Sanchez Energy Corp (SN -$0.08 or -0.22% to $36.12) is extended from its prior base. Its 50-day moving average (DMA) line and prior highs near $32 define support to watch on pullbacks. The high-ranked Oil & Gas firm completed a new Public Offering on 6/12/14 after it last appeared in this FSU section on 6/09/14 with annotated graphs under the headline, "Finished Near Session Low After Hitting new 52-Week High".

SN has traded up as much as +18% since highlighted in the 5/22/14 mid-day report (read here). Other Featured Stocks have tallied even larger gains while, during that same period, the benchmark S&P 500 Index has risen just +4.9%. This demonstrates the benefits of following the proven fact-based system of investing.

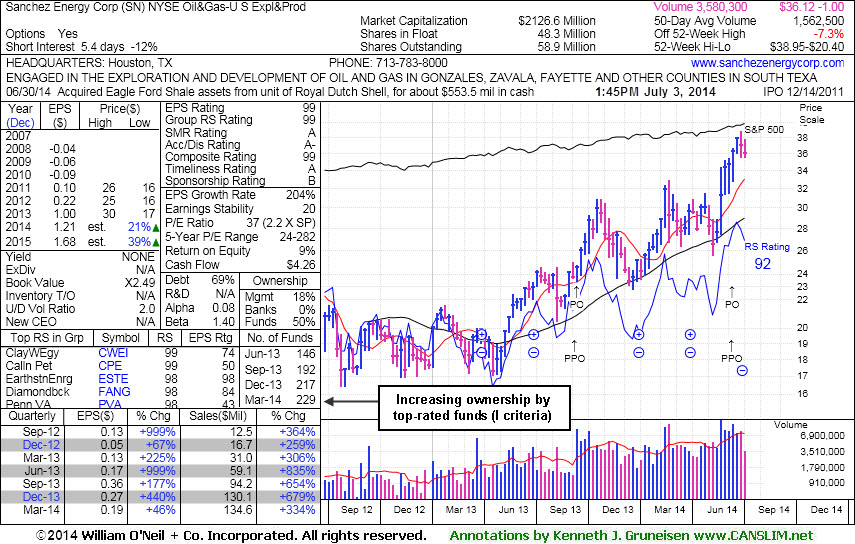

It reported earnings +46% on +334% sales revenues for the Mar '14 quarter. Quarterly comparisons show strong sales revenues and earnings increases well above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history showed losses in the years prior to its IPO in Dec '11, yet it has done well in the earnings department since and earned the highest possible Earnings Per Share Rating of 99. The number of top-rated funds owning its shares rose from 147 in Jun '13 to 229 in Mar '14, a reassuring sign concerning the I criteria.

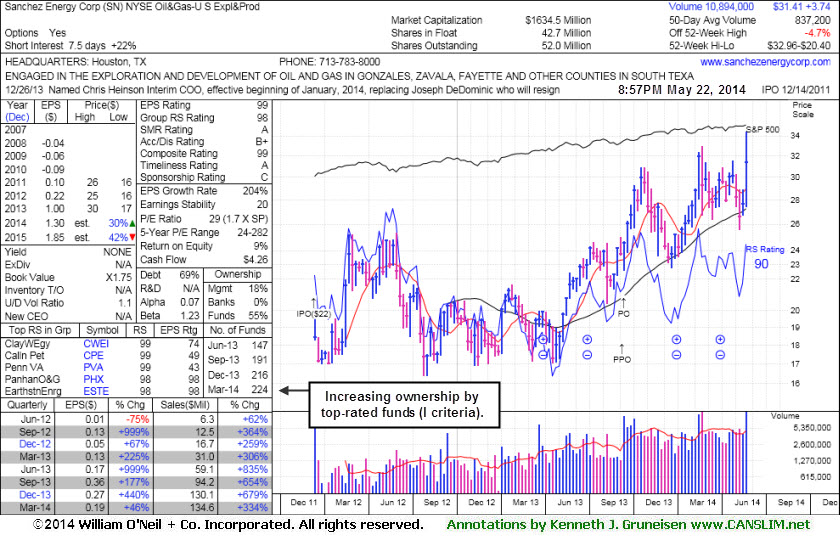

It reported earnings +46% on +334% sales revenues for the Mar '14 quarter. Quarterly comparisons show strong sales revenues and earnings increases well above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history showed losses in the years prior to its IPO in Dec '11, yet it has done well in the earnings department since and earned the highest possible Earnings Per Share Rating of 99. The number of top-rated funds owning its shares rose from 147 in Jun '13 to 227 in Mar '14, a reassuring sign concerning the I criteria.

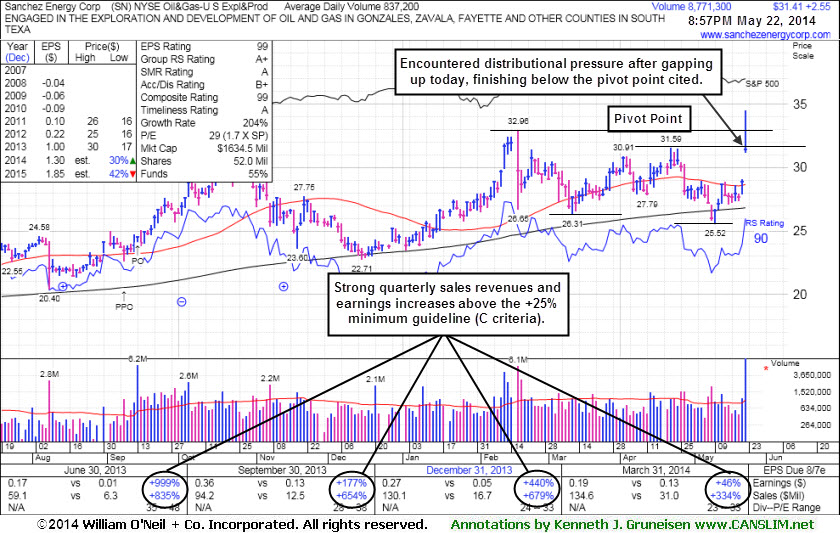

Sanchez Energy Corp (SN +$2.55 or +8.84% to $31.41) was highlighted in yellow with pivot point cited based on its 4/22/14 high in the earlier mid-day report (read here). It gapped up today and hit a new 52-week high, but it encountered distributional pressure near prior highs and finished near the session low, rather than convincingly rallying from a "double bottom" base. Confirming volume-driven gains into new high territory would be a welcome reassurance to watch for, as disciplined investors may watch for it to clinch a proper technical buy signal. Keep in mind 3 out of 4 stocks move in the direction of the major averages (M criteria). Confirming gains from the broader market averages coupled with an expansion in leadership (stocks hitting new 52-week highs) would be a welcome reassurance that the market has established a meaningful rally.

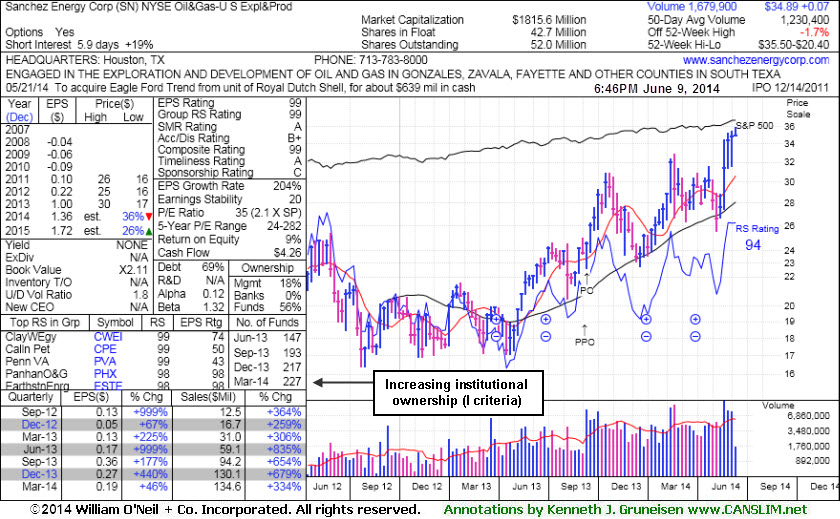

It reported earnings +46% on +334% sales revenues for the Mar '14 quarter. Quarterly comparisons show strong sales revenues and earnings increases well above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history showed losses in the years prior to its IPO in Dec '11, yet it has done well in the earnings department since and earned the highest possible Earnings Per Share Rating of 99. The number of top-rated funds owning its shares rose from 147 in Jun '13 to 224 in Mar '14, a reassuring sign concerning the I criteria.