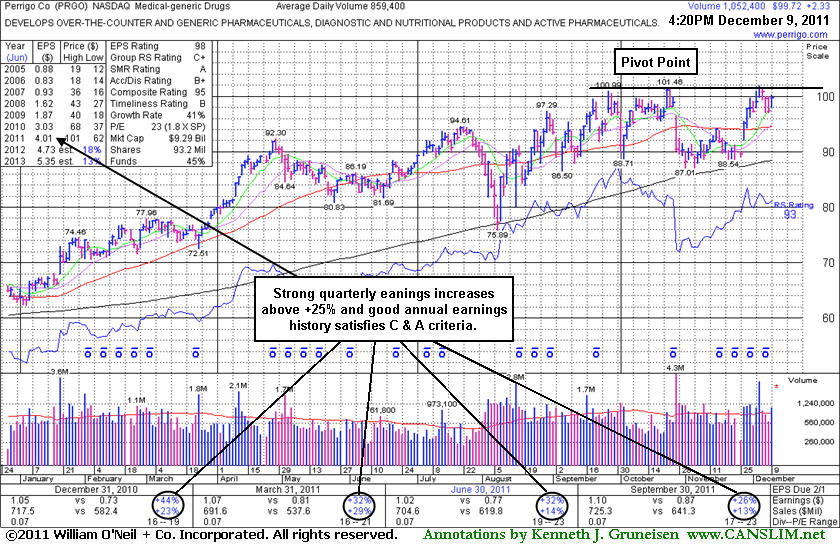

It reported earnings +26% on +13% sales revenues for the quarter ended September 30, 2011 versus the year ago period. Strong quarterly and annual earnings history satisfies the C & A criteria of the investment system. Ownership by top-rated funds rose from 647 in Dec '10 to 773 in Dec '11, which is a reassuring trend concerning the I criteria. It found prompt support at its 200 DMA line during the earlier consolidation. It is still considered a riskier late-stage setup. It faces resistance due to overhead supply up through the $102 area, and disciplined investors would watch for additional confirming gains with heavy volume before considering any new buying efforts.

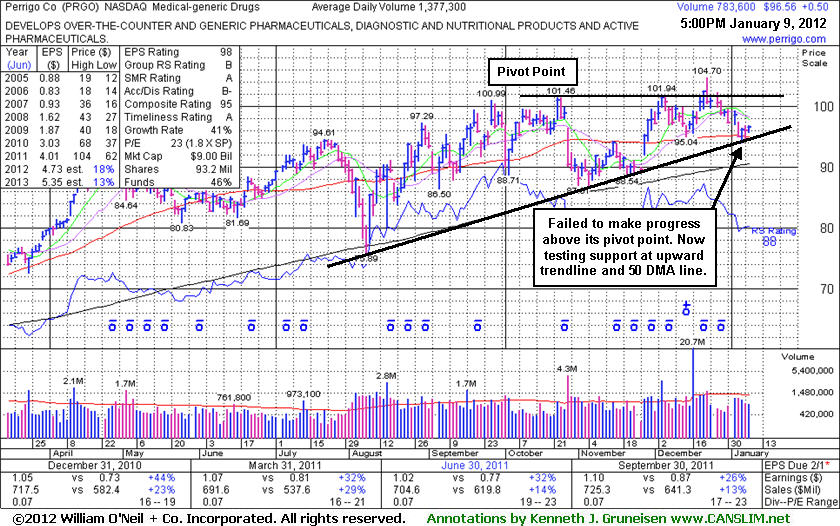

Perrigo Co (PRGO +$2.24 or +2.30% to $99.63) was featured in yellow in the mid-day report earlier today with a new pivot point cited based on its 10/25/11 high plus 10 cents. It has formed a late-stage base, while confirming gains above its pivot point are still needed to trigger a proper new technical buy signal.

It reported earnings +26% on +13% sales revenues for the quarter ended September 30, 2011 versus the year ago period. Strong quarterly and annual earnings history satisfies the C & A criteria of the investment system. Ownership by top-rated funds rose from 647 in Dec '10 to 703 in Sep '11, which is a reassuring trend concerning the I criteria. It found prompt support at its 200 DMA line during the latest consolidation from new all-time highs that were hit since it was last noted in the 10/04/11 mid-day report. Following its last appearance in this FSU section with an annotated graph on 7/13/11 under the headline, "New Orderly Base And Better Earnings Increases", it slumped its 200-day moving average (DMA) line and was dropped from the Featured Stocks list. Now it is considered a riskier late-stage setup. It faces no resistance due to overhead supply, but disciplined investors would watch for additional confirming gains with heavy volume.

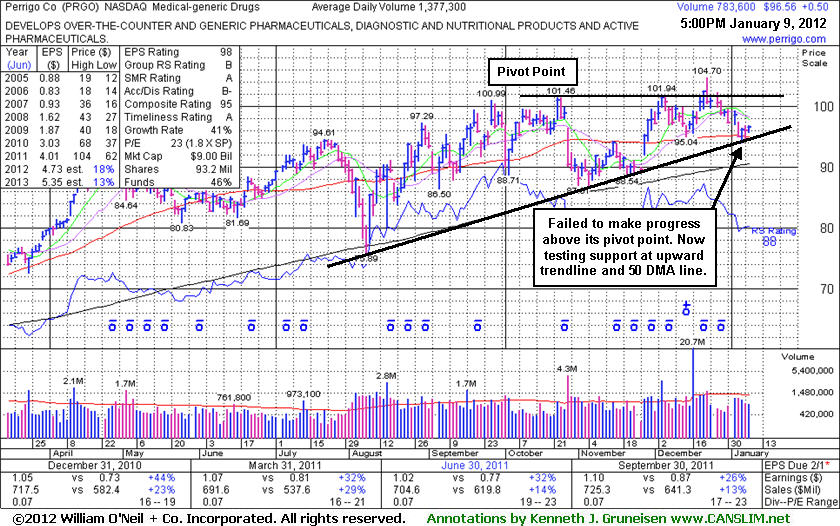

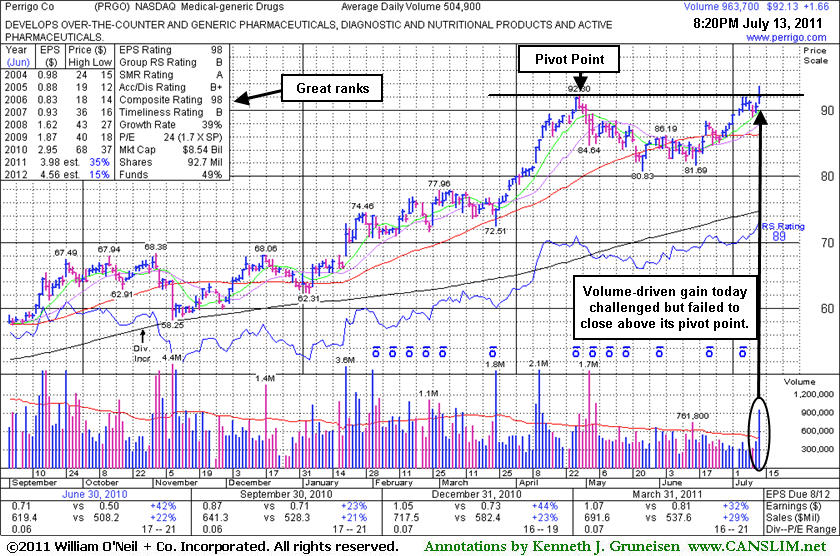

Perrigo Co (PRGO +$1.66 or +1.83% to $92.13) hit a new 52-week high today after a small gap up. While rising from an orderly saucer shaped 11-week base with a shorter than 1-week handle its color code was changed to yellow when featured in the mid-day report (read here) with new pivot point cited based on its 52-week high plus 10 cents. A strong volume-driven gain and close above its pivot may trigger a technical buy signal, however it is considered a riskier late-stage setup. It faces no resistance due to overhead supply but it did not quite finish the session high enough to clinch a convincing buy signal today, so disciplined investors may watch for additional confirming gains with heavy volume.

Following its last appearance in this FSU section with an annotated graph on 11/09/10 under the headline, "Weakening Technical And Fundamental Characteristics Raised Concerns", it was noted and dropped from the Featured Stocks list. Technically, it broke out in January and found support at its 50 DMA line during its ascent, however its Relative Strength line did not lead the way or provide confirmation and it was not highlighted following its 1/20/11 "breakaway gap" into new high territory. Following its sub par earnings increase in September there had been fundamental concerns as well. However, it improved earnings +44% on +23% sales for the quarter ended Dec 31, 2010. The March 2011 quarter also showed increases above the +25% guideline. It was noted in the 5/03/11 mid-day report - "Disciplined investors may watch for secondary buy points to possibly develop and be noted. Found support at its 50 DMA line, and made steady progress following its 1/20/11 breakaway gap'. Found support near its 200 DMA line since noted on 11/09/10 when it was dropped from the Featured Stocks list - 'Reported its smallest percentage earnings increase in 5 quarters, after +73%, +56%, +52%, +42%, in the Sept '09, Dec '09, Mar '10, and Jun '10 quarters respectively versus the year ago periods, its earnings were up just +23% for the latest quarter ended September 30, 2010.'"

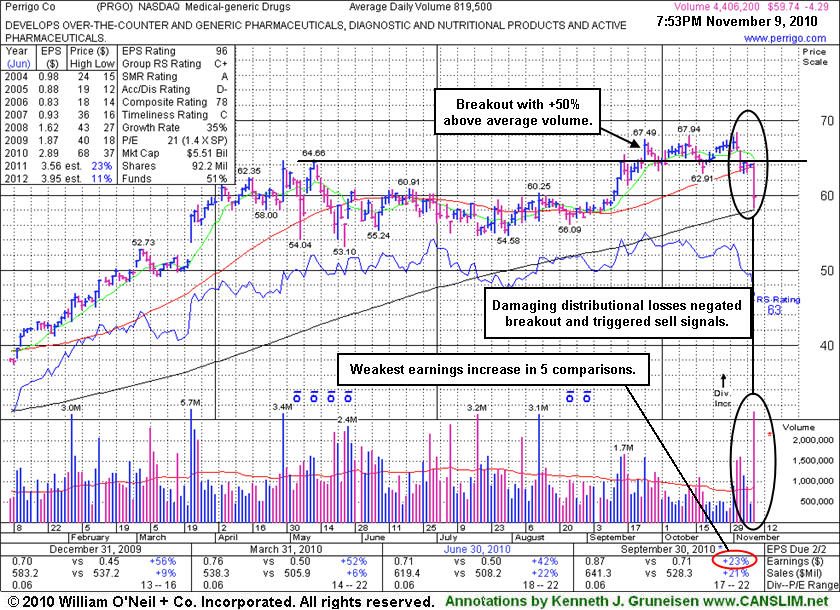

Perrigo Co (PRGO -$4.29 or -6.70% to $59.74) was down considerably today with more than 5 times average volume, a sign of heavy distributional pressure while violating its 50-day moving average (DMA) line and prior lows triggering technical sell signals. While it may find support near its 200 DMA line, only a prompt rebound above its short-term average would help its outlook. Based on deterioration it will be dropped from the Featured Stocks list tonight.

Following its last appearance in this FSU section with an annotated graph on 9/15/10 under the headline, "Strong Close Near Pivot Point After Mid-Day Report, its subsequent 9/24/10 gap up gain with +50% above average volume for a new 52-week high had triggered a technical buy signal with volume near the minimum guideline. However, it stalled there and failed to produce any confirming gains afterward with volume conviction. On 11/02/10 it was noted - "Reported its smallest percentage earnings increase in 5 quarters, after +73%, +56%, +52%, +42%, in the Sept '09, Dec '09, Mar '10, and Jun '10 quarters respectively versus the year ago periods, its earnings were up just +23% for the latest quarter ended September 30, 2010." Then on 11/03/10, a loss with heavy volume followed the worrisome negative reversal after it had hit a new 52-week high on the prior session. Its color code was then changed to green "based on disappointing technical action and weaker earnings growth."

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

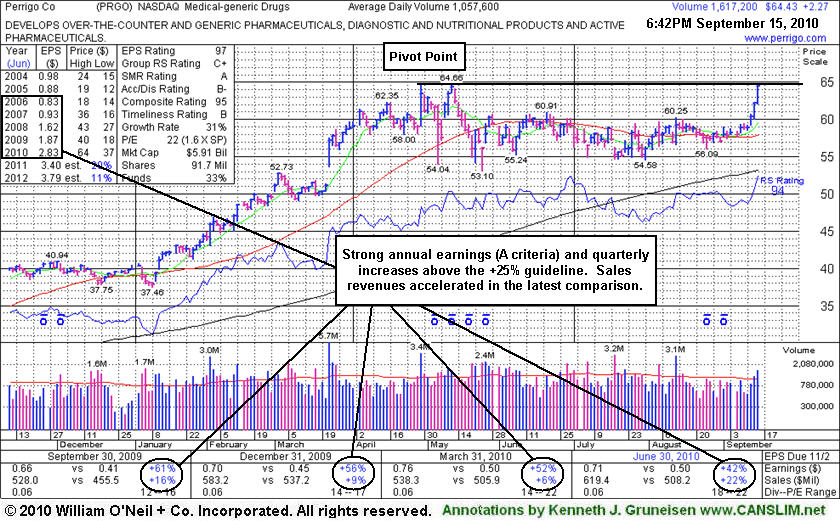

Perrigo Co (PRGO +$2.27 or +3.65% to $64.43) rallied near its 52-week high and finished at a new high close today. After an orderly 5-month base, its color code was changed to yellow as it was featured in yellow in the mid-day report today (read here), while confirming gains with above average volume and a close above the pivot point cited would trigger a technical buy signal. No overhead supply remains to act as resistance. The high-ranked Medical - Generic Drugs firm's sales revenues showed a +22% increase (acceleration) in the latest quarter. It has shown very strong quarterly earnings increases and has a good annual earnings (A criteria) history.