Charts courtesy www.stockcharts.com

Restoration Hardware Hld (RH +$2.86 or +3.21% to $91.95) was highlighted in yellow with a new pivot point cited based on its 3/30/15 high plus 10 cents in the earlier mid-day report (read here). Technically, there was a volume-driven breakout on 7/16/15, and volume totals have been cooling since while consolidating above prior highs in the $100-102 area defining initial support. Recently it reported earnings +28% on +15% sales revenues for the Apr '15 quarter, an improvement after Jan '15 earnings of +23% were below the +25% minimum earnings guideline (C criteria).

The Retail - Home Furnishings firm found support at its 200 DMA line during its consolidation after dropped from the Featured Stocks list on 2/17/15. It was last shown in this FSU section on 2/03/15 with annotated graphs under the headline, "Quiet Rebound Above 50-Day Moving Average Helped Technical Stance" after a damaging loss on higher volume triggered a technical sell signal. There were a couple of big volume-driven gains along the way as it gradually overcame resistance due to overhead supply up through the $100 level. The fresh technical breakout and better earnings make the stock a more promising buy candidate.

It reported earnings +37%, +53%, +23%, and 28% in the Jul, Oct '14, Jan and Apr '15 quarterly comparisons, respectively, so 3 of the past 4 comparisons show strong quarterly earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) growth has been very strong since reorganization and trading began on 11/02/12. It completed a Secondary Offering 7/12/13 and named a new CEO 1/31/14. Its Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 274 in Dec '13 to 399 in Jun '15, a reassuring sign of increasing institutional interest (I criteria).

Charts courtesy www.stockcharts.com

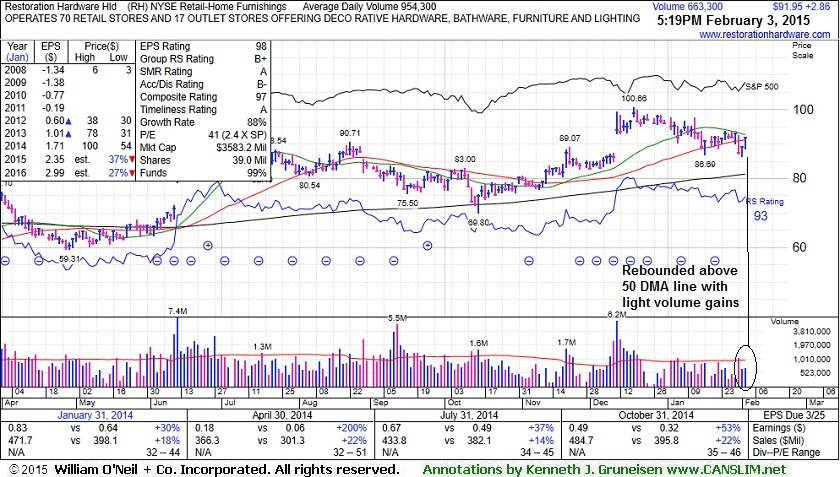

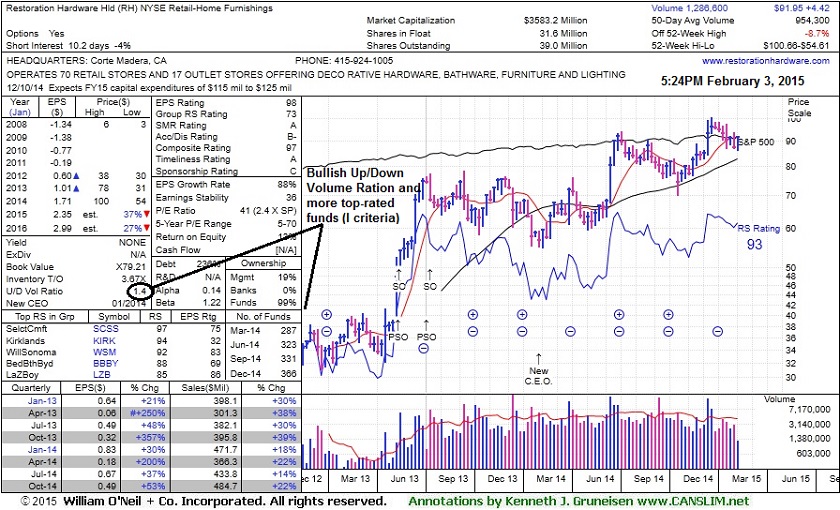

Restoration Hardware Hld (RH +$2.86 or +3.21% to $91.95) quietly rebounded above its 50-day moving average (DMA) line today with a 2nd gain backed by light volume after a damaging loss on higher volume triggered a technical sell signal. The gains helped its technical stance and outlook to improve, however, it still faces resistance due to overhead supply up through the $100 level that may hinder its upward price progress for the near term. Meanwhile, any stock producing a fresh technical breakout might make a more promising buy candidate.

RH was last shown in this FSU section on 1/15/15 with annotated graphs under the headline, "Fell Near 50-Day Moving Average After Negating Prior Breakout".The Retail - Home Furnishings firm had been sputtering after losses negated the prior breakout. Members were reminded - "Subsequent losses leading to a close below its old high close ($93.05 on 6/30/14) would completely negate the recent breakout and raise concerns." RH was first highlighted in yellow with a pivot point cited based on its 6/30/14 high plus 10 cents in the 12/11/14 mid-day report (read here). Convincing volume-driven gains helped clinch a convincing technical buy signal, but it stalled soon thereafter.

It reported that Oct '14 earnings rose +53% on +22% sales revenues versus the year ago period, continuing its streak of strong quarterly earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) growth has been very strong since reorganization and trading began on 11/02/12. It completed a Secondary Offering 7/12/13 and named a new CEO 1/31/14. Its Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 274 in Dec '13 to 366 in Dec '14, a reassuring sign of increasing institutional interest (I criteria).

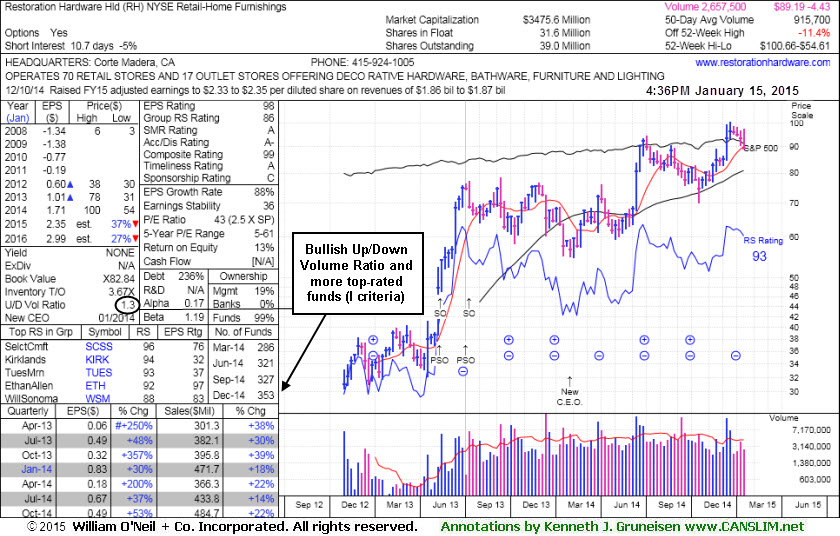

Restoration Hardware Hld (RH -$2.28 or -2.45% to $90.89) fell today testing its 50-day moving average (DMA) line which defines important support. It has been sputtering with volume totals cooling after recent losses negated the prior breakout and raised concerns. The Retail - Home Furnishings firm was last shown in this FSU section on 12/26/14 with annotated graphs under the headline, "Consolidating Above Prior Highs With Volume Totals Cooling". Members were reminded - "Subsequent losses leading to a close below its old high close ($93.05 on 6/30/14) would completely negate the recent breakout and raise concerns."

RH was first highlighted in yellow with a pivot point cited based on its 6/30/14 high plus 10 cents in the 12/11/14 mid-day report (read here). Convincing volume-driven gains helped clinch a convincing technical buy signal, but it stalled soon thereafter.

It reported that Oct '14 earnings rose +53% on +22% sales revenues versus the year ago period, continuing its streak of strong quarterly earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) growth has been very strong since reorganization and trading began on 11/02/12. It completed a Secondary Offering 7/12/13 and named a new CEO 1/31/14. Its Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 274 in Dec '13 to 353 in Dec '14, a reassuring sign of increasing institutional interest (I criteria).

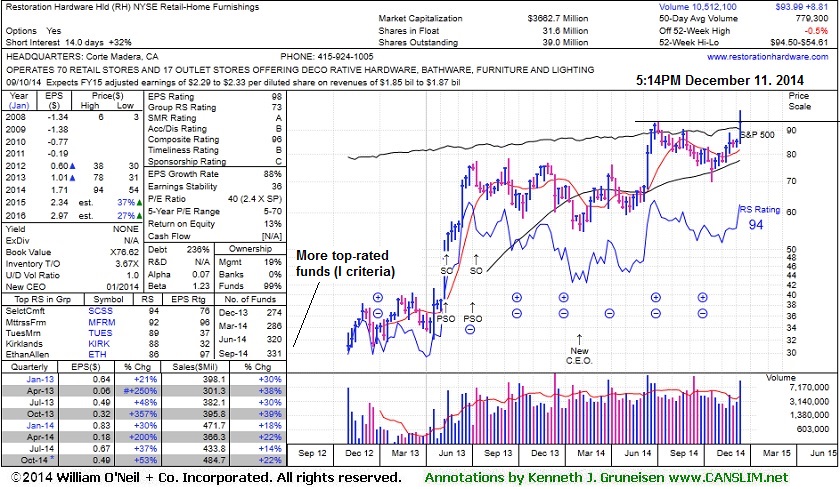

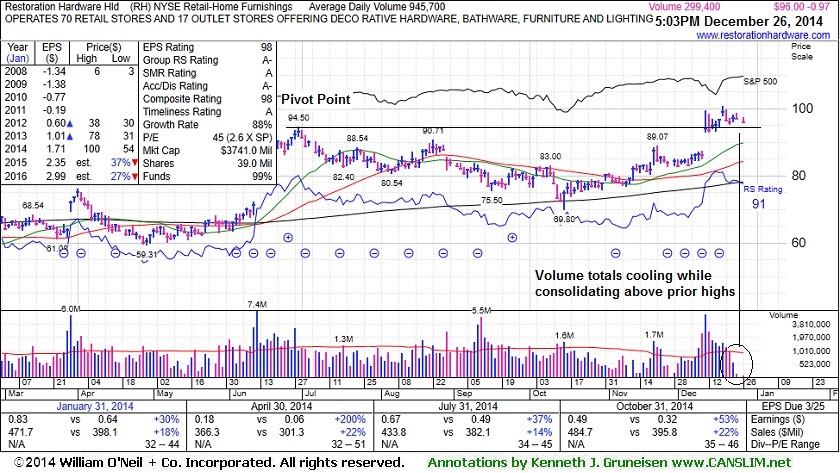

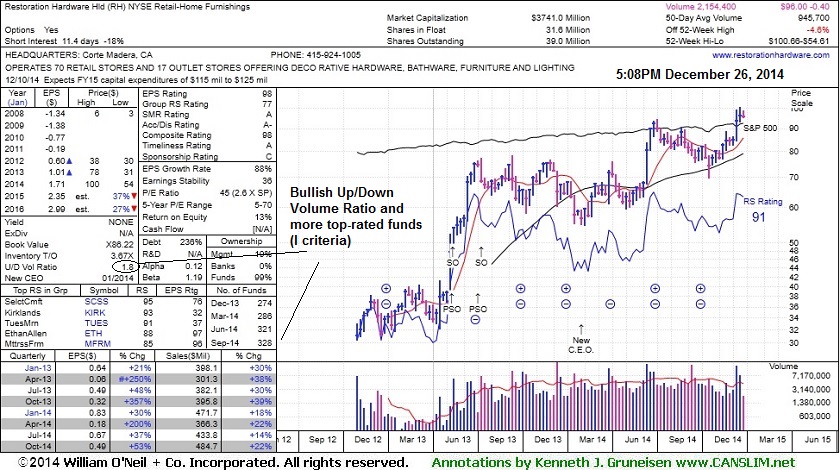

Restoration Hardware Hld (RH -$0.97 or -1.00% to $96.00) has seen volume totals cooling while consolidating below its "max buy" level. Subsequent losses leading to a close below its old high close ($93.05 on 6/30/14) would completely negate the recent breakout and raise concerns.

It was last shown in this FSU section on 12/11/14 with annotated graphs under the headline, "Close in Lower Third of Intra-day Range Indicates Distributional Pressure", after highlighted in yellow with a pivot point cited based on its 6/30/14 high plus 10 cents in the earlier mid-day report (read here). Convincing volume-driven gains helped clinch a convincing technical buy signal.

It reported that Oct '14 earnings rose +53% on +22% sales revenues versus the year ago period, continuing its streak of strong quarterly earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) growth has been very strong since reorganization and trading began on 11/02/12. It completed a Secondary Offering 7/12/13 and named a new CEO 1/31/14. Its Up/Down Volume Ratio of 1.8 is an unbiased indication its shares have been under accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 274 in Dec '13 to 328 in Sep '14, a reassuring sign of increasing institutional interest (I criteria).

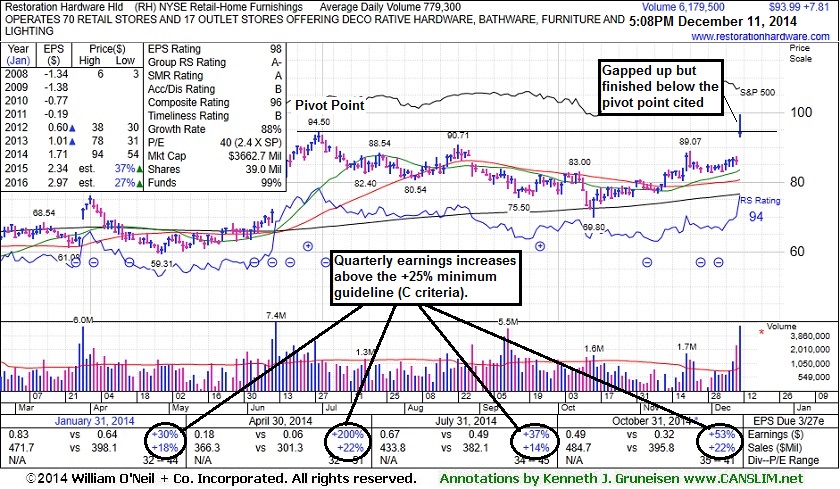

Restoration Hardware Hld (RH +$7.81 or +9.06% to $93.99) was highlighted in yellow with a pivot point cited based on its 6/30/14 high plus 10 cents in the earlier mid-day report (read here). It gapped up today and rallied to a new 52-week high and best-ever close with considerable volume +693% above average. However, it is worth noting that it closed in the lower third of its intra-day range and below the pivot point cited, a sign it was encountering distributional pressure near prior highs. Therefore, more convincing volume-driven gains in the days ahead are needed to help clinch a convincing technical buy signal.

Volume and volatility often increase near earnings news. It reported that Oct '14 earnings rose +53% on +22% sales revenues versus the year ago period, continuing its streak of strong quarterly earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) growth has been very strong since reorganization and trading began on 11/02/12. It completed a Secondary Offering 7/12/13 and named a new CEO 1/31/14. The number of top-rated funds owning its shares rose from 274 in Dec '13 to 331 in Sep '14, a reassuring sign of increasing institutional interest (I criteria).