Summer Infant Inc (SUMR +$0.12 or +1.76% or $6.93) has seen its Accumulation/Distribution rank fall, from a B- when it was first featured in the 5/04/10 mid-day report, to a worst possible E rating today. Since negating its breakout, volume behind the latest gains has been light. Gains above its 50-day moving average (DMA) line and above recent chart highs near $7.40 would be an encouraging technical improvement. Meanwhile, recent chart lows in the $6.25 area define the next important support level to watch.

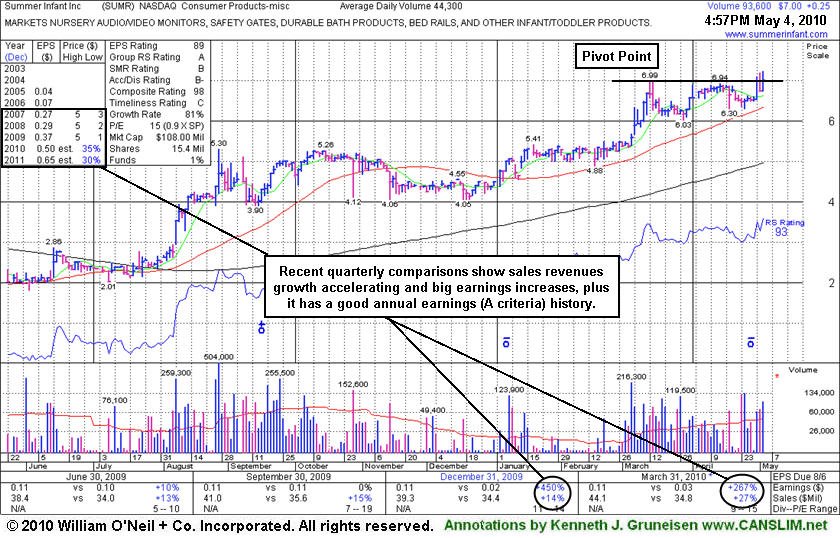

Recent quarterly comparisons show sales revenues growth accelerating and big earnings increases (triple digit percentages), plus it has a good annual earnings (A criteria) history. Low-priced stocks are supposed to be avoided under the fact-based system because they are typically riskier candidates, however, when all key criteria are satisfied and market conditions are bullish buying efforts may be justified. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and since 6/15/2010 (read here) when the new rally produced a follow-through day, distributional has begun weighing on the market again.

Summer Infant Inc (SUMR -$0.60 or -8.39% or $6.65) gapped down today, violating prior chart highs and its 50-day moving average (DMA) line, with its considerable loss on higher volume (3 times average) triggering technical sell signals. Recent losses with above average volume raised concerns. Today's weakness led to a 50 DMA violation that stands in stark contrast with its last appearance in this FSU section on 5/21/10 under the headline "Positive Reversal Near Chart Support Levels" when that short-term average acted as support.

Recent quarterly comparisons show sales revenues growth accelerating and big earnings increases (triple digit percentages), plus it has a good annual earnings (A criteria) history. Low-priced stocks are supposed to be avoided under the fact-based system because they are typically riskier candidates, however, when all key criteria are satisfied and market conditions are bullish buying efforts may be justified. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and odds are currently stacked against investors' success until a new rally with a follow-through day from at least one of the major averages confirms that strength is returning to stocks.

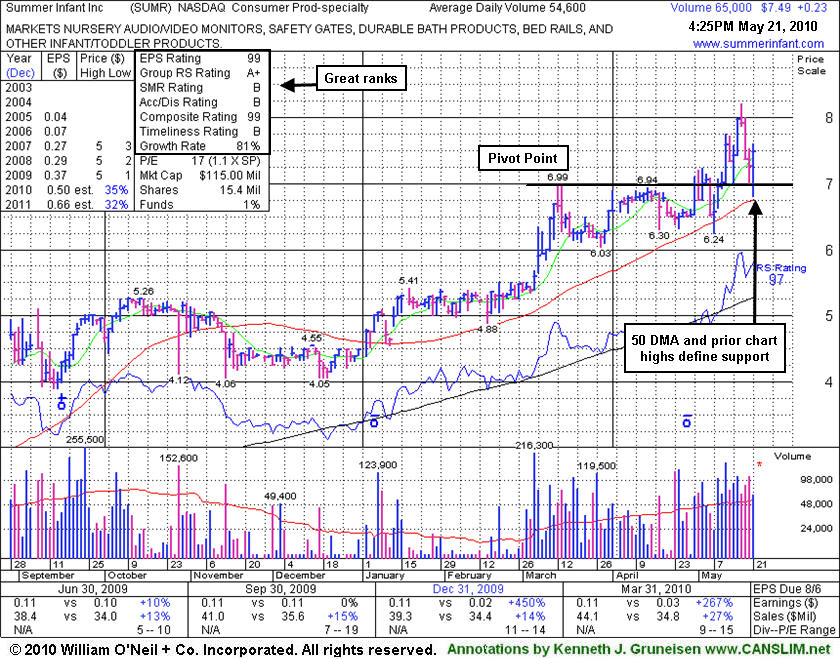

Summer Infant Inc (SUMR +$0.23 or +3.17% or $7.49) finished near its previously cited "max buy" level after early weakness tested support of prior chart highs and its 50-day moving average (DMA) line. The positive reversal and close near its session high was encouraging.

SUMR was featured in the 5/04/10 mid-day report (read here) with notes while - "Inching into new high ground this week on the right side of a 7-week flat base above its 50 DMA line and well above prior chart highs in the $5 area. Color code is yellow with pivot point noted based upon its 3/15/10 high plus ten cents. Quarterly earnings (C criteria) in the 2 latest quarterly comparisons showed great increases while sales revenues growth accelerated to +27% in the period ended Mach 31, 2010. It has a good annual earnings (A criteria) history, and a small supply (S criteria) of only 11.0 million shares in the public float. Technically, a gain and strong close above its pivot point with heavy volume would trigger a buy signal."

Earlier mid-day report appearances included notes (which can be reviewed using the "view all notes" link on any stock) that were critical of the company's prior sales and earnings growth history. Recent quarterly comparisons show sales revenues growth accelerating and big earnings increases (triple digit percentages), plus it has a good annual earnings (A criteria) history. Low-priced stocks are supposed to be avoided under the fact-based system because they are typically riskier candidates, however, when all key criteria are satisfied and market conditions are bullish buying efforts may be justified. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and odds are currently stacked against investors' success until a new rally with a follow-through day from at least one of the major averages confirms that strength is returning to stocks.

Summer Infant Inc (SUMR +0.25 or +3.70% or $7.00) closed the session 2 cents above its best prior close, but not above its pivot point. Featured in the mid-day report (read here) earlier today - "Inching into new high ground this week on the right side of a 7-week flat base above its 50 DMA line and well above prior chart highs in the $5 area. Color code is yellow with pivot point noted based upon its 3/15/10 high plus ten cents. Quarterly earnings (C criteria) in the 2 latest quarterly comparisons showed great increases while sales revenues growth accelerated to +27% in the period ended Mach 31, 2010. It has a good annual earnings (A criteria) history, and a small supply (S criteria) of only 11.0 million shares in the public float. Technically, a gain and strong close above its pivot point with heavy volume would trigger a buy signal."

Earlier mid-day report appearances included notes (which can be reviewed using the "view all notes" link on any stock) that were critical of the company's prior sales and earnings growth history. Recent quarterly comparisons show sales revenues growth accelerating and big earnings increases (triple digit percentages), plus it has a good annual earnings (A criteria) history. Low-priced stocks are supposed to be avoided under the fact-based system because they are typically riskier candidates, however, when all key criteria are satisfied and market conditions are bullish buying efforts may be justified. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses are adding to concerns about the current rally's tenacity.