6/30/2015 1:21:48 PM - Pulling back to its 50 DMA line. Prior mid-day reports cautioned - "Reported greatly improved sales revenues and earnings for the Apr '15 quarter, but fundamental concerns remain (C and A criteria). It survived but failed to impress since dropped from the Featured Stocks list on 11/29/13."

6/23/2015 12:17:57 PM - Stubbornly held its ground and made gradual progress since last noted with caution in the 6/05/15 mid-day report - "Reported greatly improved sales revenues and earnings for the Apr '15 quarter, but fundamental concerns remain (C and A criteria). It survived but failed to impress since dropped from the Featured Stocks list on 11/29/13."

6/5/2015 12:10:46 PM - Prior mid-day reports repeatedly cautioned members - "Reported greatly improved sales revenues and earnings for the Apr '15 quarter, but fundamental concerns remain (C and A criteria). It survived but failed to impress since dropped from the Featured Stocks list on 11/29/13."

6/2/2015 12:03:34 PM - Making is 3rd consecutive mid-day report appearance. Prior reports cautioned members - "Reported greatly improved sales revenues and earnings for the Apr '15 quarter, but fundamental concerns remain (C and A criteria). It survived but failed to impress since dropped from the Featured Stocks list on 11/29/13."

6/1/2015 12:29:14 PM - Making is 2nd consecutive mid-day report appearance. Noted 5/29/15 with caution - "Reported greatly improved sales revenues and earnings for the Apr '15 quarter, but fundamental concerns remain (C and A criteria). It survived but failed to impress since dropped from the Featured Stocks list on 11/29/13."

5/29/2015 12:17:00 PM - Reported greatly improved sales revenues and earnings for the Apr '15 quarter, but fundamental concerns remain (C and A criteria). It survived but failed to impress since dropped from the Featured Stocks list on 11/29/13.

11/29/2013 12:37:49 PM - It may likely find support at its 200 DMA line, but it is being dropped from the Featured Stocks list tonight. A damaging gap down and volume-driven loss on the prior session triggered another worrisome technical sell signal, and prior reports repeatedly reminded members - "Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price."

11/27/2013 5:49:26 PM - G - Color code is changed to green after a considerable gap down and damaging volume-driven loss today triggered another worrisome technical sell signal. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price.

11/26/2013 1:09:48 PM - Y - Color code is changed to yellow after rallying back above its 50 DMA line, as its volume-driven gain is helping its technical stance improve. Recently slumped into the prior base raising concerns after its prior breakout. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

11/22/2013 8:10:35 PM - G - Still sputtering below its 50 DMA line which has recently acted as resistance after triggering a technical sell signal. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

11/19/2013 6:31:12 PM - G - Violated its 50 DMA line with volume-driven losses triggering a technical sell signal. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price. See the latest FSU analysis for more details and new annotated daily and weekly graphs.

11/18/2013 1:29:57 PM - Y - Reversed into the red after initially gapping up today. Found support at its 50 DMA line during its recent consolidation. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

11/15/2013 4:21:03 PM - Y - Rallied today with average volume after finding support at its 50 DMA line. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

11/13/2013 2:40:48 PM - Y - Posting a gain today with higher volume as it finds support at its 50 DMA line. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

11/8/2013 6:19:55 PM - Y - Posted a gain today with lighter volume as it found support at its 50 DMA line. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

11/7/2013 9:05:01 PM - Y - Slumped near its 50 DMA line with today's damaging loss on slightly above average volume. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

11/4/2013 6:09:55 PM - Y - Posted a solid gain today on below average volume, consolidating near prior highs in the $45 area defining initial support to watch. Prior volume-driven gains above the pivot point triggered a technical buy signal. Disciplined investors avoid chasing "extended" stocks and limit losses by selling any stock that falls more than -7% from their purchase price.

10/30/2013 3:08:22 PM - Y - Retreating today on lighter volume however it has slumped below prior highs in the $45 area defining initial support to watch raising some concern. Prior volume-driven gains above the pivot point triggered a technical buy signal. Disciplined investors avoid chasing "extended" stocks and limit losses by selling any stock that falls more than -7% from their purchase price.

10/23/2013 12:01:47 PM - Y - Abruptly retreating from its new 52-week high with today's considerable loss. Prior highs in the $45 area define initial support to watch. Disciplined investors avoid chasing "extended" stocks and limit losses by selling any stock that falls more than -7% from their purchase price.

10/17/2013 4:15:13 PM - Y - Hit another new 52-week high today with a 2nd consecutive volume-driven gain while rising above its pivot point clinching a technical buy signal. Highlighted in yellow while building on a flat base in the 10/11/13 mid-day report (read here) and noted - "Subsequent volume-driven gains for new highs may trigger a technical buy signal."

10/16/2013 12:28:40 PM - Y - Hitting a new 52-week high today with volume running at an above average pace while rising above its pivot point. Highlighted in yellow while building on a flat base in the 10/11/13 mid-day report (read here) and noted - "Subsequent volume-driven gains for new highs may trigger a technical buy signal."

10/15/2013 6:52:42 PM - Y - Pulled back today with near average volume, still perched near its 52-week high. Highlighted in yellow while building on a flat base in the 10/11/13 mid-day report (read here). Subsequent volume-driven gains for new highs may trigger a technical buy signal.

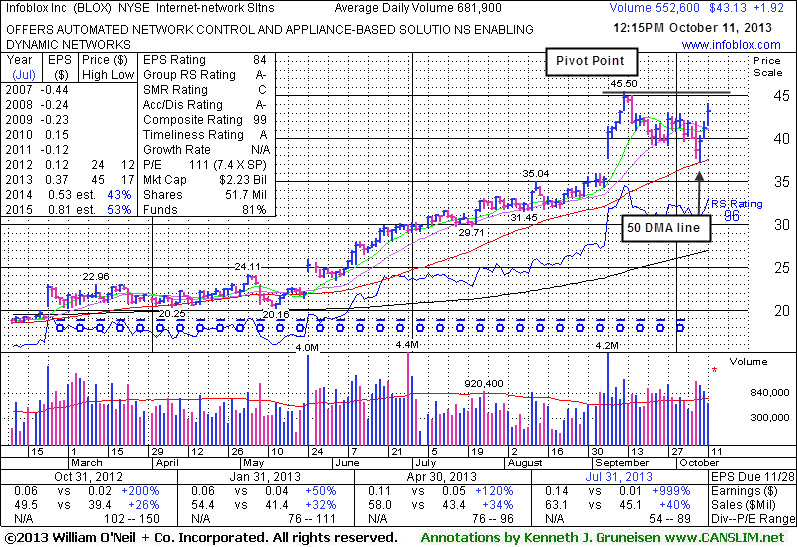

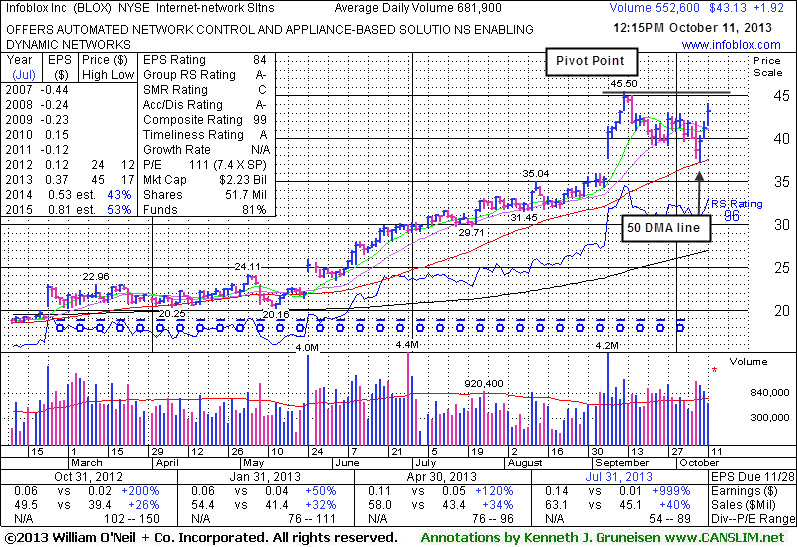

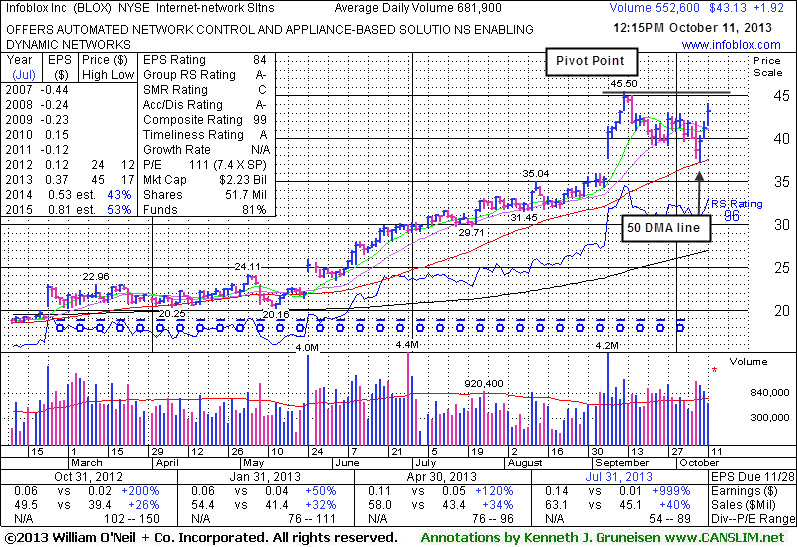

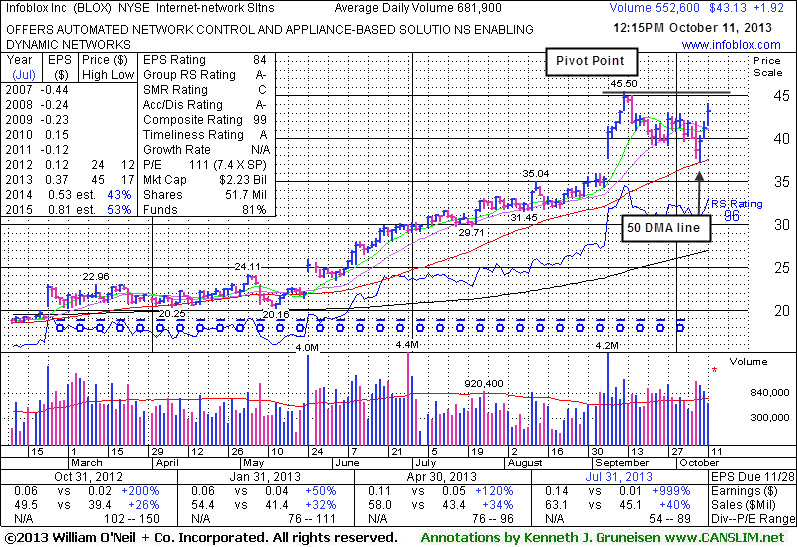

10/11/2013 6:09:14 PM - Y - Rallied near its 52-week high with today's 3rd consecutive volume-driven gain. Highlighted in yellow while building on a flat base in the earlier mid-day report (read here). Subsequent volume-driven gains for new highs may trigger a technical buy signal. Found support while consolidating in an orderly fashion above its 50 DMA line. Strong sales revenues and solid earnings increases in the Oct '12, Jan, Apr, and Jul '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Up and down annual earnings (A criteria) prior to its 2012 IPO is a concern. Since completing a Secondary Offering on 10/04/12 it followed with choppy action and then an impressive rebound and rally. See the latest Featured Stock analysis for more details and an annotated weekly graph.

10/11/2013 12:19:32 PM - Y - Consolidating within close striking distance of its 52-week high. Color code is changed to yellow while building on a flat base. Subsequent volume-driven gains for new highs may trigger a technical buy signal. Found support while consolidating in an orderly fashion above its 50 DMA line. Strong sales revenues and solid earnings increases in the Oct '12, Jan, Apr, and Jul '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Up and down annual earnings (A criteria) prior to its 2012 IPO is a concern. Since completing a Secondary Offering on 10/04/12 it followed with choppy action and then an impressive rebound and rally.

10/10/2013 11:55:12 AM - Consolidating above its 50 DMA line in an orderly fashion. Strong sales revenues and solid earnings increases in the Oct '12, Jan, Apr, and Jul '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Noted in prior mid-day reports with caution - "Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12."

9/27/2013 11:54:33 AM - Consolidating after spiking to new all-time highs, extended from any sound base. Strong sales revenues and solid earnings increases in the Oct '12, Jan, Apr, and Jul '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Bullish action has continued since noted in the 6/20/13 mid-day report with caution - "Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12."

9/12/2013 12:18:28 PM - Up today for another considerable volume-driven gain, and no resistance remains while spiking to new all-time highs. Strong sales revenues and solid earnings increases in the Oct '12, Jan, Apr, and Jul '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Bullish action has continued since noted in the 6/20/13 mid-day report with caution - "Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12."

9/6/2013 12:12:18 PM - Gapped up today for a considerable volume-driven gain, spiking to new all-time highs. Strong sales revenues and solid earnings increases in the Oct '12, Jan, Apr, and Jul '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Bullish action has continued since last noted in the 6/20/13 mid-day report with caution - "Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12."

6/20/2013 12:00:05 PM - Hitting new all-time highs yet again today and adding to a spurt of volume-driven gains. The 6/11/13 mid-day report noted - "Technically it broke out on 5/24/13, then held its ground and rallied further into new high territory with volume-driven gains. Strong sales revenues and solid earnings increases in the Oct '12, Jan and Apr '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12."

6/19/2013 12:09:42 PM - Hitting new all-time highs again today and adding to a spurt of volume-driven gains. The 6/11/13 mid-day report noted - "Technically it broke out on 5/24/13, then held its ground and rallied further into new high territory with volume-driven gains. Strong sales revenues and solid earnings increases in the Oct '12, Jan and Apr '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12."

6/18/2013 12:19:01 PM - Hovering near its all-time high, stubbornly holding its ground following a spurt of volume-driven gains. The 6/11/13 mid-day report noted - "Technically it broke out on 5/24/13, then held its ground and rallied further into new high territory with volume-driven gains. Strong sales revenues and solid earnings increases in the Oct '12, Jan and Apr '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12."

6/12/2013 12:38:06 PM - Perched at its all-time high following 4 consecutive gains with ever-increasing volume. The 6/11/13 mid-day report noted - "Technically it broke out on 5/24/13, then held its ground and rallied further into new high territory with volume-driven gains. Strong sales revenues and solid earnings increases in the Oct '12, Jan and Apr '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12."

6/11/2013 12:13:13 PM - Technically it broke out on 5/24/13, then held its ground and rallied further into new high territory with volume-driven gains. Strong sales revenues and solid earnings increases in the Oct '12, Jan and Apr '13 quarterly comparisons versus the year ago periods satisfy the C criteria. Up and down annual earnings (A criteria) is a concern. Limited and erratic history is a concern since it completed a Secondary Offering on 10/04/12.