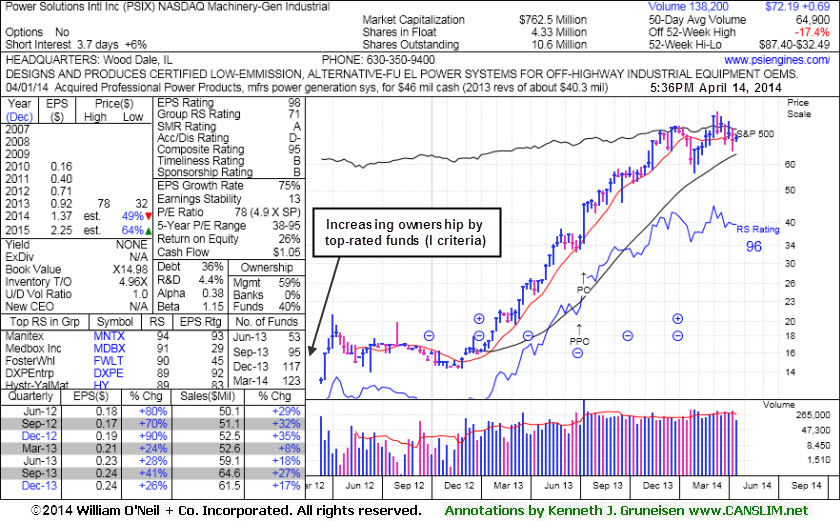

The high-ranked firm from the Machinery - General Industrial group has tallied multiple gains back by above average volume since last shown in this FSU section on 4/14/14 with annotated graphs under the headline, "Halted Slide After Slump Below 50-Day Moving Average". Disciplined investors avoid chasing stocks more than +5% above prior highs and always sell if any stock falls more than -7% from their purchase price. The 50-day moving average (DMA) line defines near-term support to watch.

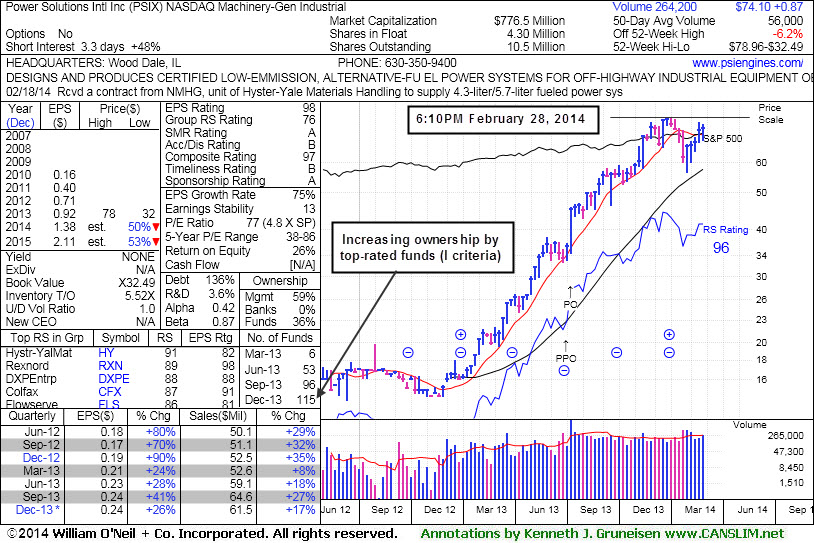

PSIX was highlighted in yellow with a pivot point cited based on its 2/21/14 high in the 2/28/14 mid-day report (read here). It stalled shortly after its 3/06/14 technical breakout, having made only a little headway into new high territory. It reported earnings +26% on +17% sales revenues for the Dec '13 quarter, its 3rd consecutive quarter with earnings above the +25% minimum guideline (C criteria). The number of top-rated funds owning its shares rose from 6 in Mar '13 to 125 in Mar '14, a reassuring trend concerning the I criteria. The small supply of only 4.33 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling. Additional leadership in the Machinery - General Industrial group (L criteria) is reassuring.

PSIX was highlighted in yellow with a pivot point cited based on its 2/21/14 high in the 2/28/14 mid-day report (read here). It stalled shortly after its 3/06/14 technical breakout, having made only a little headway into new high territory. It reported earnings +26% on +17% sales revenues for the Dec '13 quarter, its 3rd consecutive quarter with earnings above the +25% minimum guideline (C criteria). The number of top-rated funds owning its shares rose from 6 in Mar '13 to 123 in Mar '14, a reassuring trend concerning the I criteria. The small supply of only 4.33 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling. Additional leadership in the Machinery - General Industrial group (L criteria) is reassuring.

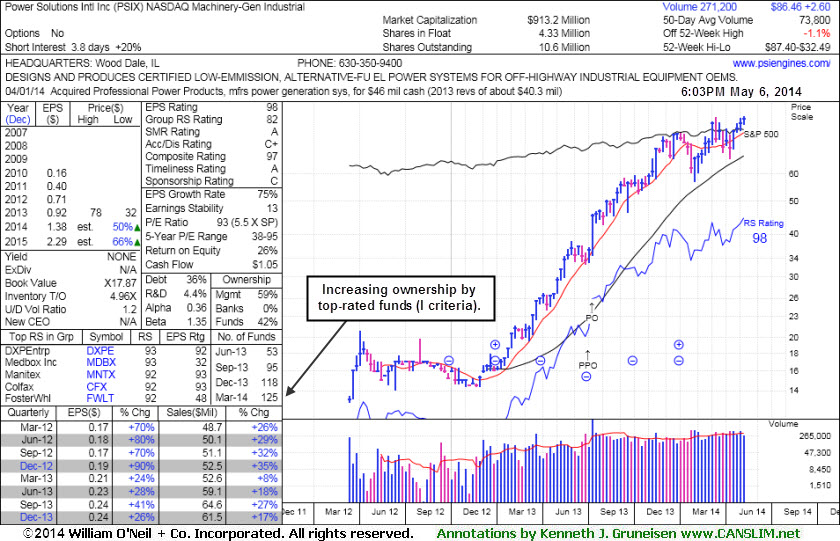

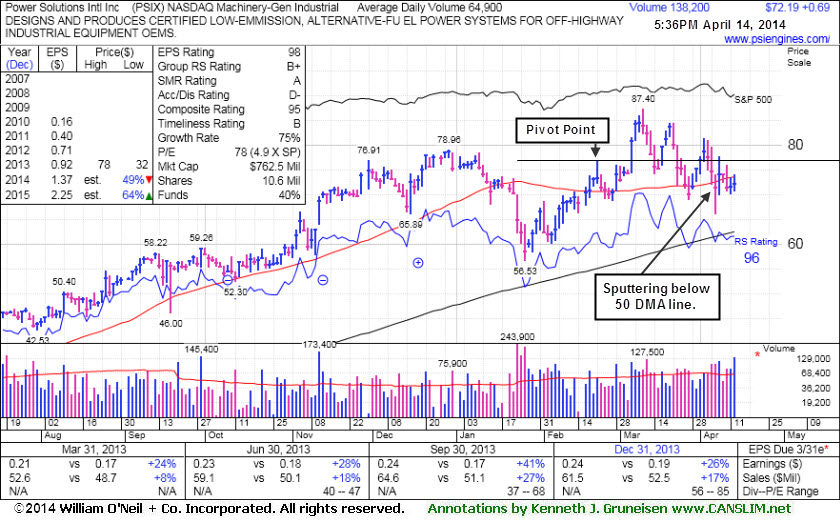

Power Solutions Int'l Inc (PSIX +$1.76 or +2.34% to $76.93) is consolidating just above its 50-day moving average (DMA) line after halting its latest slide near that important short-term average. The high-ranked firm from the Machinery - General Industrial group was last shown in this FSU section on 3/18/14 with annotated graphs under the headline, "Halted Slide After Undercutting Prior Highs on Pullback". Afterward it slumped well below prior highs in the $78 area raising concerns while completely negating the recent breakout. Disciplined investors avoid chasing stocks more than +5% above prior highs and always sell if any stock falls more than -7% from their purchase price.

PSIX was highlighted in yellow with a pivot point cited based on its 2/21/14 high in the 2/28/14 mid-day report (read here). It stalled shortly after its 3/06/14 technical breakout having made only a little headway into new high territory. It reported earnings +26% on +17% sales revenues for the Dec '13 quarter, its 3rd consecutive quarter with earnings above the +25% minimum guideline (C criteria). The number of top-rated funds owning its shares rose from 6 in Mar '13 to 116 in Dec '13, a reassuring trend concerning the I criteria. The small supply of only 4.33 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling. Additional leadership in the Machinery - General Industrial group (L criteria) is reassuring.

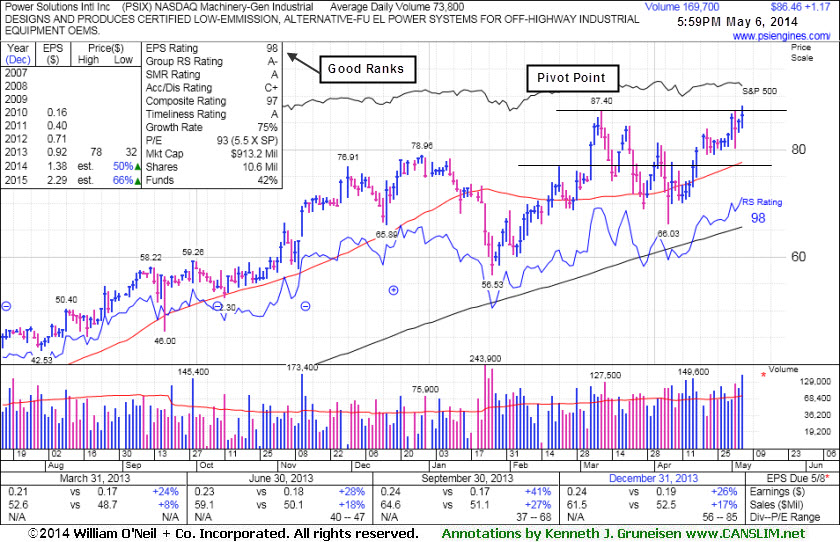

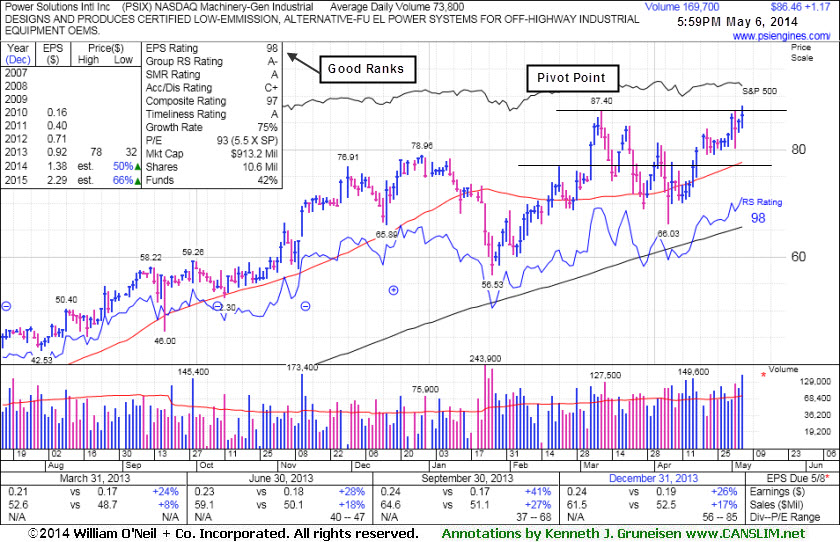

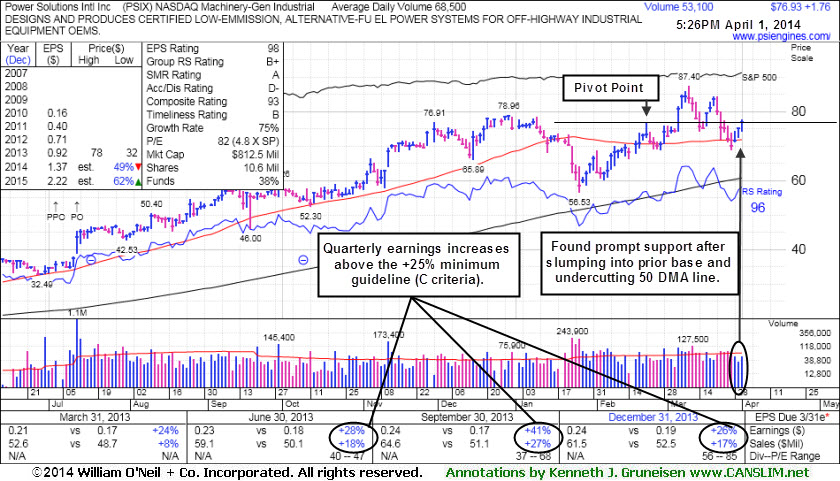

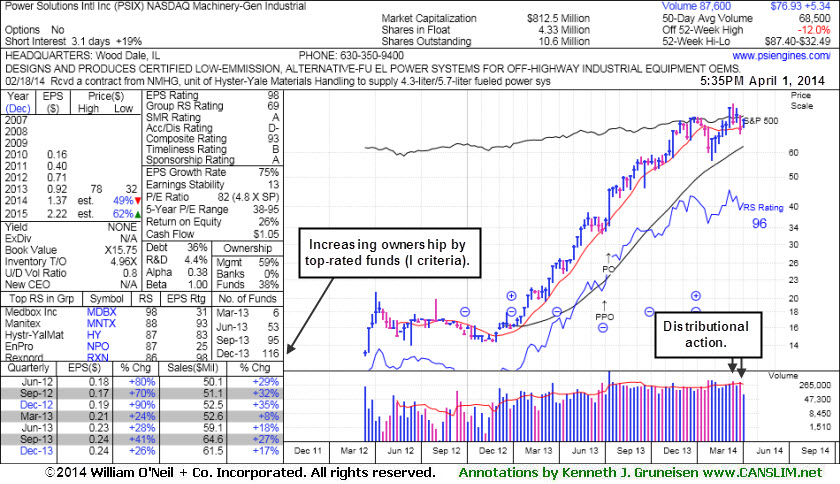

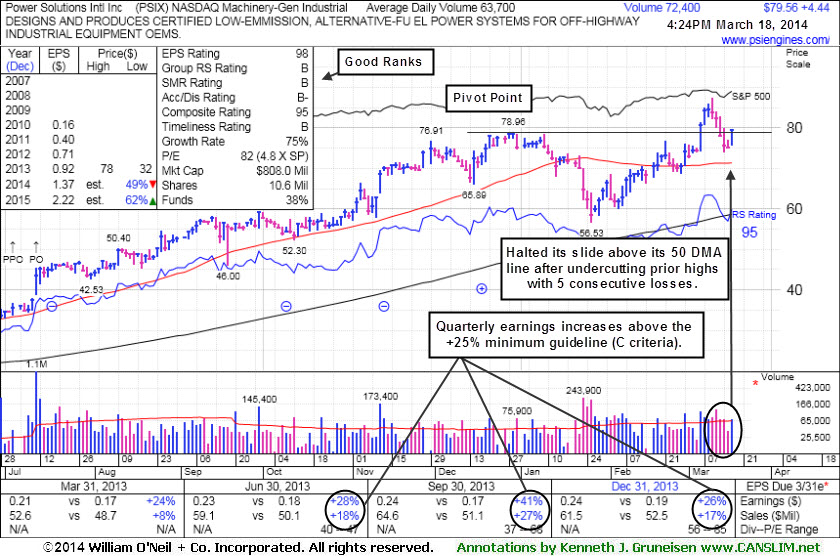

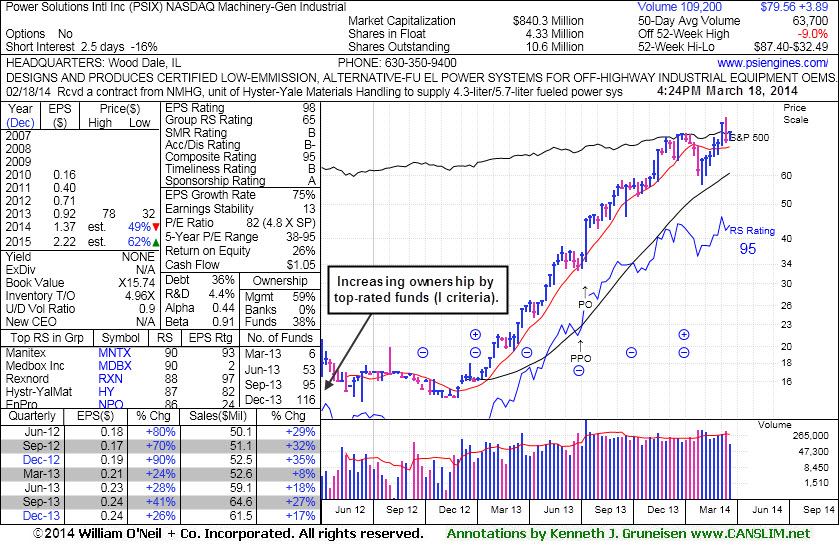

Power Solutions Int'l Inc (PSIX +$4.43 or +5.90% to $79.55) halted its slide above its 50-day moving average (DMA) line and finished near the session high with a solid gain today following 5 consecutive losses. It briefly undercut prior highs in the $78 area raising concerns, yet appears to have found prompt support. Disciplined investors avoid chasing stocks more than +5% above prior highs and always sell if any stock falls more than -7% from their purchase price.

The high-ranked firm from the Machinery - General Industrial group was last shown in this FSU section on 2/28/14 with annotated graphs under the headline, "Earnings Solid and Forming a Cup-With-Handle", after highlighted in yellow with a pivot point cited based on its 2/21/14 high in the earlier mid-day report (read here). It reported earnings +26% on +17% sales revenues for the Dec '13 quarter, its 3rd consecutive quarter with earnings above the +25% minimum guideline (C criteria).

The number of top-rated funds owning its shares rose from 6 in Mar '13 to 116 in Dec '13, a reassuring trend concerning the I criteria. The small supply of only 4.33 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling. Additional leadership in the Machinery - General Industrial group (L criteria) is reassuring.

PSIX faces some resistance up through the $78 area while currenly forming a 10-week cup-with-handle base pattern. Subsequent volume-driven gains above the pivot point may trigger a technical buy signal, meanwhile it is ideal for investors' watch lists.

The number of top-rated funds owning its shares rose from 6 in Mar '13 to 115 in Dec '13, a reassuring trend concerning the I criteria. The small supply of only 4.3 million shares (S criteria) can contribute to greater price volatility in the event of institutional buying or selling. The Machinery - General Industrial group is high ranked and leadership in the group (L criteria) is reassuring.