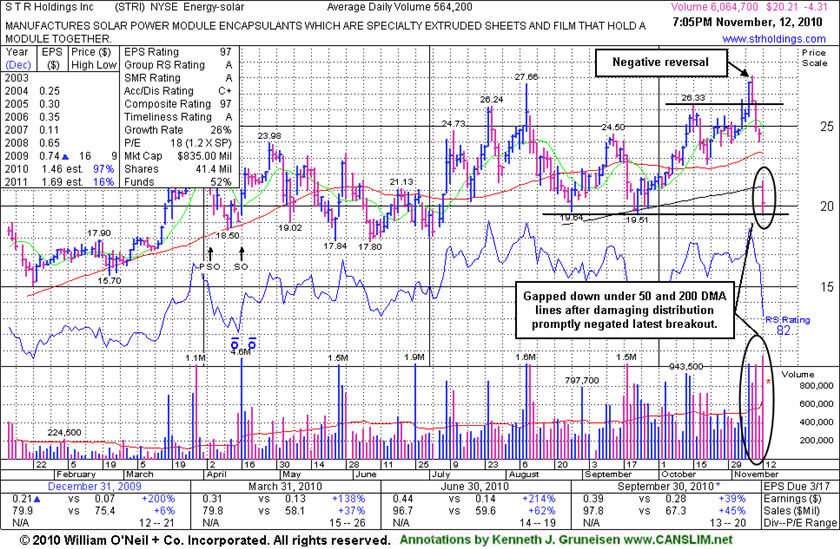

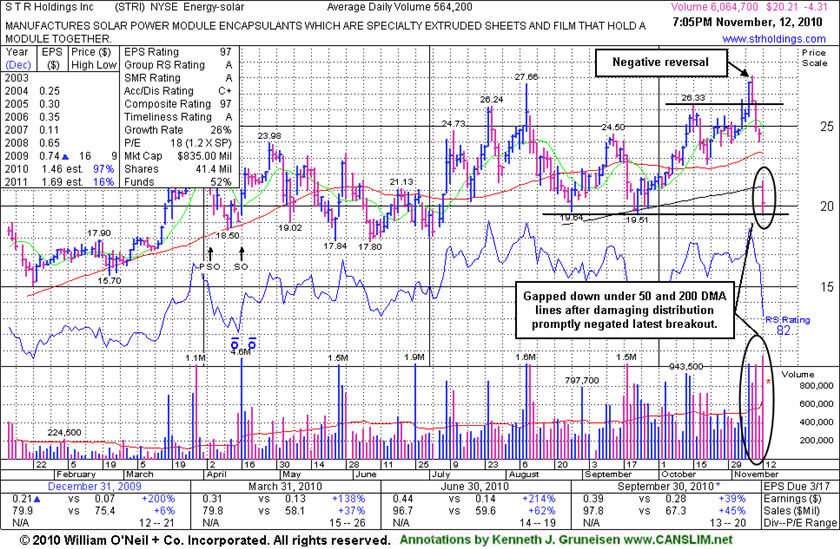

S T R Holdings Inc (STRI -17.58%) gapped down today following its report of +39% earnings on +45% sales for the quarter ended September 30, 2010, immediately violating its 50-day moving average (DMA) line and 200 DMA line triggering technical sell signals. Damaging distribution had promptly negated latest breakout. Prior lows in the $19.50 area may act as a support level, however its outlook is questionable and it will be dropped from the Featured Stocks list tonight based upon the distributional action coupled with the market's poor response following its latest earnings report. Disciplined investors who follow the rule of selling if a stock ever falls more than -7% from their buy price were likely to have sold prior to the considerable gap down today.

STRI was recently featured in the 11/08/10 mid-day report (read here) and had finished that session strong, hitting a new 52-week high with more than 3 times average volume, triggering a technical buy signal. Attention was given to the point that earnings news for the latest quarter was due soon, and that volume and volatility often increase near earnings news. It was noted - "Careful trading discipline can be crucial to your success. Disciplined investors avoid chasing stocks extended more than +5% above prior highs and always limit losses if a stock falls more than -7% from their purchase price. This high-ranked firm hailing from the Energy - Solar group's limited history since public trading began on 11/06/09 is a concern, meanwhile it formed an orderly base since a Secondary Offering was completed on 4/16/10."

Investors were alerted to worrisome distributional action in ongoing notes that were published as it color code was changed from yellow to green after a "negative reversal" was noted on 11/10/10 (see "view all notes" links). Active investors can be immediately emailed copies of the latest notes without waiting to read them in the published reports. Simply click the "Alert me of new notes" link by any stock you wish to add to your (Alerts) watchlist.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

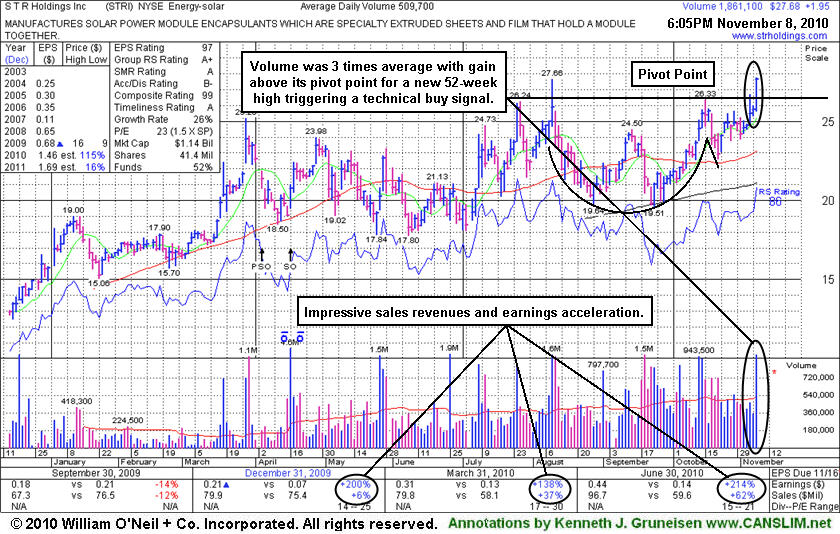

S T R Holdings Inc (STRI +7.58%) finished the session strong and hit a new 52-week high with today's gain on more than 3 times average volume triggering a technical buy signal. In today's mid-day report (read here) it was highlighted in yellow with a pivot point based on its 10/15/10 high plus ten cents. It pulled back and found support at its 200 DMA line since the old high was hit when last noted in the 8/10/10 mid-day report. Recent quarters showed sales revenues and earnings accelerating impressively. Earnings news for the latest quarter ended September 30, 2010 is due this Friday. Volume and volatility often increase near earnings new so careful trading discipline can be crucial to your success. Disciplined investors avoid chasing stocks extended more than +5% above prior highs and always limit losses if a stock falls more than -7% from their purchase price. This high-ranked firm hailing from the Energy - Solar group's limited history since public trading began on 11/06/09 is a concern, meanwhile it formed an orderly base since a Secondary Offering was completed on 4/16/10.