Fitness Firm Forming a New Base - Friday, July 26, 2019

Planet Fitness Inc Cl A (PLNT +$1.34 or +1.72% to $79.16) tallied 3 consecutive gains that lacked volume conviction as it rebounded above its 50-day moving average (DMA) line ($76.72). A new pivot point has been cited based on its 6/18/19 high plus 10 cents. Subsequent gains above its pivot point backed by at least +40% above average volume are needed to trigger a proper new (or add-on) technical buy signal. Disciplined investors know to be patient and watch for volume-driven gains as fresh proof of institutional buying demand which can lead to a meaningful and sustained advance in price. It has rebounded to where, in recent weeks, it met stubborn resistance near the $81 level. Meanwhile, recent lows ($73.25 on 7/23/19 and $70.10 on 6/26/19) define important near-term support to watch on pullbacks.

It is due to report Jun '19 quarterly earnings news on 8/06/16. Volume and volatility often increase near earnings news. Fundamentals have been strong. It last reported earnings +30% on +23% sales revenues for its first quarter ended March 31, 2019, marking a 5th consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

It is due to report Jun '19 quarterly earnings news on 8/06/16. Volume and volatility often increase near earnings news. Fundamentals have been strong. It last reported earnings +30% on +23% sales revenues for its first quarter ended March 31, 2019, marking a 5th consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

PLNT suffered damaging volume-driven losses but proved resilient since last shown in this FSU section on 6/21/19 with an annotated graph under the headline, "Undercut 50-Day Moving Average With Volume Behind Losses". It has not paused to spend much time basing while it traded up as much as +43.4% since first highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here).

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 642 in Jun '19, a reassuring sign concerning the I criteria. However, the current Up/Down Volume Ratio of 0.8 is an unbiased indication its shares have been under distributional pressure over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 77.7 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

Undercut 50-Day Moving Average With Volume Behind Losses - Friday, June 21, 2019

Planet Fitness Inc Cl A (PLNT $76.01 -$2.18 -2.79%) has encountered distributional pressure. Its 2nd consecutive volume-driven loss on Friday violated its 50-day moving average (DMA) line ($76.37) raising concerns and triggering a technical sell signal. The prior low ($73.73 on 5/23/19) defines the next important near-term support top watch. It did not form a sound base and there was a "negative reversal" at its high when last noted with caution following 4 consecutive gains marked by below average volume.

Fundamentals remain strong as it recently reported earnings +30% on +23% sales revenues for its first quarter ended March 31, 2019, marking a 5th consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

PLNT found support above its 50 DMA line and wedged higher after last shown in this FSU section on 5/23/19 with an annotated graph under the headline, "Pulling Back From High After Impressive Rally". It traded up as much as +43.4% since first highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here).

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 601 in Mar '19, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 1.2 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of C. Its small supply of 76.9 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

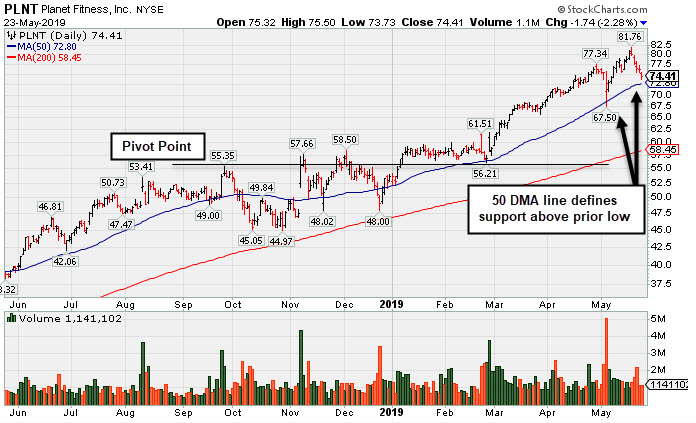

Pulling Back From High After Impressive Rally - Thursday, May 23, 2019

Planet Fitness Inc Cl A (PLNT -$1.74 or -2.28% to $74.41) pulled back today for a 5th consecutive loss after getting very extended from any sound base. Its 50-day moving average (DMA) line ($72.80) and prior low define near-term support.

Fundamentals remain strong as it recently reported earnings +30% on +23% sales revenues for its first quarter ended March 31, 2019, marking a 5th consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

PLNT traded up as much as +43% since first highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here). It rallied impressively into new high territory since last shown in this FSU section on 4/05/19 with an annotated graph under the headline, "Perched Near High Very Extended From Prior Base".

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 595 in Mar '19, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 1.2 is an unbiased indication its shares have been under slight accumulation over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 76.1 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

Perched Near High Very Extended From Prior Base - Friday, April 5, 2019

Planet Fitness Inc Cl A (PLNT +$0.72 or +1.02% to $71.47) is perched at its all-time high, very extended from any sound base. Its 50-day moving average (DMA) line (62.70) defines near-term support above prior highs in the $59-60 area.

Fundamentals remain strong. It reported earnings +42% on +30% sales revenues for the Dec '18 quarter, marking a 4th consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Recent comparisons showed impressive sales revenues acceleration. Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

PLNT was highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here). It rallied impressively since last shown in this FSU section on 2/27/19 with an annotated graph under the headline, "Met Distributional Pressure While Hitting New High After Earnings".

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 580 in Dec '18, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 2.0 is an unbiased indication its shares have been under accumulation over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 80.2 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

Met Distributional Pressure While Hitting New High After Earnings - Wednesday, February 27, 2019

Planet Fitness Inc Cl A (PLNT +$1.56 or +2.74% to $58.45) ended near the session's low after a big gap up today hitting another new all-time high. It posted a volume-driven gain ending above the "max buy" level and its color code was changed to green. It endured distributional pressure this week but found support near its 50-day moving average DMA line ($56.52) and recent low.

It reported earnings +42% on +30% sales revenues for the Dec '18 quarter, marking a 4th consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Recent comparisons showed impressive sales revenues acceleration. Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

PLNT was highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here). It was last shown in this FSU section on 1/25/19 with an annotated graph under the headline, "Hovering in a Tight Range Near All-Time High".

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 530 in Dec '18, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 80.2 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

Hovering in a Tight Range Near All-Time High - Friday, January 25, 2019

Planet Fitness Inc Cl A (PLNT -$0.05 or -0.09% to $57.57) has been quietly consolidating below its "max buy" level and holding its ground in a tight range near its all-time high. Its 50-day moving average DMA line ($54.69) defines important near-term support to watch above the recent low ($48).

PLNT was highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here). It was last shown in this FSU section on 1/04/19 with an annotated graph under the headline, " Found Prompt Support Near 50-Day Moving Average Line".

Bullish action came after it reported earnings +47% on +40% sales revenues for the Sep '18 quarter, marking a 3rd consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Recent comparisons showed impressive sales revenues acceleration. Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 524 in Dec '18, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 80.2 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

Found Prompt Support Near 50-Day Moving Average Line - Friday, January 4, 2019

Planet Fitness Inc Cl A (PLNT +$2.12 or +4.02% to $54.92) is consolidating above its 50-day moving average (DMA) line ($52.23) after finding prompt in recent weeks. It faces little resistance due to overhead supply up to the $58.50 level. The recent low ($48.00) and its 200 DMA line ($47.06) define the important near-term support.is still perched near its all-time high, showing strength and resilience in an unhealthy market environment. Its 50-day moving average (DMA) line and recent low ($48.02 on 11/20/18) define important near-term support to watch on pullbacks.

PLNT was highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here). It was last shown in this FSU section on 12/14/18 with an annotated graph under the headline, "Fitness Firm Remains Near High Despite Unhealthy Environment".

Bullish action came after it reported earnings +47% on +40% sales revenues for the Sep '18 quarter, marking a 3rd consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Recent comparisons showed impressive sales revenues acceleration. Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 497 in Sep '18, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 80.2 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

Fitness Firm Remains Near High Despite Unhealthy Environment -

Planet Fitness Inc Cl A (PLNT -$0.44 or -0.81% to $54.02) is still perched near its all-time high, showing strength and resilience in an unhealthy market environment. Its 50-day moving average (DMA) line and recent low ($48.02 on 11/20/18) define important near-term support to watch on pullbacks.

PLNT was highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here). It was last shown in this FSU section on 11/29/18 with an annotated graph under the headline, "Fitness Firm Perched Near All-Time High".

Bullish action came after it reported earnings +47% on +40% sales revenues for the Sep '18 quarter, marking a 3rd consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Recent comparisons showed impressive sales revenues acceleration. Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 497 in Sep '18, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 1.2 is an unbiased indication its shares have been under accumulation over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 80.2 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

Fitness Firm Perched Near All-Time High - Thursday, November 29, 2018

Planet Fitness Inc Cl A (PLNT -$0.77 or -1.36% to $55.98) is perched near its all-time high. Its 50-day moving average (DMA) line and recent low ($48.02 on 11/20/18) define important near-term support to watch on pullbacks. It was highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the 11/07/18 mid-day report (read here). Big Gain for New High With Nearly 4 Times Average Volume - 11/7/2018

Bullish action came after it reported earnings +47% on +40% sales revenues for the Sep '18 quarter, marking a 3rd consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Recent comparisons showed impressive sales revenues acceleration. Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 494 in Sep '18, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 80.2 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com

Big Gain for New High With Nearly 4 Times Average Volume - Wednesday, November 7, 2018

Planet Fitness Inc Cl A (PLNT +$8.09 or +17.04% to $55.57) was highlighted in yellow with pivot point cited based on its 9/26/18 high plus 10 cents in the earlier mid-day report (read here). It gapped up today hitting a new all-time high. The big gain and close above the pivot point backed by nearly 4 times average volume triggered a technical buy signal. Recently it had met resistance and sputtered below its 50-day moving average (DMA) line ($49.62).

Bullish action came after it reported earnings +47% on +40% sales revenues for the Sep '18 quarter, marking a 3rd consecutive quarterly earnings comparison above the +25% minimum guideline (C criteria). Recent comparisons showed impressive sales revenues acceleration. Annual earnings (A criteria) history included a small downturn in FY '15 but has been strong since. Completed its Aug 2015 IPO at $14.06 and completed Secondary Offerings on 6/22/16, 9/26/16, 3/10/17 and 5/08/17.

The number of top-rated funds owning its shares rose from 373 in Dec '17 to 494 in Sep '18, a reassuring sign concerning the I criteria. The current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. It has earned a Timeliness Rating of A and Sponsorship Rating of B. Its small supply of 80.2 million shares in the public float can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy of www.stockcharts.com