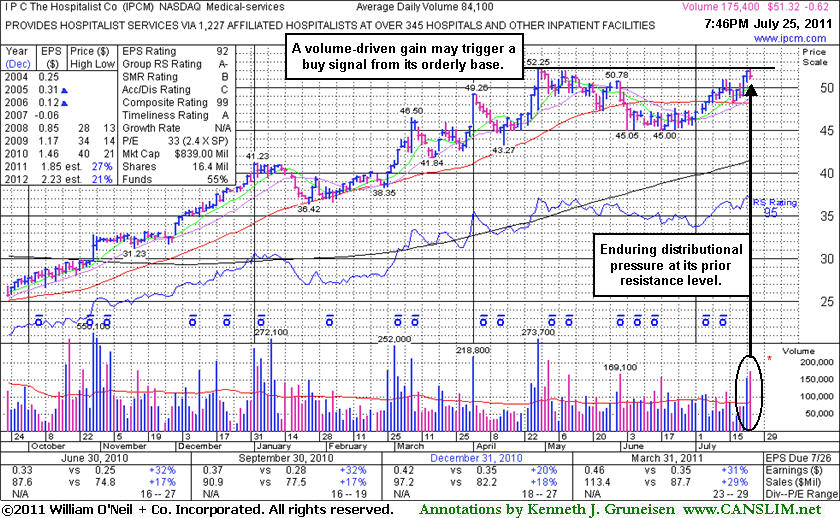

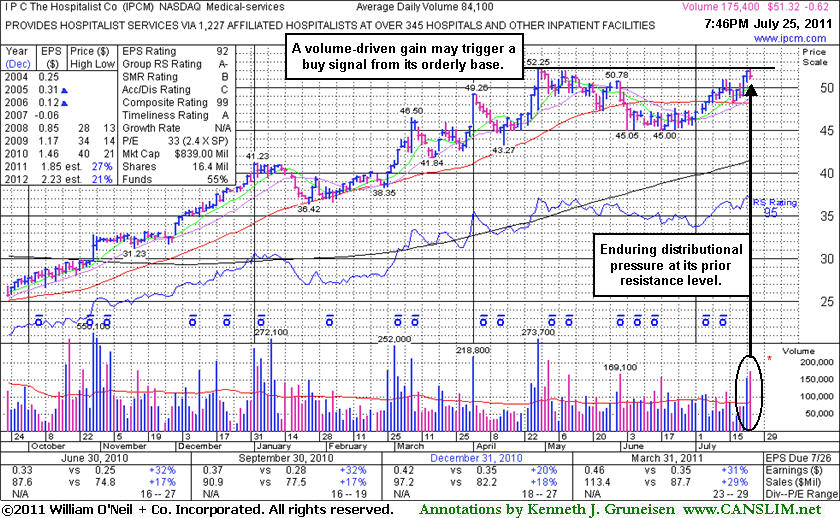

I P C The Hospitalist Co (IPCM -1.19%) encountered distributional pressure today when challenging prior resistance. It is due to report earnings after the close on Thursday, July 28th. In today's mid-day report its color code was changed to yellow with pivot point cited based on its 52-week high plus 10 cents. It has formed an orderly saucer shaped base since noted in the 5/11/11 mid-day report. It reported +31% earnings on +29% sales revenues for the quarter ended March 31, 2011 versus the year ago period. Its annual earnings (A criteria) growth has been impressive since January 2008 beginning of its public trading history. Its small supply (S criteria) of only 16.4 million outstanding shares can contribute to greater volatility. The number of top-rated funds owning its shares rose from 272 in Sep '10 to 293 in Mar '11, but fell to 281 in Jun '11. Overall the ongoing trend as been indicative of greater institutional ownership (I criteria).

Volume and volatility often increase near earnings news. Disciplined investors may be careful about any stock near earnings news, especially if it has not even triggered a convincing technical buy signal. Patience may be paramount for now, and while this high-ranked leader is setting up it makes a good candidate for investors' watch lists. A stock should always trigger a convincing technical buy signal before it is bought. Concerns have been raised by breakdowns in other Medical stocks including Edwards Lifesciences Corp (EW), which had been on the Featured Stocks list and was recently dropped after failing to trigger a sound buy signal, and HCA Holdings Inc (HCA -19.19%) which is mentioned in today's Market Commentary section after an earnings disappointment and considerable loss. Both serve as a reminder to always play good defense and limit losses if any stock you own ever gets into trouble. Strictly limiting losses at -7% is the only way to eliminate the chances of even greater losses.