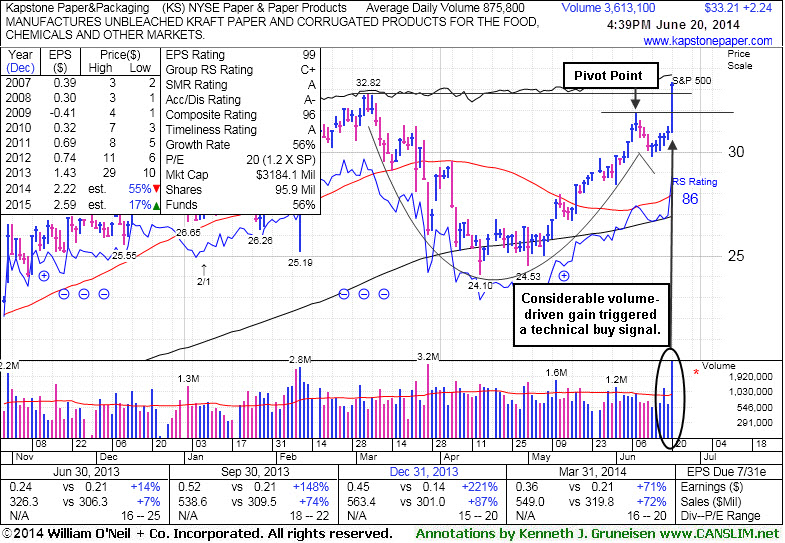

Four Times Average Volume Behind Big Breakout Gain - Friday, June 20, 2014

Kapstone Paper & Packaging (KS +$2.24 or +7.23% to $33.21) finished strong after highlighted in yellow in the earlier mid-day report (read here) while rallying from a cup-with-handle base pattern. It traded more than 4 times average volume while triggering a technical buy signal, rallying above its pivot point, then continuing on into new 52-week high territory. No resistance remains due to overhead supply.

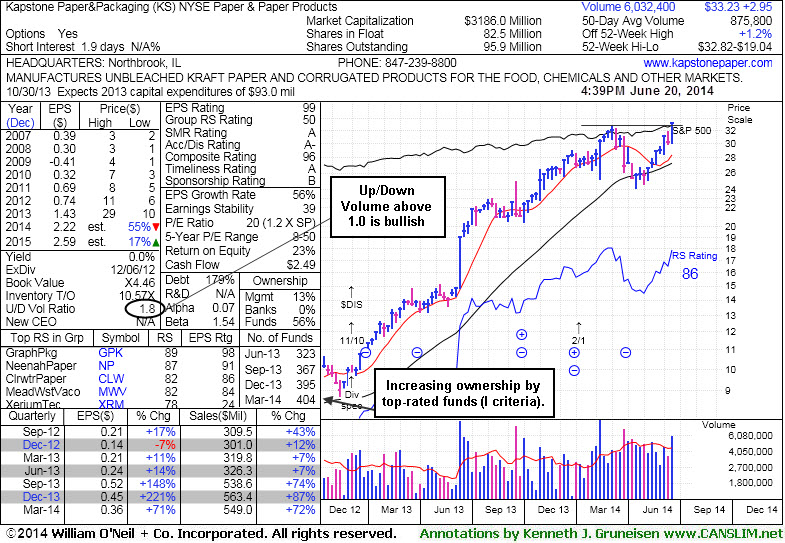

It found support near its 200-day moving average (DMA) line during its consolidation then rebounded. It reported earnings +71% on +72% sales revenues for the Mar '14 quarter, its 3rd consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) have been improving steadily since a downturn and loss in FY '09. The number of top-rated funds owning its share rose from 323 in Jun '13 to 404 in Mar '14, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.8 is also an unbiased indication its shares have been under accumulation over the past 50 days. The Paper and Paper Products industry group has a mediocre C+ Group Relative Strength rating, however leadership from several other companies in the group is a reassuring sign concerning the L criteria.