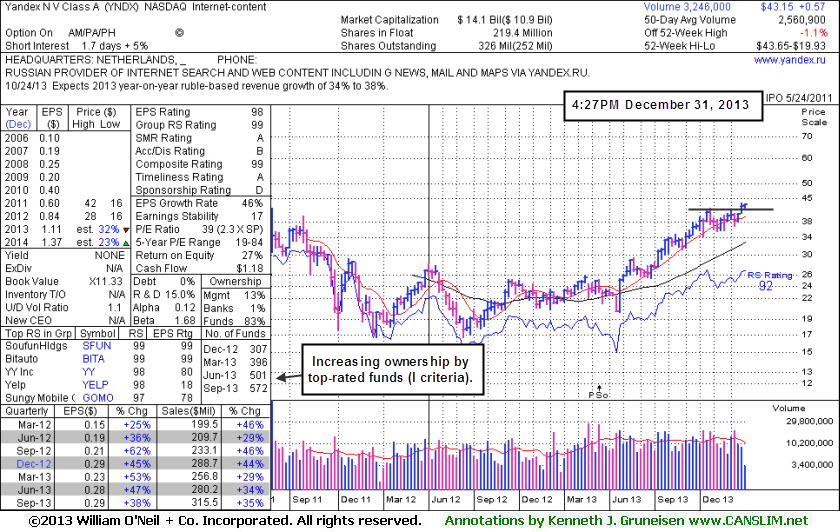

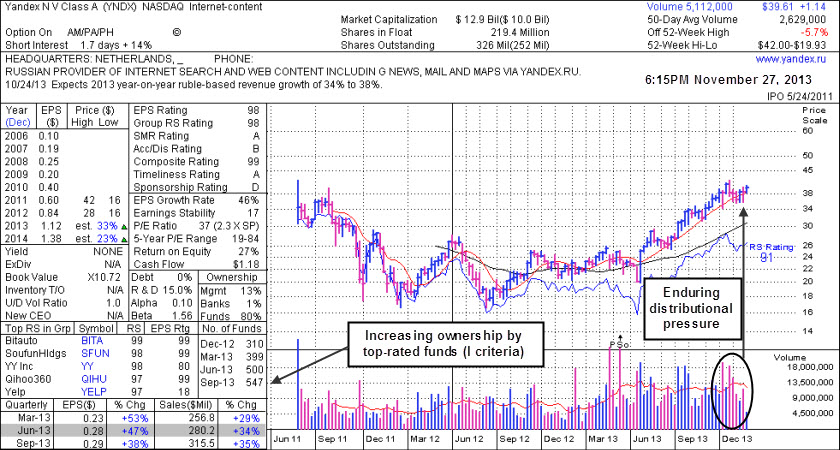

Prior lows in the $35-36 area define the next important chart support levels to watch below its 50 DMA line where any subsequent violations would raise concerns and trigger more worrisome technical sell signals. The company has shown strong quarterly sales revenues and earnings increases, including +38% earnings on +35% sales revenues for the Sep '13 quarter versus the year ago period. It has earned high ranks including a 98 Earnings Per Share(EPS) rating, and it has maintained a strong quarterly and annual earnings history (C and A criteria). The number of top-rated funds owning its shares rose from 276 in Sep '12 to 572 in Sep '13, a reassuring sign concerning the I criteria. The Internet - Content group has recently shown leadership and it currently has the highest possible A+ Group Relative Strength Rating, a reassuring sign concerning the L criteria of the fact-based investment system.

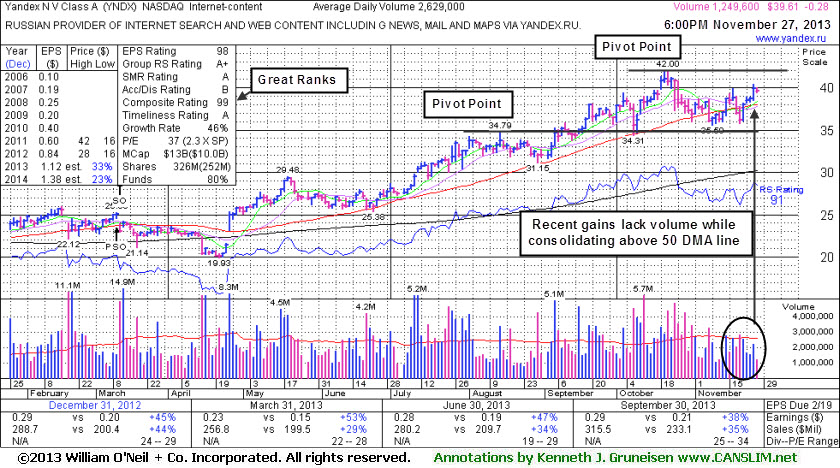

The company has shown strong quarterly sales revenues and earnings increases, including +38% earnings on +35% sales revenues for the Sep '13 quarter versus the year ago period. It has earned high ranks including a 98 Earnings Per Share(EPS) rating, and it has maintained a strong quarterly and annual earnings history (C and A criteria). The number of top-rated funds owning its shares rose from 276 in Sep '12 to 547 in Sep '13, a reassuring sign concerning the I criteria. The Internet - Content group has recently shown leadership and it currently has the highest possible A+ Group Relative Strength Rating, a reassuring sign concerning the L criteria of the fact-based investment system.

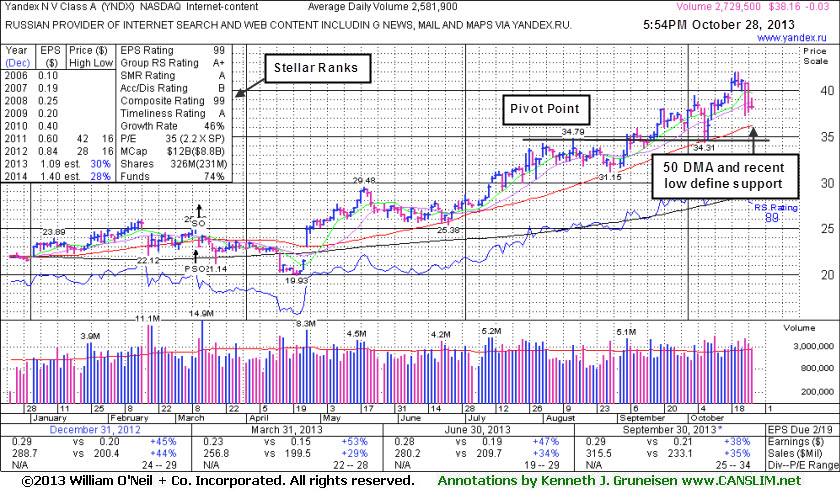

Yandex (YNDX -$0.03 or -0.08% to $38.16) held its ground today while trading lighter, near-average volume. Volume was higher while retreating abruptly from new 52-week highs hit last week, a sign of distributional pressure. Its 50-day moving average (DMA) line defines important near-term support to watch along with recent lows where any subsequent violations would raise concerns and trigger technical sell signals.

The company has shown strong quarterly sales revenues and earnings increases, including +38% earnings on +35% sales revenues for the Sep '13 quarter versus the year ago period. It has earned high ranks including the highest possible 99 Earnings Per Share(EPS) rating, and it has maintained a strong quarterly and annual earnings history (C and A criteria). The number of top-rated funds owning its shares rose from 276 in Sep '12 to 527 in Sep '13, a reassuring sign concerning the I criteria. The Internet - Content group has recently shown leadership and it currently has the highest possible A+ Group Relative Strength Rating, a reassuring sign concerning the L criteria of the fact-based investment system. YNDX has managed to make a choppy ascent since last shown in this FSU section on 9/18/13 with an annotated daily graph under the headline, "Gains Lacked Volume Conviction While Hitting New Highs". It is extended from its prior base, and the annotated weekly graph points out the distributional action in recent weeks as volume was above average on its pullbacks.

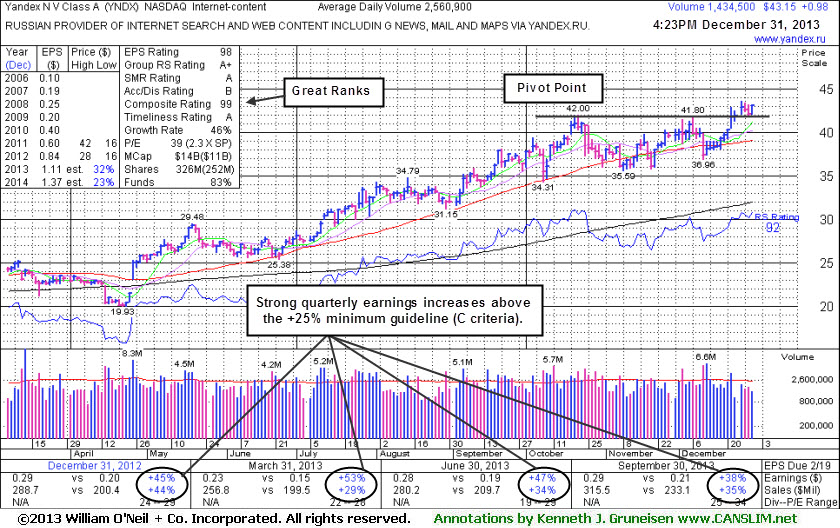

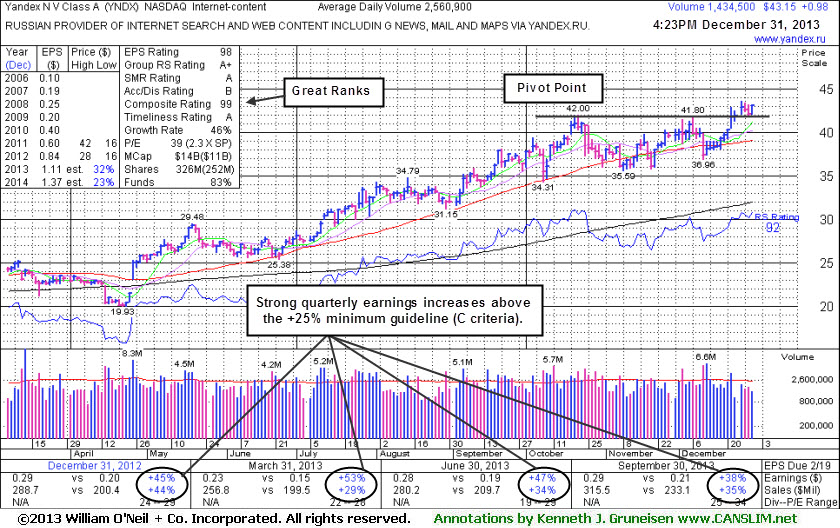

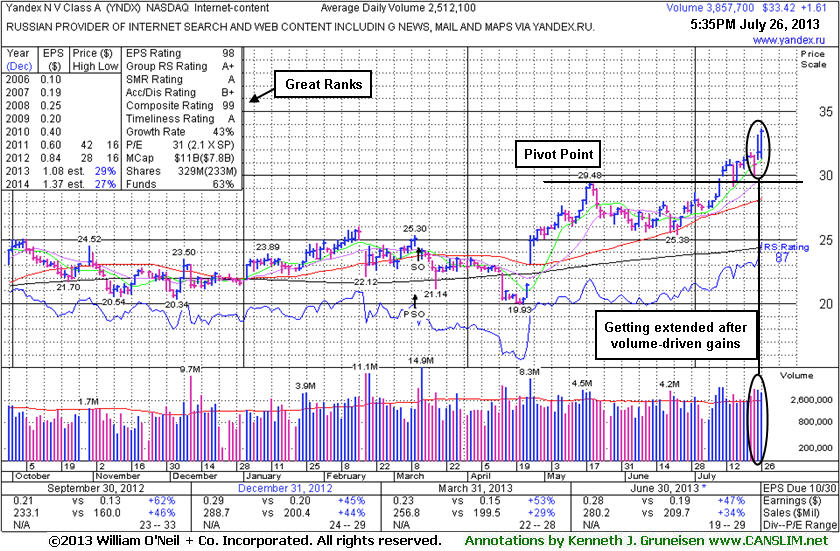

The company has shown strong quarterly sales revenues and earnings increases through Jun '13 versus the year ago periods. It has earned high ranks and maintained a strong quarterly and annual earnings history (C and A criteria). The number of top-rated funds owning its shares rose from 276 in Sep '12 to 476 in Jun '13, a reassuring sign concerning the I criteria. The Internet - Content group has recently shown leadership and it currently has the highest possible A+ Group Relative Strength Rating, a reassuring sign concerning the L criteria of the fact-based investment system.

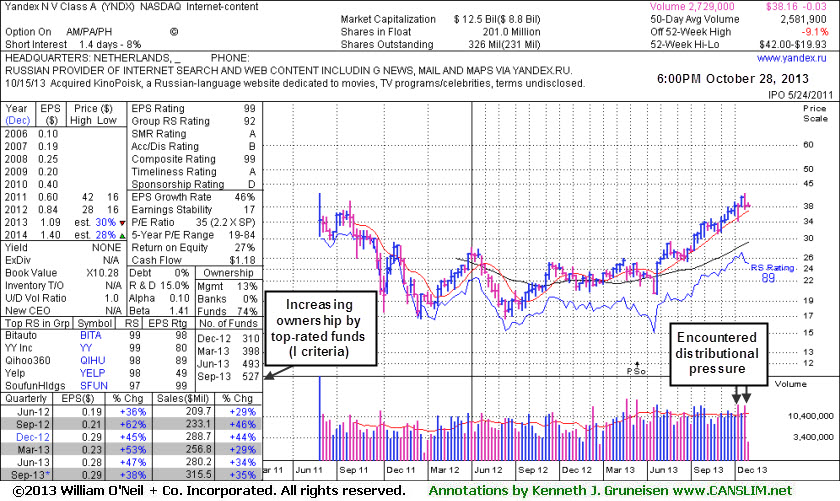

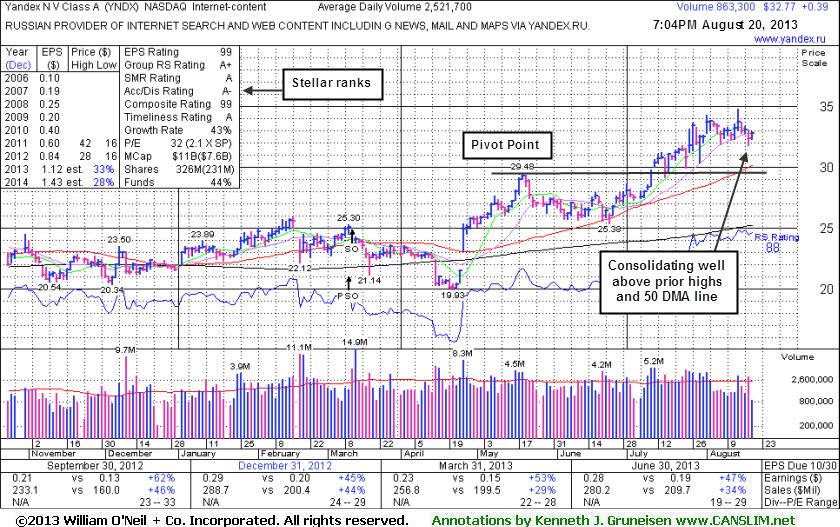

The company has shown strong quarterly sales revenues and earnings increases through Jun '13 versus the year ago periods. It has earned high ranks and maintained a strong quarterly and annual earnings history (C and A criteria). The number of top-rated funds owning its shares rose from 276 in Sep '12 to 431 in Jun '13, a reassuring sign concerning the I criteria. The Internet - Content group has recently shown leadership and it currently has the highest possible A+ Group Relative Strength Rating, a reassuring sign concerning the L criteria of the fact-based investment system.

Yandex (YNDX +$1.61 or +5.06% to $33.42) spiked to another new 52-week high with a 2nd consecutive volume-driven gain, getting more extended from its previous base. Disciplined investors do not chase stocks more than +5% above their pivot point. Doing so increases the chance that an ordinary pullback may trigger the strict sell rules which limit losses when any stock falls more than -7% from their purchase price.

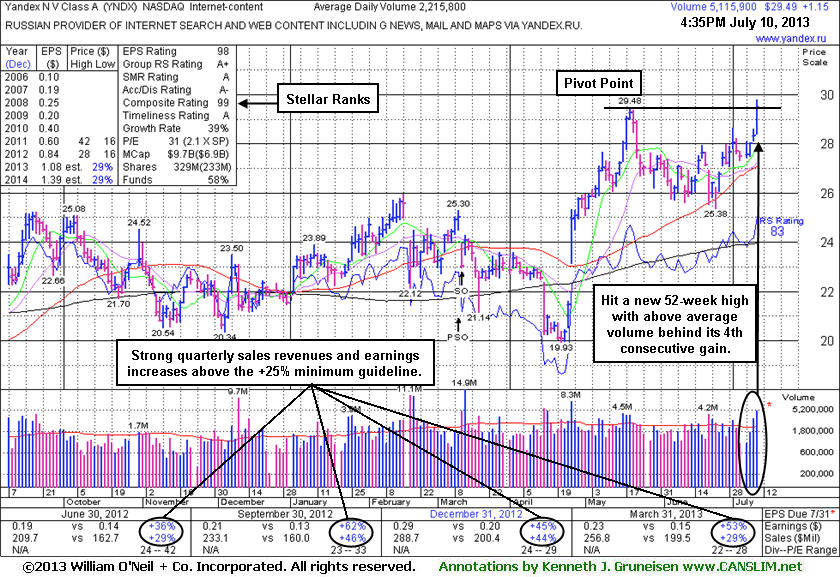

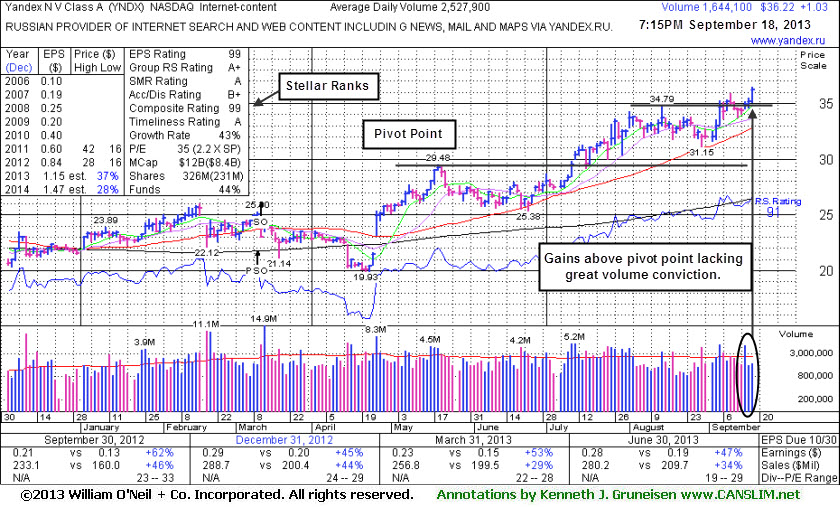

YNDX was highlighted in yellow with pivot point ($29.58) cited based on its 5/20/13 high plus 10 cents and an annotated weekly graph was included in the 7/10/13 mid-day report (read here) and it appeared in the FSU section that evening with an annotated graph under the headline, "Finished Near Pivot Point With Solid Volume-Driven Gain". Then it gapped up and rallied above the $30 threshold the next day with another volume-driven gain clinching a proper technical buy signal. When consolidating it found support above prior highs in the $28-29 area which defined initial support to watch.

The company has shown strong quarterly sales revenues and earnings increases through Jun '13 versus the year ago periods. It has earned high ranks and maintained a strong quarterly and annual earnings history (C and A criteria). The number of top-rated funds owning its shares rose from 276 in Sep '12 to 431 in Jun '13, a reassuring sign concerning the I criteria. The Internet - Content group has recently shown leadership and it currently has the highest possible A+ Group Relative Strength Rating, a reassuring sign concerning the L criteria of the fact-based investment system.

YNDX has shown strong quarterly sales revenues and earnings increases through Mar '13 versus the year ago periods. It has earned high ranks and maintained a strong quarterly and annual earnings history (C and A criteria). The number of top-rated funds owning its shares rose from 276 in Sep '12 to 403 in Jun '13, a reassuring sign concerning the I criteria. The Internet - Content group has recently shown leadership and it currently has the highest possible A+ Group Relative Strength Rating, a reassuring sign concerning the L criteria of the fact-based investment system.