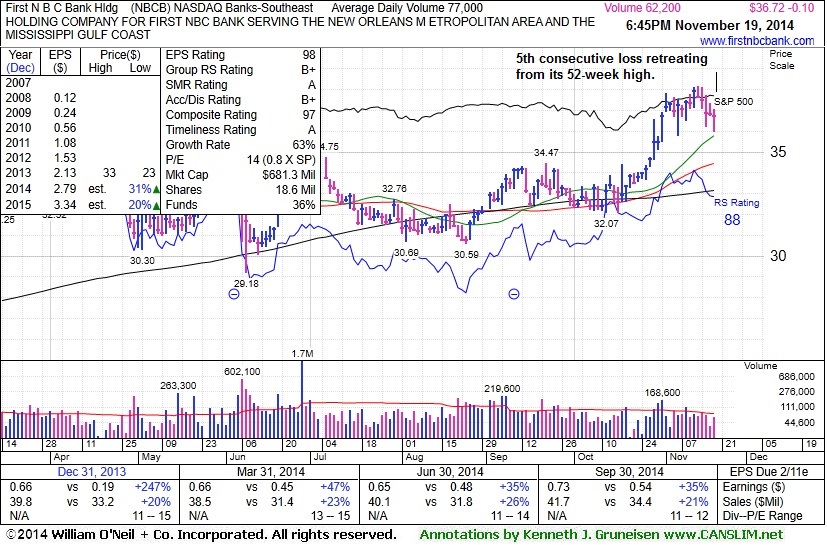

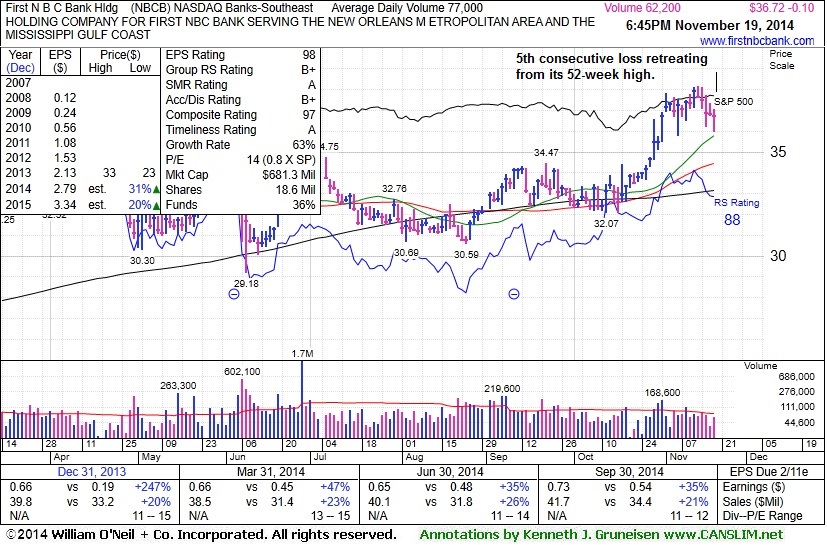

First N B C Bank Hldg (NBCB -$0.10 or -0.27 to $36.72) was down today for a 5th consecutive session with lighter volume, slumping further below its "max buy" level. Prior highs near $34 define near-term support to watch on pullbacks. Disciplined investors avoid chasing stocks more than +5% above their prior highs and always limit losses by selling any stocks that fall more than -7% from their purchase price.

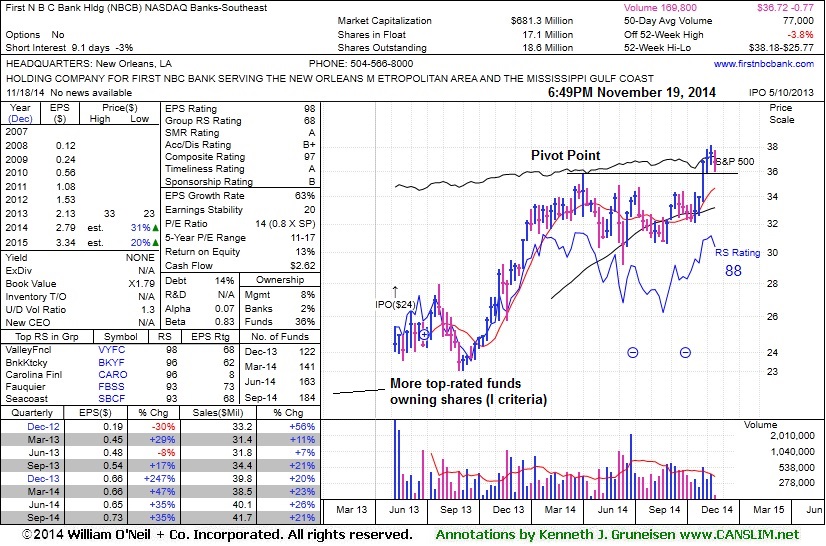

It was last shown in this FSU section on 11/03/14 mid-day report with annotated graphs under the headline, "Financial Firm at 52-Week High Tallied 8th Consecutive Gain". It finished strong after highlighted in yellow with pivot point (shown on the weekly graph below) based on its 4/02/14 high plus 10 cents in the 10/31/14 mid-day report (read here). The big gain above the pivot point backed by +79% above average volume clinched a technical buy signal. Its small supply of only 18.6 million shares (S criteria) outstanding can contribute to greater price volatility in the event of institutional buying or selling.

The high-ranked Bank holding company reported earnings +35% on +21% sales revenues for the Sep '14 quarter, its 4th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has also been strong. The current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 122 in Dec '13 to 184 in Sep '14, a reassuring sign concerning the I criteria.

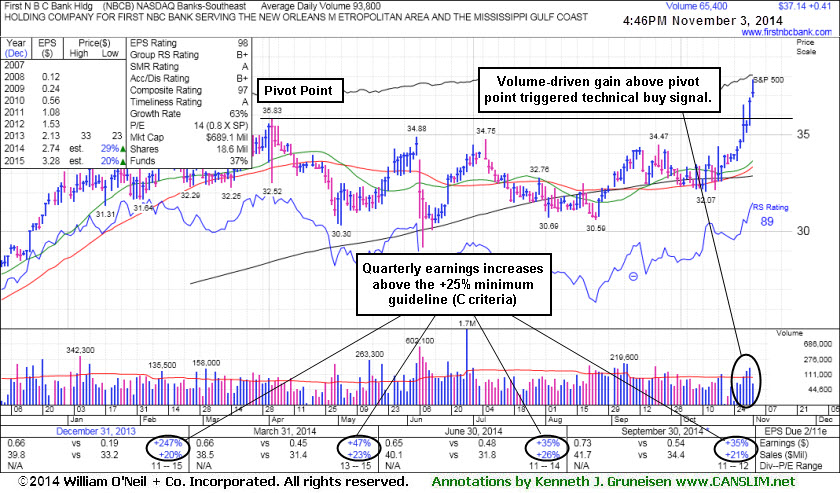

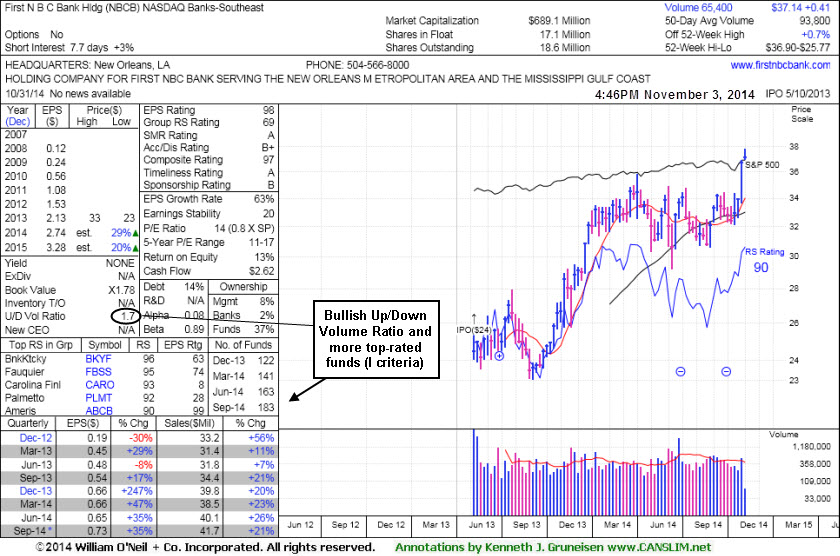

First N B C Bank Hldg (NBCB +$0.41 or +% to $37.14) hit another new 52-week high today. It finished strong after highlighted in yellow with pivot point cited based on its 4/02/14 high plus 10 cents in the 10/31/14 mid-day report (read here). The big gain above the pivot point backed by +79% above average volume clinched a technical buy signal. No resistance remains due to overhead supply after 8 consecutive gains. Its small supply of only 18.5 million shares (S criteria) outstanding can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors avoid chasing stocks more than +5% above their prior highs and always limit losses by selling any stocks that fall more than -7% from their purchase price.

The high-ranked Bank holding company reported earnings +35% on +21% sales revenues for the Sep '14 quarter, its 4th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has also been strong. The current Up/Down Volume Ratio of 1.7 is an unbiased indication its shares have been under accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 122 in Dec '13 to 183 in Sep '14, a reassuring sign concerning the I criteria.