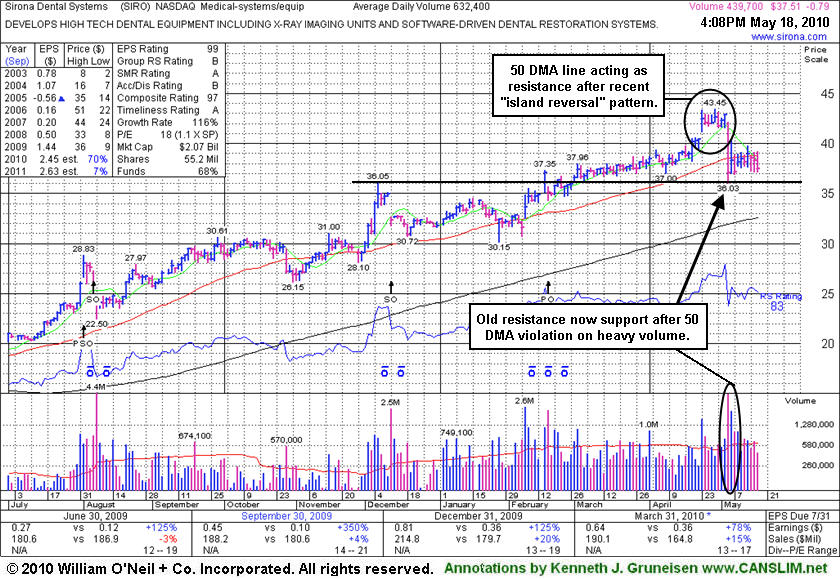

50 DMA Acts As Resistance After Recent Island Reversal Pattern - Tuesday, May 18, 2010

Sirona Dental Systems (SIRO -$0.83 or -2.15% to $37.48) is continuing to sputter below its 50-day moving average (DMA) line which is acting as resistance. On 5/05/10 it endured heavy distributional pressure after reporting +231% earnings on +15% sales revenues for the quarter ended March 31, 2010 versus the year ago period. Since its last appearance in this FSU section on 4/22/10 under the headline "Wedging Up For Another New High Close" a gap up on 4/23/10 and then a subsequent gap down on 5/05/10 formed a worrisome "island reversal" pattern. Prior chart highs in the $36 area define important support to watch, while the outlook becomes more questionable the longer it lingers below its 50 DMA line.

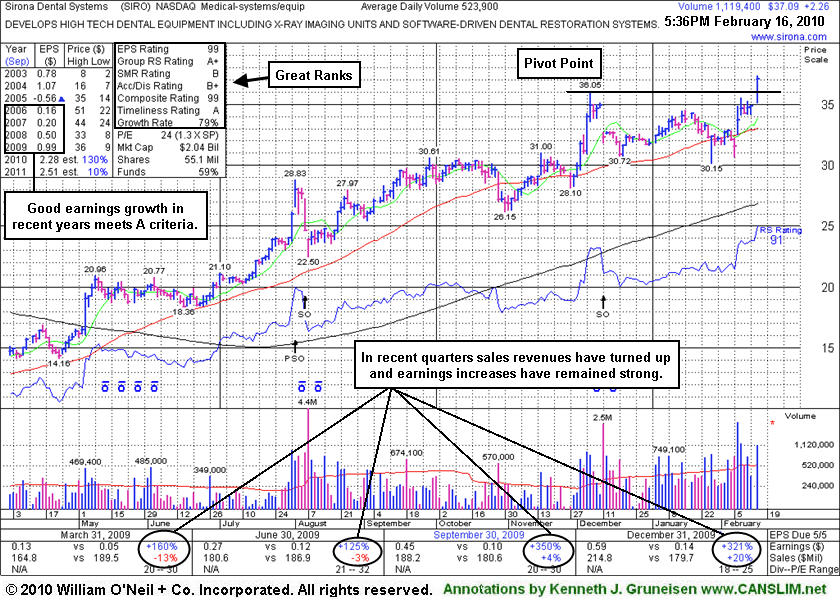

SIRO was featured in yellow in the 2/16/10 mid-day report (read here) as it broke out from a 10-week flat base. Fundamentally, following 3 negative comparisons, its sales revenues and earnings increases in the Sep, Dec '09 and Mar '10 quarterly comparisons showed a return to growth. Quarterly earnings increases have been very strong along with great annual earnings growth in recent years (good C and A criteria). While rallying from January 2009 lows near $10 underwriters helped this high-ranked Medical - Systems/Equipment firm complete Secondary Offerings on 8/06/09 and 12/11/09, and yet another Public Offering on 2/17/10. The number of top-rated funds owning its shares rose from 55 in Mar '09 to 99 in Mar '10, which is nice reassurance with respect to the I criteria of the investment system. Companies often attract new institutional investors with the help of underwriters, but offerings often have the near-term effect of hindering upward price progress. Company management reportedly still owns a 70% interest in the company's shares even after those offerings, keeping them very motivated to maintain and build shareholder value.

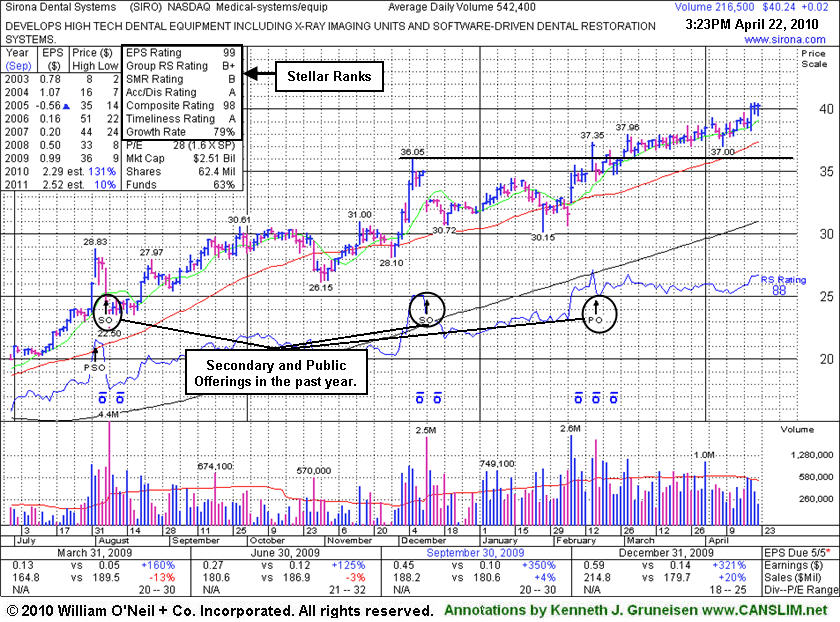

Wedging Up For Another New High Close - Thursday, April 22, 2010

Sirona Dental Systems (SIRO +$0.20 or +0.50% to $40.42) has been wedging continually higher in recent weeks, and today it inched up for yet another new high close. It is not near a sound base now, and the company is scheduled to report results for the latests quarter before the market opens on May 5th. Prior chart highs and its 50-day moving average (DMA) line in the $36 area define important support to watch. It was featured in yellow in the 2/16/10 mid-day report (read here) as it broke out from a 10-week flat base.

Fundamentally, following 3 negative comparisons, its sales revenues in the Sep and Dec '09 quarters showed a return to growth. Quarterly earnings increases have been very strong along with great annual earnings growth in recent years (good C and A criteria). As it has rallied from January 2009 lows near $10, clearly it has been able to get help from underwriters as this high-ranked Medical - Systems/Equipment firm completed Secondary Offerings on 8/06/09 and 12/11/09, and yet another Public Offering on 2/17/10. The number of top-rated funds owning its shares rose from 55 in Mar '09 to 94 in Mar '10, which is nice reassurance with respect to the I criteria of the investment system. Companies often attract new institutional investors with the help of underwriters, but offerings often have the near-term effect of hindering upward price progress. Company management reportedly still owns a 70% interest in the company's shares even after those offerings, keeping them very motivated to maintain and build shareholder value.

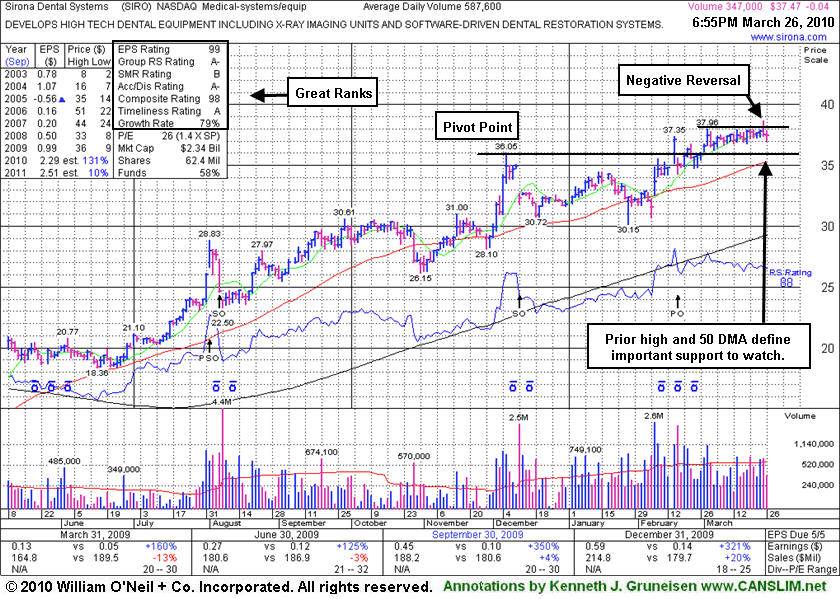

Little Progress Following Post-Breakout Offering - Friday, March 26, 2010

Sirona Dental Systems (SIRO -$0.22 or -0.59% to $36.99) held its ground today following a negative reversal on 3/25/10 for a small loss after early gains helped it briefly hit a new 52-week high above its "max buy" level. Prior chart highs and its 50-day moving average (DMA) line in the $35-36 area define important support to watch. Any subsequent weakness below its pivot point or its 50-day moving average (DMA) line would raise concerns. It has not made much progress since it was featured in yellow in the 2/16/10 mid-day report (read here) as it broke out from a 10-week flat base. The considerable 2/16/10 gain triggered a technical buy signal and an annotated graph was included under the headline "Medical - Systems/Equipment Firm Identified While Breaking Out."

Fundamentally, following 3 negative comparisons, its sales revenues in the Sep and Dec '09 quarters showed a return to growth. Quarterly earnings increases have been very strong along with great annual earnings growth in recent years (good C and A criteria). As it has rallied from January 2009 lows near $10, clearly it has been able to get help from underwriters as this high-ranked Medical - Systems/Equipment firm completed Secondary Offerings on 8/06/09 and 12/11/09, and yet another Public Offering on 2/17/10. The number of top-rated funds owning its shares rose from 55 in Mar '09 to 86 in Dec '09, which is nice reassurance with respect to the I criteria of the investment system. Companies often attract new institutional investors with the help of underwriters, but offerings often have the near-term effect of hindering upward price progress. Company management reportedly still owns a 70% interest in the company's shares even after those offerings, keeping them still very motivated to maintain and build shareholder value.

High-Ranked Leader Attracting More Institutional Owners - Tuesday, March 09, 2010

Sirona Dental Systems (SIRO -$0.22 or -0.59% to $36.99) suffered a small loss on below average volume today leaving it still perched above its pivot point yet below its max buy level. It has not made significant headway since it was featured in yellow in the 2/16/10 mid-day report (read here) as it broke out from a 10-week flat base. The considerable 2/16/10 gain triggered a technical buy signal and an annotated graph was included under the headline "Medical - Systems/Equipment Firm Identified While Breaking Out."Fundamentally, following 3 negative comparisons, its sales revenues in the Sep and Dec '09 quarters showed a return to growth. Quarterly earnings increases have been very strong along with great annual earnings growth in recent years (good C and A criteria). As it has rallied from January 2009 lows near $10, clearly it has been able to get help from underwriters as this high-ranked Medical - Systems/Equipment firm completed Secondary Offerings on 8/06/09 and 12/11/09, and yet another Public Offering on 2/17/10. The number of top-rated funds owning its shares rose from 55 in Mar '09 to 79 in Dec '09, which is nice reassurance with respect to the I criteria of the investment system. Often companies attract new institutional investors with the help of underwriters. Any weakness below its pivot point or its 50-day moving average (DMA) line would raise concerns.

Medical - Systems/Equipment Firm Identified While Breaking Out - Tuesday, February 16, 2010