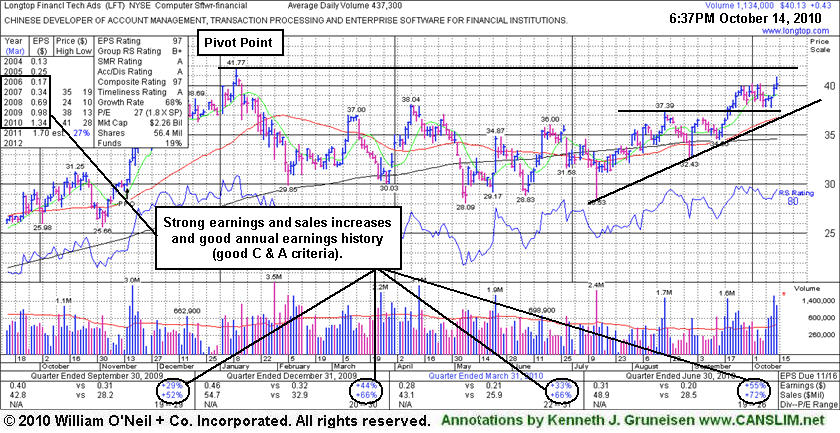

Longtop Financl Tech Ads (LFT -$1.80 or -4.66% to $36.80) violated its 50-day moving average (DMA) line on the prior session, raising concerns. It was down considerably today amid widespread weakness in many China-based companies, and its large loss raised more serious concerns and triggered a more worrisome technical sell signal. Its damaging distributional loss led to a test of support at its 200 DMA line and an intra-day violation of a recent chart low ($37.71 on 11/15/10) before rebounding to close back above that prior low. A subsequent rebound above its 50 DMA line would help its outlook, meanwhile it will be dropped from the Featured Stocks list again as of tonight. Its Relative Strength rank has slumped to a mediocre 53, below the 80+ guideline for new buy candidates under the investment system.

After LFT was featured in yellow in the 10/18/10 mid-day report (read here) following a 10-month long flat base it had briefly undercut its 50 DMA line and then spiked above the pivot point cited to new all-time highs. Earnings results in the latest quarterly report also stand out now as having slumped under the +25% guideline, raising fundamental concerns.

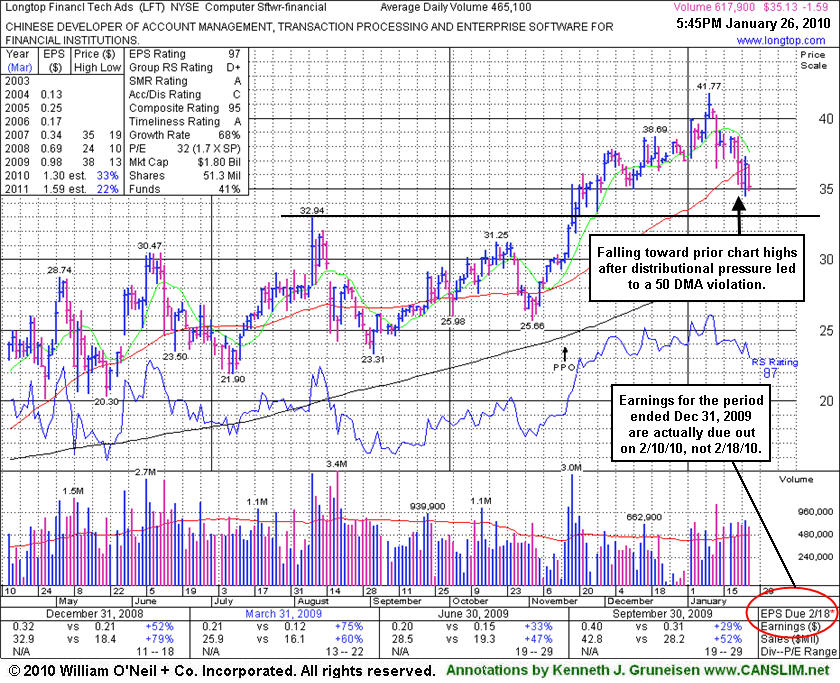

Longtop Financl Tech Ads (LFT -$1.59 or -4.33% to $35.13) suffered another loss on above average volume today, ending at its lowest close since November while promptly slumping back below its 50-day moving average (DMA) line. The company is due to report earnings on Wednesday, February 10 after the market close. Widespread weakness in China-based issues has clearly been a factor in recent days. Its outlook becomes increasingly questionable the longer it remains trading below its 50 DMA line. Meanwhile, prior resistance in the $33 area defines the next an important support level to watch.

News of a proposed offering of additional shares on 11/16/09 seemed well received by the market. Its fundamentals remain strong. The number of top-rated funds owning an interest in its shares rose from 20 funds in Dec '08 to 61 funds in Dec '09, which is reassuring concerning the I criteria. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Return on Equity of +20% is above the +17% guideline. Upward progress can often be hindered by additional share offerings for the near-term, yet institutional investors typically increase their interest through the process. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here).

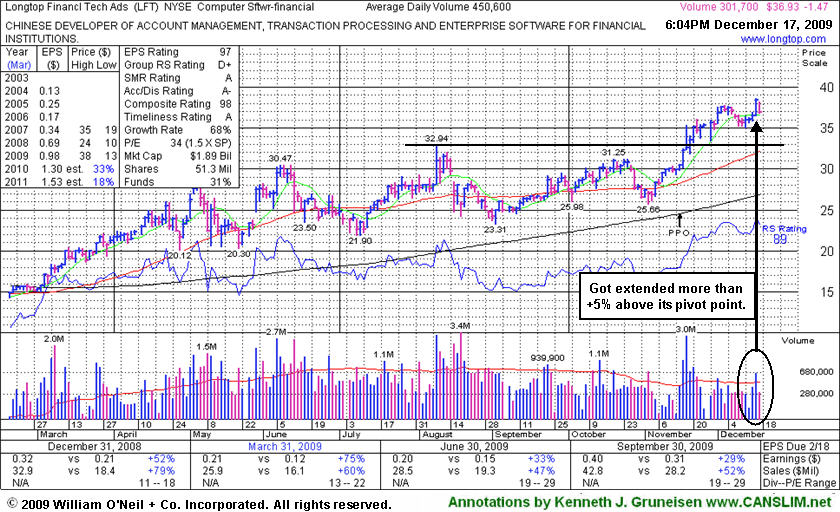

Longtop Financl Tech Ads (LFT -$0.79 or -1.98% to $39.10) suffered a loss on higher volume today after gapping down, but it ended near its session high. Its prior gain with above average volume for a new all-time high had helped it get extended after recently rising from a choppy 14-week base. It is trading more than +5% above its pivot point and above its "max buy" price, so disciplined investors would avoid chasing it. Its Up/Down Volume Ratio of 2.3 is an unbiased sign of recent accumulation taking place. Recent highs and its 50-day moving average line are now coinciding in the $33 area and defining an important support level to watch.

A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong. The number of top-rated funds owning an interest in its shares rose from 20 funds in Dec '08 to 55 funds in Sept '09, which is reassuring concerning the I criteria. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Return on Equity of +20% is above the +17% guideline. Upward progress can often be hindered by additional share offerings for the near-term, yet institutional investors typically increase their interest through the process. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here).

Longtop Financl Tech Ads (LFT -$1.47 or -3.83% to $36.93) suffered a loss on lighter volume today as it erased a large part of its prior gain with above average volume for a new all-time high. It has gotten extended after recently rising from a choppy 14-week base. It is extended more than +5% above its pivot point and above its "max buy" price, so disciplined investors would avoid chasing it. Its Up/Down Volume Ratio of 2.4 is an unbiased sign of recent accumulation taking place. Recent highs and its 50-day moving average line are now coinciding in the $31 area and defining an important support level to watch.

A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong. The number of top-rated funds owning an interest in its shares rose from 20 funds in Dec '08 to 52 funds in Sept '09, which is reassuring concerning the L criteria. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Return on Equity of +20% is above the +17% guideline. Upward progress can often be hindered by additional share offerings for the near-term, yet institutional investors typically increase their interest through the process. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here).

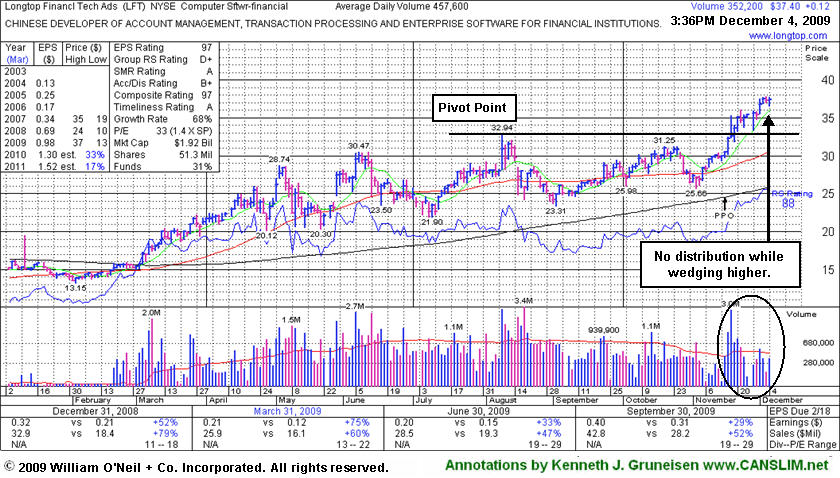

Longtop Financl Tech Ads (LFT +$0.18 or +0.48% to $37.46) has been wedging higher, encountering no distributional pressure. It is extended more than +5% above its pivot point and above its "max buy" price, so disciplined investors would avoid chasing it. Recent highs in the $31 area are an initial support level to watch.

A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong. The number of top-rated funds owning an interest in its shares rose from 20 funds in Dec '08 to 50 funds in Sept '09, which is reassuring concerning the L criteria. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Return on Equity of +20% is above the +17% guideline. Upward progress can often be hindered by additional share offerings for the near-term, yet institutional investors typically increase their interest through the process. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here).

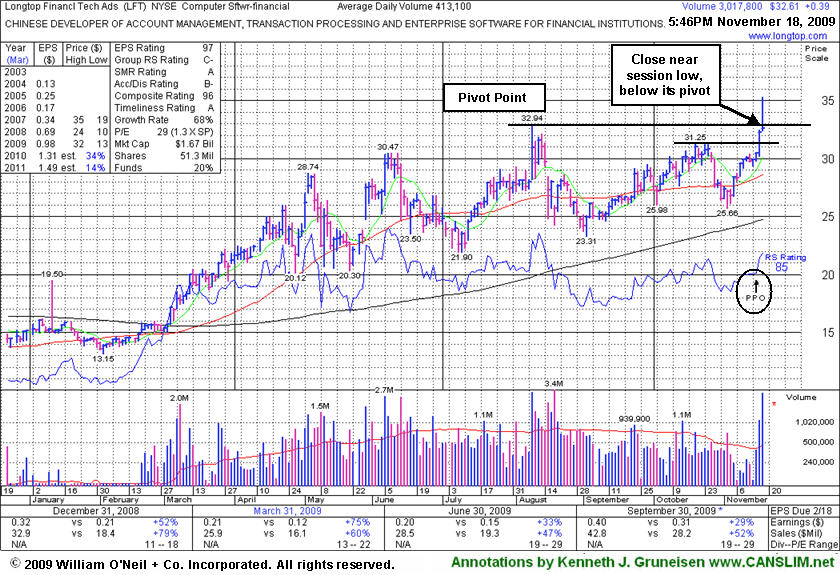

Longtop Financl Tech Ads (LFT +$0.39 or +1.21% to $32.61) opened with a breakaway gap up today that helped it blast from a choppy 14-week base, confirming a powerful technical breakout with heavy volume. However, its close near the session low raised some concerns because it technically put it back below its pivot point after it had briefly traded above its "max buy" price and above Oct 2007 all-time high. Recent highs in the $31 area are an initial support level to watch.

The newspaper described it differently, mentioning a "deep handle" with light volume. However, the correction from its $31.25 high to its $25.65 low was more than just a deep handle. It retraced more than 50% of its prior rally from its $23.31 low, making it not a proper cup-with-handle. That is why it was described as a choppy base instead. From the book "How To Make Money In Stocks" we have studied many examples that rose many-fold in price. The book emphasizes that there is no need to get in "early", because any stock that goes to $60 must first clear $32, $33,and $34. Point being, we prefer to be careful about following the rules.

A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong. The number of top-rated funds owning an interest in its shares rose from 20 funds in Dec '08 to 42 funds in Jun '09, which is reassuring concerning the L criteria. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Return on Equity of +20% is above the +17% guideline. Its progress could be hindered by future share offerings. This Chinese Computer Software firm had filed a registration of approximately 16 million shares for resale which was noted in previous analysis. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here).

Longtop Financl Tech Ads (LFT -$0.13 or -0.47% to $27.71) is holding its ground after rebounding above its 50-day moving average (DMA) line. Substantial losses on heavy volume indicative of distributional pressure negated its recent breakout a week after its considerable gap up gain with heavy volume on 8/10/09 had helped it reach a new 52-week high. It gapped down on 8/17/09 for a damaging loss, and after it technically negated its recent breakout the stock's color code was changed to green. It gapped down again on 8/19/09 after reporting results for the quarter ended June 30, 2009, falling substantially on heavy volume 4 times average.

This high-ranked leader needs more time to form a new sound base before it might be considered an ideal buy candidate again, meanwhile investors have reasons for caution. The number of top-rated funds owning an interest in its shares rose from 20 funds in Dec '08 to 38 funds in Jun '09, which is reassuring concerning the L criteria. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Return on Equity of +20% is above the +17% guideline. Its progress could be hindered by future share offerings. This Chinese Computer Software firm filed a registration of approximately 16 million shares for resale not long ago, yet there have been no subsequent headlines concerning a proposed offering. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here).

Longtop Financl Tech Ads (LFT +$1.96 or +6.21% to $31.57) ended at a new high close today, following through with an additional gain above its pivot point backed by +55% above average volume. That was a sign of prompt support and institutional buying demand after a pullback toward prior chart highs on the prior session that had erased most of the considerable gap up gain with heavy volume from 8/10/09 which had helped it reach a new 52-week high. This previously featured high-ranked leader showed up in Monday's Mid-Day Breakouts Report (read here) with a note indicating " Y - Gapped up today and rallied for a considerable gain with heavy volume, reaching a new 52-week high, yet pulling back from intra-day highs. Color code is changed to yellow with new pivot point and max buy prices noted. It has repaired its 50 DMA violation and rebounded impressively since weak action it to be dropped from the Featured Stocks list on 7/08/09." A technical issue, however, left it listed in the lower portion of the mid-day report without the usual highlighting in yellow and isolation at the top of the report, while it also did not get added to the Featured Stocks page where members may view all currently featured stocks and their latest notes. If you have feedback or questions for us at any time, please use the inquiry form here. Thank you to our attentive members who called the matter to our attention!

The number of top-rated funds owning an interest in its shares rose from 20 funds in Dec '08 to 31 funds in Jun '09, which is reassuring concerning the L criteria. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Return on Equity of +20% is above the +17% guideline. Keep in mind that the company is due to report earnings for the latest quarter after the market close on August 18th. Additionally, its progress could be hindered by future share offerings. This Chinese Computer Software firm filed a registration of approximately 16 million shares for resale not long ago, yet there have been no subsequent headlines concerning a proposed offering. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here).

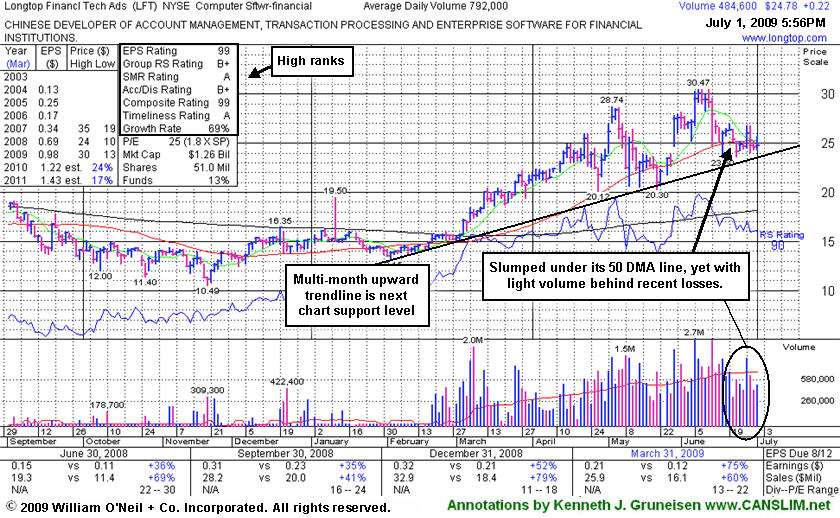

Longtop Financl Tech Ads (LFT +$0.22 or +0.90% to $24.78) recently slumped under its 50-day moving average (DMA) line, and its outlook gets increasingly questionable the longer it remains trading below that important short-term average. Any subsequent losses leading to deterioration below its multi-month upward trendline would raise additional concerns and trigger a more worrisome technical sell signal. Keep in mind that its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here). Return on Equity of +20% is above the +17% guideline. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases.

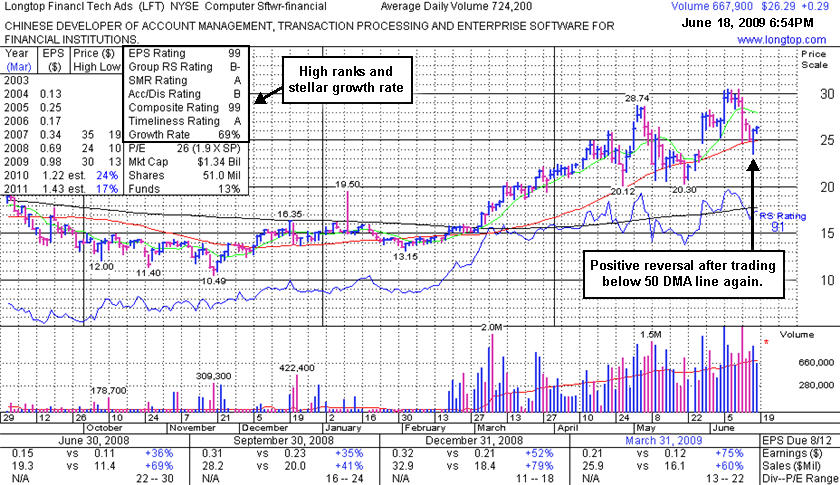

Longtop Financl Tech Ads (LFT +$0.29 or +1.12% to $26.29) held its ground today with a small gain on lighter volume. That followed a "positive reversal" which was another encouraging sign of institutional support after a brief violation of its 50-day moving average (DMA) line. However, it recently has encountered another dose of worrisome distributional pressure, and it needs more time to form a sound new base pattern -as noted under the headline "More Time Needed For Another Sound Base To Form" in its prior FSU appearance (read here).

Any subsequent losses leading to deterioration below its short-term average would raise additional concerns and trigger a more worrisome technical sell signal. Keep in mind that its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

Longtop Financl Tech Ads (LFT +$0.12 or +0.44% to $27.12) has been holding its ground since it gapped up on 5/28/09 after reporting another strong quarter. It needs more time to form another sound base, and its progress could be hindered by future share offerings. The stock's prompt repair of its recent 50-day moving average (DMA) line violation, and its gap up are both indicative of solid institutional (the I criteria) support and buying demand. It found support on its first test of its 50 DMA line, then sprinted to new highs with gains backed by heavier volume, but it was soon hit with a wave of distributional pressure and technically violated its 50 DMA line, triggering a technical sell signal. That prompted its last appearance in this Featured Stock Update section on 5/21/09 under the headline "Technical Violation of 50-Day Average Raises Concerns".

As previously noted, this Chinese Computer Software firm might be hindered by future share offerings. On 4/27/09 it filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. Often, light volume consolidations under the "max buy" level after a powerful breakout can offer patient investors opportunities to accumulate a high-ranked leader's shares within the guidelines of the investment system. But in this case, heavy distribution and a potentially diluting stock offering are two very good reasons to be cautious for the near term. If it forms a new orderly base in the weeks ahead, then another ideal entry point may present itself."

LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here). Return on Equity of +24% is above the +17% guideline. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases.

Longtop Financl Tech Ads (LFT -$1.80 or -7.92% to $20.94) suffered a considerable loss today with higher volume, which was a sign of distributional pressure. It violated its 50 DMA line, triggering a technical sell signal. As previously noted (View all notes), this Chinese Computer Software firm might be hindered by future share offerings. On 4/27/09 it filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. Often, light volume consolidations under the "max buy" level after a powerful breakout can offer patient investors opportunities to accumulate a high-ranked leader's shares within the guidelines of the investment system. But in this case, heavy distribution and a potentially diluting stock offering are two very good reasons to be cautious for the near term. If it forms a new orderly base in the weeks ahead, then another ideal entry point may present itself."

A prompt repair of its 50 DMA violation would help its outlook, but even then it needs more time to form another sound base. Its outlook gets increasingly questionable the longer it spends trading, or the worse it sinks, below that important short-term average. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here). Return on Equity of +24% is above the +17% guideline. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

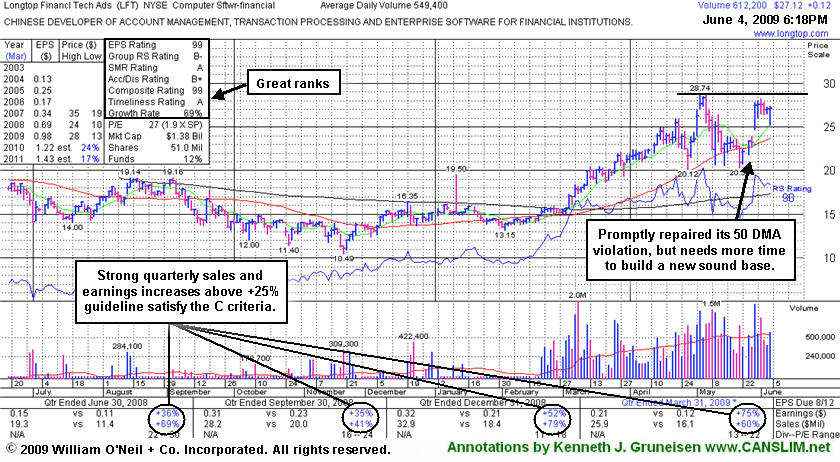

Longtop Financial Tech Ads (LFT -$3.25 or -12.66% to $22.42) ended near its session low with a considerable loss on heavy volume, its third consecutive loss with above average volume, indicating obvious distributional pressure. As previously noted (View all notes), this Chinese Computer Software firm might be hindered by future share offerings. On 4/27/09 it filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. Often, light volume consolidations under the "max buy" level after a powerful breakout can offer patient investors opportunities to accumulate a high-ranked leader's shares within the guidelines of the investment system. But in this case, heavy distribution and a potentially diluting stock offering are two very good reasons to be cautious for the near term. If it forms a new orderly base in the weeks ahead, then another ideal entry point may present itself.

Important support to watch remains its 50-day moving average (DMA) line, which closely coincides with the pivot point originally identified when LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here). Return on Equity of +24% is above the +17% guideline. It has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of the few favorable looking leaders showing up in recent CANSLIM.net reports, Chinese firms have obviously enjoyed a heavy weighting. Caution is advised due to the inherent risk of international exposure, as you could wake up one morning and, based upon geo-political news or events, you could see the entire group of foreign stocks trading drastically down or up. While the current leadership is noted in China-linked stocks, and it could be an ongoing phenomenon; investors are reminded to make disciplined buys and sells always. Mindray Medical International Ltd. (MR) and China Medical Technologies Inc. (CMED) are two fine examples of former leaders hailing from China. Both companies are still producing impressive quarterly sales revenues and earnings increases, but they have slumped badly since being dropped from the CANSLIM.net Featured Stocks list in 2008.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Of the few favorable looking leaders showing up in recent CANSLIM.net reports, Chinese firms have obviously enjoyed a heavy weighting. Caution is advised due to the inherent risk of international exposure, as you could wake up one morning and, based upon geo-political news or events, you could see the entire group of foreign stocks trading drastically down or up. While the current leadership is noted in China-linked stocks, and it could be an ongoing phenomenon; investors are reminded to make disciplined buys and sells always. Mindray Medical International Ltd. (MR) and China Medical Technologies Inc. (CMED) are two fine examples of former leaders hailing from China. Both companies are still producing impressive quarterly sales revenues and earnings increases, but they have slumped badly since being dropped from the CANSLIM.net Featured Stocks list in 2008.

Longtop Financial Tech Ads (LFT +$0.88 or +3.82% to $23.91) is now consolidating well above important support at prior chart highs and its 50-day moving average (DMA) line. Its gain on 4/14/08 with +67% above average volume helped confirm a technical buy signal yet lifted it above its "max buy" level. Lighter volume pullbacks have offered disciplined investors opportunities to accumulate shares within +5% of the stock's pivot point as per the investment system's guidelines. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here). If one studies its weekly chart they will notice more up weeks than down weeks with above average volume, and it has an Up/Down Volume Ratio of 1.8 . Both are bullish signs of institutional accumulation (the I criteria). Return on Equity of +24% is above the +17% guideline. Its quarterly sales revenues and earnings increases have been well above the +25% guideline and it has a good annual earnings history (good C & A criteria).

This Chinese developer of computer software for financial institutions hails from the Computer Software-Financial Group which is currently ranked solidly in the top quartile of industry groups, satisfying the L criteria. There is still some remaining overhead supply that may act as a source of resistance. Management has a large percentage ownership interest in the company, which is good because it keeps the directors focused on maintaining and growing shareholder value. But in the event those insiders might decide to unload a fair part of those shares in a subsequent stock offering, such news could be expected to hinder its upward price progress for some time.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Of the few favorable looking leaders showing up in recent CANSLIM.net reports, Chinese firms have obviously enjoyed a heavy weighting. Caution is advised due to the inherent risk of international exposure, as you could wake up one morning and, based upon geo-political news or events, you could see the entire group of foreign stocks trading drastically down or up. While the current leadership is noted in China-linked stocks, and it could be an ongoing phenomenon; investors are reminded to make disciplined buys and sells always. Mindray Medical International Ltd. (MR) and China Medical Technologies Inc. (CMED) are two fine examples of former leaders hailing from China. Both companies are still producing impressive quarterly sales revenues and earnings increases, but they have slumped badly since being dropped from the CANSLIM.net Featured Stocks list in 2008.

Longtop Financial Tech Ads (LFT +$0.47 or +1.96% to $24.46) hit a new 52-week high as today's gain with lighter volume was its 10th gain in 11 sessions. It is now extended from a sound base, making it not buyable within the investment system's guidelines. LFT was first featured at $22.19 on Thursday, April 02, 2009 in the CANSLIM.net Mid Day Breakouts Report (read here). Its weekly chart below shows more up weeks than down weeks with above average volume, and it has an Up/Down Volume Ratio of 1.9 which is also a bullish sign of institutional accumulation (the I criteria). Return on Equity of +24% is above the +17% guideline. Its quarterly sales revenues and earnings increases have been well above the +25% guideline and it has a good annual earnings history (good C & A criteria).

This Chinese developer of computer software for financial institutions hails from the Computer Software-Financial Group which is currently ranked solidly in the top quartile of industry groups, satisfying the L criteria. There is still some remaining overhead supply that may act as a source of resistance. Management has a large percentage ownership interest in the company, which is good because it keeps the directors focused on maintaining and growing shareholder value. But in the event those insiders might decide to unload a fair part of those shares in a subsequent stock offering, such news could be expected to hinder its upward price progress for some time.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Of the few favorable looking leaders showing up in recent CANSLIM.net reports, Chinese firms have obviously enjoyed a heavy weighting. Caution is advised due to the inherent risk of international exposure, as you could wake up one morning and, based upon geo-political news or events, you could see the entire group of foreign stocks trading drastically down or up. While the current leadership is noted in China-linked stocks, and it could be an ongoing phenomenon; investors are reminded to make disciplined buys and sells always. Mindray Medical International Ltd. (MR) and China Medical Technologies Inc. (CMED) are two fine examples of former leaders hailing from China. Both companies are still producing impressive quarterly sales revenues and earnings increases, but they have slumped badly since being dropped from the CANSLIM.net Featured Stocks list in 2008.

Longtop Financial Tech Ads (LFT +$0.03 or +0.14% to $21.67) hit a new 52-week high today, then failed to hold its gain or close above the $21.81 pivot point cited when it was first featured in yellow in today's CANSLIM.net Mid Day Breakouts Report (read here). Volume was above average behind recent gains that helped it clear prior chart highs in the $19 area that are now an important support level to watch on pullbacks. Volume behind this week's gains has been short of the +50% above average volume minimum guideline, while a sustained advance is considered more likely once proof of heavy institutional buying demand shows up in the form of confirming gains above its pivot point. Its weekly chart below shows more up weeks than down weeks with above average volume, and it has an Up/Down Volume Ratio of 1.6 which is also a bullish sign. Return on Equity of +24% is above the +17% guideline. Its quarterly sales revenues and earnings increases have been well above the +25% guideline and it has a good annual earnings history (good C & A criteria).

This Chinese developer of computer software for financial institutions has earned high ranks based upon strong annual and quarterly sales revenues and earnings increases (looking good concerning the C & A criteria). It hails from the Computer Software-Financial Group which is currently ranked 11th on the 197 Industry Groups list, putting it solidly in the top quartile and satisfying the L criteria. There is still some remaining overhead supply that may act as a source of resistance, however a powerful breakout above its long-term chart high ($21.71 on 5/19/08) with heavy volume could signal the start of a more significant advance. Management has a large percentage ownership interest in the company, which is good because it keeps the directors focused on maintaining and growing shareholder value. But in the event those insiders might decide to unload a fair part of those shares in a subsequent stock offering, such news could be expected to hinder its upward price progress for some time.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile