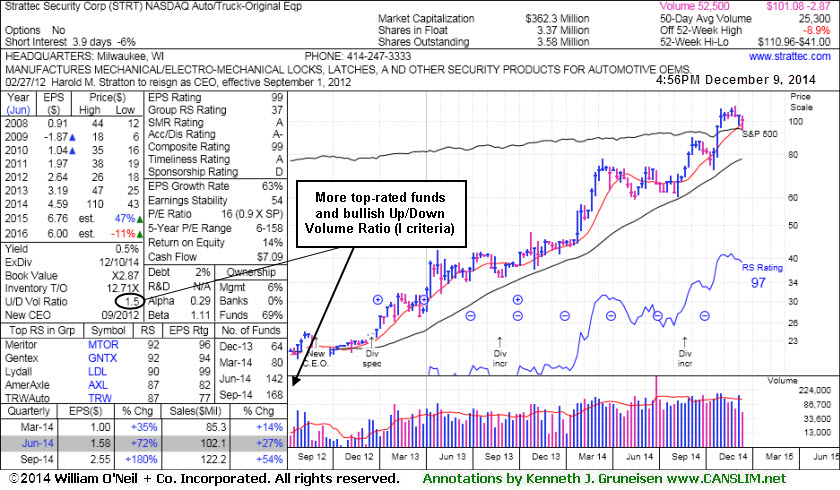

Little Overhead Supply in Thinly Traded Company - Tuesday, December 09, 2014

Strattec Security Corp (STRT +$0.52 or +0.52% to $101.08) managed a "positive reversal" today after testing support at its 50-day moving average (DMA) line. After forming an advanced "3-weeks tight" base it has not produced the volume-driven gains for new highs needed to trigger a new (or add-on) technical buy signal. Prior highs in the $89 area define the next important near-term support to watch below its 50 DMA line. Subsequent violations would raise concerns and trigger technical sell signals. The thinly-traded stock has a small supply (S criteria) of only 3.37 million shares in the public float which can contribute to greater price volatility in the event of institutional buying or selling.

STRT was last shown in this FSU section on 11/20/14 with annotated graphs under the headline, "Formed New Advanced '3-Weeks Tight' Base". The pivot point cited was based on its 10/28/14 high plus 10 cents. The Auto/Truck - Original Equipment firm has created a little resistance due to overhead supply up through the $110 level while recently consolidating.

It has traded up as much as +55.25% since first highlighted in yellow at $71.47 with pivot point based on its 6/06/14 high plus 10 cents in the 8/22/14 mid-day report (read here). Quarterly earnings increases through Sep '14 were above the +25% minimum guideline satisfy the C criteria and its annual earnings (A criteria) history has been strong.

Increasing ownership by top-rated funds (I criteria) is a reassuring sign. The number of top-rated funds owning its shares rose from 59 in Sep '14 to 168 in Sep '14, a very reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days.

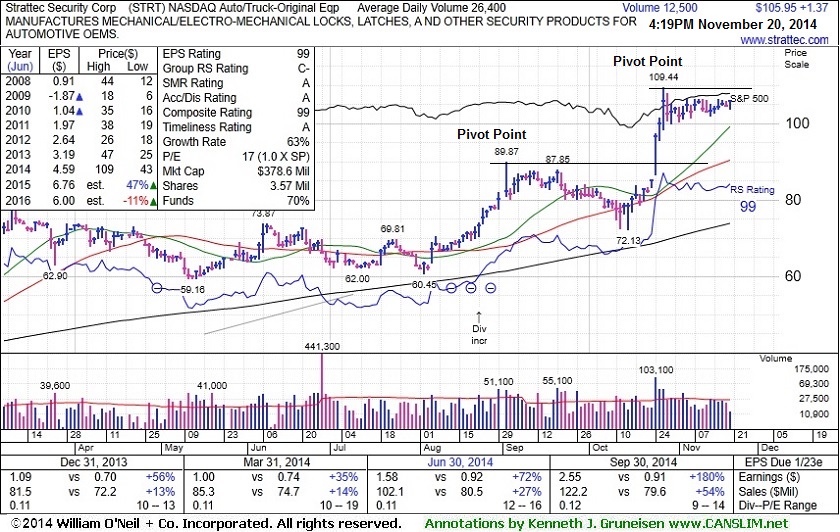

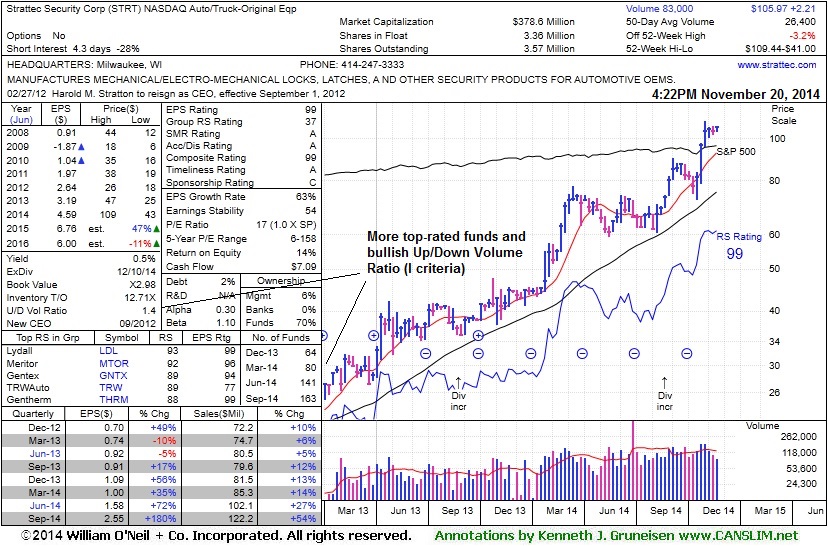

Formed New Advanced "3-Weeks Tight" Base - Thursday, November 20, 2014

Strattec Security Corp (STRT +$1.42 or +1.36% to $106.00) has been stubbornly holding its ground near its 52-week high. Its color code was changed to yellow after having formed an advanced "3-weeks tight" base and a new pivot point is cited based on its 10/28/14 high. The Auto/Truck - Original Equipment firm has no resistance remaining due to overhead supply. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal. Prior highs in the $89 area coincide with its 50 DMA line ($90) defining important near-term support to watch on pullbacks.

It was last shown in this FSU section on 11/04/14 with annotated graphs under the headline, "Stock With Small Supply Quickly Got Extended From Prior Base". It has traded up as much as +53.1% since first highlighted in yellow at $71.47 with pivot point based on its 6/06/14 high plus 10 cents in the 8/22/14 mid-day report (read here).

The thinly-traded stock has a small supply (S criteria) of only 3.36 million shares in the public float which can contribute to greater price volatility in the event of institutional buying or selling. Quarterly earnings increases through Sep '14 were above the +25% minimum guideline satisfy the C criteria and its annual earnings (A criteria) history has been strong. Increasing ownership by top-rated funds (I criteria) is a reassuring sign. The number of top-rated funds owning its shares rose from 59 in Sep '14 to 163 in Sep '14, a very reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days.

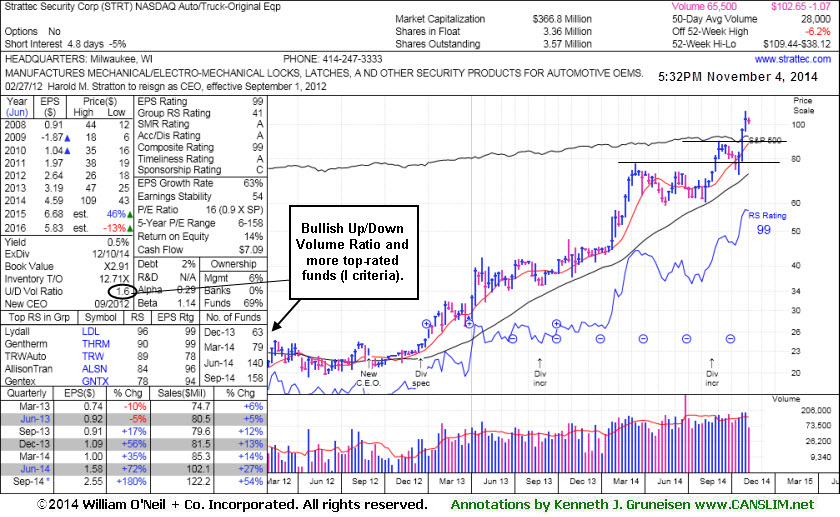

Stock With Small Supply Quickly Got Extended From Prior Base - Tuesday, November 04, 2014

Strattec Security Corp (STRT +$0.49 or +0.48% to $102.65) is hovering near its 52-week high, stubbornly holding its ground after volume-driven gains. The Auto/Truck - Original Equipment firm is very extended beyond its "max buy" level. Prior highs in the $88 area define important near-term support to watch above its 50-day moving average (DMA) line.

STRT was last shown in this FSU section on 10/20/14 with annotated graphs under the headline, "Building Base-On-Base Pattern Ahead of Earnings News". A powerful volume-driven gain on 10/24/14 cleared its base-on-base pattern leaving no resistance remaining due to overhead supply. It has traded up as much as +53.1% since first highlighted in yellow at $71.47 with pivot point based on its 6/06/14 high plus 10 cents in the 8/22/14 mid-day report (read here).

The thinly-traded stock has a small supply (S criteria) of only 3.36 million shares in the public float which can contribute to greater price volatility in the event of institutional buying or selling. Quarterly earnings increases through Sep '14 were above the +25% minimum guideline satisfy the C criteria and its annual earnings (A criteria) history has been strong. Increasing ownership by top-rated funds (I criteria) is a reassuring sign. The number of top-rated funds owning its shares rose from 59 in Sep '14 to 158 in Sep '14, a very reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days.

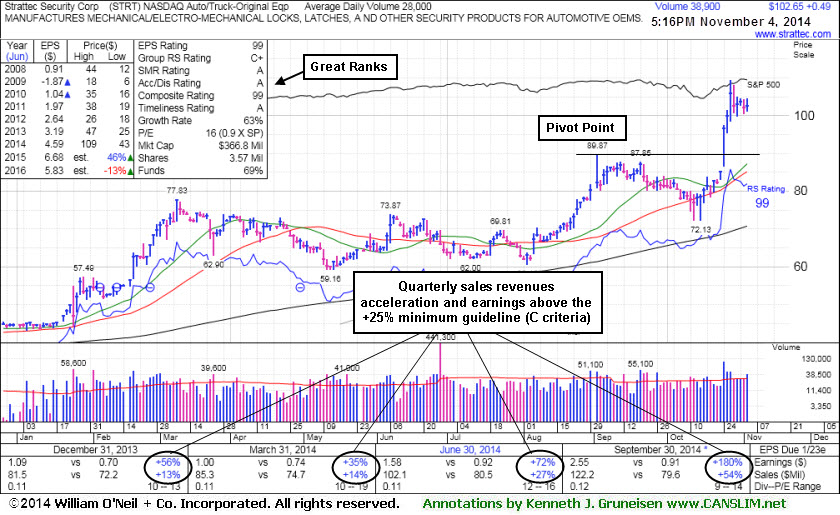

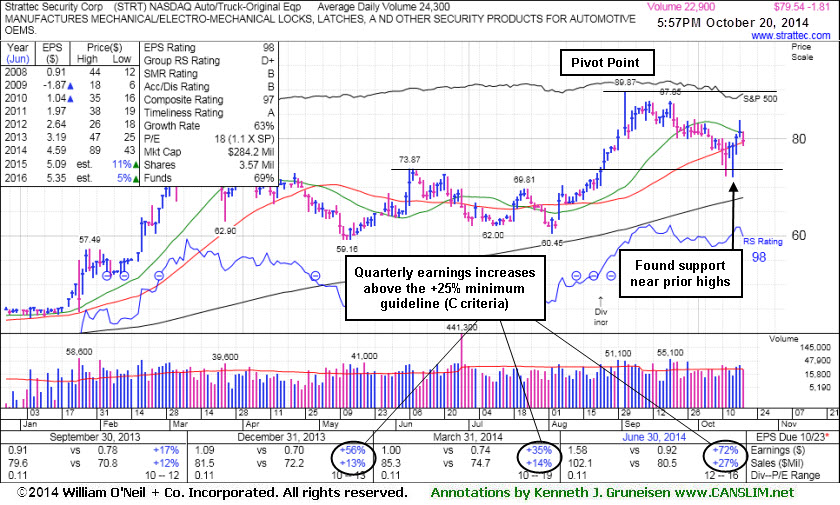

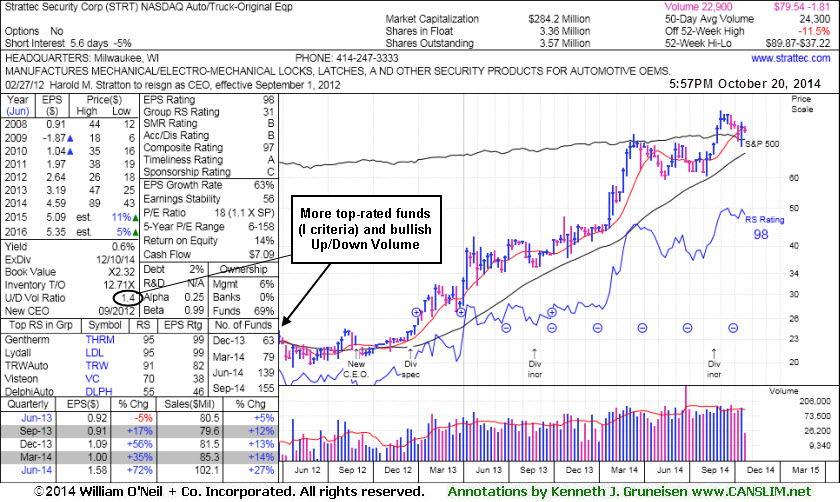

Building Base-On-Base Pattern Ahead of Earnings News - Monday, October 20, 2014

Strattec Security Corp (STRT -$1.81 or -2.22% to $79.54) recently found encouraging support near its 50-day moving average (DMA) line while building on a base-on-base pattern. However, poor market conditions (M criteria) have raised overriding concerns arguing against any new buying efforts until a solid follow through day from at least one of the major averages confirms that strength is returning to the broader market. The recent low ($72.13 on 10/15/14) defines important near-term support to watch where any violation would raise more serious concerns. Meanwhile, it faces near term resistance due to overhead supply up through the $89 level. Subsequent volume-driven gains above the pivot point cited may trigger a new (or add-on) technical buy signal.

STRT was last shown in this FSU section on 9/26/14 with annotated graphs under the headline, "Consolidating Above Prior Highs and 50-Day Moving Average Line". It was first highlighted in yellow at $71.47 with pivot point based on its 6/06/14 high plus 10 cents in the 8/22/14 mid-day report (read here).

Keep in mind that it is due to report earnings results for the Sep '14 quarter on Thursday, October 23rd, and volume and volatility often increase near earnings news. The thinly-traded stock has a small supply (S criteria) of only 3.36 million shares in the public float which can contribute to greater price volatility in the event of institutional buying or selling. Quarterly earnings increases through Jun '14 above the +25% minimum guideline satisfy the C criteria and its annual earnings (A criteria) history has been strong. Increasing ownership by top-rated funds (I criteria) is a reassuring sign. The number of top-rated funds owning its shares rose from 59 in Sep '14 to 155 in Sep '14, a very reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. The Auto/Truck - Original Equipment group's strong Group Relative Strength rank is a reassuring sign concerning the L criteria.

\

\

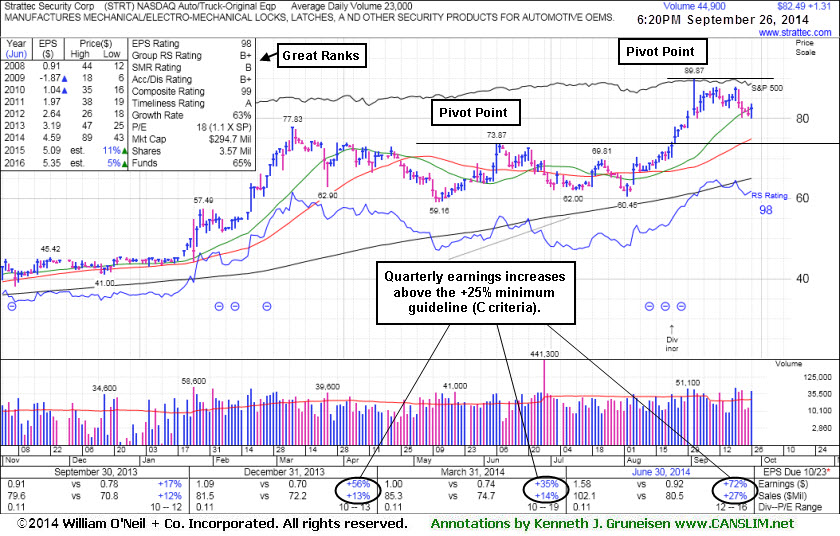

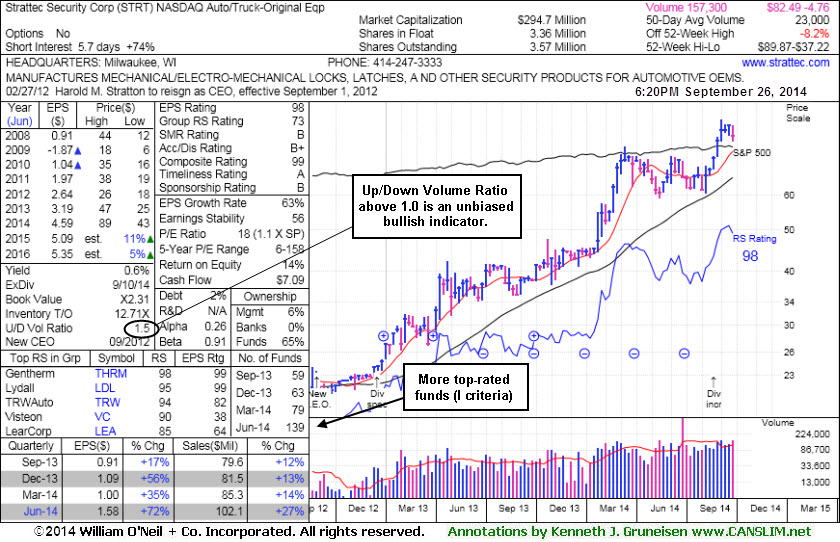

Consolidating Above Prior Highs and 50-Day Moving Average Line - Friday, September 26, 2014

Strattec Security Corp (STRT +$1.31 or +1.61% to $82.49) is perched -8.2% off its 52-week high. It has pulled back after forming an advanced "3-weeks tight" base. Subsequent volume-driven gains above the new pivot point cited may trigger a new (or add-on) technical buy signal. Its 50-day moving average (DMA) line ($74.87) and prior highs define important support to watch on pullbacks.

STRT was last shown in this FSU section on 9/10/14 with annotated graphs under the headline, "Extended From Prior Highs and Previously Noted Base". It was first highlighted in yellow at $71.47 with pivot point based on its 6/06/14 high plus 10 cents in the 8/22/14 mid-day report (read here).

Quarterly earnings increases through Jun '14 above the +25% minimum guideline satisfy the C criteria and its annual earnings (A criteria) history has been strong. Increasing ownership by top-rated funds (I criteria) is a reassuring sign. The number of top-rated funds owning its shares rose from 59 in Sep '14 to 139 in Jun '14, a very reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days. The Auto/Truck - Original Equipment group's strong Group Relative Strength rank is a reassuring sign concerning the L criteria. The thinly-traded stock has a small supply (S criteria) of only 3.36 million shares in the public float which can contribute to greater price volatility in the event of institutional buying or selling.

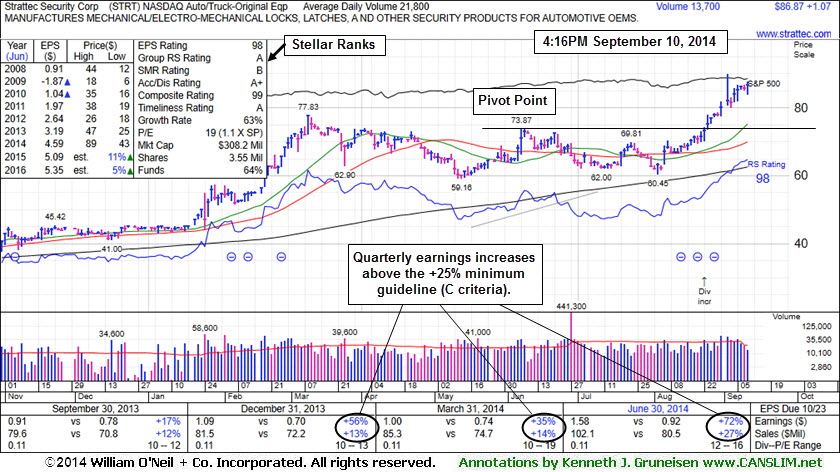

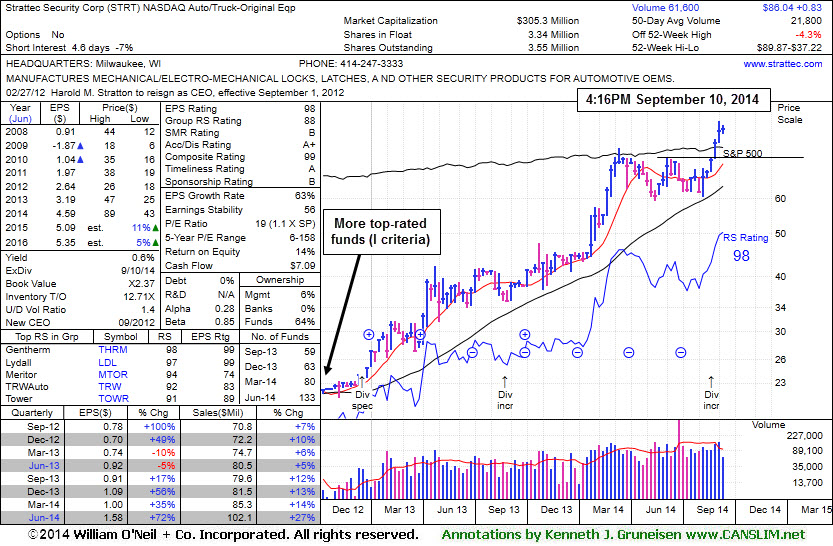

Extended From Prior Highs and Previously Noted Base - Wednesday, September 10, 2014

Strattec Security Corp (STRT +$0.36 or +0.42% to $86.04) is hovering at its 52-week high, pausing after recent gains. It is extended from its prior base. Prior highs in the $74-77 area define initial support to watch on pullbacks. It held its ground stubbornly and made gradual progress since last shown in this FSU section on 8/22/14 with annotated graphs under the headline, "Small Supply of Shares and Perched Near All-Time Highs".

It was first highlighted in yellow at $71.47 with pivot point based on its 6/06/14 high plus 10 cents in the earlier mid-day report (read here). While currently perched at new highs (N criteria) no overhead supply remains to act as resistance. Disciplined investors avoid chasing extended stocks, so patient investors may watch for a secondary buy point or new base to possibly form and be noted in the weeks ahead.

Quarterly earnings increases through Jun '14 above the +25% minimum guideline satisfy the C criteria and its annual earnings (A criteria) history has been strong. Increasing ownership by top-rated funds (I criteria) is a reassuring sign. The number of top-rated funds owning its shares rose from 59 in Sep '14 to 133 in Jun '14, a very reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. The Auto/Truck - Original Equipment group's strong Group Relative Strength rank is a reassuring sign concerning the L criteria. The thinly-traded stock has a small supply (S criteria) of only 3.34 million shares in the public float which can contribute to greater price volatility in the event of institutional buying or selling.

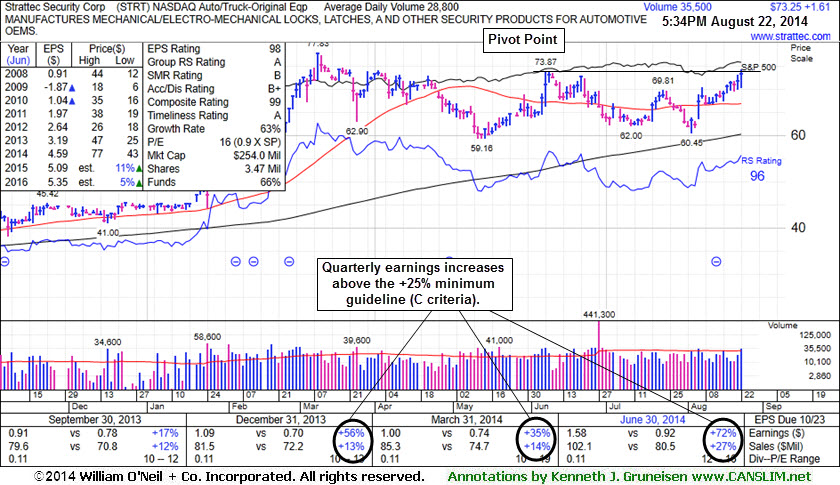

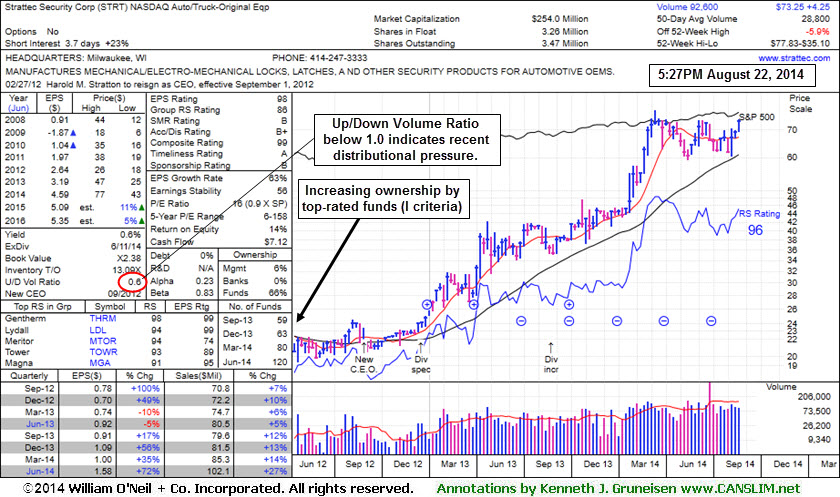

Small Supply of Shares and Perched Near All-Time Highs - Friday, August 22, 2014

Strattec Security Corp (STRT +$1.61 or +2.25% to $73.25) finished strong after highlighted in yellow with pivot point based on its 6/06/14 high plus 10 cents in the earlier mid-day report (read here). Disciplined investors may watch for subsequent volume-driven gains above the pivot to trigger a proper technical buy signal. It is also perched within close striking distance of a new highs (N criteria) with very little overhead supply to act as resistance.

Quarterly earnings increases through Jun '14 above the +25% minimum guideline satisfy the C criteria and its annual earnings (A criteria) history has been strong. Increasing ownership by top-rated funds (I criteria) is a reassuring sign. The number of top-rated funds owning its shares rose from 59 in Sep '14 to 120 in Jun '14, a very reassuring sign concerning the I criteria. However, its current Up/Down Volume Ratio of 0.6 is an unbiased indication its shares have endured distributional pressure over the past 50 days. The Auto/Truck - Original Equipment group's strong Group Relative Strength rank is a reassuring sign concerning the L criteria. The thinly-traded stock has a small supply (S criteria) of only 3.26 million shares in the public float which can contribute to greater price volatility in the event of institutional buying or selling.