Nxp Semiconductors N V (NXPI -$1.18 or -1.13% to $103.42) pulled back today with below average volume. It has been quietly consolidating near its 50-day moving average (DMA) line which has recently acted as support. More damaging losses undercutting the 50 DMA line and prior lows ($101.15 on 6/09/15) may raise concerns and trigger worrisome technical sell signals.

NXPI stalled soon after it triggered a technical buy signal with 3 consecutive volume-driven gains into new high territory. It was last shown in this FSU section on 6/01/15 with annotated graphs under the headline, "Quietly Perched at All-Time High Following Volume-Driven Gains", as it touched a new high but reversed into the red for a small loss on light volume.

It has reported earnings +36%, +54%, +59%, +36%, and +38% for the Mar, Jun, Sep, Dec '14, and Mar '15 quarters, respectively, versus the year ago periods. The strong and steady earnings above the +25% minimum guideline satisfy the C criteria. Sales revenues rose +15%, +14%, +21%, +19%, and +18% during that same span of time. Its annual earnings (A criteria) history is a good match the investment system guidelines.

Nxp Semiconductors N V (NXPI -$0.27 or -0.24% to $111.98) touched a new high today but reversed into the red for a small loss on light volume. It triggered a technical buy signal last week as it rallied into new high territory with 3 consecutive volume-driven gains. No overhead supply remains to act as resistance. On pullbacks its 50-day moving average (DMA) line ($101.93) defines important near-term chart support where more damaging losses may raise concerns and trigger worrisome technical sell signals.

It has reported earnings +36%, +54%, +59%, +36%, and +38% for the Mar, Jun, Sep, Dec '14, and Mar '15 quarters, respectively, versus the year ago periods. The strong and steady earnings above the +25% minimum guideline satisfy the C criteria. Sales revenues rose +15%, +14%, +21%, +19%, and +18% during that same span of time. Its annual earnings (A criteria) history is a good match the investment system guidelines.

NXPI was last shown in this FSU section on 5/08/15 with annotated graphs under the headline, "Rallied Toward Prior Highs Following Earnings News". On 3/02/15 it gapped up for a considerable gain and new all-time high on news it was to acquire Freescale Semiconductor Inc (FSL) in an $11.8 Billion deal. During the consolidation that followed a new pivot point was cited, but it briefly undercut its 50 DMA line and took several weeks to finally overcome all resistance due to overheard supply.

The weekly chart covering a 2-year period shows earlier pivot points that were identified. It traded up as much as +49.15% since highlighted in yellow at $76.43 with a pivot point based on its 11/28/14 high plus 10 cents in the 1/05/15 mid-day report (read here). There had been an abrupt pullback and impressive rebound after an earlier breakout. The number of top-rated funds owning its shares rose from 683 in Mar '14 to 1,027 in Mar '15, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 98 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

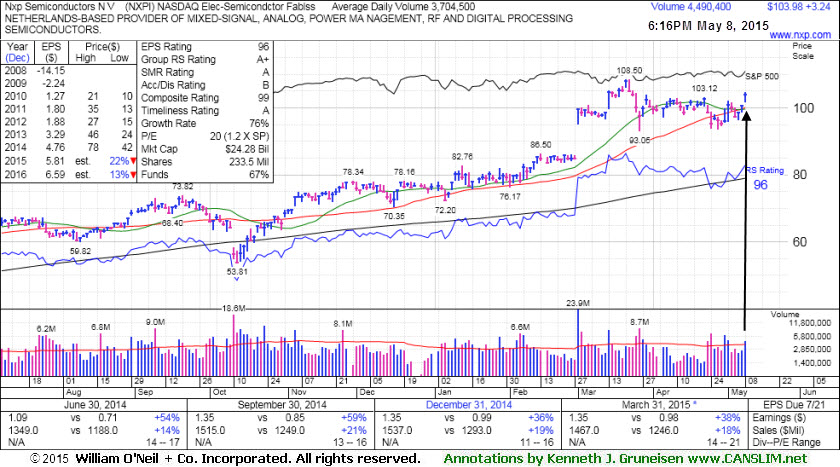

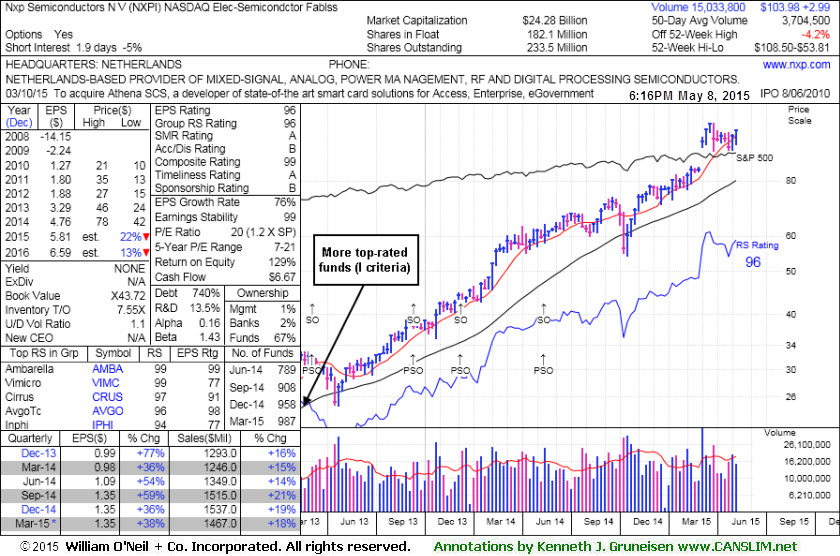

Nxp Semiconductors N V (NXPI +$3.24 or +3.22% to $103.98) posted a gain with above average volume, rallying near its 52-week high after finding support near its 50-day moving average (DMA) line. It reported earnings +38% on sales revenues +18% for the Mar '15 quarter. Little overhead supply remains through the $108 level which may act as resistance. A subsequent volume-driven breakout to new highs may trigger a new technical buy signal. Recent lows near $93.50 define important chart support where more damaging losses may raise concerns and trigger worrisome technical sell signals.

NXPI was last shown in this FSU section on 4/16/15 with annotated graphs under the headline, "Forming New Base Above 50-Day Moving Average Line". It gapped up for a considerable gain and new all-time high on 3/02/15 news it will acquire Freescale Semiconductor Inc (FSL) in an $11.8 Billion deal. It traded up as much as +41.9% since first highlighted in yellow with a pivot point based on its 11/28/14 high plus 10 cents in the 1/05/15 mid-day report (read here).

Fundamentals remain strong through the Mar '15 quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history is a good match the investment system guidelines. The number of top-rated funds owning its shares rose from 683 in Mar '14 to 987 in Mar '15, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 96 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

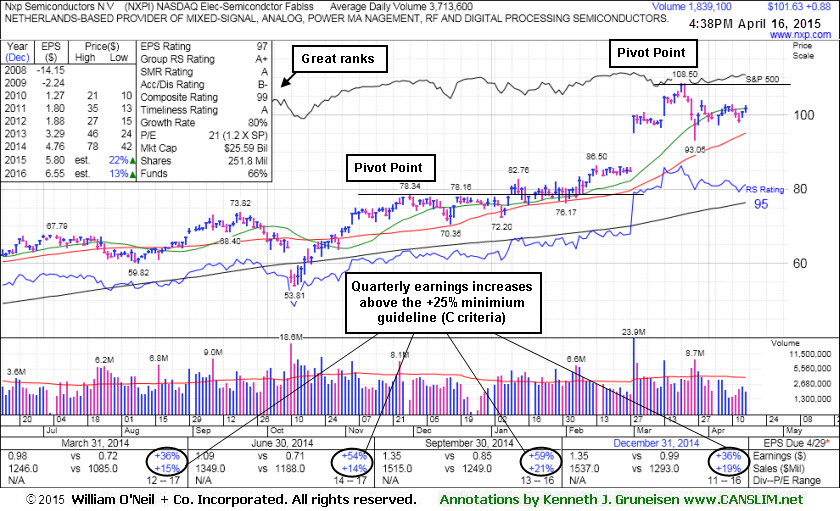

Nxp Semiconductors N V (NXPI +$0.88 or +0.87% to $101.63) has seen its trading volume totals drying up while consolidating. Its color code was changed to yellow with new pivot point cited based on its 3/23/15 high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a new (or add-on) technical buy signal. Disciplined investors watching it now might wait for fresh proof of heavy institutional buying demand before taking action.

The 50-day moving average (DMA) line ($95.12) defines important near-term support to watch above the recent lows. Subsequent violations would raise concerns and trigger a technical sell signal. NXPI halted its slide immediately after it was last shown in this FSU section on 3/26/15 with annotated graphs under the headline, "Pullback Following Considerable Rally of 41.9% Since Start of Year". It had just suffered a 4th consecutive loss on ever-increasing volume while retreating from its all-time high, yet finished in the upper part of its intra-day range, an encouraging sign it was finding support.

It gapped up for a considerable gain and new all-time high on 3/02/15 news it will acquire Freescale Semiconductor Inc (FSL) in an $11.8 Billion deal. It traded up as much as +41.9% since first highlighted in yellow with a pivot point based on its 11/28/14 high plus 10 cents in the 1/05/15 mid-day report (read here).

Fundamentals remain strong through the Dec '14 quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history is a good match the investment system guidelines. Its slightly bullish 1.2 Up/Down Volume Ratio is above 1.0, an unbiased indication of institutional accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 683 in Mar '14 to 948 in Mar '15, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 98 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

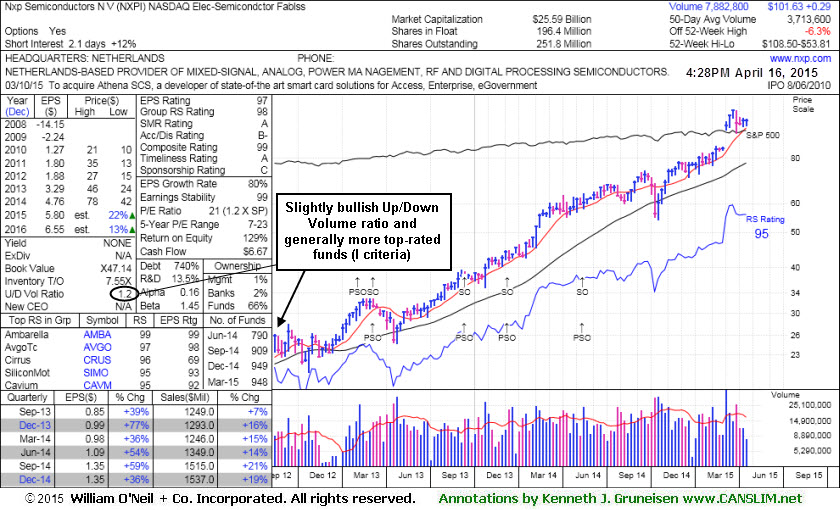

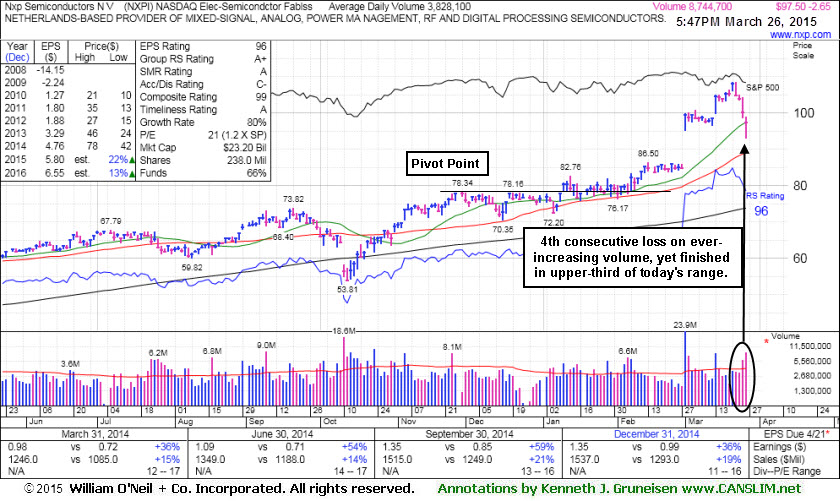

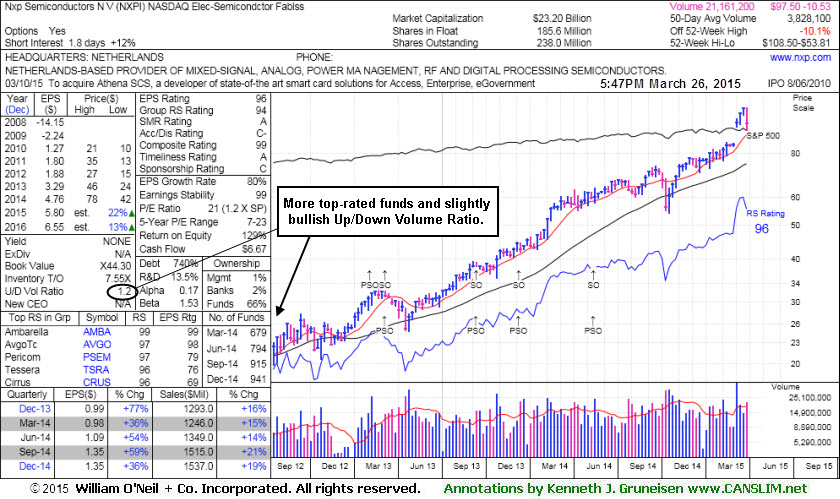

NXPI was last shown in this FSU section on 3/09/15 with annotated graphs under the headline, "Very Extended Following Gap Up Gain on M&A News". It gapped up for a considerable gain and new all-time high on 3/02/15 news it will acquire Freescale Semiconductor Inc (FSL) in an $11.8 Billion deal. It traded up as much as +41.9% since first highlighted in yellow with a pivot point based on its 11/28/14 high plus 10 cents in the 1/05/15 mid-day report (read here). Subsequent gains above the pivot point on 1/09/15 were backed by +66% above average volume. That offered investors fresh proof of institutional buying demand driving the stock to new highs (N criteria) that triggered a new technical buy signal.

Fundamentals remain strong through the Dec '14 quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history is a good match the investment system guidelines. Its slightly bullish 1.2 Up/Down Volume Ratio is above 1.0, an unbiased indication of institutional accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 683 in Mar '14 to 941 in Dec '14, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 94 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

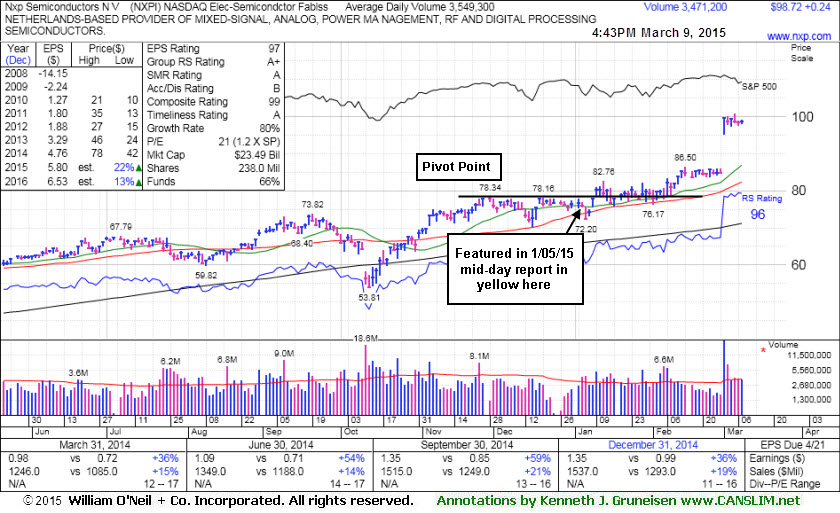

Nxp Semiconductors N V (NXPI +$0.24 or +0.24% to $98.72) is very extended from any sound base. It gapped up for a considerable gain and new all-time high on 3/02/15 news it will acquire Freescale Semiconductor Inc (FSL) in an $11.8 Billion deal. Disciplined investors avoid chasing extended stocks. NXPI was last shown in this FSU section on 2/17/15 with annotated graphs under the headline, "Perched at All-Time High, Extended From Prior Base".

It was highlighted in yellow with a pivot point based on its 11/28/14 high plus 10 cents in the 1/05/15 mid-day report (read here). Subsequent gains above the pivot point on 1/09/15 were backed by +66% above average volume. That offered investors fresh proof of institutional buying demand driving the stock to new highs (N criteria) that triggered a new technical buy signal.

Fundamentals remain strong through the Dec '14 quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history is a good match the investment system guidelines.

Its slightly bullish 1.4 Up/Down Volume Ratio is above 1.0, an unbiased indication of institutional accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 683 in Mar '14 to 946 in Dec '14, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 92 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

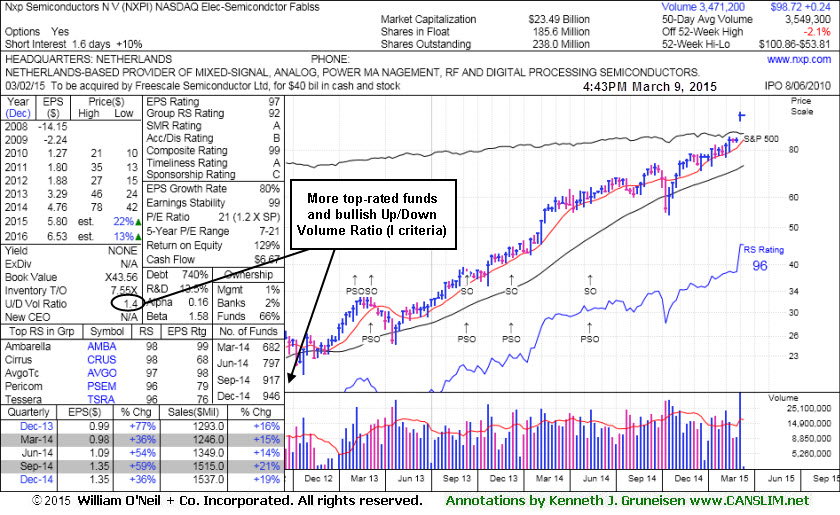

Nxp Semiconductors N V (NXPI -$1.07 or -1.26% to $83.72) is hovering near its new all-time high (N criteria) with volume totals cooling after rallying above its "max buy" level. Disciplined investors avoid chasing stocks more than +5% above their prior high or pivot point and always limit losses by selling any stock that falls more than -7% from their purchase price. When NXPI was last shown in this FSU section on 1/22/15 with annotated graphs under the headline, "50-Day Moving Average Acted as Support After 'Negative Reversal'", its finish in the upper third of its intra-day range was noted as a reassuring sign that it was finding support.

It was highlighted in yellow with a pivot point based on its 11/28/14 high plus 10 cents in the 1/05/15 mid-day report (read here). Subsequent gains above the pivot point on 1/09/15 were backed by +66% above average volume. That offered investors fresh proof of institutional buying demand driving the stock to new highs (N criteria) that triggered a new technical buy signal.

Fundamentals remain strong through the Dec '14 quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history is a good match the investment system guidelines.

Its slightly bullish 1.2 Up/Down Volume Ratio is above 1.0, an unbiased indication of institutional accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 683 in Mar '14 to 929 in Dec '14, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 93 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

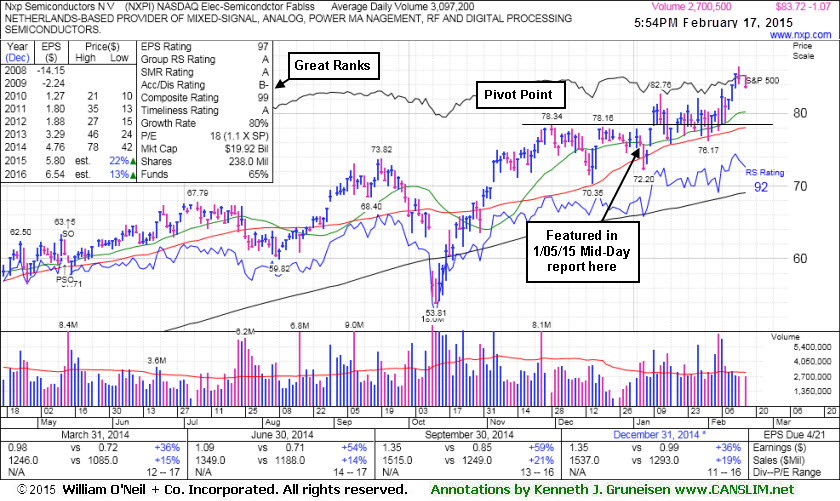

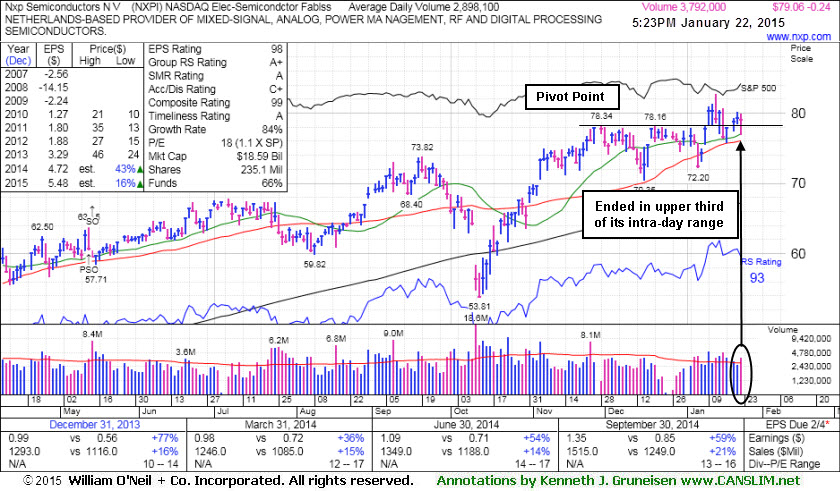

Nxp Semiconductors N V (NXPI -$0.24 or -0.30% to $79.06) finished with a loss today and the volume total was above average, but its finish in the upper third of its intra-day range was a reassuring sign that it was finding support. It is consolidating above its 50-day moving average (DMA) line which acted as support following a "negative reversal" last week at its 52-week high. A subsequent violation of the 50 DMA line would raise concerns and trigger a technical sell signal, although a look at its chart shows that it promptly repaired a recent violation of that important short-term average.

NXPI was last shown in this FSU section on 1/05/15 with annotated graphs under the headline, "Little Resistance Remains Due to Overhead Supply". It undercut its 50 DMA line shortly after highlighted in yellow with a pivot point based on its 11/28/14 high plus 10 cents in the mid-day report (read here). Then it promptly repaired the violation, a sign of reassuring institutional support. Subsequent gains above the pivot point on 1/09/15 were backed by +66% above average volume. That offered investors fresh proof of institutional buying demand driving the stock to new highs (N criteria) that triggered a new technical buy signal.

Fundamentals remain strong through the Sep '14 quarter with earnings above the +25% minimum guideline (C criteria) and its annual earnings (A criteria) history is a good match the investment system guidelines. Disciplined investors avoid chasing stocks more than +5% above their prior high or pivot point and always limit losses by selling any stock that falls more than -7% from their purchase price.

Its slightly bullish 1.2 Up/Down Volume Ratio is above 1.0, an unbiased indication of institutional accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 683 in Mar '14 to 906 in Dec '14, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 96 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

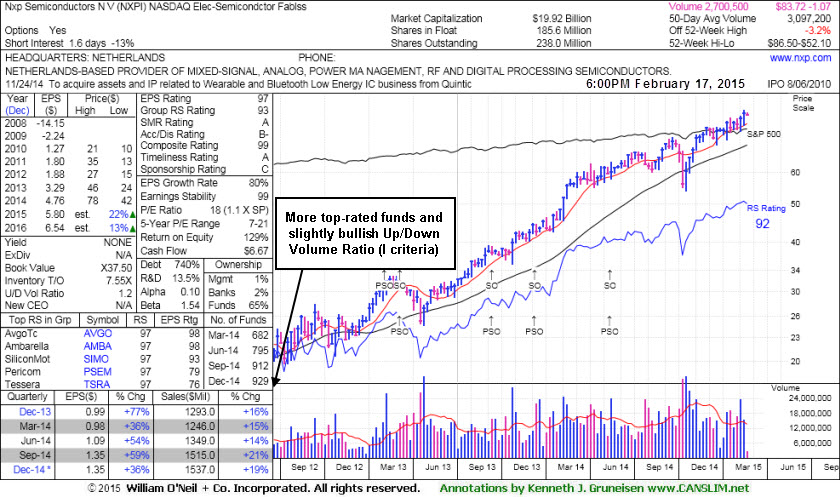

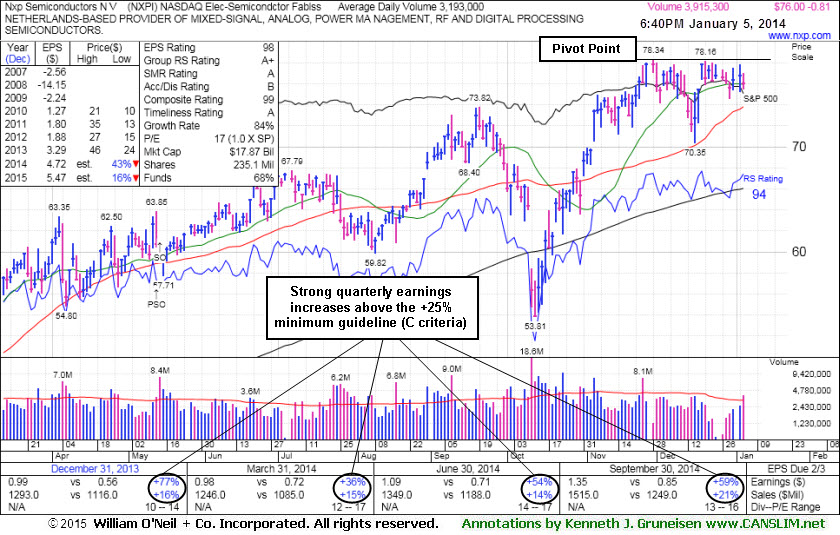

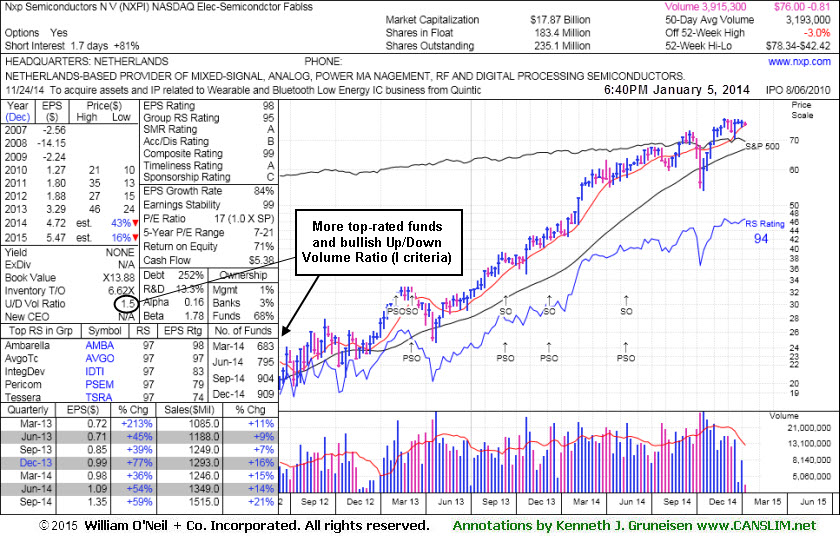

Nxp Semiconductors N V (NXPI -$0.81 or -1.05% to $76.00) has been building a new flat base while consolidating above its 50-day moving average (DMA) line, perched within close striking distance of its 52-week high. It was highlighted in yellow with a pivot point based on its 11/28/14 high plus 10 cents in the earlier mid-day report (read here). Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a new technical buy signal. Little resistance remains, however investors are reminded to be patient and watch for fresh proof of institutional buying demand driving the stock to new highs (N criteria).

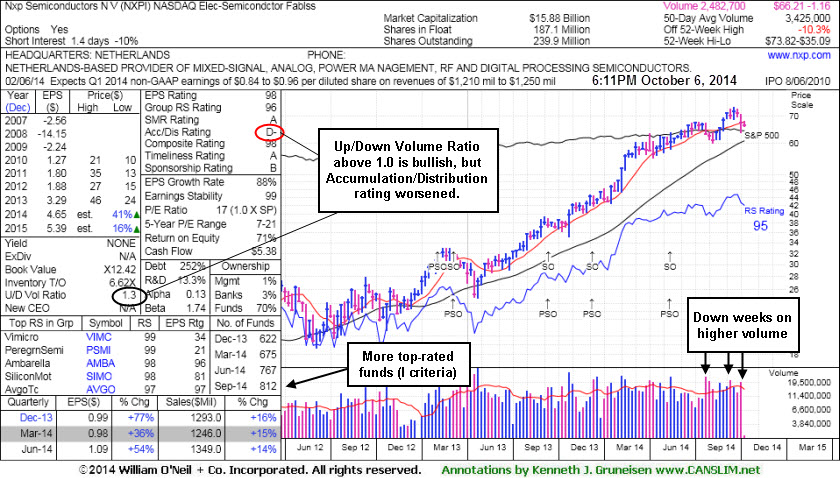

Fundamentals remain strong through the Sep '14 quarter with earnings above the +25% minimum guideline (C criteria) and its annual earnings (A criteria) history is a good match the investment system guidelines. NXPI rebounded impressively since damaging losses violated its 200 DMA line and it was dropped from the Featured Stocks list on 10/13/14. It was last shown in this FSU section on 10/06/14 with annotated graphs under the headline,, "Halted Slide After Negating Breakout and Undercutting 50-Day Average. Disciplined investors avoid chasing stocks more than +5% above their prior high or pivot point and always limit losses by selling any stock that falls more than -7% from their purchase price.

Its bullish 1.5 Up/Down Volume Ratio is above 1.0, an unbiased indication of institutional accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 683 in Mar '14 to 909 in Dec '14, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 95 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

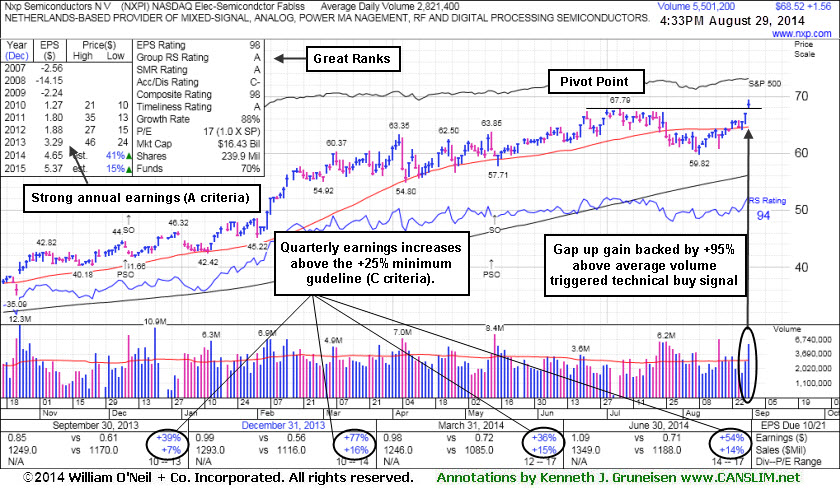

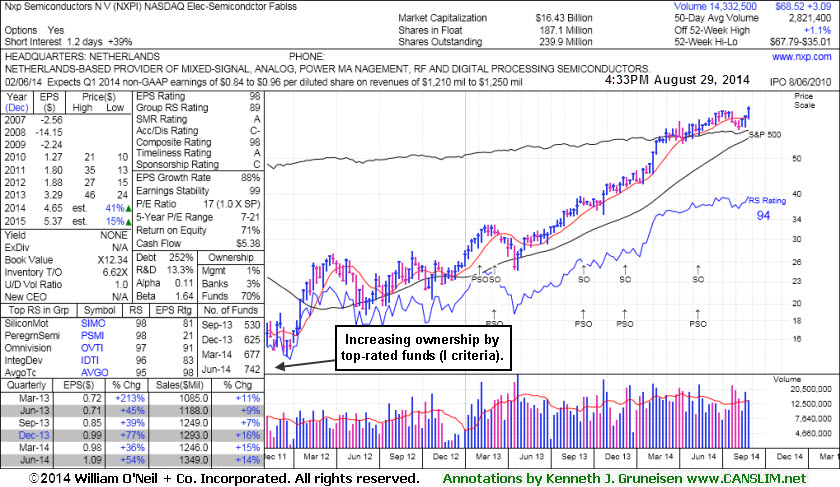

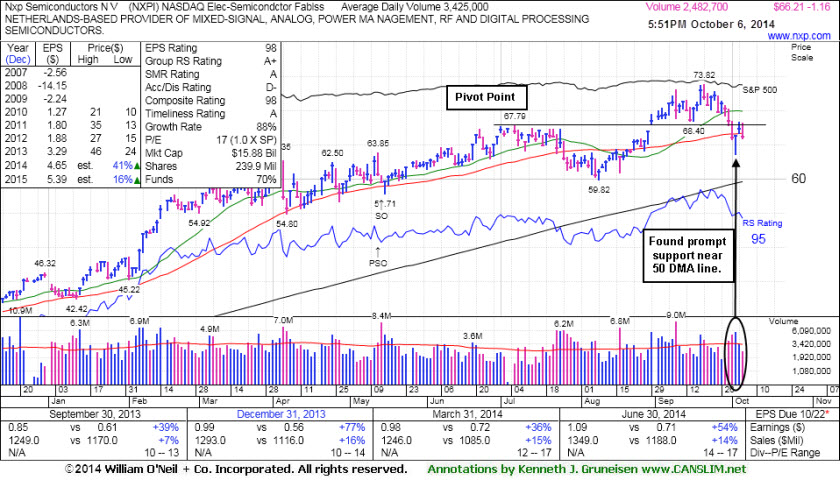

In recent weeks it tallied losses with higher volume as seen on the weekly graph below and it still has a bullish Up/Down Volume Ratio above 1.0, however its Accumulation/Distribution rating fell to D- from C+ since last shown in this FSU section on 9/17/14 with annotated graphs under the headline "Consolidating Above Pivot Point and Below 'Max Buy' Level". NXPI was highlighted in yellow with pivot point cited based on its 7/07/14 high plus 10 cents in the 8/29/14 mid-day report (read here). Its gap up gain backed by +95% above average volume helped it trigger a technical buy signal. Quarterly earnings (C criteria) through Jun '14 have shown strong growth and its annual earnings (A criteria) history is a good match the investment system guidelines. The number of top-rated funds owning its shares rose from 530 in Sep '13 to 812 in Jun '14, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 96 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

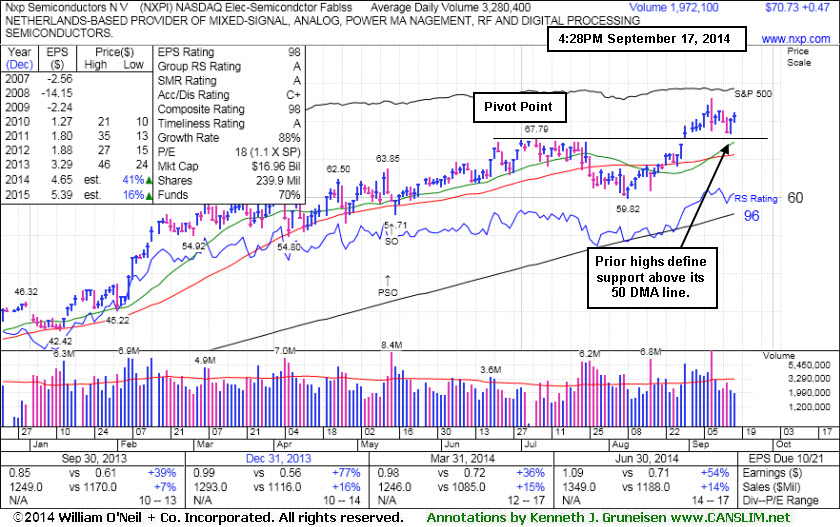

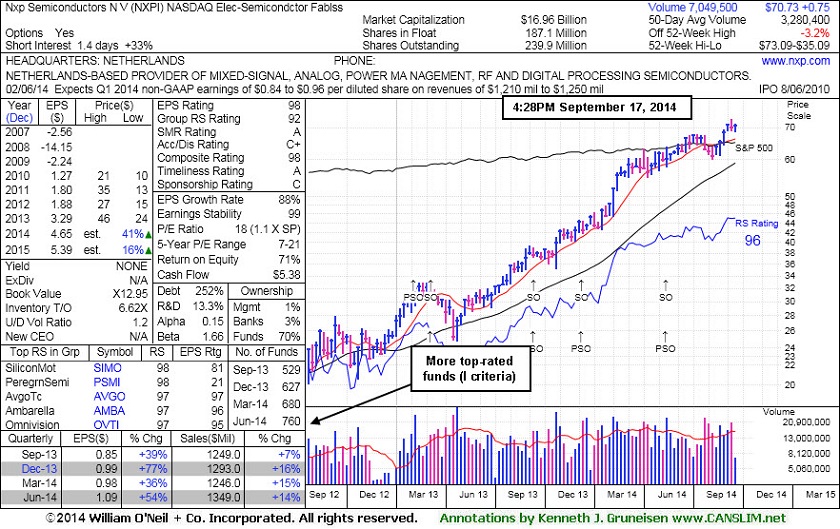

Nxp Semiconductors N V (NXPI +$0.47 or +0.67% to $70.73) has recently been consolidating above prior highs in the $67 area and above its 50-day moving average (DMA) line defining near-term support to watch on pullbacks. It is perched -3.2% off its 52-week high, remaining above its pivot point and below its "max buy" level. No overhead supply remains to act as resistance. Disciplined investors avoid chasing stocks more than +5% above their prior high or pivot point and always limit losses by selling any stock that falls more than -7% from their purchase price.

NXPI was last shown in this FSU section on 8/29/14 with annotated graphs under the headline, "Gap Up For New High With Volume Triggered Technical Buy Signal", after highlighted in yellow with pivot point cited based on its 7/07/14 high plus 10 cents in the earlier mid-day report (read here). Its gap up gain backed by +95% above average volume helped it trigger a technical buy signal.

Quarterly earnings (C criteria) through Jun '14 have shown strong growth and its annual earnings (A criteria) history is a good match the investment system guidelines. The number of top-rated funds owning its shares rose from 530 in Sep '13 to 760 in Jun '14, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 92 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

Quarterly earnings (C criteria) through Jun '14 have shown strong growth and its annual earnings (A criteria) history is a good match the investment system guidelines. The number of top-rated funds owning its shares rose from 530 in Sep '13 to 742 in Jun '14, a reassuring sign concerning the I criteria. The Elec - Semicondctor Fablss group has a high 89 Group Relative Strength Rating and leadership from others in the industry group is a reassuring sign concerning the L criteria. It completed a Secondary Offering on 5/14/14 and earlier Secondary Offerings on 2/04/13, 3/08/13, 9/13/13, and 12/10/13.

Disciplined investors avoid chasing stocks more than +5% above their prior high or pivot point and always limit losses by selling any stock that falls more than -7% from their purchase price.