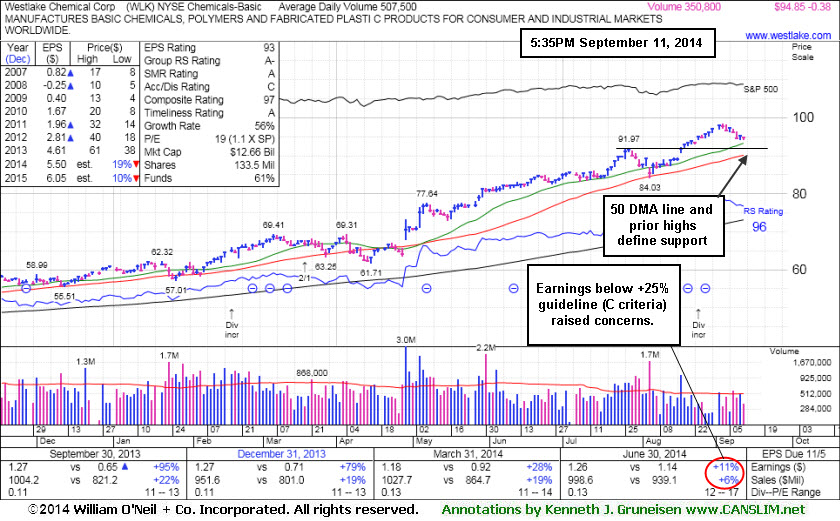

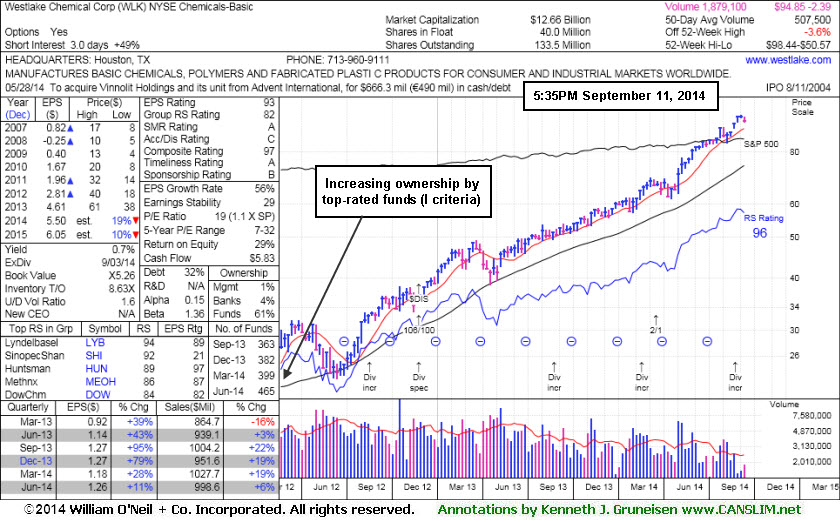

Consolidating Above Near-Term Support Levels - Thursday, September 11, 2014

Westlake Chemical Corp (WLK -$0.38 or -0.40% to $94.85) is consolidating above prior highs in the $92 area and its 50-day moving average (DMA) line ($90.14). For investors who may be continuing to give it the benefit of the doubt despite the recently noted fundamental flaw any subsequent violations would raise greater concerns and trigger technical sell signals. Technical strength has continued despite having reported earnings +11% on +6% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns.Its 50 DMA line acted as support during its consolidation since last shown in this FSU section on 8/21/14 under the headline, "Technically Strong Despite Fundamental Concerns Raised By Most Current Quarterly Earnings". WLK traded up as much as +35.2% from when it was first featured in yellow at $72.79 rallying from a "double bottom" base in the 4/29/14 mid-day report (read here).

The Chemicals - Basic industry group has a Group Relative Strength rating of 82 and strong action and leadership from others in the group is a reassuring sign concerning the L criteria. WLK's annual earnings growth rate (A criteria) has been strong after a downturn in FY '08 and '09. The number of top-rated funds owning its shares rose from 381 in Sep '13 to 465 in Jun '14, a reassuring trend concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days. The small supply of only 40 million shares (S criteria) in the public float is ideal, while it can contribute to greater price volatility in the event of new institutional buying or selling.

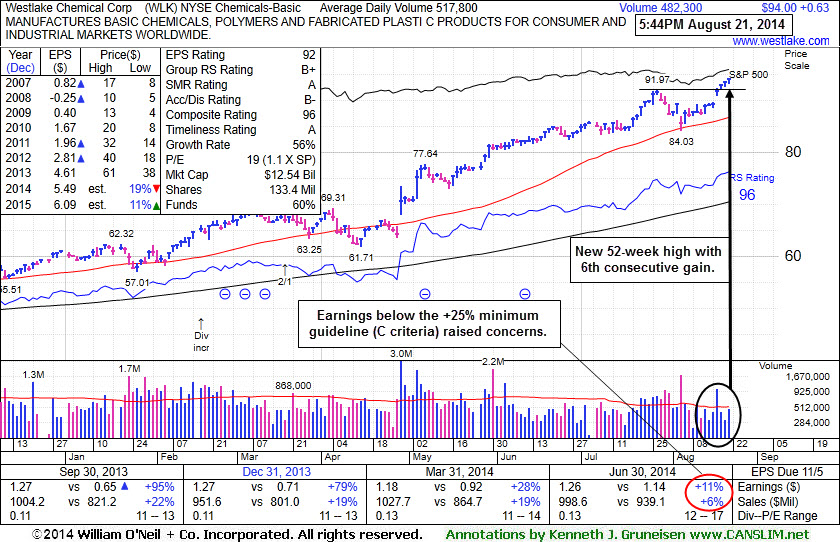

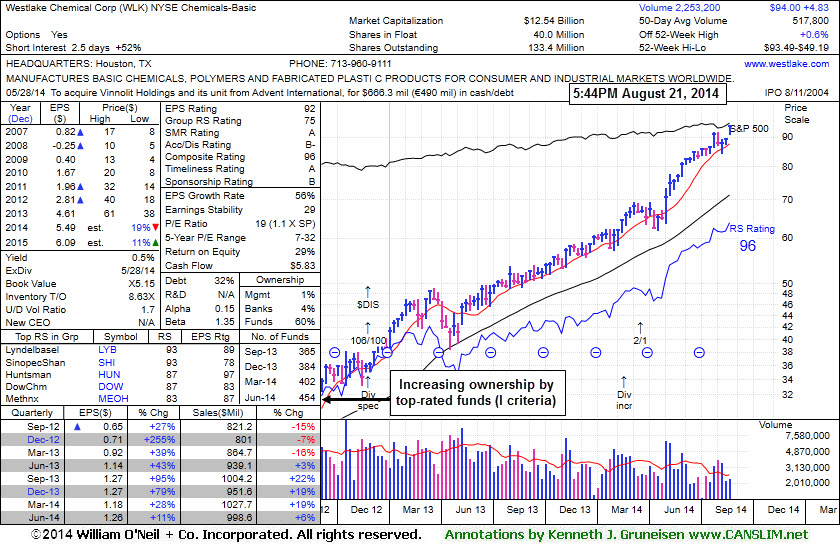

Technically Strong Despite Fundamental Concerns Raised By Most Current Quarterly Earnings - Thursday, August 21, 2014

Westlake Chemical Corp (WLK +$0.63 or +0.67% to $94.00) hit yet another new 52-week high with today's 6th consecutive gain, still showing technical strength. It recently reported earnings +11% on +6% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. For investors who may be continuing to give it the benefit of the doubt despite the fundamental flaw its 50-day moving average (DMA) line ($86.67) defines near-term support where a subsequent violation would raise greater concerns and trigger a technical sell signal. Its 50 DMA line acted as support during its consolidation since last shown in this FSU section on 7/25/14 under the headline, "Extended From Prior Base After Streak of 8 Consecutive Gains", hitting another new 52-week high but noted with caution - "Getting more extended from any sound base pattern."WLK is up +29.1% from when it was first featured in yellow at $72.79 rallying from a "double bottom" base in the 4/29/14 mid-day report (read here). The Chemicals - Basic industry group has a Group Relative Strength rating of 75 and strong action and leadership from others in the group is a reassuring sign concerning the L criteria.

Its annual earnings growth rate (A criteria) has been strong after a downturn in FY '08 and '09. The number of top-rated funds owning its shares rose from 381 in Sep '13 to 454 in Jun '14, a reassuring trend concerning the I criteria. The small supply of only 40 million shares (S criteria) in the public float is ideal, while it can contribute to greater price volatility in the event of new institutional buying or selling.

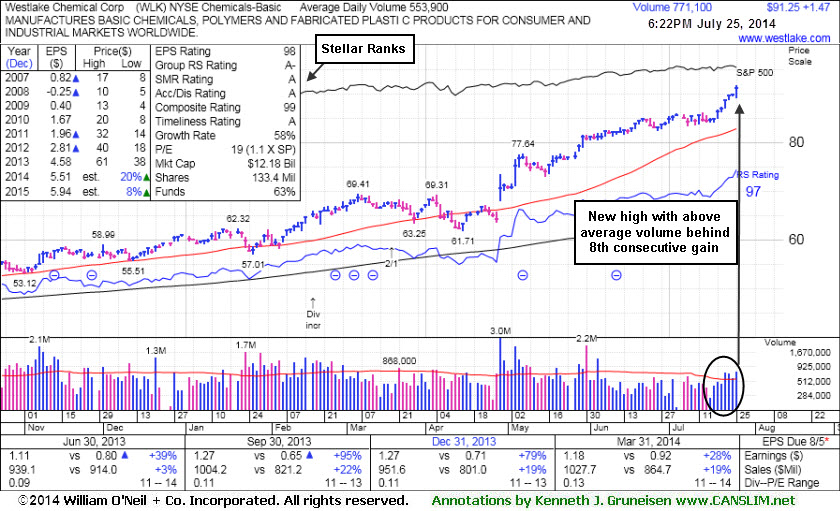

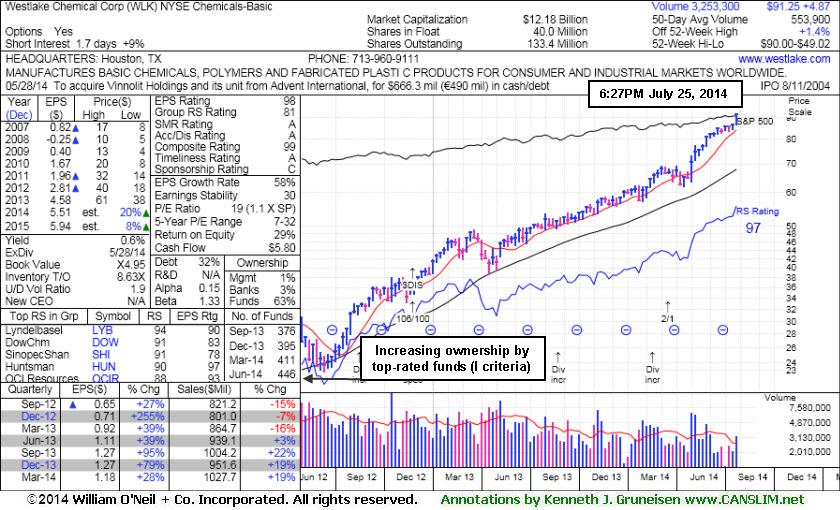

Extended From Prior Base After Streak of 8 Consecutive Gains - Friday, July 25, 2014

Westlake Chemical Corp (WLK +$1.47 or +1.64% to $91.25) hit another new 52-week high with above average volume behind today's 8th consecutive gain, getting more extended from any sound base pattern. Its 50-day moving average (DMA) line ($82.79) defines important near-term support to watch on pullbacks. It is up +25.4% from when it was first featured in yellow at $72.79 rallying from a "double bottom" base in the 4/29/14 mid-day report (read here).It was last shown in this FSU section on 7/07/14 under the headline, "Great Ranks and Reassuring Leadership in Chemical Group". The Chemicals - Basic industry group has a Group Relative Strength rating of 81 and strong action and leadership from others in the group is a reassuring sign concerning the L criteria. It reported +28% earnings on +19% sales for the Mar '14 quarter, and it has earned great ranks as its quarterly earnings increases have been above the +25% minimum (C criteria). Its annual earnings growth rate (A criteria) has also been strong after a downturn in FY '08 and '09. The number of top-rated funds owning its shares rose from 381 in Sep '13 to 446 in Jun '14, a reassuring trend concerning the I criteria. The small supply of only 40 million shares (S criteria) in the public float is ideal, while it can contribute to greater price volatility in the event of new institutional buying or selling.

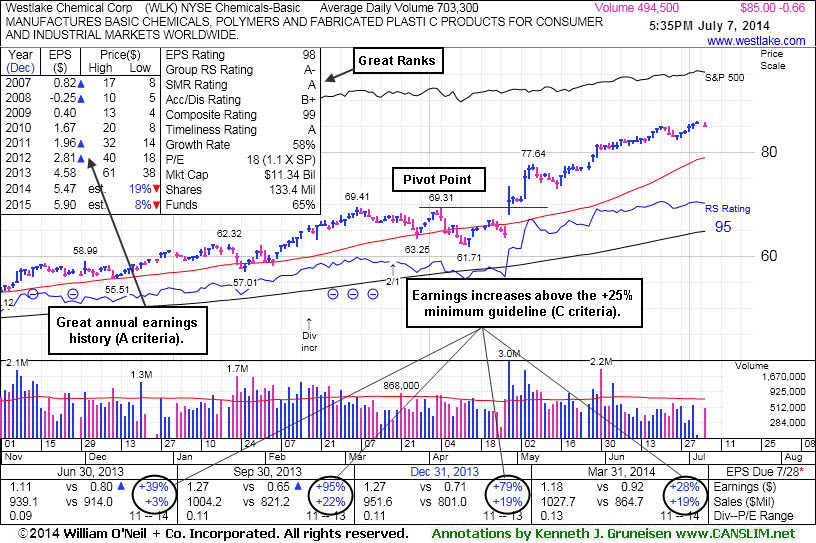

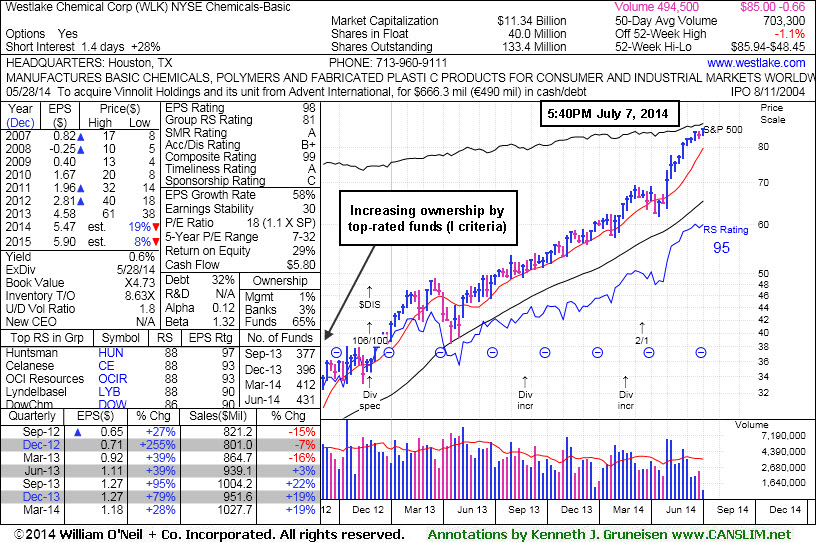

Great Ranks and Reassuring Leadership in Chemical Group - Monday, July 07, 2014

Westlake Chemical Corp (WLK -$0.66 or -0.77% to $85.00) is hovering near its 52-week high, extended from any sound base pattern. Its 50-day moving average (DMA) line defines important near-term support to watch on pullbacks. It was last shown in this FSU section on 6/13/14 under the headline, "Chemical Firm Quietly Posted 7th Consecutive Weekly Gain". Volume totals have been below average in recent weeks while holding its ground, a sign that very few investors have headed for the exit. The Chemicals - Basic industry group has a Group Relative Strength rating of 81 and strong action and leadership from others in the group is a reassuring sign concerning the L criteria.It finished the session up +16.8% from when it was first featured in yellow at $72.79 rallying from a "double bottom" base in the 4/29/14 mid-day report (read here). It reported +28% earnings on +19% sales for the Mar '14 quarter, and it has earned great ranks as its quarterly earnings increases have been above the +25% minimum (C criteria). Its annual earnings growth rate (A criteria) has also been strong after a downturn in FY '08 and '09. The number of top-rated funds owning its shares rose from 381 in Sep '13 to 431 in Mar '14, a reassuring trend concerning the I criteria. The small supply of only 40 million shares (S criteria) in the public float is ideal, while it can contribute to greater price volatility in the event of new institutional buying or selling.

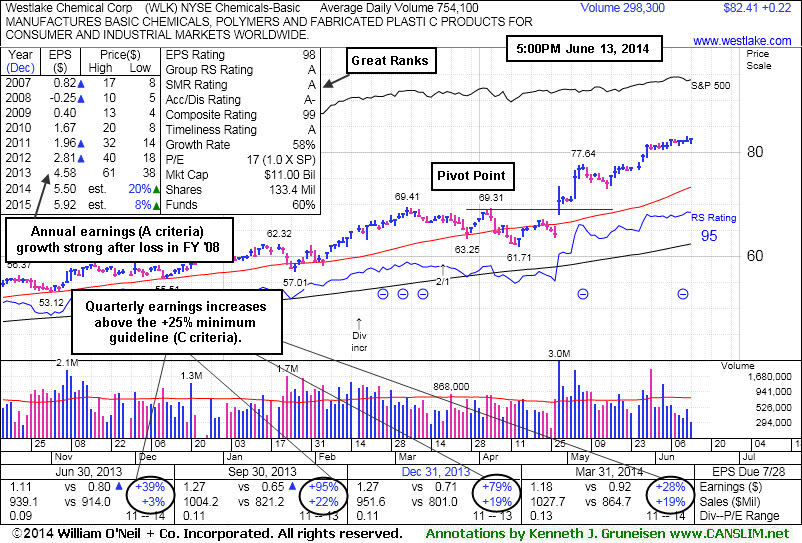

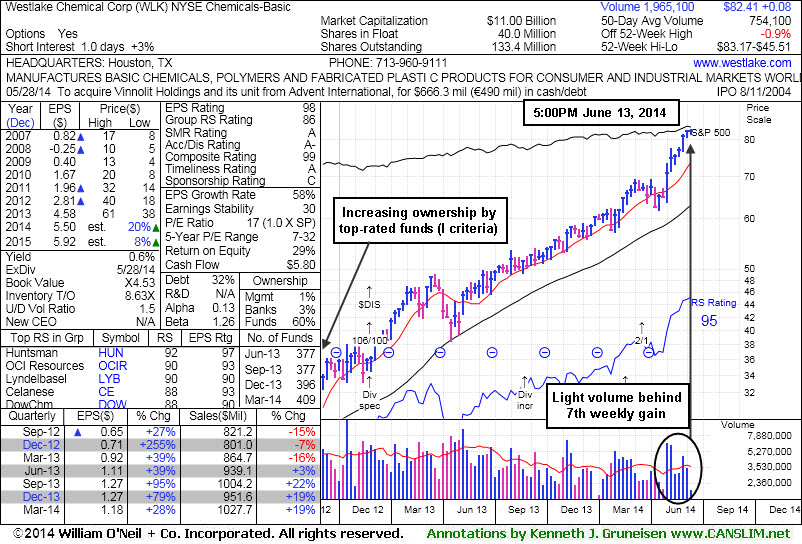

Chemical Firm Quietly Posted 7th Consecutive Weekly Gain - Friday, June 13, 2014

Westlake Chemical Corp (WLK +$0.22 or +0.27% to $82.41) remains quietly perched at its 52-week high. It is extended from any sound base after tallying 7 consecutive weekly gains. Very few investors have headed for the exit as the daily volume totals have been below average while it has held its ground stubbornly since last shown in this FSU section on 5/30/14 under the headline, "Extended From Prior Base After 5 Weekly Gains". Prior highs near $77 define important near-term support to watch on pullbacks. It is well above its 50-day moving average (DMA) line, the next familiar and very important support level for chart readers.It finished Friday's session up +13.2% from when it was first featured in yellow at $72.79 rallying from a "double bottom" base in the 4/29/14 mid-day report (read here). It reported +28% earnings on +19% sales for the Mar '14 quarter, and it has earned great ranks as its quarterly earnings increases have been above the +25% minimum (C criteria). Its annual earnings growth rate (A criteria) has also been strong after a downturn in FY '08 and '09. The number of top-rated funds owning its shares rose from 381 in Sep '13 to 409 in Mar '14, a reassuring trend concerning the I criteria. The small supply of only 40 million shares (S criteria) in the public float is ideal, while it can contribute to greater price volatility in the event of new institutional buying or selling.

The Chemicals - Basic industry group has seen its Group Relative Strength rating rise from 65 to 86 since shown in this FSU section on 4/29/14 with annotated graphs under the headline, "Technical Breakout From Double Bottom Base Pattern". Strong action and leadership from others in the group is a reassuring sign concerning the L criteria.

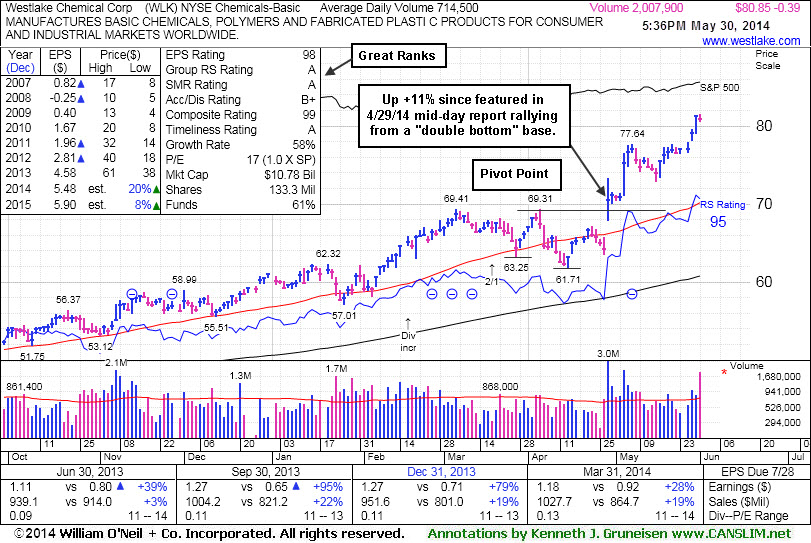

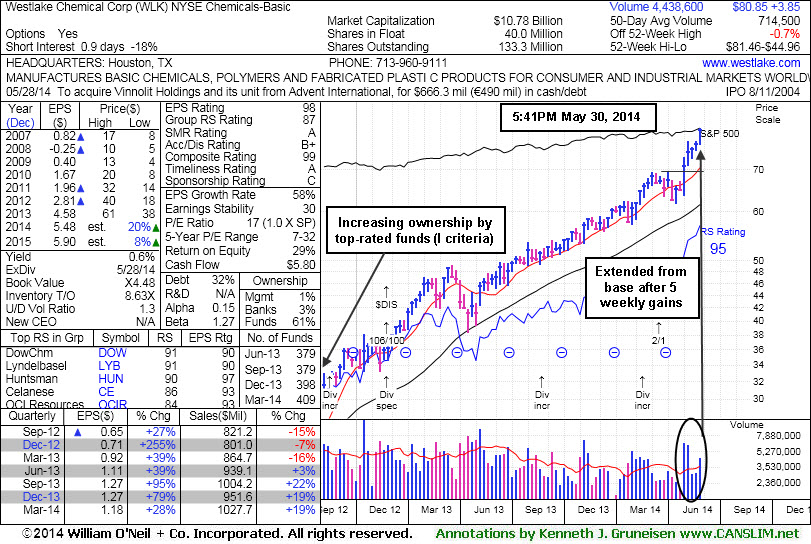

Extended From Prior Base After 5 Weekly Gains - Friday, May 30, 2014

Westlake Chemical Corp (WLK -$0.39 or -0.48% to $80.85) is perched near a new 52-week high after 5 consecutive weekly gains. It finished Friday's session up +11% from when it was first featured in yellow at $72.79 rallying from a "double bottom" base in the 4/29/14 mid-day report (read here). The recent low ($72.84 on 5/15/14) defines important near-term support to watch on pullbacks. It was last shown in this FSU section on 5/08/14 with annotated graphs under the headline, "Extended From Base Following Volume Driven Gains", rallying above its "max buy" level +5% above its pivot point.It reported +28% earnings on +19% sales for the Mar '14 quarter, and it has earned great ranks as its quarterly earnings increases have been above the +25% minimum (C criteria). Its annual earnings growth rate (A criteria) has also been strong after a downturn in FY '08 and '09. The number of top-rated funds owning its shares rose from 381 in Sep '13 to 409 in Mar '14, a reassuring trend concerning the I criteria. The small supply of only 40 million shares (S criteria) in the public float is ideal, while it can contribute to greater price volatility in the event of new institutional buying or selling.

The Chemicals - Basic industry group has seen its Group Relative Strength rating rise from 65 to 87 since shown in this FSU section on 4/29/14 with annotated graphs under the headline, "Technical Breakout From Double Bottom Base Pattern". Strong action and leadership from others in the group is a reassuring sign concerning the L criteria.

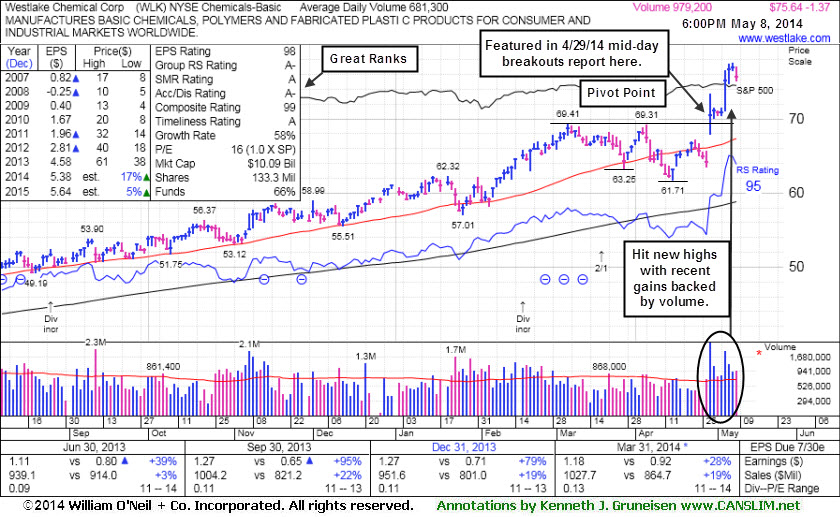

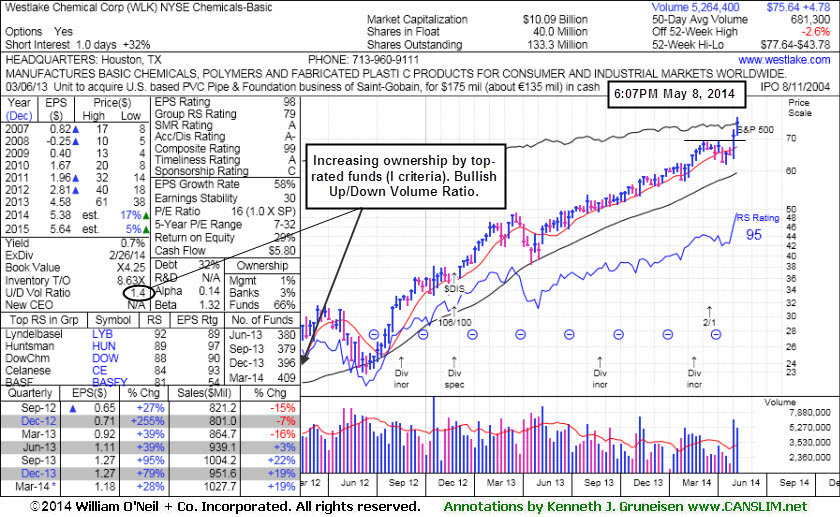

Extended From Base Following Volume Driven Gains - Thursday, May 08, 2014

Westlake Chemical Corp (WLK -$1.37 or +-1.78% to $75.64) is perched near its 52-week high after rallying above its "max buy" level with a recent spurt of volume-driven gains. Prior highs in the $69 area define near-term support to watch. It reported +28% earnings on +19% sales for the Mar '14 quarter, and it has earned great ranks as its quarterly earnings increases have been above the +25% minimum (C criteria).Its annual earnings growth rate (A criteria) has also been strong after a downturn in FY '08 and '09. The number of top-rated funds owning its shares rose from 381 in Sep '13 to 409 in Mar '14, a reassuring trend concerning the I criteria. The Chemicals - Basic industry group has seen its Group Relative Strength rating rise from 65 to 79 since last shown in this FSU section on 4/29/14 with annotated graphs under the headline, "Technical Breakout From Double Bottom Base Pattern". Strong action and leadership from others in the group is a reassuring sign concerning the L criteria.

The company was highlighted in yellow at $72.79 with pivot point cited based on its 4/04/14 high in the 4/29/14 mid-day report (read here). The plastics maker separated its ethylene assets into a tax-advantaged partnership in which it plans to sell shares to the public. It gapped up for a considerable volume-driven gain and a new 52-week high, rallying from a "double bottom" base. While the stock's bullish action triggered a technical buy signal, members were cautioned that 3 out of 4 stocks tend to move in the same direction of the major averages (M criteria).

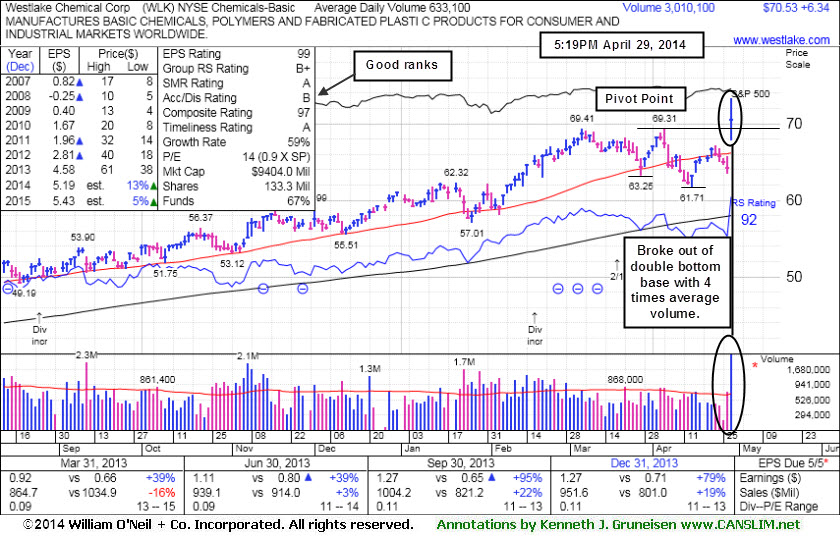

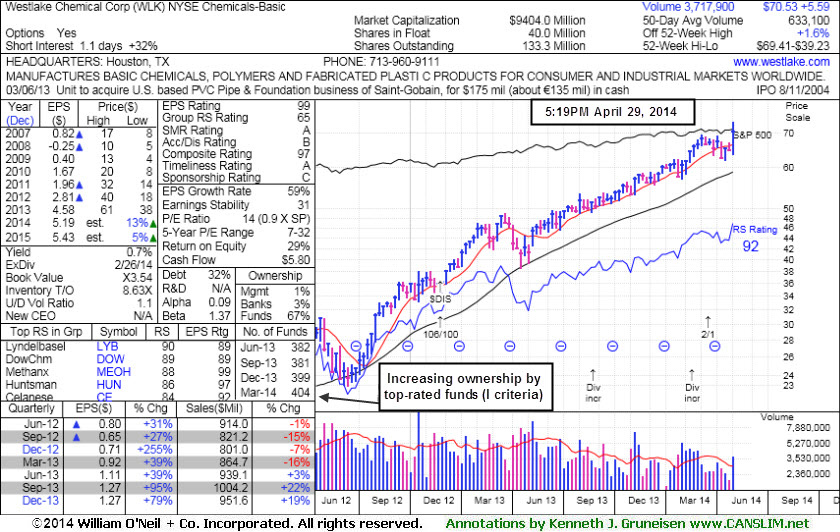

Technical Breakout From Double Bottom Base Pattern - Tuesday, April 29, 2014

Westlake Chemical Corp (WLK +$6.34 or +9.88% to $70.53) was highlighter in yellow with pivot point cited based on its 4/04/14 high in the earlier mid-day report (read here). The plastics maker separated its ethylene assets into a tax-advantaged partnership in which it plans to sell shares to the public. It gapped up today for a considerable volume-driven gain and a new 52-week high, rallying from a "double bottom" base. While the stock's bullish action triggered a technical buy signal, members were cautioned that 3 out of 4 stocks tend to move in the same direction of the major averages (M criteria). Confirming gains from the major averages are still needed as reassurance the broader market is strong.

It has earned good ranks and its quarterly earnings increases have been above the +25% minimum (C criteria) in recent comparisons through Dec '13. Its annual earnings growth rate (A criteria) has also been strong after a downturn in FY '08 and '09. The number of top-rated funds owning its shares rose from 381 in Sep '13 to 404 in Mar '14, a reassuring trend concerning the I criteria. Although the Chemicals - Basic industry group has a mediocre 65 Group Relative Strength, strong action and leadership from others in the group is a reassuring sign concerning the L criteria.