Finished Strong While Challenging Pivot Point and Recent Highs - Tuesday, September 16, 2014

Finished Strong While Challenging Pivot Point and Recent Highs - Tuesday, September 16, 2014

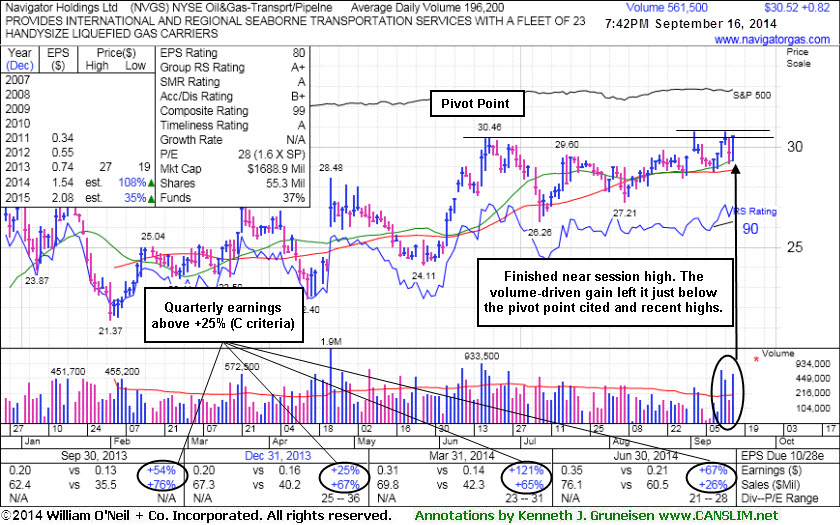

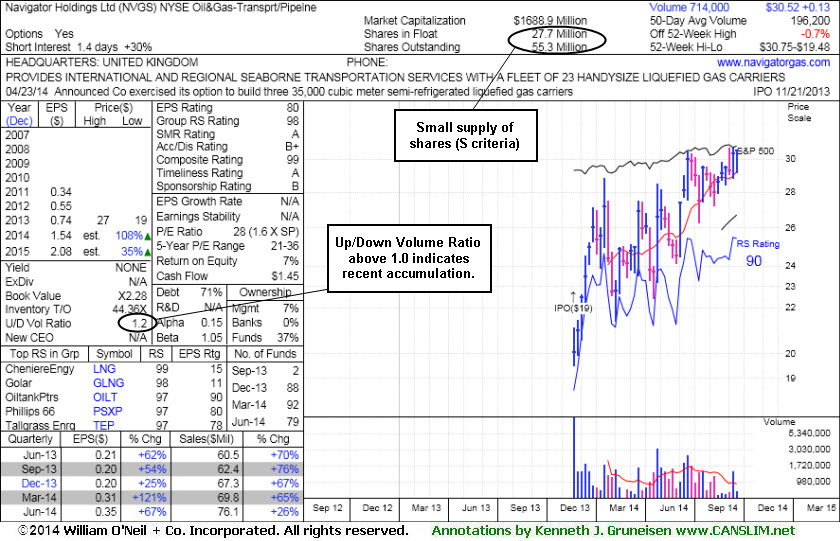

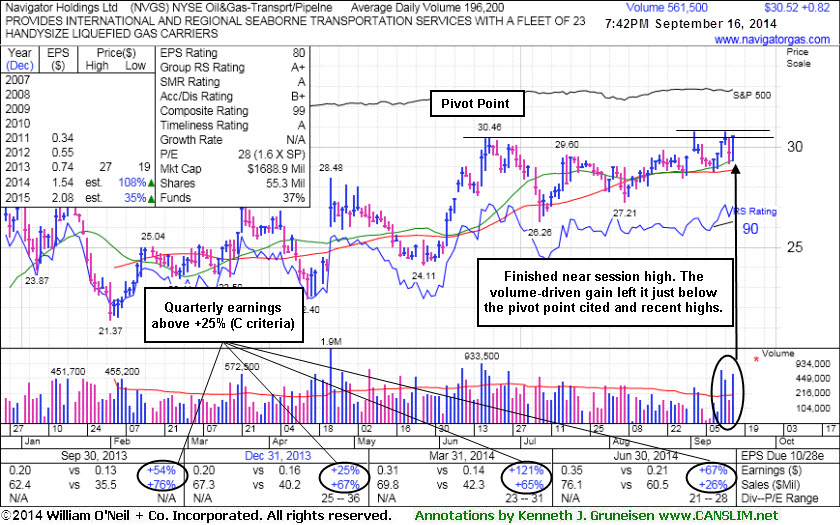

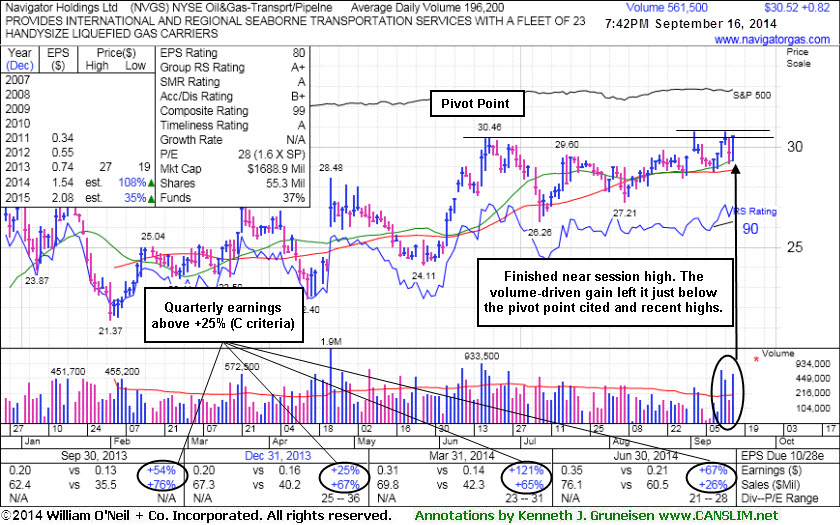

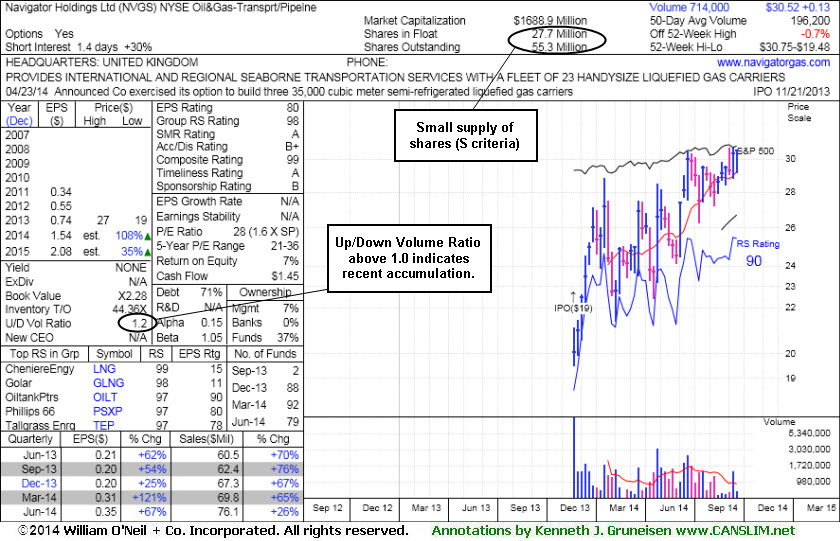

Navigator Holdings Ltd (NVGS +$0.82 or to $30.52) finished near the session high with a volume-driven gain after highlighted in yellow in the earlier mid-day report (read here). It formed an orderly base and found support when consolidating near its 50-day moving average (DMA) line. While it has recently been stalling, subsequent volume-driven gains above the cited pivot point based on its 6/19/14 high plus 10 cents could trigger a convincing technical buy signal. It came very close to that threshold with today's gain, and it is perched near its 52-week high with very little resistance remaining due to overhead supply. A powerful rally into new (N criteria) all-time high territory could help to confirm that meaningful buying demand is lurking from the institutional crowd which could lead to a sustained price advance.

The Oil & Gas - Transport/Pipeline industry group has an A+ Group Relative Strength rating, a reassuring sign concerning the L criteria. Its earnings history has been strong through the Jun '14 quarter with increases above the +25% minimum guideline (C criteria). Its limited annual earnings (A criteria) history is a concern, meanwhile a good number of top-rated funds (I criteria) have chosen to buy shares while it has rallied from its IPO at $19 on 11/21/13.

It has a small supply of only 27.7 million shares (S criteria) in the public float which can contribute to greater price volatility in the event of institutional buying or selling. Its current up/Down Volume ratio of 1.2 is an unbiased indication its shares have been under accumulation over the past 50 days.