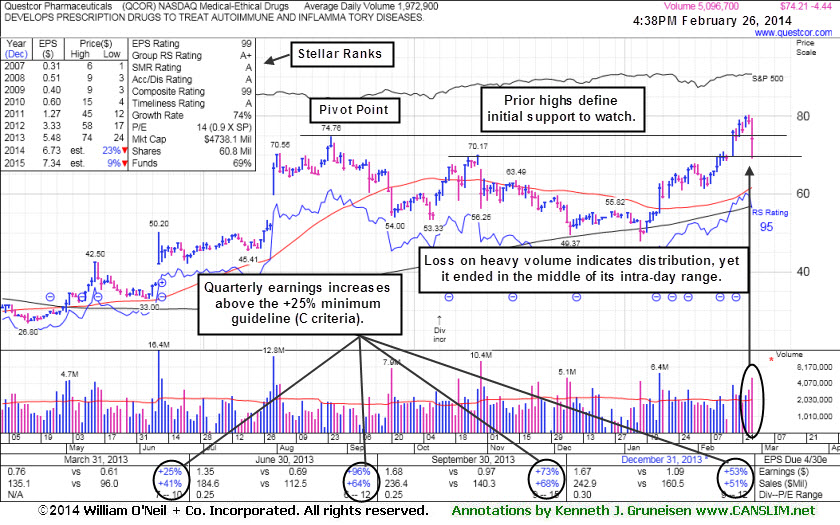

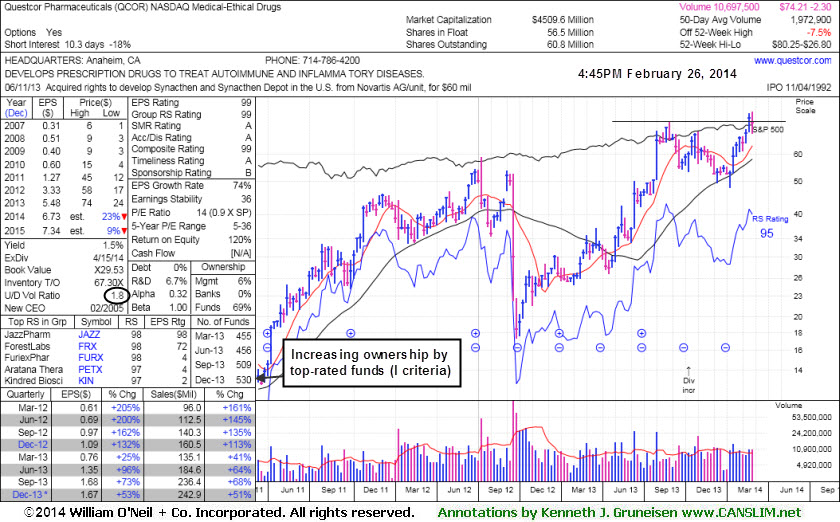

The high ranked leader hails from the Medical - Ethical Drugs group which has an A+ rating, and leadership in the group is an encouraging sign concerning the L criteria. It Reported earnings +53% on +51% sales revenues for the Dec '13 quarter, continuing its streak of strong quarterly earnings increases satisfying the C criteria of the fact-based system. Considering its deep consolidation to its 200-day moving average (DMA) line, the latest technical breakout to new highs has the look of what could be the beginning of a substantial and sustained leg up.

Any slump leading to a close below its old high close ($72.34 on 8/26/13) would raise concerns by completely negating the latest breakout. Prior highs in the $74 area and $70 area define initial support levels to watch above other chart highs and above its 50 DMA line (now $61.63). Disciplined investors sell if any stock falls more than -7% from their purchase price per the fact-based investment system's sell rules.

It found support at its 200-day moving average (DMA) line then rebounded from a deep slump since dropped from the Featured Stocks list on 9/20/13 due to technical deterioration after members were cautioned - "A breach of the prior low ($60.31 on 9/11/13) may trigger a more worrisome technical sell signal." Prior to that it was last shown in this FSU section on 8/26/13 with annotated graphs under the headline, "Wedging to New Highs Despite Market's Negative Drag".

Since a FY '09 downturn its annual earnings (A criteria) growth has been strong. The small supply (S criteria) of 60.8 million shares outstanding can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 455 in Mar '13 to 530 in Dec '13, a reassuring sign concerning the I criteria.

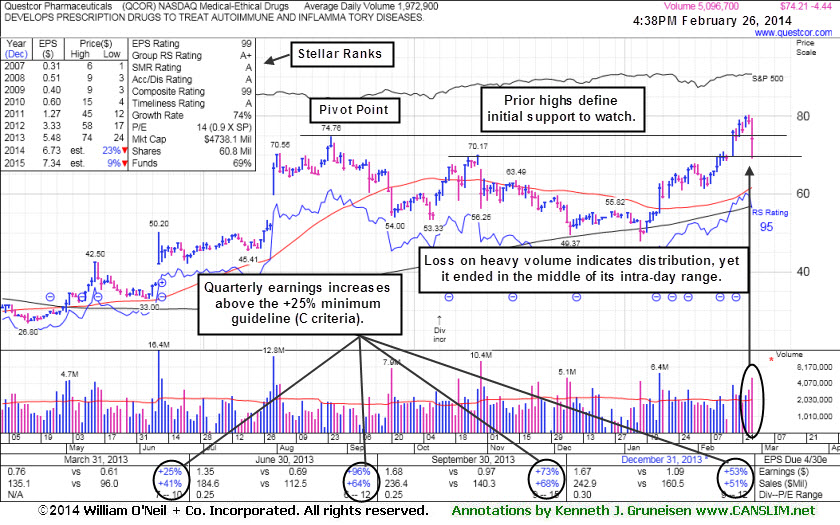

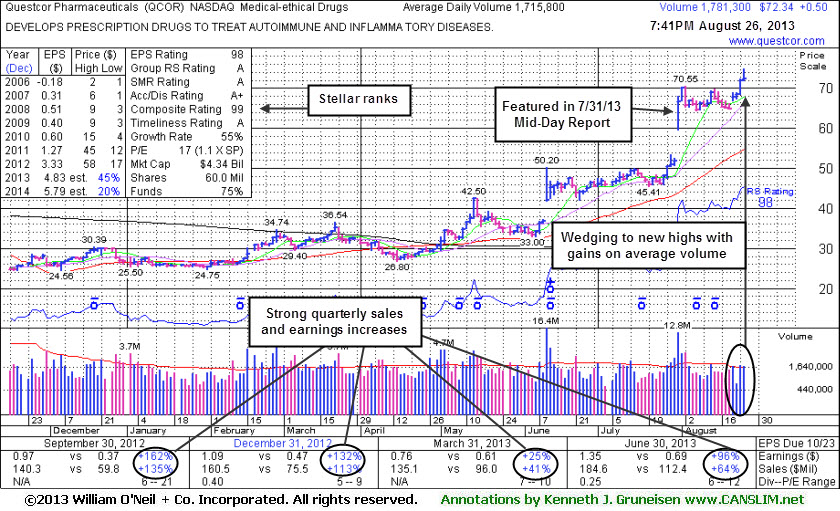

Questcor Pharmaceuticals (QCOR +$0.50 or +0.70% to $72.34) hit another new high today, bucking the mostly negative market. It is extended beyond its "max buy" level after rallying from a tight trading range. It held its ground stubbornly despite the broader market "correction" weighing against most stocks (M criteria) since its last appearance in this FSU section on 8/01/13 with an annotated graph under the headline, "Following Breakaway Gap Getting Extended Quickly". It was highlighted in yellow in the 7/31/13 mid-day report (read here) with a weekly graph which illustrated its powerful long-term breakout to new highs. The pivot point cited was based on its 7/09/12 high plus 10 cents, a prior high which is not shown on its annotated daily graph included below.

Regular readers may note that a "breakaway gap" has been noted many times in the past as one valid exception to the rule which limits investors from buying stocks at more than +5% above their prior chart high or pivot point. The newspaper and experts teaching the Certification suggest that in a very bullish market environment it is permissible to buy stocks as much as 10% above their prior highs when a stock stages a powerful breakaway gap. However, the risk of being stopped out with a -7% loss on an ordinary pullback increases the further above prior highs one purchases a stock, which why it is usually best to buy as near the pivot point as possible after a technical breakout. Patient investors may also watch for secondary buy points or new bases to possibly develop and be noted in the weeks ahead.

Considering its deep consolidation below its 200-day moving average (DMA) line over the past year, the technical breakout to new highs has the look of what could be the beginning of a substantial and sustained leg up. However, the quick pullback in its past also serves as a reminder for investors to always have a stop loss order in place or follow strict selling rules in the event of any damaging losses. It rebounded impressively from its September 2012 lows in the $17 area.

It reported earnings +96% on +64% sales for the Jun '13 quarter, continuing its streak of strong quarterly comparisons with solid sales revenues and earnings increases satisfy the C criteria of the fact-based system. Since a FY '09 downturn its annual earnings (A criteria) growth has been strong. The small supply (S criteria) of 60 million shares outstanding can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 441 in Dec '12 to 471 in Jun '13, a reassuring sign concerning the I criteria. The Medical - Ethical Drugs group has an A rating and leadership in the group is an encouraging sign concerning the L criteria.

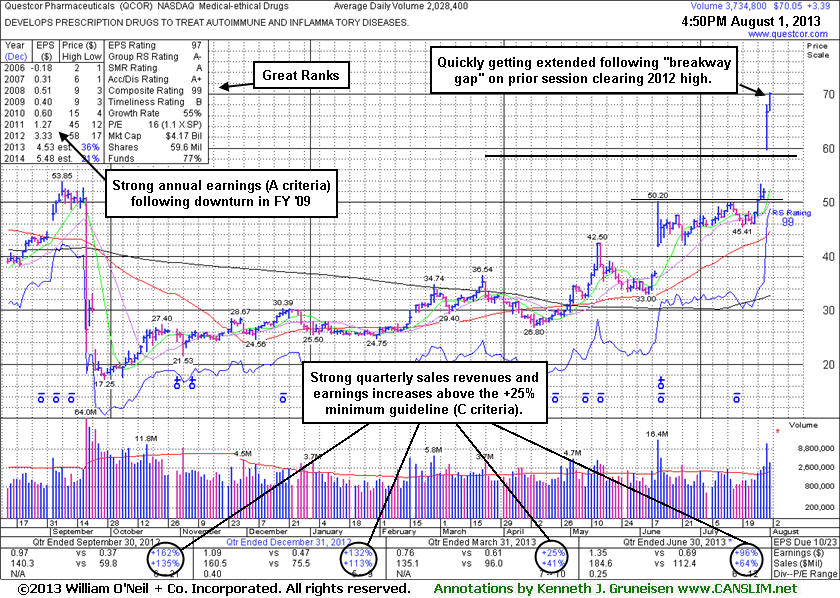

Questcor Pharmaceuticals (QCOR +$3.39 or +5.09% to $70.05) blasted higher with additional volume-driven gains today and its color code was changed to green after quickly getting even more extended from its "max buy" level. It was highlighted in yellow in the 7/31/13 mid-day report (read here) with a weekly graph which illustrated its powerful long-term breakout to new highs. The pivot point cited was based on its 7/09/12 high plus 10 cents, a prior high which is not shown on its annotated daily graph included below.

Regular readers may note that a "breakaway gap" has been noted many times in the past as one valid exception to the rule which limits investors from buying stocks at more than +5% above their prior chart high or pivot point. The newspaper and experts teaching the Certification suggest that in a very bullish market environment it is permissible to buy stocks as much as 10% above their prior highs when a stock stages a powerful breakaway gap. However, the risk of being stopped out with a -7% loss on an ordinary pullback increases the further above prior highs one purchases a stock, which why it is usually best to buy as near the pivot point as possible after a technical breakout. Patient investors may also watch for secondary buy points or new bases to possibly develop and be noted in the weeks ahead.

Considering its deep consolidation below its 200-day moving average (DMA) line over the past year, the technical breakout to new highs has the look of what could be the beginning of a substantial and sustained leg up. However, the quick pullback in its past also serves as a reminder for investors to always have a stop loss order in place or follow strict selling rules in the event of any damaging losses. It rebounded impressively from its September 2012 lows in the $17 area.

QCOR had recently been noted as it cleared a shorter and very orderly flat base. It reported earnings +96% on +64% sales for the Jun '13 quarter, continuing its streak of strong quarterly comparisons with solid sales revenues and earnings increases satisfy the C criteria of the fact-based system. Since a FY '09 downturn its annual earnings (A criteria) growth has been strong. The small supply (S criteria) of 59.6 million shares outstanding can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 441 in Dec '12 to 464 in Jun '13, a reassuring sign concerning the I criteria. The Medical - Ethical Drugs group has an A- rating and leadership in the group is an encouraging sign concerning the L criteria.