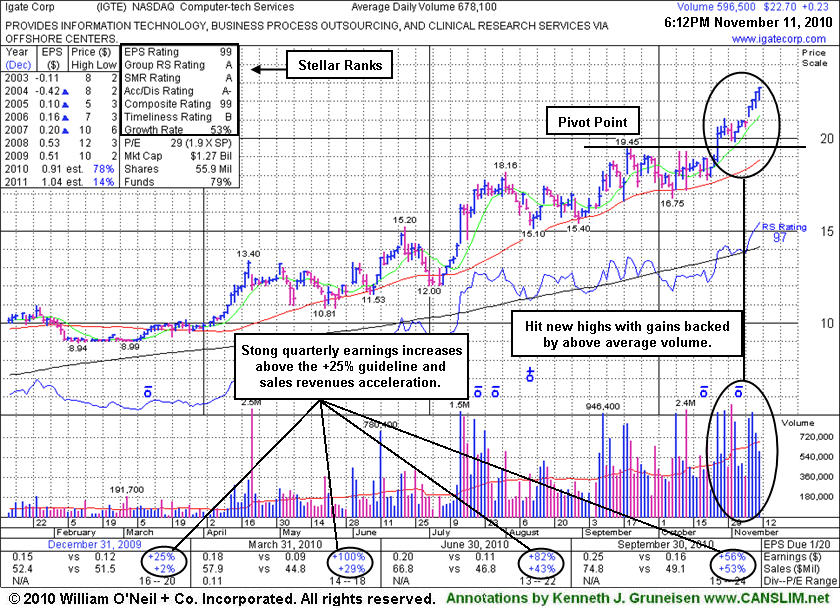

Insider Ownership Keeps Management Motivated - Thursday, November 11, 2010

When company management "insiders" have a hefty percentage of ownership, that keeps them motivated to maintain and build shareholder value. When they are doing well with growing sales and earnings, a bunch of investment banking firms are likely to be knocking on their door asking them if they want to raise the company more money by issuing new shares (which dilute the existing shares' value) or raise themselves money by selling their (insiders') shares already owned, or both. Through the help of underwriters, they typically attract greater institutional ownership interest in their stock, which is generally a favorable characteristic. An increasing number of top-rated mutual funds owning a company's shares is always very reassuring.

Igate Corp (IGTE +$0.22 or +0.98% to $22.69) posted a 4th consecutive gain today for another new high. After a streak of recent gains with above average volume it is extended from its latest base. Disciplined investors avoid chasing stocks more than +5% above a sound base pattern. Prior chart highs in the $19 area define initial chart support above its 50-day moving average (DMA) line. It eventually charged higher after it found support above that important short-term average line since its last appearance in this FSU section with an annotated graph on 9/10/10 under the headline "Resistance Being Encountered Near Prior Highs".

The number of top-rated funds owning its shares rose from 203 in Dec '09 to 232 in Sep '10. Investors may be concerned about potential dilution, as it reportedly filed a recent registration statement. However there is no assurance that any subsequently proposed offerings will cause a problem for investors who follow sound buying and selling discipline. Impressive sales revenues acceleration in the latest period is a very favorable sign, further reducing a concern noted in much earlier mid-day reports - "The downturn in FY '09 earnings hurts its annual earnings (A criteria) track record."

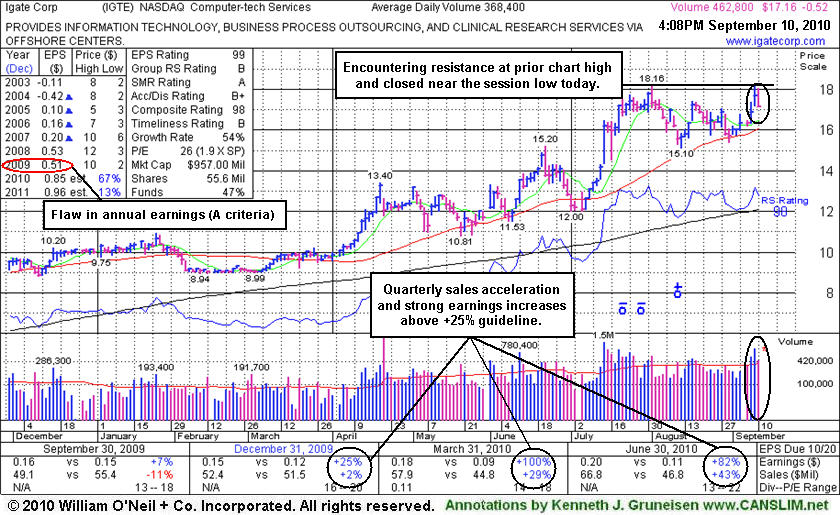

Resistance Being Encountered Near Prior Highs - Friday, September 10, 2010

Igate Corp (IGTE -0.52 or -2.94% to $17.16) traded above average volume, churning near its 52-week high. The heavier volume and lack of meaningful price progress above its pivot point is considered a sign of distributional pressure. Its weak close near Friday's session low was a discouraging sign after constructive gains with heavy volume earlier in the week. Its color code was changed to yellow as it met the 9/08/10 mid-day report screening criteria (read here), identifying it as an ideal leader for investors' watchlists. This high-ranked Fremont, CA-based firm built an orderly new base. However, it is a riskier "late-stage" base. Another concern was noted in prior mid-day reports -"The downturn in FY '09 earnings hurts its annual earnings (A criteria) track record." (see red circle)