2/14/2024 12:52:50 PM - Gapped down today violating its 50 DMA line. Reported Sep '23 quarterly earnings +23% on +7% sales revenues versus the year ago period. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). Subpar sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

11/8/2023 12:37:41 PM - Hitting a new 52-week high with today's 2nd consecutive volume-driven gain, but it faces resistance due to old overhead supply up to the $123 level. Reported Sep '23 quarterly earnings +29% on +9% sales revenues versus the year ago period. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

11/7/2023 12:22:57 PM - Gapped up today hitting a new 52-week high, but it faces resistance due to old overhead supply up to the $123 level. Due to report Sep '23 quarterly results. Reported earnings +10% on +4% sales revenues for the Jun '23 quarter versus the year ago period. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

9/21/2023 12:00:35 PM - Gapped up on 8/09/23 hitting a new 52-week high, but it faces resistance due to overhead supply up to the $123 level. Found support near its 50 DMA line during the recent consolidation. Reported earnings +10% on +4% sales revenues for the Jun '23 quarter versus the year ago period. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

8/16/2023 12:14:14 PM - Gapped up on 8/09/23 hitting a new 52-week high, but it faces resistance due to overhead supply up to the $123 level. Found support near its 50 DMA line during the recent consolidation. Reported earnings +10% on +4% sales revenues for the Jun '23 quarter versus the year ago period. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

8/28/2020 11:57:42 AM - Gapped up today for its 9th consecutive gain, hitting a new 52-week high. Found support near its 50 DMA line and prior highs during the recent consolidation. Reported earnings +29% on +13% sales revenues for the Jun '20 quarter versus the year ago period. The 3 prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

7/29/2020 12:40:18 PM - Gapped down today retreating from its 52-week high, slumping near its 50 DMA line ($106) annd prior highs. Reported earnings +29% on +13% sales revenues for the Jun '20 quarter versus the year ago period. The 3 prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

7/2/2020 12:43:30 PM - Hitting a new 52-week high with today's "breakaway gap" and considerable volume-driven gain. Found support near its 50 DMA line ($101) in recent weeks. Reported earnings +9% on +8% sales revenues for the Mar '20 quarter versus the year ago period, its 3rd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

6/26/2020 12:24:25 PM - Found support near its 50 DMA line ($101). Reported earnings +9% on +8% sales revenues for the Mar '20 quarter versus the year ago period, its 3rd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

4/30/2020 12:24:05 PM - Gapped down today for a 3rd consecutive volume-driven loss, retreating from multi-year highs and testing its 50 DMA line ($94.18). Reported earnings +9% on +8% sales revenues for the Mar '20 quarter versus the year ago period, its 3rd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

4/29/2020 12:13:41 PM - Gapped down today retreating from multi-year highs and testing its 50 DMA line ($94.23). Reported earnings +9% on +8% sales revenues for the Mar '20 quarter versus the year ago period, its 3rd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. It was dropped from the Featured Stocks list on 6/15/15.

4/16/2020 12:35:41 PM - Powering to new multi-year highs with today's big gain after briefly consolidating above its 50 DMA line. Prior mid-day reports cautioned members - "Reported earnings +15% on +8% sales revenues for the Dec '19 quarter, below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

4/7/2020 12:06:12 PM - Perched near multi-year highs, now consolidating above its 50 DMA line. Prior mid-day reports cautioned members - "Reported earnings +15% on +8% sales revenues for the Dec '19 quarter, below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

3/26/2020 12:20:44 PM - Slumped from multi-year highs, now consolidating near its 200 DMA line. Prior mid-day reports cautioned members - "Reported earnings +15% on +8% sales revenues for the Dec '19 quarter, below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

3/19/2020 12:32:34 PM - Slumped from multi-year highs and rebounded near its 50 DMA line. Prior mid-day reports cautioned members - "Reported earnings +15% on +8% sales revenues for the Dec '19 quarter, below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

3/18/2020 12:40:14 PM - Slumped from multi-year highs and it is rebounding near its 50 DMA line today. Prior mid-day reports cautioned members - "Reported earnings +15% on +8% sales revenues for the Dec '19 quarter, below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

3/17/2020 12:45:36 PM - Slumped from multi-year highs and it is sputtering near its 200 DMA line ($87.83). The 2/12/20 mid-day report last cautioned members - "Reported earnings +15% on +8% sales revenues for the Dec '19 quarter, below the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

2/12/2020 12:11:24 PM - Gapped up today hitting new multi-year highs. Reported earnings +15% on +8% sales revenues for the Dec '19 quarter, below the +25% minimum earnings guideline (C criteria). Prior mid-day reports noted - "Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

10/29/2019 12:06:54 PM - Retreating from multi-year highs slumping below its 50 DMA line and undercutting prior lows. Reported earnings +17% on +6% sales revenues for the Sep '19 quarter, below the +25% minimum earnings guideline (C criteria). The 10/28/19 mid-day report noted - "Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

10/28/2019 12:17:59 PM - Perched near multi-year highs. Due to report earnings news. Found support near its 50 DMA line since prior mid-day reports cautioned members - "Reported earnings +29% on +6% sales revenues for the Jun '19 quarter, its 5th consecutive comparison above the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

9/16/2019 12:22:14 PM - Perched near multi-year highs. Found support above its 50 DMA line since prior mid-day reports cautioned members - "Reported earnings +29% on +6% sales revenues for the Jun '19 quarter, its 5th consecutive comparison above the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

9/13/2019 12:19:16 PM - Perched near multi-year highs. Found support above its 50 DMA line since prior mid-day reports cautioned members - "Reported earnings +29% on +6% sales revenues for the Jun '19 quarter, its 5th consecutive comparison above the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

9/12/2019 12:14:24 PM - Perched near multi-year highs and wedging higher in recent weeks with gains lacking great volume. Found support above its 50 DMA line since the 8/14/19 mid-day report last cautioned members - "Reported earnings +29% on +6% sales revenues for the Jun '19 quarter, its 5th consecutive comparison above the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

8/14/2019 12:05:41 PM - Pulling back abruptly from multi-year highs. The 8/13/19 mid-day report cautioned members - "Reported earnings +29% on +6% sales revenues for the Jun '19 quarter, its 5th consecutive comparison above the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15."

8/13/2019 12:10:24 PM - Perched at a multi-year high. Reported earnings +29% on +6% sales revenues for the Jun '19 quarter, its 5th consecutive comparison above the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15.

7/31/2019 12:30:42 PM - Gapped up today hitting a new multi-year high. Reported earnings +29% on +6% sales revenues for the Jun '19 quarter, its 5th consecutive comparison above the +25% minimum earnings guideline (C criteria). Sub par sales revenues growth remains a concern. Went through a choppy consolidation since dropped from the Featured Stocks list on 6/15/15.

10/31/2018 12:13:28 PM - Gapped up on the prior session rebounding near its 50 DMA line ($70). Reported earnings +47% on +7% sales revenues for the Sep '18 quarter. Prior comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). Rebounded after a deep slump since dropped from the Featured Stocks list on 6/15/15.

8/1/2018 12:29:39 PM - Gapped down today slumping near its 200 DMA line ($68.15). Reported earnings +34% on +9% sales revenues for the Jun '18 quarter. Prior comparisons were below the +25% minimum earnings guideline (C criteria), a fundamental flaw. Rebounded after a deep slump since dropped from the Featured Stocks list on 6/15/15.

2/7/2017 12:08:11 PM - Reported earnings +10% on +6% sales revenues for the Sep '16 quarter, and prior comparisons were below the +25% minimum earnings guideline (C criteria), a fundamental flaw. Rebounded after a deep slump since dropped from the Featured Stocks list on 6/15/15.

11/2/2016 12:23:38 PM - Reported earnings +10% on +6% sales revenues for the Sep '16 quarter, and prior comparisons were below the +25% minimum earnings guideline (C criteria), a fundamental flaw. Rebounding after a deep slump since dropped from the Featured Stocks list on 6/15/15.

11/1/2016 12:06:04 PM - Reported earnings +10% on +6% sales revenues for the Sep '16 quarter, and prior comparisons were below the +25% minimum earnings guideline (C criteria), a fundamental flaw. Rebounding after a deep slump since dropped from the Featured Stocks list on 6/15/15.

10/28/2016 12:16:00 PM - Reported earnings +10% on +6% sales revenues for the Sep '16 quarter, and prior comparisons were below the +25% minimum earnings guideline (C criteria), a fundamental flaw. Rebounding after a deep slump since dropped from the Featured Stocks list on 6/15/15.

10/27/2016 12:15:10 PM - Reported earnings +10% on +6% sales revenues for the Sep '16 quarter, and prior comparisons were below the +25% minimum earnings guideline (C criteria), a fundamental flaw. Rebounding after a deep slump since dropped from the Featured Stocks list on 6/15/15.

6/15/2015 5:40:44 PM - Met resistance at its 50 DMA line after a damaging loss triggered a technical sell signal. It will be dropped from the Featured Stocks list tonight. See the latest FSU analysis for more details and an annotated graph. Prior reports repeatedly cautioned members - "Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal."

6/10/2015 11:40:19 AM - G - Rebounding near its 50 DMA line with today's gain. A damaging loss on the prior session triggered a technical sell signal and prior reports repeatedly cautioned members - "Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal."

6/9/2015 12:07:17 PM - G - Gapped down today violating its 50 DMA line with a damaging loss and triggering a technical sell signal. Prior reports repeatedly cautioned members - "Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal."

6/8/2015 1:17:07 PM - G - Consolidating very near its 50 DMA line ($74.65) where a damaging violation would trigger a technical sell signal. Prior reports cautioned - "Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal."

6/1/2015 12:15:57 PM - G - Encountering more distributional pressure today and slumping toward its 50 DMA line ($74.32) where a damaging violation would trigger a technical sell signal. Prior reports cautioned - "Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal."

5/29/2015 6:03:17 PM - G - Loss today on higher volume was indicative of distributional pressure while still consolidating near its 52-week high. Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

5/26/2015 5:41:52 PM - G - Still quietly consolidating near its 52-week high with volume-totals cooling. Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

5/20/2015 7:10:03 PM - G - Quietly consolidating near its 52-week high with volume-totals cooling. Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

5/14/2015 6:23:22 PM - G - Rallied for a new high today with average volume and finished near the session high. Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

5/12/2015 10:34:06 PM - G - Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

5/6/2015 6:46:00 PM - G - Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. See the latest FSU analysis for more details and new annotated graphs. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

5/4/2015 5:35:35 PM - G - Posted a gain today on light volume. Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. Churned heavy volume last week while retreating from its 52-week high. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

4/29/2015 12:06:47 PM - G - Color code is changed to green as concerned were raised after gapping down today, a 2nd consecutive loss with above average volume while retreating from its 52-week high. Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

4/28/2015 6:12:44 PM - Y - Pulled back today with higher volume. Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Members were recently cautioned as it did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch.

4/27/2015 6:27:27 PM - Y - Recent gains above the pivot point have not been backed by the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch. Due to report earnings on Tuesday, 4/28/15 after the market close.

4/20/2015 1:03:02 PM - Y - Color code is changed to yellow with new pivot point cited based on its 3/20/15 high plus 10 cents. Gains above a stock's pivot point must be backed by at least +40% above average volume to trigger a new (or add-on) technical buy signal. Its 50 DMA line and recent lows in the $68 area define near-term support to watch. Due to report earnings on 4/28/15 after the market close.

4/13/2015 6:14:21 PM - G - Volume totals have been cooling while holding its ground near its high, a sign that few investors have headed for the exit. Its 50 DMA line and recent lows in the $68 area define near-term support to watch. See the latest FSU analysis for more details and new annotated graphs.

4/10/2015 6:33:37 PM - G - Volume totals have been cooling, a sign few investors have headed for the exit while holding its ground near its high. Consolidating well above its 50 DMA line and recent lows in the $68 area defining near-term support to watch on pullbacks.

4/6/2015 6:29:14 PM - G - Consolidating well above its 50 DMA line and recent lows in the $68 area defining near-term support to watch on pullbacks.

3/30/2015 7:31:03 PM - G - Consolidating with volume totals cooling. Recent lows highs in the $68.50 area define near-term support above its 50 DMA line.

3/23/2015 5:32:26 PM - G - Following brief consolidation gains lacked great volume conviction. Prior highs in the $65 area and its 50 DMA line define important support to watch on pullbacks. See latest FSU analysis for more details and new annotated graphs.

3/16/2015 6:03:32 PM - G - Rallied from a brief consolidation to a new 52-week high with today's gain lacking great volume conviction. Prior highs in the $65 area and its 50 DMA line coincide defining important support to watch on pullbacks.

3/10/2015 5:38:27 PM - G - Pulled back toward its "max buy" level with today's 3rd consecutive loss. Prior highs in the $65 area define initial support to watch on pullbacks.

3/4/2015 6:36:24 PM - G - Holding its ground extended from its prior base. Prior highs in the $65 area define initial support to watch on pullbacks. See the latest FSU analysis for more details and new annotated graphs.

3/2/2015 6:45:12 PM - G - Rallied today with above average volume. It is extended from its prior base. Prior highs in the $65 area define initial support to watch on pullbacks.

2/23/2015 5:31:49 PM - G - Pulled back today with near average volume after getting extended from its prior base. Prior highs in the $65 area define initial support to watch on pullbacks.

2/17/2015 12:09:37 PM - G - Color code is changed to green after getting extended from its prior base. Prior highs in the $65 area define initial support to watch on pullbacks.

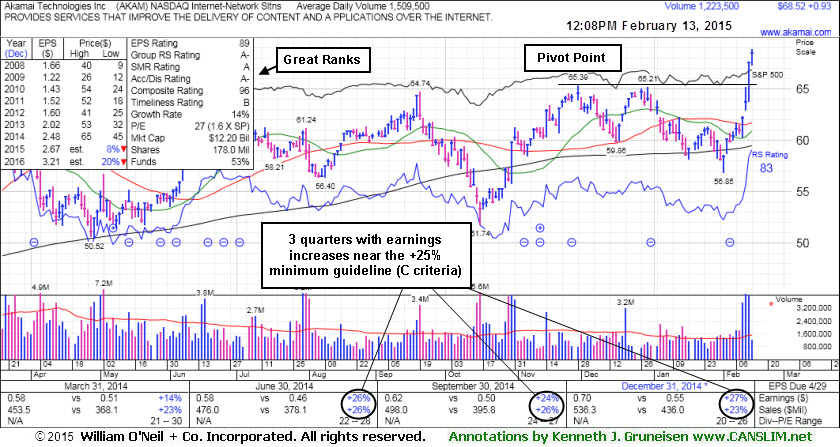

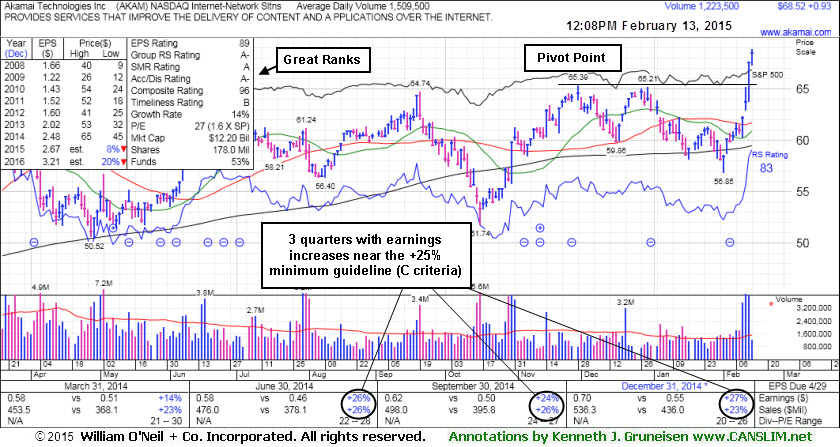

2/13/2015 5:55:20 PM - Y - Highlighted in yellow with pivot point based on its 11/28/14 high plus 10 cents in the earlier mid-day report (read here). Hit a new 52-week high today with +90% above average volume behind its 4th consecutive gain. Technically, it broke out on the prior session and it is quickly getting extended. Reported earnings +27% on +23% sales revenues for the Dec '14 quarter, and the 2 prior quarterly comparisons were very near the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been steady. See the latest FSU analysis for more details and new annotated graphs.

2/13/2015 12:23:16 PM - Y - Color code is changed to yellow with pivot point based on its 11/28/14 high plus 10 cents. Spiking to new 52-week highs today with a 4th consecutive gain marked by above average volume. Technically, it broke out on the prior session and it is quickly getting extended. Reported earnings +27% on +23% sales revenues for the Dec '14 quarter, and the 2 prior quarterly comparisons were very near the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been steady.

9/19/2014 12:09:33 PM - Reversed into the red today after spiking to new 52-week highs with recent gains marked by higher volume. Rebounded from below its 50 DMA line since noted with caution in the 8/01/14 mid-day report - "Reported earnings +26% on +26% sales revenues for the Jun '14 quarter, but prior quarterly comparisons were below the +25% minimum guideline (C criteria)."

9/15/2014 12:16:40 PM - Retreating today after challenging its 52-week high with recent gains. Rebounded from below its 50 DMA line since last noted with caution in the 8/01/14 mid-day report - "Reported earnings +26% on +26% sales revenues for the Jun '14 quarter, but prior quarterly comparisons were below the +25% minimum guideline (C criteria)."

8/1/2014 11:36:16 AM - Violating its 50 DMA line today. Reported earnings +26% on +26% sales revenues for the Jun '14 quarter, but prior quarterly comparisons were below the +25% minimum guideline (C criteria).

7/31/2014 11:42:01 AM - Consolidating above its 50 DMA line. Reported earnings +26% on +26% sales revenues for the Jun '14 quarter, but prior quarterly comparisons were below the +25% minimum guideline (C criteria).

10/9/2013 12:18:17 PM - Slumping below its 50 DMA line with today's 3rd consecutive loss. Last noted in the 9/23/13 mid-day report with caution - "Reported earnings +24% on +14% sales revenues for the Jun '13 quarter, its 2nd quarterly comparison below the +25% minimum guideline in the past 3 quarters. Sales revenues and earnings history are below the fact-based investment system's guidelines."

9/23/2013 12:01:44 PM - Perched near its 52-week high following a streak of 9 consecutive gains. The 9/19/13 mid-day report cautioned members - "Reported earnings +24% on +14% sales revenues for the Jun '13 quarter, its 2nd quarterly comparison below the +25% minimum guideline in the past 3 quarters. Sales revenues and earnings history are below the fact-based investment system's guidelines."

9/19/2013 11:50:48 AM - Hitting a new 52-week high with today's 9th consecutive gain. Reported earnings +24% on +14% sales revenues for the Jun '13 quarter, its 2nd quarterly comparison below the +25% minimum guideline in the past 3 quarters. Sales revenues and earnings history are below the fact-based investment system's guidelines.

12/7/2012 11:58:28 AM - Gapped up from below its 50 DMA line to challenge its 52-week high on the prior session. It had also gapped up from below its 50 DMA line to challenge its 52-week high with a volume-driven gain when last noted in the 10/25/12 mid-day report - "Reported earnings +26% on +23% sales revenues for the Sep '12 quarter, its first quarterly earnings increase above the +25% minimum guideline in more than 2 years. Sales revenues and earnings history are below the fact-based investment system's guidelines."

10/25/2012 11:54:45 AM - Gapped up from below its 50 DMA line to challenge its 52-week high today with above average volume. Reported earnings +26% on +23% sales revenues fore the Sep '12 quarter, its first quarterly earnings increase above the +25% minimum guideline in more than 2 years. Prior mid-day reports noted- "Sales revenues and earnings history are below the fact-based investment system's guidelines."

10/28/2010 12:24:40 PM - Touched a new 52-week high today after gapping up for a second consecutive gain with above average volume. It slumped below its 50 DMA line after it was last noted in the 9/02/10 mid-day and earlier reports - "Gain on heavier volume helping it rally from the previously noted 'double bottom' type base pattern. Sales revenues and earnings history are below the fact-based investment system's guidelines."

9/2/2010 12:18:30 PM - Hitting a new 52-week high today. Last noted in the 8/20/10 in the mid-day report as a - "Gain on heavier volume helping it rally from the previously noted 'double bottom' type base pattern. Sales revenues and earnings history are below the fact-based investment system's guidelines."

8/20/2010 12:42:04 PM - Hit a new 52-week high today with its gain on heavier volume helping it rally from the previously noted "double bottom" type base pattern. Sales revenues and earnings history are below the fact-based investment system's guidelines.

8/19/2010 12:06:01 PM - Gain today has it approaching prior highs of a "double bottom" type base pattern. Sales revenues and earnings history are below the fact-based investment system's guidelines.

6/14/2010 12:16:11 PM - Hit another new 52-week high today, and it is extended from any sound base. Sales revenues and earnings history are below the fact-based investment system's guidelines.

6/10/2010 12:26:07 PM - Hit a new 52-week high today, and it is extended from any sound base. Sales revenues and earnings history are below the fact-based investment system's guidelines.

6/4/2010 12:24:00 PM - Holding its ground near its 52-week high, extended from any sound base. Sales revenues and earnings history are below the fact-based investment system's guidelines.

5/18/2010 12:15:54 PM - Hit a new 52-week high today, extended from any sound base. Sales revenues and earnings history are below the fact-based investment system's guidelines.

5/17/2010 12:42:17 PM - Consolidating near its 52-week high, recently finding support well above its 50 DMA line. Sales revenues and earnings history are below the fact-based system's guidelines.

4/30/2010 12:31:17 PM - Holding its ground today after a gap up on 4/29/10 for a new 52-week high. Sales revenues and earnings history are below the fact-based system's guidelines.

4/29/2010 11:52:08 AM - Gapped up today for a new 52-week high. Sales revenues and earnings history are below the fact-based system's guidelines.