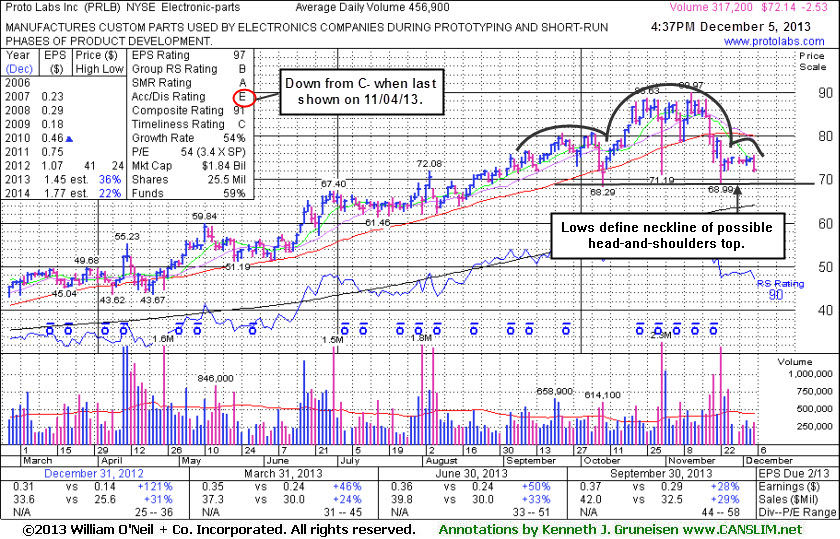

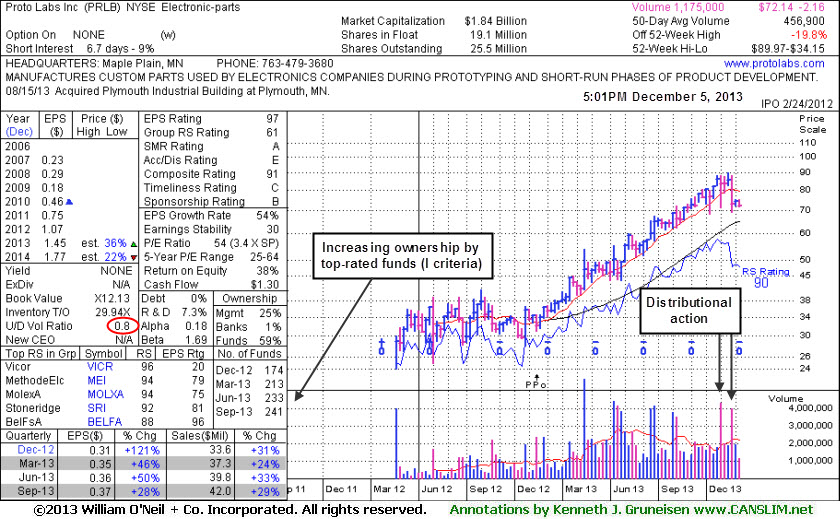

Possible Head-and-Shoulders Top After Distributional Action - Thursday, December 05, 2013

Proto Labs Inc (PRLB -$2.53 or -3.39% to $72.14) has been failing to attract buying demand after slumping well below its 50-day moving average (DMA) line which is now downward sloping and may act as resistance. In recent months it did not form any sound base pattern. It will be dropped from the Featured Stocks list tonight. The annotated daily graph shows a possible "head-and-shoulders" topping pattern forming. Any subsequent violation of support at the prior lows defining the neckline would trigger a worrisome technical sell signal.

Its Accumulation/Distribution rating has slumped from C- to the worst possible E rating since the high-ranked Electronic - Parts firm was last shown in this FSU section on 11/04/13 with annotated graphs under the headline, "Undercut 50-Day Moving Average Yet Found Prompt Support". Its current Up/Down Volume Ratio of 0.8 is an unbiased indication its shares have been under distributional pressure over the past 50 days. PRLB traded up as much as +80% since first featured at $49.97 highlighted in the 4/10/13 mid-day report (read here). The weak action of late has been a sign of profit taking and its outlook only gets worse the longer it lingers below its 50 DMA line, while a rebound above that short-term average is necessary for its outlook to improve.

It reported earnings +28% on +29% sales revenues for the Sep '13 quarter, above the +25% minimum earnings guideline. That continued its strong growth trend satisfying the C criteria and helped it maintain a very high 97 Earnings Per Share rank. Its small supply of only 19.1 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 131 in Jun '12 to 241 in Sep '13, a reassuring trend concerning the I criteria.

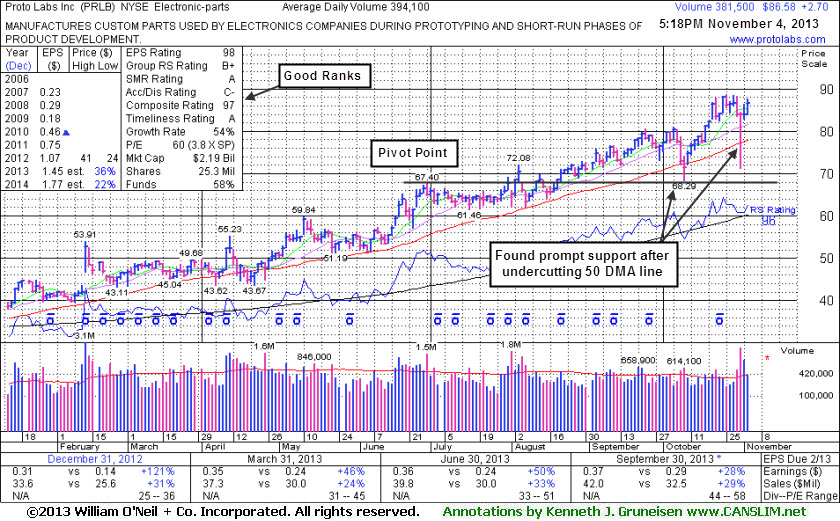

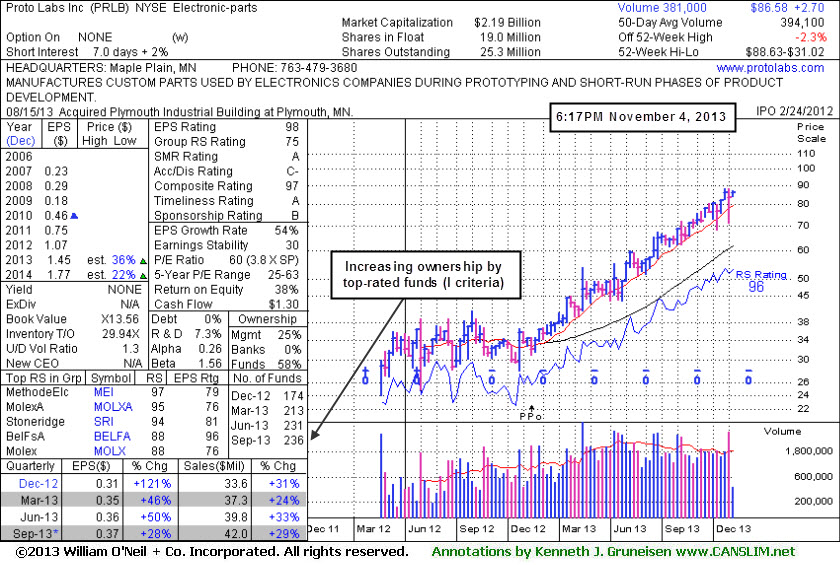

Undercut 50-Day Moving Average Yet Found Prompt Support - Monday, November 04, 2013

Proto Labs Inc (PRLB +$2.70 or +3.22% to $86.58) recently reported earnings +28% on +29% sales revenues for the Sep '13 quarter, above the +25% minimum earnings guideline. That continued its strong growth trend satisfying the C criteria and helped it maintain a very high 98 Earnings Per Share rank. It found prompt support last week after undercutting its 50-day moving average (DMA) line again briefly. The Prior low $68.29 on 10/09/13 defines the next important near-term support level where subsequent violations may trigger worrisome technical sell signals.The high-ranked Electronic - Parts firm was last shown in this FSU section with an annotated graph on 9/25/13 under the headline, "Extended Following Additional Volume-Driven Gains". Disciplined investors avoid chasing stocks more than +5% above their prior highs. PRLB has traded up as much as +77.4% since first featured at $49.97 highlighted in the 4/10/13 mid-day report (read here). It has not formed a sound base in recent weeks.

Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. Its small supply of only 19 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 131 in Jun '12 to 236 in Sep '13, a reassuring trend concerning the I criteria.

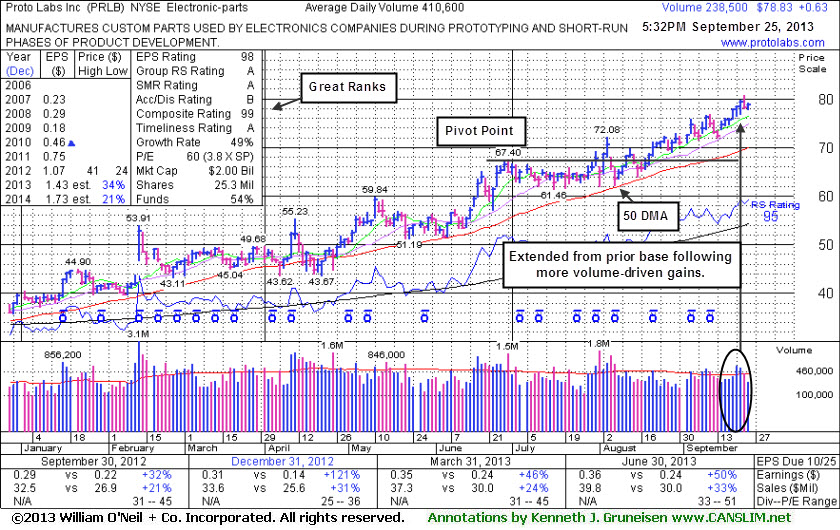

Extended Following Additional Volume-Driven Gains - Wednesday, September 25, 2013

Proto Labs Inc (PRLB +$0.63 or +0.81% to $78.83) is extended from its prior base following more volume-driven gains into new high territory. Disciplined investors avoid chasing stocks more than +5% above their prior highs. Patient investors might watch for a new base or secondary buy point to possibly form and be noted in the weeks ahead. Support to watch on pullbacks is at its 50-day moving average (DMA) line. PRLB has traded up as much as +57.8% since first featured at $49.97 highlighted in the 4/10/13 mid-day report (read here). Earnings were +50% on +33% sales revenues for the Jun '13 quarter, continuing its strong growth trend satisfying the C criteria and helping it earn a very high 98 Earnings Per Share rank.

The high-ranked Electronic - Parts firm was last shown in this FSU section with an annotated graph on 8/27/13 under the headline, "Pulled Back on Lighter Volume". Since then it has distanced itself from prior highs and avoided damaging distribution days. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. Its small supply of only 19 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 131 in Jun '12 to 228 in Jun '13, a reassuring trend concerning the I criteria.

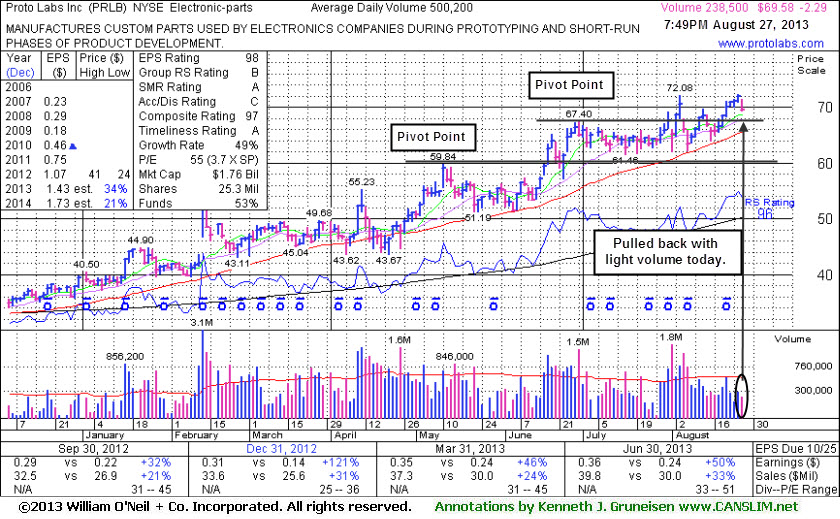

Pulled Back on Lighter Volume - Tuesday, August 27, 2013

Proto Labs Inc (PRLB -$2.29 or -3.19% to $69.58) pulled back with light volume today. The high-ranked Electronic - Parts firm was last shown in this FSU section with an annotated graph on 8/05/13 under the headline, "Follow Through Gains Backed By Volume", as it rallied with +77% above average volume and powered further above its pivot point for yet another new 52-week high.

Its 50-day moving average (DMA) line defines important support just below its prior highs in the $67 area. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price. Its small supply of only 19 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutionaal buying or selling.

PRLB was first featured in yellow in the 4/10/13 mid-day report (read here). Earnings were +50% on +33% sales revenues for the Jun '13 quarter, continuing its strong growth trend satisfying the C criteria and helping it earn a very high 98 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 131 in Jun '12 to 228 in Jun '13, a reassuring trend concerning the I criteria.

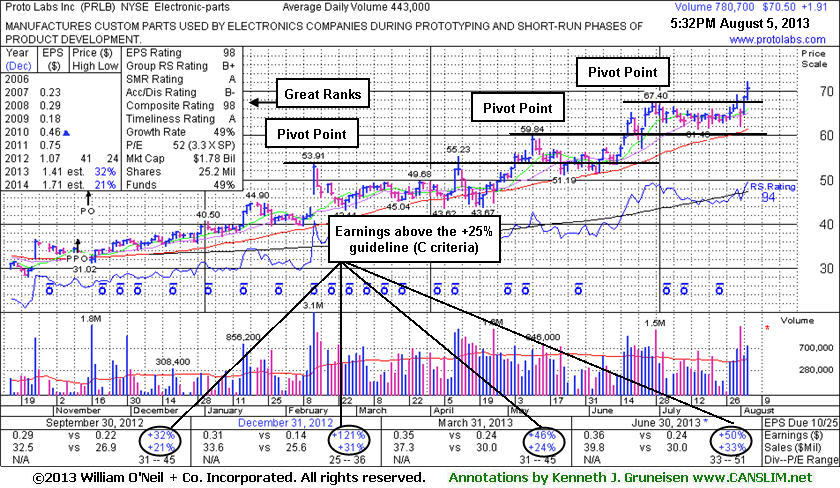

Follow Through Gains Backed By Volume - Monday, August 05, 2013

Proto Labs Inc (PRLB +$1.91 or +2.78% to $70.50) rallied with +77% above average volume as it powered further above its pivot point for yet another new 52-week high, a confirming gain following last week's new (or add-on) technical buy signal. Its 50-day moving average (DMA) line defines important support just below recent lows in the $61 area. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price. Its small supply of only 18.9 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling.The high-ranked Electronic - Parts firm was last shown in this FSU section with an annotated graph on 7/15/13 under the headline, "Volume Totals Cooling During Tight Consolidation Near Highs". PRLB has traded up +41% from $49.97 when first featured in yellow in the 4/10/13 mid-day report (read here). Earnings were +50% on +33% sales revenues for the Jun '13 quarter, continuing its strong growth trend satisfying the C criteria and helping it earn a very high 98 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 131 in Jun '12 to 218 in Jun '13, a reassuring trend concerning the I criteria.

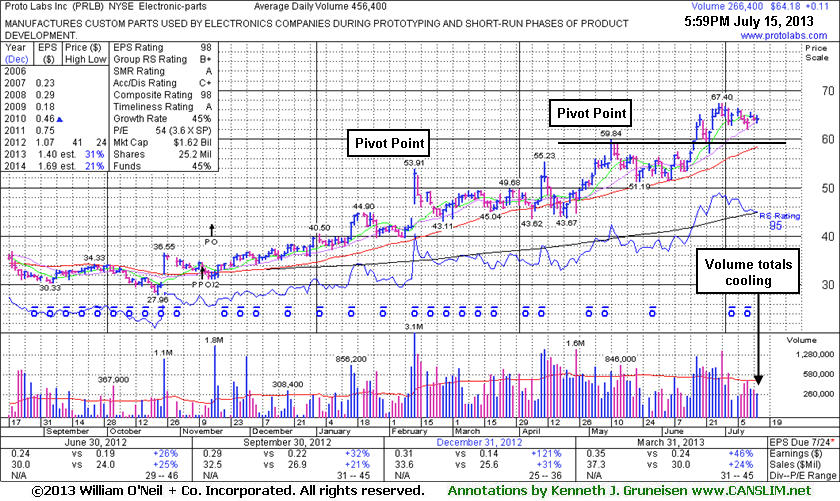

Volume Totals Cooling During Tight Consolidation Near Highs - Monday, July 15, 2013

Proto Labs Inc (PRLB +$0.11 or +0.17% to $64.18) is still holding its ground stubbornly near its 52-week high with volume totals cooling following a "negative reversal" with on 6/28/13 with heavy volume. Prior highs near $59 define near-term support, and those highs closely coincide with its 50-day moving average (DMA) line, a very familiar support level recognized by chart readers.PRLB may continue to find support prior highs in the $59 area and form a new sound base of greater length. In fact, it may be noted that an advanced "3-weeks tight" base has been formed by the past 3 weekly finishes in close proximity, however no new pivot point has been cited. It made limited progress above its last pivot point while the market was in a "correction". While the major indices have tallied 3 consecutive weekly gains, however, its Relative Strength line slumped. The Relative Strength rating is still a very strong 95. Keep in mind that 3 out of 4 stocks tend to move in the direction of the major averages (M criteria), and favorable action in the broader market currently encourages disciplined investors to make new buying efforts only in stocks within all of the fact-based investment system's guidelines. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price.

It will issue its financial results for the second quarter of 2013 before the opening of the market on Thursday, Aug. 1, 2013. The high-ranked Electronic - Parts firm was last shown in this FSU section with an annotated graph on 6/26/13 under the headline, "Fundamentals and Technical Action Remain Strong". A new pivot point was then cited on 6/17/13, and it subsequently broke out with a considerable volume-driven gain on 6/18/13 triggering a new (or add-on) technical buy signal. It has traded up as much as +34.9% from $49.97 when first featured in yellow in the 4/10/13 mid-day report (read here). Earnings were +46% on +24% sales revenues for the Mar '13 quarter, continuing its strong growth trend satisfying the C criteria and helping it earn a very high 98 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 131 in Jun '12 to 214 in Jun '13, a reassuring trend concerning the I criteria. Its small supply of only 18.9 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling. Its Up/Down Volume Ratio of 1.2 is another unbiased indication that its shares have been under accumulation over the past 50 days.

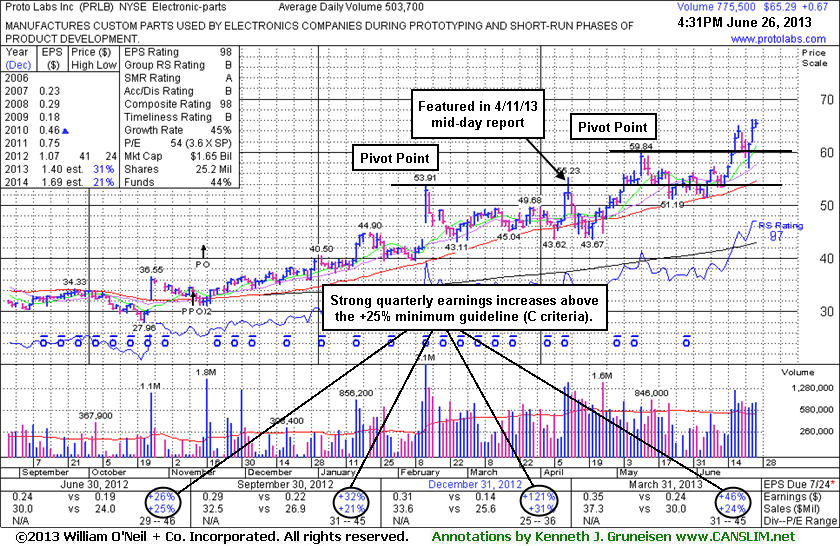

Fundamentals and Technical Action Remain Strong - Wednesday, June 26, 2013

Proto Labs Inc (PRLB +$0.67 or +1.04% to $65.29) is perched at its 52-week high after posting 2 additional volume-driven gains following its noted "positive reversal" on 6/24/13. It found prompt support near prior highs. The high-ranked Electronic - Parts firm was last shown in this FSU section with an annotated graph on 6/12/13 under the headline, "Finding Support Above 50-Day Moving Average Line". A new pivot point was then cited on 6/17/13, and it subsequently broke out with a considerable volume-driven gain on 6/18/13 triggering a new (or add-on) technical buy signal. It has traded up as much as +32.6% from $49.97 when first featured in yellow in the 4/10/13 mid-day report (read here). It recently reported earnings +46% on +24% sales revenues for the Mar '13 quarter, continuing its strong growth trend satisfying the C criteria.PRLB may continue to find support prior highs in the $59 area, however any slump back into its prior base would raise concerns. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price. Keep in mind that 3 out of 4 stocks tend to move in the direction of the major averages (M criteria), and weak action in the broader market has recently been recognized as a "correction" which prompts disciplined investors to adopt a more defensive stance.

The number of top-rated funds owning its shares rose from 131 in Jun '12 to 212 in Mar '13, a reassuring trend concerning the I criteria. Its small supply of only 18.9 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling. Its Accumulation/ Distribution Rating is currently a B, having improved from a D rating which was noted as a concern earlier. Its Up/Down Volume Ratio of 1.4 is another unbiased indication that its shares have been under accumulation over the past 50 days.

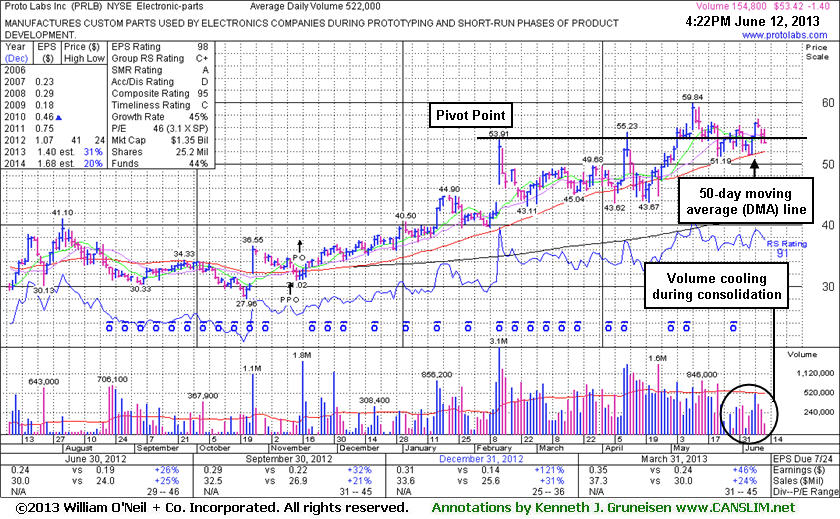

Finding Support Above 50-Day Moving Average Line - Wednesday, June 12, 2013

Proto Labs Inc (PRLB -$1.40 or -2.55% to $53.42) is consolidating above important support at its 50-day moving average (DMA) line with volume totals cooling in recent weeks. A subsequent violation may trigger a technical sell signal. The high-ranked Electronic - Parts firm was last shown in this FSU section with an annotated graph on 5/24/13 under the headline, "Finished Week With Quiet Gains After Negating Prior Breakout". It may continue to find support above its 50-day moving average (DMA) line and resume rallying, however disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price. Keep in mind that 3 out of 4 stocks tend to move in the direction of the major averages (M criteria) and weak action in the broader market this week has been recognized as a "correction" which prompts disciplined investors to adopt a more defensive stance.

The previously cited pivot point (based on its 2/13/13 high) still was considered a very important threshold as it hit a new 52-week high on 5/03/13 with a solid gain backed by +47% above average volume, sufficient to clinch a technical buy signal. However, subsequent gains lacked volume conviction, and then distributional action began taking its toll. The number of top-rated funds owning its shares rose from 131 in Jun '12 to 207 in Mar '13, a reassuring trend concerning the I criteria. Its small supply of only 18.9 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling. Its Accumulation/ Distribution Rating is currently a D and was noted as a concern earlier. It recently reported earnings +46% on +24% sales revenues for the Mar '13 quarter, continuing its strong growth trend satisfying the C criteria.

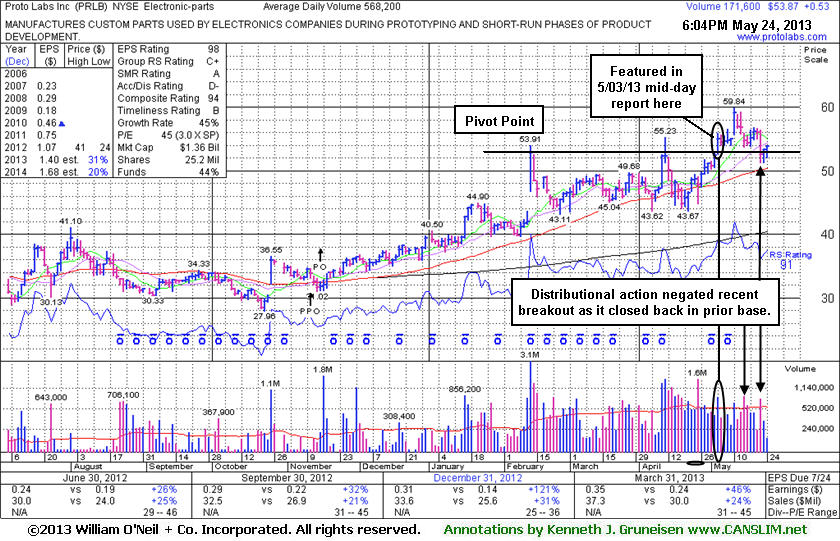

Finished Week With Quiet Gains After Negating Prior Breakout - Friday, May 24, 2013

Proto Labs Inc (PRLB +$0.53 or +0.99% to $53.87) tallied small gains with very light volume after a damaging loss with above average volume led to a retreat below its pivot point. It remains above its 50-day moving average (DMA) line, however its close below its old high close ($52.82 on 2/13/13) on Wednesday completely negated its technical breakout as it slumped back into its prior base. It was last shown in this FSU section with an annotated graph on 5/03/13 under the headline, "Volume +47% Above Average Behind Gain for New Highs", after highlighted in yellow in the earlier mid-day report (read here). The previously cited pivot point (based on its 2/13/13 high) still was considered a very important threshold as it hit a new 52-week high with a solid gain backed by +47% above average volume, sufficient to clinch a technical buy signal. However, subsequent gains lacked volume conviction, and then distributional action began taking its toll.

The number of top-rated funds owning its shares rose from 131 in Jun '12 to 204 in Mar '13, a reassuring trend concerning the I criteria. Its small supply of only 18.9 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling. Its Accumulation/ Distribution Rating of D- was noted as a concern after losses with above average volume following its earlier breakout attempt which failed. It recently reported earnings +46% on +24% sales revenues for the Mar '13 quarter, continuing its strong growth trend satisfying the C criteria. The high-ranked Electronic - Parts firm may likely find support above its 50-day moving average (DMA) line and continue rallying, however disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price.

Volume +47% Above Average Behind Gain for New Highs - Friday, May 03, 2013

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.Proto Labs Inc (PRLB +$2.63 or +5.02% to $55.05 ) was highlighted in yellow in the earlier mid-day report (read

here) and it returned to the Featured Stocks list with the previously cited pivot point still considered a very important threshold. It hit a new 52-week high today and posted a solid gain backed by +47% above average volume. That was sufficient to clinch a technical buy signal. It recently reported earnings +46% on +24% sales revenues for the Mar '13 quarter, continuing its strong growth trend satisfying the C criteria. The high-ranked Electronic - Parts firm found prompt support near its 50-day moving average (DMA) line after undercutting that important short-term average when dropped from the Featured Stocks list back on 4/18/13. Volume was light or average behind gains as it rebounded.The number of top-rated funds owning its shares rose from 131 in Jun '12 to 204 in Mar '13, a reassuring trend concerning the I criteria. Its small supply of only 18.9 million shares (S criteria) in the publicly traded float is ideal, yet it can contribute to greater price volatility in the event of institutional buying or selling. Its Accumulation/ Distribution Rating of D- is a concern after losses with above average volume following its earlier breakout attempt which failed.

Longtime readers may recall a change in recent years where the bare minimum volume threshold for fans of the fact-based investment system was lowered to +40% above average from +50% above average. With that in mind, while Friday's session for PRLB may have been above the +40% threshold, however the market's biggest winners often vaulted above their pivot points with very heavy volume totals that were several times that of a typical trading session. In this case, additional volume-driven gains could provide an encouraging reassurance that serious institutional buying demand is lurking and can lead to a substantial and sustained advance in price.

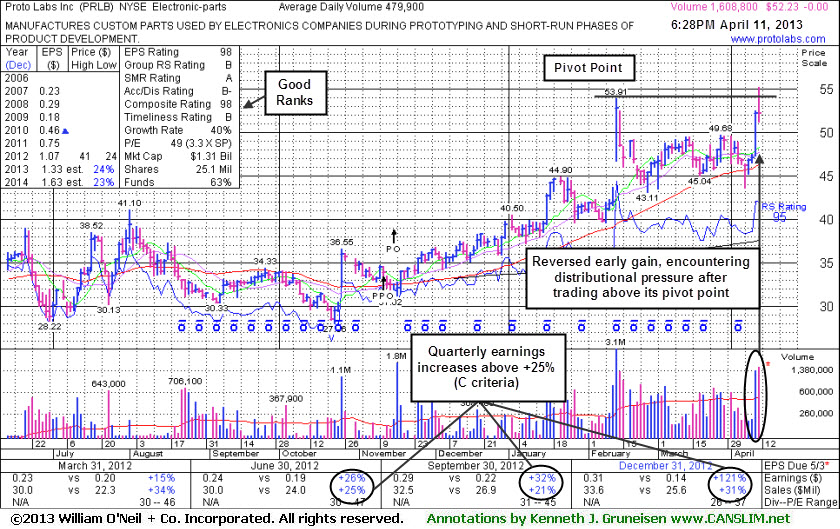

Encountered Distributional Pressure After Trading Above Pivot Point - Thursday, April 11, 2013

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Proto Labs Inc (PRLB $52.23) finished unchanged today after making its 2nd consecutive mid-day report appearance. It had finished strong on the prior session after highlighted in yellow in the mid-day report (read here) but didn't trigger a technical buy signal. Then it hit a new 52-week high and traded above the pivot point cited based on its 2/13/13 high plus 10 cents, but it encountered distributional pressure and ended the session flat. A strong finish above the pivot point would have clinched a convincing technical buy signal.

It found support at its 50-day moving average (DMA) line recently. It had been noted in the 2/14/13 mid-day report with caution while retreating following a considerable "breakaway gap". The high-ranked Electronics - Parts firm reported earnings +121% on +31% sales revenues for the quarter ended December 31, 2012 versus the year ago period, marking a 3rd consecutive quarter with earnings increases above the +25% minimum guideline (C criteria) and helping it match up better with the fact-based investment system's winning models. Completed a new Public Offering on 11/15/12. The number opf top-rated funds owning its shares rose from 132 in Jun '12 to 199 in Mar '13, a reassuring sign concerning the I criteria.