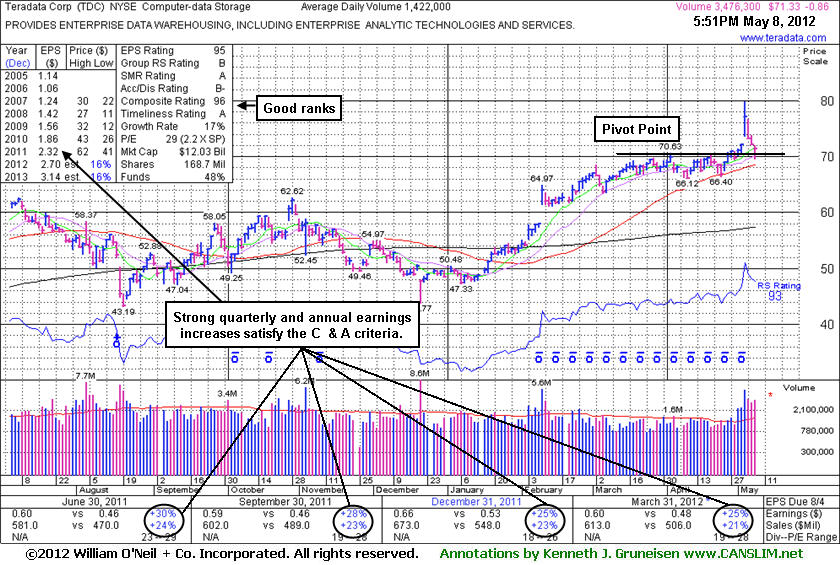

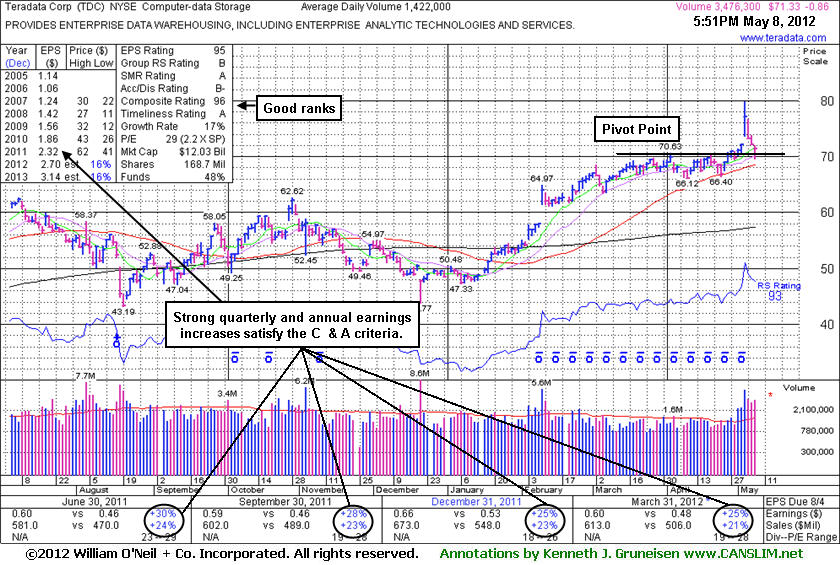

Teradata Corp (TDC -$0.86 or -1.19% to $71.33) pulled back today for a 3rd consecutive loss backed by above average volume, encountering distributional pressure after a streak of 3 consecutive volume-driven gains into new high territory. The 5/03/12 mid-day report (read here) showed it highlighted in yellow as volume-driven gains from a tight consolidation and "square box" base above its 50-day moving average (DMA) line met the guidelines for a technical buy signal. It quickly got extended from an ideal buy range. Now it has retreated under its "max buy" level, however historic studies have proven that investors have better odds when buying stocks while they are on the rise rather than accumulating stocks while retreating after an earlier breakout.

Concerns have also increased regarding the direction of the broader market (M criteria) due to recent technical damage noted in the major indices' charts. Disciplined investors know to always limit losses if ever any stock falls more than -7% from their purchase price.

Technically, on 2/09/11 it broke out from a 15-week cup shaped base without a handle then continued rising while finding support at its 50 DMA line. The 4 latest quarterly comparisons showed earnings increases above the +25% minimum guideline satisfy the C criteria, and it has a good annual earnings (A criteria) history. The number of top-rated funds owning its shares rose from 1,010 in Jun '11 to 1,100 in Mar '12, a reassuring sign concerning the I criteria. Its Up/Down Volume Ratio of 1.6 also is an unbiased indication its shares have been under accumulation in the past 50 days.