Fundamental concerns were raised by earnings +16% on +27% sales revenues for the quarter ended March 31, 2013 versus the year ago period, below the +25% minimum earnings guideline (C criteria). It is more ideal when a company shows accelerating sales revenues and earnings increases. Often a bullish price/volume chart anticipates strong earnings results in the coming quarter, while bearish price/volume chart patterns frequently predict weaker earnings in the future. Time will say if it can resume growth above the +25% rate. Consensus estimates are currently calling for +21% and +19% earnings growth in FY '13 and '14, respectively. Earnings growth is crucial to the fact-based investment approach and obviously weighs into the newspaper's Earnings Per Share (EPS) rating system. Its current EPS rank of 93 is still well above the 80+ guideline for buy candidates.

Because the fact-based system suggests watching for technical sell signals before exiting profitable position it was previously noted - "Investors who may own it might choose to give the stock the benefit of the doubt unless it flashes any weak action, however a disciplined investor following the fact-based system would usually avoid making new buying efforts in any companies failing to solidly satisfy the fundamental guidelines."

The number of top-rated funds owning its shares rose from 168 in Jun '12 to 214 in Jun '13, a reassuring sign concerning the I criteria. The company completed a new Public Offering on 12/06/12 and, technically, it broke out above previously stubborn resistance in $19 area with volume-driven gains in January.

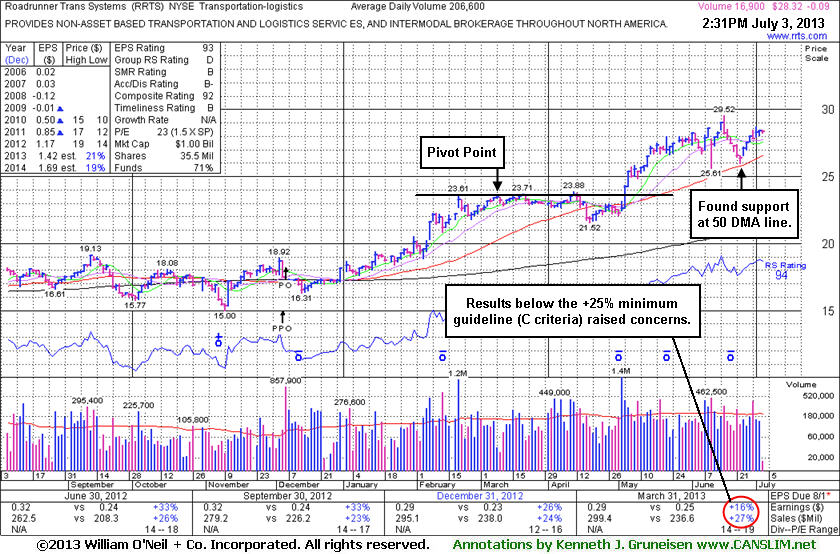

Roadrunner Transportation Systems Inc (RRTS $-0.09 or -0.32% to 28.32) has been wedging higher without great volume conviction after finding support above its 50-day moving average (DMA) line. It is perched within close striking distance of its 52-week high. Fundamental concerns were raised by its sub par earnings increase in the Mar '13 quarter.

Its last appearance in this FSU section was on 6/20/13 with an annotated graph under the headline, "Following Negative Reversal With Losses on Lighter Volume". The prior highs in the $23 area define support to watch below its 50-day moving average (DMA) line. It showed resilience near its 50-day moving average (DMA) line, then started the month of May with a spike higher with heavy volume behind big gains. Because the fact-based system suggests watching for technical sell signals before exiting profitable position it was previously noted - "Investors who may own it might choose to give the stock the benefit of the doubt unless it flashes any weak action, however a disciplined investor following the fact-based system would usually avoid making new buying efforts in any companies failing to solidly satisfy the fundamental guidelines."

Fundamental concerns recently were raised after it reported earnings +16% on +27% sales revenues for the quarter ended March 31, 2013 versus the year ago period, below the +25% minimum earnings guideline (C criteria). It is more ideal when a company shows accelerating sales revenues and earnings increases. Often a bullish price/volume chart anticipates strong earnings results in the coming quarter, while bearish price/volume chart patterns frequently predict weaker earnings in the future. Time will say if it can resume growth above the +25% rate. Consensus estimates are currently calling for +21% and +19% earnings growth in FY '13 and '14, respectively. Earnings growth is crucial to the fact-based investment approach and obviously weighs into the newspaper's Earnings Per Share (EPS) rating system. Its current EPS rank of 93 is still well above the 80+ guideline for buy candidates.

The number of top-rated funds owning its shares rose from 168 in Jun '12 to 206 in Mar '13, a reassuring sign concerning the I criteria. The company completed a new Public Offering on 12/06/12 and, technically, it broke out above previously stubborn resistance in $19 area with volume-driven gains in January.

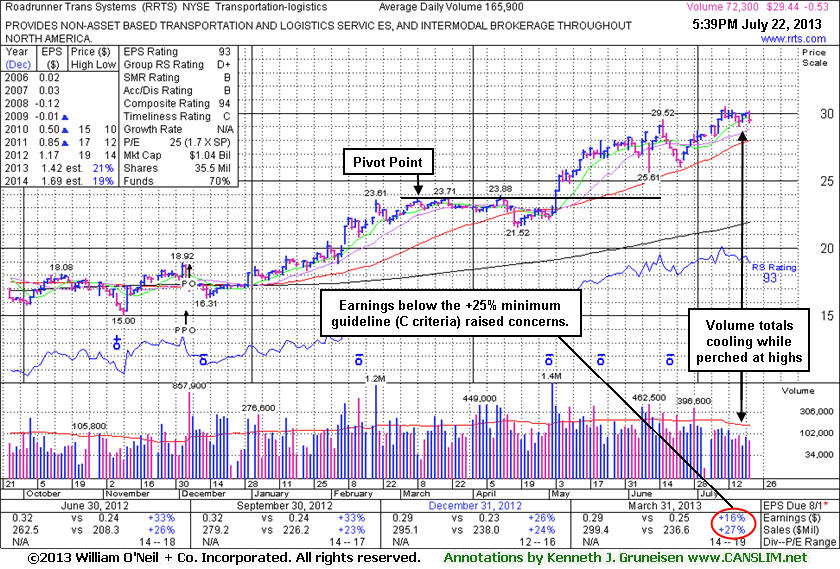

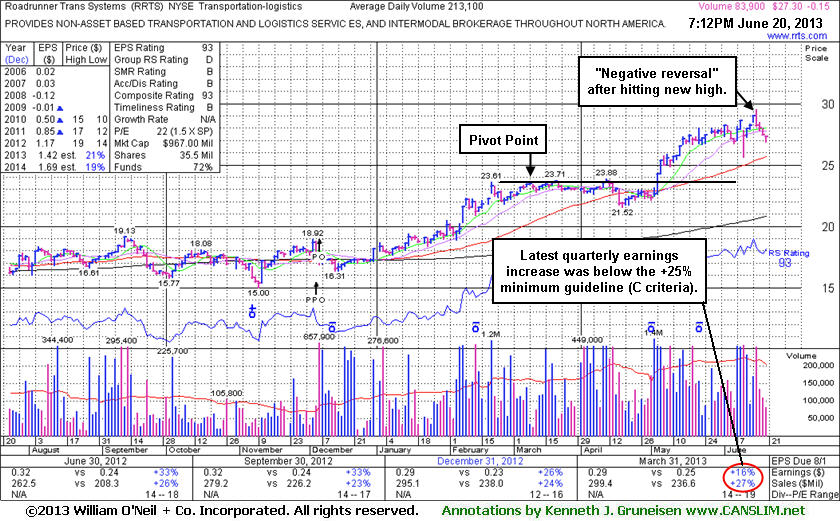

Roadrunner Transportation Systems Inc (RRTS $-0.15 or -0.55% to 27.30) has fallen 3 more sessions on lighter volume since the "negative reversal" on heavy volume at its 52-week high on 6/17/13. Its last appearance in this FSU section was on 6/04/13 with an annotated graph under the headline, "Chart Shows 'Wedging' Higher In Recent Weeks on Light Volume.". The prior highs in the $23 area define support to watch below its 50-day moving average (DMA) line. It showed resilience near its 50-day moving average (DMA) line, then started the month of May with a spike higher with heavy volume behind big gains. Because the fact-based system suggests watching for technical sell signals before exiting profitable position it was previously noted - "Investors who may own it might choose to give the stock the benefit of the doubt unless it flashes any weak action, however a disciplined investor following the fact-based system would usually avoid making new buying efforts in any companies failing to solidly satisfy the fundamental guidelines."

Fundamental concerns recently were raised after it reported earnings +16% on +27% sales revenues for the quarter ended March 31, 2013 versus the year ago period, below the +25% minimum earnings guideline (C criteria). It is more ideal when a company shows accelerating sales revenues and earnings increases. Often a bullish price/volume chart anticipates strong earnings results in the coming quarter, while bearish price/volume chart patterns frequently predict weaker earnings in the future. Time will say if it can resume growth above the +25% rate. Consensus estimates are currently calling for +21% and +19% earnings growth in FY '13 and '14, respectively. Earnings growth is crucial to the fact-based investment approach and obviously weighs into the newspaper's Earnings Per Share (EPS) rating system. Its current EPS rank of 93 is still well above the 80+ guideline for buy candidates.

The number of top-rated funds owning its shares rose from 168 in Jun '12 to 201 in Mar '13, a reassuring sign concerning the I criteria. The company completed a new Public Offering on 12/06/12 and, technically, it broke out above previously stubborn resistance in $19 area with volume-driven gains in January.

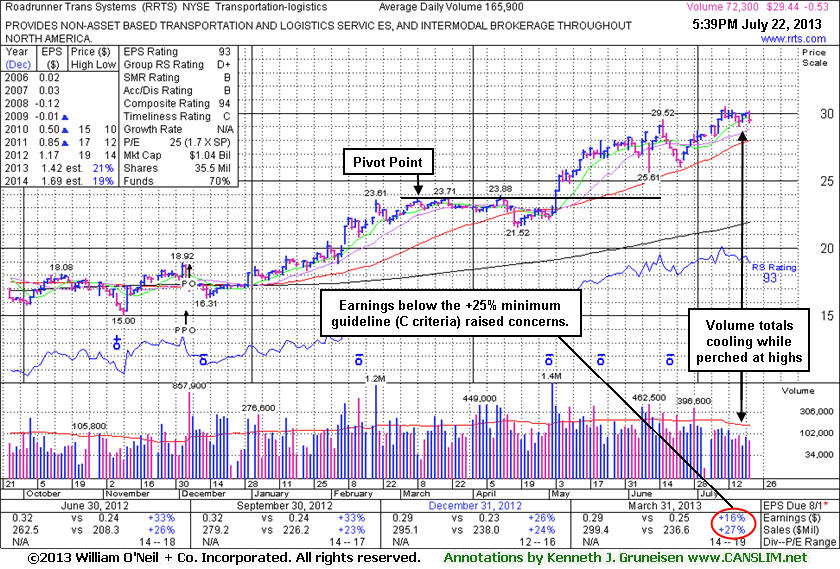

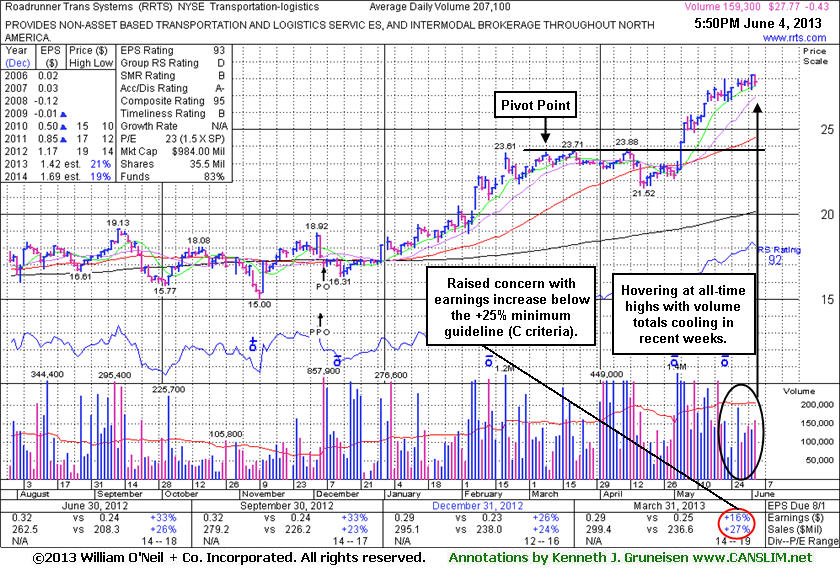

Roadrunner Transportation Systems Inc (RRTS $-0.43 or -1.52% to 27.77) is extended from its latest base. In recent weeks it "wedged" higher with gains lacking great volume conviction while volume totals have been cooling. On pullbacks, the prior highs in the $23 area define support to watch below its 50-day moving average (DMA) line. It showed resilience near its 50-day moving average (DMA) line, then started the month of May with a spike higher with heavy volume behind big gains. However, fundamental concerns were raised by its sub par earnings increase in the Mar '13 quarter, below the +25% minimum guideline (C criteria), as covered in the stock's last appearance in this FSU section on 5/14/13 with an annotated graph under the headline, "Technically Strong Despite Newly Noted Fundamental Shortcoming". It reported earnings +16% on +27% sales revenues for the quarter ended March 31, 2013 versus the year ago period, below the +25% minimum earnings guideline (C criteria). Because the fact-based system suggests watching for technical sell signals before exiting profitable position it was previously noted - "Investors who may own it might choose to give the stock the benefit of the doubt unless it flashes any weak action, however a disciplined investor following the fact-based system would usually avoid making new buying efforts in any companies failing to solidly satisfy the fundamental guidelines."

Decelerating sales revenues and earnings increases in sequential quarterly comparisons through the Dec '12 quarter were noted earlier. Concerns raised by the Mar '13 results added to problem with respect to matching up with with historic models of past great winners. As June has only just begun, it will be many weeks before the results of the company's Jun '13 quarter are reported. It is more ideal when a company shows accelerating sales revenues and earnings increases. Often a bullish price/volume chart anticipates strong results, and a bearish price/volume chart pattern frequently predicts weaker earnings, but only time will say if it can resume growth above the +25% rate. Consensus estimates are currently calling for +21% and +19% earnings growth in FY '13 and '14, respectively. Earnings growth is crucial to the fact-based investment approach and obviously weighs into the newspaper's Earnings Per Share (EPS) rating system. Its current EPS rank of 93 is still well above the 80+ guideline for buy candidates.

The number of top-rated funds owning its shares rose from 168 in Jun '12 to 201 in Mar '13, a reassuring sign concerning the I criteria. The company completed a new Public Offering on 12/06/12 and, technically, it broke out above previously stubborn resistance in $19 area with volume-driven gains in January. Regular readers may recall that, based on weak action, RRTS had been dropped from the Featured Stocks list on 5/18/12 following a choppy period.

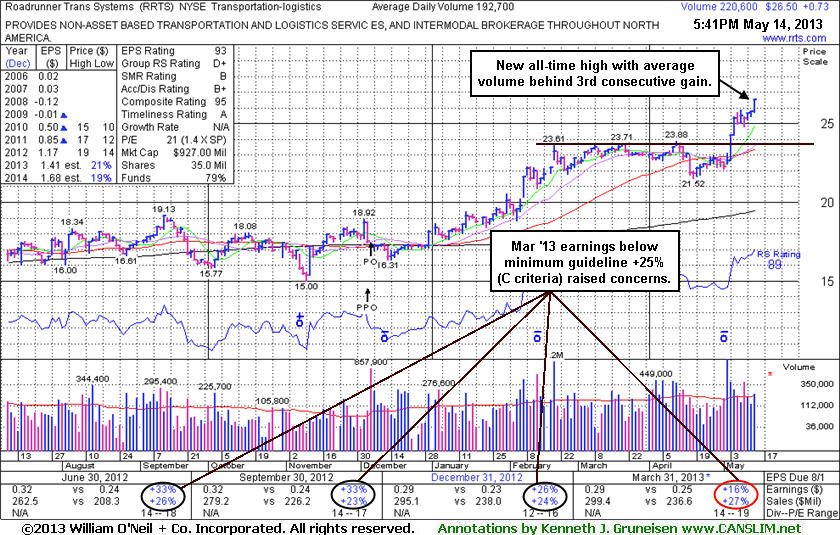

Roadrunner Transportation Systems Inc (RRTS $+0.73 or +2.83% to 26.50) finished strong today with a gain on average volume for another new all-time high, getting more extended from its latest base. Prior highs in the $23 area define support to watch above its 50-day moving average (DMA) line. Fundamentally, concerns have been raised by its report of earnings +16% on +27% sales revenues for the quarter ended March 31, 2013 versus the year ago period, below the +25% minimum earnings guideline (C criteria). Investors who may own it might choose to give the stock the benefit of the doubt unless it flashes any weak action, however a disciplined investor following the fact-based system would usually avoid making new buying efforts in any companies failing to solidly satisfy the fundamental guidelines.

Its last appearance in this FSU section was on 4/23/13 with an annotated graph under the headline, " Groups' Weakness and Slump Under 50 Day Moving Average Line Hurt Stance " after its violation of the recent low and slump below its 50-day moving average (DMA) line triggered technical sell signals. It was then noted - "Decelerating sales revenues and earnings increases in sequential quarterly comparisons through the Dec '12 quarter are noted as a concern. It is more ideal when a company shows accelerating sales revenues and earnings increases." It showed resilience near its 50 DMA line, then started the month of May with a spike higher with heavy volume behind big gains.

The number of top-rated funds owning its shares rose from 168 in Jun '12 to 197 in Mar '13, a reassuring sign concerning the I criteria. The company completed a new Public Offering on 12/06/12 and, technically, it broke out above previously stubborn resistance in $19 area with volume-driven gains in January. Regular readers may recall that, based on weak action, RRTS had been dropped from the Featured Stocks list on 5/18/12 following a choppy period.

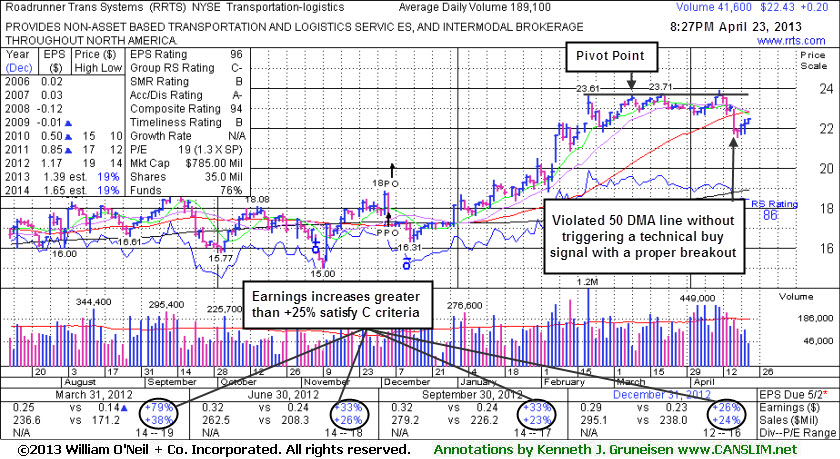

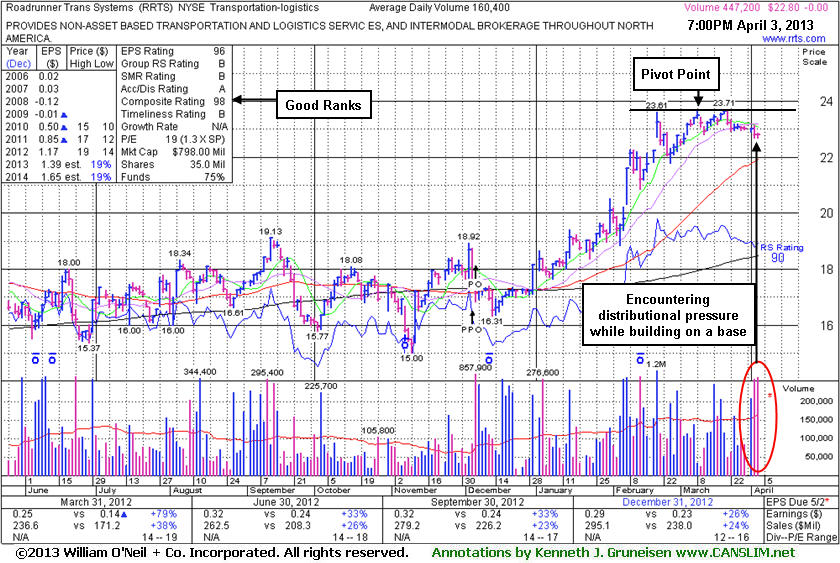

Roadrunner Transportation Systems Inc (RRTS $+$0.20 or +0.90% to 22.43) recently violated the recent low and slumped below its 50-day moving average (DMA) line triggering technical sell signals. Only a prompt rebound above that important short-term average would help its outlook improve. Its last appearance in this FSU section was on 4/03/13 with an annotated graph under the headline, "Encountering Distributional Pressure While Building a New Base", after highlighted in yellow with new pivot point cited based on its 3/08/13 high plus 10 cents while consolidating in a flat base pattern in the earlier mid-day report (read here). Prior reports reminded members - "Disciplined investors may watch for a fresh technical breakout before taking action." The Transportation - Logistics group currently has seen the previously noted "mediocre (67) Relative Strength Rating slump to a more discouraging 31 rating, raising more serious concerns with respect to the L criteria. Investors' odds are most favorable when choosing stocks in groups that are showing better leadership rather than waning.

The number of top-rated funds owning its shares rose from 168 in Jun '12 to 196 in Mar '13, a reassuring sign concerning the I criteria. The company completed a new Public Offering on 12/06/12 and, technically, it broke out above previously stubborn resistance in $19 area with volume-driven gains in January. Regular readers may recall that, based on weak action, RRTS had been dropped from the Featured Stocks list on 5/18/12 following a choppy period.

It reported earnings +26% on +24% sales revenues for the quarter ended December 31, 2012 versus the year ago period, continuing its streak of quarters with earnings increases above the +25% minimum guideline (satisfying the C criteria). Fundamentals remain strong enough to still satisfy the C and A criteria, however decelerating sales revenues and earnings increases in sequential quarterly comparisons through the Dec '12 quarter are noted as a concern. It is more ideal when a company shows accelerating sales revenues and earnings increases.

Confirming volume-driven gains into new high ground from it and other leaders in the group would be a welcome reassurance to disciplined investors. But the longer it lingers below its 50 DMA line the worse its outlook gets.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Roadrunner Transportation Systems Inc (RRTS $22.80) was highlighted in yellow with new pivot point cited based on its 3/08/13 high plus 10 cents while consolidating in a flat base pattern in the earlier mid-day report (read here). The company completed a new Public Offering on 12/06/12 and, technically, it broke out above previously stubborn resistance in $19 area with volume-driven gains in January. Disciplined investors may watch for a fresh technical breakout before taking action.

Regular readers may recall that, based on weak action, RRTS had been dropped from the Featured Stocks list on 5/18/12 following a choppy period. Its last appearance in this FSU section was on 4/09/12 with an annotated graph under the headline, "Consolidation Near Important Chart Support Level". A subsequent breakout was very short-lived and it soon slumped below its 50-day and 200-day moving average (DMA) lines during its consolidation, raising concerns. It reported earnings +26% on +24% sales revenues for the quarter ended December 31, 2012 versus the year ago period, continuing its streak of quarters with earnings increases above the +25% minimum guideline (satisfying the C criteria). Fundamentals remain strong enough to still satisfy the C and A criteria, however decelerating sales revenues and earnings increases in sequential quarterly comparisons through the Dec '12 quarter are noted as a concern. It is more ideal when a company shows accelerating sales revenues and earnings increases.

The number of top-rated funds owning its shares rose from 168 in Jun '12 to 198 in Mar '13, a reassuring sign concerning the I criteria. The Transportation - Logistics group currently has a mediocre (67) Relative Strength Rating, which is a bit of a concern with respect to the L criteria, however there is at least one other strong leader in the group showing recent strength. Confirming volume-driven gains into new high ground from it and other leaders in the group would be a welcome reassurance to disciplined investors.

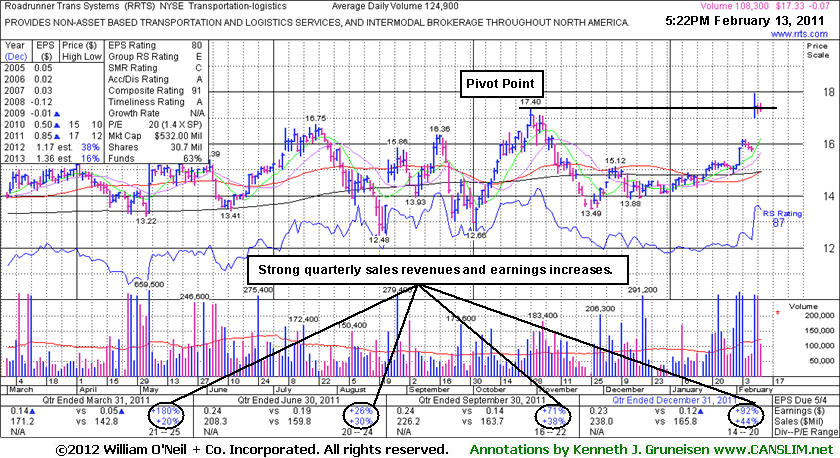

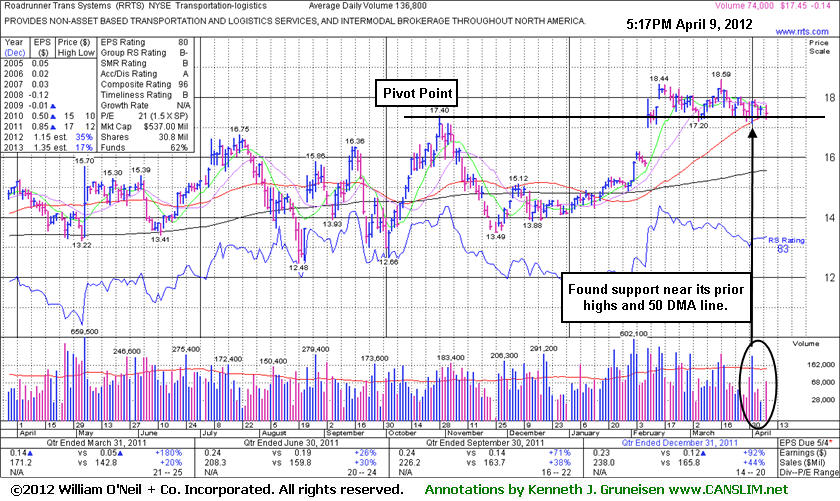

RRTS was last shown in this FSU section on 2/13/12 with an annotated daily graph under the headline, "Awaiting Confirming Gains With Volume as Reassurance", while perched near its 52-week high with no resistance remaining following a considerable gap up gain on 2/09/12 with heavy volume. It was first featured in yellow when highlighted in the 2/10/12 mid-day report (read here). Subsequently, a confirming gap up and gain on 2/15/12 with heavy volume was a solid reassurance its shares were in demand from the institutional crowd, technically, as it rallied above the pivot point. It failed to distance itself from prior highs, however, yet it has stubbornly held its ground.

It reported earnings +92% on +44% sales revenues for the quarter ended December 31, 2011 versus the year ago period, continuing its streak of strong quarters satisfying the C criteria. The number of top-rated funds owning its shares rose from 97 in Mar '11 to 142 in Mar '12, a reassuring sign concerning the I criteria. The Transportation - Logistics group currently has a mediocre (58) Relative Strength Rating, which is a bit of a concern with respect to the L criteria, however there is at least one other strong leader in the group showing recent strength. Confirming volume-driven gains into new high ground from it and other leaders in the group would be a welcome reassurance to disciplined investors.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. In other cases, stocks may be featured in CANSLIM.net's Mid-Day Breakouts Report.after recent action already triggered technical buy signal. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Roadrunner Transportation Systems Inc (RRTS -$0.07 or -0.40% to $17.33) is holding its ground perched at its 52-week high with no resistance remaining following a considerable gap up gain on 2/09/12 with heavy volume. It was featured in yellow with a pivot point cited based on its 10/28/11 high plus 10 cents when highlighted in the 2/10/12 mid-day report (read

here) while it was noted - "Subsequent confirming gains with volume would be a welcome reassurance since it has encountered some resistance and technically finished the prior session just below the pivot point cited. Reported earnings +92% on +44% sales revenues for the quarter ended December 31, 2011 versus the year ago period, continuing its streak of strong quarters satisfying the C criteria."The number of top-rated funds owning its shares rose from 97 in Mar '11 to 142 in Dec '11, a reassuring sign concerning the I criteria. The Transportation - Logistics group currently has a low Relative Strength Rating, which is a bit of a concern with respect to the L criteria, however there is at least one other strong leader in the group, Echo Global Logistics Inc (ECHO), showing recent strength. Confirming volume-driven gains into new high ground from it and other leaders in the group would be a welcome reassurance to disciplined investors.