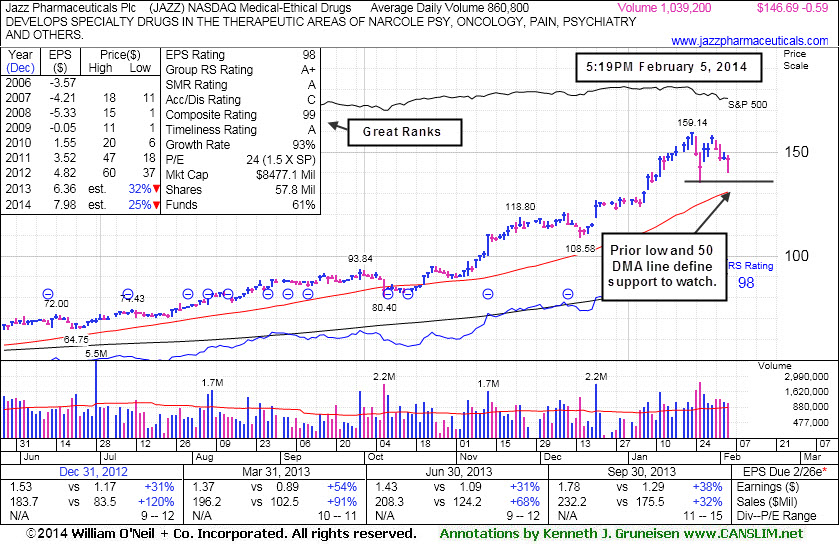

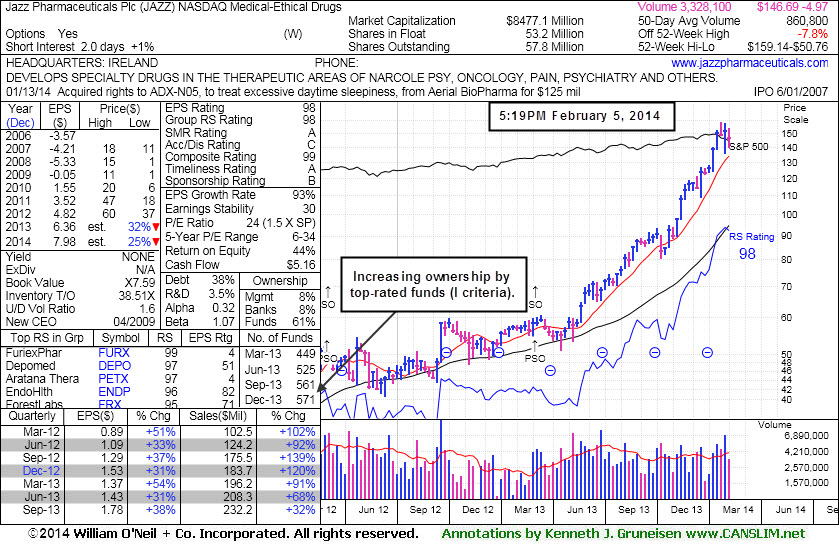

Jazz Pharmaceuticals Plc (JAZZ -$0.26 or -0.15% to $170.03) is perched near its 52-week and all-time high, very extended from any sound base. Its 50-day moving average (DMA) line and recent lows in the $135 area define important support to watch on pullbacks. Its last appearance in this FSU section was on 2/05/14 with annotated graphs under the headline, "Consolidating After Getting Very Extended".

The company is due to report financial results on Tuesday, February 25, 2014, after the close. Keep in mind that volume and volatility often increase near earnings news.

JAZZ has rallied as much as +87.7% since highlighted in yellow in the 9/30/13 mid-day report (read here). The pivot point cited was based its 9/03/13 high plus 10 cents after an advanced "3-weeks tight" base. It may have looked like an expensive stock which had run too high already to many investors at that time. When it finished that session with a solid gain backed by +160% above average volume reports noted that it clinched a technical buy signal. Volume at least +40% above average is the minimum volume necessary behind a breakout before action should be taken by investors. In this case the volume met the guideline, providing the necessary proof of sufficient institutional buying demand.

Prior notes have reminded members of the dangers of chasing extended stocks - "Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price."

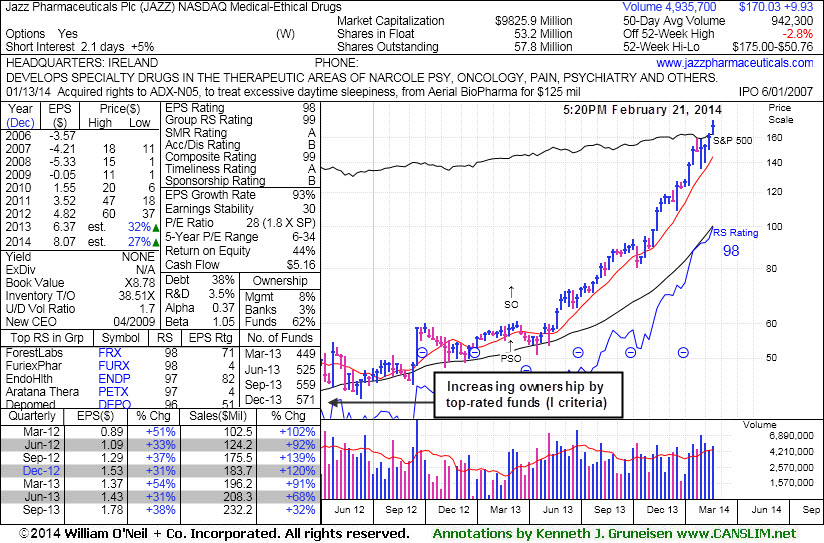

Fundamentals remain strong (C and A criteria) today with its strong sales and earnings increases continuing through the Sep '13 quarter. Its annual earnings (A criteria) history includes big FY '10, '11, and '12 earnings after a history of losses.

The number of top-rated funds owning its shares rose from 351 in Mar '12 to 571 in Dec '13, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with an A+ rating for its Group Relative Strength.

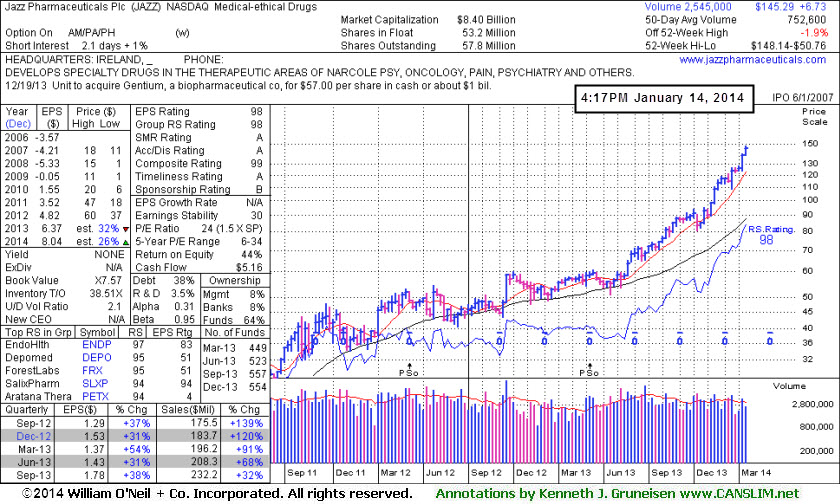

Jazz Pharmaceuticals Plc (JAZZ -$0.49 or -0.33% to $146.79) has been retreating from its 52-week high after getting extended from any sound base. Its prior low and 50-day moving average (DMA) line ($130.74 now) define important support to watch where violations may trigger technical sell signals.

Its last appearance in this FSU section was on 1/14/14 with annotated graphs under the headline, "Very Extended From Sound Base Following Big Volume-Driven Gains". JAZZ has rallied as much as +70.75% since highlighted in yellow in the 9/30/13 mid-day report (read here). The pivot point cited was based its 9/03/13 high plus 10 cents after an advanced "3-weeks tight" base. It may have looked like an expensive stock which had run too high already to many investors at that time. When it finished that session with a solid gain backed by +160% above average volume reports noted that it clinched a technical buy signal. Volume at least +40% above average is the minimum volume necessary behind a breakout before action should be taken by investors. In this case the volume met the guideline, providing the necessary proof of sufficient institutional buying demand.

Prior notes have reminded members of the dangers of chasing extended stocks - "Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price."

Fundamentals remain strong (C and A criteria) today with its strong sales and earnings increases continuing through the Sep '13 quarter. Its annual earnings (A criteria) history includes big FY '10, '11, and '12 earnings after a history of losses.

The number of top-rated funds owning its shares rose from 351 in Mar '12 to 571 in Dec '13, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with an A+ rating for its Group Relative Strength.

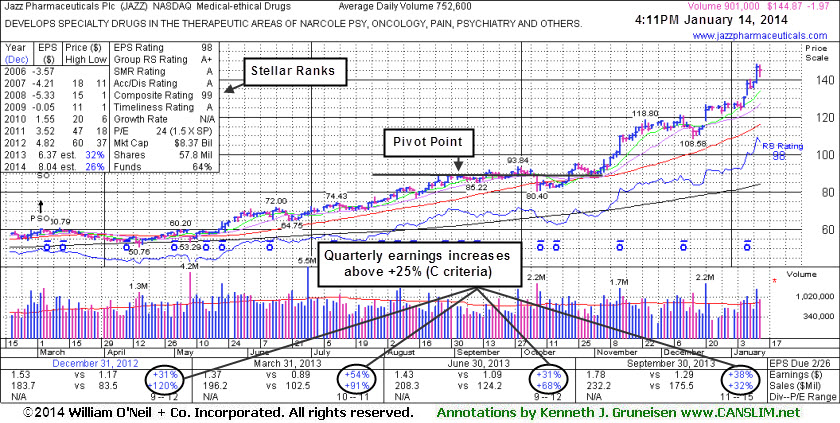

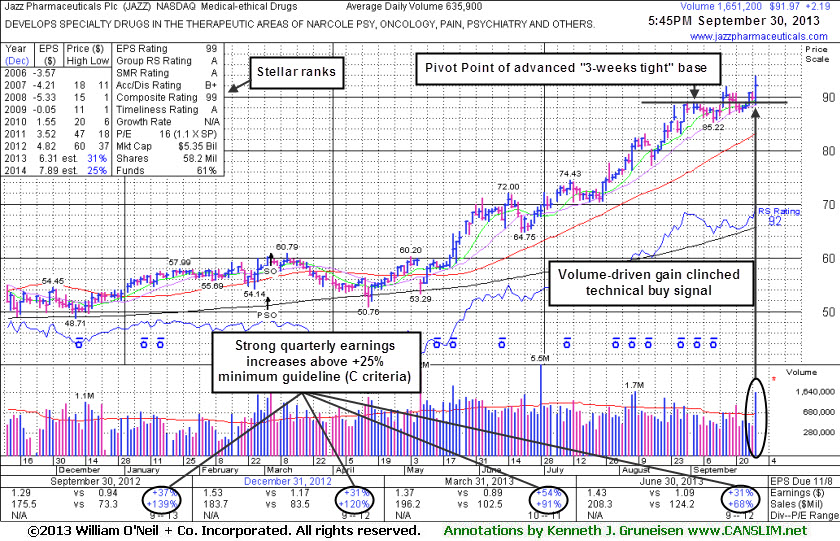

It has rallied as much as +58.9% since highlighted in yellow in the 9/30/13 mid-day report (read here). The pivot point cited was based its 9/03/13 high plus 10 cents after an advanced "3-weeks tight" base. It may have looked like an expensive stock which had run too high already to many investors at that time. When it finished that session with a solid gain backed by +160% above average volume reports noted that it clinched a technical buy signal. Volume at least +40% above average is the minimum volume necessary behind a breakout before action should be taken by investors. In this case the volume met the guideline, providing the necessary proof of sufficient institutional buying demand.

Its last appearance in this FSU section was on 12/10/13 with annotated graphs under the headline, "Technically Extended Stock May Be a Dangerous Chase". It is on track for its 3rd consecutive weekly gain and may possibly go on to produce more climactic gains, however prior notes have reminded members of the dangers of chasing extended stocks - "Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price."

Fundamentals remain strong (C and A criteria) today with its strong sales and earnings increases continuing through the Sep '13 quarter. Its annual earnings (A criteria) history includes big FY '10, '11, and '12 earnings after a history of losses.

The number of top-rated funds owning its shares rose from 351 in Mar '12 to 554 in Dec '13, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with an A rating for its Group Relative Strength.

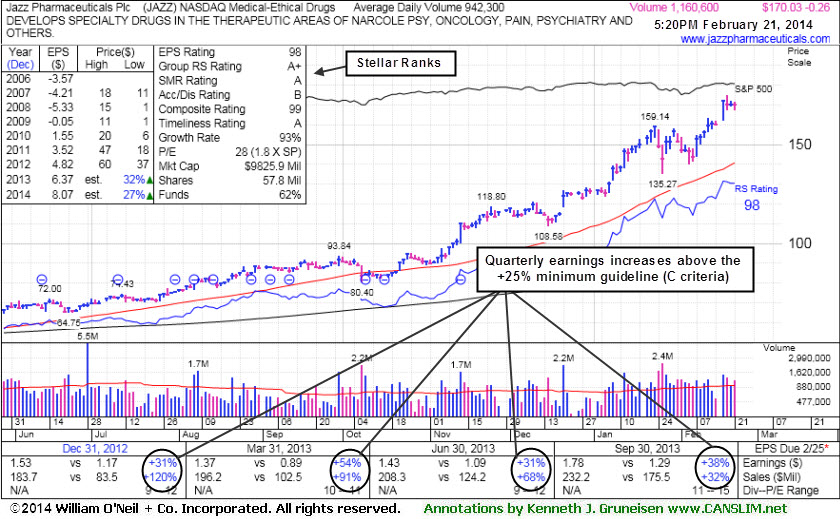

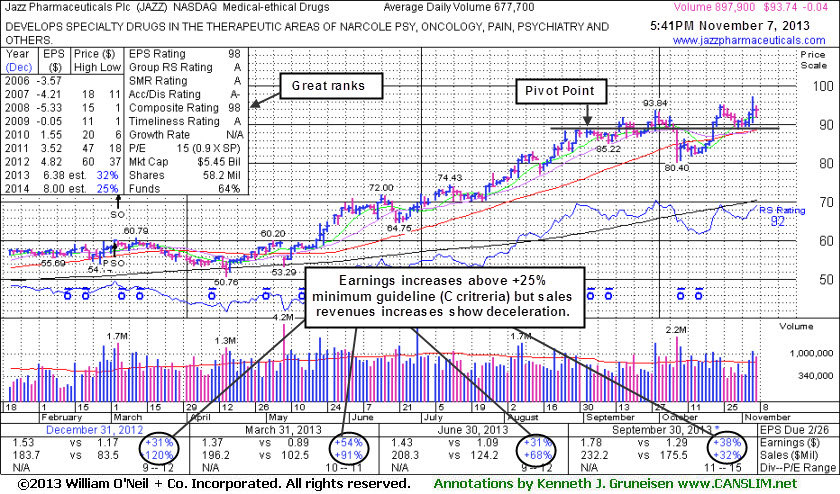

Jazz Pharmaceuticals Plc (JAZZ +$2.50 or +2.13% to $119.63) is still hovering near its 52-week high, stubbornly holding its ground while extended from any sound base. It is on track for its 6th consecutive weekly gain and may possibly go on to produce more climactic gains, however prior notes have reminded members of the dangers of chasing extended stocks - "Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price."

Its last appearance in this FSU section was on 11/07/13 with annotated graphs under the headline, "Hovering Near All-Time Highs Following Volume-Driven Gains". Its rally continued from that point and it quickly got much more extended from a sound technical buy point.

On 9/30/13 an annotated graph under the headline, "Strong Finish With High Volume Indicative of Accumulation" showed details of its earlier breakout. It had been highlighted in yellow in that day's mid-day report (read here). The pivot point cited was based its 9/03/13 high plus 10 cents after an advanced "3-weeks tight" base. It may have looked like an expensive stock which had run too high already to many investors at that time. When it finished that session with a solid gain backed by +160% above average volume reports noted that it clinched a technical buy signal. Volume at least +40% above average is the minimum volume necessary behind a breakout before action should be taken by investors. In this case the volume met the guideline, providing the necessary proof of sufficient institutional buying demand.

Fundamentals remain strong (C and A criteria) today with its strong sales and earnings increases continuing through the Sep '13 quarter. Its annual earnings (A criteria) history includes big FY '10, '11, and '12 earnings after a history of losses.

The number of top-rated funds owning its shares rose from 351 in Mar '12 to 550 in Sep '13, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with an A rating for its Group Relative Strength.

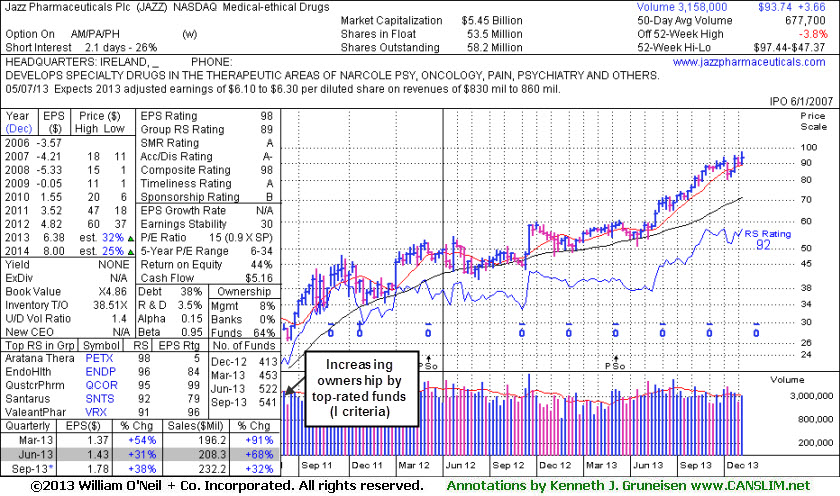

Jazz Pharmaceuticals Plc (JAZZ -$0.04 or -0.04% to $93.74) is perched near its 52-week high. Choppy action in recent weeks is not recognized as a sound base pattern. However it showed resilience and rallied back from a slump below its 50-day moving average (DMA) line with volume-driven gains helping it hit new highs. Its last appearance in this FSU section was on 9/30/13 with an annotated graph under the headline, "Strong Finish With High Volume Indicative of Accumulation". It had been highlighted in yellow in that day's mid-day report (read here) with pivot point cited based its 9/03/13 high plus 10 cents after an advanced "3-weeks tight" base. It finished that session with a solid gain backed by +160% above average volume clinching a technical buy signal.

Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price. Fundamentals remain strong (C and A criteria) today with its strong sales and earnings increases continuing through the Sep '13 quarter. Its annual earnings (A criteria) history includes big FY '10, '11, and '12 earnings after a history of losses.

The number of top-rated funds owning its shares rose from 351 in Mar '12 to 541 in Sep '13, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with an A rating for its Group Relative Strength.

Fundamentals remain strong (C and A criteria) today with its strong sales and earnings increases continuing through the Jun '13 quarter. Its annual earnings (A criteria) history includes big FY '10, '11, and '12 earnings after a history of losses. It did not spent much time basing and recently had wedged to new all-time highs with gains lacking great volume conviction. It was noted in the 8/07/13 mid-day report with caution - "Disciplined investors may watch for a secondary buy point or new base to possibly develop and be noted in the weeks ahead. Completed a Secondary Offering on 3/05/13. Fundamentals (C and A criteria) remain strong and it showed resilience at its 200 DMA line and rebounded since dropped from the Featured Stocks list on 4/01/13." Its last appearance in this FSU section was on 3/07/13 with an annotated graph under the headline, "Secondary Offering May Hinder Progress Yet Attract Institutional Interest". Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest.

The number of top-rated funds owning its shares rose from 351 in Mar '12 to 519 in Jun '13, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with an A rating for its Group Relative Strength.

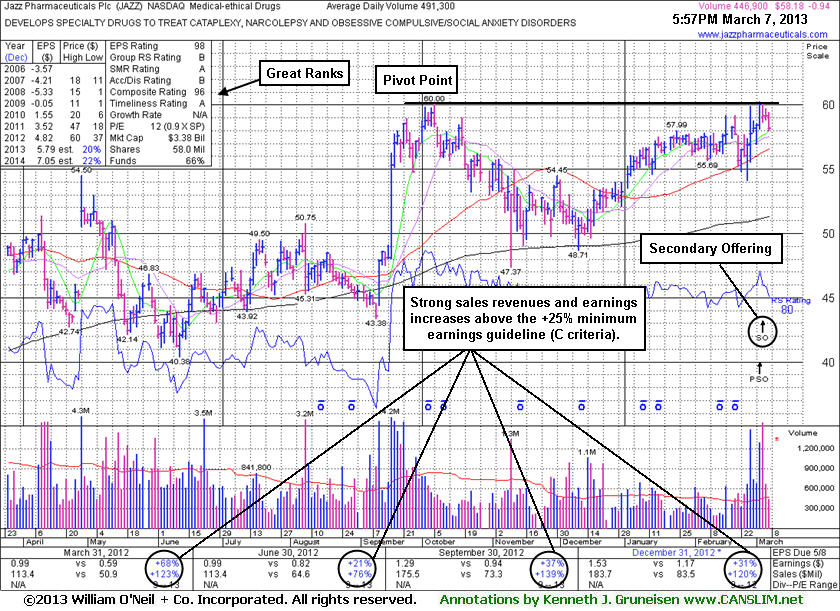

Jazz Pharmaceuticals Plc (JAZZ -$0.94 or -1.59% to $58.18) was highlighted in yellow with a pivot point cited based on its 10/05/12 high plus 10 cents in the 3/05/13 mid-day report (read here). Disciplined investors note that it has rallied near an area of previous resistance. Proof of fresh institutional buying demand is necessary to confirm a proper technical buy signal before taking action may be appropriate. It could spend more time basing, whereas a gain with at least +40% above average volume while rising above its pivot point may clinch a technical buy signal. The stock found support at its 200-day moving average (DMA) line in recent months and rebounded to its 52-week high before completing a Secondary Offering. Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest.

Fundamentals remain strong (C and A criteria) today with its strong sales and earnings increases continuing through the Dec '12 quarter. Based on technical weakness it was dropped from the Featured Stocks list back on 5/15/12 while enduring damaging distributional pressure shortly after its appearance in this FSU section on 4/27/12 with an annotated graph under the headline, "Four Times Average Volume While Rising From Double Bottom Base". It undercut its 200 DMA line and took months to rebound, yet when it blasted to new highs it made limited headway before again retreating to its 200 DMA line. It found support near that long-term average in a manner which indicates that the institutional crowd believes in the company. Its annual earnings (A criteria) history includes big FY '10, '11, and '12 earnings after a history of losses. The number of top-rated funds owning its shares rose from 351 in Mar '12 to 422 in Dec '12, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with a B rating for its Group Relative Strength.

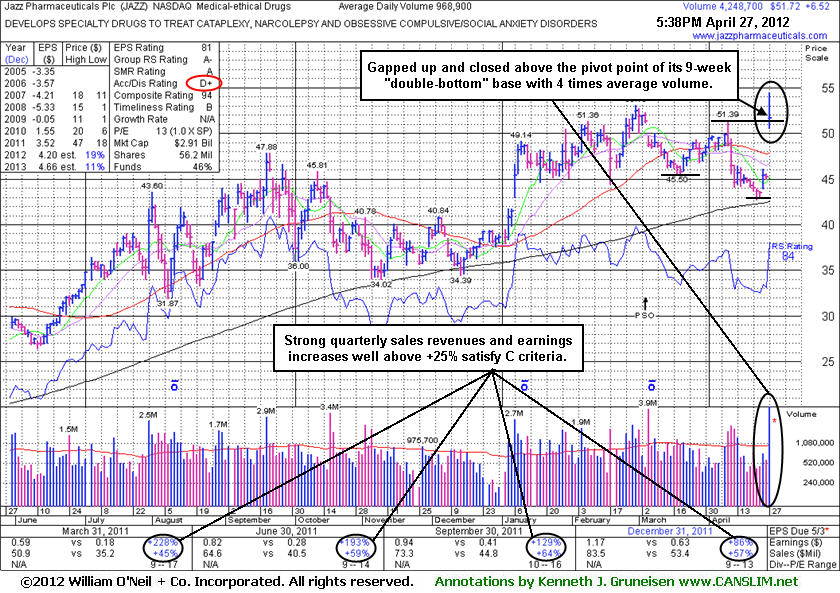

Jazz Pharmaceuticals Plc's (JAZZ +$6.52 or +14.42% to $51.72) considerable gap up gain today was backed by 4 times average volume, rising from a "double bottom" base and touching a new all-time high (N criteria). The mid-day report (read here) included it highlighted in yellow with a pivot point cited based on its 4/10/12 high. The close above its pivot point clinched a technical buy signal, however its finish in the lower half of its intra-day range was a sign that it was also encountering some resistance near its 52-week high. Of some concern is its poor D+ Accumulation/Distribution Rating (see red circle). The current Up/Down Volume Ratio of 0.7 also is an unbiased indication that its shares have been coming under distributional pressure during the past 50 days. It proposed a Secondary Offering on 3/05/12. Disciplined investors avoid chasing stocks that get too extended from a sound base, and they always limit losses if ever any stock falls -7% from their purchase price.

Its annual earnings (A criteria) history is limited, however quarterly comparisons through Dec '11 have shown strong sales revenues and earnings (good C criteria) increases. Its big FY '10 and '11 earnings followed losses in prior years. The number of top-rated funds owning its shares rose from 236 in Jun '11 to 344 in Mar '12, a very reassuring sign concerning the I criteria. The Medical - Ethical Drugs group is currently showing good leadership (L criteria) while coming in with an A- rating for its Group Relative Strength. Its upcoming earnings release will be noted, and investors should expect that volume and volatility frequently increase near earnings news.

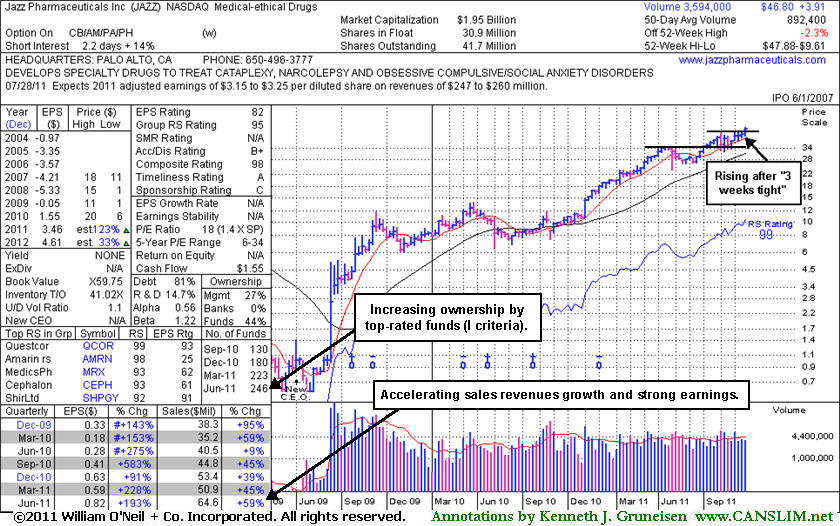

Jazz Pharmaceuticals Inc (JAZZ +$3.06 or +7.01% to $46.80) hit a new all-time high today with a gain backed by more than 3 times average volume. The breakout came after news it plans to take over Dublin-based Azur Pharma Ltd in a deal to add a new (N criteria) pain drug and diversify its product portfolio. The earlier mid-day report (read here) highlighted it in yellow after a recent consolidation was considered a "3-weeks tight" pattern. It quietly held its ground at all-time highs following the previously noted choppy 5-week consolidation not recognized as a sound base pattern.

Ownership by top-rated funds rose from 117 in Jun '10 to 246 in Jun '11, a reassuring sign concerning the I criteria. It reported earnings +193% on +59% sales revenues for the quarter ended June 30, 2011, and strong earnings in recent comparisons (C criteria) were backed by accelerating sales revenues growth. Regular readers may note prior concerns that FY '10 was its first ever profitable year, while the investment system's A criteria calls for a strong 3-5 year earnings growth history. Recent quarterly comparisons showed greatly improved sales revenues and earnings increases. Although the Medical - Ethical Drugs firm rose more than 80-fold from its low of $0.52 in April 2009, its fundamental and technical strength may warrant a closer look today. Disciplined investors know to always limit losses if ever any stock falls more than -7% from their purchase price.