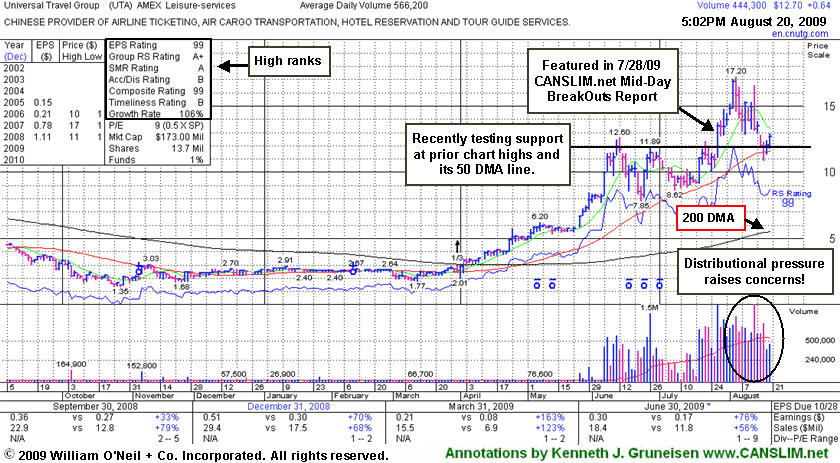

Universal Travel Group (UTA +$0.64 or +5.06% to $12.70) has posted gains on light volume after recently encountering heavy distributional pressure, pulling back near prior chart highs and its 50-day moving average line. The Chinese provider of airline tickets and travel related services erased all of its gains since it gapped up on 7/28/09 when rising from a choppy 6-week base. Strong action had prompted it to be featured in yellow at $12.87 in the 7/28/09 CANSLIM.net Mid-Day Breakouts report (read here), and it subsequently traded as much as +33.64% higher. Its considerable gain above its pivot point came with very heavy volume nearly 6 times its average daily trading total. Heavy volume, well above the minimum +50% above average volume guideline, has accompanied many of the market's biggest historic winners.

The investment system has a rule that says whenever a stock rises +20% or more in 2-3 weeks or less from when it was bought, that stock should be held for at least 8 weeks and be given a chance to produce bigger gains. The rule was created because the market's most explosive winners often got off to a strong start. However, the stock's bad breakdown and deteriorating market environment (the M criteria) argue strongly against giving it the benefit of any doubt. For now it is making a stand at an important level, but keep in mind that there is a lot of risk after its many-fold run from its March lows. The fact that it is trading more than +100% above its 200-day moving average line gives investors another reason to be especially disciplined about making proper entries and exits. Always limit losses if any stock falls more than -7% from your buy point.

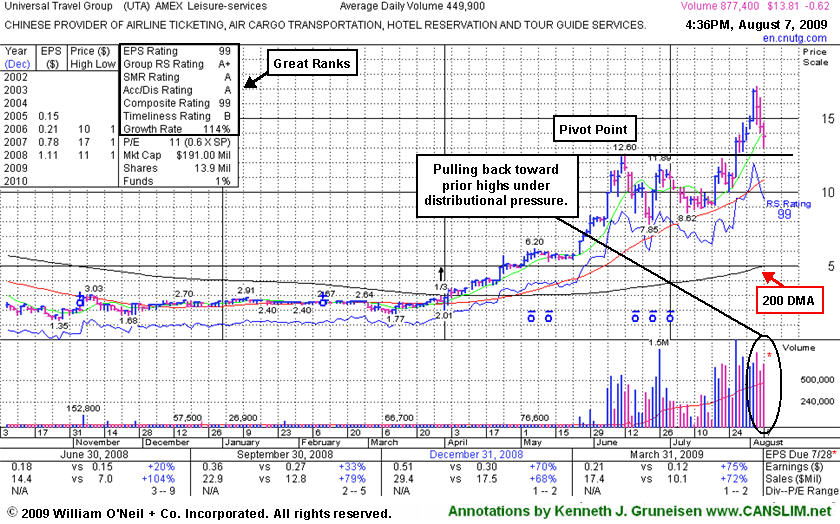

Universal Travel Group (UTA -$0.55 or -3.81% to $13.81) has been encountering distributional pressure, pulling back toward prior chart highs that are a very important support level now. The Chinese provider of airline tickets and travel related services gapped up on 7/28/09 when rising from a choppy 6-week base above its 50-day moving average line. Strong action prompted it to be featured in yellow at $12.87 in that day's mid-day breakouts report (read here), and it has subsequently traded as much as +33.64% higher. Its considerable gain above its pivot point came with very heavy volume nearly 6 times its average daily trading total. Heavy volume, well above the minimum +50% above average volume guideline, has accompanied many of the market's biggest historic winners.

Keep in mind that the investment system has a rule that says whenever a stock rises +20% or more in 2-3 weeks or less from when it was bought, that stock should be held for at least 8 weeks and be given a chance to produce bigger gains. The rule was created because the market's most explosive winners often got off to a strong start. It could be worth giving UTA the benefit of the doubt, but also keep in mind that there is a lot of risk after its many-fold run from its March lows. The fact that it is trading more than +100% above its 200-day moving average line gives investors another reason to be especially disciplined about making proper entries and exits. Always limit losses if any stock falls more than -7% from your buy point. Subsequent deterioration leading to any closes back under its prior high closes would raise concerns by negating its latest bullish breakout.

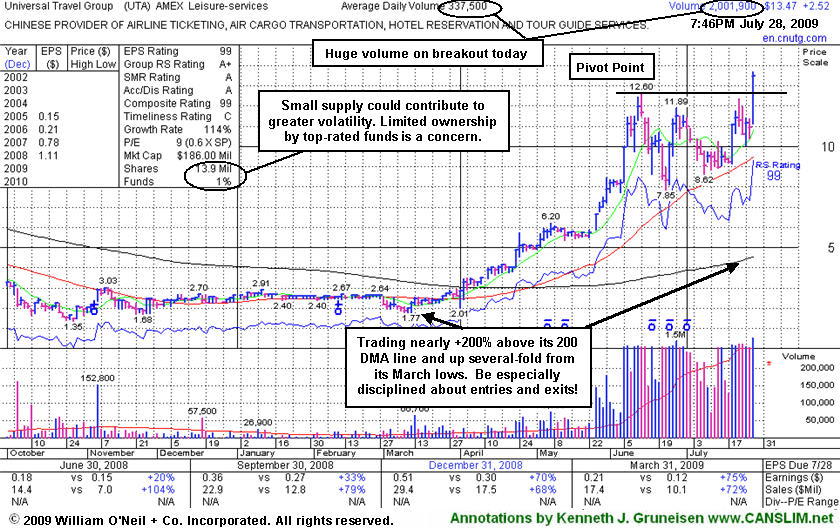

Universal Travel Group (UTA +23.01%), a Chinese provider of airline tickets and travel related services gapped up today, rising from a choppy 6-week base above its 50-day moving average line with a considerable gain on very heavy volume nearly 6 times its average daily trading total. The strong action prompted it to be featured in yellow with pivot point and max buy levels noted in the 7/28/09 mid-day breakouts report (read here). Keep in mind the considerable many-fold run it has already had from its March lows, and the fact that it is trading almost +200% above its 200-day moving average line. Those are very good reasons for investors to be especially disciplined about making proper entries and exits, so members should avoid chasing it more than +5% above its pivot point, and as always, strictly limit losses if any stock falls more than -7% from your buy point. After such a big one-day gain it could very easily consolidate in the near term. Subsequent deterioration leading to any closes back under its prior high closes would raise concerns by negating its latest bullish breakout.