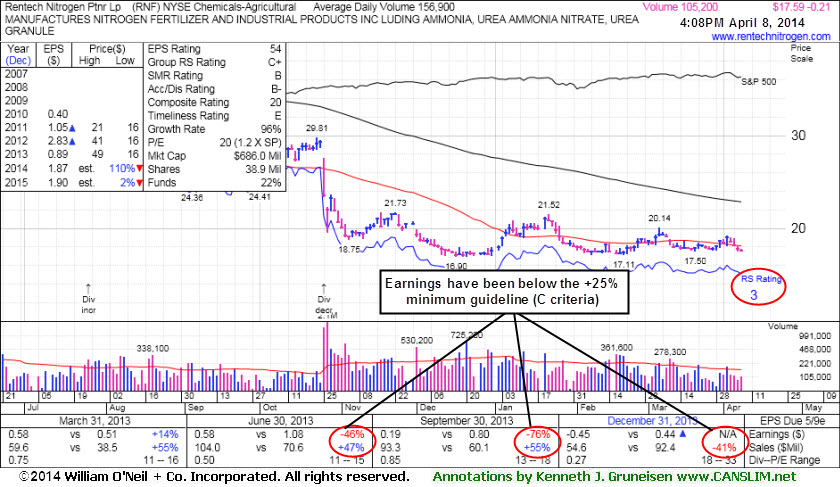

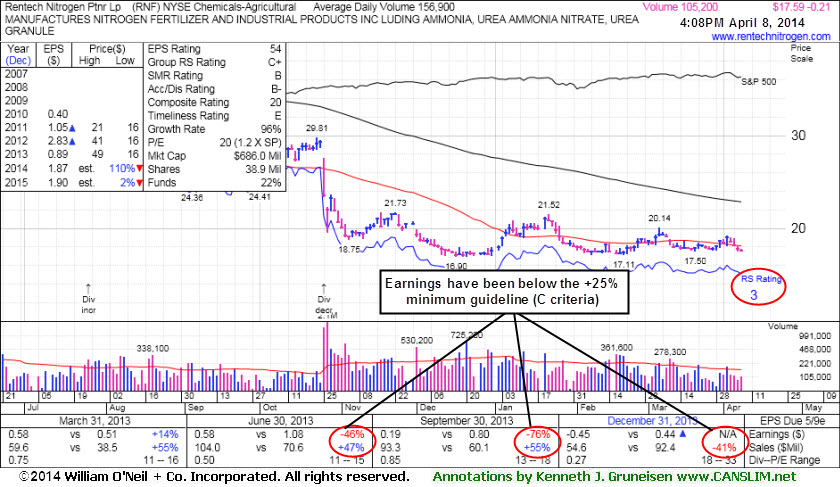

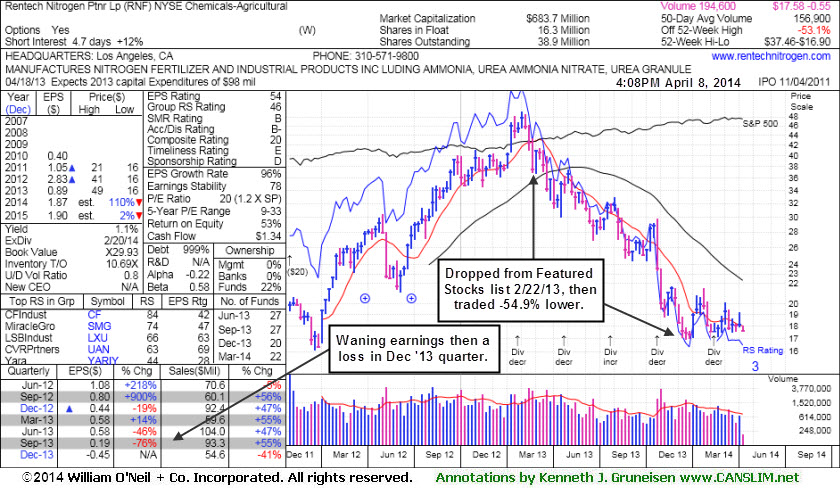

Market conditions (the M criteria) are challenging at times. There are few stocks included on the Featured Stocks list and none of the companies need additional review in detail with annotated graphs. At times like these we have an opportunity to look back and review previously featured stocks which were dropped. This can serve as an educational review of the investment system's tactics and a reminder that high-ranked leaders eventually fall out of favor. In this example we look back at a company dropped from the Featured Stocks list on February 22, 2013. Since then its fundamentals have deteriorated and it has fallen even more out of favor with the institutional crowd while trading as much as -54.9% lower.

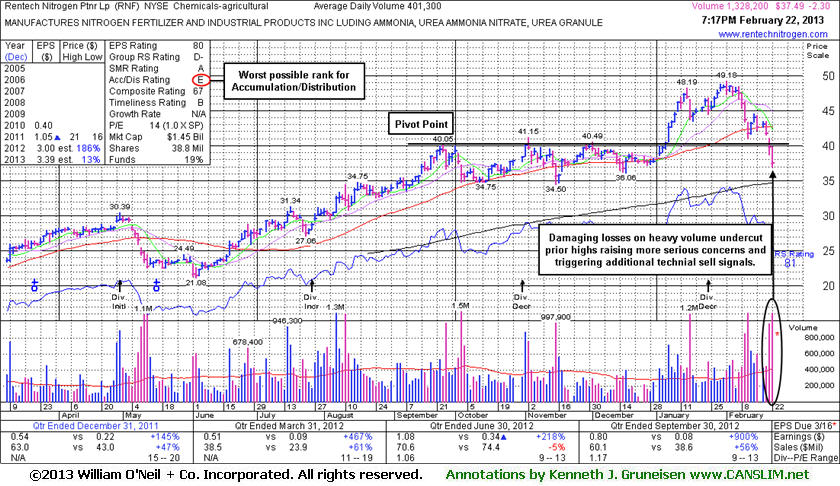

Rentech Nitrogen Ptnr LP (RNF -$0.21 to $17.59) made its last appearance in this FSU section on 2/22/13 when it was dropped from the Featured Stocks list. Annotated graphs were included under the headline, "Damaging Losses on Heavy Volume Violated Old Highs", as heavy volume more than 3 times average followed the prior session's gap down after violating its 50-day moving average (DMA) line. The damaging losses sent it below prior highs near $40-41 and the weak action raised serious concerns while triggering additional technical sell signals. Not all stocks dropped from the Featured Stocks list fall as badly, but this is a vivid example of why investors should follow the investment system's sell rules and reduce the possibility of more devastating losses.

It was previously noted with caution - "The number of top-rated funds owning its shares had fallen from 52 in Jun '12 to 36 as of Dec '12, a disconcerting sign concerning the I criteria. Only 22 top-rated funds owned it by Dec '13. Repeating a point emphasized before in this FSU section - "Disciplined investors avoid chasing extended stocks more than +5% above their pivot point. Making sloppy buy decisions by chasing extended stocks invites a much greater chance that an ordinary consolidation might prompt investors to invoke the investment system's strict loss-limiting sell rule after a pullback of -7% or more from their purchase price."

It was last shown in this FSU section on 2/12/13 with an annotated graph under the headline, "Violation of 50-Day Moving Average Came With Heavy Volume", and it was previously noted with caution - "The number of top-rated funds owning its shares had fallen from 52 in Jun '12 to 36 as of Dec '12, a disconcerting sign concerning the I criteria. It next earnings report is scheduled for Tuesday, March 19, 2013. Based on the weak technical action it has the worst possible Accumulation/Distribution rating of E (see red circle). Repeating a point emphasized before in this FSU section - "Disciplined investors avoid chasing extended stocks more than +5% above their pivot point. Making sloppy buy decisions by chasing extended stocks invites a much greater chance that an ordinary consolidation might prompt investors to invoke the investment system's strict loss-limiting sell rule after a pullback of -7% or more from their purchase price."

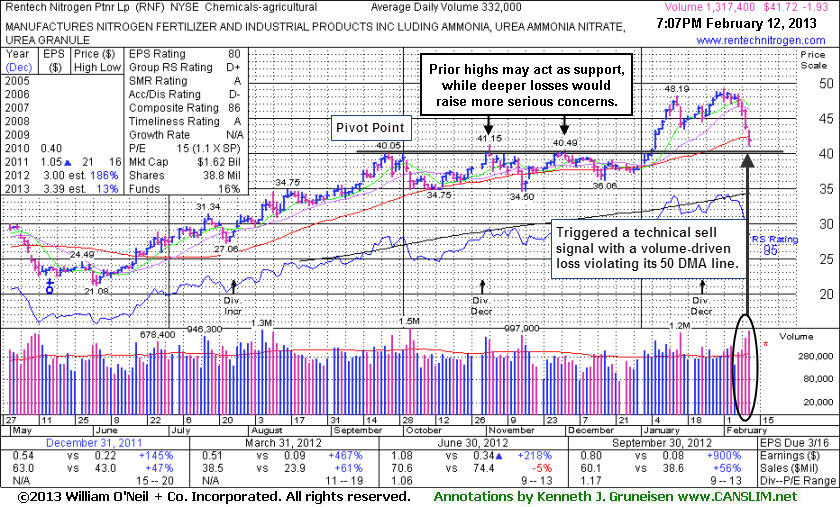

Rentech Nitrogen Ptnr LP (RNF -$1.93 or -4.42% to $41.72) fell today on heavier volume 4 times above average. After a weak finish on the prior session it gapped down and undercut its 50-day moving average (DMA) line ($42.34 now) with a volume-driven loss and weak finish raising serious concerns and triggering a technical sell signal. A prompt sign of support would be an encouraging sign, however it could spend a lot of time consolidating and doing some new base building. Meanwhile, it faces resistance due to overhead supply up through the $49 level that could hinder its progress, especially versus any other fresh breakout which may show up. Prior highs near $41 may act as support, however any deeper losses would raise more serious concerns and trigger additional worrisome sell signals. It next earnings report is scheduled for Tuesday, March 19, 2013.

It was last shown in this FSU section on 1/24/13 with an annotated graph under the headline, "Distributional Pressure After Getting Extended From Ideal Buy Range". It subsequently rallied for new 52-week highs but then it stalled without making meaningful headway above prior highs in the $48 area. It was previously noted with caution - "The number of top-rated funds owning its shares had fallen from 52 in Jun '12 to 36 as of Dec '12, a disconcerting sign concerning the I criteria.

Repeating a point emphasized in this FSU section - "Disciplined investors avoid chasing extended stocks more than +5% above their pivot point. Making sloppy buy decisions by chasing extended stocks invites a much greater chance that an ordinary consolidation might prompt investors to invoke the investment system's strict loss-limiting sell rule after a pullback of -7% or more from their purchase price."

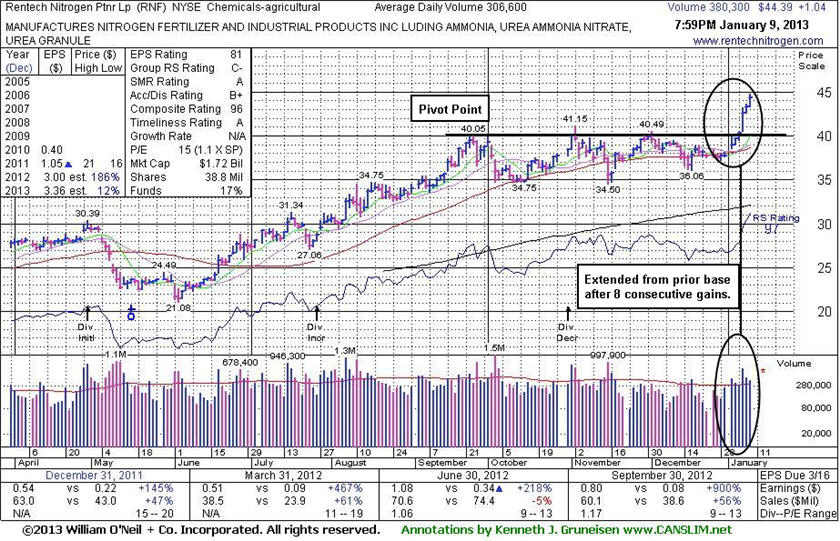

Rentech Nitrogen Ptnr LP (RNF -$1.35 or -2.91% to $44.99) encountered more distributional pressure today with higher volume behind its loss. Prior highs in the $40 area define near-term support to watch. It was last shown in this FSU section on 1/09/13 with an annotated graph under the headline, "Extended From Base After 8 Session Winning Streak". Since then it tallied additional gains, and it has now retreated -6.6% from its 52-week high. It was previously noted - "The number of top-rated funds owning its shares had fallen from 52 in Jun '12 to 36 as of Dec '12, a disconcerting sign concerning the I criteria. However, its current Up/Down Volume Ratio of 1.4 indicates a reassuring sign of institutional accumulation over the past 50 days." Today its Up/Down Volume Ration sits at 1.2.

Repeating a point emphasized in this FSU section - "Disciplined investors avoid chasing extended stocks more than +5% above their pivot point. Making sloppy buy decisions by chasing extended stocks invites a much greater chance that an ordinary consolidation might prompt investors to invoke the investment system's strict loss-limiting sell rule after a pullback of -7% or more from their purchase price."

Its last appearance in this FSU section was on 12/19/12 with an annotated graph under the headline, "Still Awaiting Volume-Driven Gain Above Pivot Point", as it improved its technical stance by rebounding above its 50-day moving average (DMA) line with a volume-driven gain. We noted at that time - "Disciplined investors may still be watching for volume-driven gains for a new high close to trigger a technical buy signal. Meanwhile, recent lows define chart support to watch where subsequent violations may raise serious concerns and trigger technical sell signals."

Its gain on 1/07/13 was backed by +144% above average volume, well above the minimum volume threshold of +40% above average volume needed to trigger a proper technical buy signal. It quickly got extended from prior highs. If one was willing to chase it +5% above its prior high of $41.15 then $43.21 would be the highest one might consider the stock buyable without being too extended from its prior base. Repeating a point emphasized in yesterday's FSU section - "Disciplined investors avoid chasing extended stocks more than +5% above their pivot point. Making sloppy buy decisions by chasing extended stocks invites a much greater chance that an ordinary consolidation might prompt investors to invoke the investment system's strict loss-limiting sell rule after a pullback of -7% or more from their purchase price."

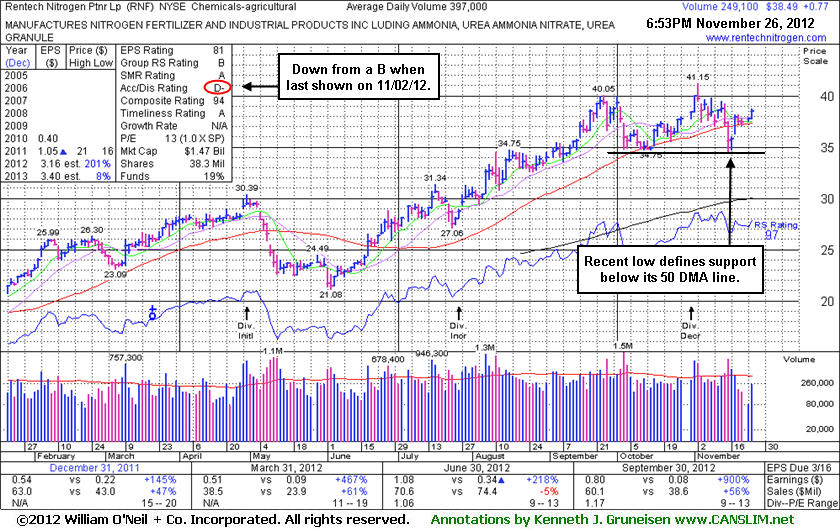

Rentech Nitrogen Ptnr LP (RNF +$0.61 or +1.61% to $38.45) improved its technical stance by rebounding above its 50-day moving average (DMA) line with a volume-driven gain on the prior session, and it posted another gain today on lighter volume. Disciplined investors may still be watching for volume-driven gains for a new high close to trigger a technical buy signal. Meanwhile, recent lows define chart support to watch where subsequent violations may raise serious concerns and trigger technical sell signals.

Its last appearance in this FSU section was on 11/26/12 with an annotated graph under the headline, "Rebounded Above 50 DMA Line Near 52-Week High". The market direction (M criteria) was noted as favorable again for taking action on new buy candidates. However, concerns have been raised by its Accumulation/Distribution Rating which stands at a D today (see red circle). As previously mentioned - "That is a good reason to not jump in "early" but to instead wait for proof of fresh institutional buying demand."

On 11/01/12 its color code was changed to yellow with a new pivot point cited based on its 9/25/12 high plus 10 cents, but the noted "negative reversal" kept it from triggering a new buy signal and it has since zig zagged above and below its 50 DMA line. On 8/07/12 it triggered a technical buy signal with its considerable gain backed by +266% above average volume as it rallied above its earlier pivot point into new high territory. It traded as much as +35.4% higher within less than 2 months afterward.

The number of top-rated funds owning its shares fell from 52 in Jun '12 to 47 as of Sep '12, a slightly disconcerting sign concerning the I criteria. However, its current Up/Down Volume Ratio of 1.2 indicates a slightly reassuring sign of institutional accumulation over the past 50 days.

Rentech Nitrogen Ptnr LP (RNF +$0.77 or +2.04% to $38.49) recently rebounded above its 50-day moving average (DMA) line helping its technical stance improve and its color code was changed to yellow. The market direction (M criteria) has also been noted in tonight's market commentary as favorable again for taking action on any new buy candidates. Subsequent volume-driven gains above its previously cited pivot point may trigger a new (or add-on) technical buy signal.

Concerns have been raised by the fact that its Accumulation/Distribution Rating has again slumped to a D- from a B rating since its last appearance in this FSU section on 11/02/12 with an annotated graph under the headline, "New High Today Followed By Negative Reversal". That is a good reason to not jump in "early" but to instead wait for proof of fresh institutional buying demand. It had hit a new 52-week high and then reversed for a loss with above average volume which broke a streak of 5 consecutive gains. On 11/01/12 its color code was changed to yellow with a new pivot point cited based on its 9/25/12 high plus 10 cents, but the noted "negative reversal" kept it from triggering a new buy signal.

On 8/07/12 it triggered a technical buy signal with its considerable gain backed by +266% above average volume as it rallied above its earlier pivot point into new high territory. It traded as much as +35.4% higher within less than 2 months afterward. The number of top-rated funds owning its shares rose from 42 in Dec '11 to 51 as of Sep '12, a reassuring sign concerning the I criteria.

Rentech Nitrogen Ptnr LP (RNF -$0.33 or -.92% to $35.59) touched a new 52-week high today, but a negative reversal led to a loss with above average volume which broke a streak of 5 consecutive gains. It recently found support at its 50-day moving average (DMA) line defining important near-term support.

Its Accumulation/Distribution Rating has improved to a B rating from a D+ when it made its last appearance in this FSU section on 10/04/12 with an annotated graph under the headline, "Distributional Pressure Violated Upward Trendline". A volume-driven loss had violated an upward trendline defining near-term chart support in the $37 area, yet it made a stand at it 50 DMA line and formed a new base of sufficient length. On 11/01/12 its color code was changed to yellow with a new pivot point cited based on its 9/25/12 high plus 10 cents, yet it was cautiously noted - "Volume-driven gains above its pivot point may trigger a new (or add-on) technical buy signal. Disciplined investors know to watch for the market direction (M criteria) to produce a FTD and be noted as favorable again before acting on any new buy candidates."

On 8/07/12 it triggered a technical buy signal with its considerable gain backed by +266% above average volume as it rallied above its earlier pivot point into new high territory. It traded as much as +35.4% higher within less than 2 months afterward. The number of top-rated funds owning its shares rose from 42 in Dec '11 to 50 as of Sep '12, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is also an unbiased indication that its shares have been under accumulation over the past 50 days.

Rentech Nitrogen Ptnr LP (RNF -$0.33 or -.92% to $35.59) suffered a 3rd consecutive loss with above average volume today. As previously noted, its volume-driven loss on the prior session violated an upward trendline defining near-term chart support in the $37 area which may be considered an early sell signal. The next important support comes into play at its 50-day moving average (DMA) line (now $34.30) where a subsequent violation may trigger a more serious technical sell signal.

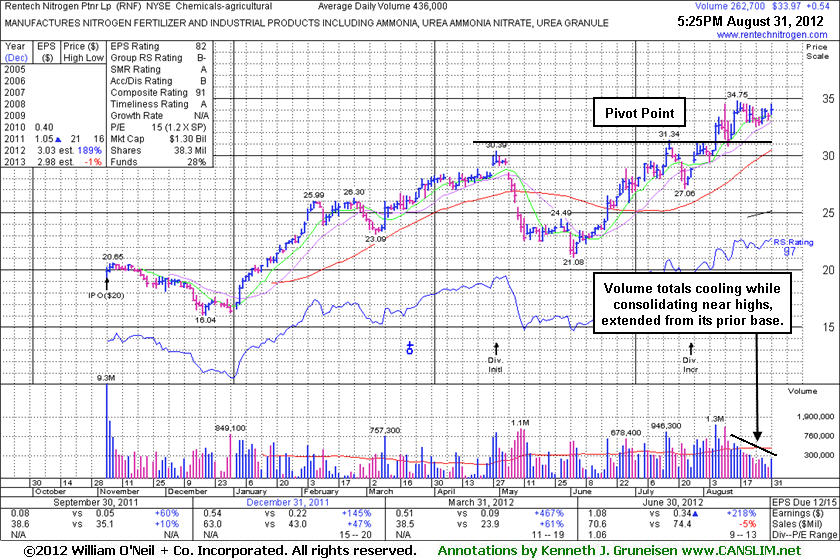

Its last appearance in this FSU section was on 8/31/12 with an annotated graph under the headline, "Following Breakout Volume Totals Have Cooled While Holding Its Ground". It went on to higher territory, but started encountering distributional pressure and was hit by losses on higher volume in recent weeks. Its Accumulation/Distribution Rating has slumped to a D+ (see red circle) from a B rating when it was shown in this FSU section on 8/31/12. More time is needed, however, for it to possibly form a new base or secondary buy point. Patient investors may watch for it to first make a successful test of its 50 DMA or 10-week moving average (WMA) line and bounce back up. And example of this type of secondary buy point was shown in this FSU section yesterday (read here).

RNF is extended from its prior base. On 8/07/12 it triggered a technical buy signal with its considerable gain backed by +266% above average volume as it rallied above its pivot point into new high territory. It traded as much as +35.4% higher within less than 2 months afterward.

The number of top-rated funds owning its shares rose from 42 in Dec '11 to 47 as of Jun '12, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is also an unbiased indication that its shares have been under accumulation over the past 50 days.

Rentech Nitrogen Ptnr LP (RNF +$0.24 or +0.80% to $30.37) is still perched near its high today. In the 7/27/12 mid-day report it was highlighted again in yellow with new pivot point cited based upon its 7/17/12 high while noted - "Subsequent volume-driven gains above the pivot may trigger a technical buy signal, meanwhile it is ideal for investors to have on their watchlist. Rebounding toward its 52-week high while working on a cup-with-high handle base pattern. Fundamentals remain strong. Rebounded impressively from a deep consolidation below its 50 DMA line. It was dropped from the Featured Stocks list on 5/10/12 due to damaging technical action."

There are 42 top-rated funds of of Jun '11 that own an interest in its shares, and concerning the I criteria, its current Up/Down Volume Ratio of 1.6 is an unbiased indication that its shares have been under accumulation over the past 50 days. Without confirming gains with at least +40% above average volume while rising above its pivot point, however, disciplined investors would continue to wait for proof of fresh institutional buying demand before taking action. That kind of action is always reassuring but no guarantee that a stock will go on to produce great gains, so disciplined investors always limit losses if any stock falls more than -7% from its purchase price.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

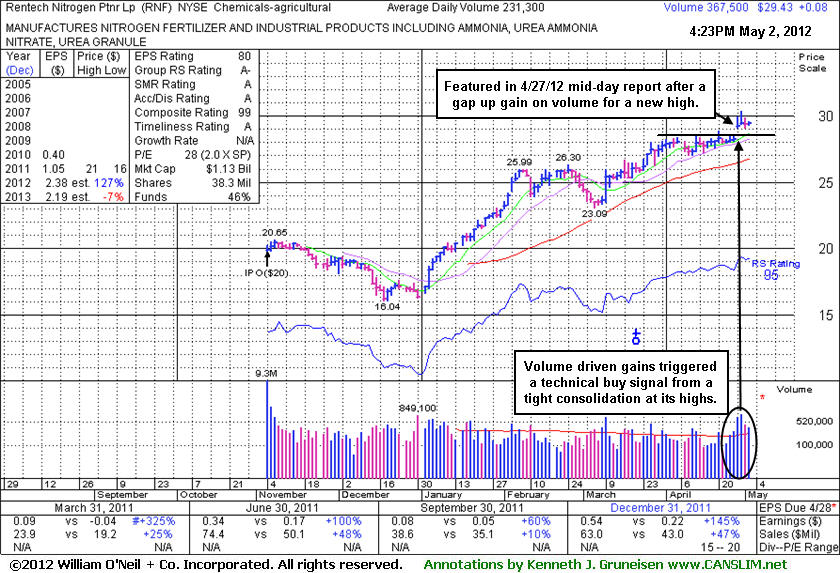

Rentech Nitrogen Ptnr Lp (RNF +$0.08 or +0.27% to $29.43) is hovering near its new 52-week high (N criteria) today, stubbornly holding its ground after a spurt of gains on ever-increasing volume. The recent orderly consolidation in a tight range was longer than a "3-weeks tight" base pattern and RNF was highlighted in yellow in the 4/27/12 mid-day breakouts report (read here) when rallying above the pivot point cited based on its 4/12/12 high plus 10 cents. It has sufficient ranks and showed strong earnings increases satisfying the C criteria. Its 11/04/11 IPO was priced at $20, and its limited history is a concern. The number of top-rated funds owning its shares rose from 42 in Dec '11 to 49 in Mar '12, a reassuring sign concerning the I criteria. Leadership from other companies in the Chemicals - Agriculture group (concerning the L criteria) is a reassuring sign.