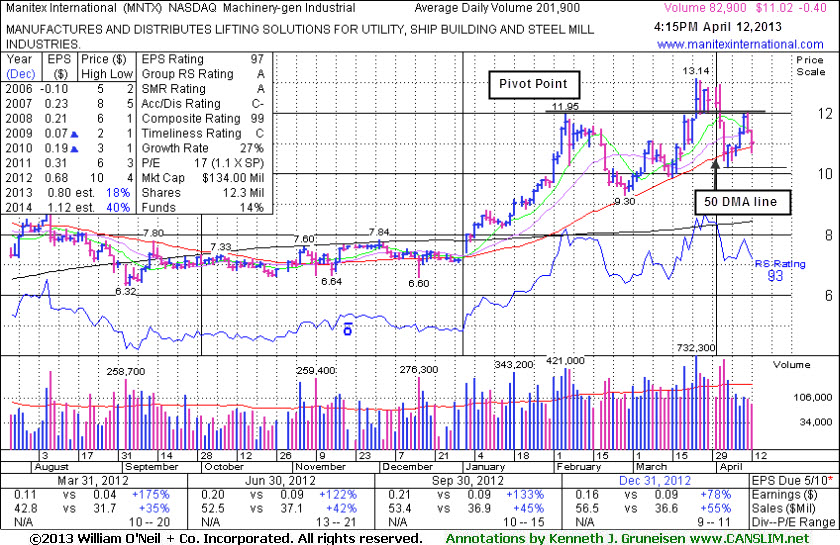

Finding Support Near 50-Day Average Following Distributional Pressure - Friday, April 12, 2013

Manitex International (MNTX +$0.40 or +3.50% to $11.02) has been testing support at its 50-day moving average (DMA) line. The recent low ($10.21 on 4/04/13) defines important near-term support below its 50 DMA line. The high-ranked leader from the Machinery - General industrial group promptly encountered distributional pressure after a considerable gain with heavy volume on 3/25/13 cleared its pivot point and triggered a technical buy signal. Members have been repeatedly reminded - "Disciplined investors avoid chasing extended stocks and always limit losses by selling if any stock falls more than -7% from their purchase price."

After a stock is sold it can always be bought back again if strength returns, but following the investment system's sell rules is critical to investors' success. MNTX was last shown in this FSU section on 3/20/13 with an annotated graph under the headline, "Finished Strong While Rallying Toward its Pivot Point", after highlighted in yellow in that day's mid-day report (read here) while building on a choppy 7-week base with pivot point cited based on its 2/06/13 high plus 10 cents.

It reported earnings +78% on +55% sales revenues for the quarter ended December 31, 2012 versus the year ago period, marking its 4th consecutive quarter with earnings increasing by well above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has improved since a downturn in FY '08 and '09 earnings.

The number of top-rated funds owning its shares rose from 24 in Mar '12 to 40 in Mar '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.2 also provides an unbiased indication that its shares have been under mild accumulation over the past 50 days. Its small supply (S criteria) of only 10.3 million shares in the public float can contribute to greater price volatility in the event of any institutional buying or selling. Low-priced stocks are discouraged from consideration unless all key criteria are solidly satisfied.

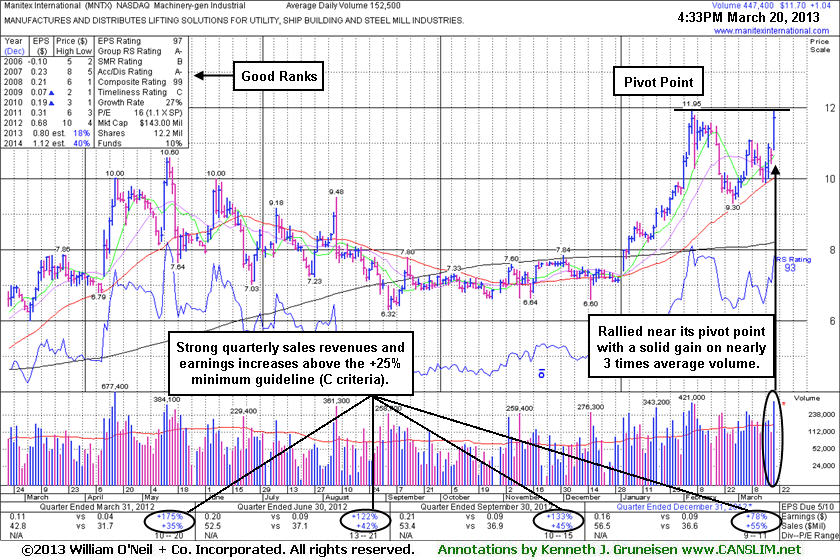

Finished Strong While Rallying Toward its Pivot Point - Wednesday, March 20, 2013

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Manitex International (MNTX +$1.04 or +9.76% to $11.70) finished strong after highlighted in yellow in the earlier mid-day report (read here) while building on a choppy 7-week base with pivot point cited based on its 2/06/13 high plus 10 cents. Subsequent volume-driven gains above the pivot point cited are still needed to trigger a technical buy signal before action may be justified under the fact-based system. This low-priced stock has rallied within striking distance of its 52-week high. It found support while consolidating above its 50-day moving average (DMA) line in recent weeks after a spurt of volume-driven gains. It reported earnings +78% on +55% sales revenues for the quarter ended December 31, 2012 versus the year ago period, marking its 4th consecutive quarter with earnings increasing by well above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has improved since a downturn in FY '08 and '09 earnings.

The number of top-rated funds owning its shares rose from 24 in Mar '12 to 34 in Dec '12, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.7 also provides an unbiased indication that its shares have been under accumulation over the past 50 days. Its small supply (S criteria) of only 10.3 million shares in the public float can contribute to greater price volatility in the event of any institutional buying or selling. Low-priced stocks are discouraged from consideration unless all key criteria are solidly satisfied. Disciplined investors know there is no advantage to getting in "early" and will watch for a proper technical buy signal to confirm that odds are favorable for a meaningful and sustained advance.