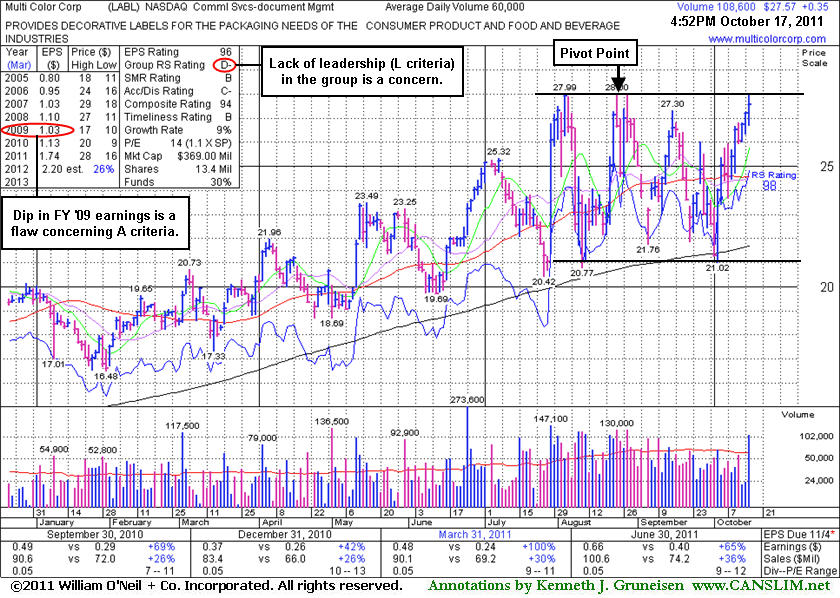

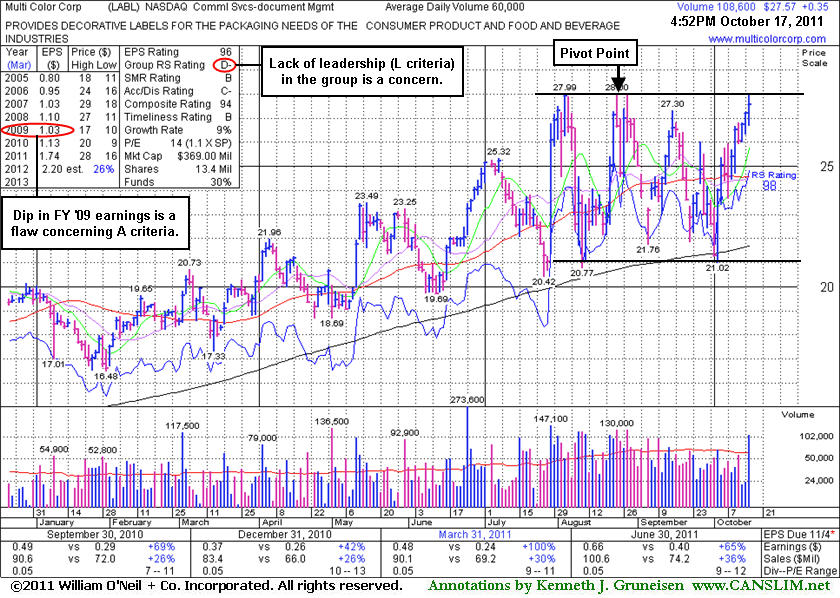

Multi Color Corp (LABL +$0.35 or +1.29% to $27.57) is perched near its 52-week high today after a choppy 10-week consolidation during which its 200-day moving average (DMA) line acted as support. No overhead supply remains to act as resistance. In the mid-day report earlier today (read here) its color code was changed to yellow with pivot point cited based on its 52-week high plus 10 cents.

Subsequent volume-driven gains into new high ground may trigger a technical buy signal. It reported earnings +65% on +36% sales revenues for the quarter ended June 30, 2011. Annual earnings (A criteria) history included a slight dip in FY '09 earnings, a fundamental flaw. The lack of leadership (L criteria) in the Commercial Services - Document Management group is also a concern. Those noted shortcomings call for caution, especially after its rally stright up from the bottom of its choppy base. A powerful volume-driven breakout could signal that institutional (I criteria) buyers are accumulating shares, but without that fresh proof disciplined investors know to wait and watch. Pyramiding can also be a helpful tactic to let the subsequent market action dictate how heavily invested one may get.