11/20/2019 12:27:40 PM - Reported earnings +31% on +16% sales revenues for the Sep '19 quarter, its 2nd consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). There are 2,284 top-rated funds that reportedly own its shares as of Sep '19 and 708.7 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report -"Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

11/19/2019 1:55:59 PM - Reported earnings +31% on +16% sales revenues for the Sep '19 quarter, its 2nd consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). There are 2,283 top-rated funds that reportedly own its shares as of Sep '19 and 708.7 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report -"Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

11/18/2019 12:08:29 PM - Reported earnings +31% on +16% sales revenues for the Sep '19 quarter, its 2nd consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). There are 2,283 top-rated funds that reportedly own its shares as of Sep '19 and 708.7 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report -"Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

10/22/2019 12:19:34 PM - Due to report earnings news. Gapped up today. Reported earnings +32% on +15% sales revenues for the Jun '19 quarter. Prior quarters have been not been strong and steady above the +25% minimum earnings guideline (C criteria). There are 2,299 top-rated funds that reportedly own its shares as of Sep '19 and 708.7 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report -"Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

8/26/2019 12:00:21 PM - Gapped up today. Reported earnings +32% on +15% sales revenues for the Jun '19 quarter. Prior quarters have been not been strong and steady above the +25% minimum earnings guideline (C criteria). There are 2,415 top-rated funds that reportedly own its shares as of Jun '19 and 708.7 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report -"Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

6/24/2019 12:10:04 PM - Gapped down today and a big loss is violating its 50 DMA line ($95.30). Fundamentals through the Mar '19 quarter have been not been strong and steady above the +25% minimum earnings guideline (C criteria). There are 2,559 top-rated funds that reportedly own its shares as of Mar '19 and 705.3 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report -"Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

4/1/2019 1:10:55 PM - Gapped up on the prior session and it was noted with caution in the mid-day report - "Fundamentals through the Dec '18 quarter have been not been strong and steady above the +25% minimum earnings guideline (C criteria). There are 2,503 top-rated funds that reportedly own its shares as of Dec '18 and 699.3 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report -'Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria).'"

3/29/2019 12:42:54 PM - Gapped up today. Fundamentals through the Dec '18 quarter have been not been strong and steady above the +25% minimum earnings guideline (C criteria). There are 2,503 top-rated funds that reportedly own its shares as of Dec '18 and 699.3 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report - "Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

2/28/2019 12:25:25 PM - Gapped down today. Fundamentals through the Dec '18 quarter have been not been strong and steady above the +25% minimum earnings guideline (C criteria). There are 2,470 top-rated funds that reportedly own its shares as of Dec '18 and 699.3 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report - "Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

2/21/2019 12:21:01 PM - Fundamentals through the Dec '18 quarter have been not been strong and steady above the +25% minimum earnings guideline (C criteria). There are 2,478 top-rated funds that reportedly own its shares as of Dec '18 and 699.3 million shares outstanding. Went through a deep consolidation since noted with caution in the 10/05/17 mid-day report - "Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

2/4/2019 12:54:09 PM - Fundamentals through the Dec '18 quarter have been not been strong and steady above the +25% minimum earnings guideline (C criteria). There are 2,452 top-rated funds that reportedly own its shares as of Dec '18 and 699.3 million shares outstanding. Went through a deep consolidation since last noted with caution in the 10/05/17 mid-day report - "Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria)."

10/5/2017 11:51:41 AM - Gapped down today, retreating near its 50 DMA line ($137.48). Fundamentals through the Jun '17 quarter have been strong (good C and A criteria). Already owned by 2,871 top-rated funds (I criteria) and it has a large supply of 782.4 million shares outstanding (S criteria).

6/22/2017 12:42:28 PM - Technically it broke out on the prior session, and it is rallying near its all-time high with today's 5th consecutive volume-driven gain. Fundamentals through the Mar '17 quarter have been strong (good C and A criteria). Already owned by 2,821 top-rated funds (I criteria) and it has a large supply of 780.8 million shares outstanding (S criteria).

11/5/2015 12:20:11 PM - Gapped down today following Sep '15 earnings news. Last noted with caution in the 7/16/15 mid-day report near all-time highs following a "breakaway gap" on M&A news. Fundamentals have been mostly strong during its gradual ascent since dropped from the Featured Stocks list on 1/30/14. Already owned by 2,456 top-rated funds (I criteria) and it has a large supply of 790.5 million shares outstanding (S criteria).

7/16/2015 12:12:53 PM - Perched at new 52-week and all-time highs following a "breakaway gap" on the prior session on M&A news. Reported earnings +29% on +20% sales revenues for the Mar '15 quarter, but fundamental concerns remain. Found support near its 200 DMA line since noted with caution in the 4/24/15 mid-day report - "Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14."

7/15/2015 12:19:33 PM - Hitting new 52-week and all-time highs with today's "breakaway gap" following M&A news. Reported earnings +29% on +20% sales revenues for the Mar '15 quarter, but fundamental concerns remain. Found support near its 200 DMA line since last noted with caution in the 4/24/15 mid-day report - "Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14."

4/24/2015 12:28:49 PM - Rebounding near its 50 DMA line which may act as resistance. Slumped since last noted with caution in the 3/31/15 mid-day report - "Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14."

3/31/2015 12:32:37 PM - Violated its 50 DMA line and met resistance when rebounding after volume-driven losses. Prior mid-day reports cautioned - "Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14."

3/26/2015 12:25:15 PM - Violated its 50 DMA line on the prior session with a big volume-driven loss. Prior mid-day reports cautioned - "Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14."

3/23/2015 12:02:02 PM - Gapped down today, retreating from its 52-week high following 5 consecutive gains. Rallied from support at its 50 DMA line. The 3/20/15 mid-day report cautioned - "Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14."

3/20/2015 12:03:20 PM - Hitting a new 52-week high with today's 5th consecutive gain, rallying from support at its 50 DMA line. Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14.

2/20/2015 12:20:30 PM - Challenging its 52-week high with today's 5th consecutive gain from below its 50 DMA line. Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14.

2/13/2015 12:31:21 PM - Slumping below its 50 DMA line while enduring distributional pressure this week. Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14.

2/12/2015 12:16:21 PM - Perched near its 52-week high but testing support at its 50 DMA line while enduring distributional pressure in recent weeks. Reported earnings +33% on +19% sales revenues for the Dec '14 quarter, however, prior quarterly earnings comparisons were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded and rallied to new highs since dropped from the Featured Stocks list on 1/30/14.

1/13/2015 11:57:47 AM - Hitting a new 52-week high today, rallying clear of all resistance due to overhead supply. Found support above its 50 DMA line in recent weeks while building a new base. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

1/12/2015 12:13:04 PM - Finding support above its 50 DMA line in recent weeks while building a new base. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

12/26/2014 12:20:55 PM - Making its 3rd consecutive mid-day report appearance, finding support at its 50 DMA line this week following a damaging volume-driven loss indicative of heavy distributional pressure. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

12/24/2014 11:16:56 AM - Making its 2nd consecutive mid-day report appearance, finding support at its 50 DMA line today following a damaging volume-driven loss indicative of heavy distributional pressure. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

12/23/2014 12:25:41 PM - Violating its 50 DMA line with a damaging volume-driven loss today indicative of heavy distributional pressure. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

12/22/2014 12:09:44 PM - Rebounding near its 52-week high following mild distributional pressure. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

12/19/2014 12:14:22 PM - Rebounding near its 52-week high following mild distributional pressure. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

11/14/2014 12:09:38 PM - Retreating from its 52-week high with higher volume behind today's loss indicative of distributional pressure. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

10/24/2014 12:24:33 PM - Hitting new 52-week and all-time highs with a spurt of gains backed by above average volume. Reported earnings +24% on +18% sales revenues for the Sep '14 quarter. Prior mid-day reports repeatedly cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

10/23/2014 12:36:25 PM - Hitting new 52-week and all-time highs with today's considerable gap up gain backed by above average volume. Prior mid-day report cautioned members - "Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

10/22/2014 12:26:15 PM - Hit new 52-week and all-time highs with today's 4th consecutive gain backed by above average volume. Found support above its 200 DMA line and rebounded quickly after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14.

10/21/2014 12:26:03 PM - Rebounding above its 50 DMA line and challenging its 52-week and all-time highs with today's 3rd consecutive big gain backed by above average volume. Found support above its 200 DMA line after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter, its 4th consecutive earnings comparison below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14.

10/20/2014 12:22:13 PM - Found support above its 200 DMA line after damaging volume-driven losses. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter. There was a "negative reversal" at its 52-week high when noted with caution in the 9/25/14 mid-day report - "Fundamental concerns remain as the 3 latest quarterly earnings comparisons through Mar '14 were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

10/13/2014 12:21:30 PM - Slumping below its 50 DMA line and violating prior lows with today's 3rd consecutive loss. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter. There was a "negative reversal" at its 52-week high when last noted with caution in the 9/25/14 mid-day report - "Fundamental concerns remain as the 3 latest quarterly earnings comparisons through Mar '14 were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

9/25/2014 12:33:18 PM - Erasing much of the prior session's considerable gap up gain, abruptly reversing into the red after touching a new 52-week high today. Reported earnings +18% on +17% sales revenues for the Jun '14 quarter. Found support at its 50 DMA line and rallied to new high territory since last noted with caution in the 7/24/14 mid-day report - "Fundamental concerns remain as the 3 latest quarterly earnings comparisons through Mar '14 were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

7/24/2014 12:11:10 PM - Gapped down today with higher volume while retreating from its 52-week high, a sign of distributional pressure following its Jun '14 quarterly earnings report. Last noted with caution in the 7/09/14 mid-day report - "Fundamental concerns remain as the 3 latest quarterly earnings comparisons through Mar '14 were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14."

7/9/2014 12:14:00 PM - Rebounding toward its 52-week high today after a bout of distributional pressure on the prior session. Fundamental concerns remain as the 3 latest quarterly earnings comparisons through Mar '14 were below the +25% minimum guideline (C criteria). It undercut its 200 DMA line during its consolidation then rebounded since dropped from the Featured Stocks list on 1/30/14.

1/30/2014 5:25:49 PM - Down again today with above average volume, raising greater concerns while slumping further below its 50 DMA line. It will be dropped from the Featured Stocks list tonight. See the latest FSU analysis for more details and new annotated graphs.

1/27/2014 12:15:14 PM - G - Down considerably today undercutting prior lows in the $157 area raising greater concerns. Violated its 50 DMA line on the prior session triggering technical sell signals.

1/24/2014 4:14:33 PM - G - Violated its 50 DMA line with today's loss on high volume raising greater concerns and triggering technical sell signals. Only a prompt rebound above the 50 DMA line would help its outlook improve.

1/21/2014 3:18:01 PM - G - Hovering within close striking distance of its 52-week high and still consolidating above its 50 DMA line which has acted as support recently. Subsequent violations would raise greater concerns and trigger technical sell signals.

1/13/2014 12:48:57 PM - G - Touched a new 52-week high today followed by a "negative reversal" for a loss on high volume. Its 50 DMA line which acted as support recently. Subsequent violations would raise greater concerns and trigger technical sell signals.

1/10/2014 5:58:46 PM - G - Holding its ground above its 50 DMA line which acted as support recently. Subsequent violations would raise greater concerns and trigger technical sell signals.

1/7/2014 5:31:02 PM - G - Halted its slide today following a damaging gap down on the prior session, retreating near its 50 DMA line which acted as support recently. Subsequent violations would raise greater concerns and trigger technical sell signals. See the latest FSU analysis for more details and new annotated daily and weekly graphs.

1/6/2014 11:59:02 AM - G - Gapped down today, retreating from its 52-week high with higher volume, slumping near its 50 DMA line which acted as support recently. Subsequent violations would raise greater concerns and trigger technical sell signals.

12/31/2013 5:23:06 PM - G - Perched within close striking distance of its 52-week high. Found prompt support near its 50 DMA line recently. Subsequent violations would raise greater concerns and trigger technical sell signals.

12/24/2013 2:48:25 PM - G - Found prompt support near prior highs in the $161 area and its 50 DMA line recently. Subsequent violations would raise greater concerns and trigger technical sell signals.

12/18/2013 1:48:58 PM - G - Undercutting prior highs in the $161 area while slumping near its 50 DMA line ($157.11 now) as it retreats from all-time highs with today's 6th consecutive loss. More damaging losses violating the 50 DMA line would raise greater concerns.

12/11/2013 6:00:39 PM - G - Retreated from its 52-week and all-time highs with today's loss after 5 consecutive gains. Prior highs in the $161 area define initial support to watch above its 50 DMA line.

12/9/2013 12:16:30 PM - G - Gapped up hitting new 52-week and all-time highs with today's 4th consecutive gain, getting extended from prior highs in the $161 area defining initial support to watch on pullbacks. See the latest FSU analysis for more details and annotated daily and weekly graphs.

12/4/2013 7:01:02 PM - G - Hovering near its 52-week and all-time highs with volume totals cooling. See the latest FSU analysis for more details and a new annotated daily and weekly graphs.

11/29/2013 2:54:45 PM - G - Hovering near its 52-week and all-time highs with volume totals cooling after volume-driven gains to new highs. Earnings +21% on +18% sales revenues for the Sep '13 quarter were below the +25% minimum guideline (C criteria) raising fundamental concerns.

11/22/2013 8:12:14 PM - G - Rallied for new 52-week and all-time highs with above average volume behind today's 7th consecutive gain. The prior low ($142.10 on 11/07/13) is the next technical support level where a subsequent violation may trigger a more worrisome technical sell signal. Earnings +21% on +18% sales revenues for the Sep '13 quarter were below the +25% minimum guideline (C criteria) raising fundamental concerns.

11/18/2013 1:32:00 PM - G - Rebounding above its 50 DMA line today, but recent gains have been lacking great volume conviction. The prior low ($142.10 on 11/07/13) is the next technical support level where a subsequent violation may trigger a more worrisome technical sell signal. Earnings +21% on +18% sales revenues for the Sep '13 quarter were below the +25% minimum guideline (C criteria) raising fundamental concerns.

11/12/2013 6:52:08 PM - G - Still lingering below its 50 DMA line. The prior low ($142.10 on 11/07/13) is the next technical support level where a subsequent violation may trigger a more worrisome technical sell signal. Earnings +21% on +18% sales revenues for the Sep '13 quarter were below the +25% minimum guideline (C criteria) raising concerns.

11/6/2013 4:01:21 PM - G - Slumping further below its 50 DMA line with today's damaging volume-driven loss raising more concerns. Earnings +21% on +18% sales revenues for the Sep '13 quarter were below the +25% minimum guideline (C criteria) raising concerns. The prior low ($143.13 on 10/09/13) is the next technical support level where a subsequent violation may trigger a more worrisome technical sell signal.

11/1/2013 6:18:05 PM - G - Halted its slide at its 50 DMA line with today's gain on light volume. The prior low ($143.13 on 10/09/13) is the next technical support level where a subsequent violation may trigger a more worrisome technical sell signal. See the latest FSU analysis for more details and new annotated daily and weekly analysis.

10/30/2013 3:13:19 PM - G - Slumping near its 50 DMA line with today's 5th loss in 6 sessions while retreating from all-time highs. Its 50 DMA line ($150.07 now) defines important near-term support while the prior low ($143.13 on 10/09/13) is the next technical support level where subsequent violations may trigger technical sell signals.

10/24/2013 5:35:24 PM - G - Encountered distributional pressure today yet remains perched near all-time highs. The recent low ($143.13 on 10/09/13) defines important near-term support where a subsequent violation may trigger a more worrisome technical sell signal.

10/17/2013 4:08:28 PM - G - Wedged above its "max buy" level and its color code is changed to green after inching higher on light volume for a 6th consecutive small gain and a new all-time high. Found support at its 50 DMA line last week as it did on prior pullbacks. The recent low ($143.13 on 10/09/13) defines important near-term support where a subsequent violation may trigger a more worrisome technical sell signal.

10/11/2013 6:13:07 PM - Y - Posted gains on lighter volume after finding support at its 50 DMA line this week. The recent low ($143.13 on 10/09/13) defines important near-term support where a subsequent violation may trigger a more worrisome technical sell signal.

10/9/2013 12:24:47 PM - Y - Today's 3rd consecutive loss is testing important near-term support near its 50 DMA line ($145.17 now) and prior lows where violations may trigger technical sell signals.

10/4/2013 11:32:47 PM - Y - Rallied for a best-ever close and hit another new 52-week high today. It is trading near its "max buy" level. Its 50 DMA line ($144.88 now) defines near-term support to watch.

9/30/2013 12:08:55 PM - Y - Hitting another new 52-week high today. Finished strong on Friday with +53% above average volume while rising above its previously cited pivot point confirming a technical buy signal. Its 50 DMA line ($143.44 now) defines near-term support to watch.

9/27/2013 4:22:42 PM - Y - Hit a new 52-week high today and finished strong with +53% above average volume while rising above its previously cited pivot point confirming a technical buy signal. Its 50 DMA line ($142.62 now) defines near-term support to watch.

9/27/2013 11:56:47 AM - Y - Hitting a new 52-week high today with volume running at an above average pace while rising above its previously cited pivot point. Its 50 DMA line ($142.62 now) defines near-term support to watch.

9/26/2013 5:56:16 PM - Y - Rallied for a best-ever close with today's gain backed by +18% above average volume. Hit a new 52-week high on 9/20/13 with +208% above average volume, but it finished the just below the pivot point. Its 50 DMA line ($142.60 now) defines near-term support to watch.

9/24/2013 6:17:17 PM - Y - Encountered mild distributional pressure today. Hit a new 52-week high on 9/20/13 with +208% above average volume, but it finished the just below the pivot point. Its 50 DMA line ($142.14 now) defines near-term support to watch.

9/20/2013 5:41:39 PM - Y - Hit a new 52-week high today with +208% above average volume, but it finished just below the new pivot point recently cited. See the latest FSU analysis for more details and a new annotated graph.

9/20/2013 12:17:42 PM - Y - Hitting a new 52-week high today with volume running at an above average pace while rising above the new pivot point cited based on its 8/01/13 high plus 10 cents. Gains above the pivot point backed by at least +40% above average volume may trigger a proper new (or add-on) technical buy signal. It formed a base-on-base type pattern. Its 50 DMA line defines important chart support.

9/12/2013 4:08:38 PM - Y - Wedging into new high territory this week with a streak of gains lacking volume conviction. New pivot point is cited based on its 8/01/13 high plus 10 cents, and subsequent volume-driven gains may trigger a new (or add-on) technical buy signal. It formed a base-on-base type pattern. Its 50 DMA line defines important chart support.

9/4/2013 11:55:25 AM - Y - Building a base-on-base type pattern, it recently found support above prior highs in the $131 area and above its 50 DMA line, important chart support levels.

8/27/2013 7:53:51 PM - Y - Down today amid widespread market weakness (M criteria). Still consolidating above prior highs in the $131 area and above its 50 DMA line, defining important chart support.

8/21/2013 9:42:54 PM - Y - Consolidating above prior highs in the $131 area coinciding with its 50 DMA line, defining important chart support. See the latest FSU analysis for more details and a new annotated graph.

8/13/2013 6:43:38 PM - Y - Color code is changed to yellow after retreating below its "max buy" level with a loss today on average volume. Prior highs in the $131 area define initial chart support above its 50 DMA line.

8/6/2013 4:14:26 PM - G - Retreated from its 52-week and all-time highs with near average but higher volume today. Extended from its prior base and support at old highs in the $131 area.

7/29/2013 6:00:46 PM - G - Extended from its prior base after last week's volume-driven gains, it is now consolidating above prior highs defining initial support in the $131 area. See the latest FSU analysis for more details and a new annotated graph.

7/25/2013 5:52:53 PM - Y - Rallied today for a solid gain and a best-ever close with average volume. Found support when consolidating above prior highs following its "breakaway gap".

7/23/2013 5:52:02 PM - Y - Touched a new high but reversed into the red today. Prior highs define initial support to watch. Breakaway gap and solid gain with twice average volume on 7/11/13 triggered a technical buy signal. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price.

7/18/2013 12:40:33 PM - Y - Up from earlier lows after a small gap down today. Prior highs define initial support to watch. Breakaway gap and solid gain with twice average volume on 7/11/13 triggered a technical buy signal. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price.

7/12/2013 6:21:32 PM - Y - Held its ground today. Breakaway gap and solid gain with twice average volume triggered a technical buy signal on the prior session as it finished above the new pivot point cited based on its 5/14/13 high plus 10 cents. See the latest FSU analysis for more details and an annotated graph.

7/11/2013 7:33:37 PM - Y - Breakaway gap and solid gain with twice average volume triggered a technical buy signal as it finished above the new pivot point cited based on its 5/14/13 high plus 10 cents. It has returned to the Featured Stocks list and is covered in greater detail in the latest FSU analysis with an annotated graph.

7/11/2013 12:28:34 PM - Y - Color code is changed to yellow with new pivot point based on its 5/14/13 high plus 10 cents. Gapped up today hitting a new 52-week high. Rebounded above its 50 DMA line with recent gains lacking great volume conviction yet helping its technical stance improve after sputtering since dropped from the Featured Stocks list on 6/05/13.

6/12/2013 12:48:55 PM - Gapped up above its 50 DMA line but reversed the early gain and slumped into the red. That important short-term average may now act as a resistance level following previously noted technical sell signals including the violation of its 5/02/13 low $114.05. A rebound above its 50 DMA line is needed for its outlook to improve. It was dropped from the Featured Stocks list on 6/05/13. See the latest FSU analysis for more details and an annotated graph.

6/5/2013 7:23:29 PM - Sank deeper below its 50 DMA line with a 4th consecutive loss backed by above average volume. Triggered another more worrisome technical sell signal as it violated the prior low (5/02/13 low $114.05) defining important chart support. It will be dropped from the Featured Stocks list tonight. See the latest FSU analysis for more details and a new annotated graph.

6/4/2013 7:03:50 PM - G - Slumped below its 50 DMA line with 3rd consecutive loss backed by above average volume triggering a technical sell signal. Prior low (5/02/13 low $114.05) defines the next important near-term chart support where a violation may raise more serious concerns.

6/3/2013 2:08:27 PM - G - Trading near its 50 DMA line after slumping lower with a 2nd consecutive loss backed by above average volume. Deterioration below that important short-term average may be considered a technical sell signal.

5/31/2013 7:09:54 PM - G - Loss today on above average volume after a "negative reversal", encountering more worrisome distributional pressure. A violation of its 50 DMA line (now $120.78) would raise concerns and trigger a technical sell signal. It is extended from any sound base pattern, yet may go on to produce more climactic gains.

5/28/2013 4:03:58 PM - G - Still consolidating above its 50 DMA line after encountering distributional pressure. A violation of its 50 DMA line (now $119.76) would raise concerns and trigger a technical sell signal. It is extended from any sound base pattern, yet may go on to produce more climactic gains.

5/23/2013 3:33:59 PM - G - Holding its ground above its 50 DMA line after encountering distributional pressure. A violation of its 50 DMA line (now $119.60) would raise concerns and trigger a technical sell signal. It is extended from any sound base pattern, yet may go on to produce more climactic gains.

5/17/2013 12:04:08 PM - G - Pulling back for a 3rd consecutive session, retreating from all-time highs. It is extended from any sound base pattern, yet may go on to produce more climactic gains. Found support at its 50 DMA line during its recent consolidation and that short-term average defines important near-term support to watch.

5/16/2013 11:55:56 AM - G - Gapped down today retreating from all-time highs. It is extended from any sound base pattern, yet may go on to produce more climactic gains. Found support at its 50 DMA line during its recent consolidation and that short-term average defines important near-term support to watch.

5/13/2013 6:01:50 PM - G - Rallied to another new high with today's 2nd consecutive gain backed by slightly above average volume. Found support at its 50 DMA line during its recent consolidation. It is extended from any sound base pattern. See the latest FSU analysis for more details and a new annotated graph.

5/10/2013 6:03:04 PM - G - Rallied to a new high close with today's considerable volume-driven gain. Found support at its 50 DMA line during its recent consolidation. It is extended from any sound base pattern.

5/6/2013 6:33:38 PM - G - Found support at its 50 DMA line as it managed a positive reversal on 5/02/13. That session's low ($114.05) defines important near-term support below its short-term average. It is extended from any sound base pattern.

4/30/2013 6:07:42 PM - G - Enduring more distributional pressure yet still stubbornly holding its ground only -8.1% off its high. It is extended from any sound base. Its 50 DMA line ($113 now) defines important near-term support to watch.

4/25/2013 11:54:30 AM - G - Holding its ground today after encountering distributional pressure and gapping down on the prior session, retreating with above average volume from its high. It is extended from any sound base. Its 50 DMA line ($111.84 now) defines important near-term support to watch.

4/24/2013 11:59:59 AM - G - Gapped down today, retreating from a new all-time high hit on the prior session before reversing into the red. It is extended from any sound base. Its 50 DMA line ($111.45 now) defines important near-term support to watch.

4/22/2013 8:23:45 PM - G - Gapped up today and hit a new all-time high, getting more extended from any sound base. Its 50 DMA line defines important near-term support to watch.

4/19/2013 7:23:45 PM - G - Consolidating above its "max buy" level, holding its ground after wedging to new highs from an advanced "3-weeks tight" base with only average volume behind its gains. Its 50 DMA line defines important near-term support to watch. See the latest FSU analysis for more details and a new annotated graph.

4/19/2013 1:07:44 PM - G - Consolidating above its "max buy" level, holding its ground after wedging to new highs from an advanced "3-weeks tight" base with only average volume behind its gains. Its 50 DMA line defines important near-term support to watch.

4/12/2013 3:09:14 PM - G - Color code is changed to green as it is now extended from any sound base pattern after wedging to new highs from an advanced "3-weeks tight" base with only average volume behind its gains

4/5/2013 6:32:33 PM - Y - It recently wedged to new highs from an advanced "3-weeks tight" base with only average volume behind its gains above the new pivot point cited based on its 3/14/13 high plus 10 cents.

3/28/2013 6:05:26 PM - Y - It wedged to new highs from an advanced "3-weeks tight" base with only average volume behind its gain today above the new pivot point cited based on its 3/14/13 high plus 10 cents. See the latest FSU analysis for more details and a new annotated weekly graph.

3/27/2013 6:30:10 PM - Y - It has formed an advanced "3-weeks tight" base and its color code is changed to yellow with new pivot point cited based on its 3/14/13 high plus 10 cents. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal. Meanwhile its 50 DMA line defines important support to watch.

3/19/2013 5:34:37 PM - G - Hovering near its all-time high after 3 consecutive small losses. Very extended from any sound base. Its 50 DMA line defines important support to watch.

3/12/2013 1:09:23 PM - G - Wedging further into new all-time high territory with today's 6th consecutive gain, getting very extended from any sound base. Its 50 DMA line defines important support to watch.

3/5/2013 1:52:36 PM - G - Hitting new all-time highs yet again with today's gain, getting extended from any sound base. Recent lows in the $96 area define near-term support above its 50 DMA line.

2/28/2013 2:14:59 PM - G - Held its ground in a tight range in recent weeks but did not form a sound base pattern before spiking to a new all-time high with today's volume-driven gain. Recent lows in the $96 area define near-term support above its 50 DMA line.

2/26/2013 1:57:46 PM - G - Holding its ground near its all-time high after a "negative reversal" on 2/20/13. Its 50 DMA line (now $92.69) defines important support to watch on pullbacks.

2/21/2013 1:24:17 PM - G - Pulling back today following a worrisome "negative reversal" on the prior session, reversing into the red for a loss on heavy volume and closing near the session low after initial gains for new all-time highs. Its 50 DMA line (now $91.17) defines important support to watch on pullbacks.

2/14/2013 7:02:13 PM - G - Volume totals have been cooling in recent weeks while it has stubbornly hovered near its all-time high, holding its ground. That price/volume action is an encouraging indication that few investors have been headed for the exit. Its 50 DMA line (now $89.92) defines important support to watch on pullbacks.

2/8/2013 4:00:02 PM - G - Still perched near its all-time high, holding its ground stubbornly while very extended from its prior base.

2/4/2013 6:19:32 PM - G - Perched near its all-time high, very extended from its prior base. See latest FSU analysis for more details and a new annotated graph.

2/1/2013 6:14:56 PM - G - Hit new 52-week and all-time highs with today's volume-driven gain after hovering in a tight range near its all-time high, very extended from its prior base.

1/30/2013 2:09:49 PM - G - Volume totals have been cooling while hovering in a tight range near its all-time high, very extended from its prior base. See the recent Featured Stock Update (FSU) analysis for the latest annotated graph and more details under the headline, "Rule Suggests Letting Explosive Winners Have Time For Greater Gains - Thursday, January 17, 2013 ".

1/24/2013 2:59:35 PM - G - Hovering in a tight range near its all-time high, very extended from its prior base. See the recent Featured Stock Update (FSU) analysis for the latest annotated graph and more details under the headline, "Rule Suggests Letting Explosive Winners Have Time For Greater Gains - Thursday, January 17, 2013 ".

1/18/2013 4:28:11 PM - G - Hit a new all-time high and finished near the session high today. Very extended from its prior base, but having rallied more than +20% in the first 2-3 weeks after its breakout, the investment system rules suggest holding such winners for a minimum of 8 weeks. See the latest FSU analysis for more details and a new annotated graph.

1/17/2013 5:05:24 PM - G - Very extended from its prior base, but having rallied more than +20% in the first 2-3 weeks after its breakout, the investment system rules suggest holding such winners for a minimum of 8 weeks. See the latest FSU analysis for more details and a new annotated graph.

1/15/2013 11:57:51 AM - G - Hit another new 52-week high today while on track for its 11th consecutive gain, very extended from its prior base. Having quickly rallied more than +20% in the first 2-3 weeks after a breakout, the investment system rules suggest holding such winners for a minimum of 8 weeks.

1/11/2013 11:58:39 AM - G - Perched at its 52-week high today after a streak of 8 consecutive gains, very extended from its prior base. Prior highs near $81-82 define initial support to watch on pullbacks.

1/10/2013 12:03:50 PM - G - On track for an 8th consecutive gain today, getting very extended from its prior base. Prior highs near $81-82 define initial support to watch on pullbacks.

1/9/2013 12:00:45 PM - G - On track for a 7th consecutive gain today with ever-increasing volume, getting very extended from its prior base. Raised its guidance and rallied well above its "max buy" level with heavy volume while adding to its streak of consecutive gains. Prior highs near $81-82 define initial support to watch on pullbacks.

1/8/2013 12:03:59 PM - G - After a strong finish on the prior session it gapped up today, getting more extended from its prior base. Raised its guidance and rallied well above its "max buy" level with heavy volume while adding to its streak of consecutive gains. Prior highs near $81-82 define initial support to watch on pullbacks.

1/7/2013 5:32:52 PM - G - Raised its guidance and hit a new 52-week high while rallying well above its "max buy" level with heavy volume behind today's 5th consecutive gain, and its color code is changed to green after getting extended from its prior base.

1/7/2013 12:10:17 PM - Y - Edging to new 52-week highs near its "max buy" level with today's 5th consecutive gain. Its 50 DMA acted as support during the recent consolidation, but waning RS Rating has been noted as cause for concern.

1/3/2013 5:54:30 PM - Y - Its 50 DMA acted as support during the recent consolidation, but waning RS Rating is cause for concern. See latest FSU analysis for more details and a new annotated graph.

1/2/2013 4:05:27 PM - Y - Gapped up today and tallied a solid gain with slightly above average volume, rallying back near its pivot point. Its 50 DMA acted as support during the recent consolidation.

12/28/2012 9:52:46 AM - Y - Down today and on track for its 5th consecutive small loss, consolidating above its 50 DMA which defines important near-term support. Slumped below its pivot point following a technical buy signal on 12/11/12. Disciplined investors always limit losses if any stock falls -7% from their purchase price.

12/21/2012 12:06:59 PM - Y - Down with above average volume today after a small gap down, enduring distributional pressure amid weakness in the broader market. Slumped below its pivot point following a technical buy signal on 12/11/12, however its small losses lacked great volume conviction. Disciplined investors always limit losses if any stock falls -7% from their purchase price.

12/17/2012 5:42:05 PM - Y - Halted its slide with a gain today. Slumped below its pivot point following a technical buy signal on 12/11/12, however its small losses lacked great volume conviction. Disciplined investors always limit losses if any stock falls -7% from their purchase price.

12/12/2012 6:50:26 PM - Y - Pulled back today and finished just below its pivot point. Triggered a technical buy signal on the prior session. Disciplined investors always limit losses if any stock falls -7% from their purchase price. See the latest FSU analysis for more details and a new annotated graph.

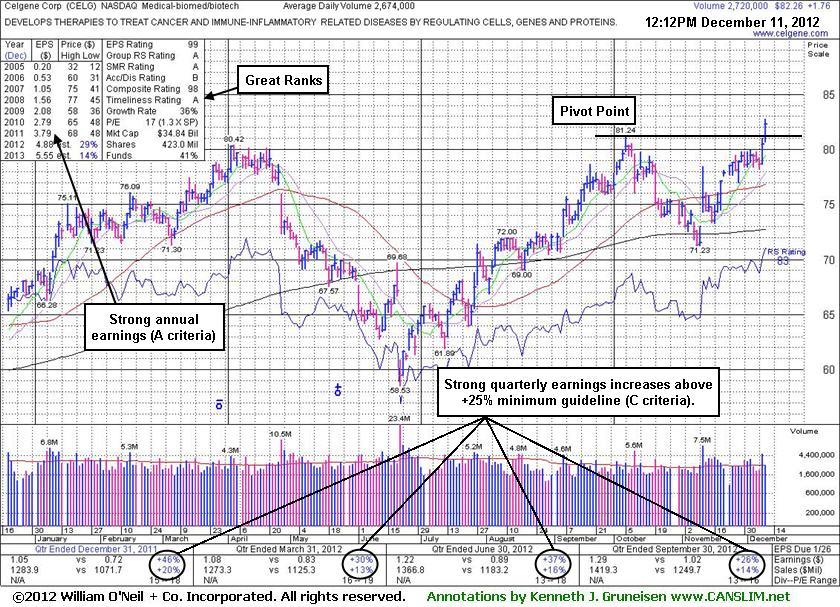

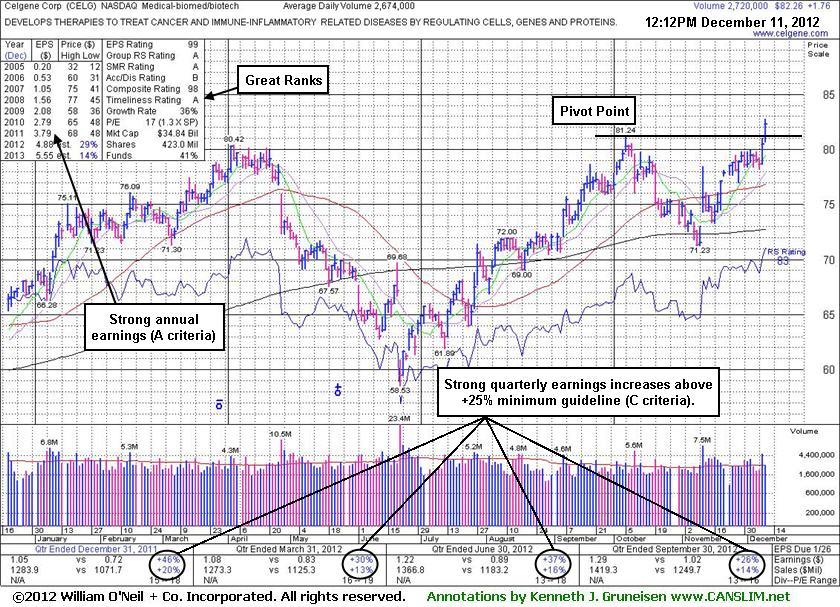

12/11/2012 6:30:18 PM - Y - Finished above its pivot point with a volume-driven gain for a new 52-week high today triggering a technical buy signal. It was highlighted in yellow with pivot point cited based on its 10/05/12 high plus 10 cents in today's mid-day report (with the annotated graph included below). Maintained a strong earnings history (C and A criteria) and rebounded impressively from a deep consolidation since dropped from the Featured Stocks list on 5/04/12.

12/11/2012 1:09:10 PM - Y - Hitting a new 52-week high today with volume running at an above average pace. Color code is changed to yellow with pivot point cited based on its 10/05/12 high plus 10 cents. A strong finish may clinch a technical buy signal. Maintained a strong earnings history (C and A criteria) and rebounded impressively from a deep consolidation since dropped from the Featured Stocks list on 5/04/12.

5/4/2012 1:33:11 PM - Suffering a 5th consecutive loss today, slumping badly since violating its 50 DMA line and triggering a technical sell signal. Based on weak action it will be dropped from the Featured Stocks list tonight.

5/2/2012 4:06:47 PM - G - Suffered another small loss on heavy volume today, slumping further since violating its 50 DMA line and triggering a technical sell signal. A rebound above its 50 DMA line is necessary for its outlook improve. Reported earnings +30% on +13% sales revenues for the quarter ended March 31, 2012 versus the year ago period.

4/26/2012 12:09:02 PM - G - Reported earnings +30% on +13% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Volume and volatility often increase near earnings news. It gapped down today, violating its 50 DMA line and triggering a technical sell signal. Only a prompt rebound above its 50 DMA line would help its outlook improve.

4/25/2012 10:30:03 AM - G - Consolidating just under its "max buy" level and above its 50 DMA line which defines important support to watch. Weakening market conditions (M criteria) are an overriding concern arguing in favor of reducing exposure to stocks, especially if more technical deterioration occurs.

4/18/2012 1:45:31 PM - G - Volume totals have been cooling while still stubbornly holding its ground and dipping below its "max buy" level briefly during the past week. Its 50 DMA line defines important support to watch.

4/11/2012 12:27:37 PM - G - Stubbornly holding its ground after rallying above its "max buy" level. Its 50 DMA line defines support to watch.

4/4/2012 11:59:23 AM - G - Pulling back today following a gain backed by +52% above average volume that confirmed a technical buy signal. Color code was changed to green after quickly rallying above its "max buy" level. Its 50 DMA line defines support to watch.

4/3/2012 4:14:45 PM - G - Today's gain backed by +52% above average volume confirmed a technical buy signal. Color code is changed to green after quickly rallying above its "max buy" level. Its 50 DMA line defines support to watch.

3/26/2012 10:11:25 PM - Y - Hit a new 52-week high today and rallied above its all-time high ($77.39 in Aug '08) with a 5th consecutive gain. The winning streak into new high territory is impressive, however to trigger a proper technical buy signal the volume behind a gain must be at least +40-50% above average, preferably greater, as a truly reassuring sign of great institutional demand capable of leading to a sustainable and meaningful price advance. Found support at its 50 DMA line on the last pullback, meanwhile any damaging violation would raise concerns and trigger technical sell signals. See the latest FSU analysis for more details and a new annotated graph.

3/22/2012 10:40:20 AM - Y - Still hovering near its 52-week high today, stubbornly holding its ground. Subsequent volume-driven gains would be a welcome and reassuring sign of fresh institutional demand. Found support at its 50 DMA line on the last pullback, meanwhile any damaging violation would raise concerns and trigger technical sell signals. Last week it barely traded above its all-time high ($77.39 in Aug '08).

3/16/2012 11:41:06 AM - Y - Perched near its 52-week high today, rising from a test of support at its 50 DMA line last week. Currently perched within striking distance of its all-time high ($77.39 in Aug '08). Any subsequent volume-driven gains would be a reassuring sign of fresh institutional demand.

3/13/2012 10:42:53 PM - Y - Rose back above its pivot point today for a new 52-week high with a gain on near average volume, not meeting the +40% above average volume threshold for a new confirming technical buy signal. Currently perched within striking distance of its all-time high ($77.39 in Aug '08). Any subsequent volume-driven gains would be a reassuring sign of fresh institutional demand

3/12/2012 4:58:00 PM - Y - During its recent consolidation it tested its 50 DMA line and prior lows in the $71 area previously noted as important chart support to watch. Currently perched within striking distance of its all-time high ($77.39 in Aug '08). Any subsequent volume-driven gains would be a reassuring sign of fresh institutional demand

3/8/2012 2:15:56 PM - Y - Rising with light volume after a pullback tested its 50 DMA line and prior lows in the $71 area previously noted as important chart support to watch. Within striking distance of its all-time high ($77.39 in Aug '08). Any subsequent volume-driven gains would be a reassuring sign of fresh institutional demand

3/2/2012 4:15:54 PM - Y - Encountered mild distributional pressure this week while slumping below its pivot point. Within striking distance of its all-time high ($77.39 in Aug '08). Any subsequent volume-driven gains would be a reassuring sign of fresh institutional demand, meanwhile its 50 DMA line and prior lows in the $71 area now coincide and define important chart support to watch.

2/28/2012 5:59:31 PM - Y - Volume totals have been cooling since it stalled and slumped below the pivot point. Still perched within close striking distance of its all-time high ($77.39 in Aug '08). Any subsequent volume-driven gains would be a reassuring sign of fresh institutional demand, meanwhile its 50 DMA line and prior lows in the $71 area now coincide and define important chart support to watch.

2/21/2012 1:52:48 PM - Y - Stalled and slumped below the pivot point after recently rising from an advanced "3-weeks tight" base pattern previously noted. Still perched within close striking distance of its all-time high ($77.39 in Aug '08). Its 50 DMA line defines initial support above its prior highs in the $68 area.

2/14/2012 6:53:11 PM - Y - Finished the session at its high and just 2 cents off its best-ever close with a gain on average volume. Held its ground in a tight range since the advanced "3-weeks tight" base pattern was previously noted. Still perched within close striking distance of its all-time high ($77.39 in Aug '08). Its 50 DMA line defines initial support above its prior highs in the $68 area.

2/9/2012 4:31:46 PM - Y - Lost ground today with above average volume, encountering distributional pressure. Formed an advanced "3-weeks tight" base pattern and it is still perched within close striking distance of its all-time high ($77.39 in Aug '08). Its 50 DMA line defines initial support above its prior highs in the $68 area.

2/3/2012 6:25:20 PM - Y - Color code was changed to yellow while forming an advanced "3-weeks tight" base pattern and stubbornly holding its ground within close striking distance of its all-time high ($77.39 in Aug '08). See the latest FSU analysis for more details and a new annotated weekly graph.

2/2/2012 6:45:20 PM - Y - Color code is changed to yellow while forming an advanced "3-weeks tight" base pattern and stubbornly holding its ground within close striking distance of its all-time high ($77.39 in Aug '08). See the latest FSU analysis for more details and a new annotated weekly graph.

2/1/2012 3:41:58 PM - G - Today's gain has it poised to possibly finish at a new high close for the year. Recently noted while also trading within close striking distance of its all-time high ($77.39 in Aug '08). Prior highs in the $68 area define support to watch on pullbacks.

1/27/2012 4:33:59 PM - G - Overcame early weakness today and managed a positive reversal. Holding its ground near its 52-week high and trading within close striking distance of its all-time high ($77.39 in Aug '08). Prior highs in the $68 area define support to watch on pullbacks.

1/20/2012 12:04:47 PM - G - Today's gain has it challenging its 52-week high hit on Tuesday and trading within close striking distance of its all-time high ($77.39 in Aug '08). Prior highs in the $68 area define support to watch on pullbacks.

1/17/2012 4:41:43 PM - G - Holding its ground after rallying beyond its "max buy" level with last week's streak of volume-driven gains. Prior highs in the $68 area define support to watch on pullbacks.

1/11/2012 5:03:48 PM - G - Color code is changed to green after rallying beyond its "max buy" level for another new 52-week high today. Its 1/10/12 gain and strong close was backed by +59% above average volume as it rallied above its pivot point triggering a technical buy signal.

1/10/2012 2:50:59 PM - Y - Gapped up today, rallying into new 52-week high territory unhindered by overhead supply. Gains above the pivot point with sufficient above average volume and a strong close may trigger a convincing new (or add-on) technical buy signal.

1/9/2012 12:43:28 PM - Y - Powering higher with above average volume today, near its 52-week high and within striking distance of its best-ever close. Volume-driven gains above the pivot point cited may help to confirm a new (or add-on) technical buy signal.

1/6/2012 12:44:04 PM - Y - Encountering mild distributional pressure while perched at its 52-week high. Volume-driven gains above the pivot point cited may trigger a new (or add-on) technical buy signal.

1/5/2012 4:32:21 PM - Y - Touched a new 52-week high today and finished at its second-best close with a gain on average volume. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal.

12/29/2011 6:10:32 PM - Y - Perched within close striking distance of its 52-week high. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal. See the latest FSU analysis for more details and a new annotated graph.

12/28/2011 5:24:14 PM - Y - Down today on below average volume, breaking a streak of 8 consecutive small gains after rallying within close striking distance of its 52-week high. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal.

12/27/2011 12:46:51 PM - Y - On track today for an 8th consecutive small gain and perched within close striking distance of its 52-week high. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal.

12/20/2011 2:11:03 PM - Y - Gapped up today after a rebound above its 50 DMA line on the prior session helped its outlook improve. Color code is changed to yellow with a new pivot point cited based on its 52-week high plus 10 cents. Now only -2.2% off its 52-week high, subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal.

12/15/2011 5:47:31 PM - G - Recently encountered resistance at its 50 DMA line. Gains above that short-term average would help its outlook improve, meanwhile it is -7.5% off its 52-week high. Recent lows and the 200 DMA line coincide to define the near-term chart support level near $60.

12/9/2011 2:18:03 PM - G - Solid gain today, rising within close range of its 50 DMA line. Gains above that short-term average would help its outlook improve, meanwhile it is -7.3% off its 52-week high. Its Relative Strength (RS) Rating has slumped to 81, down from 93 when shown in an 10/14/11 FSU analysis.

12/8/2011 12:57:22 PM - G - Gains above its short-term average are needed for its outlook to improve. Its is still consolidating within -10% of its 52-week high, however its Relative Strength (RS) Rating has slumped to 82, down from 93 when shown in an 10/14/11 FSU analysis.

12/2/2011 7:56:45 PM - G - Slumped further below its 50 DMA line with a loss today on higher volume indicative of distributional pressure. Gains above its short-term average are needed for its outlook to improve. See the latest FSU analysis for more details and a new annotated graph.

12/1/2011 6:52:51 PM - G - It remains below its 50 DMA line which may now act as resistance. Gains above its short-term average are needed for its outlook to improve. See the latest FSU analysis for more details and a new annotated graph.

11/30/2011 7:20:30 PM - G - Today's gain helped it in rebounding toward its 50 DMA line which may now act as resistance, meanwhile gains above it are needed for its outlook to improve.

11/28/2011 8:01:04 PM - G - Finished near the session high today with a solid gain on near average volume helping it rally from a slump near its 200 DMA line. A rebound above its 50 DMA line is needed for its outlook to improve.

11/25/2011 3:41:37 PM - G - Sinking toward its 200 DMA line. A rebound above its 50 DMA line is needed for its outlook to improve.

11/21/2011 1:46:58 PM - G -Gapped down today for a damaging loss following last week's violation of its 50 DMA line. Color code is changed to green while the slump below its previously noted chart low ($62.71 on 11/01/11) raises greater concerns and triggers a worrisome technical sell signal.

11/18/2011 5:55:56 PM - Y -Today's 3rd consecutive loss led to a violation of its 50 DMA line raising concerns. A damaging violation of its recent chart low ($62.71 on 11/01/11) would raise greater concerns and trigger a worrisome technical sell signals.

11/17/2011 6:14:44 PM - Y -Finished in the upper third of its intra-day range today, consolidating near its 50 DMA line defining important near-term chart support. Deterioration leading to a subsequent close below its short-term average and recent chart low ($62.71 on 11/01/11) would raise greater concerns and trigger technical sell signals.

11/16/2011 5:26:51 PM - Y -Still consolidating above its 50 DMA line defining important near-term chart support. A violation of its short-term average and recent chart low ($62.71 on 11/01/11) would raise concerns and trigger technical sell signals.

11/11/2011 12:37:56 PM - Y -Still consolidating just above its 50 DMA line defining important near-term chart support. A violation of its short-term average and recent chart low ($62.71 on 11/01/11) would raise concerns and trigger technical sell signals.

11/9/2011 9:55:21 PM - Y -Slight pickup in volume (near average) behind today's loss while consolidating just above its 50 DMA line defining important near-term chart support. A violation would raise concerns and trigger a technical sell signal.

11/8/2011 7:03:14 PM - Y - Posted a gain today on light volume while consolidating just above its 50 DMA line which defines important near-term chart support to watch. A violation would raise concerns and trigger a technical sell signal.

11/4/2011 6:28:08 PM - Y - Quietly consolidating just above its 50 DMA line which defines important near-term chart support to watch, and a violation would raise concerns and trigger a technical sell signal.

11/2/2011 5:47:33 PM - Y - Quietly held its ground today following a gap down on the prior session. Its 50 DMA line defines important near-term chart support to watch, and a violation would raise concerns and trigger a technical sell signal.

11/1/2011 4:45:06 PM - Y - Pulled back today for a second consecutive small gap down on just below average volume. Dipping under its "max buy" level, its color code was changed to yellow. Its 50 DMA line defines important near-term chart support.

10/31/2011 6:15:16 PM - Y - Pulled back today with a small gap down on below average volume, dipping under its "max buy" level, and its color code is changed to yellow. Reported earnings +36% on +37% sales revenues for the quarter ended September 30, 2011 versus the year ago period.

10/28/2011 6:25:42 PM - G - Hovering near its all-time high, slightly extended from its latest sound base pattern. Reported earnings +36% on +37% sales revenues for the quarter ended September 30, 2011 versus the year ago period.

10/27/2011 12:00:01 PM - G - Reported earnings +36% on +37% sales revenues for the quarter ended September 30, 2011 versus the year ago period. Encountering some distributional pressure today, slumping below its "max buy" level amid an otherwise strong broad-based rally.

10/25/2011 6:52:01 PM - G - It remains extended from its prior base after a loss today on average volume led to a pullback near its "max buy" level.

10/24/2011 5:55:12 PM - G - Inched to a new 52-week high today with its 3rd consecutive gain on below average volume, getting more extended from its latest base.

10/20/2011 6:35:31 PM - G - Traded within one cent of its 52-week high today yet finished near the middle of its intra-day range with a small gain on below average volume.

10/18/2011 4:39:13 PM - G - Color code is changed to green after rising back above its "max buy" level today. Historic studies showed that investors' odds of success were best when buying stocks as they were rising rather than when they were pulling back.

10/17/2011 4:06:12 PM - Y - Color code is changed to yellow after dipping under its "max buy" level today, pulling back from its 52-week high with below average volume. No resistance remains due to overhead supply after a 10/10/11 gap up.

10/14/2011 3:10:37 PM - G - Extended from its prior base, it is hovering near its 52-week high with volume totals recently cooling. No resistance remains due to overhead supply after a 10/10/11 gap up.

10/11/2011 6:03:04 PM - G - Up today with light volume. No resistance remains due to overhead supply after a 10/10/11 gap up and rally to a new 52-week high. Color code was changed to green after getting extended from its prior base.

10/10/2011 4:10:57 PM - G - Finished in the lower half of its intra-day range after a gap up and rally to a new 52-week high. Color code was changed to green after getting extended from its prior base.

10/10/2011 10:07:50 AM - G - Gapped up today and rallied to a new 52-week high beyond its "max buy" level. Color code is changed to green after getting extended from its prior base.

10/7/2011 6:51:01 PM - Y - Small losses on lighter volume followed a prompt rebound above its pivot point. Managed a positive reversal on 10/04/11 after lows testing near its 50 DMA line.

10/6/2011 5:06:23 PM - Y - Small loss today on lighter volume followed a prompt rebound above its pivot point following a positive reversal on 10/04/11 after slumping near its 50 DMA line.

10/5/2011 1:31:12 PM - Y - Up considerably today, rebounding above its pivot point without great volume conviction following a positive reversal after slumping near its 50 DMA line on the prior session. See the latest FSU analysis for more details and a new annotated graph.

10/4/2011 7:25:31 PM - Y - Managed a positive reversal today for a small gain on below average volume after initially slumping further below its pivot point to trade near its 50 DMA line. Following its breakout on 9/20/11 it abruptly pulled back near previously stubborn resistance in the $62 area which has acted as a support level.

9/30/2011 6:59:44 PM - Y - Down today with a loss on below average volume, slumping further below its pivot point. Following its breakout on 9/20/11 it abruptly pulled back near previously stubborn resistance in the $62 area which has acted as a support level.

9/28/2011 6:55:09 PM - Y - Down considerably today with a loss on below average volume, closing just under its pivot point. Following its breakout on 9/20/11 it abruptly pulled back near previously stubborn resistance in the $62 area which acted as a support level.

9/27/2011 8:17:15 PM - Y - Gapped up today for a small gain with average volume finishing at its second best close ever. Following its breakout on 9/20/11 it abruptly pulled back near previously stubborn resistance in the $62 area which acted as a support level.

9/23/2011 12:29:48 PM - Y - On track for a 3rd consecutive loss today with volume running at an above average pace. Following its breakout on 9/20/11 it has abruptly pulled back near previously stubborn resistance in the $62 area which may act as a support level.

9/22/2011 12:50:18 PM - Y - Trading near the session high after a gap down today amid widespread market weakness. It abruptly pulled back near previously stubborn resistance in the $62 area which may act as a support level.

9/22/2011 9:51:02 AM - Y - Gapped down today amid widespread market weakness, raising concerns. It has abruptly pulled back near previously stubborn resistance in the $62 area which may act as a support level. See the latest FSU analysis for more details and an annotated weekly graph.

9/21/2011 6:33:59 PM - Y - Pulled back today for a loss with above average volume and closed near the session low after trading near its "max buy" level earlier. Its considerable gain on 9/20/11 with more than 3 times average volume triggered a technical buy signal as it spiked to a new 52-week high and rallied above previously stubborn resistance in the $62 area. Disciplined investors use a tactic called "pyramiding" to avoid chasing stocks more than +5% above prior highs. See the latest FSU analysis for more details and an annotated weekly graph.

9/21/2011 12:29:08 PM - Y - Pulling back marginally thus far today after trading near its "max buy" level. Its considerable gain on 9/20/11 with more than 3 times average volume triggered a technical buy signal as it spiked to a new 52-week high and rallied above previously stubborn resistance in the $62 area. Disciplined investors use a tactic called "pyramiding" to avoid chasing stocks more than +5% above prior highs. See the latest FSU analysis for more details and an annotated weekly graph.

9/20/2011 12:26:10 PM - Y - Considerable gain today with above average volume, hitting a new 52-week high while rallying above previously stubborn resistance in the $62 area. Disciplined investors use a tactic called "pyramiding" to avoid chasing stocks more than +5% above prior highs. See the latest FSU analysis for more details and an annotated weekly graph.

9/20/2011 10:52:30 AM - Y - Considerable gain today, hitting a new 52-week high while rallying above previously stubborn resistance in the $62 area. Disciplined investors use a tactic called "pyramiding" to avoid chasing stocks more than +5% above prior highs. See the latest FSU analysis for more details and an annotated weekly graph.

9/16/2011 12:36:50 PM - Y - Color code is changed to yellow with pivot point cited based on its 52-week high plus 10 cents. It is perched within close striking distance of previously stubborn resistance in the $62 area. Quarterly and annual earnings history has remained strong while it survived but failed to impress since it was dropped from the Featured Stocks list on 10/06/08. See the Featured Stock Update section of the 9/23/08 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

10/6/2008 - Considerable loss 10/6/2008, falling deeper below its 200 DMA line to near its May 2008 lows. Based on weak technical action it was dropped from the Featured Stocks list that night. See the Featured Stock Update section of the 9/23/08 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

10/6/2008 1:36:14 PM - G - Considerable loss today, falling deeper below its 200 DMA line to near its May 2008 lows. Based on weak technical action it will be dropped from the Featured Stocks list tonight. See the Featured Stock Update section of the 9/23/08 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

10/3/2008 2:53:22 PM - G - Gain today on light volume, trading near its 200 DMA line. See the Featured Stock Update section of the 9/23/08 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

10/2/2008 4:12:03 PM - G - Loss today on lighter volume, sinking under its 200 DMA line to its lowest close since June. See the Featured Stock Update section of the 9/23/08 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

9/30/2008 4:15:53 PM - G - Gain today on heavier volume, closing above its 200 DMA line after a considerable loss on 9/29/08 with near average volume. See the Featured Stock Update section of the 9/23/08 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

9/29/2008 4:09:34 PM - G - Considerable loss today on near average volume, falling toward its 200 DMA line. See the Featured Stock Update section of the 9/23/08 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

9/24/2008 1:51:10 PM - G - See the Featured Stock Update section of the 9/23/08 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Consolidating above its 200 DMA line after bouncing last week at that long-term average. Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

9/23/2008 2:53:51 PM - G - See the Featured Stock Update section of this evening's CANSLIM.net After Market Update for analysis and an annotated graph (read here). Consolidating above its 200 DMA line after bouncing last week at that long-erm average. Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

9/22/2008 12:20:13 PM - G - Consolidating above its 200 DMA line after bouncing last week at that long-erm average. Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).

9/18/2008 8:07:54 PM - G - Considerable weakness today had it trading under its 200 DMA line briefly, then it rebounded to close in the upper half of its trading range for a smaller loss, with volume more than twice average. Disciplined investors may note that CELG did not confirm a proper technical buy signal after it was featured in the August 2008 CANSLIM.net News, whereas the detailed report's "Technical Analysis" area included the note - "Confirming gains to all-time highs with great volume conviction would be a nice reassurance that it is capable of a meaningful advance" (read here).