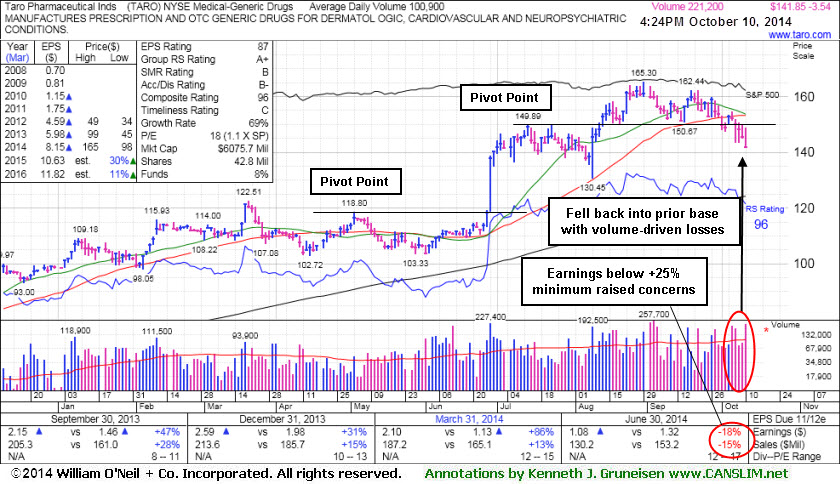

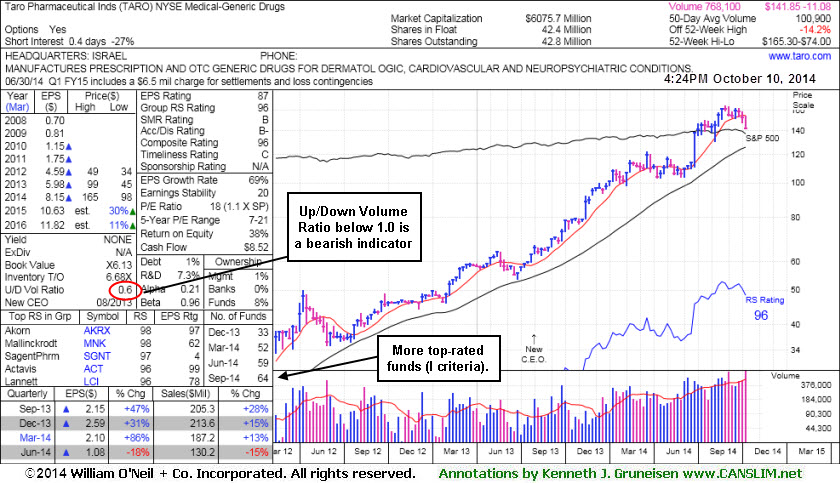

Noted Fundamental and Technical Deterioration Raised Concerns - Friday, October 10, 2014

Taro Pharmaceutical Inds (TARO -$3.69 or -2.54% to $141.70) was down again today with above average volume for its 5th consecutive loss. Damaging losses were noted as they recently raised concerns and triggered a technical sell signal. Due to deteriorating fundamentals and technicals it will be dropped from the Featured Stocks list tonight.TARO was last shown in this FSU section on 9/23/14 with annotated graphs under the headline, "Consolidating Above 50-day Moving Average and Prior Highs" enduring distributional pressure after repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns." Members were previously reminded - "Disciplined investors who may still be giving it the benefit of the doubt should be watchful for any damaging sell signals which would prompt them to lock in gains."

It traded up as much as +40.9% since first featured in yellow in the 6/26/14 mid-day report at $117.31. The Israel-based Medical - Generic Drugs firm has a small supply (S criteria) of only 44.3 million shares outstanding, which is favorable, however any institutional buying or selling could lead to great price volatility. It has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 64 as of Sep '14, a reassuring sign concerning the I criteria. However, its current Up/Down Volume Ratio of 0.6 is an unbiased indication that its shares have been under distributional pressure over the past 50 days.

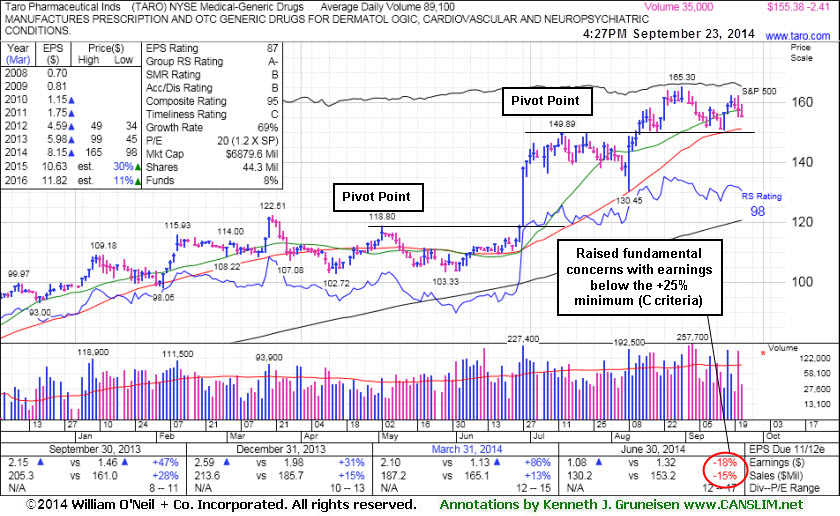

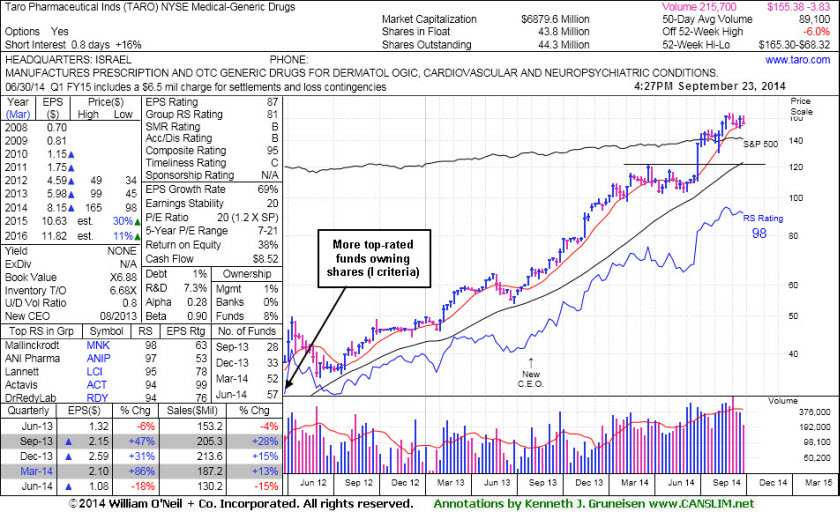

Consolidating Above 50-day Moving Average and Prior Highs - Tuesday, September 23, 2014

Taro Pharmaceutical Inds (TARO -$2.66 or -1.69% to $155.13) is consolidating -6% off its 52-week high, enduring more distributional pressure this week. It has been repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns." It found support at its 50-day moving average (DMA) line and rebounded toward prior highs since last shown in this FSU section on 9/02/14 with annotated graphs under the headline,"Churning Action Indicative of Distributional Pressure". It traded up as much as +40.9% since first featured in yellow in the 6/26/14 mid-day report at $117.31.

The Israel-based Medical - Generic Drugs firm has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 57 as of Jun '14, a reassuring sign concerning the I criteria. TARO has a small supply (S criteria) of only 44.3 million shares outstanding, which is favorable, however any institutional buying or selling could lead to great price volatility. Disciplined investors who may still be giving it the benefit of the doubt should be watchful for any damaging sell signals which would prompt them to lock in gains.

Churning Action Indicative of Distributional Pressure - Tuesday, September 02, 2014

Taro Pharmaceutical Inds (TARO -$1.41 or -0.87% to $159.75) churned above average volume at its 52-week high today and finished near the session low with a loss, a sign of distributional pressure. It has been repeatedly noted - "Extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

TARO found support at its 50-day moving average (DMA) line and rallied to new highs since last shown in this FSU section on 8/06/14 with annotated graphs under the headline,"Still Building on an Advanced Base Pattern". It traded up as much as +40.1% since first featured in yellow in the 6/26/14 mid-day report at $117.31. Members were previously reminded - "The investment system rules say a stock should be held a minimum of 8 weeks after rising more than +20% in the first 2-3 weeks from being bought." In this case the stock went on to make further progress even after the company reported earnings -18% on -15% sales revenues for the Jun '14 quarter raising fundamental concerns with earnings below the +25% minimum guideline (C criteria).

The Israel-based Medical - Generic Drugs firm has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 54 as of Jun '14, a reassuring sign concerning the I criteria. TARO has a small supply (S criteria) of only 44.3 million shares outstanding, which is favorable, however any institutional buying or selling could lead to great price volatility. Disciplined investors who may still be giving it the benefit of the doubt should be watchful for any damaging sell signals which would prompt them to lock in gains.

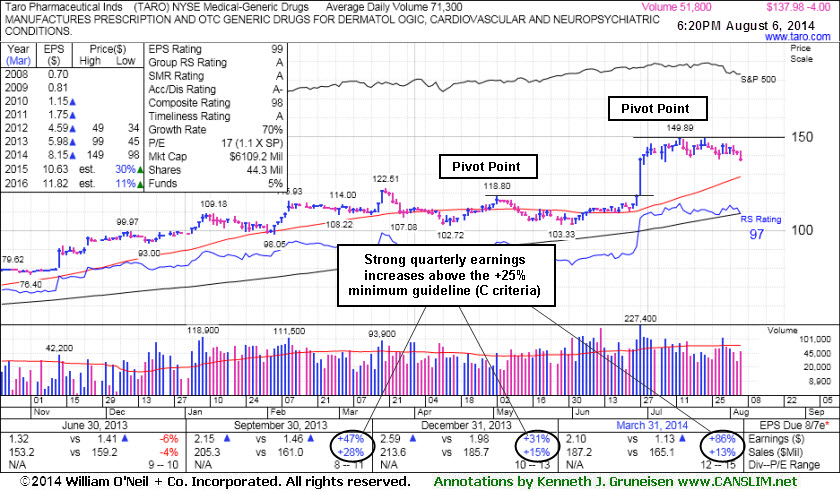

Still Building on an Advanced Base Pattern - Wednesday, August 06, 2014

Taro Pharmaceutical Inds (TARO -$4.00 or -2.82% to $137.98) is still consolidating in a tight range since forming an advanced "3-weeks tight" base. Subsequent volume-driven gains to new highs may trigger a new (or add-on) buy signal. It was last shown in this FSU section on 7/18/14 with annotated graphs under the headline,"Big Gains in First 2-3 Weeks After Breakout an Encouraging Sign". It traded up as much as +27.7% since first featured in yellow in the 6/26/14 mid-day report at $117.31. The investment system rules say a stock should be held a minimum of 8 weeks after rising more than +20% in the first 2-3 weeks from being bought. Disciplined investors avoid chasing stocks more than +5% above prior highs.

It reported earnings +86% on +13% sales revenues for the Mar '14 quarter, a 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 53 as of Jun '14, a reassuring sign concerning the I criteria.

TARO has a small supply (S criteria) of only 44.3 million shares outstanding, which is favorable, and any institutional buying or selling could lead to great price volatility. Disciplined investors always limit losses by selling any properly bought stock if it falls more than -7% from their purchase price.

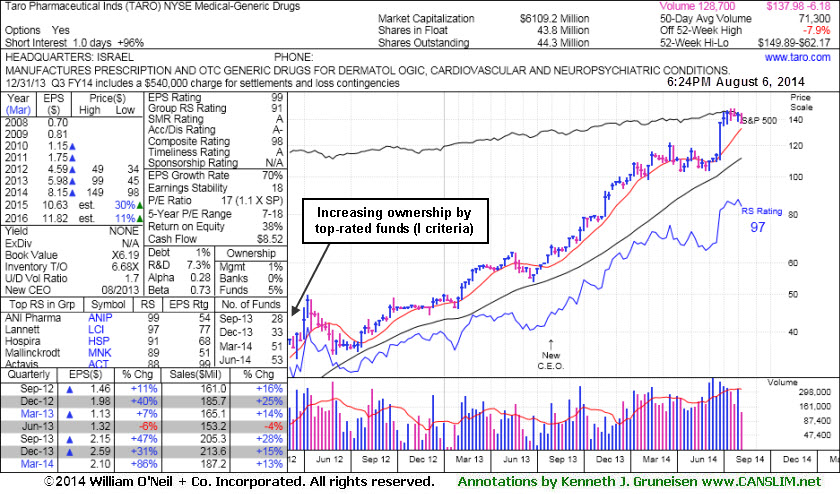

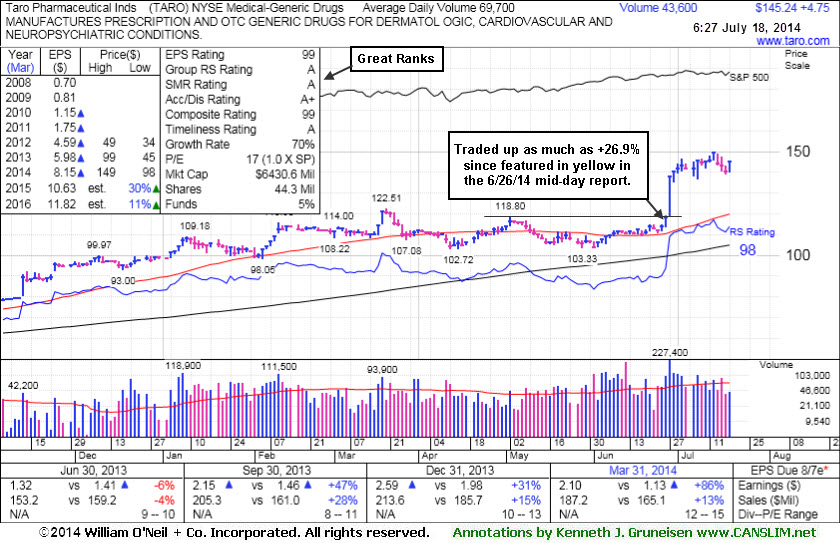

Big Gains in First 2-3 Weeks After Breakout an Encouraging Sign - Friday, July 18, 2014

Taro Pharmaceutical Inds (TARO $4.75 or +3.38% to $145.24) posted a gain on Friday after 3 consecutive losses. It is extended from its prior base and traded up as much as +26.9% since first featured in yellow in the 6/26/14 mid-day report at $117.31. The investment system rules say a stock should be held a minimum of 8 weeks after rising more than +20% in the first 2-3 weeks from being bought. Disciplined investors avoid chasing stocks more than +5% above prior highs. It was last shown in this FSU section on 6/26/14 with annotated graphs under the headline,"Fundamentally Strong Stock Challenging Prior Resistance Level", as it traded twice its average volume behind a considerable gain.

This high-ranked Medical - Generic Drug firm was highlighted in yellow in the 6/26/14 mid-day report (read here) while approaching a pivot point cited based upon its 5/02/14 high plus 10 cents. Patient and disciplined investors may watch for a proper base or secondary buy point to possibly develop and be noted in the weeks ahead. It reported earnings +86% on +13% sales revenues for the Mar '14 quarter, a 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 51 as of Jun '14, a reassuring sign concerning the I criteria.

TARO has a small supply (S criteria) of only 44.3 million shares outstanding, which is favorable, and any institutional buying or selling could lead to great price volatility. Disciplined investors always limit losses by selling any properly bought stock if it falls more than -7% from their purchase price.

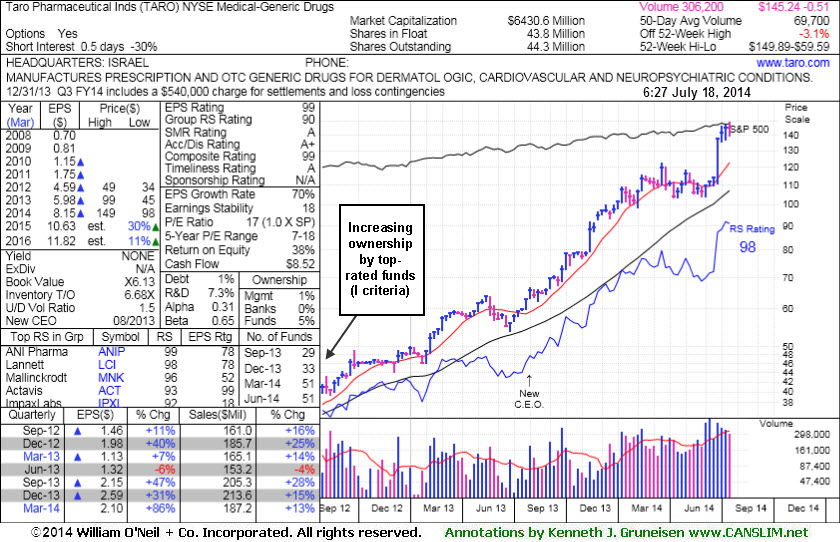

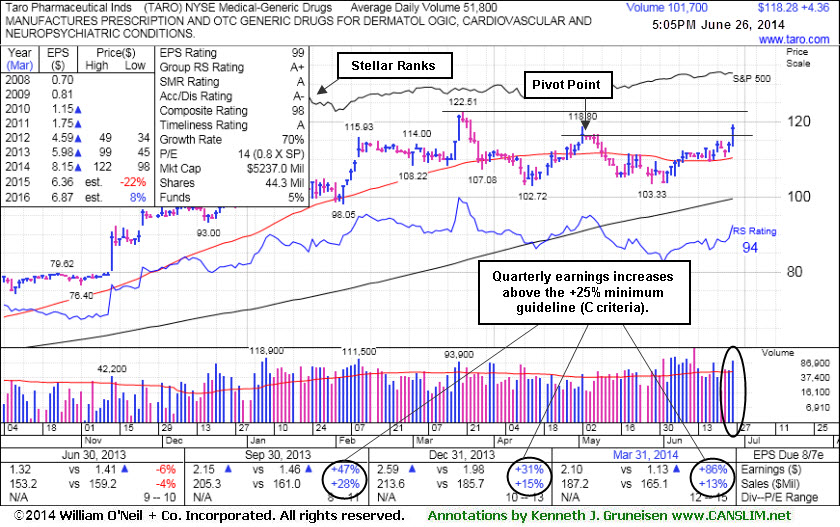

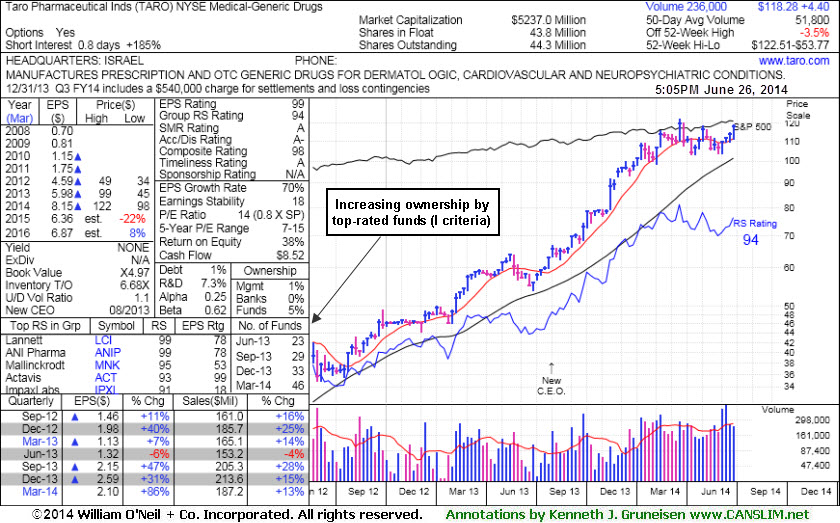

Fundamentally Strong Stock Challenging Prior Resistance Level - Thursday, June 26, 2014

Taro Pharmaceutical Inds (TARO $4.36 or +3.83% to $118.28) traded twice its average volume behind today's considerable gain. However, it is important to realize that it is rallying near an area where it has meet stiff resistance in prior months. No great advantage is to be gained by getting in "early", before fresh proof of robust new institutional buying demand.Subsequent gains backed by at least +40% above average volume while the stock rallies above its pivot point may trigger a proper technical buy signal. If it does so, it is still facing some additional resistance due to overhead supply up through $122. Additional volume-driven gains into new all-time high territory could technically signal the beginning of a far more significant price advance.

Keep in mind that disciplined investors avoid chasing stocks more than +5% above their pivot point or prior highs. This high-ranked Medical - Generic Drug firm was highlighted in yellow in the earlier mid-day report (read here) while approaching a pivot point cited based upon its 5/02/14 high plus 10 cents. Regular readers may have spotted it in black and white near the bottom of the 6/19/14 mid-day report (read here) - "Patient and disciplined investors may watch for a proper base to possibly develop and be noted in the weeks ahead. Reported earnings +86% on +13% sales revenues for the Mar '14 quarter, a 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 46 as of Mar '14, a reassuring sign concerning the I criteria."

TARO has a small supply (S criteria) of only 44.3 million shares outstanding, which is favorable, and any institutional buying or selling could lead to great price volatility. Disciplined investors always limit losses by selling any properly bought stock if it falls more than -7% from their purchase price.

\

\