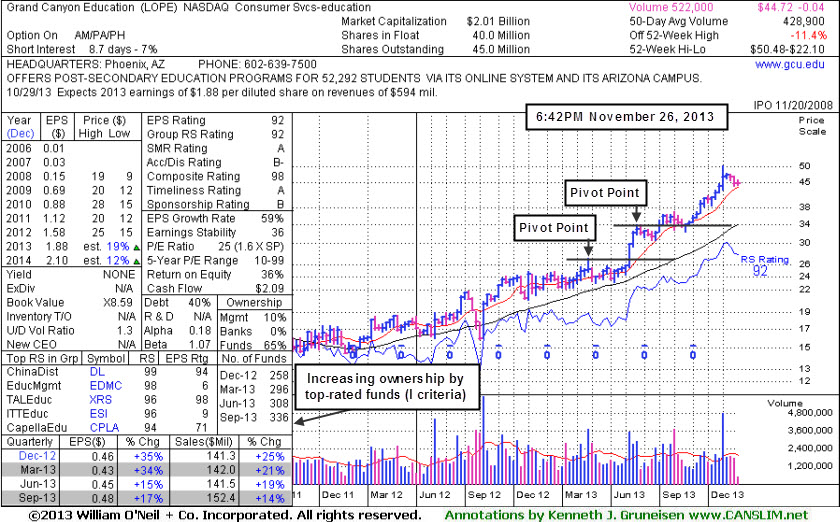

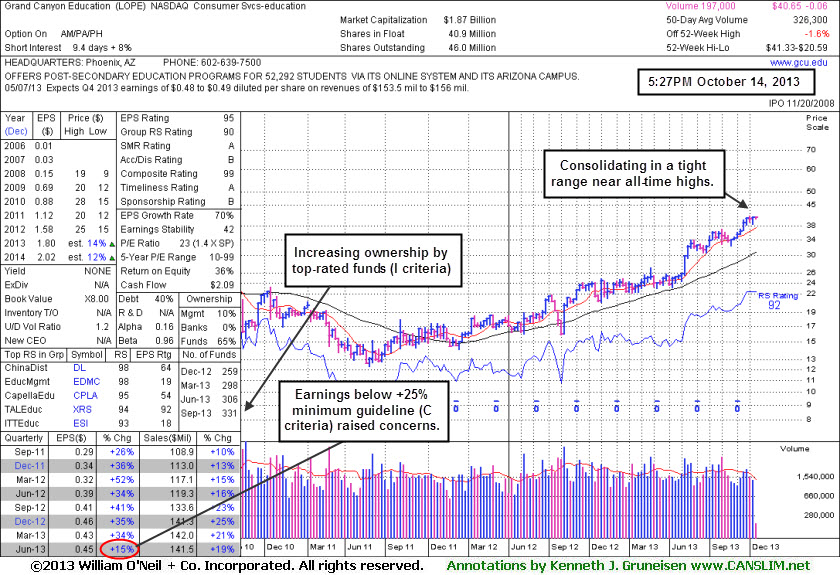

Grand Canyon Education (LOPE +$0.02 or +0.04% to $44.72) has been consolidating since its considerable volume-driven gain on 10/30/13 for a new high. It has been repeatedly noted - "Reported earnings +17% on +14% sales revenues for the Sep '13 quarter, its 2nd quarterly comparison with an earnings increase below the +25% minimum guideline (C criteria). Fundamental concerns remain while technical action has been reassuring."

The high-ranked Commercial Services - Schools firm was last shown in this FSU section on 10/14/13 under the headline, "Formed Advanced Base But Fundamental Concerns Remain", Disciplined investors might look for stronger buy candidates meeting all key criteria.

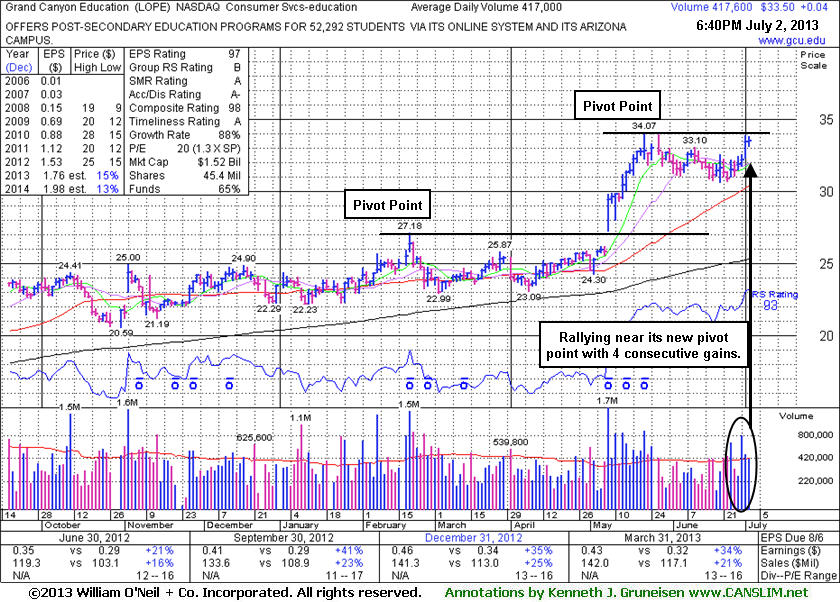

Its 50-day moving average (DMA) line defines near term support, and a subsequent violation would raise concerns and trigger a technical sell signal. Its Relative Strength Rating (92) remains above the 80+ minimum guideline. The Commercial Services - Schools group has shown leadership (L criteria) and currently has an A Rating. The weekly graph below shows pivot points identified earlier this year. The number of top-rated funds owning its shares rose from 200 in Mar '12 to 336 in Sep '13, a reassuring trend concerning the I criteria. Its small supply (S criteria) of 45 million outstanding shares could contribute to greater price volatility in the event of institutional buying or selling.

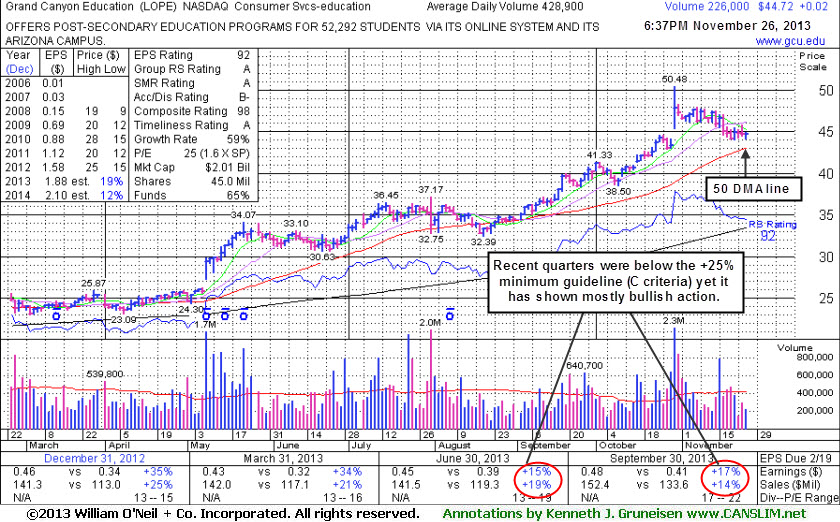

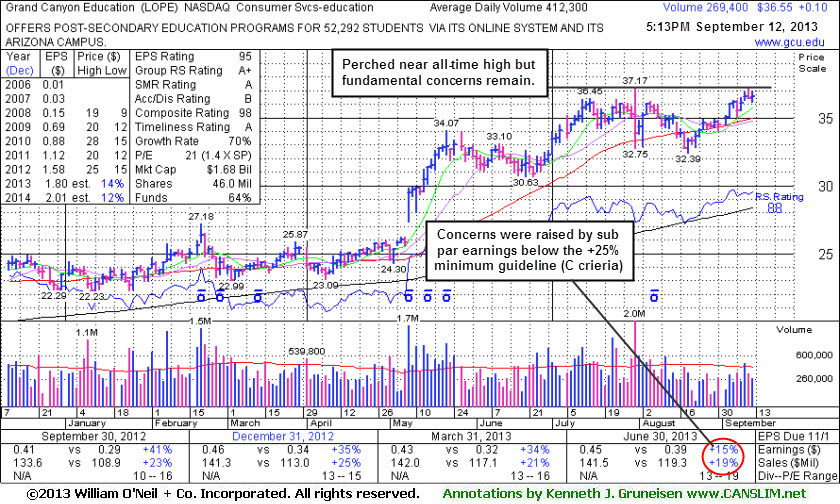

Grand Canyon Education (LOPE -$0.06 or -0.15% to $40.65) remains perched near all-time highs. Its latest consolidation may be considered an advanced "3-weeks tight" base, however, fundamental concerns remain. Disciplined investors might look for stronger buy candidates meeting all key criteria and watch to see how well its upcoming earnings report shakes out. The high-ranked Commercial Services - Schools firm was last shown in this FSU section with an annotated graph on 9/12/13 under the headline, "Perched Near All-Time High After Sub Par Quarterly Increase", with no resistance due to overhead supply. Earnings +15% on +19% sales for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria), raised fundamental concerns.

Its 50-day moving average (DMA) line defines near term support, and a subsequent violation would raise concerns and trigger a technical sell signal. Its Relative Strength Rating (92) remains above the 80+ minimum guideline. The Commercial Services - Schools group has shown leadership (L criteria) and currently has an A Rating. As it blasted into all-time high territory back in May, the headline read, "Breakaway Gap to All-Time Highs - Friday, May 10, 2013", while rallying above an earlier pivot point and also above its April 2010 high (N criteria) while noted - "Showing bullish technical action which may mark the beginning of a meaningful and sustained advance in price."

The number of top-rated funds owning its shares rose from 200 in Mar '12 to 331 in Jun '13, a reassuring trend concerning the I criteria. Its small supply (S criteria) of 46 million outstanding shares could contribute to greater price volatility in the event of institutional buying or selling.

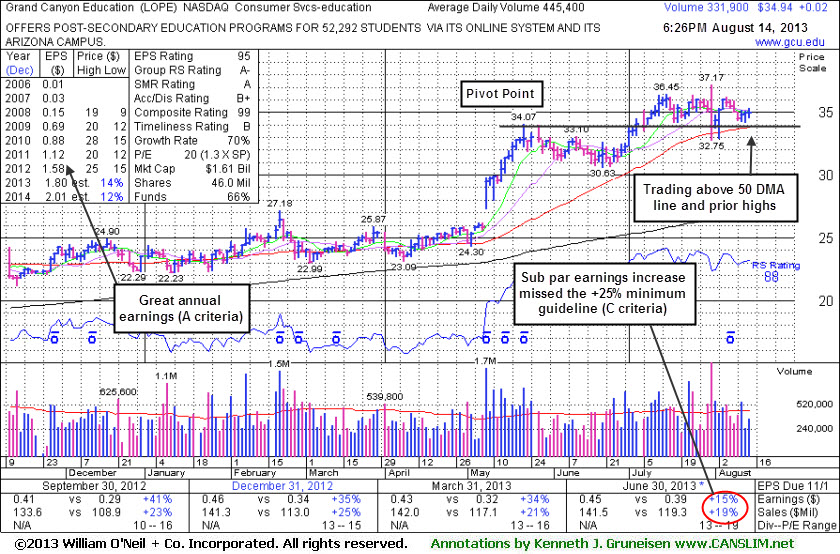

Grand Canyon Education (LOPE +$0.10 or +0.27% to $36.55) is perched near its 52-week high with no resistance due to overhead supply. Earnings +15% on +19% sales for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria), raised fundamental concerns, yet technical action has still been reassuring. Its 50-day moving average (DMA) line defines near term support, and a subsequent violation would raise concerns and trigger a technical sell signal.

It was last shown in this FSU section with an annotated graph on 8/14/13 under the headline, "Finding Support Near 50-Day Average After Disappointing Quarter". Its Relative Strength Rating (88) remains above the 80+ minimum guideline. It marked its high on 7/31/13 with a "negative reversal" after making limited headway following its latest breakout.

The Commercial Services - Schools group has shown leadership (L criteria) and currently has an A+ Rating. As it blasted into all-time high territory back in May, rallying above an earlier pivot point and also above its April 2010 high (N criteria), it was noted - "Showing bullish technical action which may mark the beginning of a meaningful and sustained advance in price." The number of top-rated funds owning its shares rose from 200 in Mar '12 to 311 in Jun '13, a reassuring trend concerning the I criteria. Its small supply (S criteria) of 46 million outstanding shares could contribute to greater price volatility in the event of institutional buying or selling.

The Commercial Services - Schools group has shown leadership (L criteria) and currently has an A- Rating. As it blasted into all-time high territory back in May, rallying above an earlier pivot point and also above its April 2010 high (N criteria), it was noted - "Showing bullish technical action which may mark the beginning of a meaningful and sustained advance in price." The number of top-rated funds owning its shares rose from 200 in Mar '12 to 306 in Jun '13, a reassuring trend concerning the I criteria. Its small supply (S criteria) of 46 million outstanding shares could contribute to greater price volatility in the event of institutional buying or selling.

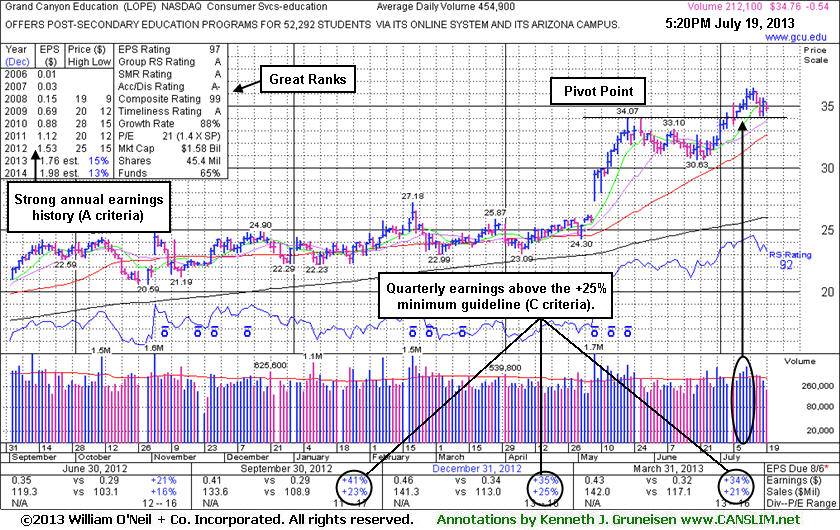

Grand Canyon Education's (LOPE -$0.54 or -1.53% to $34.76) color code was changed yellow while pulling back below its "max buy" level. It has been consolidating after a streak of volume-driven gains last week triggered a new technical buy signal and it got extended from the latest base. Prior highs in the $34 area define initial support above its 50-day moving average (DMA) line (now $32.63). Disciplined investors do not chase stocks more than +5% above their prior high or pivot point, and they always limit losses by selling if the stock falls more than -7% from their purchase price.

The Commercial Services - Schools group has shown leadership (L criteria) and currently has an A Rating. It powered above the new pivot point cited based on its 5/22/13 high plus 10 cents when it was last shown in this FSU section on 7/02/13 with an annotated graph under the headline, "Formed New Base While Perched Near All-Time Highs". As it blasted into all-time high territory back in May, rallying above an earlier pivot point and also above its April 2010 high (N criteria), it was noted - "Showing bullish technical action which may mark the beginning of a meaningful and sustained advance in price."

The number of top-rated funds owning its shares rose from 200 in Mar '12 to 288 in Jun '13, a reassuring trend concerning the I criteria. Its current Up/Down Volume Ratio of 2.3 is an unbiased indication that its shares have been under accumulation over the past 50 days. It most recently reported earnings +34% on +21% sales revenues for the Mar '13 quarter, and earnings increases were above the +25% minimum earnings guideline (C criteria) the past 3 quarterly comparisons. Its Relative Strength Rating (92) remains above the 80+ minimum guideline for buy candidates under the fact-based investment system.

Grand Canyon Education (LOPE +$0.04 or +0.12% to $33.50) managed its best-ever close today with a small gain backed by average volume. Its 50-day moving average (DMA) line and recent lows define important near-term support in the $30-31 area. LOPE was last shown in this FSU section on 6/19/13 with an annotated graph under the headline, "New Base Forming Following Prior Breakout and Big Gains", after a new pivot point was cited based on its 5/22/13 high plus 10 cents. Subsequent volume-driven gains may trigger a new technical buy signal.

As it made it to all-time high territory above its April 2010 high (N criteria) it was noted - "Showing bullish technical action which may mark the beginning of a meaningful and sustained advance in price." The Commercial Services - Schools group has shown leadership (L criteria) and currently has a B Rating. Its prior pivot point was based on its 2/20/13 high plus 10 cents. The breakaway gap was noted as one exception where investors may chase a stock more than +5% above its prior high or pivot point. However, buying further above prior highs increases the chances that a normal pullback may prompt disciplined investors to limit losses and sell if the stock falls more than -7% from their purchase price.

The number of top-rated funds owning its shares rose from 200 in Mar '12 to 295 in Mar '13, a reassuring trend concerning the I criteria. Its current Up/Down Volume Ratio of 1.8 is an unbiased indication that its shares have been under accumulation over the past 50 days. It most recently reported earnings +34% on +21% sales revenues for the Mar '13 quarter, and earnings increases were above the +25% minimum earnings guideline (C criteria) the past 3 quarterly comparisons. Its Relative Strength Rating (93) remains above the 80+ minimum guideline for buy candidates under the fact-based investment system.

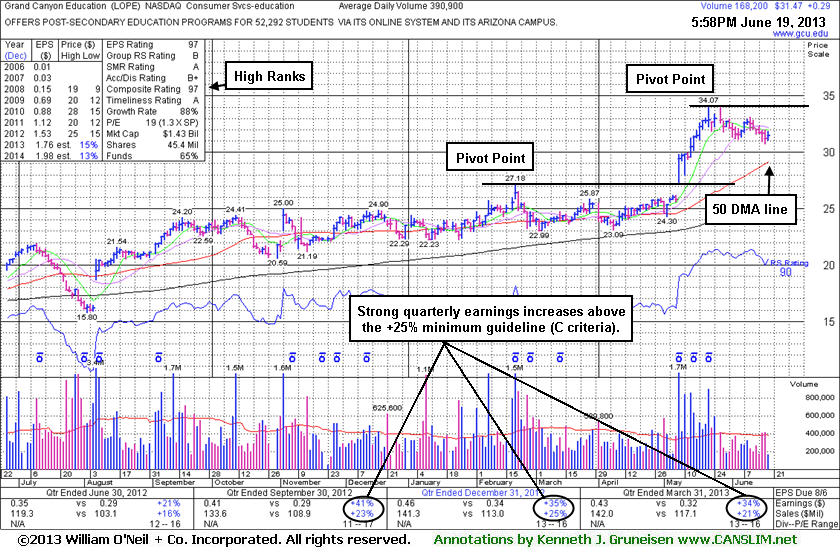

Grand Canyon Education (LOPE +$0.29 or +0.93% to $31.47) was last shown in this FSU section on 6/03/13 with an annotated graph under the headline, "Hovering Near High Following Big Gains In First Weeks After Breakout", as it was noted - "Gains of greater than +20% in the first 2-3 weeks following its "breakaway gap" suggest holding for a minimum of 8 weeks under the fact-based investment system's rules designed to help investors capture big profits from the market's biggest gainers."

It has been more than 8 weeks, and considering the broader market's weakness (M criteria) disciplined investors might be more concerned about protecting gains rather than accumulating more stocks until strength returns to the market. However, it appears to be building a new flat base, and a new pivot point was cited based on its 5/22/13 high plus 10 cents. Subsequent volume-driven gains may trigger a new technical buy signal. Volume totals have been mostly quiet or average while consolidating above its 50-day moving average (DMA) line with additional support at prior highs in the $27 area.

As it made it to all-time high territory above its April 2010 high (N criteria) it was noted - "Showing bullish technical action which may mark the beginning of a meaningful and sustained advance in price." The Commercial Services - Schools group has shown leadership (L criteria) and currently has a B Rating. Its prior pivot point was based on its 2/20/13 high plus 10 cents. The breakaway gap was noted as one exception where investors may chase a stock more than +5% above its prior high or pivot point. However, buying further above prior highs increases the chances that a normal pullback may prompt disciplined investors to limit losses and sell if the stock falls more than -7% from their purchase price.

The number of top-rated funds owning its shares rose from 200 in Mar '12 to 296 in Mar '13, a reassuring trend concerning the I criteria. Its current Up/Down Volume Ratio of 1.9 is an unbiased indication that its shares have been under accumulation over the past 50 days. It most recently reported earnings +34% on +21% sales revenues for the Mar '13 quarter, and earnings increases were above the +25% minimum earnings guideline (C criteria) the past 3 quarterly comparisons. Its Relative Strength Rating (90) remains above the 80+ minimum guideline for buy candidates under the fact-based investment system.

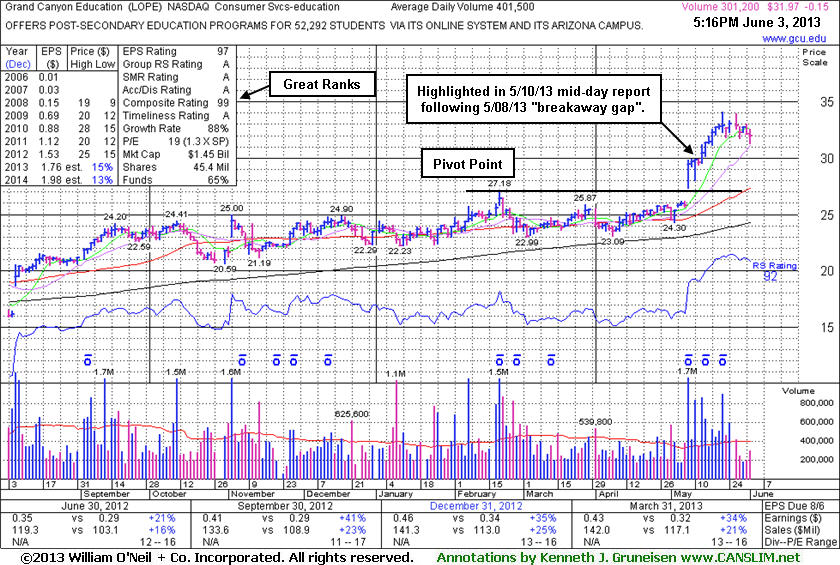

Since the stock spiked into new 52-week high territory with volume-driven gains it has held its ground. As it made it to all-time high territory above its April 2010 high (N criteria) it was noted - "Showing bullish technical action which may mark the beginning of a meaningful and sustained advance in price." The Commercial Services - Schools group has shown more leadership (L criteria) and improved to an A Rating from a D+ when it was last shown in this FSU section on 5/10/13 with an annotated graph under the headline, "

Breakaway Gap to All-Time Highs", after highlighted in yellow in the earlier 5/10/13 mid-day report (read here) following its considerable "breakaway gap" on 5/08/13. Its pivot point was based on its 2/20/13 high plus 10 cents. A breakaway gap is one noted exception where investors may chase a stock more than +5% above its prior high or pivot point. However, buying further above prior highs increases the chances that a normal pullback may prompt disciplined investors to limit losses and sell if the stock falls more than -7% from their purchase price.The number of top-rated funds owning its shares rose from 200 in Mar '12 to 292 in Mar '13, a reassuring trend concerning the I criteria. Its current Up/Down Volume Ratio of 2.3 is an unbiased indication that its shares have been under accumulation over the past 50 days. It most recently reported earnings +34% on +21% sales revenues for the Mar '13 quarter, and earnings increases were above the +25% minimum earnings guideline (C criteria) the past 3 quarterly comparisons. It found support near its 50-day moving average (DMA) line and well above its 200 DMA line recently, proving resilient after dropped from the Featured Stocks list on 4/02/13. Its Relative Strength Rating (92) has improved further above the 80+ minimum guideline for buy candidates under the fact-based investment system.

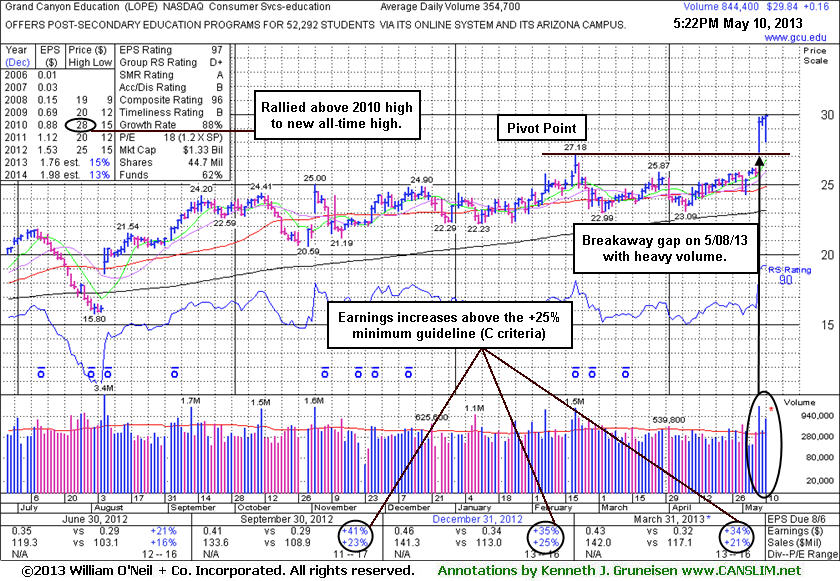

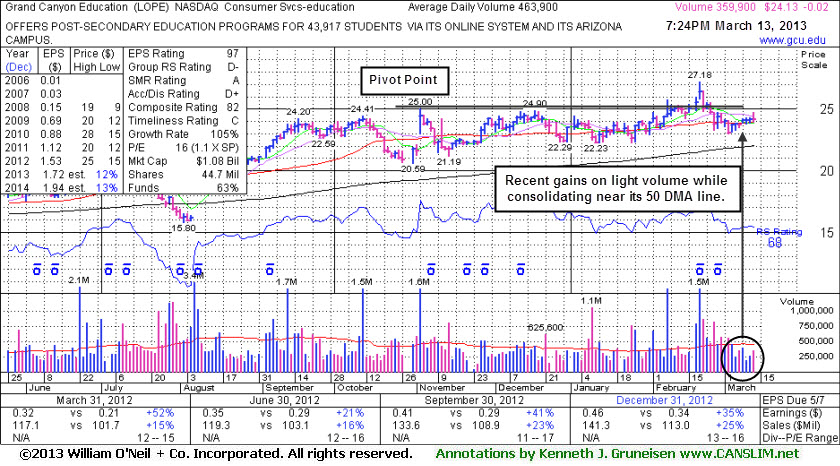

Grand Canyon Education (LOPE -$0.02 or -0.08% to $24.13) was highlighted in yellow in the earlier mid-day report (read here) while consolidating following its considerable "breakaway gap" on 5/08/13. Its pivot point is based on its 2/20/13 high plus 10 cents. A breakaway gap is one noted exception where investors may chase a stock more than +5% above its prior high or pivot point. However, buying further above prior highs increases the chances that a normal pullback may prompt disciplined investors to limit losses and sell if the stock falls more than -7% from their purchase price. The stock spiked into new 52-week high territory with volume-driven gains, and it also rallied into new all-time high territory above its April 2010 high (N criteria), showing bullish technical action which may mark the beginning of a meaningful and sustained advance in price.

The number of top-rated funds owning its shares rose from 200 in Mar '12 to 290 in Mar '13, a reassuring trend concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication that its shares have been under accumulation over the past 50 days. It most recently reported earnings +34% on +21% sales revenues for the Mar '13 quarter, and earnings increases were above the +25% minimum earnings guideline (C criteria) the past 3 quarterly comparisons. It found support near its 50-day moving average (DMA) line and well above its 200 DMA line recently, proving resilient after dropped from the Featured Stocks list on 4/02/13. It was last shown in this FSU section on 3/13/13 with an annotated graph under the headline, "Weakening Relative Strength After Negating Breakout". Since then its Relative Strength Rating (90) has improved above the 80+ minimum guideline for buy candidates under the fact-based investment system. The Commercial Services - Schools group now has a D+ Rating, however leadership (L criteria) from at least one other company in the group is an encouraging sign.

It most recently reported earnings +35% on +25% sales revenues for the Dec '12 quarter, and earnings increases were above the +25% minimum earnings guideline (C criteria) in 3 of the past 4 quarterly comparisons. The number of top-rated funds owning its shares rose from 200 in Mar '12 to 259 in Dec '12, a reassuring trend concerning the I criteria. Its current Up/Down Volume Ratio of 1.2 is still an unbiased indication that its shares have been under accumulation over the past 50 days.

Often, when a leading stock is breaking out of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors. After doing any necessary backup research, the investor is prepared to act. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

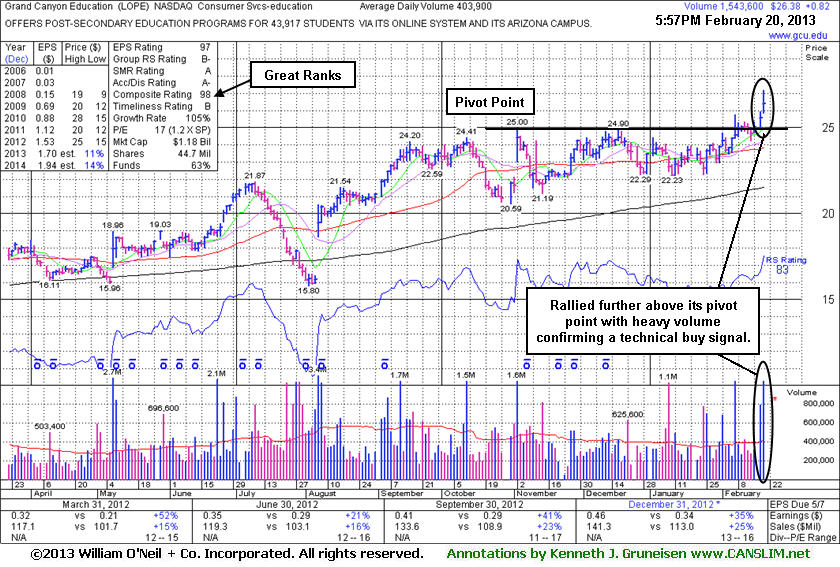

Grand Canyon Education (LOPE +$0.82 or +3.21% to $26.38) was highlighted in yellow with pivot point based on its 11/02/12 high plus 10 cents in the earlier mid-day report (read here). It recently encountered resistance in the $25 area. Its volume-driven gain on the prior session clinched a technical buy signal, and it gapped up today hitting new 52-week highs while approaching its all-time high ($28.46 in April 2010). It has earned great ranks, and Relative Strength Rating (83) is above the 80+ minimum guideline for buy candidates under the fact-based investment system. Its Relative Strength line (the jagged blue line) has simultaneously confirmed the rally into new high territory.

It most recently reported earnings +35% on +25% sales revenues for the Dec '12 quarter, and earnings increases were above the +25% minimum earnings guideline (C criteria) in 3 of the past 4 quarterly comparisons. It traded above and below its 50-day moving average (DMA) line (the red line) while consolidating since last noted in the 11/02/12 mid-day report with caution. It was last shown in this FSU section on 5/27/10 with an annotated graph under the headline, "Education Firm Enduring Distributional Pressure", as it fell on heavy volume in the wake of recently proposed regulatory changes.

Leadership in the Commercial Services - Schools group is a nice reassurance for the L criteria. The number of top-rated funds owning its shares rose from 200 in Mar '12 to 254 in Dec '12, a reassuring trend concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 also is an unbiased indication that its shares have been under accumulation over the past 50 days.

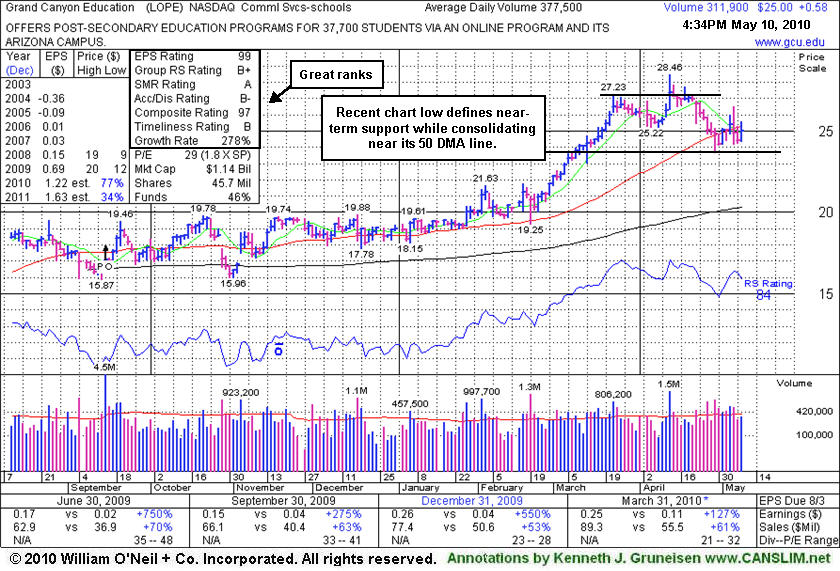

Grand Canyon Education (LOPE -$0.80 or -3.0% to $25.44) fell on heavy volume today, and the lack of price progress indicates distributional pressure as it pulled back and closed under its 50-day moving average (DMA) line. Now -10.6% off its 52-week high, it has been consolidating for a 7-week period since peaking on 4/13/10, building what may be considered a sound new base. Technically, its 4/29/10 low of $23.66 is the next important chart support, where further deterioration would raise greater concerns. The number of top-rated funds owning shares rose from 42 in Jun '09 to 62 Mar '10, providing some reassurance concerning the I criteria of the fact-based investment system. Distributional pressure negated its most recent breakout since it was featured in the 4/13/10 mid-day report (read here) when triggering a technical buy after a "3-weeks tight" type pattern. Leadership in the Commercial Services - Schools group was a nice reassurance for the L criteria, but subsequently, many for-profit schools have encountered distributional pressure in the wake of recently proposed regulatory changes. Broader market weakness (the M criteria) did nothing to help its chances. Until a follow-through-day helps confirm a solid looking new rally the odds do not look favorable for most stocks being able to rally.

Grand Canyon Education (LOPE +$0.58 or +2.38% to $25.00) posted a small gain today, yet closed below its 50-day moving average (DMA) line. Its recent chart low ($23.66 on 4/29/10) defines near-term support, where further deterioration would raise greater concerns. More time is needed for it to possibly for a sound new base. The number of top-rated funds owning shares rose from 42 in Jun '09 to 58 Mar '10, providing some reassurance concerning the I criteria of the fact-based investment system. Distributional pressure negated its most recent breakout since it was featured in the 4/13/10 mid-day report (read here) when triggering a technical buy after a "3-weeks tight" type pattern. Leadership in the Commercial Services - Schools group was a nice reassurance for the L criteria, but subsequently, many for-profit schools have encountered distributional pressure in the wake of recently proposed regulatory changes. Broader market weakness (the M criteria) did nothing to help its chances.

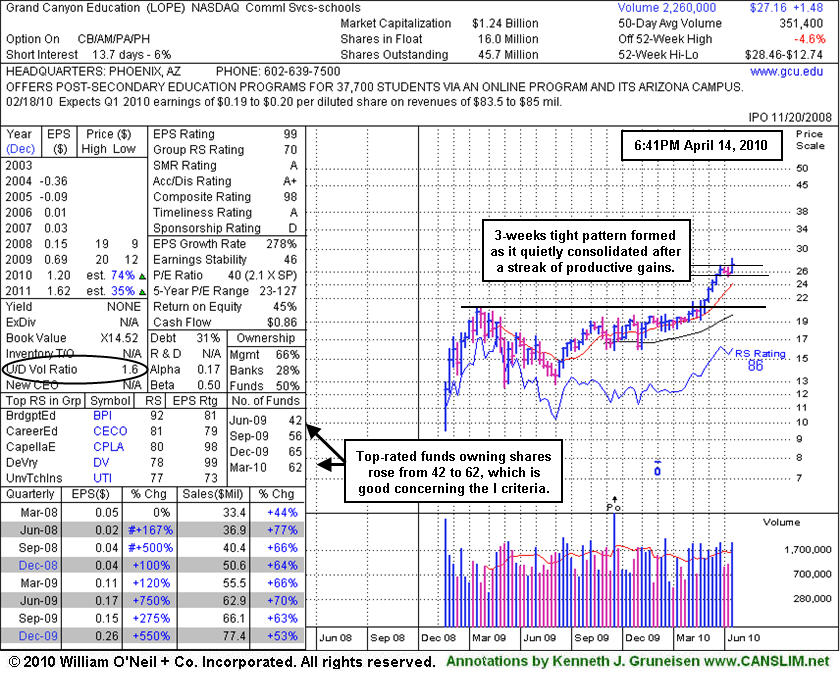

Grand Canyon Education (LOPE -$0.19 or -0.69% to $27.16) ended with a small loss today, closing just below its pivot point and -4.6% off its 52-week high. It was featured in the 4/13/10 mid-day report (read here) and finished that session near the middle of its intra-day range with a gain above its pivot point backed by more than 4 times average volume. The considerable gain triggered a technical buy after a "3-weeks tight" type pattern. That type of advanced chart pattern occasionally forms after an earlier breakout produces considerable gains. In this case, volume cooled while it stubbornly held its gains, which suggests that very few sellers were rushing to the exits. Its current Up/Down Volume Ratio of 1.6 is an unbiased indicator that it has recently been under accumulation. The number of top-rated funds owning shares rose from 42 in Jun '09 to 62 Mar '10, providing a nice reassurance concerning the I criteria of the fact-based investment system. Meanwhile, great leadership in the Commercial Services - Schools group is a nice reassurance for the L criteria. LOPE was noted in the 3/24/10 mid-day report appearance, "Patient investors may watch for an ideal entry point on pullbacks toward prior highs, of whenever a new base forms."