It was last shown in this FSU section on 12/03/12 with and annotated graph under the headline, ''Mild Distribution Day While Consolidating Above 50-Day Moving Average." It is still perched within close striking distance of its 52-week high. The prior article cautioned - "It could stay confined to that range for a long time, so disciplined investors will keep an eye on it until it shows conviction. A new pivot point is being cited based on its 11/06/12 high plus 10 cents. Subsequent volume-driven gains above that level could trigger a new technical buy signal." Prior reports also noted its waning Group Relative Strength Rating as a cause for concern.

An indication it may find good support from the institutional crowd is that the number of top-rated funds owning its shares has risen from 288 in Jun '11 to 395 in Sep '12, a reassuring sign concerning the I criteria. It released better than expected earnings +35% on +14% sales revenues for the Sep '12 quarter. Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. Vitamin Shoppe has 30.2 million shares outstanding. That small supply is not a bad thing, but could contribute to greater price volatility. Historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.

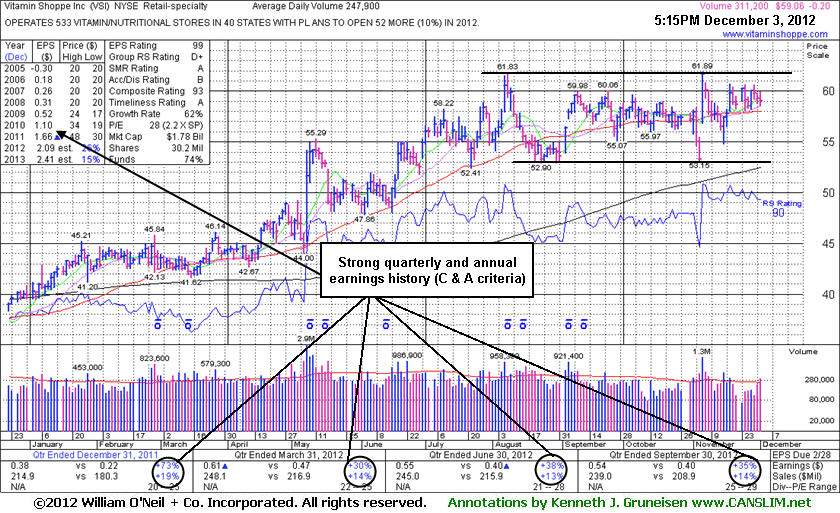

Vitamin Shoppe Inc (VSI -$0.20 or -0.34% to $59.06) encountered mild distributional pressure today. It is still perched within close striking distance of its 52-week high. The $61 area has been a stubborn resistance level in recent months while the $53 area defines a floor of chart support below its 50-day moving average (DMA) line. It could stay confined to that range for a long time, so disciplined investors will keep an eye on it until it shows conviction. A new pivot point is being cited based on its 11/06/12 high plus 10 cents. Subsequent volume-driven gains above that level could trigger a new technical buy signal.

It was last shown in this FSU section on 11/12/12 with and annotated graph under the headline, ''Promptly Negated Recent Breakout ". That report noted its waning Group Relative Strength Rating. Its chart has the look of a potentially very bad "double top" which would be completed, however, first by a slump below its 50-day moving average (DMA) line, followed by a severe breakdown undercutting its 200-day moving average (DMA) line and also violating its prior low ($52.90 on 8/23/12). An indication it may find good support from the institutional crowd is that the number of top-rated funds owning its shares has risen from 288 in Jun '11 to 390 in Sep '12, a reassuring sign concerning the I criteria.

It released better than expected earnings +35% on +14% sales revenues for the Sep '12 quarter. Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. Vitamin Shoppe has 29.7 million shares outstanding. That small supply is not a bad thing, but could contribute to greater price volatility. Historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.

Additional leadership (L criteria) shown by other stocks in the Retail - Specialty group has been a reassuring sign, however the Group Relative Strength Rating fell to 18 from 94 when the stock was shown in this section on 7/02/12. Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. The number of top-rated funds owning its shares rose from 288 in Jun '11 to 383 in Sep '12, a reassuring sign concerning the I criteria. Vitamin Shoppe has 29.7 million shares outstanding. That small supply is not a bad thing, but could contribute to greater price volatility. Historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.

Vitamin Shoppe Inc's (VSI +$1.03 or +1.81% to $57.82) volume totals have been below average in recent weeks while consolidating near its 50-day moving average (DMA) line. It still faces some resistance due to overhead supply up through the $60 area after recently stalling. It has formed a flat base of sufficient length, and a new pivot point has been cited, however disciplined investors will wait and watch for confirming gains from the stock. Odds are not favorable without proof of fresh institutional accumulation and also more reassuring signs from the broader market (M criteria). Meanwhile, recent lows near $55 define the next important chart support below its short-term average.

VSI was last shown in this FSU section on 9/10/12 with an annotated graph under the headline, "Consolidation Too Brief and Choppy for a Valid New Base", following a streak of 4 consecutive gains as it rebounded and rallied back above its 50-day moving average (DMA) line and above its previously cited pivot point. Now it has built a better base.

It reported an earnings increase of +38% on +13% sales revenues for the Jun '12 quarter. Additional leadership (L criteria) shown by other stocks in the Retail - Specialty group has still been a reassuring sign however the Group Relative Strength Rating fell to 46 from 94 when the stock was shown in this section on 7/02/12. Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. The number of top-rated funds owning its shares rose from 288 in Jun '11 to 377 in Sep '12, a reassuring sign concerning the I criteria. Vitamin Shoppe has 29.7 million shares outstanding. That small supply is not a bad thing, but could contribute to greater price volatility. Historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.

Prior lows near $52 define near-term support where any further deterioration would raise more serious concerns. VSI was last shown in this FSU section on 8/02/12 with an annotated graph under the headline, "Watch for Earnings News Due Early Next Week". It reported an earnings increase of +38% on +13% sales revenues for the Jun '12 quarter. Additional leadership (L criteria) shown by other stocks in the Retail - Specialty group has still been a reassuring sign even though the Group Relative Strength Rating fell to 64 from 94 when shown in this section on 7/02/12.

Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. The number of top-rated funds owning its shares rose from 288 in Jun '11 to 383 in Jun '12, a reassuring sign concerning the I criteria. Vitamin Shoppe has 29.7 million shares outstanding. That small supply is not a bad thing, but could contribute to greater price volatility. Historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.

Vitamin Shoppe Inc's (VSI +$0.82 or +1.49% to $55.95) nearby 50-day moving average (DMA) line and upward trendline define important chart support to watch. Violations may raise concerns and trigger technical sell signals. The company is due to report financial results before the market open on Tuesday, August 7, 2012. Volume and volatility often increase near earnings news.

Gains above its pivot point on 7/26/12 and 7/2712 were marked by above average volume, but the volume totals were not even +50% above average. For a convincing technical buy signal there should be very heavy volume driving it higher - action indicative of hearty institutional buying demand. Without great volume conviction driving a breakout, it is less likely that a stock will continue much higher for a meaningful advance. VSI was last shown in this FSU section on 7/02/12 with an annotated graph under the headline, "Volume Was Lighter Than Required For Technical Buy Signal". Earlier gains from a cup-with-handle base fell short of the minimum volume threshold for gains above a stock's pivot to clinch a proper new (or add-on) technical buy signal. Leadership (L criteria) in the Retail - Specialty group has been waning in the meanwhile, as the Group Relative Strength Rating fell to 76 from 94 when last shown.

Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. The number of top-rated funds owning its shares rose from 288 in Jun '11 to 376 in Jun '12, a reassuring sign concerning the I criteria. Vitamin Shoppe has 29.4 million shares outstanding. That small supply is not a bad thing, but could contribute to greater price volatility. However, historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.

Vitamin Shoppe Inc (VSI +$1.14 or +2.08% to $56.07) was up today with below average volume for a best-ever close and a new 52-week high. A new pivot point was recently cited based on its 6/22/12 high after forming an 8-week cup-with-handle base. The minimum threshold for gains above a stock's pivot to clinch a proper new (or add-on) technical buy signal is at least +40% above average, and it is preferable for breakouts to be backed by even greater volume. Without great volume conviction driving a breakout, it is less likely that a stock will continue much higher for a meaningful advance.

VSI was last shown in this FSU section on 6/04/12 with an annotated graph under the headline, " Consolidating Above 50-Day Moving Average and Prior Highs". During its consolidation it found support near its 50-day moving average (DMA) line. Support to watch was defined by that important short-term average and its old highs in the $48 area. Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. The number of top-rated funds owning its shares rose from 288 in Jun '11 to 333 in Mar '12, a reassuring sign concerning the I criteria. Leadership (L criteria) in the Retail - Specialty group, which has earned a 94 Group Relative Strength Rating, is a reassuring sign. Vitamin Shoppe has 29.4 million shares outstanding. That small supply is not a bad thing, but could contribute to greater price volatility. However, historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.

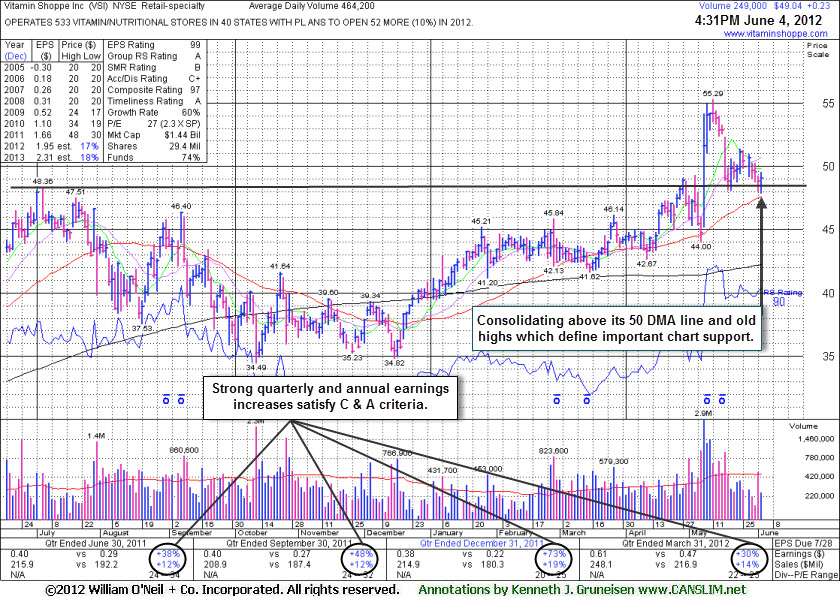

Vitamin Shoppe Inc (VSI +$0.23 or +0.47% to $49.04) halted its slide today with a small gain on light volume. During its consolidation it has slumped near its 50-day moving average (DMA) line. Support to watch is defined by that important short-term average and its old highs in the $48 area. It may eventually build a new base-on-base type pattern, yet meanwhile the direction of the broader market averages (M criteria) would need to be helped by a confirmed rally with follow-through day (FTD) before any new (or add-on) buying efforts might be justified.

It was last shown in this FSU section on 4/25/12 with an annotated graph under the headline, "Fundamentals Strong After 10-Month Cup Shaped Base", when we observed - "In the context of great winners illustrated in the book, "How to Make Money in Stocks", one may argue that a powerful breakout to new 52-week high territory could be far more telling as to its ability to go on producing gains and make a meaningful advance in the coming days and weeks." Subsequent volume-driven gains came after it reported another quarter of strong earnings growth. The gains on 5/08/12 and 5/09/12 resulted in a convincing breakout to new 52-week highs clearing the pivot point cited and triggering a new (or add-on) technical buy signal.

Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. The number of top-rated funds owning its shares rose from 290 in Jun '11 to 334 in Mar '12, a reassuring sign concerning the I criteria. Leadership (L criteria) provided by its peer in the Retail - Specialty group, GNC Holdings Inc (GNC), has been cited as another reassuring sign. Vitamin Shoppe (29.4 million) has less than 1/3 as many shares outstanding as GNC (106.5 million). That small supply is not a bad thing, but could contribute to greater price volatility. However, historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.

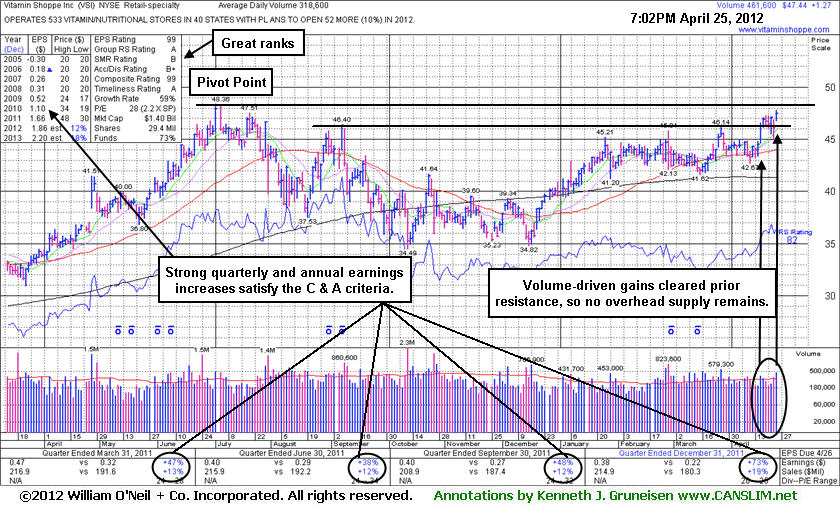

Vitamin Shoppe Inc (VSI +$1.27 or +2.75% to $47.44) gapped up today, rallying near its 52-week high. It was featured in yellow in the earlier mid-day report (read here) with pivot point based on its 7/05/11 high after a near 10-month cup shaped base. It went through a deep consolidation below its 200 DMA line since last noted in the 9/08/11 mid-day report. The $46 area was a stubborn resistance level in recent months. Some chart readers may argue that volume-driven gains cleared prior resistance and already triggered a buy signal. No overhead supply remains to hinder its progress. However, a volume-driven gain did not yet clear the pivot point which we cited and trigger a new (or add-on) technical buy signal. In the context of great winners illustrated in the book, "How to Make Money in Stocks", one may argue that a powerful breakout to new 52-week high territory could be far more telling as to its ability to go on producing gains and make a meaningful advance in the coming days and weeks.

If subsequent gains are produced, disciplined investors know that the further one chases any stock above its pivot point the greater the chances are than an ordinary pullback may necessitate selling. A tactical approach called pyramiding is taught in the Certification to help investors avoid chasing stocks and get the best results. Disciplined investors also know to always limit losses if ever any stock falls more than 7% from their purchase price!

Recent volume-driven gains helped its Relative Strength Rating (RS) rise to 82, above the 80+ guideline for buy candidates. Fundamentally, it has earned high ranks after showing strong quarterly and annual earnings increases satisfying the C and A criteria. Keep in mind that it is due to report earnings before the market open on Tuesday, May 8, 2012. Volume and volatility often increase near earnings news.

The number of top-rated funds owning its shares rose from 290 in Jun '11 to 335 in Mar '12, a reassuring sign concerning the I criteria. Leadership (L criteria) provided by its peer in the Retail - Specialty group, GNC Holdings Inc (GNC), is another reassuring sign. Vitamin Shoppe (29.4 million) has less than 1/3 as many shares outstanding as GNC (109 million). That small supply is not a bad thing, but could contribute to greater price volatility. However, historic studies have shown that once companies have grown their supply (S criteria) of shares outstanding to hundreds of millions, or even billions of shares outstanding, they are less likely candidates to be "above average" gainers.