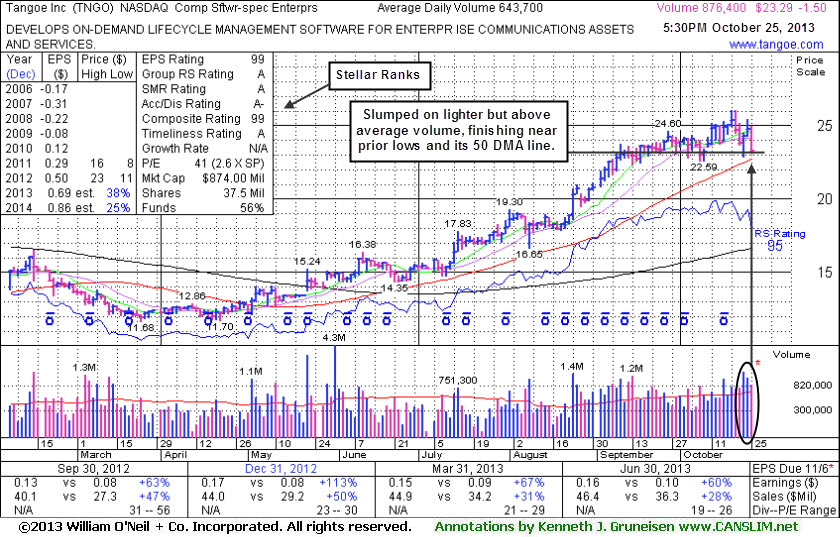

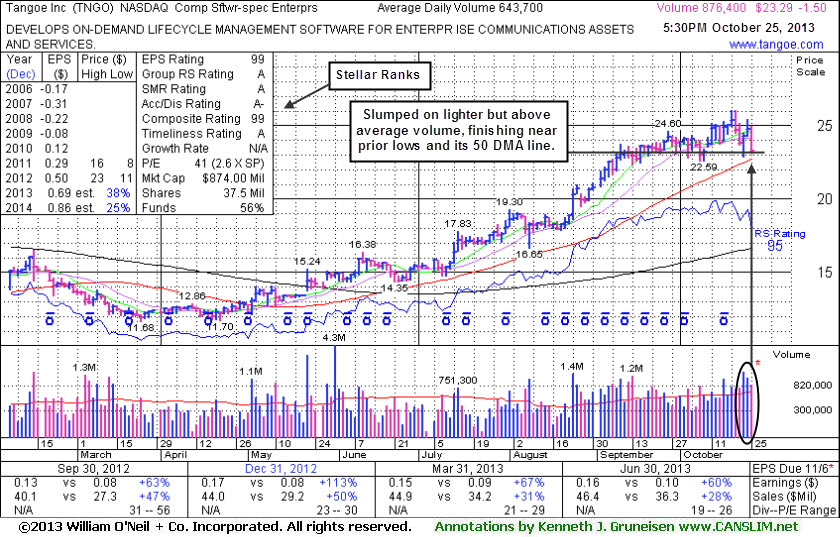

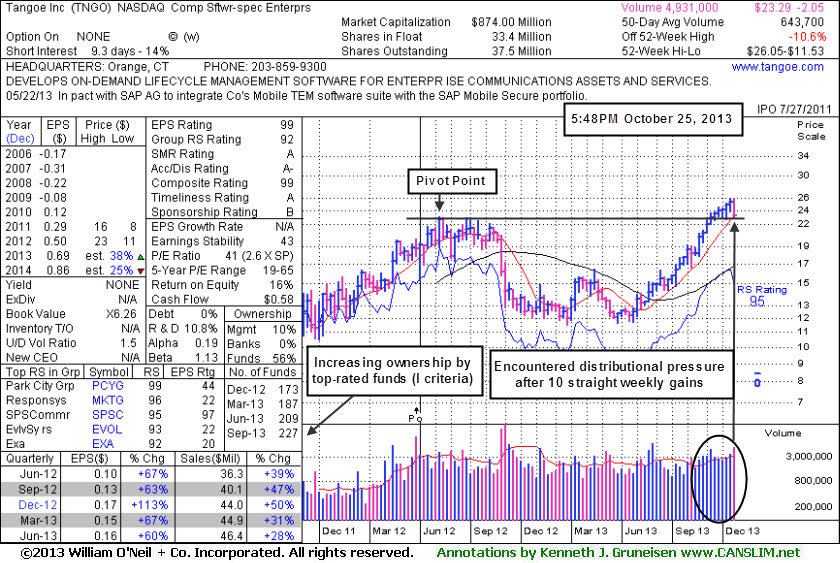

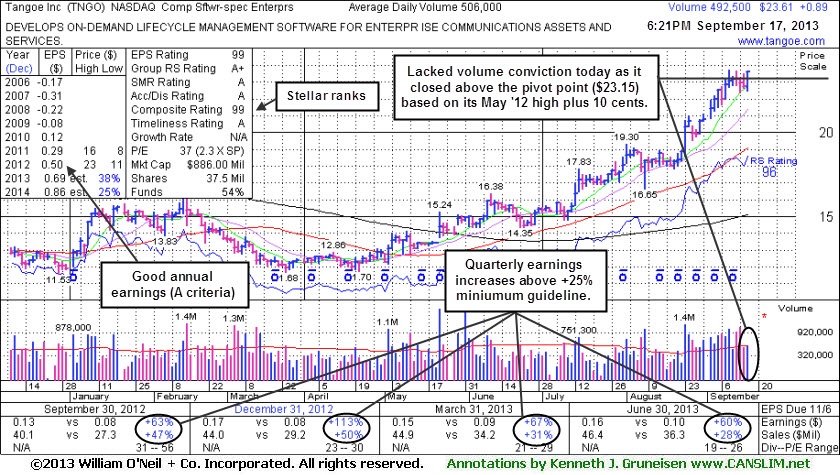

Tangoe Inc (TNGO -$1.50 or -6.05% to $23.29) encountered distributional pressure this week and broke an impressive streak of 10 consecutive weekly gains and 16 weekly gains in the 17 prior weeks. Prior lows and its 50-day moving average (DMA) line define important near-term support in the $22.50 area where subsequent violations would raise serious concerns and trigger technical sell signals. Its annotated weekly graph below helps investors view its pivot point based on its May 2012 high plus 10 cents. That is a likely support area chart-wise, while any more damaging losses into the prior base would bode poorly. Disciplined investors always limit losses if any stock falls more than -7% from their purchase price.

TNGO last appeared in this FSU section on 9/17/13 with an annotated graph under the headline, "Gains Today Lacked Volume Conviction of Institutional Demand". It was highlighted in the 9/12/13 mid-day report with an annotated weekly graph (read here). Prior mid-day report repeatedly noted - "Fundamentals remain strong with great earnings increases through the Jun '13 quarter. Rebounded and rallied impressively following a deep consolidation below its 200 DMA line since dropped from the Featured Stocks list on 8/28/12."

One encouraging sign now is that its current Up/Down Volume Ratio of 1.5 hints that its shares have been under accumulation in the past 50 days. TNGO completed a new Public Offering on 3/29/12, and such offerings often help companies attract more institutional interest. The number of top-rated funds owning its shares rose from 175 in Dec '12 to 227 in Sep '13, a reassuring sign concerning the I criteria. The company's management reportedly still owns 10% of its shares, keeping the directors motivated to look after and build shareholder value. There still are only 33.4 million shares (S criteria) in the publicly traded float, which can lead to more drastic price volatility in the event of institutional buying or selling.

Subsequent volume-driven gains may help to clinch a convicing technical breakout. Volume should be at least a minimum +40% above average behind a technical breakout in order for investors to have good reason to believe that robust institutional buying demand is driving the stock higher which may lead to a sustained advance. Disciplined investors know that no advantage is gained by getting in "early" before a proper buy signal. For an example, look at the deep slump it went through after last appearing in this FSU section on 8/24/12 with an annotated graph under the headline, "Slump Below 50 DMA Line Hurts Outlook Again", as it slumped below its 50-day moving average (DMA) line after failing to break out.

One encouraging sign now is that its current Up/Down Volume Ratio of 1.8 hints that its shares have been under accumulation in the past 50 days. TNGO completed a new Public Offering on 3/29/12, and such offerings often help companies attract more institutional interest. The number of top-rated funds owning its shares rose from 175 in Dec '12 to 210 in Jun '13, a reassuring sign concerning the I criteria. The company's management reportedly still owns 10% of its shares, keeping the directors motivated to look after and build shareholder value. There still are only 33.4 million shares (S criteria) in the publicly traded float, which can lead to more drastic price volatility in the event of institutional buying or selling.

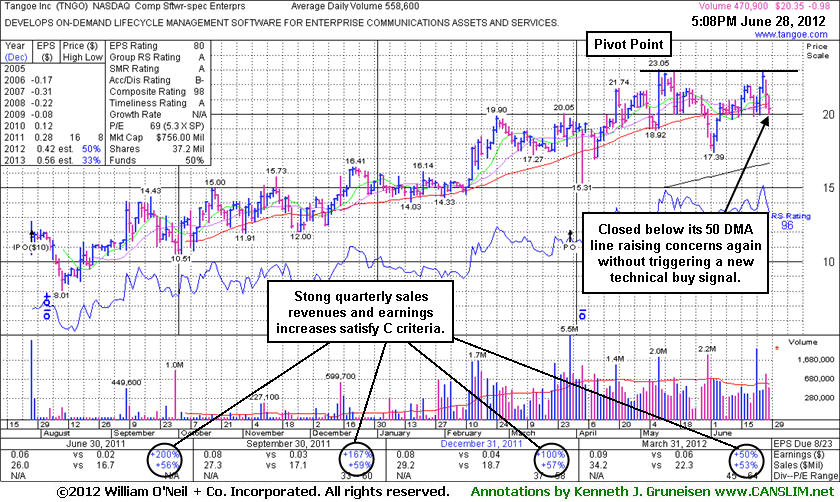

Tangoe Inc (TNGO -$0.02 or -0.10% to $19.85) recently slumped below its 50-day moving average (DMA) line after again failing to break out. It now faces resistance up to the $23 level which has been a stubborn resistance area in recent months. Prior noted repeatedly reminded members - "Volume-driven gains above its pivot point are needed to trigger a proper technical buy signal." A rebound above its 50 DMA line is needed for its technical stance and outlook to improve, meanwhile it may be vulnerable to greater damage. Its Relative Strength rank has been waning, however, one encouraging sign is that its current Up/Down Volume Ratio of 1.3 still hints that its shares have been under accumulation in the past 50 days.

TNGO had been dropped from the Featured Stocks list on 7/24/12 when it last appeared in this FSU section with an annotated graph under the headline, "Weak Action Hurts Outlook For Computer Software Firm Again". It was highlighted in yellow again in the 8/09/12 mid-day report, however, while tallying its only gain in recent history marked by above average volume. Rather than going on to produce a technical buy signal afterward it has sputtered. This week it slumped below its 50-day moving average (DMA) line, hurting its outlook and raising concerns. Its next support comes into play at its July low ($18.66) and then its 200 DMA line.

TNGO completed a new Public Offering on 3/29/12, and such offerings often help companies attract more institutional interest. The number of top-rated funds owning its shares rose from 99 in Sep '11 to 200 in Jun '12, a reassuring sign concerning the I criteria. The company's management reportedly still owns 20% of its shares, keeping the directors motivated to look after and build shareholder value. There still are only 29.7 million shares (S criteria) in the publicly traded float following the latest offering, which can lead to more drastic price volatility in the event of institutional buying or selling.

Tangoe Inc (TNGO -$0.62 or -3.16% to $18.97) slumped further below its 50-day moving average (DMA) line today with a 4th consecutive loss on light or average volume, and it also violated recent lows raising more serious concerns. Its next support comes into play near its June low and its 200 DMA line in the $17 area. It faces overhead supply up to the $23 level which has been a stubborn resistance area in recent months. Based on weak action it will be dropped from the Featured Stocks list tonight. A rebound above its 50 DMA line is needed for its technical stance and outlook to improve, meanwhile it may be vulnerable to greater damage.

TNGO was last shown in this FSU section on 6/28/12 with an annotated graph under the headline, "Failed to Trigger New Buy Signal Since Returning", and although little resistance remained due to overhead supply it failed to produce a volume-driven gain above its pivot point to trigger a technical buy signal. Keep in mind that 3 out of 4 stocks tend to go in the direction of the major averages. During the recent rally few leaders made meaningful advances, and now the broader market conditions (M criteria) are arguing against any new buying efforts again until a new confirmed rally with follow-through day.

TNGO completed a new Public Offering on 3/29/12, and such offerings often help companies attract more institutional interest. The number of top-rated funds owning its shares rose from 99 in Sep '11 to 194 in Jun '12, a reassuring sign concerning the I criteria. The company's management reportedly still owns 20% of its shares, keeping the directors motivated to look after and build shareholder value. There still are only 29.7 million shares (S criteria) in the publicly traded float following the latest offering, which can lead to more drastic price volatility in the event of institutional buying or selling.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Tangoe Inc (TNGO -$0.98 or -4.59% to $20.35) fell and closed below its 50-day moving average (DMA) line today, raising concerns without triggering a new technical buy signal, and its color code was changed to green. It returned to the Featured Stocks list as it was highlighted in yellow in the 6/27/12 mid-day report (read here) with new pivot point cited based on its 5/09/12 high plus 10 cents and it was noted - "Little resistance remains due to overhead supply and a volume-driven gain above its pivot point may trigger a new technical buy signal. Based on poor technical action when last noted on 6/01/12 it was dropped from the Featured Stocks list. However, it subsequently rebounded above its 50 DMA line and showed resilience near that important short-term average in recent weeks."

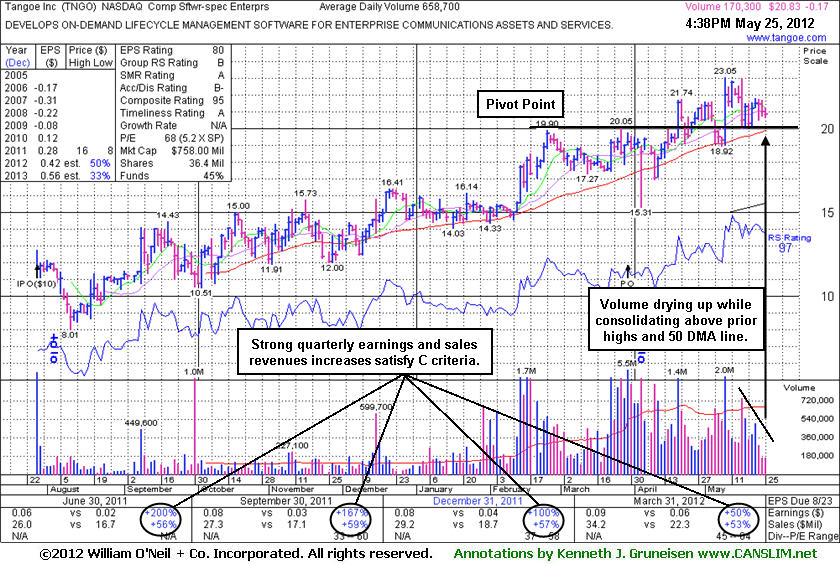

Broader market conditions (M criteria) also argue against any new buying efforts until a new confirmed rally with follow-through day. TNGO was last shown in this FSU section on 5/25/12 with an annotated graph under the headline, "Volume Drying Up While Consolidating Above Chart Support". It completed a new Public Offering on 3/29/12, and such offerings can have a near-term effect of hindering price progress. Meanwhile, underwriters often help the company attract more institutional interest through the process. The number of top-rated funds owning its shares rose from 99 in Sep '11 to 181 in Mar '12, a reassuring sign concerning the I criteria. The company's management reportedly own 37% of its shares, keeping the directors motivated to look after and build shareholder value. There still are only 23.4 million shares (S criteria) in the publicly traded float following the latest offering, which can lead to more drastic price volatility in the event of institutional buying or selling. The bullish characteristics are an encouraging match with winning models of the fact-based system which went on to produce great gains. Typically the best winners advanced over a period of 6-18 months and offered multiple entry points within the investment system's guidelines.

TNGO was last shown in this FSU section on 4/03/12 with an annotated graph under the headline, "Perched Near High Following New Public Offering", as it was perched near its 52-week high. It completed a new Public Offering on 3/29/12, and such offerings can have a near-term effect of hindering price progress. Meanwhile, underwriters often help the company attract more institutional interest through the process. The number of top-rated funds owning its shares rose from 98 in Sep '11 to 164 in Mar '12, a reassuring sign concerning the I criteria. The company's management reportedly own 37% of its shares, keeping the directors motivated to look after and build shareholder value. There still are only 23 million shares (S criteria) in the publicly traded float following the latest offering, which can lead to more drastic price volatility in the event of institutional buying or selling. The bullish characteristics are an encouraging match with winning models of the fact-based system which went on to produce great gains. Typically the best winners advanced over a period of 6-18 months and offered multiple entry points within the investment system's guidelines.

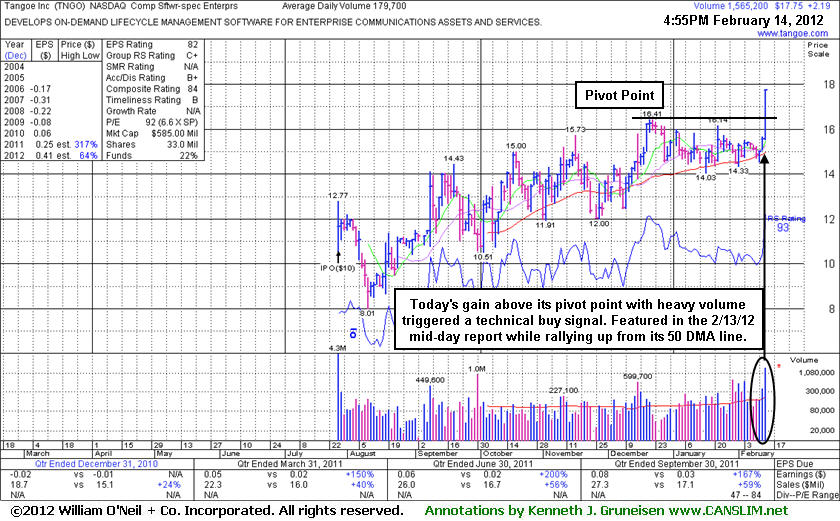

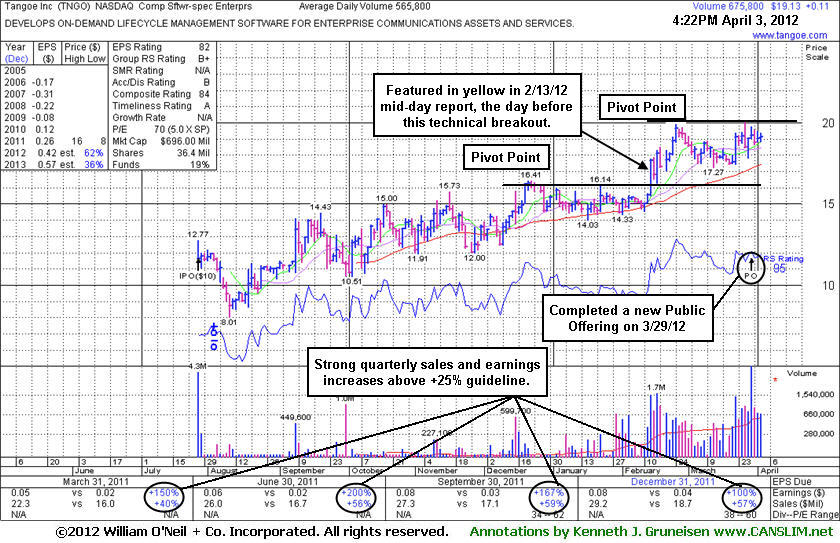

TNGO was last shown in this FSU section on 2/14/12 with an annotated graph under the headline, "Breakout Ahead of Earnings News With 8 Times Average Volume", after it blasted to a new high (N criteria) with a considerable volume-driven gain that triggered a technical buy signal. The high-ranked Computer Software firm was featured in yellow in the 2/13/12 mid-day report (read here) with a pivot point cited based on its 52-week high plus 10 cents while noted - "Currently it is consolidating above its 50 DMA line and building on an orderly base pattern while perched within close striking distance of its 52-week high. Recent quarterly comparisons showed strong sales revenues and earnings increases. Disciplined investors may watch for volume-driven gains above its pivot point which are needed to trigger a proper technical buy signal."

The number of top-rated funds owning its shares rose from 98 in Sep '11 to 133 in Dec '11, a reassuring sign concerning the I criteria. The company's management reportedly own 37% of its shares, keeping the directors motivated to look after and build shareholder value. There still are only 23 million shares (S criteria) in the publicly traded float following the latest offering, which can lead to more drastic price volatility in the event of institutional buying or selling. The bullish characteristics are an encouraging match with winning models of the fact-based system which went on to produce great gains. Typically the best winners advanced over a period of 6-18 months and offered multiple entry points within the investment system's guidelines.

Tangoe Inc (TNGO +$2.13 or +13.69% to $17.69) blasted to a new high (N criteria) today with a considerable volume-driven gain that triggered a technical buy signal. The high-ranked Computer Software firm was featured in yellow in the 2/13/12 mid-day report (read here) with a pivot point cited based on its 52-week high plus 10 cents while noted - "Currently it is consolidating above its 50 DMA line and building on an orderly base pattern while perched within close striking distance of its 52-week high. Recent quarterly comparisons showed strong sales revenues and earnings increases. Disciplined investors may watch for volume-driven gains above its pivot point which are needed to trigger a proper technical buy signal." Its considerable gain today with more than 8 times average volume lifted it more than +5% above the pivot point. Its color code was changed to green as it quickly got too extended from the prior base and rallied beyond the "max buy" level. Disciplined investors know to avoid chasing extended stocks and always limit losses if ever a stock falls more than -7% from its purchase price.

The number of top-rated funds owning its shares rose from 98 in Sep '11 to 122 in Dec '11, a reassuring sign concerning the I criteria. The company's management reportedly own 37% of its shares, keeping the directors motivated to look after and build shareholder value. There are only 20 million shares (S criteria) in the publicly traded float, which can lead to more drastic price volatility in the event of institutional buying or selling. The bullish characteristics are an encouraging match with winning models of the fact-based system which when on to produce great gains. Typically the best winners advanced over a period of 6-18 months and offered multiple entry points within the investment system's guidelines. Patient investors may watch for secondary buy points to possibly develop and be noted in the future. Keep in mind that volume and volatility often increase near earnings news, and the company is due to announce results for the quarter ended December 31, 2011 after the close on Wednesday, February 15th.