Quiet Finish Following Burst Of Buying Earlier This Week - Friday, October 15, 2010

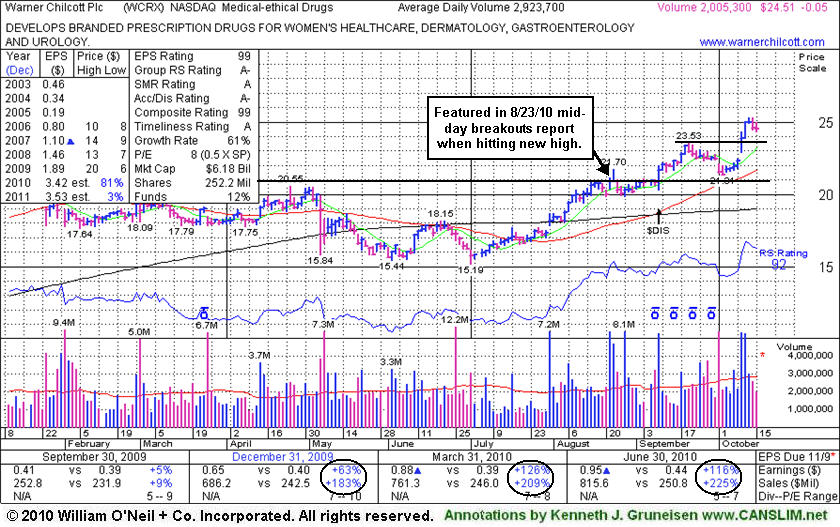

Warner Chilcott Plc (WCRX -$0.05 or -0.20% to $24.51) is up meaningfully since it was featured in the 8/23/10 mid-day report. In the FSU section it was then shown with an annotated graph under the headline "Ireland-Based Drug Firm Hitting New Highs" as it was noted - "The close above its pivot point with volume more than 3 times average helped trigger a technical buy signal as it rose from a cup shaped base." It showed drastic increases in recent quarterly comparisons as the high-ranked firm hailing from the Medical - Ethical Drugs industry has done very well since buying Procter & Gamble Co's prescription drug business in a deal first announced 8/24/09. It is clear of resistance due to overhead supply and poised to rally further.

A quirky $8.50 dividend impacted its share price on September 9th, so do not be confused when looking back at earlier reports. It rallied higher with gains backed by above average volume, then found support above prior chart highs when consolidating for a few weeks. On October 11th it gapped up with a powerful gain on heavy volume, rallying above prior highs following a consolidation near its 10-week moving average line. Its color code was changed to yellow, as it was then noted - "Buyable up to +5% above its latest high ($23.53 X 1.05 or $24.81) as a secondary buy point following its earlier technical breakout. A new pivot point is not cited as a new base was not formed." Its light volume losses on Thursday and Friday ended the week just below the upper limit of that range.

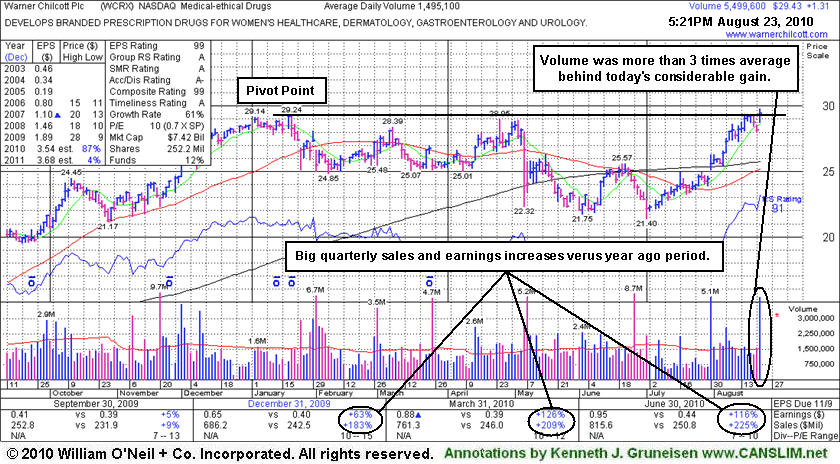

Ireland-Based Drug Firm Hitting New Highs - Monday, August 23, 2010

Warner Chilcott Plc (WCRX +$1.31 or +4.66% to $29.43) reported huge sales revenues and earnings increases in the Mar and Jun '10 quarters, so fundamentals are currently strong. It was featured in yellow in the mid-day report while hitting a new all-time high today (read here). The close above its pivot point with volume more than 3 times average helped trigger a technical buy signal as it rose from a cup shaped base formed since it was noted in the 5/06/10 mid-day report - "Earnings and sales revenues history has been below guidelines of the fact-based system, yet showed drastic increases in the quarter ended Dec 31, 2009. It encountered stubborn resistance in the $29 area since the high-ranked firm hailing from the Medical - Ethical Drugs industry was noted in a handful of Q4 2009 mid-day reports after announcing plans to buy Procter & Gamble Co's prescription drug business in a deal first announced 8/24/09." It is now clear of resistance due to overhead supply and poised to rally further. Broader market action may be expected to weigh substantially on the ultimate outcome as the M criteria if the investment system argues that 3 out of 4 stocks tend to follow along in the direction of the major averages.