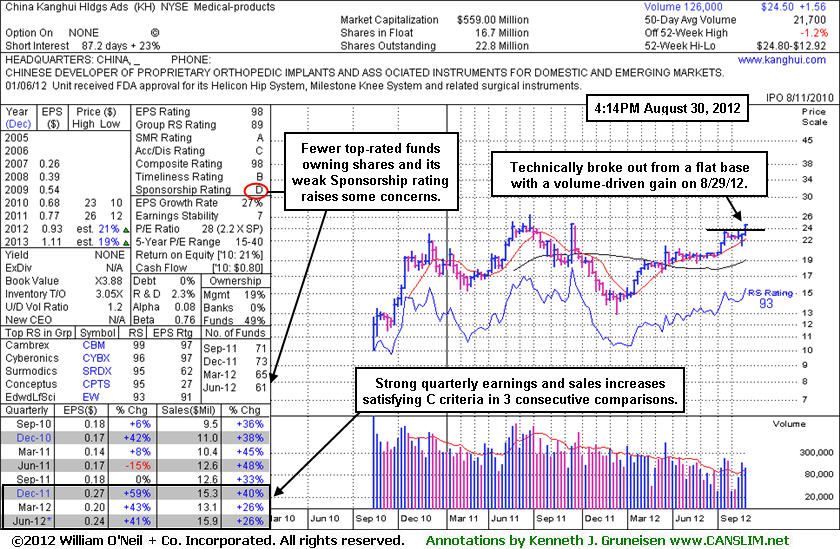

The last time it appeared in the FSU section was on 8/30/12 under the headline, "Medical Product Firm Challenging Prior Resistance Area". This Chinese Medical - Products firm was trading at $24.19 then, and it had just tallied a gain with more than 3 times average volume on the prior session which technically helped it break out of an orderly flat base pattern above its 50-day moving average (DMA) line. The prior resistance area acted as a support level in the weeks that followed. It was noted that - "Its small supply (S criteria) of only 22.8 million outstanding shares and low daily average volume can contribute to greater volatility in the event of institutional buying or selling so proper discipline is especially important. It reported earnings +41% on +26% sales revenues for the quarter ended June 30, 2012 versus the year ago period. The Dec '11 and Mar '12 quarters showed strong sales revenues and earnings increases above the +25% minimum guideline (C criteria), improving following a streak of 3 sub par quarterly comparisons. Management's 19% ownership interest keeps them motivated to build and maintain shareholder value."

China Kanghui Hldgs Ads ( -$0.15 or -0.61% to $24.50) was highlighted in yellow with pivot point cited based on its 8/16/12 high plus 10 cents in the earlier mid-day report (read here). This Chinese Medical - Products firm finished near the session high after pulling back following a gain with more than 3 times average volume on the prior session which technically helped it break out of an orderly flat base pattern above its 50-day moving average (DMA) line. Prior highs in the $25-26 area have been a stubborn resistance area, however overhead supply is not a great concern. The abrupt pullbacks and deep consolidations from prior highs serve as a reminder to always follow the loss-limiting sell rule if ever a stock falls more than -7% from your purchase price or otherwise you risk suffering even greater losses which may be difficult to make up. Its small supply (S criteria) of only 22.8 million outstanding shares and low daily average volume can contribute to greater volatility in the event of institutional buying or selling so proper discipline is especially important.

It reported earnings +41% on +26% sales revenues for the quarter ended June 30, 2012 versus the year ago period. The Dec '11 and Mar '12 quarters showed strong sales revenues and earnings increases above the +25% minimum guideline (C criteria), improving following a streak of 3 sub par quarterly comparisons. There are concerns raised by its weak Sponsorship Rating of D and the recent waning in the number of top-rated funds owning its shares. However, its current Up/Down Volume Ratio of 1.2 provides an indication that its shares have been under moderate accumulation during the past 50 days. Management's 19% ownership interest keeps them motivated to build and maintain shareholder value.