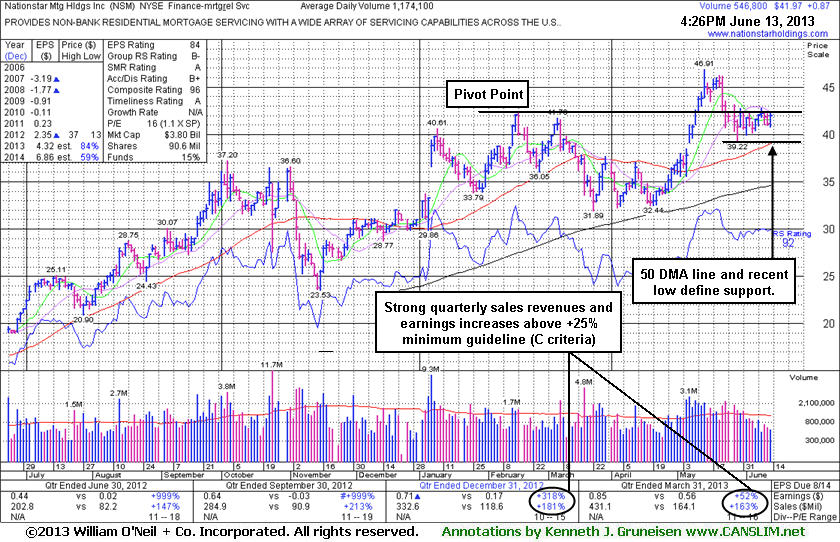

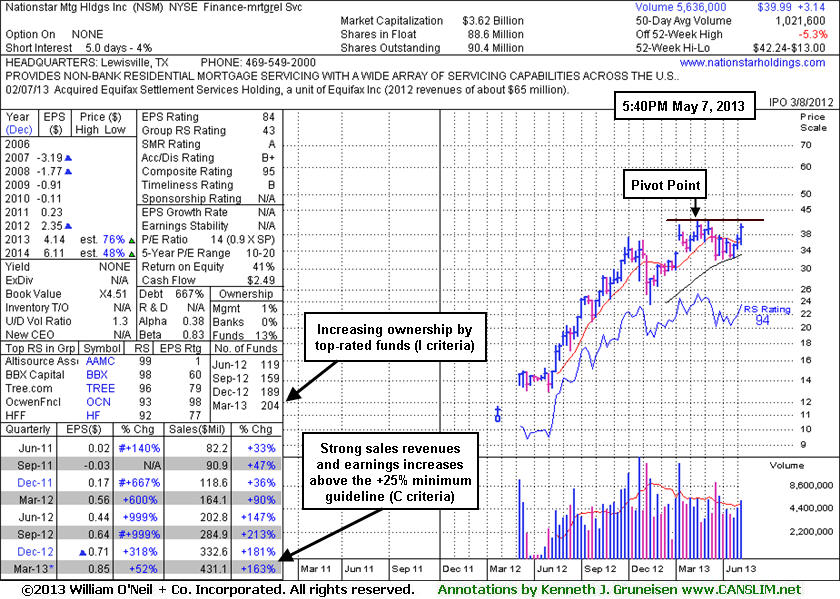

Its fundamentals remain favorable with respect to the C and A criteria. Nationstar clinched a technical buy signal while tallying a streak of volume-driven gains after its last appearance in this FSU section with an annotated graph on 5/07/13 under the headline, "Forming New Base and Fundamentals Remain Strong". It had been highlighted in yellow with pivot point cited based on its 2/15/13 high plus 10 cents in the 5/07/13 mid-day report (read here). Soon thereafter it then rallied above previously stubborn resistance in the $41-42 area with considerable volume-driven gains. It reported strong earnings and sales increases for the Mar '13 quarter well above the +25% minimum guideline (C criteria), continuing its strong earnings growth history. The Finance - Mortgage Related Services group has a Group Relative Strength Rating of B-, and leadership from at least one other high-ranked company in the group is a reassuring sign concerning the L criteria. NSM has attracted increasing ownership interest from top-rated funds, rising from 119 funds in Jun '12 to 208 in Mar '13, a reassuring sign concerning the I criteria.

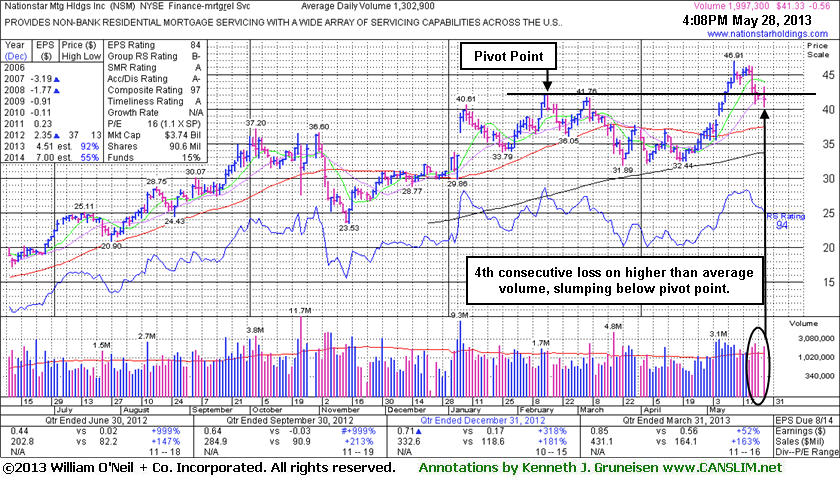

Nationstar Mtg Hldgs Inc (NSM -$0.39 or -0.93% to $41.50) has shown resilience near prior highs, but today it tallied its 5th consecutive loss with above average volume. It was previously noted that prior chart highs define initial chart support above its 50-day moving average (DMA) line (now $37.46). Disciplined investors alway limit losses by selling any stock that falls more than -7% from their purchase price. Any more damaging losses could raise more serious concerns and trigger more worrisome sell signals.

Nationstar clinched a technical buy signal while tallying a streak of volume-driven gains after its last appearance in this FSU section with an annotated graph on 5/07/13 under the headline, "Forming New Base and Fundamentals Remain Strong". It had been highlighted in yellow with pivot point cited based on its 2/15/13 high plus 10 cents in the 5/07/13 mid-day report (read here) while noted - "Its fundamentals remain favorable with respect to the C and A criteria. Today it gapped up nearly challenging its 52-week high and previously stubborn resistance in the $41-42 area with a considerable volume-driven gain. It still faces some resistance due to overhead supply. Disciplined investors will watch for convincing proof of fresh institutional buying demand to trigger a new technical buy signal before taking action."

It reported strong earnings and sales increases for the Mar '13 quarter well above the +25% minimum guideline (C criteria), continuing its strong earnings growth history. The Finance - Mortgage Related Services group has a Group Relative Strength Rating of B-, and leadership from at least one other high-ranked company in the group is a reassuring sign concerning the L criteria. NSM has attracted increasing ownership interest from top-rated funds, rising from 119 funds in Jun '12 to 207 in Mar '13, a reassuring sign concerning the I criteria.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

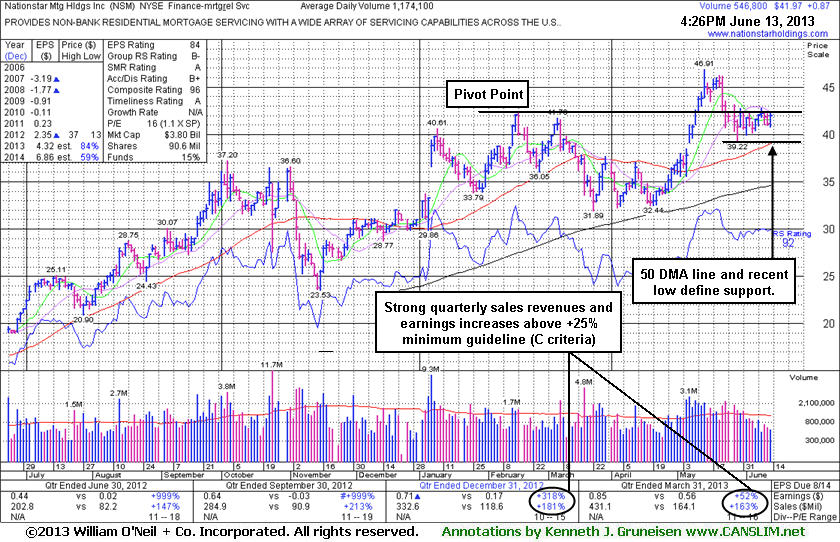

Nationstar Mtg Hldgs Inc (NSM +$2.25 or +5.96% to $39.99) was highlighted in yellow with new pivot point cited based on its 2/15/13 high plus 10 cents in the earlier mid-day report (read here) and it has returned to the Featured Stocks list. Its fundamentals remain favorable with respect to the C and A criteria. Today it gapped up nearly challenging its 52-week high and previously stubborn resistance in the $41-42 area with a considerable volume-driven gain. It still faces some resistance due to overhead supply. Disciplined investors will watch for convincing proof of fresh institutional buying demand to trigger a new technical buy signal before taking action.

Nationstar's last appearance in this FSU section with an annotated graph was on 10/11/12 under the headline, "Upward Trendline and 50-Day Moving Average Define Support to Watch". A steep upward trendline connecting July-September lows defined a near-term support level to watch above its 50-day moving average (DMA) line, and subsequent violations raised concerns and triggered technical sell signals. It found support above its 200-day moving average (DMA) line during its latest consolidation. It reported strong earnings and sales increases for the Mar '13 quarter well above the +25% minimum guideline (C criteria), continuing its strong earnings growth history. Today the Finance - Mortgage Related Services group has a mediocre Group Relative Strength Rating of C, however leadership from at least one other high-ranked company in the group is a reassuring sign concerning the L criteria. NSM has attracted increasing ownership interest from top-rated funds, rising from 119 funds in Jun '12 to 204 in Mar '13, a reassuring sign concerning the I criteria.

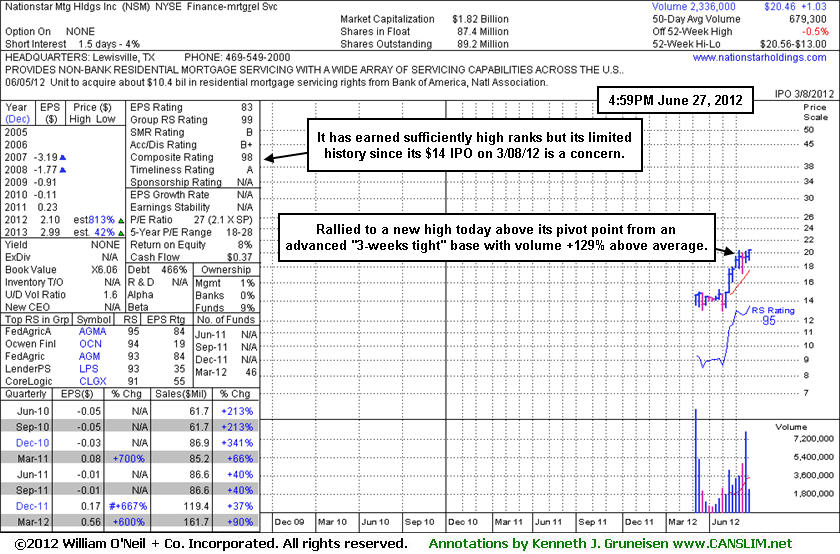

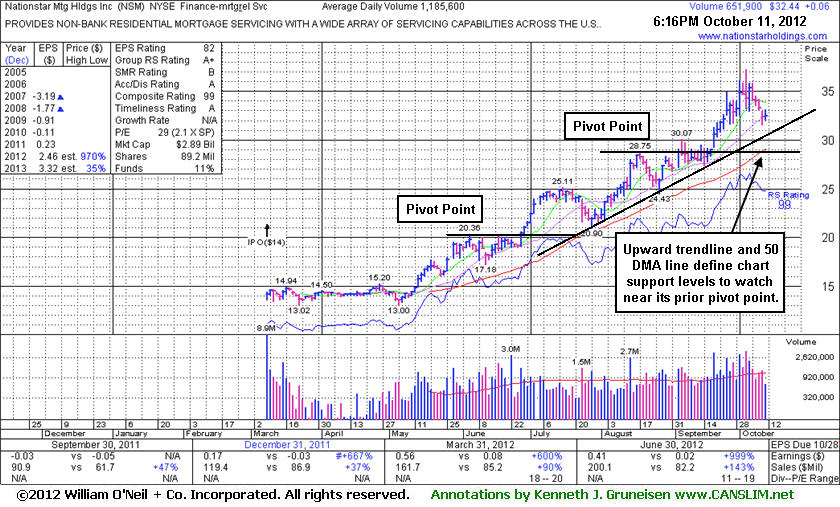

It reported strong earnings and sales increased for the Jun '12 quarter well above the +25% minimum guideline (C criteria), continuing its strong earnings growth history. The Finance - Mortgage Related Services group has the highest possible Group Relative Strength Rating of 99, a reassuring sign concerning the L criteria. NSM has attracted increasing ownership interest from top-rated funds, rising from 52 funds in Mar '12 to 149 in Sep '12, a reassuring sign concerning the I criteria.

Nationstar Mtg Hldgs Inc (NSM -$0.68 or -2.38% to $27.88) pulled back today for a 3rd consecutive loss following a worrisome "negative reversal" at its 52-week high. It has recently been noted - "A strong finish above the new pivot point cited may clear the advanced 'ascending base' pattern and clinch a new (or add-on) technical buy signal." The ascending base is marked by 3 pullbacks in the 10-20% range following an earlier technical breakout. Subsequent volume-driven gains for new highs would be a reassuring sign that it may have much further to go, but thus far it has encountered resistance near prior highs and not powered convincingly above its new pivot point.

Its last appearance in this FSU section with an annotated graph was on 8/01/12 under the headline, "Found Support Near Prior Highs and 50-Day Moving Average" while consolidating after the company had proposed an Offering of $100 million of Senior Notes. Afterward it reported strong earnings and sales increased for the Jun '12 quarter well above the +25% minimum guideline (C criteria), continuing its strong earnings growth history. The Finance - Mortgage Related Services group has the highest possible Group Relative Strength Rating of 99, a reassuring sign concerning the L criteria. NSM has attracted increasing ownership interest from top-rated funds, rising from 52 funds in Mar '12 to 119 in Jun '12, a reassuring sign concerning the I criteria.

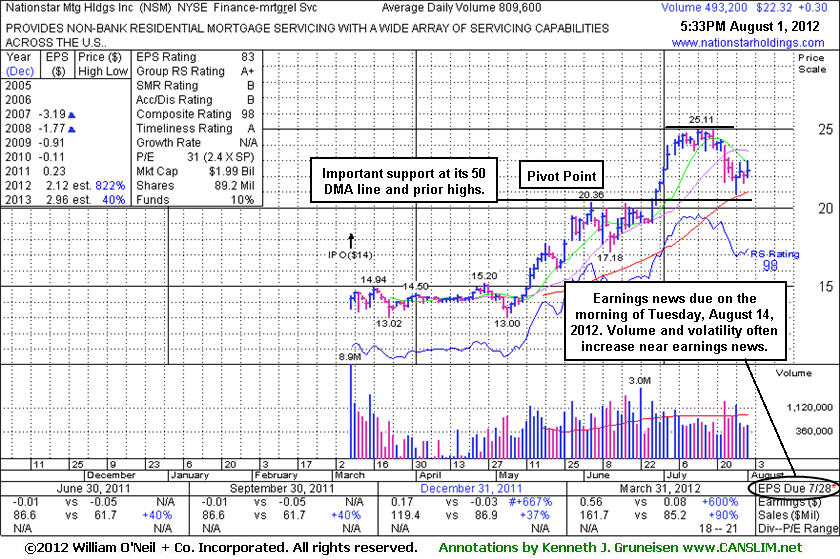

Nationstar Mtg Hldgs Inc (NSM +$0.30 or +1.36% to $22.32) is consolidating above the prior base and above its previously cited "max buy" level. Important chart support is defined by prior highs and its 50-day moving average (DMA) line in the $20 area. The company recently proposed an Offering of $100 million of Senior Notes. Its next earnings announcement is due on the morning of Tuesday, August 14, 2012, not 7/28/12 as indicated on the annotated graph. Volume and volatility often increase near earnings news.

NSM has attracted increasing ownership interest from top-rated funds, rising from 50 funds in Mar '12 to 68 in Jun '12, a reassuring sign concerning the I criteria. It has not formed a sound new base, but may form a base-on-base pattern in the weeks ahead. It was last shown in this FSU section with an annotated weekly graph on 6/27/12 under the headline, "Volume Driven Gain to Pivot Point After an Advanced Base Pattern", as it touched a new 52-week high after completing an advanced "3-weeks tight" base. Its 3 consecutive weekly closes with minimal net change defined that advanced base pattern. In the mid-day report on 6/27/12 (read here) it was highlighted in yellow with a pivot point cited based on its 6/05/12 high plus 10 cents. It posted a gain with +129% above average volume and finished that session right at the pivot point triggering a technical buy signal.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Nationstar Mtg Hldgs Inc (NSM +$1.33 or +6.95% to $20.46) touched a new 52-week high today after completing an advanced "3-weeks tight" base since last noted in the 6/20/12 mid-day report. The 3 consecutive weekly closes with minimal net change defines that type of advanced base pattern. In the mid-day report today (read here) it was highlighted in yellow with a pivot point cited based on its 6/05/12 high plus 10 cents. It posted a gain with +129% above average volume and finished right at the pivot point triggering a technical buy signal. It has earned high ranks, however prior mid-day reports noted - "Up from its $14 IPO on 3/08/12. Limited history is a concern." It has attracted ownership interest from 46 top-rated funds, a reassuring sign concerning the I criteria. Keep in mind overriding concerns regarding the M criteria and note that 3 out of 4 stocks tend to move in the direction of the major averages. The recently confirmed rally has faltered (read the full Market Commentary this evening) and caution is advised until another convincing follow-through day from at least one of the major averages hints at heavier accumulation of stocks from the institutional crowd.