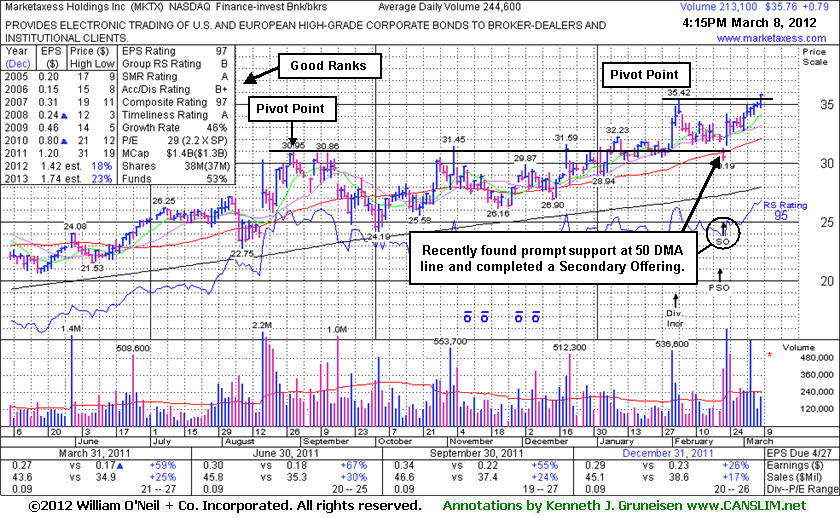

New Pivot Point Cited; Relative Strength Better After Secondary Offering - Thursday, March 08, 2012

Marketaxess Holdings Inc (MKTX +$0.75 or +2.14% to $35.72) rose to a new all-time high today with a gain backed by below average volume. No resistance remains due to overhead supply. Its last appearance in this FSU section was on 1/24/12 with an annotated graph under the headline, "Relatively Uninspired Leader Sees Volume Cooling". This week, its Relative Strength line (blue jagged line) led the way by rising above its prior high plots, an improvement contrasting from what was happening when this was discussed in the prior analysis.Its powerful volume-driven gain on 2/01/12 came immediately after it reported earnings +26% on +17% sales revenues for the quarter ended December 31, 2011 versus the year ago period. MKTX has earned good ranks and satisfies the guidelines concerning quarterly and annual earnings (C and A criteria). However, the Finance - Investment Bankers industry group currently has a Group Relative Strength Rating of 60 which indicates the group has been a mediocre performer rather than a truly strong group showing great leadership (L criteria). The market's biggest historic winners typically came from an industry group with a large batch of strong performing leaders that earned the group better ranks.

The number of top-rated funds owning its shares rose from 168 in Dec '10 to 271 in Dec '11, a reassuring sign concerning the I criteria. It completed a Secondary Offering on 2/22/12 and found prompt support near its 50-day moving average (DMA) line during its 5-week consolidation. With the help of underwriters companies often attract additional institutional ownership interest, even though offerings can have the near-term effect of hindering upward price progress.

MKTX's color code is changed to yellow with new pivot point cited based on its 2/03/12 high plus 10 cents. The gain today lifted it above the pivot point, however volume must be at least +40% above average, preferably greater, to trigger a proper technical buy signal. A lack of great volume conviction is cause for concern because without heavy buying demand from the institutional crowd a sustained advance in price is rather unlikely. Disciplined investors know that confirming gains with heavy would be a welcome reassurance, but they still offer no guarantee any stock will go on to produce more climactic gains. In more than 4 months it made limited progress since its old pivot point was cited in a 10/28/2011 report.

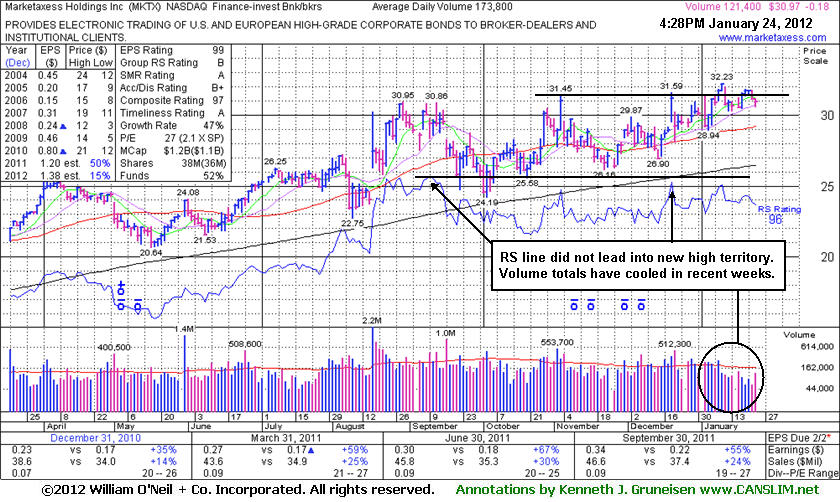

Relatively Uninspired Leader Sees Volume Cooling - Tuesday, January 24, 2012

Marketaxess Holdings Inc's (MKTX -$0.18 or -0.58% to $30.97) last appearance in this FSU section was on 12/20/11 with an annotated graph under the headline, " Volume Backed Gains Lift Stock Above Pivot Point Previously Cited", as it posted a solid gain with +88% above average volume, its 4th consecutive gain, finishing at a best-ever close. It was added - "If a new pivot point was now cited based upon its 11/03/11 high ($31.45) the close today would technically have fallen short of triggering a proper buy signal. Additional confirming gains would be a welcome reassurance." Since then there was an immediate gap down followed by some wedging action.

The annotated graph below illustrates where daily volume totals have been cooling in recent weeks while the stock has been hovering near its all-time high. There is no resistance remaining due to overhead supply. Given such favorable circumstance, its inability to make meaningful price progress raises concern and has also led to the development of a minor technical flaw. Its 96 Relative Strength rating remains very adequate as far as buy candidates are concerned, well above the 80+ guideline. But upon closer inspection, the Relative Strength line (jagged blue line) peaked out earlier. The RS line failed to lead the way into new high territory as (or before, preferably) the stock saw its price actually reach new all-time high territory. Superior buy candidates in the past winning models studied frequently saw their RS lines leading the way into new high territory before the price rose and also hit new high ground.

Its fundamentals remain strong and it reported earnings +55% on +24% sales revenues for the quarter ended September 30, 2011 versus the year ago period. MKTX has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 was previously noted as a flaw. Additionally, the Finance - Investment Bankers industry group currently has a Group Relative Strength rating of 62 which indicates the group has been a mediocre performer rather than a truly strong group showing great leadership (L criteria). The number of top-rated funds owning its shares rose from 168 in Dec '10 to 242 in Dec '11, a reassuring sign concerning the I criteria.

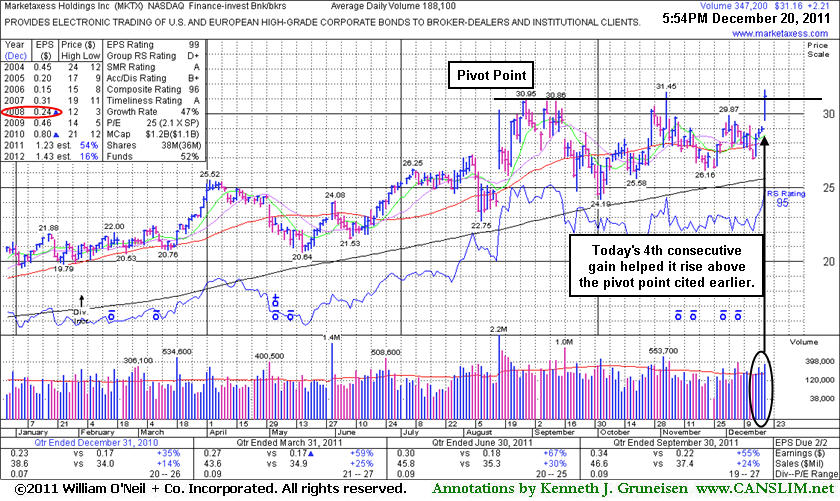

Volume Backed Gains Lift Stock Above Pivot Point Previously Cited - Tuesday, December 20, 2011

Marketaxess Holdings Inc (MKTX +$2.21 or +7.63% to $31.16 ) posted a solid gain today with +88% above average volume, its 4th consecutive gain, finishing at a best-ever close. It is clear of all resistance due to overhead supply and its big gain arguably triggered a technical buy signal. If a new pivot point was now cited based upon its 11/03/11 high ($31.45) the close today would technically have fallen short of triggering a proper buy signal. Additional confirming gains would be a welcome reassurance. Prior lows and its 200 DMA line in the $24-25 area define the next important support area to watch. Disciplined investors always limit losses if a stock falls more than -7% from their purchase price. It had been featured in yellow in the 10/28/11 mid-day report (read here) with a pivot point cited was based on its 8/30/11 high plus 10 cents. Its last appearance in this FSU section was on 11/23/11 with an annotated graph under the headline, "Deterioration Following Failed Breakout Attempt ." It sputtered for weeks without meaningful progress while weaving above and below its 50-day moving average (DMA) line.

On November 3rd it nearly met the guidelines as a buy candidate, however it was noted that evening - "Hit a new 52-week high and traded above its pivot point today, however it closed below the mark and volume was just +21% above average behind the considerable gain. The minimum guideline requires at least +40% above average volume behind a gain above a stock's pivot point to trigger a proper new (or add-on) technical buy signal. Disciplined investors may use a tactic called pyramiding to accumulate shares without chasing the stock outside of the ideal buy range." Subsequent weakness raised concerns and its color code was changed to green as it sank below its 50 DMA line. Any investors who may have made initial purchases using the "pyramiding" approach would not have accumulated a full position before the subsequent weakness prompted defensive action and the sale of the partial position if it fell -7% from the buy price. This loss-limiting example demonstrates the value of carefully following the fact-based system as investors are trained in the Certification.

Its fundamentals remain strong and it just reported earnings +55% on +24% sales revenues for the quarter ended September 30, 2011 versus the year ago period. MKTX has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 (see red oval) was previously noted as a flaw. Additionally, the Finance - Investment Bankers industry group currently has a Group Relative Strength rating of D+ which indicates the group has been a poor performer rather than a strong leader (L criteria). The number of top-rated funds owning its shares rose from 168 in Dec '10 to 238 in Sep '11, a reassuring sign concerning the I criteria.

All prior notes can be reviewed on the Company Profile page under the "View All Notes" tab. The "Featured Articles and Daily Graphs" tab on the Company Profile page allows members to view all of the previous detailed analysis and annotated graphs published on any stocks we have covered.

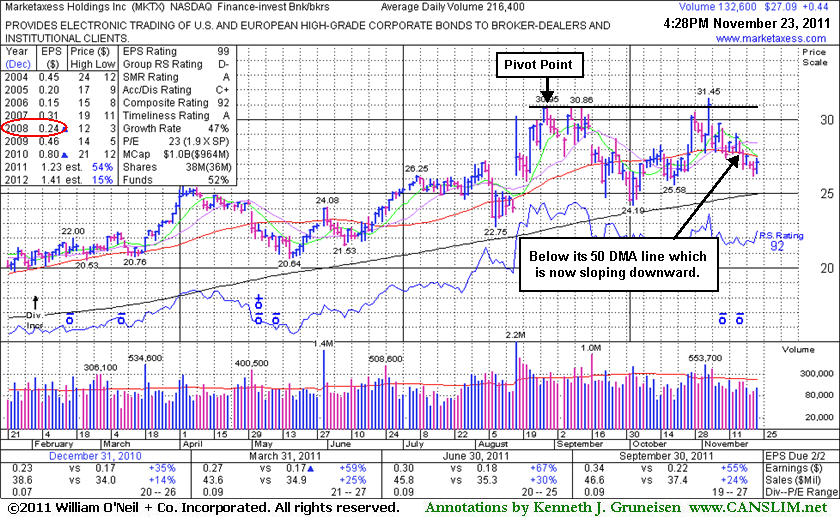

Deterioration Following Failed Breakout Attempt - Wednesday, November 23, 2011

Marketaxess Holdings Inc (MKTX +$0.44 or +1.65% to $27.09) has been sputtering for weeks without meaningful volume-driven gains for any progress. Its 50-day moving average (DMA) line is now downward sloping, and the longer it remains below that important short-term average the worse its outlook gets. Prior lows and its 200 DMA line in the $24-25 area define the next important support area to watch. Its last appearance in this FSU section was on 10/31/11 with an annotated graph under the headline, "Perched Near Highs Working on Base-On-Base Type Pattern", after an 8-week base-on-base type consolidation. It had been featured in yellow in the 10/28/11 mid-day report (read here) as a new pivot point cited was based on its 52-week high plus 10 cents.

On November 3rd it nearly met the guidelines as a buy candidate, however it was noted that evening - "Hit a new 52-week high and traded above its pivot point today, however it closed below the mark and volume was just +21% above average behind the considerable gain. The minimum guideline requires at least +40% above average volume behind a gain above a stock's pivot point to trigger a proper new (or add-on) technical buy signal. Disciplined investors may use a tactic called pyramiding to accumulate shares without chasing the stock outside of the ideal buy range." Subsequent weakness raised concerns and its color code was changed to green as it sank below its 50 DMA line. Any investors who may have made initial purchases using the "pyramiding" approach would not have accumulated a full position before the subsequent weakness prompted defensive action and the sale of the partial position if it fell -7% from the buy price. This loss-limiting example demonstrates the value of carefully following the fact-based system as investors are trained in the Certification.

Its fundamentals remain strong and it just reported earnings +55% on +24% sales revenues for the quarter ended September 30, 2011 versus the year ago period. MKTX has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 (see red oval) was previously noted as a flaw. Additionally, the Finance - Investment Bankers industry group currently has a Group Relative Strength rating of D- which indicates the group has been a poor performer rather than a strong leader (L criteria). The number of top-rated funds owning its shares rose from 168 in Dec '10 to 236 in Sep '11, a reassuring sign concerning the I criteria.

All prior notes can be reviewed on the Company Profile page under the "View All Notes" tab. The "Featured Articles and Daily Graphs" tab on the Company Profile page allows members to view all of the previous detailed analysis and annotated graphs published on any stocks we have covered.

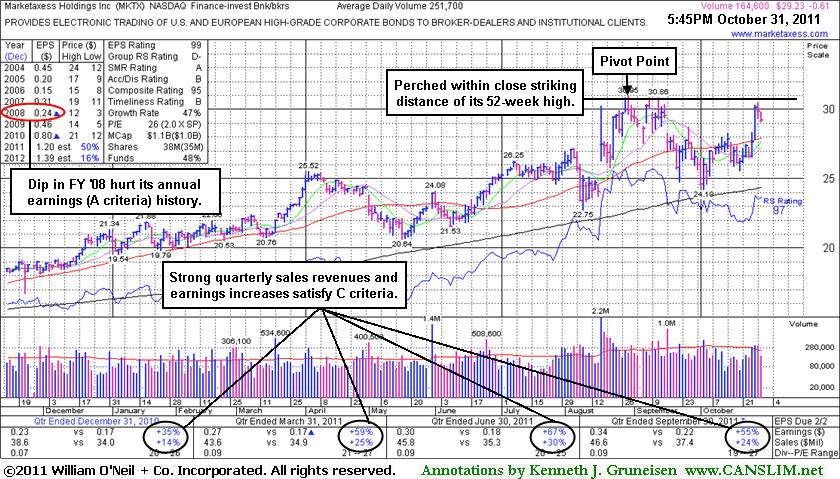

Perched Near Highs Working on Base-On-Base Type Pattern - Monday, October 31, 2011

Marketaxess Holdings Inc (MKTX -$0.61 or -2.04% to $29.23) is perched near its 52-week high today after an 8-week base-on-base type consolidation. Its rebound above its 50-day moving average (DMA) line last week helped its outlook, and its color code was changed to yellow in the 10/28/11 mid-day report (read here) as a new pivot point cited was based on its 52-week high plus 10 cents. A subsequent breakout would trigger a new technical buy signal. Fundamentals remain strong and it just reported earnings +55% on +24% sales revenues for the quarter ended September 30, 2011 versus the year ago period.

Its last appearance in this FSU section was on 9/27/11 with an annotated graph under the headline, "Holding its Ground Following News of Small Secondary Offering". Based on weak action it was then dropped from the Featured Stocks list on 10/03/11, yet it found impressive support and stayed well above its 200 DMA line. MKTX has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 (see red oval) was previously noted as a flaw. Additionally, the Finance - Investment Bankers industry group currently has a Group Relative Strength rating of D- which indicates the group has been a poor performer rather than a strong leader (L criteria). The number of top-rated funds owning its shares rose from 195 in Dec '10 to 225 in Sep '11, a reassuring sign concerning the I criteria.

All prior notes can be reviewed on the Company Profile page under the "View All Notes" tab. The "Featured Articles and Daily Graphs" tab on the Company Profile page allows members to view all of the previous detailed analysis and annotated graphs published on any stocks we have covered.

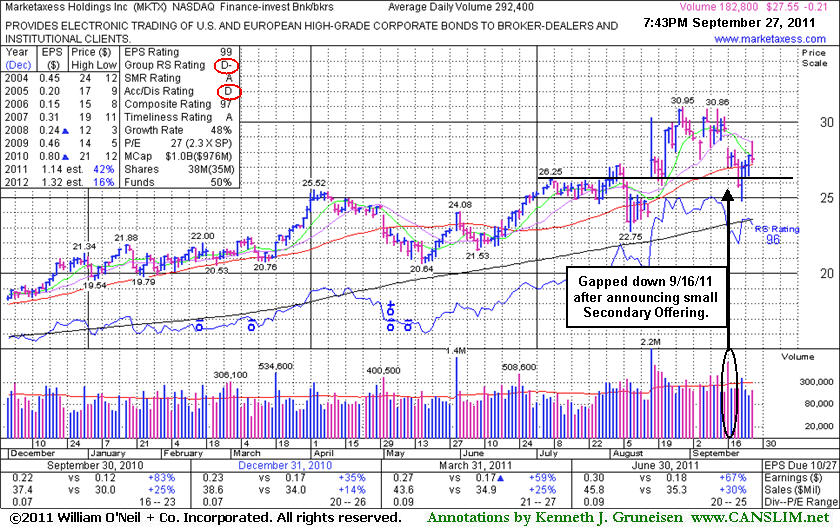

Holding its Ground Following News of Small Secondary Offering - Tuesday, September 27, 2011

Marketaxess Holdings Inc (MKTX -$0.21 or -0.76% to $27.55) erased its early gain today, and after a negative reversal it ended near the session low with a small loss on below average volume. It inched back above its 50-day moving average (DMA) line with lighter volume after recently finding support near that important short-term average and its prior highs in the $26 area. It endured some distributional pressure after its last appearance in this FSU section on 9/02/11 with an annotated graph under the headline, "Volume Totals Cooling While Hovering Near Highs". Since then, its Accumulation/Distribution rating has slumped from a B- to a D, and it has been struggling to hold its ground since a gap down on 9/16/11 following news of a small Secondary Offering of 950,000 shares priced at $28.65.

It proved resilient near its short-term average in the past after undercutting it, and it stayed well above its longer-term 200 DMA line. MKTX has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 (see red oval) was previously noted as a flaw. Additionally, the Finance - Investment Bankers industry group currently has a Relative Strength rating of D- which indicates the group has been a poor performer rather than a strong leader (L criteria). The number of top-rated funds owning its shares rose from 195 in Dec '10 to 227 in Jun '11, a reassuring sign concerning the I criteria.

All prior notes can be reviewed on the Company Profile page under the "View All Notes" tab. The "Featured Articles and Daily Graphs" tab on the Company Profile page allows members to view all of the previous detailed analysis and annotated graphs published on any stocks we have covered.

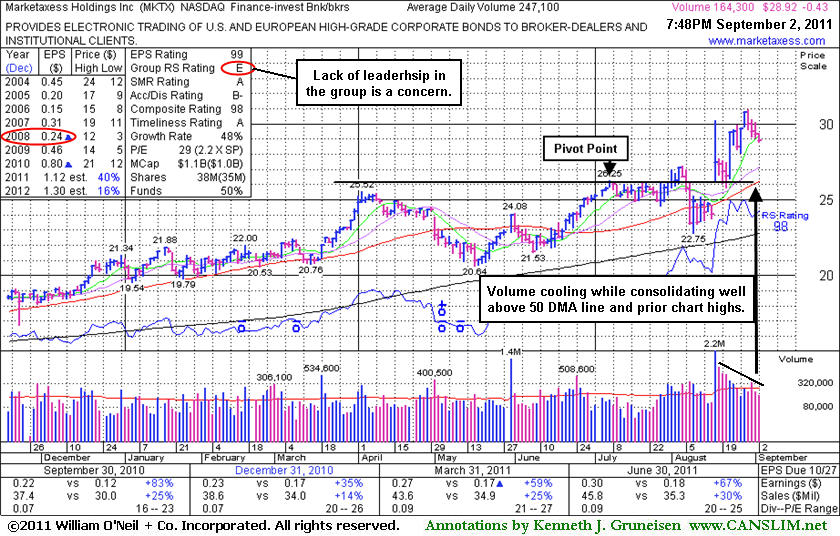

Volume Totals Cooling While Hovering Near Highs - Friday, September 02, 2011

Marketaxess Holdings Inc's (MKTX -$0.43 or -1.47% to $28.92) daily volume totals have been cooling while hovering near its all-time high. Its last appearance was in this FSU section was on 8/23/11 with an annotated graph under the headline, "Outlier's Gains Have Distanced It From Prior Base". It has been holding its ground stubbornly following a negative reversal on 8/30/11 after reaching a new high. It is extended from its prior base. Meanwhile, prior resistance in the $25-26 area defines chart support to watch along with its 50-day moving average (DMA) line. It proved resilient near that short-term average in the past after undercutting it, and it stayed above its longer-term 200 DMA line. MKTX has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 (see red oval) was previously noted as a flaw. Additionally, the Finance - Investment Bankers industry group currently has a Relative Strength rating of E which indicates the group has been a poor performer rather than a strong leader (L criteria). The number of top-rated funds owning its shares rose from 195 in Dec '10 to 229 in Jun '11, a reassuring sign concerning the I criteria.

All prior notes can be reviewed on the Company Profile page under the "View All Notes" tab. The "Featured Articles and Daily Graphs" tab on the Company Profile page allows members to view all of the previous detailed analysis and annotated graphs published on any stocks we have covered.

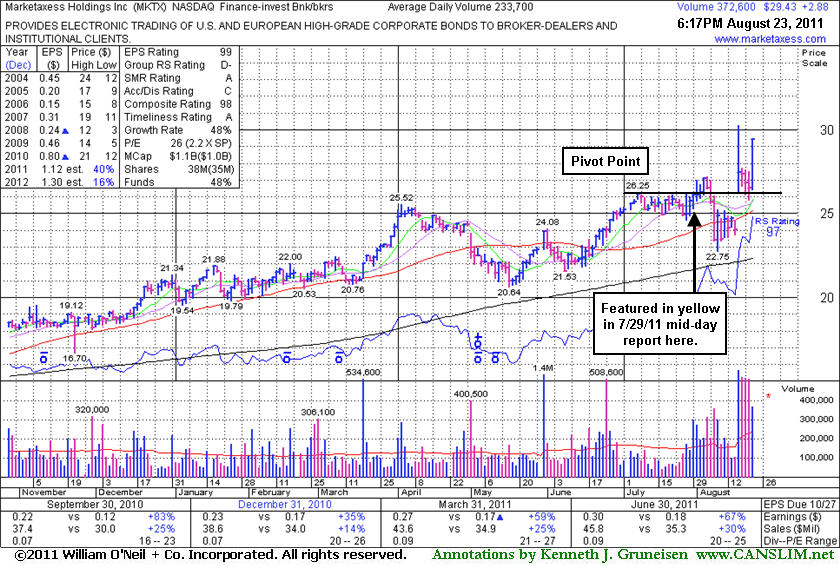

Outlier's Gains Have Distanced It From Prior Base - Tuesday, August 23, 2011

Marketaxess Holdings Inc (MKTX +$2.88 or +10.85% to $29.43) rallied considerably higher with above average volume for a new high close today after 3 consecutive small losses with above average volume. It held its ground stubbornly while consolidating since a considerable gain with heavy volume on 8/17/11 for a new 52-week high on news this operator of an electronic trading system for fixed-income securities is exploring a sale of the company. Its last appearance was in this FSU section on 8/10/11 with an annotated graph under the headline, "Distributional Action Followed Half-Hearted Breakout Attempt", as it slumped under its 50-day moving average (DMA) line. It proved resilient near that short-term average, although concerned were raised because healthy stocks do not often dip -7% below their pivot point. No overhead supply exists to hinder its progress, but it is quickly getting extended more than +5% above its prior highs. The M criteria has also been arguing against new buying efforts, with MKTX's exceptional strength making it a strong outlier in a market not offering investors favorable odds.In an earlier appearance in this FSU section on 7/29/11 an annotated graph was included under the headline, "Potential Candidate in Tight Consolidation After Cup", and on 8/01/11 it posted a small gain after churning heavy volume and touching a new 52-week high, but didn't clear its pivot point. On 8/03/11 it posted a solid gain today for a new high with only +25% above average volume, below the volume threshold for a proper technical buy signal. Damaging distributional losses then followed and were noted. All prior notes can be reviewed on the Company Profile page under the "View All Notes" tab. The "Featured Articles and Daily Graphs" tab on the Company Profile page allows members to view all of the previous detailed analysis and annotated graphs published on any stocks we have covered.

MKTX has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 was previously noted as a flaw. Additionally, the Finance - Investment Bankers industry group currently has a Relative Strength rating of D- which indicates the group has been a poor performer rather than a strong leader (L criteria). The number of top-rated funds owning its shares rose from 195 in Dec '10 to 227 in Jun '11, a reassuring sign concerning the I criteria.

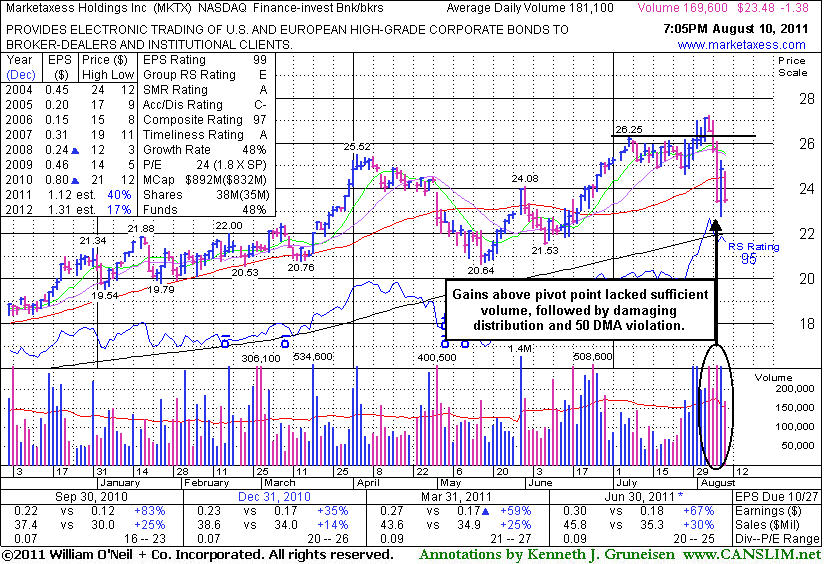

Distributional Action Followed Half-Hearted Breakout Attempt - Wednesday, August 10, 2011

Marketaxess Holdings Inc (MKTX -$1.38 or -5.55% to $23.48) slumped under its 50-day moving average (DMA) line again today on lighter volume, and that short-term average may now act as resistance. Its color code was changed to green, and as previously noted, healthy stocks do not often dip -7% below their pivot point. No overhead supply was there to hinder its progress, but damaging distribution has been hurting its chances of making meaningful headway, meanwhile the M criteria has also been arguing against new buying efforts.

Its last appearance was in this FSU section on 7/29/11 with an annotated graph under the headline, "Potential Candidate in Tight Consolidation After Cup", and on 8/01/11 it posted a small gain after churning heavy volume and touching a new 52-week high, but didn't clear its pivot point. On 8/03/11 it posted a solid gain today for a new high with only +25% above average volume, below the volume threshold for a proper technical buy signal. Damaging distributional losses then followed and were noted. All prior notes can be reviewed on the Company Profile page under the "View All Notes" tab. The "Featured Articles and Daily Graphs" tab on the Company Profile page allows members to view all of the previous detailed analysis and annotated graphs published on any stocks we have covered.

MKTX has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 was previously noted as a flaw. Additionally, the Finance - Investment Bankers industry group currently has a Relative Strength rating of E which indicates the group has been a poor performer rather than a strong leader (L criteria).

The number of top-rated funds owning its shares rose from 195 in Dec '10 to 227 in Jun '11, a reassuring sign concerning the I criteria. Fresh proof of heavy buying demand would be no guarantee it can mount a sustained rally for meaningful gains, but for now this high-ranked leader would need to first rebound above its 50 DMA line and stay there for its outlook to improve as an ideal candidate.

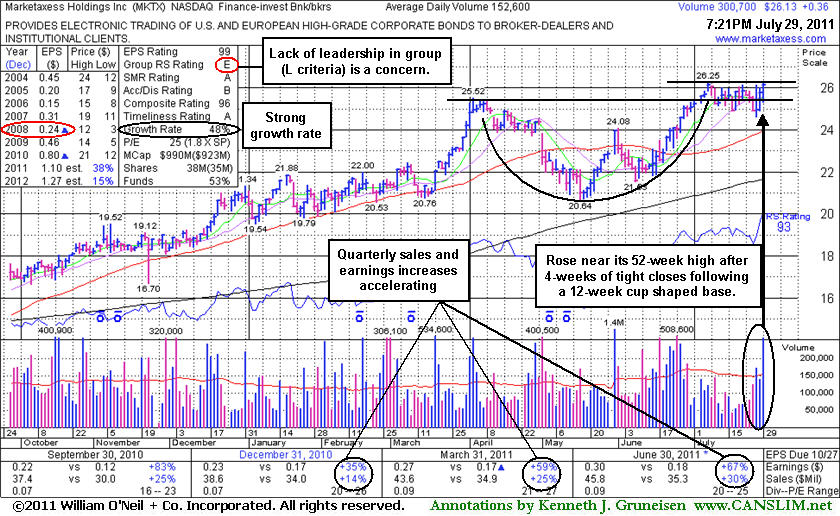

Potential Candidate in Tight Consolidation After Cup - Friday, July 29, 2011

Marketaxess Holdings Inc (MKTX +$0.36 or +1.40% to $26.13) was featured in yellow in the mid-day report today. It has been consolidating in a tight range for the past 4 weeks perched near its 52-week high while no overhead supply is there to hinder its progress. Prior to that it formed a 12-week cup shaped base. Reported earnings +67% on +30% sales revenues for the latest quarter ended June 30, 2011 versus the year ago period. It has earned high ranks and reasonably satisfies the guidelines concerning quarterly and annual earnings (C and A criteria), however a downturn in FY '08 (see red oval) is a noted flaw. Additionally, the Finance - Investment Bankers industry group currently has a Relative Strength rating of E (see red circle) 6 which indicates the group has been a poor performer rather than a strong leader (L criteria). The M criteria has also been arguing against new buying efforts.

The number of top-rated funds owning its shares rose from 195 in Dec '10 to 232 in Jun '11, a reassuring sign concerning the I criteria. Fresh proof of heavy buying demand would be no guarantee it can mount a sustained rally for meaningful gains, but for now this high-ranked leader is an ideal candidate for disciplined investors' watchlists.