In recent weeks an increasing number of leading stocks setting up and breaking of solid bases have been highlighted in the CANSLIM.net Mid-Day Breakouts Report. The most relevant factors are briefly noted in the report which allows disciplined investors to place the issue in their custom watch list and receive subsequent notes directly via email immediately when they are published (click the "Alert me of new notes" link). More detailed analysis is published soon after a stock's initial appearance in yellow once any new candidates are added to the Featured Stocks list. Letter-by-letter details concerning strengths or shortcomings of the company in respect to key fundamental criteria of the investment system appear along with annotated datagraphs highlighting technical chart patterns in the Featured Stock Update (FSU) section included in the CANSLIM.net After Market Update each day.

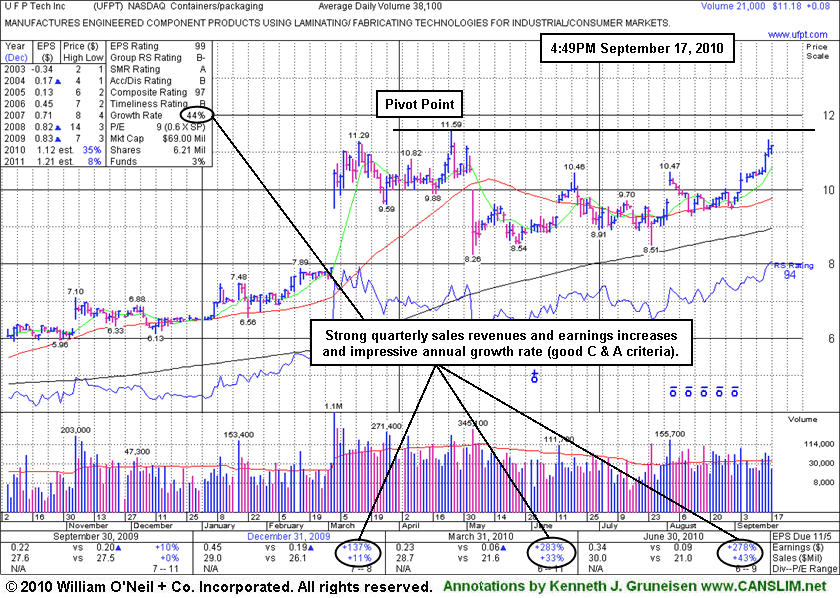

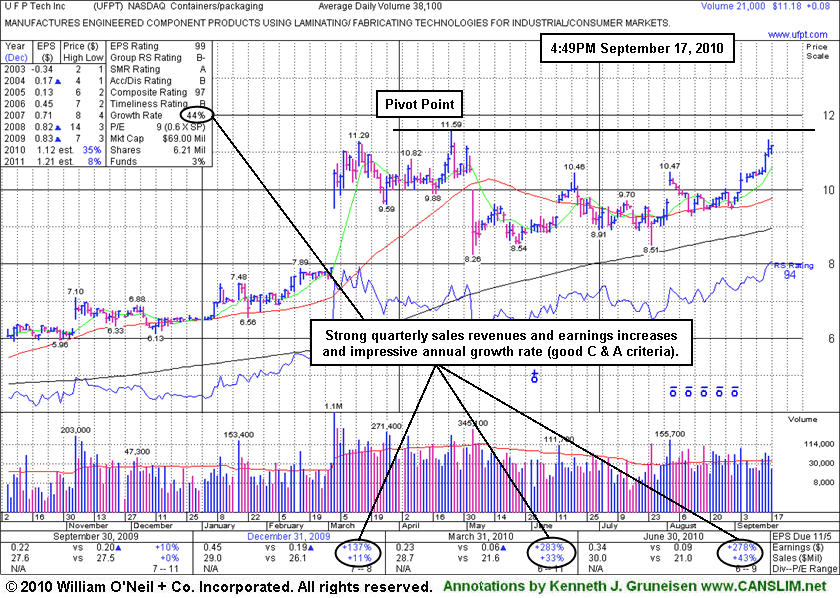

U F P Tech Inc (UFPT +$0.13 or +1.17% to $11.23) posted a 5th consecutive gain today and actually closed 3 cents above its closing price from 4/26/10, the day it hit its 52-week high and basis for its pivot point cited. No resistance remains due to overhead supply. It was featured in yellow in the 9/16/10 mid-day report (read here). Disciplined investors know that a proper technical buy signal requires a breakout on heavy volume at least +50% above average. The 3 latest quarterly comparisons showed strong sales revenues and earnings acceleration following a streak of negative or near flat comparisons. It has an impressive annual earnings (A criteria) growth rate. The stock's small supply of only 6.21 million shares (S criteria) outstanding can contribute to great price volatility in the event of institutional buying or selling. That makes disciplined buying and selling that much more critical for investors. The number of top-rated funds owning its shares rose from 6 in Sept '09 to 9 in Jun '10, a reassuring sign with respect to the I criteria.