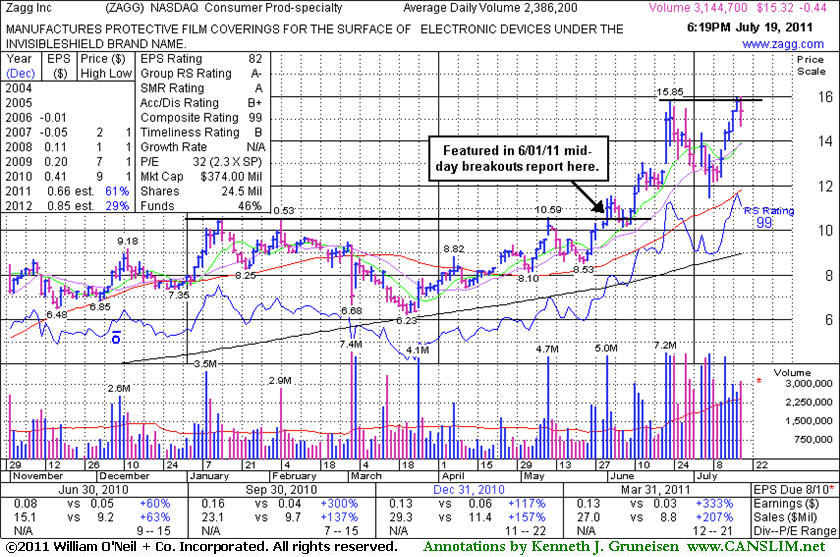

Strong Leader's Latest Consolidation is Not a Sound Base - Tuesday, July 19, 2011

Zagg Inc (ZAGG -$0.44 or -2.79% to $15.32) touched a new all-time high today, but it bucked the broader market and reversed to close with a small loss on slightly higher volume, breaking a streak of 5 consecutive gains. No overhead supply remains to act as resistance, however its short "V" shaped consolidation in recent weeks is not recognized as a sound base pattern so a new pivot point is not being cited. Its 50-day moving average (DMA) line and recent lows define chart support.

The stock's last appearance in this FSU section was on 6/23/11 and it included an annotated graph under the headline, "Outlier Tallied Big Gains and Deserves Time to Deliver More". It was explained that in the Certification program they teach investors to adhere to a rule of holding stocks for a minimum of at least 8 weeks whenever they rise more than +20% in the first 2-3 weeks after they are first bought. Stocks that quickly tallied such large gains have historically proven to produce some of the stock market's biggest gains.

Patience may allow for a proper new base to form and for a fresh technical breakout to allow new or add-on buying efforts without straying from the fact-based investment system guidelines. Remember to be patient, and do not significantly average up your cost basis with later purchases. Only buy smaller amounts upon any subsequent breakouts. Those who follow the investment system's rules never average down. Odds are better for your success are substantially better when your buys are made while a stock is rising in price, not falling.

Strong quarterly and annual earnings increases satisfy the C and A criteria. The number of top-rated funds owning its shares rose from 13 in Jun '10 to 60 in Mar '11, a reassuring sign concerning the I criteria. As always, strict buying and selling rules must be followed in order to maximize gains and minimize losses.

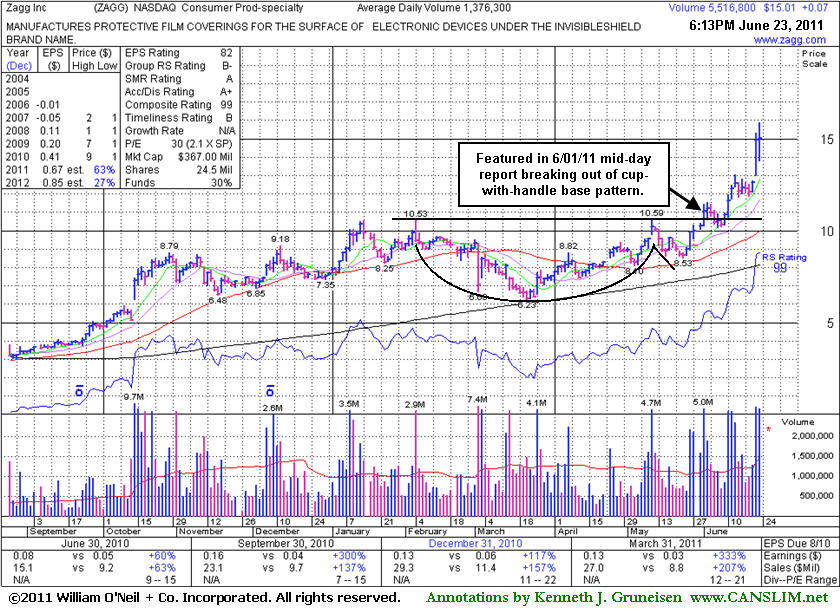

Outlier Tallied Big Gains and Deserves Time to Deliver More - Thursday, June 23, 2011

Zagg Inc (ZAGG +$0.08 or +0.56% to $15.02) hit yet another new all-time high today, overcoming a gap down for an early loss. A gap up and considerable volume-driven gain on 6/22/11 came after news it bought privately held mobile device accessories company iFrogz Inc for about $105 million. Now it is very extended from a sound base, and prior highs define initial support to watch on pullbacks. The high-ranked Consumer Product - Specialty firm was first featured in the 6/01/11 mid-day report as it broke out from a cup-with-handle type base. There was heavy volume behind its 4th consecutive gain as it triggered a technical buy signal. The FSU section on 6/01/11 included an annotated graph below the headline, "Bullish Action is a Good Start, But Broader Market is a Major Factor". The stock has been unhindered by resistance due overhead supply, but most of the time since it was featured the M criteria has been a concern. Typically 3 out of 4 stocks follow the direction of the broader market, so this outlier has clearly been the exception, rather than the rule, in recent weeks.Strong quarterly and annual earnings increases satisfy the C and A criteria. The number of top-rated funds owning its shares rose from 13 in Jun '10 to 53 in Mar '11, a reassuring sign concerning the I criteria. As always, strict buying and selling rules must always be followed in order to maximize gains and minimize losses. In the Certification they teach investors to adhere to a rule of holding stocks for a minimum of at least 8 weeks whenever they rise more than +20% in the first 2-3 weeks after they are first bought. Stocks that quickly tallied such large gains have historically proven to produce some of the stock market's biggest gains. Disciplined investors never chase stocks that are extended from a sound base, however they might watch for secondary buy points to develop and be noted.

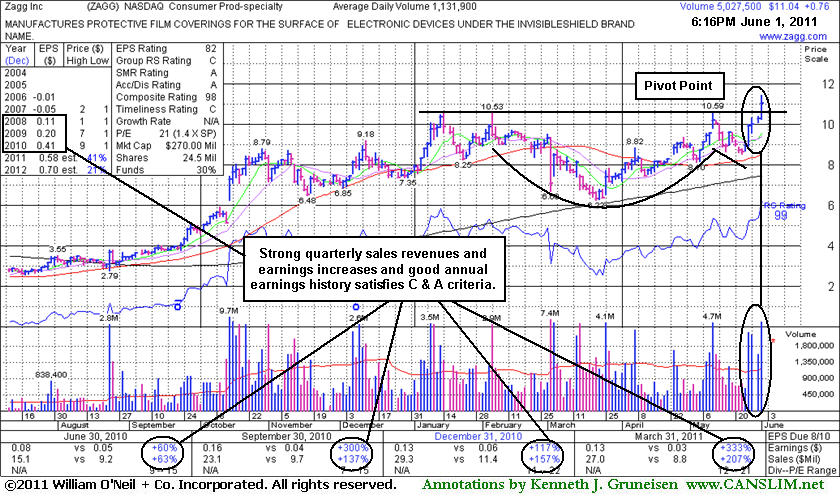

Bullish Action is a Good Start, But Broader Market is a Major Factor - Wednesday, June 01, 2011

Zagg Inc (ZAGG +$0.76 or +7.39% to $11.04) hit a new 52-week high today and closed in the upper half of its intra-day range. It broke out from a cup-with-handle type base with heavy volume behind its 4th consecutive gain triggering a technical buy signal. In recent months its 200-day moving average (DMA) line acted as support. In today's mid-day report its color code was changed to yellow with pivot point cited based on its prior high. Quarterly and annual earnings increases satisfy the C and A criteria. The number of top-rated funds owning its shares rose from 13 in Jun '10 to 53 in Mar '11, a reassuring sign concerning the I criteria. Keep in mind 3 out of 4 stocks follow along with the broader market direction, so much of the stock's future outcome will be determined by the near-term action in the major indices. At least it is unhindered by overhead supply if the rally continues, but strict buying and selling rules must always be followed in order to maximize gains and minimize losses.