losses. Reported earnings +47% on +13% sales revenues for the Mar '15 quarter, however fundamental concerns remain. Noted with caution near its 52-week high in the 3/16/15 mid-day report following a big volume-driven gain - "Prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

4/24/2015 12:43:54 PM - Undercutting its 50 DMA line with today's volume-driven loss. Reported earnings +47% on +13% sales revenues for the Mar '15 quarter, however fundamental concerns remain. Last noted with caution near its 52-week high in the 3/16/15 mid-day report following a big volume-driven gain - "Prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

3/16/2015 12:12:45 PM - Gapped up for a considerable volume-driven gain today hitting new 52-week highs. Reported earnings +12% on +15% sales revenues for the Dec '14 quarter. Fundamental concerns remain as when noted with caution in the 12/08/14 mid-day report - "Reported earnings +14% on +23% sales revenues for the quarter ended Sep 30, 2014 versus the year ago period, and prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

2/4/2015 12:16:35 PM - Gapped up for a considerable gain today rebounding from below its 50 DMA line to challenge its 52-week high. Reported earnings +12% on +15% sales revenues for the Dec '14 quarter. Fundamental concerns remain as when last noted with caution in the 12/08/14 mid-day report - "Reported earnings +14% on +23% sales revenues for the quarter ended Sep 30, 2014 versus the year ago period, and prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

12/8/2014 12:03:32 PM - Hitting another new 52-week high today. Stubbornly holding its ground and making steady progress since noted with caution in the 10/27/14 mid-day report following a big gap up gain- "Reported earnings +14% on +23% sales revenues for the quarter ended Sep 30, 2014 versus the year ago period, and prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

12/5/2014 12:29:39 PM - Perched near its 52-week high, stubbornly holding its ground and making steady progress since noted with caution in the 10/27/14 mid-day report following a big gap up gain- "Reported earnings +14% on +23% sales revenues for the quarter ended Sep 30, 2014 versus the year ago period, and prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

11/24/2014 12:30:43 PM - Perched near its 52-week high, wedging higher since noted with caution following volume-driven gains in the 10/27/14 mid-day report - "Reported earnings +14% on +23% sales revenues for the quarter ended Sep 30, 2014 versus the year ago period, and prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

10/27/2014 12:17:36 PM - Gapped up on the prior session for a new 52-week high. Rebounded above its 50 DMA line after briefly undercutting that important moving average while recently consolidating. Reported earnings +14% on +23% sales revenues for the quarter ended Sep 30, 2014 versus the year ago period, and prior comparisons were well below the +25% minimum earnings guideline (C criteria). It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11.

8/29/2012 12:11:55 PM - Rebounding above its 50 DMA line today with its 3rd consecutive gain, trading in an orderly fashion only -4% off its 52-week and all-time highs. The 7/25/12 mid-day report noted - "Reported earnings +37% on +12% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Earnings increases in the prior 4 quarterly comparisons through Mar '12 were well below the +25% minimum guideline. It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

7/26/2012 12:14:54 PM - Pulling back abruptly today following the prior session's gap up and volume-driven gain new 52-week and all-time highs. The 7/25/12 mid-day report noted - "Reported earnings +37% on +12% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Earnings increases in the prior 4 quarterly comparisons through Mar '12 were well below the +25% minimum guideline. It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11."

7/25/2012 12:31:25 PM - Gapped up today and hit new 52-week and all-time highs. Reported earnings +37% on +12% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Earnings increases in the prior 4 quarterly comparisons through Mar '12 were well below the +25% minimum guideline. It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11.

7/20/2012 12:50:19 PM - Reversed into the red after early gains today touched new 52-week and all-time highs. Earnings increases in the past 4 quarterly comparisons through Mar '12 were well below the +25% minimum guideline. It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11.

6/14/2012 11:59:04 AM - Considerable gain today for new 52-week and all-time highs. Earnings increases in the past 4 quarterly comparisons through Mar '12 were well below the +25% minimum guideline. It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11.

6/11/2012 12:08:17 PM - Little resistance remains due to overhead supply while perched only -2.7% off its 52-week and all-time highs. Earnings increases in the past 4 quarterly comparisons through Mar '12 were well below the +25% minimum guideline. It survived after a deep correction below its 200 DMA line, but it failed to impress since dropped from the Featured Stocks list on 7/22/11.

7/22/2011 11:36:10 AM - Violated its 200 DMA line today with another damaging loss on above average volume. Weakness in recent days triggered technical sell signals after failing to confirm a solid buy signal following its latest sound base pattern. Reported earnings +7% on +18% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Based on the fundamental disappointment and technical deterioration it will be dropped from the Featured Stocks list tonight.

7/21/2011 11:14:18 AM - G - Gapped down today, raising concerns while violating its 50 DMA line. Color code is charged to green while it is sinking near its prior lows in the $82 area that may act as support. Due to report earnings after today's close.

7/20/2011 6:01:40 PM - Y - This high-ranked Medical - Products firm was down today with nearly twice average volume, slumping to its 50 DMA line. Due to report earnings after the close on Thursday, July 21st.

7/18/2011 12:44:22 PM - Y - This high-ranked Medical - Products firm is up from the session's earlier lows, perched within close striking distance of its 52-week and all-time highs. Since featured in the 7/06/11 mid-day report it encountered mild distributional pressure and did not rally for a strong close above its pivot point to trigger a proper technical buy signal.

7/13/2011 8:53:23 PM - Y - This high-ranked Medical - Products firm is still quietly perched within close striking distance of its 52-week and all-time highs. Disciplined investors will watch first for volume-driven gains and a strong close above its pivot point to trigger a proper technical buy signal.

7/11/2011 4:57:10 PM - Y - This high-ranked Medical - Products firm is quietly perched within close striking distance of its 52-week and all-time highs. Disciplined investors will watch first for volume-driven gains and a strong close above its pivot point to trigger a proper technical buy signal. See the latest FSU analysis for more details and a new annotated weekly graph.

7/7/2011 7:30:19 PM - Y - The Medical - Products firm is challenging its 52-week and all-time highs with 8 consecutive small gains. Color code was changed to yellow, and a volume driven gain and strong close above its pivot point could trigger a technical buy signal. See the latest FSU analysis for more details and a new annotated weekly graph.

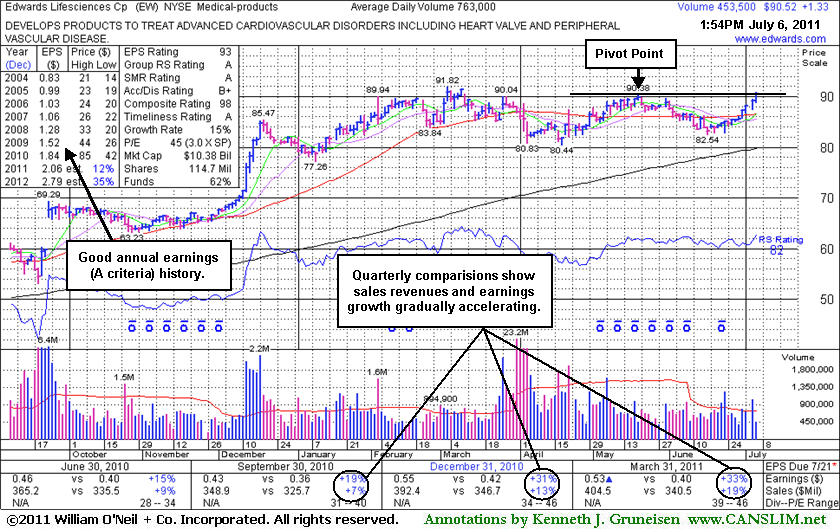

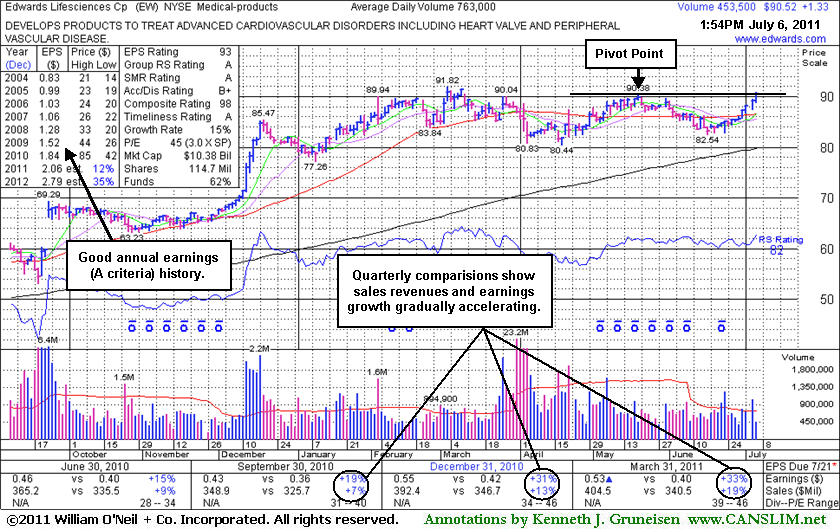

7/6/2011 - Y - The Medical - Products firm is challenging its 52-week and all-time highs today with its 7th consecutive small gain. Color code is changed to yellow, and a volume driven gain and strong close above its pivot point could trigger a technical buy signal. Recent quarterly comparisons showed accelerating sales revenues and earnings increases, and it has maintained a slow steady annual earnings (A criteria) history.

4/4/2011 12:22:53 PM - Churning above average volume while consolidating near support at its 50 DMA line. Its latest quarterly report showed slightly better earnings and sales revenues increases. Noted in prior mid-day reports - "The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.'"

4/1/2011 12:02:10 PM - Recently churning above average volume while consolidating near support at its 50 DMA line. Its latest quarterly report showed slightly better earnings and sales revenues increases. Noted in prior mid-day reports - "The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.'"

3/31/2011 12:19:51 PM - Recently finding prompt support at its 50 DMA line. Its latest quarterly report showed slightly better earnings and sales revenues increases. Noted in prior mid-day reports - "The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.'"

3/25/2011 12:02:16 PM - Gapped up today, promptly rebounding above its 50 DMA line which has acted as support. Its latest quarterly report showed slightly better earnings and sales revenues increases. Last noted in the 2/03/11 mid-day report - "The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.'"

2/3/2011 12:49:25 PM - Hit a new 52-week high today then reversed into the red following its latest quarterly earnings report showing better earnings growth. It recently inched to new highs after an orderly consolidation since noted on 12/20/10 - "The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.'"

1/20/2011 1:21:43 PM - Hovering near its 52-week high today following an orderly consolidation since noted on 12/20/10 - "After 11 consecutive gains, extended from its latest base. Found support near its 50 DMA line during an orderly base formed since noted in the 9/24/10 mid-day report following a considerable gap up - 'Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.'"

12/20/2010 12:28:50 PM - Hovering at its 52-week high today after 11 consecutive gains, extended from its latest base. Found support near its 50 DMA line during an orderly base formed since noted in the 9/24/10 mid-day report following a considerable gap up - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

12/16/2010 12:40:16 PM - Hovering at its 52-week high today after 9 consecutive gains, extended from its latest base. Found support near its 50 DMA line during an orderly base formed since noted in the 9/24/10 mid-day report following a considerable gap up - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

12/15/2010 12:32:14 PM - Hitting yet another new 52-week high today with a 9th consecutive gain, getting more extended from its latest base. Found support near its 50 DMA line during an orderly base formed since noted in the 9/24/10 mid-day report following a considerable gap up - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

12/14/2010 12:21:42 PM - Hitting yet another new 52-week high today with a 8th consecutive gain, getting extended from its latest base. Found support near its 50 DMA line during an orderly base formed since noted in the 9/24/10 mid-day report following a considerable gap up - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

12/13/2010 12:33:04 PM - Hitting a new 52-week high today with a 7th consecutive gain after finding support near its 50 DMA line during an orderly base formed since last noted in the 9/24/10 mid-day report following a considerable gap up - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

9/24/2010 12:34:33 PM - Holding its grond today, it gapped up on 9/23/10 for a new 52-week high amid headlines of an encouraging FDA approval. It recently rallied above its 50 DMA line, repairing damaging distribution, and it was noted in prior mid-day reports - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

9/23/2010 12:42:59 PM - Gapped up today for a new 52-week high amid headlines of an encouraging FDA approval. It recently rallied above its 50 DMA line, repairing damaging distribution, and it was noted in prior mid-day reports - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

9/22/2010 12:56:24 PM - Rallied above its 50 DMA line on 9/21/10 after enduring damaging distribution in recent weeks. Noted in prior mid-day reports - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

9/21/2010 12:41:53 PM - Rallying back above its 50 DMA line today after enduring damaging distribution in recent weeks. Noted in prior mid-day reports - "Endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

7/7/2010 1:01:39 PM - Gapped down today, pulling back from a new 52-week high reached on the prior session. Noted in prior mid-day reports that it - "endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

7/1/2010 12:23:50 PM - Pulling back today after a considerable gain for a new 52-week high on the prior session. Noted in prior mid-day reports that it - "endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

6/30/2010 12:13:52 PM - Considerable gain today for a new 52-week high. Noted in prior mid-day reports that it - "endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

6/24/2010 12:35:13 PM - Making a stand today near its 50 DMA line after a 6/23/10 gap down and considerable loss with higher volume. Noted in prior mid-day reports that it - "endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

6/23/2010 12:51:54 PM - Considerable loss with higher volume after gapping down today, pulling back near its 50 DMA line. Noted in prior mid-day reports that it - "endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

6/7/2010 1:16:18 PM - Consolidating above its 50 DMA line and only -3.3% off its 52-week high today. Noted in prior mid-day reports that it - "endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products."

6/2/2010 12:50:49 PM - Consolidating above its 50 DMA line and only -1% off its 52-week high today while making its 3rd mid-day report appearance in the span of 5 sessions. It has endured numerous distribution days since March yet it held up well, and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.

6/1/2010 12:33:39 PM - Consolidating above its 50 DMA line and only -2% off its 52-week high today. It has endured numerous distribution days since March, yet it held up well and on 5/28/10 its share price was impacted by a 2:1 split . The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.

5/26/2010 1:07:54 PM - Rallying above its 50 DMA line today. It has endured numerous distribution days since March. The Medical - Products firm has a slow but steady annual earnings history. Quarterly sales revenues and earnings increases have been below guidelines. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products.

1/22/2010 1:14:34 PM - Recent quarters showed good earnings increases, and it has a slow but steady annual earnings history. Sales revenues increases have been below guidelines, or fundamentally sub par. With respect to the N criteria, explosive sales revenues increases would be a true indication of great or growing demand for any company's products. Nonetheless, it has steadily advanced to all-time highs without forming any recent base since its 9/25/09 breakaway gap, having then cleared a big base-on-base pattern.

4/30/2009 1:17:45 PM - Recent quarters showed good earnings increases, and it has a slow but steady annual earnings history. Sales revenues increases have been below guidelines, or fundamentally sub par with respect to the N criteria. Explosive sales revenues increases would be a true indication of great demand for any company's products! It has been consolidating since its considerable gain on 4/28/09 helped it rally above recent chart highs to nearly challenge its 52-week high near $66.

4/29/2009 12:00:08 PM - Recent quarters showed good earnings increases, and it has a slow but steady annual earnings history. Sales revenues increases have been below guidelines, or fundamentally sub par with respect to the N criteria. Explosive sales revenues increases would be a true indication of great demand for any company's products! Its considerable gain on 4/28/09 helped it rally above recent chart highs to nearly challenge its 52-week high near $66.

3/12/2009 11:44:28 AM - Sales revenues increases have been below guidelines although recent quarters showed accelerating earnings growth and it has a slow but steady annual earnings history. It has overhead supply to contend with up to prior chart highs in the $66 area.

2/12/2009 12:57:41 PM - Sales revenues and earnings growth history has been below guidelines. Steadily rallied from support near $45, it appeas on course toward prior chart highs in the $66 area.