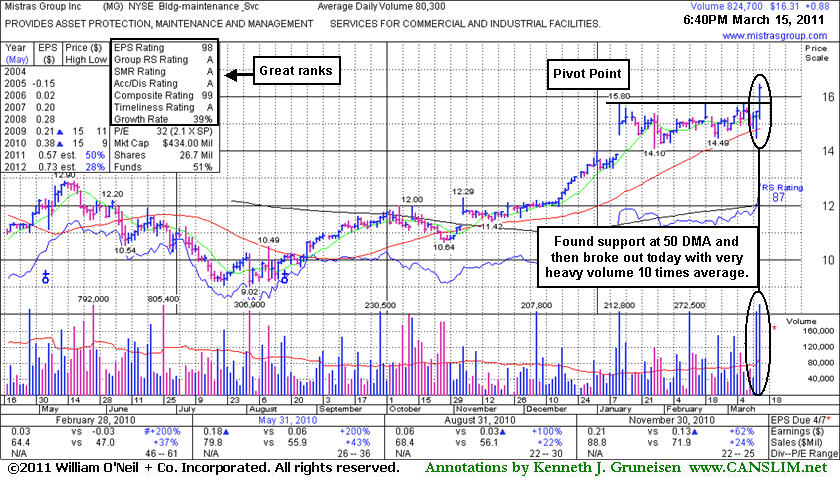

Overhead Supply Created While Consolidating in Recent Months - Wednesday, May 30, 2012

Mistras Group Inc (MG -$0.49 or -2.13% to $22.50) suffered another loss today with volume picking up to an above average pace. It slumped and traded under prior lows and tested its 200-day moving average (DMA) line defining important near-term support in the $22.50 area. While it may make a stand there and eventually show strength, its persistent lack of constructive gains is cause for concern. It now faces overhead supply up through the $25-26 area after spending several months trading at higher levels. Disciplined investors will note that a volume-driven gain above its pivot did not confirm a technical buy signal as necessary before taking any action. Based on its weak action it will be dropped from the Featured Stocks list tonight.

Its last appearance in this FSU section was on 4/02/12 with an annotated weekly graph under the headline, "Lack of Leadership in Group During Recent Set-Up". Since then it spent many week trading in a tight range while it was repeatedly noted - "A volume-driven gain above its recent chart high ($25.49 on 3/21/12) may help trigger a proper technical buy signal after a new base formation, however no new (lower) pivot point is currently being cited, and it may continue encountering stubborn resistance."

Fundamentals remain strong, with quarterly earnings increases above the +25% minimum guideline satisfying the C criteria. The number of top-rated funds owning its shares rose from 148 in Jun '11 to 185 in Mar '12, a reassuring sign concerning the I criteria.

The Building - Maintenance Services group has seen its Group Relative Strength Rating slump even further to 22. That is not a reassuring sign concerning the L criteria which calls investors to choose buy candidates with strong leadership in the industry group. The company management's still large 47% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.9 million shares outstanding and 14.8 million in the public float can contribute to greater price volatility in the event of institutional buying or selling.

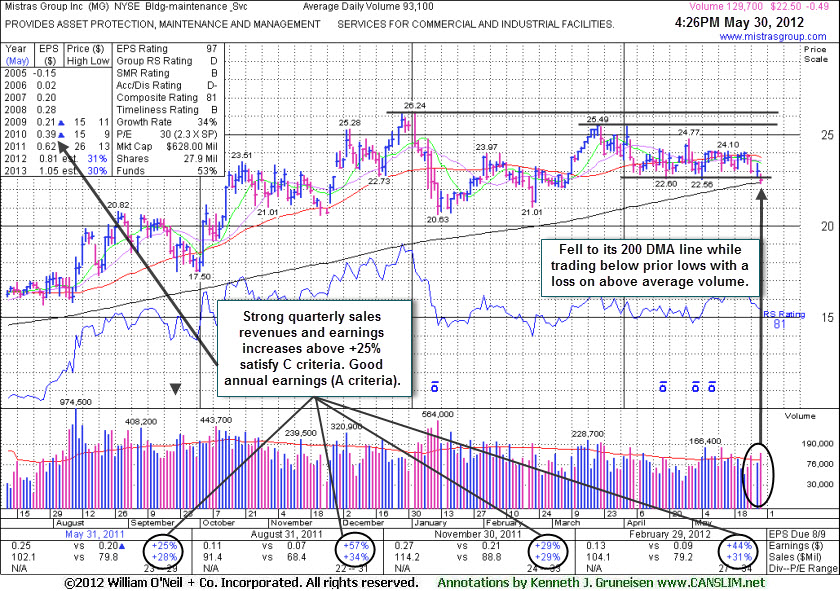

Lack of Leadership in Group During Recent Set-Up - Monday, April 02, 2012

Mistras Group Inc (MG +$0.64 or +2.69% to $24.46) tallied a gain today with near average volume. The annotated weekly graph below illustrates how it remains below the new pivot point cited in the 3/22/12 mid-day report based on its 52-week high plus 10 cents after a 12-week base. It was previously noted - "Disciplined investors will watch for a volume-driven gain above the pivot to confirm a technical buy signal before taking any action."Its last appearance in this FSU section was on 1/06/12 with an annotated daily graph under the headline, "Halted Slide After Streak of Losses on Higher Volume", and it was dropped from the Featured Stocks list on 1/11/12. Fundamentals remain strong, with quarterly earnings increases above the +25% minimum guideline satisfying the C criteria. The number of top-rated funds owning its shares rose from 128 in Mar '11 to 185 in Dec '11, a reassuring sign concerning the I criteria.

The Building - Maintenance Services group has seen its Group Relative Strength Rating slump to 32. That is not a reassuring sign concerning the L criteria which calls investors to choose buy candidates with strong leadership in the industry group. The company management's still large 47% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.9 million shares outstanding and 14.8 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors always limit losses at 7-8% if ever a stock falls that much after purchased.

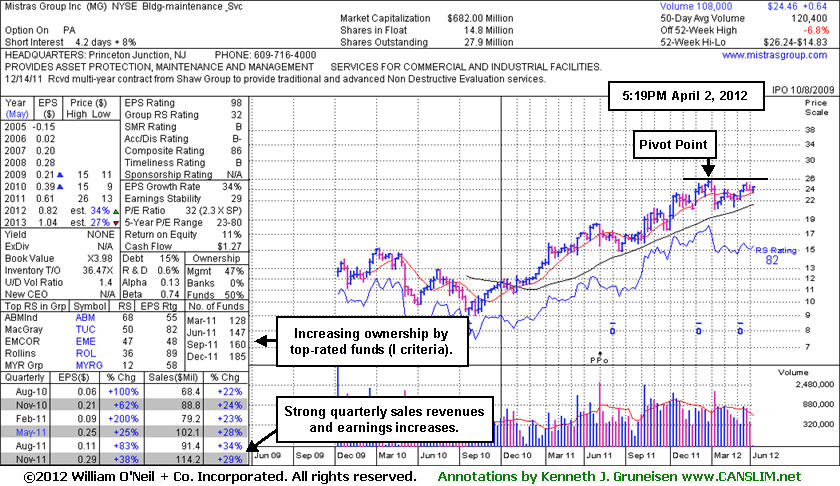

Halted Slide After Streak of Losses on Higher Volume - Friday, January 06, 2012

Mistras Group Inc (MG +$0.12 or +0.50% to $23.99) halted a 5-session losing streak today. It endured distributional pressure this week after a "negative reversal" on 1/03/12. The losses on high volume led to a dip back near its pivot point and prior highs in the $23 area defining chart support along with its 50-day moving average (DMA) line. Since its last appearance in this FSU section on 12/08/11 with an annotated daily graph under the headline, "Pullback On Light Volume Just Undercut Pivot Point ", it found support above its 50 DMA line and then it wedged to new highs without great volume conviction behind its gains. More damaging losses in the near-term may raise serious concerns and trigger technical sell signals.

A solid gain and strong close on 12/05/11 with +55% above average volume triggered a technical buy signal. The Building - Maintenance Services group has improved in its Group Relative Strength Rating to 86, up from 49 when it was shown in this FSU section on 11/11/11. That is a reassuring sign concerning the L criteria which calls investors to choose buy candidates with strong leadership in the industry group. It has maintained its solid earnings history concerning the C and A criteria. The number of top-rated funds owning its shares rose from 99 in Sep '10 to 157 in Sep '11, a reassuring sign concerning the I criteria. After its 5/05/11 Public Offering the company management's still large 47% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.7 million shares outstanding and 14.7 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors always limit losses at 7-8% if ever a stock falls that much after purchased.

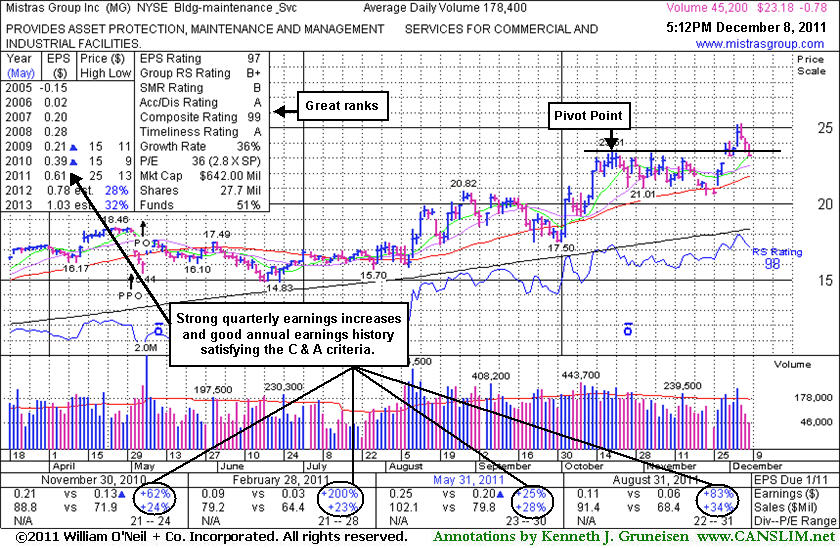

Pullback On Light Volume Just Undercut Pivot Point - Thursday, December 08, 2011

Mistras Group Inc (MG -$0.78 or -3.26% to $23.18) was down today for a 3rd consecutive small loss on lighter than average volume, slumping just below its pivot point. A solid gain and strong close on 12/05/11 with +55% above average volume triggered a technical buy signal. Prior highs in the $23 area define initial chart support to watch, so any more damaging losses in the near-term may raise concerns.

In its last appearance in this FSU section on 11/11/11 with an annotated daily graph under the headline, "Volume Cooling While Perched -7% from 52-Week High", it was consolidating in tight trading range. The Building - Maintenance Services group has improved in its Group Relative Strength Rating (now 76), up from 49, a reassuring sign concerning the L criteria which calls for leadership in the industry group. After continued consolidating it found support near its 50-day moving average (DMA) line and prior chart highs before its latest breakout.

It has maintained its solid earnings history concerning the C and A criteria. The number of top-rated funds owning its shares rose from 99 in Sep '10 to 157 in Sep '11, a reassuring sign concerning the I criteria. After its 5/05/11 Public Offering the company management's still large 47% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.7 million shares outstanding and 14.7 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors always limit losses at 7-8% if ever a stock falls that much after purchased.

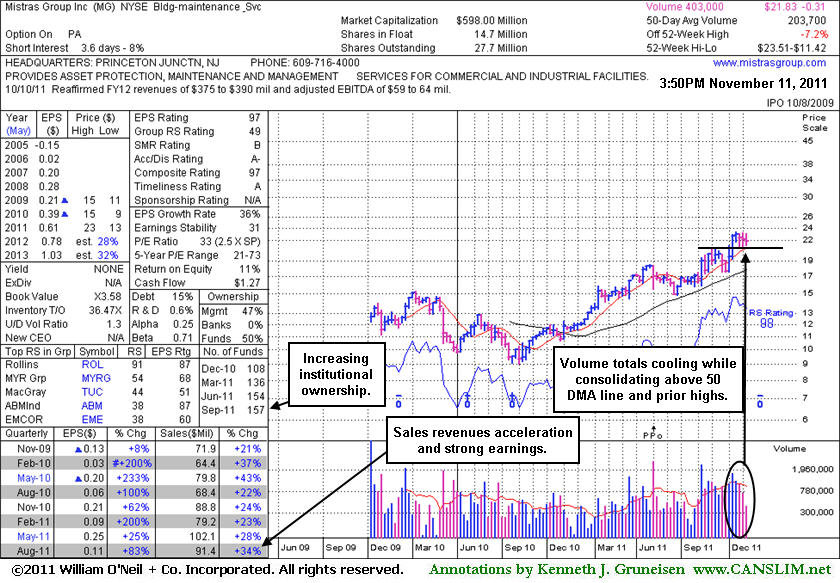

Volume Cooling While Perched -7% from 52-Week High - Friday, November 11, 2011

Mistras Group Inc (MG +$0.26 or +1.02% to $21.84) recently stalled and did not break out of a late stage "3 weeks tight" base pattern. Volume totals have cooled while it has continued consolidating above its 50-day moving average (DMA) line and prior chart highs defining important chart support. Volume-driven gains to new highs could signal another new (or add-on) technical buy signal, meanwhile any subsequent slump below its 50 DMA line and recent lows could trigger technical sell signals.

In its last appearance in this FSU section on 10/12/11 with an annotated daily graph under the headline, "Base On Base Formation Not Textbook Perfect" it was noted - "Although it is not textbook set-up, any powerful volume-driven gains to new highs may be acknowledged as a fresh sign of institutional accumulation that may lead to a more meaningful advance." Immediately after that appearance it spiked higher with a spurt of volume-driven gains and made meaningful price progress.

The Building - Maintenance Services group has seen little improvement in its Group Relative Strength Rating (now 49), which is mediocre, whereas the L criteria calls for leadership in the industry group. It has maintained its solid earnings history concerning the C and A criteria. The number of top-rated funds owning its shares rose from 99 in Sep '10 to 157 in Sep '11, a reassuring sign concerning the I criteria. After its 5/05/11 Public Offering the company management's still large 47% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.7 million shares outstanding and 14.7 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors always limit losses at 7-8% if ever a stock falls that much after purchased.

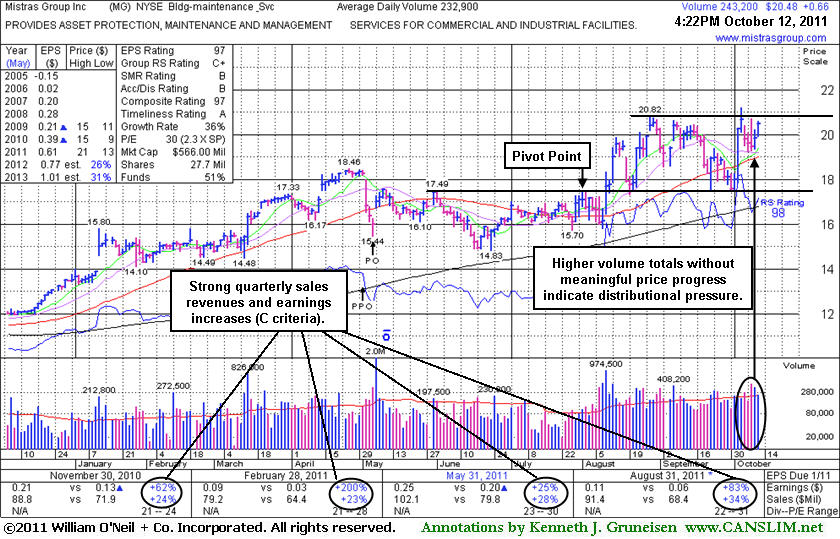

Base On Base Formation Not Textbook Perfect - Wednesday, October 12, 2011

Mistras Group Inc's (MG +$0.66 or +3.33% to $20.48) higher volume totals without meaningful price progress are an indication of distributional pressure this week. Recently it was noted as it tried to rise without great volume conviction from a 5-week consolidation that may be considered a "base-on-base" type pattern, however no new pivot point was cited. Additionally, the M criteria argues against new (or add-on) buying efforts in otherwise worthy buy candidates until the nascent new rally effort is confirmed by a solid follow-through day. Its last appearance in this FSU section was on 9/30/11 with an annotated daily graph under the headline, "Slump Under Old Highs Near Prior Pivot Point Cited". It slumped under its old highs and violated its 50-day moving average (DMA) line triggering technical sell signals. Subsequent losses could have led to more worrisome technical damage, however, its prior resistance acted as a support level while consolidating. Its prompt rebound above its 50 DMA line helped its outlook to improve. The chart below shows the current "base-on-base" pattern, but its high on 10/05/11 exceeded earlier highs which might be the basis for a new pivot point. Although it is not textbook set-up, any powerful volume-driven gains to new highs may be acknowledged as a fresh sign of institutional accumulation that may lead to a more meaningful advance.Since its last FSU analysis was published the Building - Maintenance Services group has seen little improvement in its Group Relative Strength Rating (now 47), which is mediocre, whereas the L criteria calls for leadership in the industry group. It has maintained its solid earnings history concerning the C and A criteria. The number of top-rated funds owning its shares rose from 99 in Sep '10 to 151 in Sep '11, a reassuring sign concerning the I criteria. After its 5/05/11 Public Offering the company management's still large 47% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.7 million shares outstanding and 14.7 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors always limit losses at 7-8% if ever a stock falls that much after purchased. If the market environment (M criteria) is not favorable, 3 out of 4 stocks typically follow the direction of the major averages. Disciplined investors do not fight the tape!

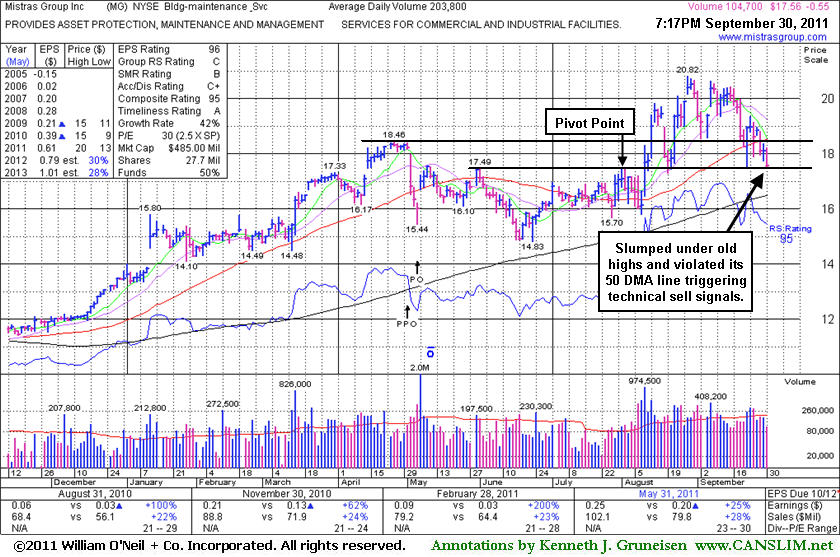

Slump Under Old Highs Near Prior Pivot Point Cited - Friday, September 30, 2011

Mistras Group Inc (MG -$0.55 or -3.04% to $17.56) has slumped under its old highs and violated its 50-day moving average line triggering technical sell signals. It finished near the pivot point cited in the mid-day report on 8/10/11 when it was then charging toward its April highs. After rallying above them to new highs its prior resistance acted as a support level while consolidating. Any subsequent losses could lead to more worrisome technical damage, meanwhile a rebound above its 50 DMA is needed for its outlook to improve. Its last appearance in this FSU section was on 9/09/11 with an annotated daily graph under the headline, "Hovering Near Highs Well Above Support".Since its last FSU analysis was published the Building - Maintenance Services group has seen its Group Relative Strength Rating slump to (42), which is mediocre, whereas the L criteria calls for leadership in the industry group. The chart below shows the stock slumping under its 50 DMA line and under old (April) highs, trading near its previously cited pivot point. It has maintained its solid earnings history concerning the C and A criteria. The number of top-rated funds owning its shares rose from 99 in Sep '10 to 153 in Jun '11, a very reassuring sign concerning the I criteria. After its 5/05/11 Public Offering the company management's still large 47% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.7 million shares outstanding and 14.7 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors always limit losses at 7-8% if ever a stock falls that much after purchased. If the market environment (M criteria) is not favorable, 3 out of 4 stocks typically follow the direction of the major averages. Disciplined investors do not fight the tape!

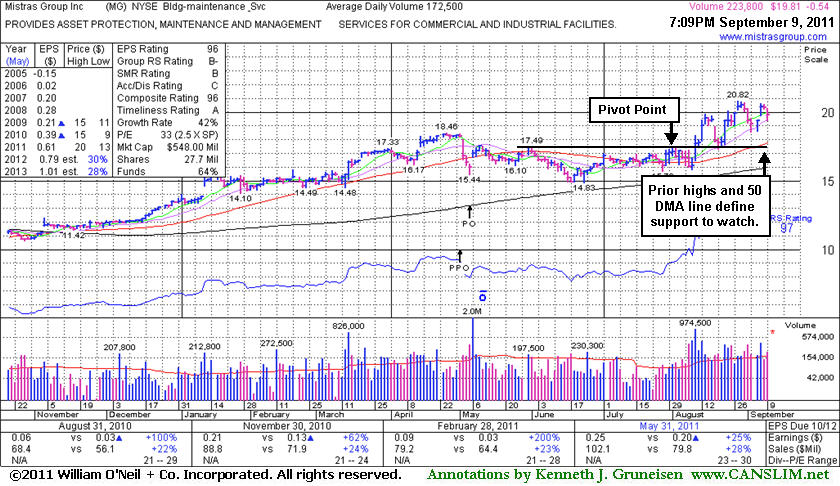

Hovering Near Highs Well Above Support - Friday, September 09, 2011

Mistras Group Inc (MG -$0.54 or -2.65% to $19.81) is holding its ground stubbornly near its 52-week high. Prior resistance in the $18 area and its 50-day moving average (DMA) line define important chart support to watch on pullbacks. Its last appearance in the FSU section was on 8/24/11 with an annotated graph included below the headline, "Hit New High After Prior Resistance Acted as Support", and we then observed - "Typically about 40% of successful breakouts pull back and test support at prior resistance before continuing higher."

The Building - Maintenance Services group has a Group Relative Strength Rating (56) that is mediocre, whereas the L criteria calls for leadership in the industry group. The chart below shows the previously noted Public Offering on 5/05/11, and it illustrates how MG found support well above its 200 DMA line. It has maintained its solid earnings history concerning the C and A criteria. The number of top-rated funds owning its shares rose from 99 in Sep '10 to 150 in Jun '11, a very reassuring sign concerning the I criteria. Management's large 59% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.7 million shares outstanding and 11.3 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors avoid chasing extended stocks more than +5% above their pivot point, and always limit losses at 7-8% if ever a stock falls that much after purchased. If the market environment is favorable, leading stocks often offer disciplined investors multiple opportunities to accumulate shares within the fact-based system's guidelines.

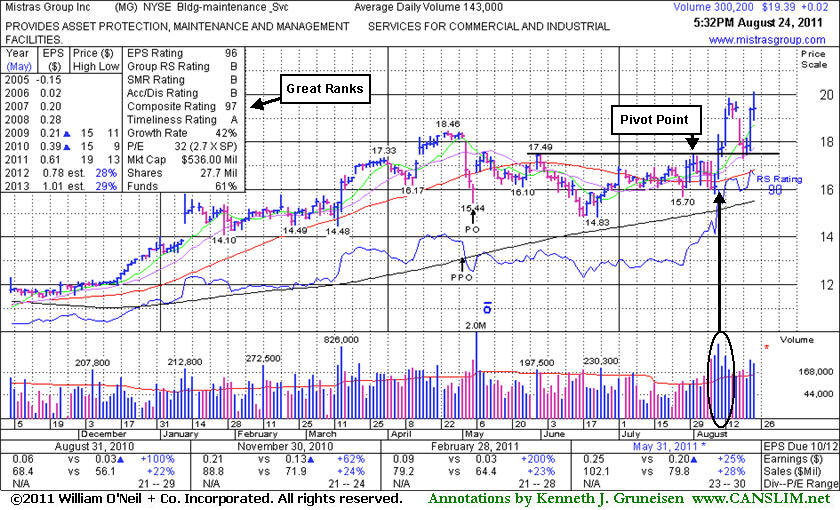

Hit New High After Prior Resistance Acted as Support - Wednesday, August 24, 2011

Mistras Group Inc (MG +$0.02 or +0.10% to $19.39) finished flat after touching a new all-time high earlier today. There is no resistance remaining due to overhead supply. Previous resistance in the $17-18 area defined important chart support after encountering mild distributional pressure following its recently noted technical breakout. Typically about 40% of successful breakouts pull back and test support at prior resistance before continuing higher.

The Accumulation/Distribution rating has improved from a D+ to a B since its last appearance in the FSU section on 8/11/11 with an annotated weekly graph included below the headline, "Management Motivated, But Market Remains Concern". At that time it was holding its ground after highlighted in yellow in the 8/10/11 mid-day report (read here) which included an annotated daily graph showing its considerable gain driven by heavy volume, rallying from a base formed since the previously noted Public Offering on 5/05/11. MG found support well above its 200 DMA line after it was dropped from the Featured Stocks list on 6/14/11. It has maintained its solid earnings history concerning the C and A criteria.

The Building - Maintenance Services group has a Group Relative Strength Rating (61) that is mediocre, but up from 51 when last summarized, whereas the L criteria calls for leadership in the industry group. The number of top-rated funds owning its shares rose from 99 in Sep '10 to 151 in Jun '11, a very reassuring sign concerning the I criteria. Management's large 59% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.7 million shares outstanding and 11.3 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors avoid chasing extended stocks more than +5% above their pivot point, and always limit losses at 7-8% if ever a stock falls that much after purchased. That is the only way to remove the chance of a small loss growing to become a much more painful and damaging loss.

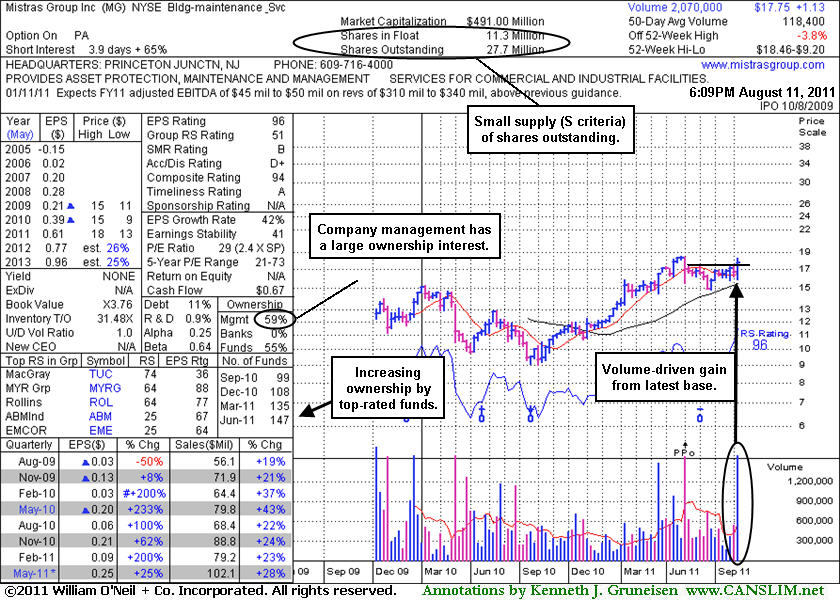

Management Motivated, But Market Remains Concern - Thursday, August 11, 2011

Mistras Group Inc (MG +$0.06 or +0.34% to $17.75) held its ground today. The 8/10/11 mid-day report (read here) included an annotated daily graph that showed its considerable gain driven by heavy volume, rallying from a base formed since the previously noted Public Offering on 5/05/11. It found support well above its 200 DMA line after it was dropped from the Featured Stocks list on 6/14/11. It maintained it solid earnings history concerning the C and A criteria. faces very little resistance due to overhead supply up to its 52-week high. Keep in mind, the M criteria still argues against new buying efforts, and disciplined investors know that 3 out of 4 stocks follow the direction of the major averages.

Its Accumulation/Distribution rating recently improved to a D+ but still is a concern. The Building - Maintenance Services group has a Group Relative Strength Rating (51) that is also mediocre, whereas the L criteria calls for leadership in the industry group. However, the number of top-rated funds owning its shares rose from 99 in Sep '10 to 147 in Jun '11, a very reassuring sign concerning the I criteria. Management's large 59% ownership interest keeps them very motivated to look after and build shareholder value. The small supply (S criteria) of only 27.7 million shares outstanding and 11.3 million in the public float can contribute to greater price volatility in the event of institutional buying or selling. Disciplined investors avoid chasing extended stocks more than +5% above their pivot point, and always limit losses at 7-8% if ever a stock falls that much after purchased. That is the only way to remove the chance of a small loss growing to become a much more painful and damaging loss.

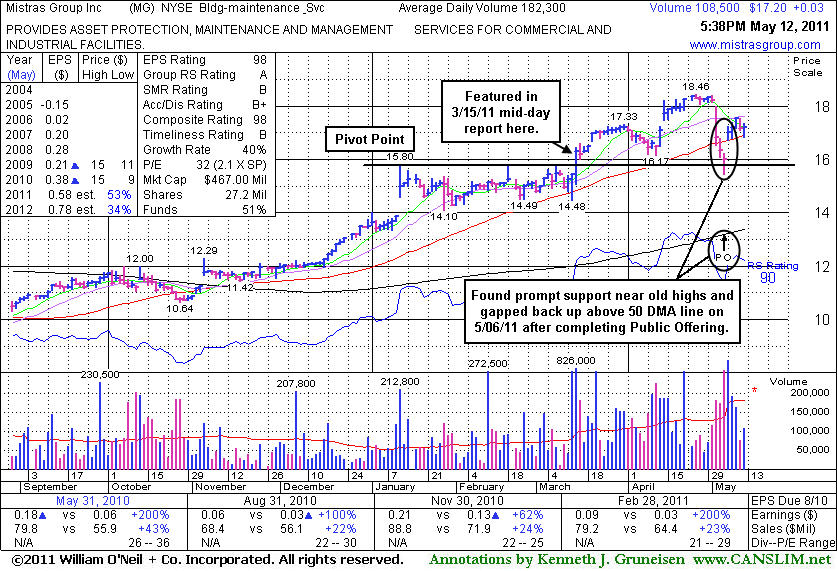

Recent Public Offering Contributed To Volatility - Thursday, May 12, 2011

Mistras Group Inc (MG +$0.03 or +0.17% to $17.20) was up today with lighter than average volume, continuing its recent consolidation above its 50-day moving average (DMA) line. Immediately after its last appearance in this FSU section on 4/12/11 with an annotated graph under the headline, "Distributional 'Churning' Pressured and Limited Progress", this high-ranked Building - Maintenance Service firm spiked higher and tallied a streak of consecutive gains with above average volume.

It has not formed a sound base pattern since a sharp downdraft last week with damaging losses on heavy volume likely prompted cautious investors into selling. After completing a new Public Offering, the gap up on 5/06/11 promptly repaired its 50 DMA violation and technically improved its outlook. Recent quarterly comparisons showed solid sales and earnings increases versus the year earlier. Some resistance remains due to overhead supply up through the $18.40 level. Disciplined investors may watch for a new sound base to possibly form and be noted. Meanwhile, odds might be more favorable with a fresh breakout.

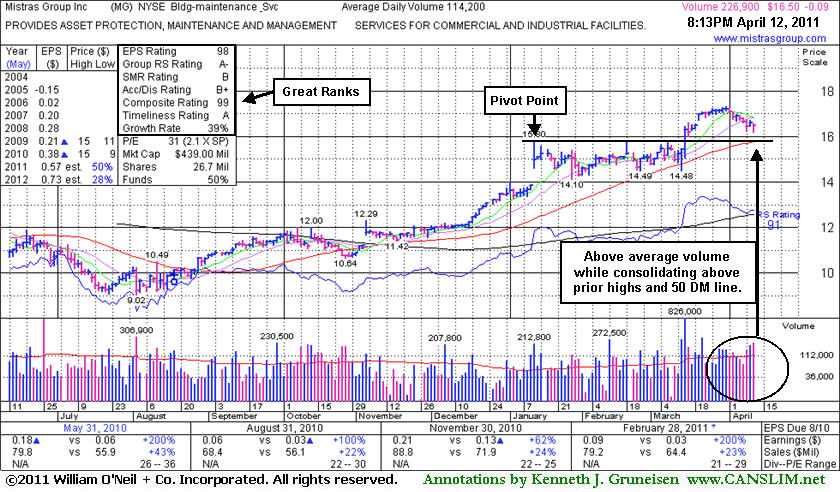

Distributional "Churning" Pressured and Limited Progress - Tuesday, April 12, 2011

Mistras Group Inc (MG -$0.09 or -0.54% to $16.50) closed near the session high today with a small loss on heavy volume while consolidating above prior highs. Today's finish near the session high, in the upper third of its intra-day range, could be considered a sign of accumulation or reassuring support showing up. Its 50-day moving average (DMA) line also defines important support to watch, and subsequent violations may trigger technical sell signals. It has not yet formed a new sound base-on-base pattern, yet it may eventually spend enough time basing such that a new pivot point may be cited.

Recent quarterly comparisons showed solid sales and earnings increases versus the year earlier. Since its last appearance in this FSU section on 3/25/11 with an annotated graph under the headline "Powerful Breakout While "M" Criteria Argues Against New Buys" the high-ranked Building - Maintenance Service firm made limited price progress even after the broader market (M criteria) showed an improvement in the trading tone. Although no resistance remained due to overhead supply, several small gains with above average volume helped it make very little additional headway - action typically considered to be a sign of "churning" or distributional pressure. Its color code was changed to yellow after dipping under its "max buy" level recently, but losses on higher volume are also signs of distributional pressure.

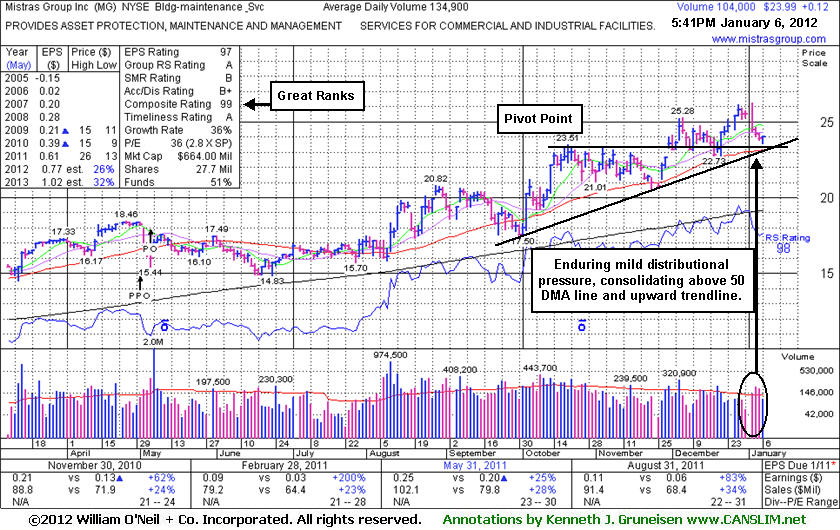

Powerful Breakout While "M" Criteria Argues Against New Buys - Tuesday, March 15, 2011

Leading stocks that are highlighted in CANSLIM.net's Mid-Day BreakOuts Report are often setting up to potentially breakout of a solid base if they have not already cleared their pivot point and triggered a technical buy signal. Relevant factors are noted in the report which can give members a decent starting point, and it is a prudent time for investors to do their own research and perhaps place that issue on their watch list. When featured in yellow they are also immediately added to the Featured Stocks page, and then they receive ongoing coverage until they are noted when ultimately dropped from that list. After doing the necessary backup research, disciplined investors sit prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines, then it would simply be removed from the watch list.

Mistras Group Inc (MG +$0.88 or +5.70% to $16.31) finished strong today, powering to a new all-time high with 10 times average volume while clearing its pivot point, triggering a technical buy signal. No resistance remains due to overhead supply. Its color code was changed to yellow with pivot point cited based on its 52-week high plus 10 cents when featured in the mid-day report earlier today while it was poised for a possible breakout (read here). Recent quarterly comparisons showed solid sales and earnings increases versus the year earlier. However, weak market conditions (M criteria) are currently an overriding concern arguing against new buying efforts until a new confirmed rally with follow-through day. In a truly bullish market environment, many more ideal breakouts like this can be spotted and they have a far better chance of succeeding to become big winners.