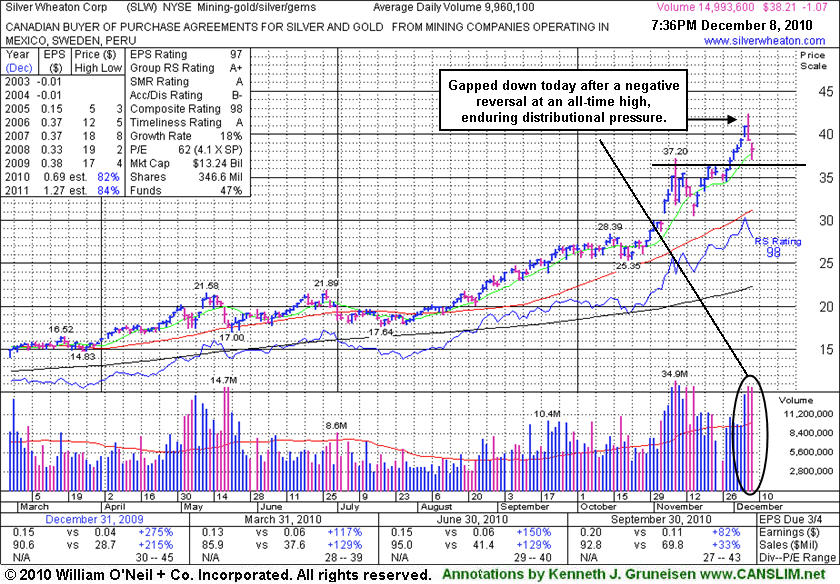

Its last appearance in this FSU section was on 12/08/10 under the headline "Gap Down Followed Negative Reversal At All-Time High". The subsequent weakness makes this a very good example of why investors should watch out for negative reversals. A negative reversal occurs whenever a stock starts the session with gains but reverses and closes with a loss. When a negative reversal occurs with heavy volume at an all-time high after a stock is extended from any sound base it can be an especially worrisome sign of distributional pressure. Although an earlier negative reversal occurred on 11/09/10, SLW fought back and rallied to new highs yet again. But often negative reversals are followed by a longer and deeper consolidation. Many great winners have marked significant tops with a negative reversal.

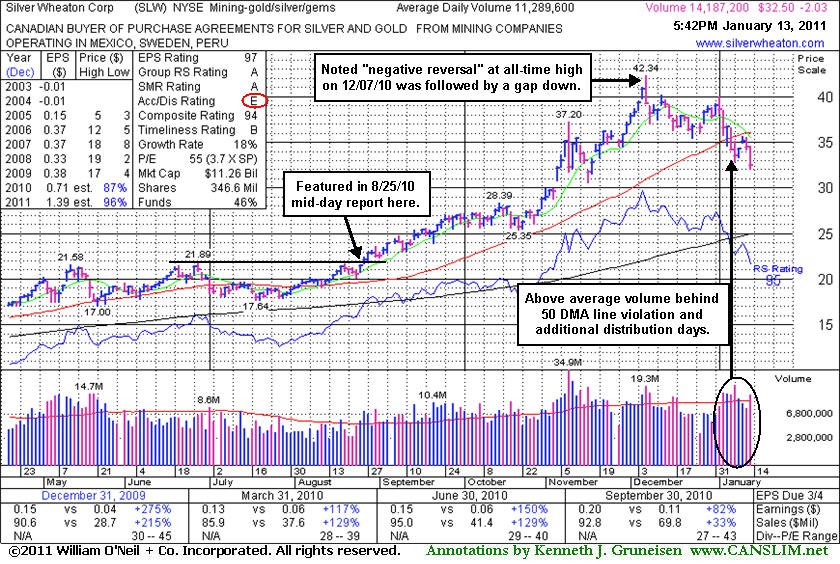

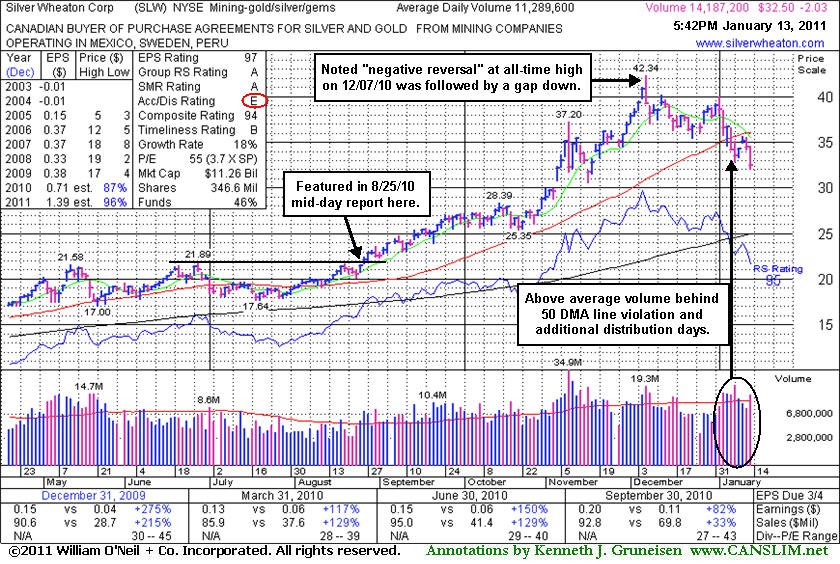

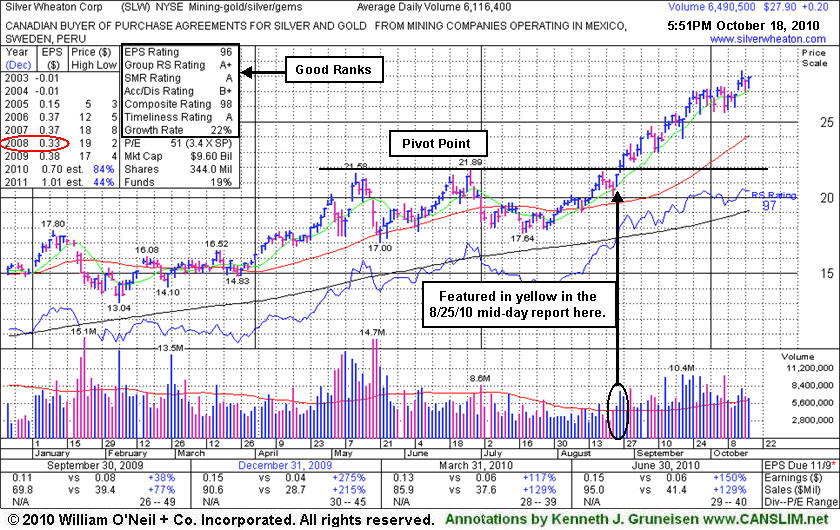

Since first featured at $21.40 in the 8/25/10 mid-day report (read here) it traded as much as +97.8% higher. In its first FSU section appearance under the headline "Another High-Ranked Mining Firm Perched Near Highs" on 8/25/10, the annotated graph seen below was included. Late-August gains had it already in play as a potential buy candidate by the time the major averages' follow-through day occurred on 9/01/10 confirming a new rally.

Silver Wheaton Corp (SLW -$1.07 or -2.72% to $27.90) gapped down today following a negative reversal on the prior session after reaching an all-time high and capping a streak of 6 consecutive gains. Enduring distributional pressure, it is extended from any sound base. Prior chart highs in the $36-37 area define initial support well above its 50-day moving average (DMA) line. Since first featured at $21.40 in the 8/25/10 mid-day report (read here) it has traded as much as +97.8% higher.

It found support above its 50-day moving average (DMA) line and then roared into new high territory with with above average volume behind its gains after it was last shown in this FSU section on 10/18/10 with an annotated graph under the headline "New High Close For High-Ranked Mining - Gold/Silver/Gems Leader". Its Up/Down Volume Ratio of 1.9 then indicated that it had been under accumulation and on the rise due to institutional (I criteria) buying demand. Even after its 2 latest damaging losses its Up/Down Volume Ratio of 1.5 still suggests a recently bullish trading bias. However it is extended from any sound base, and it has not spent much time basing during its ongoing ascent. A sound new base should develop before any add-on buying efforts might be justified under the investment system guidelines, so patience and discipline are required.

There are a few high-ranked leaders hailing from the Mining - Gold/Silver/Gems industry group which are currently included on the Featured Stocks page based on fundamental and technical strength. Current leadership in the group (L criteria) is helping many firms in the group show strength. They are ideal candidates for investors' watch lists as the broader market continues its rally. If they produce sound new bases and bullish breakouts confirming that they are attracting great institutional (I criteria) demand, some of these leaders are capable of substantial sustained advances. Meanwhile, patience and good discipline are critical.

Silver Wheaton Corp (SLW +$0.20 or +0.72% to $27.90) posted a small gain today with near average volume for a new all-time high close. Since it was last shown in this FSU section on 8/25/10 with an annotated graph under the headline "

Another High-Ranked Mining Firm Perched Near Highs" it has steadily risen +30%. This Canada-based firm in the Mining - Gold/Silver/Gems industry had a downward turn in FY '08 earnings (A criteria has been noted as a concern, see red circle). Its 4 latest quarterly comparisons showed solid sales and earnings increases (good C criteria) after 4 prior reports with negative comparisons versus the year ago period. Its Up/Down Volume Ratio of 1.9 indicates that it has recently been under accumulation and on the rise due to institutional (I criteria) buying demand. It is extended from an ideal buy point, so patient investors may be wise to wait until a secondary buy point develops before making initial or add-on buying efforts.

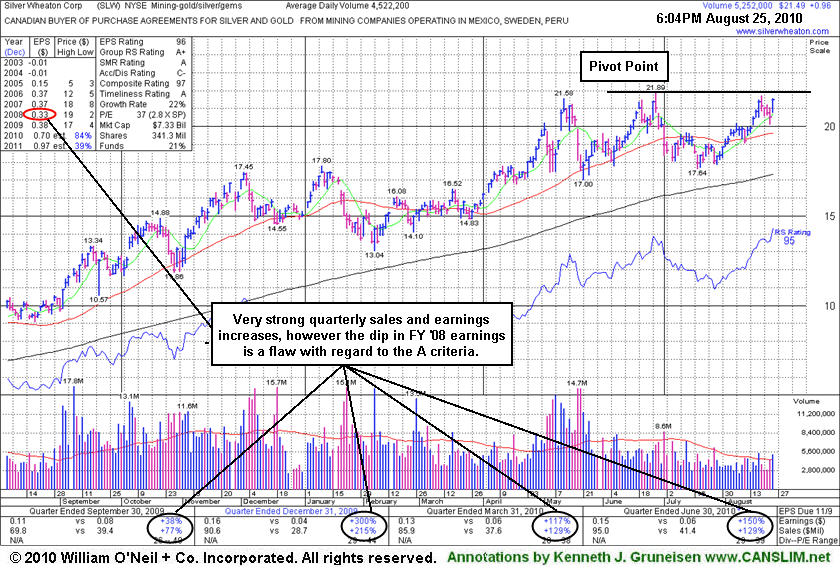

Silver Wheaton Corp (SLW +$0.96 or +4.68% to $21.49) is perched near its all-time high, no overhead supply remains to hinder its upward progress, yet the $21 area has been a stubborn resistance level a couple of times earlier this year. This Canada-based firm in the Mining - Gold/Silver/Gems industry had a downward turn in FY '08 earnings (A criteria has been noted as a concern, see red circle). Its 3 latest quarterly comparisons showed solid sales and earnings increases (good criteria) after 4 prior reports with negative comparisons versus the year ago period. It was featured in today's mid-day report (read here). Disciplined investors resist the urge to get in early and would wait to see a technical breakout with at least +50% above average volume to confirm that it is under heavy institutional (I criteria) buying demand. Additionally, keep in mind that the M criteria is now arguing against new buying efforts until a new follow-through day occurs from at least one of the major averages.

There are a few high-ranked leaders hailing from the Mining - Gold/Silver/Gems industry group which are currently included on the Featured Stocks page based on fundamental and technical strength. Current leadership in the group (L criteria) is helping most firms in the group show strength. They are ideal candidates for investors' watch lists in the event the broader market resumes its rally and only if they produce bullish breakouts confirming they are attracting great institutional (I criteria) demand capable of leading to a sustained advance. Meanwhile, patience and good discipline are critical.