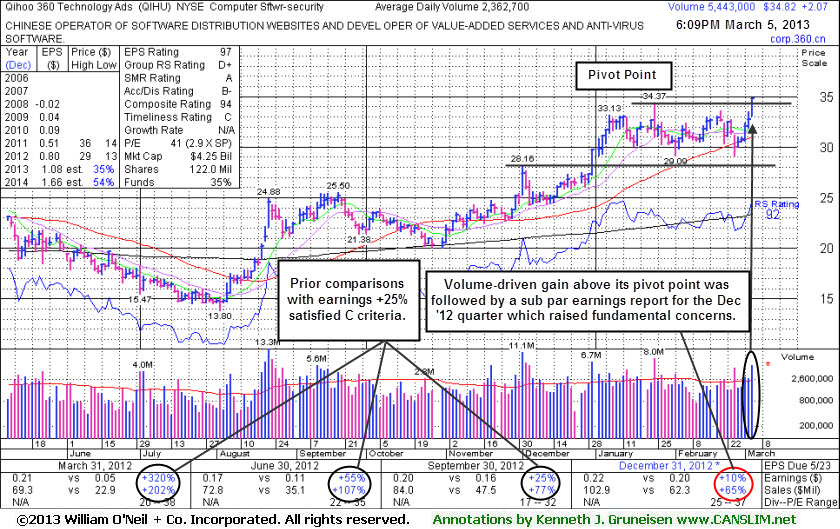

Earnings Below Guideline Raised Concerns After Technical Breakout - Tuesday, March 05, 2013

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Qihoo 360 Technology Ads (QIHU +$2.07 or +6.32% to $34.82) was highlighted in yellow with pivot point based on its 1/24/13 high plus 10 cents in the earlier mid-day report (read here). The strong finish helped it technically break out from the previously noted base-on-base pattern being formed. However, it reported earnings +10% on +65% sales revenues for the Dec '12 quarter, below the +25% minimum earnings guideline (C criteria) after the close which raised fundamental concerns. As previously noted - "Volume and volatility often increase near earnings news."

It found prompt support at its 50-day moving average (DMA) line last week and above average volume behind today's 5th consecutive helped it hit a new 52-week high. The number of top-rated funds owning its share rose from 89 in Jun '12 to 116 in Dec '12, a reassuring sign concerning the I criteria. Strength from other leaders in the Computer Software - Security industry group has been a reassuring sign concerning the L criteria, although the group's current Relative Strength rating of D+ is below average. Prior mid-day reports cautioned - "Deceleration in its sales revenues and earnings growth rate in sequential quarterly comparisons through Sep '12 is cause for concern. Faces additional overhead supply up through the $36 area. Found support at its 200 DMA line in recent weeks. This Chinese Computer Software - Security firm's quarterly earnings (C criteria) and sales revenues increases have been strong."