Keep in mind that the latest notes for companies listed on the Featured Stocks page are published in each daily After Market Update, and in addition, the "Alert me of new notes" link/feature allows active members to immediately opt-in to receive email copies of the latest notes from our experts as soon as they are published. May it serve as an educational example of multiple warning signs to look back and review the recent notes that were published concerning the price/volume action in a company that will be dropped from the Featured Stocks list tonight.

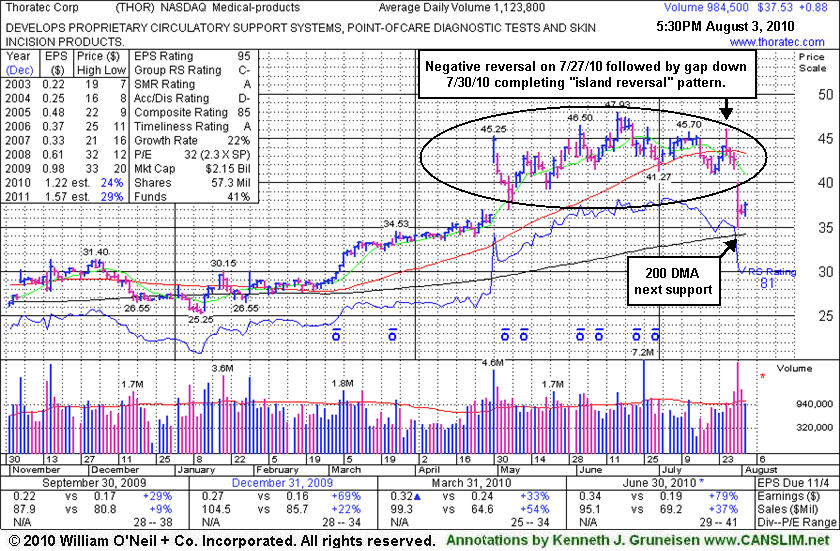

Thoratec Corp (THOR +$0.88 or +2.40% to $37.53) posted a small gain today on lighter volume. It will be dropped from the Featured Stocks list tonight. It faces a lot of overhead supply since the previously noted damaging gap down on 7/30/10 triggered technical sell signals. Its chart now shows a worrisome "island reversal" type pattern. The negative reversal on 7/27/10 also stands out on its chart today as an ominous sign prior to the more serious technical damage that came.

Market technicians may expect its upward price progress to likely be hindered now by selling pressure as investors who accumulated shares while trading at higher levels in recent months look for a chance to exit at better prices. Meanwhile, its 200-day moving average (DMA) line may serve as the next support level.

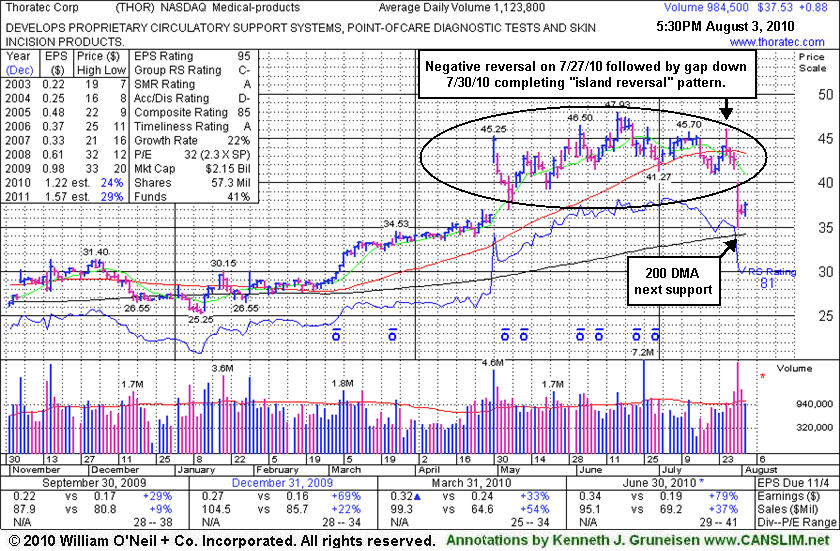

In its last FSU appearance on 7/16/10 under the headline "Short-Term Average - Important Support Level Put Test " after violating its 50-day moving average line it was noted - "Its recent low ($41.27 on 7/01/10) defines the next important chart support level to watch now."

7/21/10 - Closed at the session low today and concerns have increased due to technical damage. A streak of 4 consecutive losses with below average volume included violations of its 50 DMA line and prior chart low. A prompt rebound above its short-term average would help its outlook, meanwhile the path of least resistance may lead this high-ranked Medical Products firm lower.

7/26/10 - This high-ranked Medical Products firm posted a 3rd consecutive gain on light volume and closed above its 50 DMA line today. Earnings news is due after the close on Thursday 7/29/10. Color code is changed to yellow as the prompt rebound above its short-term average, after briefly undercutting its prior chart low, helped its outlook improve.

7/28/10 - This high-ranked Medical Products has slumped under its 50 DMA line, and its color code is changed to green again. It has not produced a constructive gain with above average volume since peaking on 6/16/10. Earnings news is due after the close on Thursday 7/29/10.

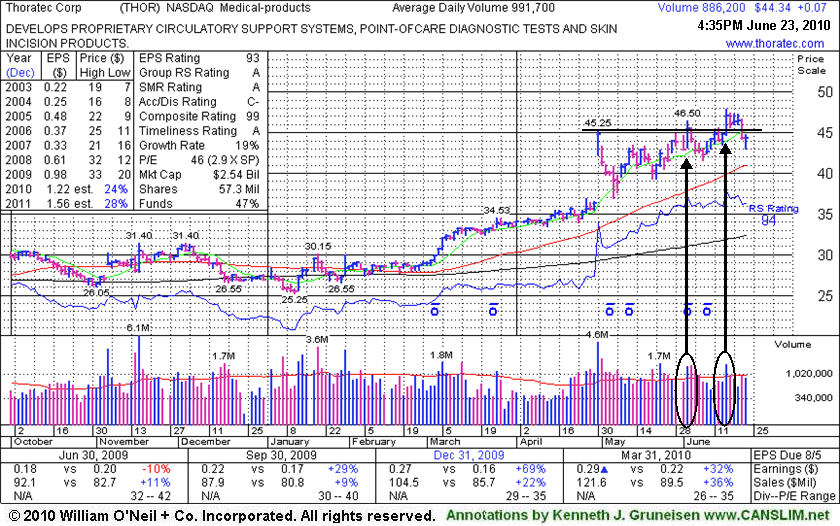

Thoratec Corp (THOR -$1.94 or -4.31% to $43.03) suffered a considerable loss today on light volume, just barely violating its 50-day moving average line amid widespread market weakness. Its recent low ($41.27 on 7/01/10) defines the next important chart support level to watch now. It struggled initially after breaking out from a choppy 5-week base with a considerable gain on 6/02/10 backed by above average volume. Then it posted a solid gain on 6/16/10 for a new high on above average volume, reconfirming the earlier technical buy signal. On 6/16/10 it marked its $47.93 high, and its short-term average acted as support since it was last reviewed in this FSU section on 6/23/10 with an annotated graph under the headline "Medical Products Firm Showing Resilience."

Recent quarterly comparisons showed impressive acceleration in its sales revenues increases while earnings above the +25% minimum guideline satisfied the C criteria. Based on weakness it was dropped from the Featured Stocks list on 2/23/09, yet it has shown especially bullish action since its breakout on 3/05/10. It was mentioned long ago in a 12/15/08 interview on WBBM 780AM - (listen here) and it was featured in yellow in the 12/05/08 Mid-Day Breakouts Report (read here). THOR had rebounded impressively after being featured in the past, then subsequently dropped from the CANSLIM.net Featured Stocks list on 2/2/2006.

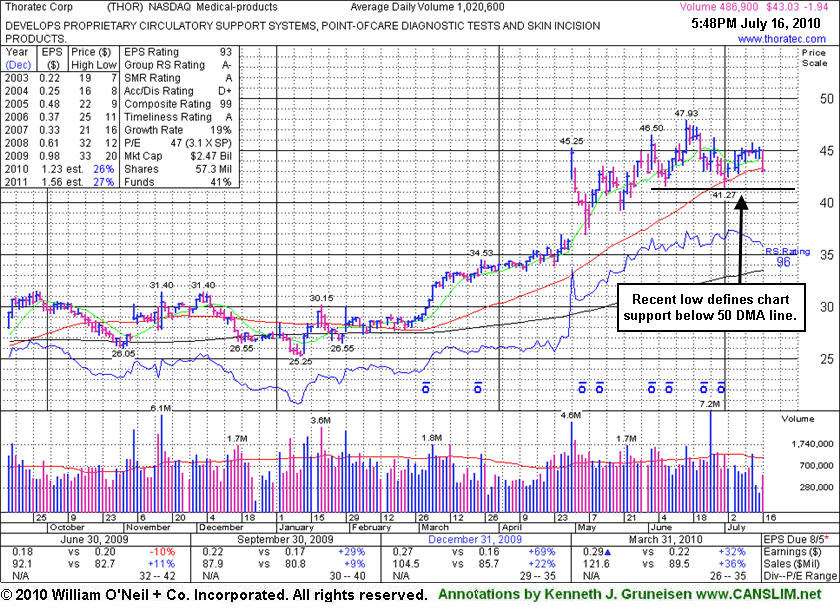

Thoratec Corp (THOR +$0.07 or +0.16% to $44.34) overcame early weakness today, closing -7.5% off its all-time high, but its latest slump under its pivot point has raised some concerns. It struggled initially after breaking out from a choppy 5-week base with a considerable gain on 6/02/10 backed by above average volume. Then it posted a solid gain on 6/16/10 for a new high on above average volume, reconfirming the earlier technical buy signal. In addition to its technical strength, recent quarterly comparisons showed impressive acceleration in its sales revenues increases while earnings above the +25% minimum guideline satisfied the C criteria. If the market's (M criteria) latest confirmed rally produces some strong performing leaders, this high-ranked Medical - Products firm could be among the winners. No overhead supply exists to act as resistance.

Based on weakness it was dropped from the Featured Stocks list on 2/23/09, yet it has shown especially bullish action since its breakout on 3/05/10. It was mentioned long ago in a 12/15/08 interview on WBBM 780AM - (listen here) and it was featured in yellow in the 12/05/08 Mid-Day Breakouts Report (read here). THOR had rebounded impressively after being featured in the past, then subsequently dropped from the CANSLIM.net Featured Stocks list on 2/2/2006.

Thoratec Corp (THOR -$1.25 or -2.75% to $44.21) pulled back today after breaking out from a choppy 5-week base with a considerable gain on 6/02/10 backed by above average volume. Today's close leaves it -4.9% off its all-time high reached on the prior session. Healthy stocks typically do not slump back below their pivot point by more than -7% in a bullish market environment. In addition to its technical strength, recent quarterly comparisons showed impressive acceleration in its sales revenues increases while earnings above the +25% minimum guideline satisfied the C criteria. If the latest confirmed rally produces some strong performing leaders, this high-ranked Medical - Products firm could be among the winners. No overhead supply exists to act as resistance.

Based on weakness it was dropped from the Featured Stocks list on 2/23/09, yet it has shown especially bullish action since its breakout on 3/05/10. It was mentioned long ago in a 12/15/08 interview on WBBM 780AM - (listen here) and it was featured in yellow in the 12/05/08 Mid-Day Breakouts Report (read here) THOR had rebounded impressively after being featured in the past, then subsequently dropped from the CANSLIM.net Featured Stocks list on 2/2/2006.

Thoratec Corporation (THOR -$0.83 or -3.43% to $25.05) fell for a 3rd straight day and the high-ranked Medical - Products firm closed the session at its lowest level since it was featured in yellow in the 12/05/08 Mid-Day Breakouts Report (read here). It is consolidating above its 200 DMA line, having erased the considerable 2/13/09 gain with heavy volume. For its outlook to improve it would need to rally back above its 50-day moving average (DMA) line. It rallied when announcing a definitive agreement to acquire HeartWare International for $282 million. It recently reported its 3rd consecutive quarter of solid sales and earnings increases, but recent losses with above average volume led to violations of its 50 DMA line and prior chart highs in the $29 area - triggering technical sell signals. It was mentioned in a 12/15/08 interview on WBBM 780AM - listen here. Prior CANSLIM.net reports pointed out concerns due to its up and down annual earnings (the A criteria) history. THOR returned to the Featured Stocks list on 12/05/08, having rebounded impressively after being dropped from the CANSLIM.net Featured Stocks list on 2/2/2006. THOR was first featured on Tuesday, November 29, 2005 in the CANSLIM.net Mid Day Breakouts Report (read here).

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Initial chart support to watch is often a stock's 50-day moving average (DMA) line. Another area of support, recent chart lows, can also be a very important level to watch when a stock is continuing to consolidate. In order to ensure the overall health of the stock, the lower boundary should not be violated. Technically, if the lower boundary is violated, this signals that the stock is deteriorating and bears are gaining control, making the odds start to favor the possibility of further downside testing.

Thoratec Corporation (THOR +$0.03 or +0.10% to $29.00) is testing support near its 50-day moving average (DMA) line and prior chart highs in the $29 area - previously noted as a "technically an important support level." Its chart now resembles a typical base-on-base type pattern. The high-ranked Medical - Products firm was featured in yellow in the 12/05/08 Mid-Day Breakouts Report (read here) and, soon thereafter, it was mentioned in a 12/15/08 interview on WBBM 780AM (listen here). Its up and down annual earnings (the A criteria - see red boxed area) history is unimpressive, however, its 2 most recent quarters showed giant sales and earnings increases that make it an interesting turn around story. THOR has rebounded impressively after being featured in the past, then subsequently dropped from the CANSLIM.net Featured Stocks list on 2/2/2006. This stock was first featured on Tuesday, November 29, 2005 in the CANSLIM.net Mid Day Breakouts Report (read here).

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Statistically, about 40% of winning stocks will pull back after breaking out. In other words, it is not uncommon for stocks to pullback and retest support near their pivot point after breaking out. It is important to see the bulls show up and offer support at or above the pivot point. This may offer investors a chance to increase their exposure before the stock continues advancing. However, there are important caveats that the market remain in a confirmed rally, and that volume should contract as the stock in question pulls back towards its pivot point. Heavy volume behind losses can be cause for concern, especially if the stock does not find support at its pivot point. Whenever a recent breakout is completely negated by a loss that leads to a close back in the prior base, this is construed as a technical sell signal and a sign that the bears are regaining control.

Thoratec Corporation (THOR -$0.54 or -1.87% to $29.35) gapped down today for a small loss on below average volume, drawing some concern. It has recently dipped under its pivot point while consolidating near prior chart highs in the $29 area - previously noted as a "technically an important support level." The company was mentioned in a 12/15/08 interview on WBBM 780AM (listen here). This high-ranked Medical - Products firm was featured in yellow in the 12/05/08 Mid-Day Breakouts Report (read here). Its annual earnings growth showed a downturn from 2005-2007 which prior CANSLIM.net reports noted as a shortcoming (concerning the A criteria - see red boxed area). However, its 2 most recent quarters showed giant sales and earnings increases that make it an interesting turn around story.

THOR was first featured on Tuesday, November 29, 2005 in the CANSLIM.net Mid Day Breakouts Report (read here), then subsequently dropped from the CANSLIM.net Featured Stocks list on 2/2/2006. Little resistance due to overhead supply remains to hinder its upward progress. Of course, the broader market action will play a large role in determining whether it can manage a sustained rally, as 3 out of 4 stocks tend to follow along with the direction of the major market averages.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Reversal days are a great way to stay ahead of potential changes to a recent trend. A positive reversal occurs when a stock opens up the session heading lower, then reverses and ultimately closes the day higher. Positive reversals are often considered more severe if the stock's initial losses drive it to a new low, but it then reverses and closes the day higher on heavier than average volume and ends near the session's utmost highs. Reversals can occur on a daily, weekly or a monthly chart. In general, when a longer time frame is involved, greater implications may be given as to the severity or significance of the reversal. Volume is directly correlated with the severity of the action as well.

Thoratec Corp (THOR +$3.40 or +13.74% to $28.15) gapped down today, then managed a positive reversal for a gain on above average volume, closing near the session high and only 40 cents below its best ever close. That helped it end higher with above average volume for a second consecutive week and, as seen on the weekly graph below, there are obviously more recent weeks where the stock traded up, rather than down, with above average volume. Another bullish characteristic to its chart is the fact that this high-ranked Medical - Products firm, gapped up on 12/05 and 12/08 for considerable gains, reaching a new all-time high. Gaps are often very telling technical indications of institutional positioning. However, THOR still has not triggered a convincing technical buy signal by rallying and closing above its pivot point, instead encountering some distributional pressure in the $29 area. That previous chart resistance level is a logical place for it to pause. Volume necessary to trigger a proper technical buy signal is a minimum of +150% of the daily average volume as the stock rises convincingly above its pivot point.

THOR was featured in yellow in the 12/05/08 CANSLIM.net Mid-Day Breakouts Report (read here), and more detailed analysis was included with an annotated graph showing its daily price/volume action in that evening's Featured Stock Update section under the headline "Turnaround Story May Be Worth Watching." Its annual earnings (the A criteria - see red boxed area on the annotated graph below) history has been up and down, which is cause for some concern, however, its 2 most recent quarters showed giant sales and earnings increases, making it an interesting turn around story. THOR has rebounded impressively after being featured in the past, then subsequently dropped from the CANSLIM.net Featured Stocks list on 2/2/2006. This stock was first featured on Tuesday, November 29, 2005 in the CANSLIM.net Mid Day Breakouts Report (read here).

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

Thoratec Corp (THOR +$3.40 or +13.74% to $28.15), a high-ranked Medical - Products firm, gapped up today and posted a considerable gain with volume more than triple its average daily trading total while approaching prior chart highs in the $29 area. Little resistance is remaining, and a convincing rally above its pivot point to new all-time highs would be a technical breakout. The minimum guideline for volume to trigger a proper technical buy signal is +150% of the daily average volume as the stock rises above its pivot point. THOR was featured in yellow in today's Mid-Day Breakouts Report (read here). Its two most recent quarterly comparisons showed solid sales revenues and earnings increases.

THOR found impressive support near its 200 DMA line near its October-November lows. Its annual earnings (the A criteria) history has been up and down, which is cause for some concern, however, its 2 most recent quarters showed giant sales and earnings increases, making it an interesting turn around story. THOR has rebounded impressively after being featured in the past, then subsequently dropped from the CANSLIM.net Featured Stocks list on 2/2/2006. This stock was first featured on Tuesday, November 29, 2005 in the CANSLIM.net Mid Day Breakouts Report (read here).

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

A classic example of the success enjoyed by many CANSLIM.net readers usually starts when an investor reads a CANSLIM.net report and buys a featured stock as it is rising above its pivot point on at least +50% above average volume. After a stock breaks out above its pivot point, there is only a +5% window that investors have to purchase the stock under the proper guidelines. Once a stock rises above the "maximum buy price" the risk of a shake out balloons, meaning that even a normal retracement in the stock might force you to employ the 7-8% loss cutting rule. Much can be told by the stock's daily action in the weeks and months that follow a breakout. Typically, a light volume and orderly pullback suggests that the bulls remain in control. However, high volume pullbacks that violate support paint a totally different picture.

Thoratec Corp. (THOR +$2.17 or +8.67% to $22.86) was first featured on November 11th, 2005 in the CANSLIM.net Mid-Day Breakouts Report (read here) as it was setting up to potentially break out above its pivot point. The note then was, "Better base now as consolidation has continued. An above average volume (+150%) break above the pivot point of $20.19 would trigger a technical buy signal." On the following day, THOR blasted above its pivot point on massive volume. It rallied +12.5% before pulling back, and it was encouraging to see the volume dry up as it retraced the recent gains while it stayed above its pivot point, and above prior chart highs and well above its 50 DMA line. It traced out a new base without triggering a technical sell signal. Today's action allowed it to clear a short 4-week base on more than three times its average volume. One additional reason this issue appears ready to move onward and upward is that it has now cleared longer-term chart highs previously hit in October 2001.