In recent weeks we have taken the opportunity to use this section to revisit some of the previously featured stocks that were dropped some time ago based on technical weakness. Studying what happened afterwards should hopefully allow investors to get a better understanding of the importance of having a sell discipline. Limiting losses while they are small is critically important to your success, and this investment system's rule is to always sell a losing stock after it falls more than 7-8% from your buy price. These well-known, high-profile companies serve now as perfect examples that will hopefully allow investors in the future to recognize the warning signs and technical sell signals so they will know when it is time to lock in profits or minimize losses per the investment system's sell rules.

Sapient Corporation (SAPE +$0.06 or +1.57% to $3.88) now faces a tremendous amount of resistance due to overhead supply, making it unlikely to be a market leader in the near term. Concerns were raised and noted in CANSLIM.net's ongoing reports during its streak of damaging losses with above average volume that occurred shortly after it was first featured on Wednesday, August 13, 2008 in the CANSLIM.net Mid Day Breakouts Report (read here) with a $9.22 pivot point. Obviously, technical sell signals prompted investors to unload shares long ago.

SAPE has traded as much as -53.26% lower since 9/29/08 when it violated its 200-day moving average (DMA) line and was dropped from the Featured Stocks list. The 200 DMA line plays a pivotal role relative to a stock's price. If the price of a stock is above its 200 DMA, then odds are that its 200 DMA will act as longer term support. Conversely, if the price is below its 200 ,then the moving average acts as resistance. Obviously, if a technical breakdown or violation takes place on heavy volume it is a more serious concern.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

--

|

Sapient Corportation |

||

|

Ticker Symbol: SAPE (NASDAQ) |

Industry Group: Computer-tech Services |

Shares Outstanding: 125,700,000 |

|

Price: $9.27 8/29/2008 |

Day's Volume: 951,300 8/29/2008 |

Shares in Float: 76,700,000 |

|

52 Week High: $9.55 8/29/2008 |

50-Day Average Volume: 1,335,100 |

Up/Down Volume Ratio: 2.0 |

|

Pivot Point: $9.22 12/27/2007 high plush $0.10 |

Pivot Point +5% = Max Buy Price: $9.68 |

Web Address: http://www.sapient.com/ |

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

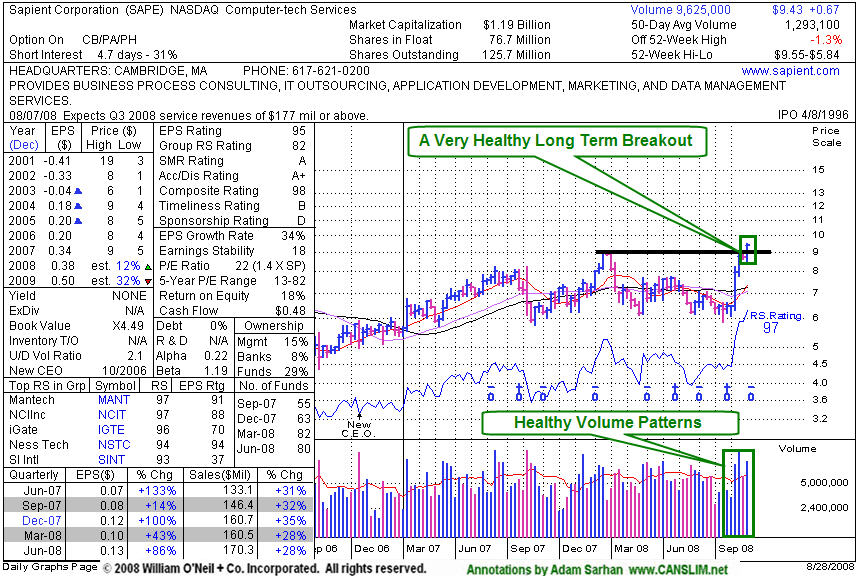

CANSLIM.net Profile: Sapient Corporation provides business, marketing, and technology consulting services worldwide. The company offers its services to technology, communications, energy and utilities, financial services, media and entertainment, automotive, transportation, health care and life sciences, education, consumer/retail products, and travel and hospitality markets, as well as to federal, state, and local government clients in the U.S. and to provincial and other governmental entities in Canada and Europe. Sapient Corporation was founded in 1990 and is headquartered in Cambridge, Massachusetts. It hails from the Computer-Tech Services group which is presently ranked 39th on the 197 Industry Groups list, which is within the much-preferred top quartile of groups needed to satisfy the L criteria. The number of top-rated funds with an ownership interest has grown from 55 funds in Sept '07 to 80 funds as of Jun '08, a sign of increasing institutional interest (the I criteria). Its quarterly sales revenues and earnings increases have been well above the +25% guideline in the 3 latest comparisons versus the year earlier period.

What to Look For and What to Look Out For: Look for the stock to continue offering investors a chance to accumulate shares below its maximum buy price ($9.68). Keep in mind that much of a stock's success depends on the broader market's ability to sustain a meaningful rally, otherwise 3 out of 4 stocks are likely to struggle in the event that the latest rally encounters additional pressure and fails. It is very important for the stock's pullback to be contained, whereas a violation of its $9.22 pivot point would have the effect of technically negating its latest breakout, raising concerns. Conversely, if the stock finds support near/above its pivot point then begins advancing again, preferably on higher volume, then odds would favor that higher prices will follow. Confirming gains on above average volume could provide a reassuring "follow through" that would help reaffirm its recent technical buy signal.

Technical Analysis: The daily chart shows above average volume behind its gains as it broke out of a long multi-month base in late August. There was detailed analysis included with a wealth of data in the annotated weekly chart in the Featured Stock Update section of the Thursday, August 28, 2008 CANSLIM.net After Market Update under the headline "Computer Services Firm Jumps To New High!" A couple of weeks earlier, SAPE first appeared featured in yellow on Wednesday, August 13, 2008 in the CANSLIM.net Mid Day Breakouts Report (read here) with a $9.22 pivot point, $9.68 max buy point. Its pivot point cited in the report was based upon its 12/27/07 high plus ten cents. There is no resistance remaining due to overhead supply which would hinder further gains. Technically, it broke out of a very long multi-year base with gains backed by very heavy volume (best viewed on a longer term graph).

Healthy stocks that are within close striking distance of new highs are often great buy candidates for investors to keep on their watch lists, especially when the companies match favorably with all of the investment system's criteria. When a stock is more than -10% off its 52-week high, and if it has violated its 50-day moving average (DMA) line, then the outlook only gets worse and worse as it spends a greater period of time trading deeper under that important short-term average line. By the time a stock's 50 DMA line starts sloping downward it should also be acknowledged that the stock has been struggling for a long while, in which case it might be time to reduce exposure and look for places to put that money to work in stronger buy candidates.

Sapient Corporation (SAPE UP +$0.13 or +1.40% to $9.43) ) vaulted to a new multi year high with a gain on above average volume today. A considerable 8/27/08 gain on heavy volume helped this stock trigger a technical buy signal when it vaulted above its $9.22 pivot point on heavy turnover. This stock was first featured on Wednesday, August 13, 2008 in the CANSLIM.net Mid Day Breakouts Report (read here) with a $9.22 pivot point, $9.68 max buy point and the following note: "Y - Rising toward 52-week and multi-year highs with multiple gains on above average volume, and there is little remaining overhead supply to act as resistance. There is good leadership (the L criteria) in the Computer - Tech Services group. Increasing institutional interest (the I criteria) is being shown as 83 top rated funds owned shares as of Jun '08, up from 55 in Sept '07. Good quarterly earnings growth and annual earnings help satisfy the C & A criteria. Low priced stocks are riskier choices which should generally be avoided unless all criteria are well satisfied. A new technical buy signal may be triggered by a proper breakout above its pivot point with a minimum of +50% above average volume." SAPE sports strong ranks; an Earnings Per Share (EPS) rating of 95, and a Relative Strength (RS) rating of 97. Its Return on Equity is reported at a very robust +18%, which is above the +17% guideline. Sapient closed below its maximum buy price which means that a prudent investor can still accumulate this high ranked leader within the proper guidelines. Remember to always limit losses per the 7-8% sell rule, and never hold a stock if it falls more than that from your purchase price.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile