7/20/2023 12:30:18 PM - Panamanian Airline is perched at its 52-week high following volume-driven gains. Noted in prior mid-day reports - "Reported earnings +470% on +52% sales revenues for the Mar '23 quarter versus the year-ago period. Prior quarterly comparisons also showed great improvement. A big loss in FY '20 leaves fundamental concerns."

7/17/2023 12:25:14 PM - Panamanian Airline is perched at its 52-week high following volume-driven gains. Noted in prior mid-day reports - "Reported earnings +470% on +52% sales revenues for the Mar '23 quarter versus the year-ago period. Prior quarterly comparisons also showed great improvement. A big loss in FY '20 leaves fundamental concerns."

7/14/2023 12:11:21 PM - Panamanian Airline reversed into the red after today's early gain for a new 52-week high following a volume-driven gain. Noted in prior mid-day reports - "Reported earnings +470% on +52% sales revenues for the Mar '23 quarter versus the year-ago period. Prior quarterly comparisons also showed great improvement. A big loss in FY '20 leaves fundamental concerns."

6/20/2023 12:16:16 PM - Panamanian Airline is pulling back from its 52-week high with today's 3rd consecutive loss following volume-driven gains. Noted in prior mid-day reports - "Reported earnings +470% on +52% sales revenues for the Mar '23 quarter versus the year-ago period. Prior quarterly comparisons also showed great improvement. A big loss in FY '20 leaves fundamental concerns."

6/12/2023 12:39:05 PM - Panamanian Airline is perched at its 52-week high following volume-driven gains. Last noted in the 5/11/23 mid-day report - "Reported earnings +470% on +52% sales revenues for the Mar '23 quarter versus the year-ago period. Prior quarterly comparisons also showed great improvement. A big loss in FY '20 leaves fundamental concerns."

5/11/2023 12:13:42 PM - Gappped up today rallying for a new 52-week high. Reported earnings +470% on +52% sales revenues for the Mar '23 quarter versus the year-ago period. Prior quarterly comparisons also showed great improvement. A big loss in FY '20 leaves fundamental concerns.

3/23/2023 12:18:41 PM - Stalled after touching a new 52-week high on 3/09/23 and abruptly slumped below its 50 DMA line ($91.52). Reported earnings +127% on +55% sales revenues for the Dec '22 quarter versus the year-ago period. Prior quarterly comparisons also showed great improvement. A big loss in FY '20 leaves fundamental concerns.

2/3/2023 12:17:16 PM - Pulling back today after it was perched within striking distance of its 52 week high. Reported earnings +316% on +82% sales revenues for the Sep '22 quarter versus the year ago period. Prior quarterly comparisons also showed great improvement. A big loss in FY '20 leaves fundamental concerns.

11/19/2013 12:29:22 PM - Perched near its 52 week high following a small volume-driven loss indicative of distributional pressure on the prior session. Reported earnings +19% on +15% sales revenues for the Sep '13 quarter. Prior quarterly comparisons have not been strong and steady above the +25% guideline (C criteria), leaving fundamental concerns. Despite fundamental shortcomings its shares found support and then rallied considerably since dropped from the Featured Stocks list on 9/30/11.

10/10/2013 11:56:42 AM - Powering toward its 52 week high with today's gap up and volume-driven gain. Reported earnings +45% on +15% sales revenues for the Jun '13 quarter. Prior mid-day reports cautioned members - "Reported earnings +37% on +18% sales revenues for the Mar '13 quarter. The 5 prior quarterly comparisons had earnings below the +25% guideline (C criteria), leaving fundamental concerns. Despite fundamental shortcomings its shares found support and then rallied considerably since dropped from the Featured Stocks list on 9/30/11."

8/8/2013 12:30:44 PM - Perched near its 52 week high after volume-driven gains reaching new high territory. Reported earnings +45% on +15% sales revenues for the Jun '13 quarter. Found support at its 50 DMA line since last noted in the 5/24/13 mid-day report with caution - "Reported earnings +37% on +18% sales revenues for the Mar '13 quarter. The 5 prior quarterly comparisons had earnings below the +25% guideline (C criteria), leaving fundamental concerns. Despite fundamental shortcomings its shares found support and then rallied considerably since dropped from the Featured Stocks list on 9/30/11."

5/24/2013 12:28:47 PM - Perched near its 52 week high, consolidating after volume-driven gains into new high territory. Gapped up when last noted in the 5/14/13 mid-day report with caution - "Reported earnings +37% on +18% sales revenues for the Mar '13 quarter. The 5 prior quarterly comparisons had earnings below the +25% guideline (C criteria), leaving fundamental concerns. Despite fundamental shortcomings its shares found support and then rallied considerably since dropped from the Featured Stocks list on 9/30/11."

5/14/2013 12:20:15 PM - Gapped up for another new 52 week high today. Reported earnings +37% on +18% sales revenues for the Mar '13 quarter. The 5 prior quarterly comparisons had earnings below the +25% guideline (C criteria), leaving fundamental concerns. Despite fundamental shortcomings its shares found support and then rallied considerably since dropped from the Featured Stocks list on 9/30/11.

5/8/2013 12:15:00 PM - Hitting another new 52 week high with today's gap up gain. Recently found support at its 50 DMA line and prior highs defining near-term support in the $110-111 area. Reported earnings +4% on +18% sales revenues in the Dec '12 quarter. Prior mid-day reports cautioned - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

4/19/2013 12:13:01 PM - Hitting new 52 week highs today. Recently found support at its 50 DMA line and prior highs defining near-term support in the $110-111 area. Reported earnings +4% on +18% sales revenues in the Dec '12 quarter. Prior mid-day reports cautioned - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

4/11/2013 11:52:09 AM - Consolidating near its 50 DMA line and prior highs defining near-term support in the $110-111 area. Reported earnings +4% on +18% sales revenues in the Dec '12 quarter. Prior mid-day reports cautioned - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

1/24/2013 12:10:57 PM - Retreating from new 52-week highs hit last week. Prior mid-day reports cautioned - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

12/4/2012 11:52:31 AM - Rebounding toward its 52-week high today following a brief consolidation. Prior mid-day reports noted - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

11/19/2012 12:10:25 PM - Retreating from its 52-week high with above average volume behind today's 6th loss in the span of 7 sessions. It is extended from any sound base. Prior mid-day reports noted - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

11/14/2012 12:04:53 PM - Consolidating near its 52-week high, extended from any sound base. Prior mid-day reports noted - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

11/12/2012 12:22:54 PM - Consolidating near its 52-week high, extended from any sound base. Prior mid-day reports noted - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

11/9/2012 12:26:19 PM - Perched near its 52-week high, extended from any sound base. Prior mid-day reports noted - "Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

11/8/2012 12:03:42 PM - Perched at its 52-week high today. Reported earnings +8% on +24% sales revenues for the quarter ended September 30, 2012 versus the year ago period. That marks 4 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11.

10/31/2012 12:02:59 PM - Hit another new 52-week high today while adding to a recent spurt of volume-driven gains. The 10/19/12 mid-day report noted - "Reported earnings +3% on +21% sales revenues for the quarter ended June 30, 2012 versus the year ago period. That marks 3 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

10/19/2012 12:30:25 PM - Hitting new 52-week highs today while adding to a recent spurt of volume-driven gains. Reported earnings +3% on +21% sales revenues for the quarter ended June 30, 2012 versus the year ago period. That marks 3 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11.

6/8/2012 12:12:36 PM - Slumping below its 50 DMA line which has acted as resistance this week. Last noted in the 5/10/12 mid-day report when it hit a new 52-week high - "Reported earnings +10% on +29% sales revenues for the quarter ended March 31, 2012 versus the year ago period. That marks 2 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11."

5/10/2012 12:00:05 PM - Gapped up from below its 50 DMA line today and its considerable volume-driven gain helped it touch a new 52-week high. Reported earnings +10% on +29% sales revenues for the quarter ended March 31, 2012 versus the year ago period. That marks 2 quarterly comparisons with earnings below the +25% guideline since dropped from the Featured Stocks list on 9/30/11.

4/10/2012 12:28:41 PM - Hovering near its 52-week high today after making more progress following a big volume-driven gain on 3/26/12. Found support above its 50 DMA line while consolidating under prior chart highs since noted in the 2/21/12 mid-day report - "Reported earnings +3% on +23% sales revenues for the quarter ended December 31, 2011 versus the year ago period and went through a consolidation below its 200 DMA line again since noted in the 11/08/11 mid-day report - Its choppy consolidation is not considered to be a sound base pattern. The rebound above its 50 DMA line helped its outlook improve. Due to report earnings on November 9th. It promptly repaired a recent violation of its 200 DMA line after it was dropped from the Featured Stocks list on 9/30/11.'"

3/28/2012 12:05:29 PM - Hit another new 52-week high today, making more progress following a big volume-driven gain on 3/26/12. Found support above its 50 DMA line while consolidating under prior chart highs since noted in the 2/21/12 mid-day report - "Reported earnings +3% on +23% sales revenues for the quarter ended December 31, 2011 versus the year ago period and went through a consolidation below its 200 DMA line again since noted in the 11/08/11 mid-day report - Its choppy consolidation is not considered to be a sound base pattern. The rebound above its 50 DMA line helped its outlook improve. Due to report earnings on November 9th. It promptly repaired a recent violation of its 200 DMA line after it was dropped from the Featured Stocks list on 9/30/11.'"

3/26/2012 12:25:01 PM - Solid gain today on higher volume, hitting a new 52-week high. Found support above its 50 DMA line while consolidating under prior chart highs since last noted in the 2/21/12 mid-day report - "Reported earnings +3% on +23% sales revenues for the quarter ended December 31, 2011 versus the year ago period and went through a consolidation below its 200 DMA line again since noted in the 11/08/11 mid-day report - Its choppy consolidation is not considered to be a sound base pattern. The rebound above its 50 DMA line helped its outlook improve. Due to report earnings on November 9th. It promptly repaired a recent violation of its 200 DMA line after it was dropped from the Featured Stocks list on 9/30/11.'"

2/21/2012 12:22:55 PM - Pulling back from its 52-week high hit on the prior session, encountering distributional pressure today. Reported earnings +3% on +23% sales revenues for the quarter ended December 31, 2011 versus the year ago period and went through a consolidation below its 200 DMA line again since last noted in the 11/08/11 mid-day report - "Its choppy consolidation is not considered to be a sound base pattern. The rebound above its 50 DMA line helped its outlook improve. Due to report earnings on November 9th. It promptly repaired a recent violation of its 200 DMA line after it was dropped from the Featured Stocks list on 9/30/11."

11/8/2011 12:59:40 PM - Still hovering near its 52-week high today, however its choppy consolidation is not considered to be a sound base pattern. The rebound above its 50 DMA line helped its outlook improve. Due to report earnings on November 9th. It promptly repaired a recent violation of its 200 DMA line after it was dropped from the Featured Stocks list on 9/30/11.

11/2/2011 12:41:10 PM - Still perched near its 52-week high today, however its choppy consolidation is not considered to be a sound base pattern. The rebound above its 50 DMA line helped its outlook improve. Due to report earnings on November 9th. It promptly repaired a recent violation of its 200 DMA line after it was dropped from the Featured Stocks list on 9/30/11.

10/27/2011 12:05:23 PM - Perched near its 52-week high today, however its choppy consolidation is not considered to be a sound base pattern. The rebound above its 50 DMA line helped its outlook improve. It promptly repaired a recent violation of its 200 DMA line after it was dropped from the Featured Stocks list on 9/30/11.

10/24/2011 1:27:27 PM - Rallying near its 52-week high today, however its choppy consolidation is not considered to be a sound base pattern. The rebound above its 50 DMA line helped its outlook improve. It promptly repaired a recent violation of its 200 DMA line after it was dropped from the Featured Stocks list on 9/30/11.

9/30/2011 7:02:42 PM - Down today with above average volume testing its 200 DMA line previously noted as the next important support area to watch. Based on weak action it will be dropped from the Featured Stocks list tonight. Only a prompt rebound above its 50 DMA line would help its outlook improve.

9/29/2011 5:14:04 PM - G - Small gain today with below average volume. Holding its ground since a gap down on 9/22/11 violated its 50 DMA line and triggered a technical sell signal. Recent lows and its 200 DMA line define the next important support area to watch.

9/26/2011 7:05:40 PM - G - Gain today with above average volume halted a streak of 3 consecutive losses with above average volume that violated its 50 DMA line and raised concerns. See latest FSU analysis for more details and a new annotated weekly graph.

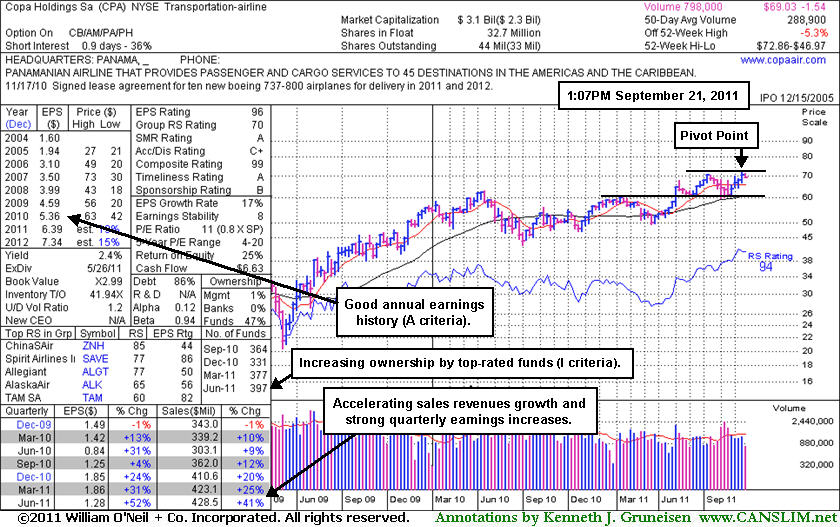

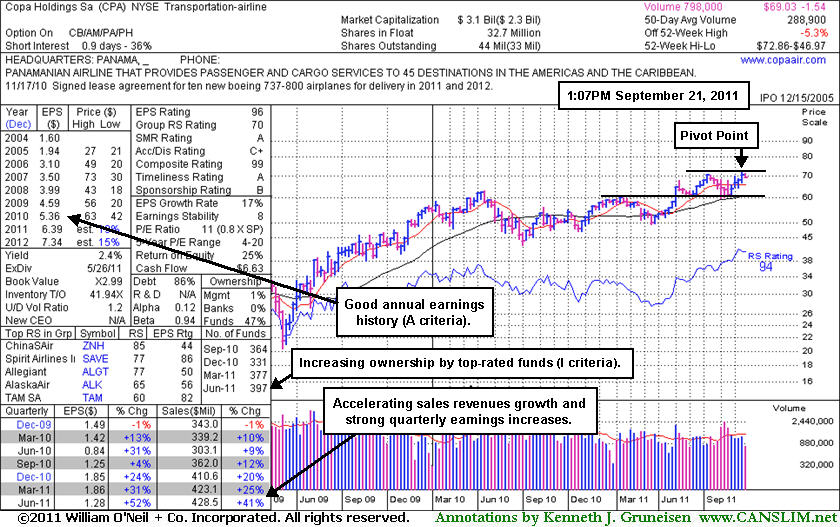

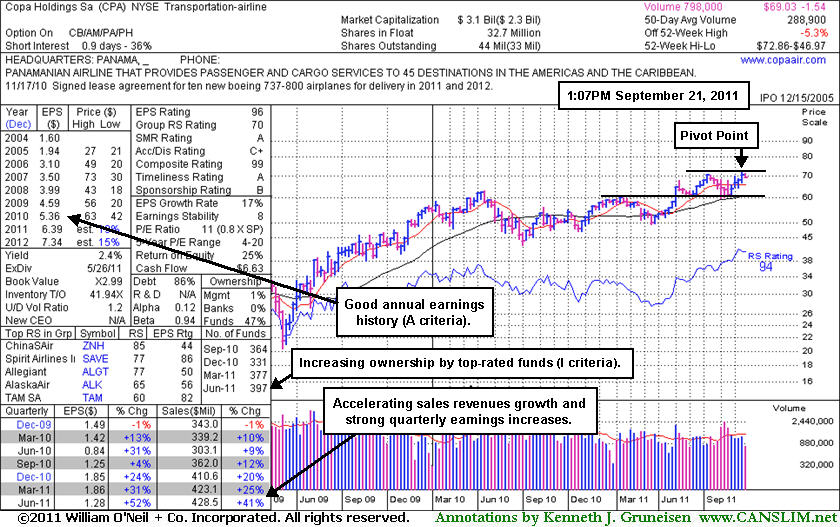

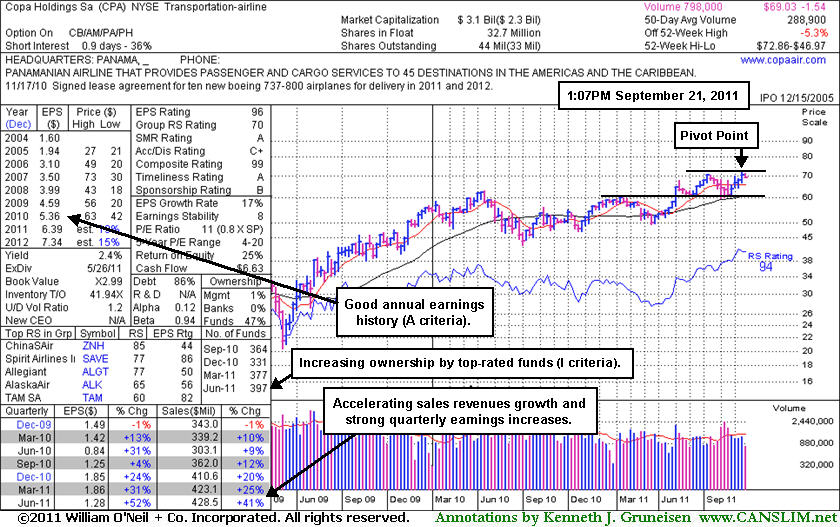

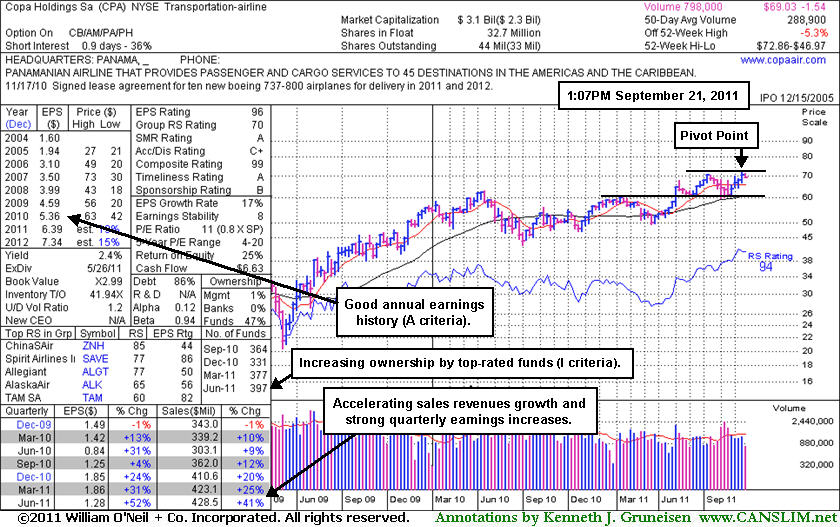

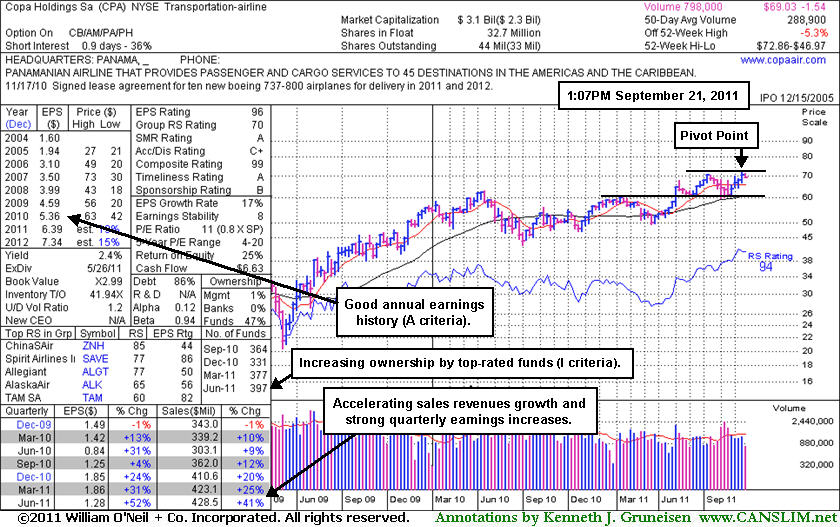

9/22/2011 9:53:40 AM - G - Gapped down today and violated its 50 DMA line raising concerns, and its color code is changed to green. Finished at the prior session low after a damaging loss with above average volume. While forming a high handle following a 10-week cup shaped base pattern it was highlighted in yellow in the 9/21/11 mid-day report with a pivot point based on its 9/14/11 high. It is normally best if the volume totals are light while a "handle" is formed, so the distributional loss it suffered may not bode well. Additionally, as it was noted earlier - "Confirming gains with heavy volume for a new high close are needed before disciplined investors might consider this high-ranked Panama-based airline a legitimate buy candidate. Found support above its 200 DMA line and prior highs in the $59 area during its recent consolidation. It is hovering near its 52-week high and within close striking distance of its 2007 all-time high ($73.33). Reported earnings +52% on +41% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Sales revenues and earnings have improved in the 3 most recent quarterly comparisons (Dec '10, Mar and Jun '11) after a streak of negative or weak comparisons. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

9/21/2011 6:43:24 PM - Y - Finished at the session low today after a damaging loss with above average volume. While forming a high handle following a 10-week cup shaped base pattern it was highlighted in yellow in today's mid-day report with a pivot point based on its 9/14/11 high. It is normally best if the volume totals are light while a "handle" is formed, so the distributional loss it suffered may not bode well. Additionally, as it was noted earlier - "Confirming gains with heavy volume for a new high close are needed before disciplined investors might consider this high-ranked Panama-based airline a legitimate buy candidate. Found support above its 200 DMA line and prior highs in the $59 area during its recent consolidation. It is hovering near its 52-week high and within close striking distance of its 2007 all-time high ($73.33). Reported earnings +52% on +41% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Sales revenues and earnings have improved in the 3 most recent quarterly comparisons (Dec '10, Mar and Jun '11) after a streak of negative or weak comparisons. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

9/21/2011 - Y - Confirming gains with heavy volume for a new high close are needed before disciplined investors might consider this high-ranked Panama-based airline a legitimate buy candidate. Color code is changed to yellow with pivot point based on its 9/14/11 high while it is now forming a high handle following a 10-week cup shaped base pattern. Found support above its 200 DMA line and prior highs in the $59 area during its recent consolidation. It is hovering near its 52-week high and within close striking distance of its 2007 all-time high ($73.33). Reported earnings +52% on +41% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Sales revenues and earnings have improved in the 3 most recent quarterly comparisons (Dec '10, Mar and Jun '11) after a streak of negative or weak comparisons. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

9/9/2011 12:06:35 PM - Reported earnings +52% on +41% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Found support above its 200 DMA line during its consolidation since noted in the 7/11/11 mid-day report - "Sales revenues and earnings have improved in the 2 most recent quarterly comparisons (Dec '10 and Mar '11) after a streak of negative or weak comparisons. This Panama-based airline is at its 52-week high and within close striking distance of its 2007 all-time high ($73.33). Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign."

9/8/2011 12:30:06 PM - Reported earnings +52% on +41% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Found support above its 200 DMA line during its consolidation since last noted in the 7/11/11 mid-day report - "Sales revenues and earnings have improved in the 2 most recent quarterly comparisons (Dec '10 and Mar '11) after a streak of negative or weak comparisons. This Panama-based airline is at its 52-week high and within close striking distance of its 2007 all-time high ($73.33). Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign."

7/11/2011 12:16:41 PM - Sales revenues and earnings have improved in the 2 most recent quarterly comparisons (Dec '10 and Mar '11) after a streak of negative or weak comparisons. This Panama-based airline is at its 52-week high and within close striking distance of its 2007 all-time high ($73.33). Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

6/16/2011 12:07:15 PM - Sales revenues and earnings have improved in the 2 most recent quarterly comparisons after a streak of negative or weak comparisons. This Panama-based airline is perched -7.4% off its 52-week high today, building a base above prior highs and its 50 DMA line. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

12/10/2009 12:31:36 PM - Fundamentals are below guidelines and sales revenues and earnings have decelerated for this Panama-based airline. It hit a new 52-week high today and found support at its 50 DMA line several times this year. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

8/26/2009 12:53:33 PM - Sales revenues and earnings have decelerated for this Panama-based airline. It hit a new 52-week high today and found support at its 50 DMA line several times this year. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

8/6/2009 12:41:57 PM - Gapped up today for a new 52-week high after reporting financial results showing just a +12% earnings increase on lower (-7%) sales revenues for the quarter ended June 30, 2009. The group's Relative Strength and ranks are poor, whereas studies of the greatest stock market winners found that the best stocks generally come from the top 22% of industry groups. Panama-based airline recently found support above its 50 DMA line. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

6/25/2009 12:38:18 PM - Rallying near its 52-week high today with its second consecutive gain backed by heavy volume. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign. The group's Relative Strength and ranks are poor, whereas studies of the greatest stock market winners found that the best stocks generally come from the top 22% of industry groups. Panama-based airline recently found support above its 50 DMA line.

7/6/2007 12:26:04 PM - Group rank below guidelines. Studies of the greatest stock market winners show the best stocks generally come from the top 22% of industry groups.

6/28/2007 12:30:23 PM - Group rank below guidelines. Studies of the greatest stock market winners show the best stocks generally come from the top 22% of industry groups.

5/17/2007 12:29:04 PM - Group rank below guidelines. Studies of the greatest stock market winners show the best stocks generally come from the top 22% of industry groups.

5/16/2007 12:29:31 PM - Group rank below guidelines. Studies of the greatest stock market winners show the best stocks generally come from the top 22% of industry groups.

2/14/2007 12:40:14 PM - Base remains somewhat questionable at this point to buy from. Fundamentals and ranks make guidelines.

2/13/2007 12:42:27 PM - Base remains questionable.

2/7/2007 12:38:35 PM - Base remains questionable.

2/5/2007 1:32:10 PM - Base remains questionable.

2/1/2007 12:35:03 PM - Base remains questionable.

1/17/2007 12:51:15 PM - Base remains questionable.

1/16/2007 12:53:02 PM - Base remains questionable.

1/11/2007 12:39:19 PM - Base remains questionable.

1/10/2007 12:37:16 PM - Base remains questionable.

1/9/2007 12:39:27 PM - Base remains questionable.

1/3/2007 12:57:46 PM - Base questionable.

12/13/2006 12:34:02 PM - No base to buy from.

12/12/2006 12:39:07 PM - No base to buy from.

12/11/2006 12:36:12 PM - No base to buy from.

11/24/2006 11:16:15 AM - No base to buy from.

11/20/2006 12:34:52 PM - New highs again today yet no base to buy from.

11/17/2006 12:58:08 PM - New highs today yet base remains questionable.

11/16/2006 1:02:58 PM - New highs today yet base remains questionable.

11/15/2006 12:29:18 PM - New highs today yet base remains questionable.

11/14/2006 12:33:20 PM - New highs today yet base remains questionable.

11/13/2006 12:38:23 PM - Gap open today yet base remains questionable.

10/23/2006 12:47:40 PM - Price is way too extended from the sound base of support of $24.

10/10/2006 12:32:22 PM - Price is way too extended from the sound base of support of $24.

10/4/2006 12:56:28 PM - Price is way too extended from the sound base of support of $24.

9/21/2006 12:46:00 PM - Price is way too extended from the sound base of support of $24.

9/20/2006 12:29:49 PM - Price is way too extended from the sound base of support of $24.

9/19/2006 12:43:37 PM - Price is way too extended from the sound base of support of $24.

9/14/2006 12:35:44 PM - Price is way too extended from the sound base of support of $24.

9/6/2006 12:43:53 PM - Price is way too extended from the sound base of support of $24.

9/1/2006 12:27:19 PM - Price is way too extended from the sound base of support of $24.

8/30/2006 12:52:45 PM - Price is way too extended from the sound base of support of $24.

8/28/2006 12:52:24 PM - Price is way too extended from the sound base of support of $24.

8/24/2006 12:43:57 PM - Price is way too extended from the sound base of support of $24.