In recent weeks an increasing number of leading stocks setting up and breaking of solid bases have been highlighted in the CANSLIM.net Mid-Day Breakouts Report. The most relevant factors are briefly noted in the report which allows disciplined investors to place the issue in their custom watch list and receive subsequent notes directly via email immediately when they are published (click the "Alert me of new notes" link). More detailed analysis is published soon after a stock's initial appearance in yellow once any new candidates are added to the Featured Stocks list. Letter-by-letter details concerning strengths or shortcomings of the company in respect to key fundamental criteria of the investment system appear along with annotated datagraphs highlighting technical chart patterns in the Featured Stock Update (FSU) section included in the CANSLIM.net After Market Update each day.

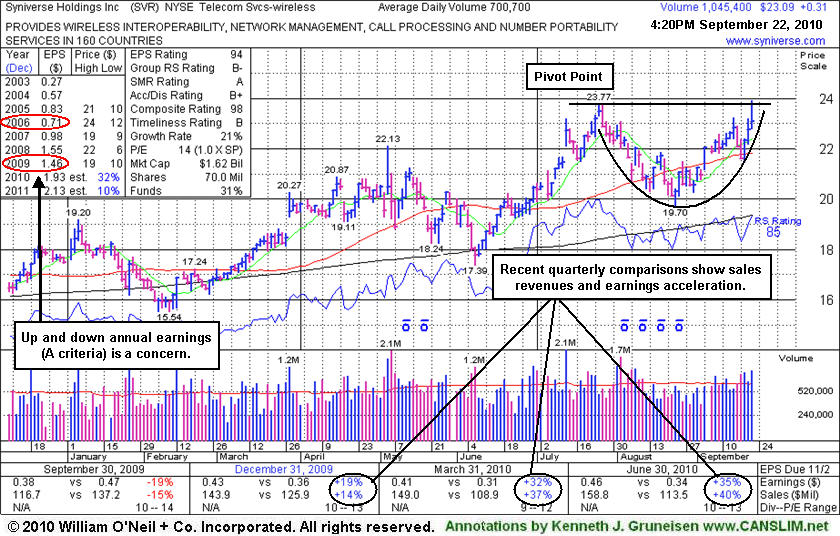

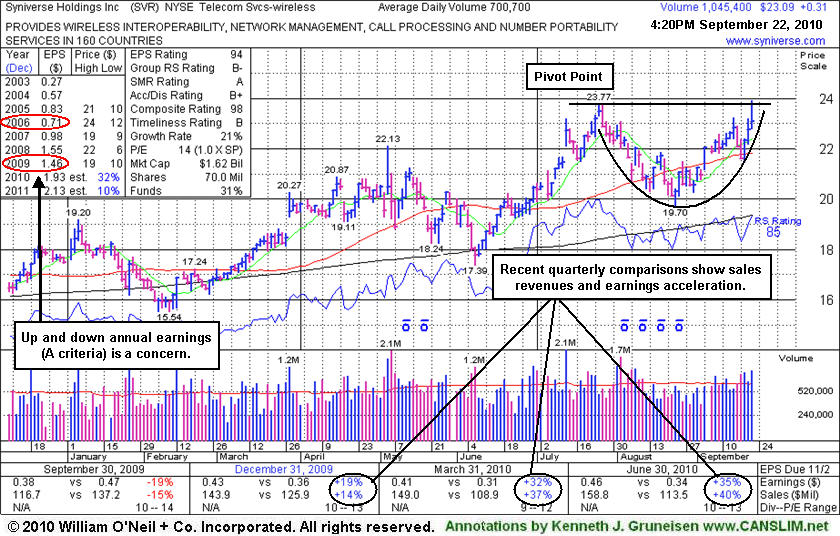

Syniverse Holdings Inc (SVR +$0.31 or +1.36% to $23.09) spiked up to a new 52-week high earlier today and was featured in yellow in the mid-day report (read here). It has formed a saucer-like base in the past 9 weeks that included a couple of weeks trading under its 50-day moving average (DMA) line (the red line). It found support near prior chart highs following the previously noted 7/13/10 breakaway gap to a new multi-year high. No overhead supply remains to act as resistance. Recent quarterly comparisons show encouraging sales revenues and earnings acceleration versus the year-ago periods. While it has maintained a strong growth rate, its up and down annual earnings history (A criteria) remains a concern (see red ovals) .

Disciplined investors may watch for convincing gains into new high ground with heavy volume to confirm a technical buy signal before accumulating shares at prices up to +5% above its prior highs. Remember to proceed with caution, meaning only buying a small position in the strongest names that are breaking out on heavy volume. Then, if and only if, the stock advances 2-3% take another small position. Repeat this process one more time to round out your entire position. For example, if one wanted to buy $10,000 of stock; $5,000 would be the first buy, then if the stock rallies +2% the next buy would be $3,000, and the final $2,000 worth would be accumulated if the stock advances yet another +2%. This strategy is known as "pyramiding" and is extremely useful when used properly, as it allows the market action to help dictate how heavily you invest.