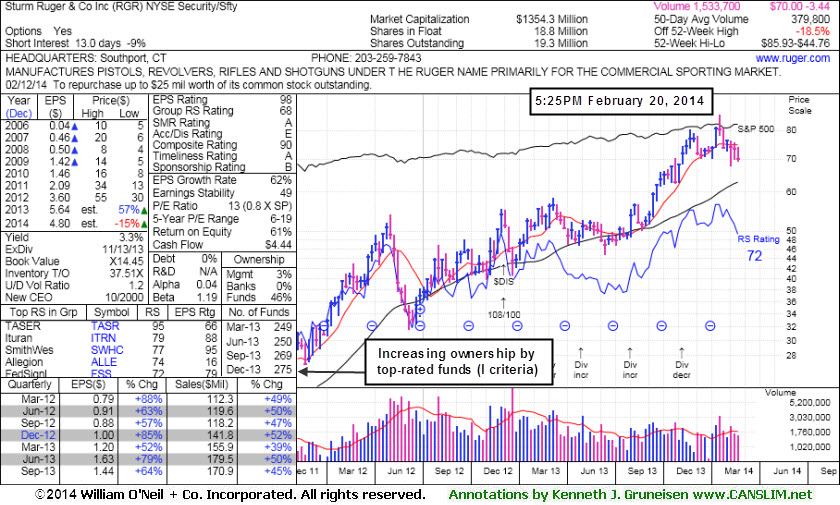

Weak Technical Action Hurting Outlook - Thursday, February 20, 2014

Sturm Ruger & Co Inc (RGR -$1.00 or -1.41% to $70.00) is sputtering below its 50-day moving average (DMA) line which recently acted as resistance. Its Relative Strength rating has slumped to 72, below the 80+ minimum guideline for buy candidates. It will be dropped from the Featured Stocks list tonight due to weak technical deterioration. It faces overhead supply up through the $85 level after recent distributional action. It was last shown in this FSU section on 2/04/14 with an annotated graph under the headline, "Slumped Into Prior Base Negating Breakout and Violated 50-Day Average", while enduring worrisome distributional pressure. It negated the prior breakout and slumped back into the prior base raising concerns. Disciplined investors always limit losses if ever any stock falls more than -7% from where it was purchased.It reported earnings +64% on +45% sales revenues for the quarter ended September 30, 2013 versus the year ago period, the 10th consecutive quarterly comparison with a strong earnings increase well above the +25% minimum guideline (C criteria) backed by strong sales revenues growth. It also has a good annual earnings (A criteria) history. The number of top-rated funds owning its shares rose from 248 in Mar '13 to 275 in Dec '13, a slightly reassuring sign concerning the I criteria. Keep in mind that some mutual fund managers are also restricted by their fund family's rules from buying companies that make firearms, tobacco, or alcohol products.

See additional details in the article "Ken's Mailbag Q&A 12/10/12 - Challenges of when to lock in a profit or accumulate more shares".

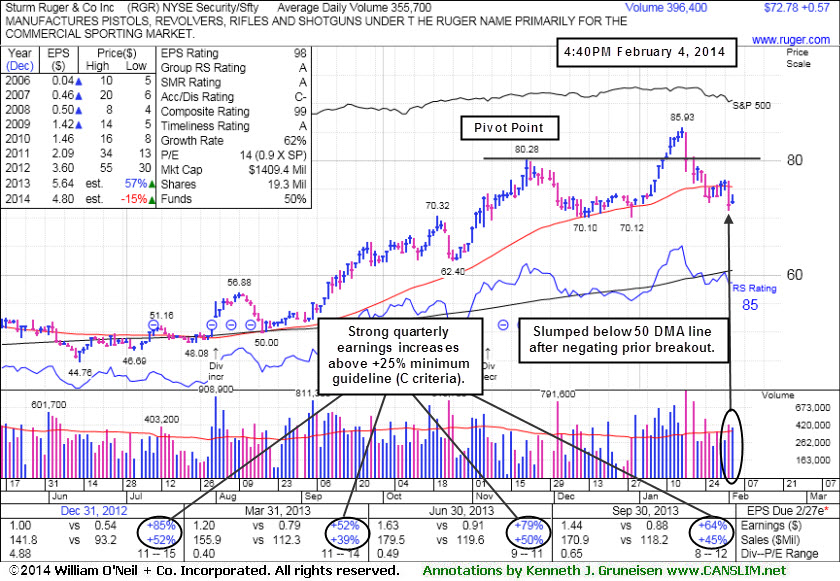

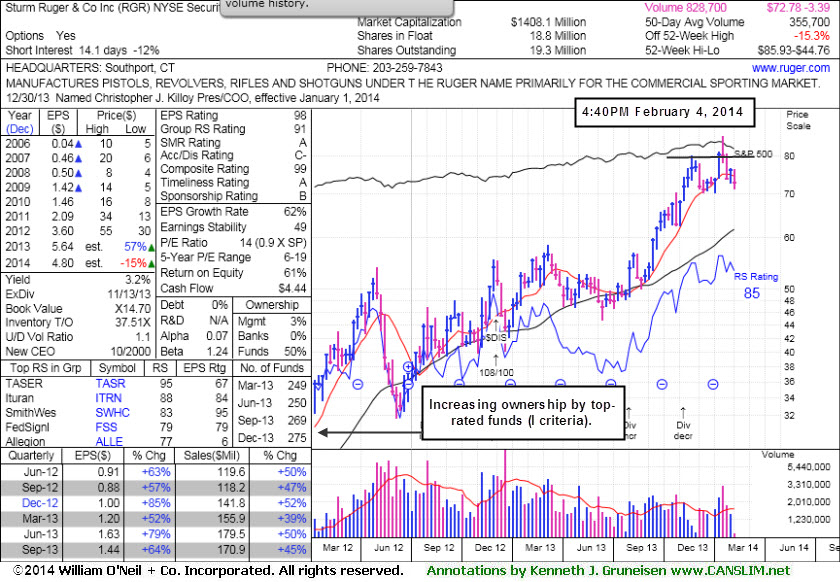

Slumped Into Prior Base Negating Breakout and Violated 50-Day Average - Tuesday, February 04, 2014

Sturm Ruger & Co Inc (RGR +$0.57 or +0.79% to $72.78) slumped further below its 50-day moving average (DMA) line on the prior session, enduring more worrisome distributional pressure. It recently negated the prior breakout and slumped back into the prior base raising concerns. Disciplined investors always limit losses if ever any stock falls more than -7% from where it was purchased. The Security/Safety firm now faces overhead supply up through the $85 level which may act as resistance. It made limited headway after last shown in this FSU section on 1/13/14 with an annotated graph under the headline, "Hit New Highs With 6th Consecutive Gain", as a solid gain above its pivot point was backed by +75% above average volume confirming a technical buy signal.It reported earnings +64% on +45% sales revenues for the quarter ended September 30, 2013 versus the year ago period, the 10th consecutive quarterly comparison with a strong earnings increase well above the +25% minimum guideline (C criteria) backed by strong sales revenues growth. It also has a good annual earnings (A criteria) history. The number of top-rated funds owning its shares rose from 248 in Mar '13 to 275 in Dec '13, a slightly reassuring sign concerning the I criteria. Keep in mind that some mutual fund managers are also restricted by their fund family's rules from buying companies that make firearms, tobacco, or alcohol products.

See additional details in the article "Ken's Mailbag Q&A 12/10/12 - Challenges of when to lock in a profit or accumulate more shares".

Hit New Highs With 6th Consecutive Gain - Monday, January 13, 2014

Sturm Ruger & Co Inc (RGR +$1.35 or +1.68% to $81.90) hit new highs with today's 6th consecutive gain. The solid gain above its pivot point was backed by +75% above average volume confirming a technical buy signal. It stubbornly held its ground and rallied since highlighted in yellow at $78.87 in the 1/08/14 mid-day report (read here). Pyramiding is a smart tactic taught in the Certification designed to let the market action dictate your entries while proper discipline suggests that gains above a stock's pivot point should have at least +40% above average volume to trigger a valid technical buy signal. Disciplined investors always limit losses if ever any stock falls more than -7% from where it was purchased.

It was last shown in this FSU section on 12/24/12 with an annotated graph under the headline, "Violated 50-Day Average After Damaging Losses Negated Prior Breakout ", triggering a technical sell signal while violating its 50-day moving average (DMA) line and enduring distributional pressure.

It reported earnings +64% on +45% sales revenues for the quarter ended September 30, 2013 versus the year ago period, the 10th consecutive quarterly comparison with a strong earnings increase well above the +25% minimum guideline (C criteria) backed by strong sales revenues growth. It also has a good annual earnings (A criteria) history. The number of top-rated funds owning its shares rose from 248 in Mar '13 to 272 in Sep '13, a slightly reassuring sign concerning the I criteria. Keep in mind that some mutual fund managers are also restricted by their fund family's rules from buying companies that make firearms, tobacco, or alcohol products.

See additional details in the article "Ken's Mailbag Q&A 12/10/12 - Challenges of when to lock in a profit or accumulate more shares".

Violated 50-Day Average After Damaging Losses Negated Prior Breakout - Friday, December 14, 2012

Sturm Ruger & Co Inc (RGR -$2.16 or -4.53% to $45.57) was down again today with above average volume, triggering a technical sell signal while violating its 50-day moving average (DMA) line and enduring more distributional pressure. Recent damaging losses completely negated its prior breakout raising concerns. It was last shown in this FSU section on 11/21/12 with an annotated graph under the headline, "Bullish Action in Outlier While Market Remains in a Correction", as it rallied and closed above its pivot point with volume +75% above average triggering a technical buy signal. The prior article cautioned members - "Its steep decline from its May high urges caution, even though it has rebounded impressively."

In the 11/20/12 mid-day report (read here) it was highlighted in yellow with pivot point cited based on its 11/08/12 high after a cup-with-handle base with an annotated graph. The way it encountered resistance near prior highs was a concern following the breakout. Disciplined investors always limit losses if ever any stock falls more than -7% from where it was purchased.

It reported earnings +57% on +47% sales revenues for the quarter ended September 30, 2012 versus the year ago period, the 6th consecutive quarterly comparison with a strong earnings increase well above the +25% minimum guideline (C criteria) backed by strong sales revenues growth. It also has a good annual earnings (A criteria) history. The number of top-rated funds owning its shares rose from 282 in Mar '12 to 290 in Sep '12, a slightly reassuring sign concerning the I criteria. Keep in mind that some mutual fund managers are also restricted by their fund family's rules from buying companies that make firearms, tobacco, or alcohol products.

See additional details in the article "Ken's Mailbag Q&A 12/10/12 - Challenges of when to lock in a profit or accumulate more shares".

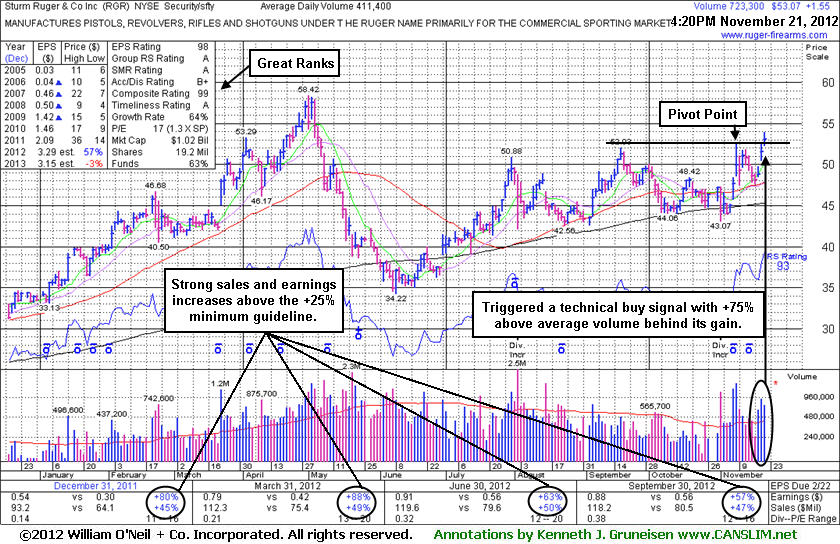

Bullish Action in Outlier While Market Remains in a Correction - Wednesday, November 21, 2012

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. Sometimes stocks are highlighted shortly after a technical breakout, yet while the potential buy candidate may still be considered action-worthy. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.Sturm Ruger & Co Inc (RGR +$1.55 or +3.01% to $53.07) traded up and closed above its pivot point today with volume +75% above average pace. Technically, the gain triggered a buy signal. It still faces a little resistance up through the $58 level. In the 11/20/12 mid-day report (read here) it was highlighted in yellow with pivot point cited based on its 11/08/12 high after a cup-with-handle base with an annotated graph. It already broke out of a "double bottom" base with its volume-driven gain on 11/08/12 clearing the 10/18/12 high of $48.42. The way it encountered resistance near prior highs in the $52 area was a concern following the breakout from the recent double bottom pattern. Its steep decline from its May high urges caution, even though it has rebounded impressively. Additionally, the M criteria remains an overriding concern arguing against new buying efforts until the market produces a follow-through-day, because 3 out of 4 stocks go in the direction of the broader market and the market is still in a correction until noted otherwise.

Since noted on 5/14/12 when dropped from the Featured Stocks list RGR found support near its 200-day moving average (DMA) line during its deep consolidation from highs, then it rebounded impressively. It had first rallied as much as +25.4% higher after it was highlighted in the 3/22/12 mid-day report and shown in that evening's report under the headline "Volume-Driven Breakout Shoots to New High", when a strong finish with more than 4 times average volume helped it clinch a technical buy signal.

It reported earnings +57% on +47% sales revenues for the quarter ended September 30, 2012 versus the year ago period, the 6th consecutive quarterly comparison with a strong earnings increase well above the +25% minimum guideline (C criteria) backed by strong sales revenues growth. It also has a good annual earnings (A criteria) history. The number of top-rated funds owning its shares rose from 282 in Mar '12 to 290 in Sep '12, a slightly reassuring sign concerning the I criteria. Keep in mind that some mutual fund managers are also restricted by their fund family's rules from buying companies that make firearms, tobacco, or alcohol products.

Volume-Driven Breakout Shoots to New High - Thursday, March 22, 2012

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. Sometimes stocks are highlighted shortly after a technical breakout, yet while the potential buy candidate may still be considered action-worthy. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Sturm Ruger & Co Inc (RGR +$5.63 or +13.31% to $47.93) was featured in the earlier mid-day report highlighted in yellow with pivot point cited based on its 52-week high plus 10 cents after a 5-week flat base pattern. It found support above its 50-day moving average (DMA) line while consolidating since hitting its old high on 2/22/12, and its considerable gap up gain today helped it hit a new 52-week high. The strong finish with more than 4 times average volume helped it clinch a technical buy signal.

It reported earnings +80% on +45% sales revenues for the quarter ended December 31, 2011 versus the year ago period. Its 3 latest quarterly comparisons showed strong earnings increases well above the +25% minimum guideline while sales revenues showed impressive acceleration. It also has a good annual earnings (A criteria). The number of top-rated funds owning its shares rose from 204 in Mar '11 to 289 in Dec '11, a reassuring sign concerning the I criteria.

Keep in mind that it may be considered a riskier "late stage" base after it had a few legs up in 2011. Some mutual fund managers are also restricted by their fund family's rules from buying companies that make firearms, tobacco, or alcohol products. Disciplined investors know their odds are most favorable if they accumulate shares within +5% of the pivot point, and they always limit losses by selling if every any stock falls more than -7% from their purchase price.