Retail/Wholesale - Building Products Firm Again Slumps Under 50 DMA Line - Friday, June 04, 2010

Lumber Liquidators Hldgs (LL -$2.25 or -7.48% to $27.82) suffered a considerable loss today that led to a violation of its 50-day moving average (DMA) line and December '09 highs, again raising concerns. A "negative reversal" on 4/26/10 marked its all-time high shown in this FSU section under the headline "Negative Reversal Today; Fresh Earnings News Wednesday" after hitting its $33.41 high. . Further deterioration below its recent chart lows would raise concerns and trigger more worrisome technical sell signals.Sequentially, its quarterly comparisons show accelerating sales revenues with earnings above the +25% guideline versus the year ago period in the 3 most current (C criteria) quarters. LL quickly got extended beyond the "max buy" guideline used by disciplined investors after it was recently featured at $29.87 in the 4/22/10 the mid-day report (read here) with a timely note as it was - "rising from an orderly cup shaped pattern (without a proper handle) formed since last noted on 12/17/09. It rallied steadily after a 'breakaway gap' on 8/05/09 helped it clear stubborn resistance in the $17 area. Quarterly sales and earnings increases have recently shown encouraging acceleration while growth rates have previously been noted as below the investment system's guidelines." The number of top-rated funds owning its shares rose from 24 in Dec '09 to 60 in Mar '10, an encouraging sign concerning the I criteria of the fact-based system.

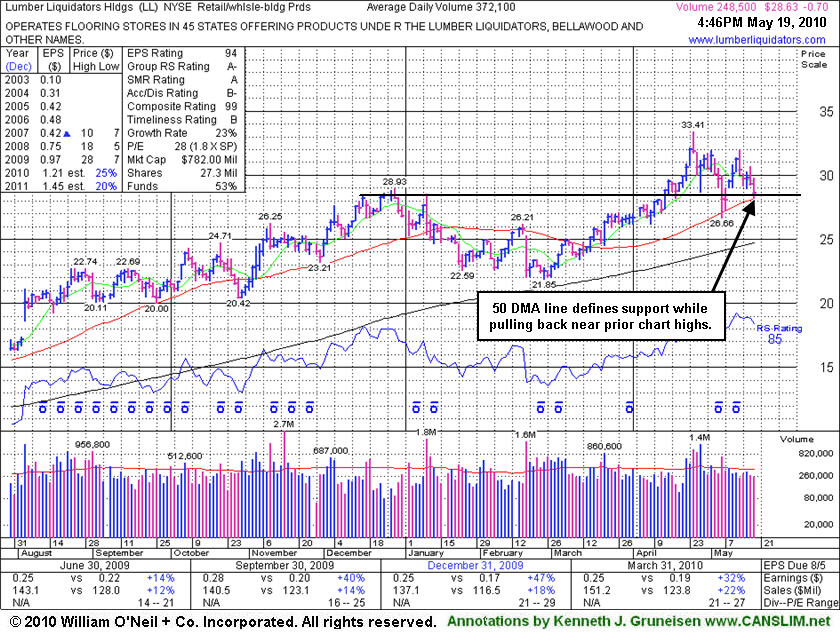

Consolidation Near Prior Highs Defining Support - Wednesday, May 19, 2010

Lumber Liquidators Hldgs (LL -$0.69 or -2.35% to $28.64) is consolidating near its 50-day moving average (DMA) line. Further deterioration would raise concerns and trigger more worrisome technical sell signals. It found support near that short-term average recently and promptly rebounded back above its December 2009 highs. Its last appearance in this FSU section on 4/26/10 under the headline "Negative Reversal Today; Fresh Earnings News Wednesday" illustrated a worrisome "negative reversal" after hitting its $33.41 high. The action was indicative of distributional pressure, as selling offset any new buying efforts. Sequentially, its quarterly comparisons show accelerating sales revenues with earnings above the +25% guideline versus the year ago period in the 3 most current (C criteria) quarters

LL quickly got extended beyond the "max buy" guideline used by disciplined investors after it was recently featured at $29.87 in the 4/22/10 the mid-day report (read here) with a timely note as it was - "rising from an orderly cup shaped pattern (without a proper handle) formed since last noted on 12/17/09. It rallied steadily after a 'breakaway gap' on 8/05/09 helped it clear stubborn resistance in the $17 area. Quarterly sales and earnings increases have recently shown encouraging acceleration while growth rates have previously been noted as below the investment system's guidelines." The number of top-rated funds owning its shares rose from 24 in Dec '09 to 60 in Mar '10, an encouraging sign concerning the I criteria of the fact-based system.

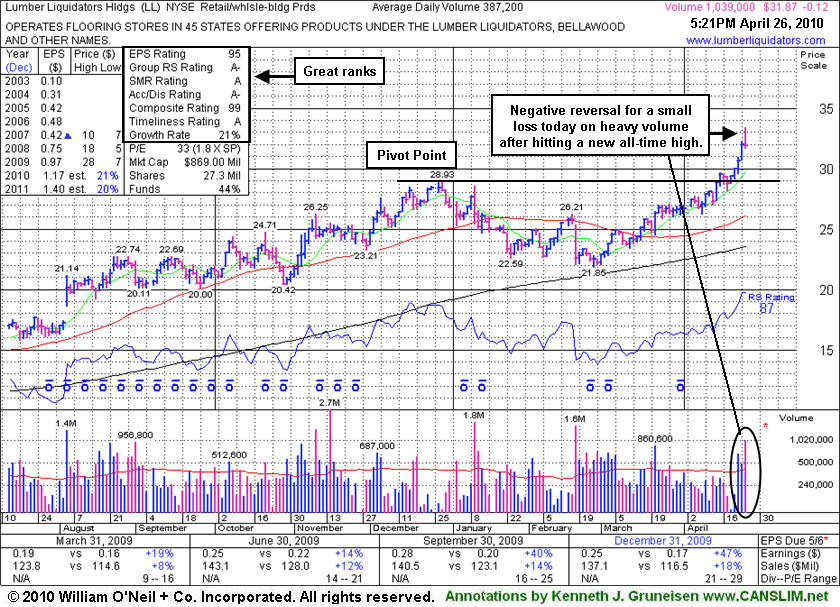

Negative Reversal Today; Fresh Earnings News Wednesday - Monday, April 26, 2010

Lumber Liquidators Hldgs (LL -0.12 or -0.38% to $31.87) traded up to new all-time high today, but it erased the whole gain and closed near the session low for a worrisome "negative reversal" and small loss with heavy volume. The action was indicative of distributional pressure, as selling offset any new buying efforts. Patient investors might watch for a chance to accumulate shares on light volume pullbacks, rather than chasing it more than +5% above its old highs or pivot point. Sequentially is quarterly comparisons show accelerating sales revenues and earnings +40% and +47% in the Sep and Dec '09 quarterly comparisons, respectively, versus the year ago periods. It is due to report earnings before the open on Wednesday, 4/28/10.

LL quickly got extended beyond the "max buy" guideline used by disciplined investors after it was recently featured at $29.87 in the 4/22/10 the mid-day report (read here) with a timely note as it was - "rising from an orderly cup shaped pattern (without a proper handle) formed since last noted on 12/17/09. It rallied steadily after a 'breakaway gap' on 8/05/09 helped it clear stubborn resistance in the $17 area. Quarterly sales and earnings increases have recently shown encouraging acceleration while growth rates have previously been noted as below the investment system's guidelines." The number of top-rated funds owning its shares rose from 25 in Dec '09 to 53 in Mar '10, an encouraging sign concerning the I criteria of the fact-based system.